ChangeWave Research: Consumer Spending August 15, 2011

August Consumer Spending Report U.S. Consumer Spending Heads South in August

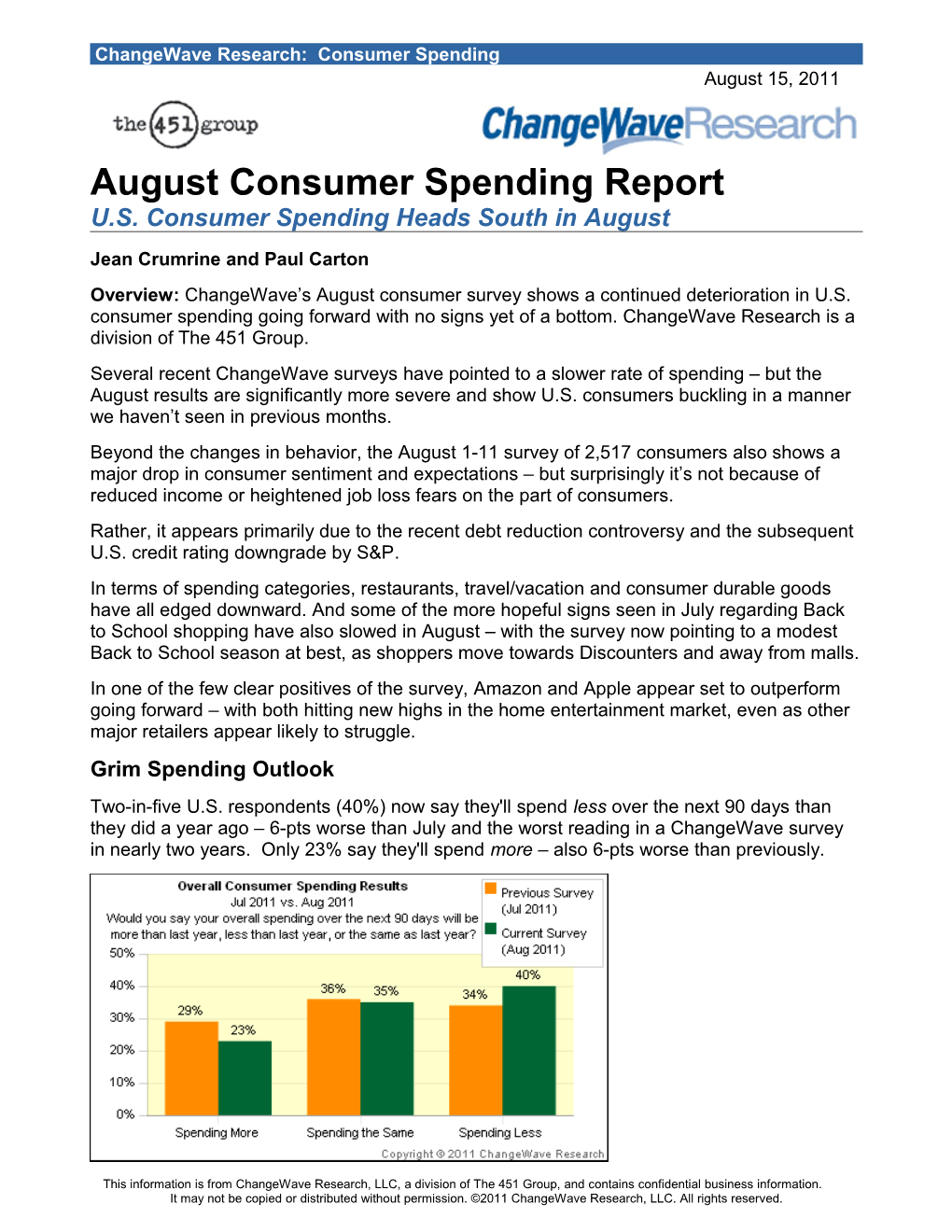

Jean Crumrine and Paul Carton Overview: ChangeWave’s August consumer survey shows a continued deterioration in U.S. consumer spending going forward with no signs yet of a bottom. ChangeWave Research is a division of The 451 Group. Several recent ChangeWave surveys have pointed to a slower rate of spending – but the August results are significantly more severe and show U.S. consumers buckling in a manner we haven’t seen in previous months. Beyond the changes in behavior, the August 1-11 survey of 2,517 consumers also shows a major drop in consumer sentiment and expectations – but surprisingly it’s not because of reduced income or heightened job loss fears on the part of consumers. Rather, it appears primarily due to the recent debt reduction controversy and the subsequent U.S. credit rating downgrade by S&P. In terms of spending categories, restaurants, travel/vacation and consumer durable goods have all edged downward. And some of the more hopeful signs seen in July regarding Back to School shopping have also slowed in August – with the survey now pointing to a modest Back to School season at best, as shoppers move towards Discounters and away from malls. In one of the few clear positives of the survey, Amazon and Apple appear set to outperform going forward – with both hitting new highs in the home entertainment market, even as other major retailers appear likely to struggle. Grim Spending Outlook Two-in-five U.S. respondents (40%) now say they'll spend less over the next 90 days than they did a year ago – 6-pts worse than July and the worst reading in a ChangeWave survey in nearly two years. Only 23% say they'll spend more – also 6-pts worse than previously.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Consumer Spending Putting These Findings in Context. As the following chart shows, in recent months we have been seeing a slow but steady downturn in consumer spending behavior.

