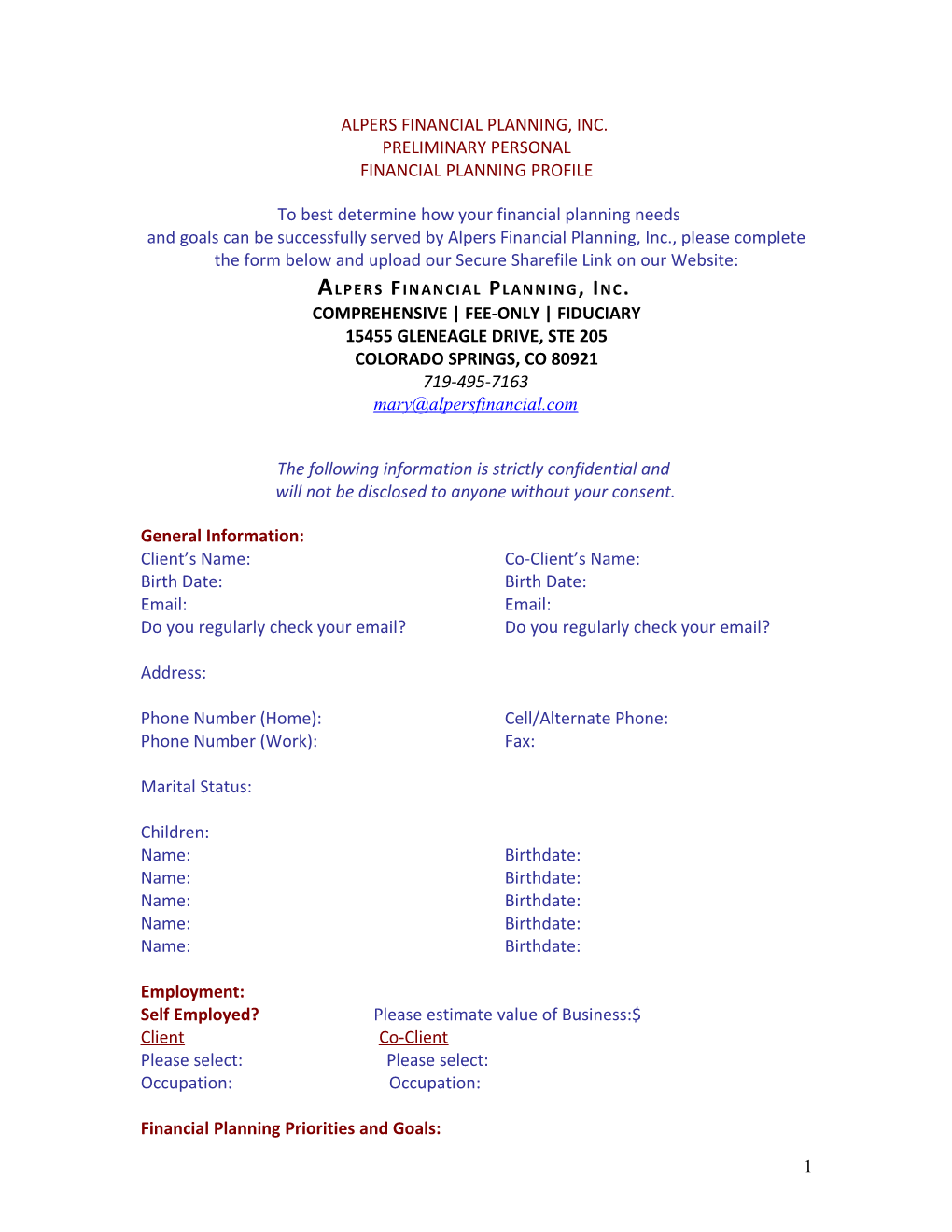

ALPERS FINANCIAL PLANNING, INC. PRELIMINARY PERSONAL FINANCIAL PLANNING PROFILE

To best determine how your financial planning needs and goals can be successfully served by Alpers Financial Planning, Inc., please complete the form below and upload our Secure Sharefile Link on our Website: ALPERS FINANCIAL PLANNING, INC. COMPREHENSIVE | FEE-ONLY | FIDUCIARY 15455 GLENEAGLE DRIVE, STE 205 COLORADO SPRINGS, CO 80921 719-495-7163 [email protected]

The following information is strictly confidential and will not be disclosed to anyone without your consent.

General Information: Client’s Name: Co-Client’s Name: Birth Date: Birth Date: Email: Email: Do you regularly check your email? Do you regularly check your email?

Address:

Phone Number (Home): Cell/Alternate Phone: Phone Number (Work): Fax:

Marital Status:

Children: Name: Birthdate: Name: Birthdate: Name: Birthdate: Name: Birthdate: Name: Birthdate:

Employment: Self Employed? Please estimate value of Business:$ Client Co-Client Please select: Please select: Occupation: Occupation:

Financial Planning Priorities and Goals:

1 What are your three most important financial concerns or goals? 1.

2.

3.

Asset Information: Please estimate the following, including all amounts in retirement accounts: Personal Home current value: $ Other Real Estate: $ Non-Retirement Mutual Funds, Stocks, Bonds: $ 401K/403B/457/Pension Accounts: $

IRA/SEP/SIMPLE/ROTH Accounts: $ Checking/Savings Accounts: $ Other Assets (cars,collectibles,etc): $

Liability Information: Please estimate the following: First Mortgage: $ Other Liabilities: $ Years Remaining: Installment Loans: $ Home Equity Line Balance: $ Credit Cards: $ Second Mortgage: $ Auto Loans: $ Years Remaining:

Annual Earned Income: Salaries: $ Company: $ Company: Other Income/Bonus/Commission: $ Gross Self Employment/Rental Income: $

Retirement/Pension/Social Security Income: $ per Month OR $ per Year. Is your income fairly uniform and reliable?

Contributions/Savings: Are you contributing on a regular basis to a retirement plan such as 401K/403B/457 deferred compensation or IRA, SEP, SIMPLE or ROTH? Annual Amount(s): Into which Accounts?

How much Life Insurance do you have? Client $ Co-Client: $

Wills/Trust: Do you have a will? Do you have a trust? Date Signed:

2 Date Signed:

Other Information:

Do you know your approximate annual or monthly living expenses are (excluding taxes)? $ Per Year OR $ Per Month

Do you have a computer at home? Do you use Quicken, Mvelopes or Microsoft Money software to track expenses? What do you expect to earn on your investments? % per year. How have you reacted and what did you do last year when the stock market significantly dropped? If not retired, at what age do you expect to retire or “pretire”? Age

Have you ever been unhappy with the recommendations of a stockbroker, insurance agent and/or financial advisor or consultant? Please explain, if yes:

Is there any other information you would like to provide at this time? Please use this space provided:

Please contact us if you have any questions.

Thank you, Mary

Mary R. Alpers, CFP®, EA, MBA President

3