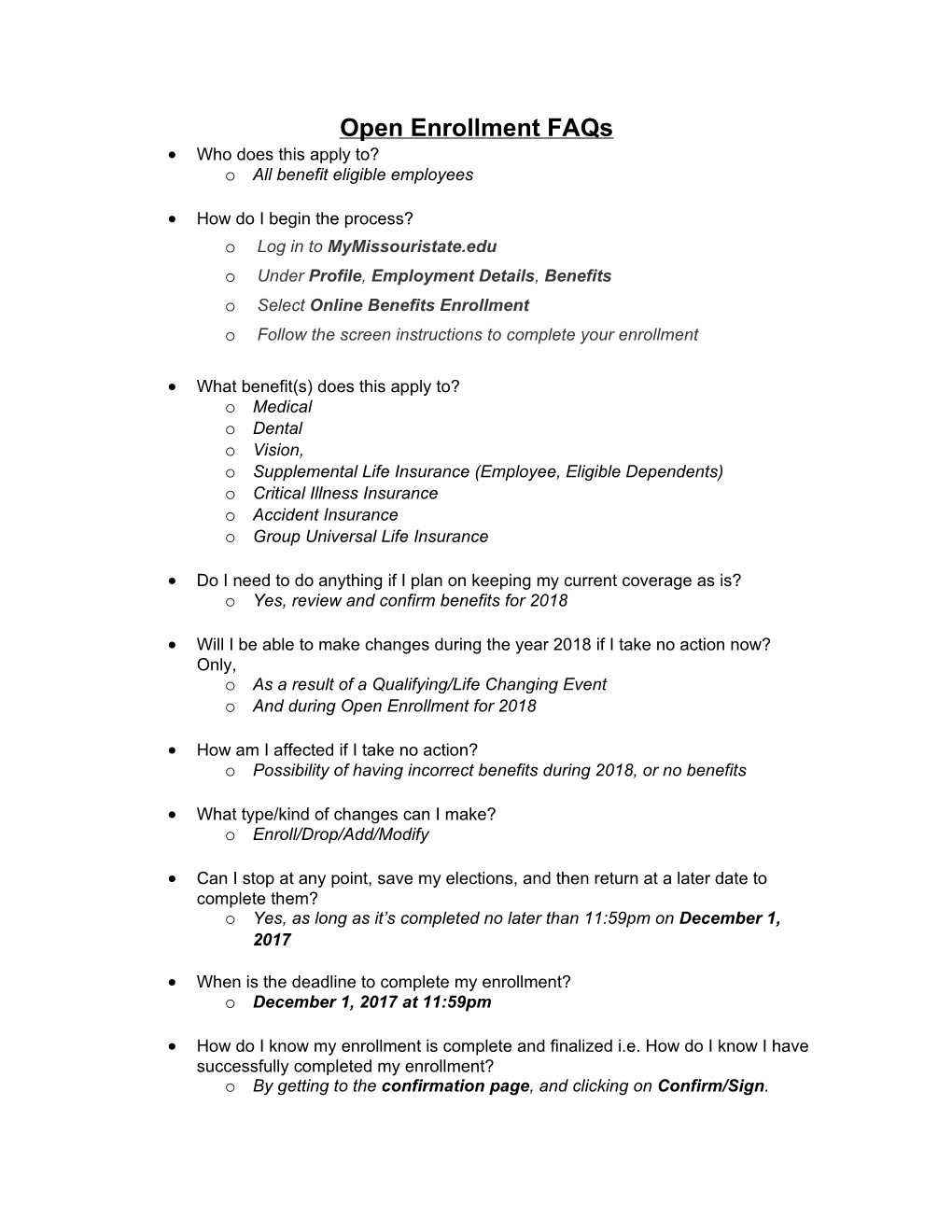

Open Enrollment FAQs Who does this apply to? o All benefit eligible employees

How do I begin the process? o Log in to MyMissouristate.edu o Under Profile, Employment Details, Benefits o Select Online Benefits Enrollment o Follow the screen instructions to complete your enrollment

What benefit(s) does this apply to? o Medical o Dental o Vision, o Supplemental Life Insurance (Employee, Eligible Dependents) o Critical Illness Insurance o Accident Insurance o Group Universal Life Insurance

Do I need to do anything if I plan on keeping my current coverage as is? o Yes, review and confirm benefits for 2018

Will I be able to make changes during the year 2018 if I take no action now? Only, o As a result of a Qualifying/Life Changing Event o And during Open Enrollment for 2018

How am I affected if I take no action? o Possibility of having incorrect benefits during 2018, or no benefits

What type/kind of changes can I make? o Enroll/Drop/Add/Modify

Can I stop at any point, save my elections, and then return at a later date to complete them? o Yes, as long as it’s completed no later than 11:59pm on December 1, 2017

When is the deadline to complete my enrollment? o December 1, 2017 at 11:59pm

How do I know my enrollment is complete and finalized i.e. How do I know I have successfully completed my enrollment? o By getting to the confirmation page, and clicking on Confirm/Sign. I’m a recent new hire who has gone through enrolling in my benefits. Do I still need to go through this process again? o Yes, in order to maintain your current benefits.