All-told we’ve witnessed a net 28-pt drop over the past five months – a magnitude unmatched since the last recession, though we note that overall spending levels going forward still aren’t nearly as bad as they were during the height of the recession in early 2009

Rather, the current results appear similar to the spending levels seen back in February 2008, only weeks after the last recession actually began.

A Decline Across All Income Levels. The latest decline in spending is occurring across all income levels, and is most pronounced among higher income households, which last month had temporarily shown signs of stabilizing.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 2 ChangeWave Research: Consumer Spending Individual Spending Categories

In terms of individual categories, spending on restaurants, consumer durable goods, travel/vacation and autos have all edged downward this month.

Restaurant spending is down for the fourth month in a row – just 10% say they’ll spend more on eating out compared to 33% less – a drop of another 4-pts since July.

Consumer Durable Goods spending has also declined a net 3-pts this month – only 10% say they’ll spend more on consumer durable goods over the next 90 days and 26% less.

After experiencing an uptick in the previous survey, Auto spending has registered a 3-pt decline, while Travel/ Vacation spending is down 8-pts, although that is partially due to seasonal factors.

In other findings, spending on Household Repairs/ Improvements is unchanged from previously. And after slowing in recent surveys, Consumer Electronics spending also remains essentially unchanged for August – which is not good news considering we’re already in the Back to School season.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 3 ChangeWave Research: Consumer Spending

A Sharp Deterioration in Consumer Expectations and Confidence

In a further worrisome sign, consumer expectations and confidence readings in our August survey have seriously deteriorated as well.

Consumer Expectations. A total of 63% now believe the overall direction of the economy is going to worsen over the next 90 days and only 9% think the economy is going to improve – a huge 24-pt downward swing since our previous survey in July.

Stock Market Confidence. In another sign of collapsing confidence, 70% now say they are Less Confident in the U.S. stock market than they were 90 days ago – 20-pts worse than in July. Only 7% say they’re More Confident, which is 6-pts worse than previously.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 4 ChangeWave Research: Consumer Spending

Underlying Reasons for the Downturn

During the course of the last recession, ChangeWave surveys showed a huge jump in the percentage of consumers reporting they were spending less because they were saving more money. And in a telltale sign, our July and August surveys show a resurgence of the trend towards greater savings.

Significantly more consumers now say they’re spending less because they’re Saving More Money (29%) – up a full 7-pts over the past two months.

But is the sudden surge in savings behavior a result of real world changes to the economy, or is it due to a change in perceptions among consumers? We asked a series of questions to find out: First, in a surprise finding, the percentage who say they’re spending less because of Reduced Income (36%) has actually declined 3-pts this month – and is now at its lowest level in more than two years.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 5 ChangeWave Research: Consumer Spending Secondly, the percentage who say they’re worried about someone in their family losing their job (31%) – while still high – has barely budged over the past two months (up only 1- pt). So if neither reduced income nor heightened job loss fears are driving the current downturn, then what explains the dual pullback we’re seeing in consumer confidence and in actual spending behavior?

Stated somewhat differently, could the current consumer downturn be more a result of psychological factors than economic ones?

To find out, we asked respondents a series of questions to gauge whether the recent U.S. credit rating downgrade and the debt reduction controversy has had any impact on their spending behavior.

Standard & Poor’s recently announced they had lowered the U.S. credit rating from AAA to AA+, stating that the recent debt-reduction bill did not go far enough to improve the government’s fiscal situation. Has this development made you more likely to Increase your spending for the next 90 days, more likely to Decrease your spending, or is it having No Impact on your spending for the next 90 days?

Current Survey Aug ‘11 More Likely to Decrease Spending for Next 90 Days Because of 47% the U.S. Credit Downgrade More Likely to Increase Spending for Next 90 Days Because of 1% the U.S. Credit Downgrade No Impact on My Spending for Next 90 Days 48% Don’t Know 4% * Note this question was asked of consumers who participated in the survey from August 8-11 – after S&P announced its lowering of the U.S. credit rating.

In a clear sign of the psychological impact that the U.S. credit downgrade has had on consumers, nearly one-in-two (47%) say they’re more likely to Decrease spending for the next 90 days because of the S&P downgrade.

