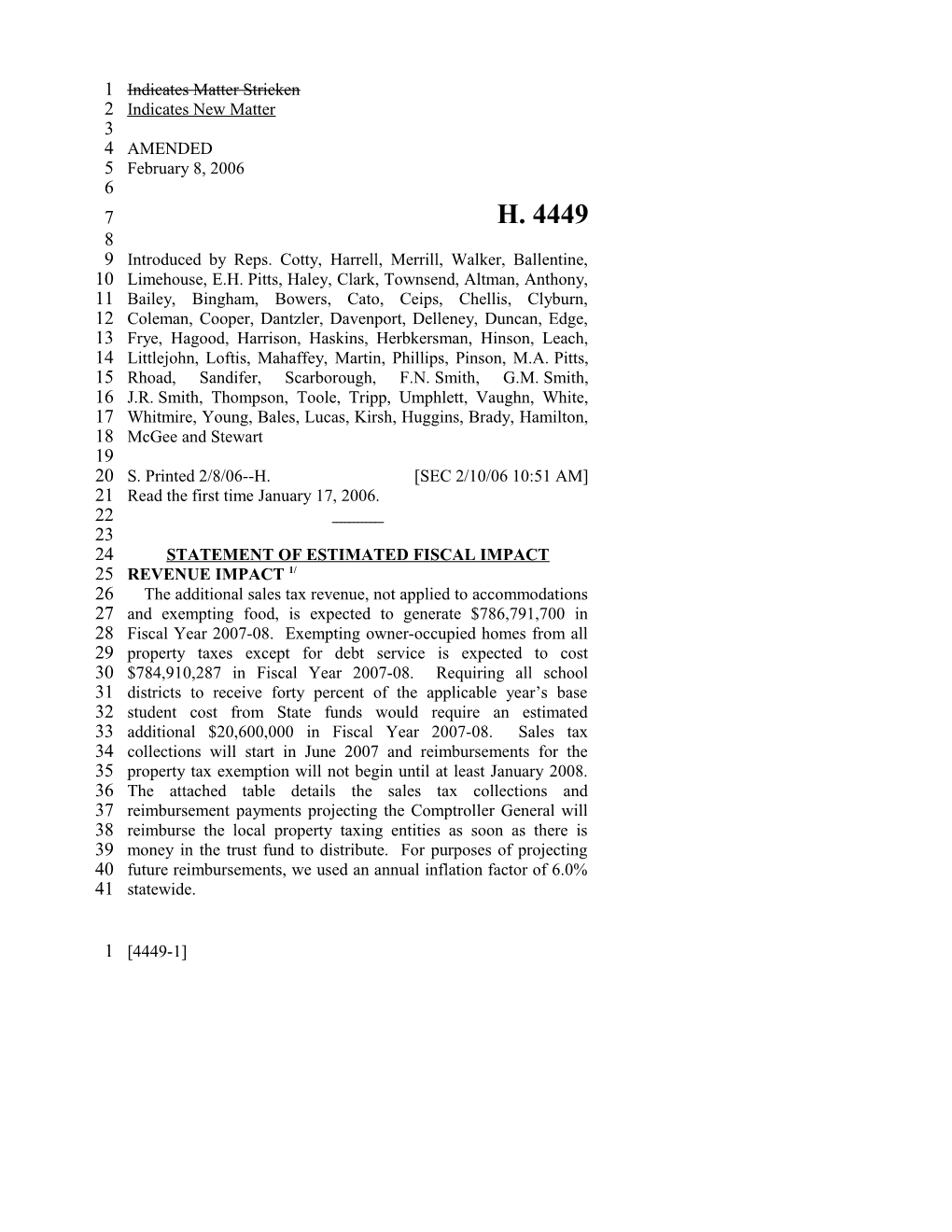

1 Indicates Matter Stricken 2 Indicates New Matter 3 4 AMENDED 5 February 8, 2006 6 7 H. 4449 8 9 Introduced by Reps. Cotty, Harrell, Merrill, Walker, Ballentine, 10 Limehouse, E.H. Pitts, Haley, Clark, Townsend, Altman, Anthony, 11 Bailey, Bingham, Bowers, Cato, Ceips, Chellis, Clyburn, 12 Coleman, Cooper, Dantzler, Davenport, Delleney, Duncan, Edge, 13 Frye, Hagood, Harrison, Haskins, Herbkersman, Hinson, Leach, 14 Littlejohn, Loftis, Mahaffey, Martin, Phillips, Pinson, M.A. Pitts, 15 Rhoad, Sandifer, Scarborough, F.N. Smith, G.M. Smith, 16 J.R. Smith, Thompson, Toole, Tripp, Umphlett, Vaughn, White, 17 Whitmire, Young, Bales, Lucas, Kirsh, Huggins, Brady, Hamilton, 18 McGee and Stewart 19 20 S. Printed 2/8/06--H. [SEC 2/10/06 10:51 AM] 21 Read the first time January 17, 2006. 22 23 24 STATEMENT OF ESTIMATED FISCAL IMPACT 25 REVENUE IMPACT 1/ 26 The additional sales tax revenue, not applied to accommodations 27 and exempting food, is expected to generate $786,791,700 in 28 Fiscal Year 2007-08. Exempting owner-occupied homes from all 29 property taxes except for debt service is expected to cost 30 $784,910,287 in Fiscal Year 2007-08. Requiring all school 31 districts to receive forty percent of the applicable year’s base 32 student cost from State funds would require an estimated 33 additional $20,600,000 in Fiscal Year 2007-08. Sales tax 34 collections will start in June 2007 and reimbursements for the 35 property tax exemption will not begin until at least January 2008. 36 The attached table details the sales tax collections and 37 reimbursement payments projecting the Comptroller General will 38 reimburse the local property taxing entities as soon as there is 39 money in the trust fund to distribute. For purposes of projecting 40 future reimbursements, we used an annual inflation factor of 6.0% 41 statewide.