If I have questions/issues, whom do I contact? o HR – 417.836.5102, 8am – 5pm, Mon - Fri o Call Center –877.282.0808 - 7am – 4pm, Mon - Fri o Email – [email protected] o Paula Huey, Denise Lofton, and Michel Bampoe

What about the Cafeteria Plan, where do I go to complete that enrollment? Go to www.asiflex.com/missouristate Click on the Enrollment tab at the top of the screen, Click on "Click here to begin your Online Open Enrollment Session!” New for the 2018 benefit plan year, you may elect to receive an ASIFlex debit card for use in paying for qualified health, dental, and vision care expenses.

Can I increase my Life Insurance? o Yes, you can increase by one level as long as it is not over the guaranteed issue. .

What and where can I find rates? o Medical Coverage You Pay MSU Pays Employee Only $30 $418.16 Employee/Spouse $350.91 $553.16 Employee/Children $252.89 $418.16 Family $393.20 $553.16 o Dental Coverage You Pay MSU Pays Employee Only $0 $33.03 Employee/Spouse $27.25 $33.03 Employee/Children $21.22 $33.03 Family $42.78 $33.03

o Vision (VSP) Coverage You Pay MSU Pays Employee Only $7.65 $0 Employee/Spouse $14.95 $0 Employee/Children $16.05 $0 Family $23.85 $0 o Life Insurance Age Cost per Age Brackets Cost per $1000 Brackets $1000 Less $0.04 50-54 $0.22 than age 30 30-34 $0.05 55-59 $0.42 35-39 $0.07 60-64 $0.65 40-44 $0.09 65-69 $1.26 45-49 $0.14 70 and older* $1.83

o Dependent Life Options Spouse Coverage/Child(ren Monthly Cost ) Option 1 $10,000 Child(ren): $5,000 $1.15 Option 2 $20,000 Child(ren): $10,000 $2.30 Option 3 $30,000 Child(ren): $20,000 $3.90 Option 4 $40,000 Child(ren): $20,000 $8.70 Option 5 $50,000 Child(ren): $20,000 $13.70

o Critical Illness (Non – Tobacco User) – Low Plan ($10,000) Ages Employee Employee/Spouse Employee/Children Family 18-35 $11.92 $20.14 $11.92 $20.14 36-50 $21.82 $34.99 $21.82 $34.99 51-60 $40.22 $62.59 $40.22 $62.59 61-63 $60.42 $92.89 $60.42 $92.89 64+ $86.72 $132.34 $86.72 $132.34 (Tobacco User) Low Plan($10,000) Ages Employee Employee/Spouse Employee/Childre Family n 18-35 $16.02 $26.29 $16.02 $26.29 36-50 $33.12 $51.94 $33.12 $51.94 51-60 $63.72 $97.84 $63.72 $97.84 61-63 $90.22 $137.59 $90.22 $137.59 64+ $130.92 $198.64 $130.92 $198.64

(Non-Tobacco User) – High Plan ($20,000) Ages Employee Employee/Spouse Employee/Children Family 18-35 $17.31 $28.23 $17.31 $28.23 36-50 $37.12 $57.94 $37.12 $57.94 51-60 $73.94 $113.16 $73.94 $113.16 61-63 $114.33 $173.75 $114.33 $173.75 64+ $166.91 $252.63 $166.91 $252.63

(Tobacco User) – High Plan ($20,000) Ages Employee Employee/Spouse Employee/Children Family 18-35 $25.50 $40.52 $25.50 $40.52 36-50 $59.70 $91.82 $59.70 $91.82 51-60 $120.94 $183.66 $120.94 $183.66 61-63 $173.94 $263.16 $173.94 $263.16 64+ $255.32 $385.24 $255.32 $385.24

o Accident insurance Mode Plan Employee Employee/Spouse Employee/Children Family Monthly Low $17.99 $33.86 $36.84 $44.89 High $24.67 $47.22 $51.68 $63.45

Have there been any rate increases for 2018? o No

Group Universal Life Insurance o Visit GUL page for rates