With the U.S. government debt reduction impasse finally resolved, has it made you more likely to Increase your spending for the next 90 days, more likely to Decrease your spending, or is it having no impact on your spending for the next 90 days? Current Survey Aug ‘11 More Likely to Decrease Spending for Next 90 Days 35% Because Debt Reduction Impasse was Resolved More Likely to Increase Spending for Next 90 Days Because Debt 0% Reduction Impasse was Resolved No Impact on My Spending for Next 90 Days 63% Don’t Know 1%

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 6 ChangeWave Research: Consumer Spending Similarly, the debt reduction controversy in Washington has had a huge impact on consumer spending behavior. Better than one-in-three respondents (35%) report they’re more likely to Decrease spending for the next 90 days because of the debt reduction controversy – even though Congress has already at least temporarily resolved the issue.

Bottom Line: The August consumer survey shows a continued deterioration in U.S. consumer spending behavior going forward with no signs yet of a bottom. Moreover, the survey results are strikingly similar to the spending levels registered during the second month of the previous recession (Feb 2008).

In short, the August results are significantly more severe than anything we’ve seen recently and are accompanied by consumer behavioral changes that we last saw during 2009 – in particular, a surge in the percentage saving more money.

In one of the more striking findings of the survey, this month’s change in consumer behavior and sentiment doesn’t appear to be due to heightened job loss fears or suddenly reduced income (note the % spending less because of Reduced Income actually declined in August).

Rather, the August deterioration in consumer spending appears primarily due to the recent debt reduction controversy and subsequent U.S. credit rating downgrade by S&P.

In other words, the August consumer downturn appears more a result of psychological factors than purely economic ones. And although our surveys have been showing a gradual decline in consumer spending in recent months, we note that the serious pullback we're seeing in August is equivalent to that of the previous three months combined.

But in a real sense, the fact that psychological factors are involved may provide a ray of hope. For even as consumer spending behavior appears likely to worsen going forward, it also appears that consumer confidence building measures – if successfully applied – could help return the U.S. to a growth path.

Where is FDR when we really need him?

Other Findings

The ChangeWave survey points to a modest Back to School season at best. Among those doing Back to School shopping, 29% say they’ll spend More Money than last year and 17% Less – for a net change score of +12. But those results are down 2-pts from a year ago and are 3-pts lower than in August 2009.

Going forward, Mall retailers like Macy’s (M; -3 pts), Nordstrom (JWN; -3 pts) and JCPenney (JCP; -3 pts) look like they’re being hardest hit by the slowdown in consumer spending, while Discounters like Costco (COST; unchanged), Walmart (WMT; unchanged) and Target (TGT; +1 pt) appear relatively unscathed.

The August findings remain grim for Best Buy (BBY; 32%). After falling 4-pts over the past two surveys they are up just 1-pt from their lowest level ever in a ChangeWave survey.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 7 ChangeWave Research: Consumer Spending In some of the most positive findings of the survey, Amazon (AMZN) and Apple (AAPL) appear set to outperform going forward – with both hitting new highs in the home entertainment market, even as other major retailers appear likely to struggle.

For Amazon it’s their biggest consumer spending uptick in a year, with 38% saying they’ll shop there for home entertainment and computer networking products in the next 90 days – a 6-pt jump since July and their highest level ever in a ChangeWave survey.

Apple (19%) has also hit a new all-time high in the home entertainment and computer networking market – up 2-pts from July.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 8 ChangeWave Research: Consumer Spending Summary of Key Findings US Consumer Worsening Consumer Major Retailer Trends Spending Hurtles Expectations and Consumers Leaving the Mall Towards a Double Dip Confidence Macy’s (down 3-pts) Nordstrom (down 3-pts) Nearly two-in-five (40%) U.S. Consumer Expectations JCPenney (down 3-pts) respondents say they’ll spend 63% believe economy will Less Money over next 90 worsen over next 90 days – Move Toward Discounters days than they did a year ago 17-pts worse than July Target (up 1-pt) – but that’s 6-pts worse than Only 9% think it will improve Costco (unchanged) July – 7-pts worse Walmart (unchanged) Just 23% say they’ll spend Stock Market Confidence More – 6-pts worse than last 70% now say they’re Less Home Entertainment month Confident in the U.S. stock Shopping market than 90 days ago – U.S. Debt Reduction and Winners 20-pts worse than July Amazon (38%) – up 6-pts S&P Downgrade are Key Just 7% say they’re More Apple (19%) – up 2-pts Contributing Factors Confident – down 6-pts Losers 47% say they’re more likely Most Spending Best Buy (32%) – up just 1- to Decrease spending for pt from all-time low in July next 90 days due to S&P’s Categories Edge U.S. credit downgrade Downward Back to School Outlook – 35% say they’re more likely Travel/Vacation (-8) to Decrease spending Restaurants (-4) Modest at Best because of the debt reduction Durable Goods (-3) 29% say they’ll spend More controversy – even though Automobiles (-3) Money than last year while the impasse has been 17% say Less – but that’s resolved Others Remain Flat down 2-pts from a year ago Consumer Electronics (0) and 3-pts since 2009 Household Repairs/ Improvements (0)