1 [4449-1] 1 Explanation 2 The following sections of the bill have an impact on State or 3 local revenue. 4 Section 12-36-1110 5 This bill would add Section 12-36-1110 imposing an additional 6 sales and use tax equal to two percent on all taxable items pursuant 7 to Chapter 36; however, the additional sales tax does not apply to 8 the statewide accommodations tax. The additional sales tax is not 9 expected to be implemented until after May 2007 because it 10 becomes effective after ratification of the referendum when the 11 General Assembly returns in early 2007. The additional two cents 12 of sales and use tax is expected to raise an estimated 13 $1,302,000,000 in FY2007-08. Excluding the accommodations tax 14 from the additional sales tax would amount to an estimated 15 reduction of $42,570,700 in FY2007-08. The net effect would be 16 an estimated increase of $1,259,429,300 in FY2007-08. 17 Section 12-36-2120 18 This bill would add an appropriately numbered item at the end 19 of Section 12-36-2120 to exempt unprepared food which lawfully 20 may be purchased with United States Department of Agriculture 21 food coupons. This exemption would not apply to any local sales 22 and use tax imposed or enacted before May 31 of the year this item 23 takes effect. Exempting the sales tax currently collected on food 24 would cost $337,598,300 in Fiscal Year 2007-08. Exempting food 25 from the additional two percent sales tax imposed in Section 12- 26 36-110 would cost an additional $135,039,300 in Fiscal Year 27 2007-08. 28 SECTION 3 Section 12-37-220(B) 29 This Section, beginning with the tax year in which this item 30 takes effect, exempts one hundred percent of the fair market value 31 of owner-occupied residential property from all property taxes 32 imposed for everything except for property taxes imposed for the 33 repayment of general obligation debt. We estimate this will 34 exempt $784,910,287 of property taxes that would have been paid 35 on owner-occupied homes at the end of Tax Year 2007 which 36 corresponds to Fiscal Year 2007-08. This property is considered 37 taxable property for purposes of bonded indebtedness. 38 Section 12-37-932 39 This Section of the bill would change the way property is 40 assessed in this State from the five year reassessment cycle to 41 modifying the fair market value of real property only when 42 transferred, sold or improved with some exceptions. The ‘base 43 year’ for establishing fair market value is defined as the value for