The ChangeWave Research Network is a group of 25,000 highly qualified business, technology, and medical professionals in leading companies of select industries—credentialed professionals who spend their everyday lives working on the frontline of technological change. ChangeWave surveys its Alliance members on a range of business and investment research and intelligence topics, collects feedback from them electronically, and converts the information into proprietary quantitative and qualitative reports.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 9 ChangeWave Research: Consumer Spending Table of Contents

Summary of Key Findings...... 9

The Findings...... 11

(A) Overall U.S. Consumer Spending...... 11

(B) Individual Spending Categories...... 14

(C) Consumer Expectations and Confidence...... 18

(D) Underlying Reasons for Downturn...... 20

(E) Retailers and Back to School Shopping...... 24

(F) Home Entertainment Shopping...... 28

(G) Impact of the Economy on Investors...... 30

ChangeWave Research Methodology...... 31

About ChangeWave Research...... 31

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 10 ChangeWave Research: Consumer Spending The Findings

Introduction: ChangeWave’s August consumer survey shows a continued deterioration in U.S. consumer spending going forward with no signs yet of a bottom. ChangeWave Research is a division of The 451 Group. Several recent ChangeWave surveys have pointed to a slower rate of spending – but the August results are significantly more severe and show U.S. consumers buckling in a manner we haven’t seen in previous months.

Beyond the changes in behavior, the August 1-11 survey of 2,517 consumers also shows a major drop in consumer sentiment and expectations – but surprisingly it’s not because of reduced income or heightened job loss fears on the part of consumers.

Rather, it appears primarily due to the recent debt reduction controversy and the subsequent U.S. credit rating downgrade by S&P.

In terms of spending categories, restaurants, travel/vacation and consumer durable goods have all edged downward. And some of the more hopeful signs seen in July regarding Back to School shopping have also slowed in August – with the survey now pointing to a modest Back to School season at best, as shoppers move towards Discounters and away from malls.

In one of the few clear positives of the survey, Amazon and Apple appear set to outperform going forward – with both hitting new highs in the home entertainment market, even as other major retailers appear likely to struggle. (A) Overall U.S. Consumer Spending

Two-in-five U.S. respondents (40%) now say they'll spend less over the next 90 days than they did a year ago – 6-pts worse than July and the worst reading in a ChangeWave survey since October 2009. Only 23% say they'll spend more – also 6-pts worse than previously.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 11 ChangeWave Research: Consumer Spending Would you say your overall spending over the next 90 days will be more than last year, less than last year, or the same as last year? Current Previous Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey Survey Aug ‘11 Jul ‘11 Jun ‘11 May ‘11 Apr ‘11 Aug ‘10 Jul ‘10 More Spending Than 23% 29% 32% 35% 37% 32% 30% Last Year Less Spending Than 40% 34% 31% 28% 27% 32% 32% Last Year Spending Will Remain 35% 36% 35% 35% 35% 36% 36% the Same as Last Year Don't Know 2% 2% 1% 2% 1% 1% 2% Putting These Findings in Context. As the following chart shows, in recent months we have been seeing a slow but steady downturn in consumer spending behavior.

All-told we’ve witnessed a net 28-pt drop over the past five months – a magnitude unmatched since the last recession, though we note that overall spending levels going forward still aren’t nearly as bad as they were during the height of the recession in early 2009

Rather, the current results appear similar to the spending levels seen back in February 2008, only weeks after the last recession actually began.

A Decline Across All Income Levels. The latest decline in spending is occurring across all income levels, and is most pronounced among higher income households, which last month had temporarily shown signs of stabilizing.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 12 ChangeWave Research: Consumer Spending

Current Survey (Aug 2011) – Breakdown by Income Levels Less $100,001 Greater Than Total - Than $100,00 $150,000 $150,000 0 More Spending Than Last Year 23% 19% 24% 27% Less Spending Than Last Year 40% 46% 39% 34% Spending Will Remain the Same as 35% 33% 35% 38% Last Year

Previous Survey (Jul 2011) – Breakdown by Income Levels Less $100,001 Greater Than Total - Than $100,00 $150,000 $150,000 0 More Spending Than Last Year 29% 22% 33% 35% Less Spending Than Last Year 34% 41% 30% 28% Spending Will Remain the Same as 36% 34% 36% 36% Last Year

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 13 ChangeWave Research: Consumer Spending (B) Individual Spending Categories

Which of the following consumer items will you be spending more money on over the next 90 days compared to last year? (Check All That Apply) Current Previous Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey Survey Aug ‘11 Jul ‘11 Jun ‘11 May ‘11 Apr ‘11 Aug ‘10 Jul ‘10 Household Repairs/ 31% 31% 36% 35% 35% 32% 34% Improvements Travel/Vacation 24% 29% 32% 30% 32% 27% 30% Consumer Electronics 15% 13% 15% 17% 16% 17% 15% Healthcare Services 12% 13% 12% 12% 13% 13% 13% Restaurants/Everyday 10% 12% 13% 14% 16% 13% 12% Entertainment Durable Goods for the 10% 11% 13% 14% 13% 12% 11% Home Children's Services 7% 8% 8% 9% 7% 9% 9% (e.g. camp, education, lessons, other activities) Automobile Purchase 6% 7% 6% 6% 7% 7% 6% Other Services (e.g. 4% 3% 4% 3% 4% 4% 4% adult education, fitness activities

And which of the following consumer items will you be spending less money on over the next 90 days than last year? (Check All That Apply) Current Previou Previous Previous Previous Previous Previous Survey s Survey Survey Survey Survey Survey Aug ‘11 Survey Jul ‘11 Jun ‘11 May ‘11 Apr ‘11 Jul ‘10 Aug ‘10 Consumer Electronics 34% 32% 31% 31% 30% 31% 33% Restaurants/Everyday 33% 31% 31% 27% 25% 28% 28% Entertainment Travel/Vacation 31% 28% 27% 24% 23% 28% 29% Durable Goods for the 26% 24% 24% 23% 21% 25% 26% Home Automobile Purchase 22% 20% 21% 22% 20% 21% 23% Household Repairs/ 16% 16% 15% 15% 13% 16% 16% Improvements Other Services (e.g. 9% 9% 9% 9% 8% 10% 9% adult education, fitness activities) Children's Services 8% 9% 9% 8% 8% 8% 9% (e.g. camp, education, lessons, other activities) Healthcare Services 7% 7% 7% 8% 8% 8% 7%

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 14 ChangeWave Research: Consumer Spending Change in Net Difference Score - Current Survey (Aug 2011) vs. Previous Survey (Jul 2011) Current Previous Survey Survey Change in Net Net Net Difference Difference Difference Score Score Score (Aug ’11) (Jul ’11) Other Services (e.g. adult education, health and fitness -5 -6 +1 activities) Household Repairs/Improvements +15 +15 0 Consumer Electronics -19 -19 0 Children’s Services (e.g. camp, education, lessons, -1 -1 0 other activities) Healthcare Services +5 +6 -1 Automobile Purchase -16 -13 -3 Durable Goods for the Home -16 -13 -3 Restaurants/Everyday Entertainment -23 -19 -4 Travel/Vacation -7 +1 -8

Individual Spending Categories. In terms of individual categories, spending on restaurants, consumer durable goods, travel/vacation and autos have all edged downward this month.

Restaurant spending is down for the fourth month in a row – just 10% say they’ll spend more on eating out compared to 33% less – a drop of another 4-pts since July.

Consumer Durable Goods spending has also declined a net 3-pts this month – only 10% say they’ll spend more on consumer durable goods over the next 90 days and 26% less.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 15 ChangeWave Research: Consumer Spending

After experiencing an uptick in the previous survey, Auto spending has registered a 3-pt decline, while Travel/ Vacation spending is down 8-pts, although that is partially due to seasonal factors.

In other findings, spending on Household Repairs/ Improvements is unchanged from previously. And after slowing in recent surveys, Consumer Electronics spending also remains essentially unchanged for August – which is not good news considering we’re already in the Back to School season.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 16 ChangeWave Research: Consumer Spending

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 17 ChangeWave Research: Consumer Spending (C) A Sharp Deterioration in Consumer Expectations and Confidence In a further worrisome sign, consumer expectations and confidence readings in our August survey have seriously deteriorated as well.

In your opinion, which of the following statements best describes the overall direction of the economy over the next 90 days?

Previous Previous Previous Previou Current Previous Previous Survey Survey Survey s Survey Survey Survey Jun‘11 May ‘11 Apr ‘11 Survey Aug ‘11 Jul ‘11 Jul ‘10 Aug ‘10 The economy is going to 9% 16% 11% 25% 30% 16% 12% improve over the next 90 days The economy is going to 63% 46% 51% 38% 32% 40% 57% worsen over the next 90 days The economy is going to 28% 37% 37% 36% 37% 47% 30% remain the same over the next 90 days

Consumer Expectations. A total of 63% now believe the overall direction of the economy is going to worsen over the next 90 days and only 9% think the economy is going to improve – a huge 24-pt downward swing since our previous survey in July.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 18 ChangeWave Research: Consumer Spending Are you now more or less confident in the U.S. stock market compared to 90 days ago? Current Previou Previous Previous Previous Previous Previous Survey s Survey Survey Survey Survey Survey Aug ‘11 Survey Jul ‘11 Jun‘11 May ‘11 Apr ‘11 Jul ‘10 Aug ‘10 More Confident 7% 13% 7% 18% 26% 16% 4% Than 90 Days Ago Less Confident 70% 50% 60% 42% 34% 44% 71% Than 90 Days Ago No Change 20% 35% 29% 36% 37% 37% 23% Don't Know 3% 3% 2% 1% 3% 3% 2%

Stock Market Confidence. In another sign of collapsing confidence, 70% now say they are Less Confident in the U.S. stock market than they were 90 days ago – 20-pts worse than in July. Only 7% say they’re More Confident, which is 6-pts worse than previously.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 19 ChangeWave Research: Consumer Spending (D) Underlying Reasons for the Downturn

During the course of the last recession, ChangeWave surveys showed a huge jump in the percentage of consumers reporting they were spending less because they were saving more money. And in a telltale sign, our July and August surveys show a resurgence of the trend towards greater savings.

Significantly more consumers now say they’re spending less because they’re Saving More Money (29%) – up a full 7-pts over the past two months.

But is the sudden surge in savings behavior a result of real world changes to the economy, or is it due to a change in perceptions among consumers? We asked a series of questions to find out:

First, in a surprise finding, the percentage who say they’re spending less because of Reduced Income (36%) has actually declined 3-pts this month – and is now at its lowest level in more than two years.

Here’s the complete breakdown of reasons given by consumers who say they are spending less:

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 20 ChangeWave Research: Consumer Spending For those who will be spending less than last year, what are the most important reasons why? (Choose No More Than Three) Previou Previou Current Previous Previous Previous Previous Reasons Given By Respondents s s Survey Survey Survey Survey Survey Spending Less Survey Survey Aug ‘11 Jul ‘11 May ‘11 Aug ‘10 Jul ‘10 Jun ‘11 Apr ‘11 Cost of Living/Inflation Inflation/Increase Cost of Living 43% 39% 43% 47% 40% 17% 19% Higher Energy Costs 24% 26% 33% 35% 30% 11% 9% Medical Expenses 10% 10% 10% 7% 9% 10% 11% Education Expenses 7% 6% 5% 5% 6% 9% 5% Trying to Improve Personal Finances Reducing Debt 26% 25% 26% 26% 29% 35% 34% Saving More Money 29% 25% 22% 22% 24% 33% 30% Investing More Money 8% 6% 8% 8% 10% 9% 9% Big Ticket Purchases/Expenses Home Improvement Expenses 10% 9% 11% 8% 10% 10% 10% Recent Purchase of Big Ticket Item(s) 8% 8% 7% 6% 7% 9% 7% Purchased New Home 3% 1% 2% 2% 4% 3% 2% Mortgage/Home Equity Costs Mortgage Payment Increased 3% 3% 3% 3% 4% 4% 3% Home Equity Loan Payment Increased 1% 1% 1% 1% 1% 2% 1% Other Reduced Income 36% 39% 36% 36% 38% 46% 46% Value of Home Decreased 11% 10% 13% 9% 9% 12% 12% Traveling Less 9% 12% 9% 7% 10% 12% 12%

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 21 ChangeWave Research: Consumer Spending Secondly, the percentage who say they’re worried about someone in their family losing their job (31%) – while still high – has barely budged over the past two months (up only 1-pt).

How much do you worry that you or someone in your family may lose their job because of layoffs, closings, downsizing or other company cutbacks? Do you worry about this a great deal, quite a bit, only a little or not at all?

Current Previous Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey Survey Aug ‘11 Jul ‘11 Jun ‘11 May ‘11 Apr ‘11 Aug ‘10 Jul ‘10 A Great Deal 9% 8% 10% 8% 8% 8% 10% Quite a Bit 22% 22% 20% 19% 20% 21% 20% Only a Little 43% 45% 45% 49% 43% 45% 45% Not At All 25% 25% 25% 23% 28% 25% 25%

So if neither reduced income nor heightened job loss fears are driving the current downturn, then what explains the dual pullback we’re seeing in consumer confidence and in actual spending behavior?

Stated somewhat differently, could the current consumer downturn be more a result of psychological factors than economic ones?

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 22 ChangeWave Research: Consumer Spending U.S. Debt Reduction and S&P Downgrade are Key Contributing Factors

To find out, we asked respondents a series of questions to gauge whether the recent U.S. credit rating downgrade and the debt reduction controversy has had any impact on their spending behavior.

Standard & Poor’s recently announced they had lowered the U.S. credit rating from AAA to AA+, stating that the recent debt-reduction bill did not go far enough to improve the government’s fiscal situation.

Has this development made you more likely to Increase your spending for the next 90 days, more likely to Decrease your spending, or is it having No Impact on your spending for the next 90 days?

Current Survey Aug ‘11 More Likely to Decrease Spending for Next 90 Days Because of 47% the U.S. Credit Downgrade More Likely to Increase Spending for Next 90 Days Because of 1% the U.S. Credit Downgrade No Impact on My Spending for Next 90 Days 48% Don’t Know 4% * Note this question was asked of consumers who participated in the survey from August 8-11 – after S&P announced its lowering of the U.S. credit rating.

In a clear sign of the psychological impact that the U.S. credit downgrade has had on consumers, nearly one-in-two (47%) say they’re more likely to Decrease spending for the next 90 days because of the S&P downgrade.

With the U.S. government debt reduction impasse finally resolved, has it made you more likely to Increase your spending for the next 90 days, more likely to Decrease your spending, or is it having no impact on your spending for the next 90 days? Current Survey Aug ‘11 More Likely to Decrease Spending for Next 90 Days 35% Because Debt Reduction Impasse was Resolved More Likely to Increase Spending for Next 90 Days Because Debt 0% Reduction Impasse was Resolved No Impact on My Spending for Next 90 Days 63% Don’t Know 1%

Similarly, the debt reduction controversy in Washington has had a huge impact on consumer spending behavior. Better than one-in-three respondents (35%) report they’re more likely to Decrease spending for the next 90 days because of the debt reduction controversy – even though Congress has already at least temporarily resolved the issue.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 23 ChangeWave Research: Consumer Spending (E) Retailer Trends

Major Retailer Trends

Going forward, Mall retailers like Macy’s (M; -3 pts), Nordstrom (JWN; -3 pts) and JCPenney (JCP; -3 pts) look like they’re being hardest hit by the slowdown in consumer spending, while Discounters like Costco (COST; unchanged), Walmart (WMT; unchanged) and Target (TGT; +1 pt) appear relatively unscathed.

Here’s a look at the spending picture for Target, Costco and Walmart over the past two years of ChangeWave surveys:

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 24 ChangeWave Research: Consumer Spending We want to learn more about how consumers will be spending their shopping dollars over the next 90 days. For each of the following stores, please tell us if you will be spending more money, about the same amount, or less money over the next 90 days compared with the previous 90 days. Year- Monthly Same Less Net to-Year More Change Amount No Mone Scor Chang Money From of Money y e e From Jul ‘11 Money Aug ‘10 Target 8% 11% -3 +1 +1 47% 28% Walmart 9% 11% -2 0 -3 51% 24% Costco 9% 6% +3 0 -3 36% 43% Sam’s Club 4% 4% 0 0 -1 21% 64% Bloomingdale’s 1% 3% -2 0 0 4% 84% Sears 2% 11% -9 0 0 24% 54% BJ’s Wholesale 1% 2% -1 -1 0 7% 81% Club Ross 2% 4% -2 -1 -1 12% 74% T.J. Maxx 2% 6% -4 -1 -1 17% 65% Dillard’s 1% 5% -4 -1 -1 9% 77% Bed, Bath, & 3% 9% -6 -2 -2 27% 53% Beyond JC Penney 2% 10% -8 -3 -2 23% 57% Kohl’s 4% 9% -5 -2 NA 30% 48% K-Mart 1% 7% -6 -1 -1 17% 66% Nordstrom 1% 7% -6 -3 -2 13% 70% Macy’s 2% 11% -9 -3 -3 25% 54%

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 25 ChangeWave Research: Consumer Spending Back to School Outlook

The ChangeWave survey points to a modest Back to School season at best. Among those doing Back to School shopping, 29% say they’ll spend More Money than last year and 17% Less – for a net change score of +12. But those results are down 2-pts from a year ago and are 3-pts lower than in August 2009.

Do you think you (and your family) will be spending more money on "Back to School" shopping this year, less money, or about the same amount of money this year compared to last year?

Previou Previou Previou Current s s s Survey Survey Survey Survey Aug ‘11 Aug ‘10 Aug ‘09 Aug ‘08 More Money on Back to School 29% 34% 35% 32% Shopping Than Last Year Less Money on Back to School 17% 20% 20% 21% Shopping Than Last Year About the Same Amount of 51% 44% 44% 47% Money as Last Year Don't Know 2% 1% 0% 1%

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 26 ChangeWave Research: Consumer Spending For those who are spending MORE money on "Back to School" shopping this year compared to last year, what are the top one or two reasons why?

And for those who are spending LESS money on "Back to School" shopping this year compared to last year, what are the top one or two reasons why?

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 27 ChangeWave Research: Consumer Spending (F) Home Entertainment Shopping We also asked respondents where they’d be shopping for home entertainment and computer/ networking products over the next 90 days. Over the next 90 days, which of the following stores do you think you and your family will shop at for home entertainment and computer/ networking products? (Choose No More Than Three) Current Previous Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey Survey Aug ‘11 Jul ‘11 Jun ‘11 May ‘11 Apr ‘11 Aug ‘10 Jul ‘10 Amazon 38% 32% 36% 36% 36% 31% 26% Best Buy 32% 31% 33% 35% 34% 38% 34% Costco 21% 20% 21% 22% 22% 22% 20% Apple 19% 17% 17% 17% 18% 14% 14% Walmart 13% 12% 12% 12% 13% 15% 14% Staples 9% 9% 10% 9% 9% 9% 9% Fry's Electronics 8% 8% 8% 8% 8% 8% 9% Newegg 8% 5% 7% 7% 7% 7% 6% Sam's Club 7% 8% 6% 8% 6% 8% 8% eBay 6% 6% 7% 7% 6% 7% 7% Office Depot 5% 5% 6% 5% 6% 6% 6% TigerDirect 6% 5% 6% 5% 5% 6% 5% Target 4% 5% 4% 5% 5% 5% 5% FutureShop 3% 3% 3% 3% 3% 3% 3% Micro Center 3% 2% 3% 3% 3% 3% 3% OfficeMax 3% 2% 3% 3% 3% 3% 3% BJ's Wholesale Club 2% 2% 2% 2% 2% 2% 2% Buy.com 3% 3% 3% 3% 3% 3% 3% Dell Online 2% 3% 3% 3% 3% 4% 4% Radio Shack 2% 2% 2% 2% 2% 2% 2% Other 6% 6% 5% 6% 5% 6% 5% Home Entertainment Retailers. In some of the most positive findings of the survey, Amazon (AMZN) and Apple (AAPL) appear set to outperform going forward – with both hitting new highs in the home entertainment market, even as other major retailers appear likely to struggle.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 28 ChangeWave Research: Consumer Spending For Amazon it’s their biggest consumer spending uptick in a year, with 38% saying they’ll shop there for home entertainment and computer networking products in the next 90 days – a 6-pt jump since July and their highest level ever in a ChangeWave survey.

Apple (19%) has also hit a new all-time high in the home entertainment and computer networking market – up 2-pts from July.

The August findings remain grim for Best Buy (BBY; 32%). After falling 4-pts over the past two surveys they are up just 1-pt from their lowest level ever in a ChangeWave survey.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 29 ChangeWave Research: Consumer Spending (G) Impact of the Economy on Investors

We also asked respondents about their investing plans going forward, and find that the rate of money outflow from U.S. Stocks (-16; down 9-pts) has accelerated since July. Non-U.S. Stocks (-2; down 3-pts) are experiencing a net money outflow as well. In light of recent events, will you be investing more money or less money going forward in each of the following vehicles?

Here’s the complete breakdown: Chang Same More Less Net e Amoun No Money Money Score in Net t of Money Score Money Gold 20% 4% +16 +5 22% 44% Going to Cash 22% 7% +15 +5 32% 25% Short-Side Investments 14% 4% +10 +5 16% 53% (stocks, ETFs, etc.) Money Market Funds 8% 10% -2 +4 31% 39% Other Commodities 12% 4% +8 +2 20% 50% Currencies 5% 3% +2 +1 11% 67% Equity Options 8% 8% 0 +1 17% 56% Bonds 4% 10% -6 +1 23% 51% High-Yield/ Income/ Dividend 17% 4% +13 0 25% 42% Focused Vehicles Real Estate 7% 5% +2 0 18% 57% ETFs 12% 9% +3 0 33% 35% CDs (Certificates of Deposit) 2% 6% -4 0 13% 64% Index Options 4% 6% -2 -1 13% 63% Mutual Funds 4% 11% -7 -1 33% 42% Non-U.S. Stocks 14% 16% -2 -3 37% 24% U.S. Stocks 12% 28% -16 -9 42% 13%

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 30 ChangeWave Research: Consumer Spending ChangeWave Research Methodology

This report presents the findings of a recent ChangeWave survey on consumer spending patterns. The survey was conducted between August 1 – 11, 2011. A total of 2,517 U.S. respondents participated in the survey.

ChangeWave's proprietary research and business intelligence gathering system is based upon the systematic gathering of valuable business and investment information directly over the Internet from accredited members.

The Research Network is assembled from senior technology and business executives in leading companies of select industries. Nearly half of members (48%) have advanced degrees (e.g., Master's or Ph.D.) and 86% have at least a four-year bachelor's degree.

The business and investment intelligence provided by ChangeWave provides a real-time view of companies, technologies and business trends in key market sectors, along with an in-depth perspective of the macro economy – well in advance of other available sources.

About ChangeWave Research ChangeWave Research, an independent division of The 451 Group, is a survey research firm that identifies and quantifies change in corporate buying & business trends, telecom trends, and consumer spending & electronics trends. The ChangeWave Research Network is a group of 25,000 highly qualified business, technology, and medical professionals – as well as early adopter consumers – who work in leading companies of select industries. ChangeWave surveys its Network members weekly on a range of business and consumer topics, and converts the information into a series of proprietary quantitative and qualitative reports.

ChangeWave delivers its products and services on the Web at www.ChangeWaveResearch.com. ChangeWave Research does not make any warranties, express or implied, as to results to be obtained from using the information in this report. Investors should obtain individual financial advice based on their own particular circumstances before making any investment decisions based upon information in this report. About The 451 Group The 451 Group is a leading technology-industry analyst company focused on the business of enterprise IT innovation. The company's analysts provide critical and timely insight into the market and competitive dynamics of innovation in emerging technology segments. The 451 Group is headquartered in New York, with offices in key locations, including San Francisco, Washington, DC, London, Boston, Seattle and Denver. For additional information on The 451 Group, go to: www.the451group.com. For More Information: ChangeWave Research Telephone: 301-250-2363 7101 Wisconsin Ave. Fax: 301-926-8413 Suite 1350 www.ChangeWaveResearch.com Bethesda, MD 20814 [email protected]

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 31 ChangeWave Research: Consumer Spending

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. 32