1 [4449-2] 1 property tax year 2006. According to the Department of 2 Revenue’s County Reassessment Schedule, Chester, Lancaster and 3 McCormick are the only counties scheduled to implement 4 reassessment programs in Tax Year 2006. This is not expected to 5 have any significant impact on local property tax revenue in the 6 first year. Over time, this change in the way property is assessed 7 could change the incidence of taxation that would occur under 8 current law by shifting property taxes within and among all the 9 classes of property. 10 Part II Section 1 11 (A) (1) For the period January through December 2007, property 12 taxing entities other than school districts will be reimbursed dollar 13 for dollar for the exempt owner-occupied property. These 14 reimbursements will be made by the Comptroller General on or 15 after January 1, 2008 upon application of the property taxing 16 entity. These applications for reimbursement are expected to total 17 $372,910,488 in Fiscal Year 2007-08. 18 (2) Beginning January 1, 2008 property taxing entities other 19 than school districts will be reimbursed the amount they received 20 in the previous year plus the annual reimbursement increase. Each 21 entity will receive from the reimbursement increase their 22 percentage of total dollars they received from the previous year. 23 (B)(1) For the period January through December 2007, school 24 districts will be reimbursed dollar for dollar for the exempt owner- 25 occupied property. These reimbursements will be made by the 26 Comptroller General on or after January 1, 2008 upon application 27 of the school districts. These applications for reimbursement are 28 expected to total $498,595,679 in Fiscal Year 2007-08. 29 (2) Beginning January 1, 2008 school districts will be 30 reimbursed the amount they received in the previous year plus the 31 annual reimbursement increase. Each entity will receive from the 32 reimbursement increase their percentage of weighted pupil units 33 applied to the reimbursement increase. 34 (C) Beginning with the 2008 reimbursements, all property 35 taxing entities reimbursements must be increased on an annual 36 basis by an inflation factor. This inflation factor will be defined as 37 the increase in the Southeast Region Consumer Price Index plus 38 the increase in population. Overall, the Southeastern CPI 39 increased by 3.6% from Calendar year 2004 to Calendar year 40 2005. The average population growth statewide has been 1.4% per 41 year.

1 [4449-3] 1 Section 3 2 If revenues in the Homestead Exemption Fund are insufficient to 3 pay all reimbursements required by law, the difference must be 4 paid by the state general fund. 5 Section 4-9-56 6 This section, beginning in 2007, allows a property taxing entity 7 to increase millage for general operating purposes by a factor equal 8 to the percentage increase in the previous year of the Consumer 9 Price Index, Southeast Region, plus the percentage increase in 10 population. Any millage above this would require a supermajority 11 vote of seventy-five percent of the total membership of the 12 governing body of the entity. Overall, the Southeastern CPI 13 increased by 3.6% from Calendar year 2004 to Calendar year 14 2005. The average population growth statewide has been 1.4% per 15 year. 16 Part III Section 2 Section 12-37-670 17 This section allows a county by ordinance to require an owner of 18 land on which a new structure has been erected and which has not 19 been appraised for taxation to list the new structure for taxation 20 with the county auditor by the first day on the next month after a 21 certificate of occupancy is issued for the structure. Additional 22 property tax attributable to improvements listed on or before June 23 30th is due for July to December 31 for that property tax year. This 24 bill would change the schedule of how property taxes are paid and 25 could generate a $19 million one-time windfall of property taxes in 26 the first year if all counties adopted an ordinance allowed pursuant 27 to this section. 28 Section 5 Section 59-20-22 29 This section would require all school districts to receive forty 30 percent of the applicable year’s base student cost from state funds. 31 Bringing all school districts to forty percent will require an 32 additional $20,600,000 in Fiscal Year 2007-08. 33 34 Approved By: 35 William C. Gillespie 36 Board of Economic Advisors 37 38 1/ This statement meets the requirement of Section 2-7-71 for a state revenue 39 impact by the BEA, or Section 2-7-76 for a local revenue impact or Section 6-1- 40 85(B) for an estimate of the shift in local property tax incidence by the Office of 41 Economic Research. 42

1 [4449-4] 1 Projected Owner-Occupied Projected Applications 2 County and Other for Reimbursements 3 Operations Property by County and Other 4 Tax Collections for the Exempted 5 Under Taxes on Operations 6 Current Law for Homes 7 FY 2007 Dollar for Dollar 8 FY 2008 9 10 ABBEVILLE 1,468,628 1,630,655 11 AIKEN 11,222,563 12,460,701 12 ALLENDALE 245,443 272,521 13 ANDERSON 11,462,439 12,727,042 14 BAMBERG 635,562 705,681 15 BARNWELL 863,671 958,956 16 BEAUFORT 17,438,669 19,362,605 17 BERKELEY 6,527,782 7,247,965 18 CALHOUN 645,192 716,373 19 CHARLESTON 40,334,259 44,784,169 20 CHEROKEE 3,832,025 4,254,797 21 CHESTER 1,364,101 1,514,597 22 CHESTERFIELD 1,299,737 1,443,131 23 CLARENDON 1,620,658 1,799,459 24 COLLETON 997,507 1,107,558 25 DARLINGTON 2,046,500 2,272,282 26 DILLON 760,545 844,453 27 DORCHESTER. 9,272,569 10,295,573 28 EDGEFIELD 1,385,955 1,538,862 29 FAIRFIELD 1,265,893 1,405,553 30 FLORENCE 6,416,508 7,124,414 31 GEORGETOWN 5,238,545 5,816,492 32 GREENVILLE 41,336,266 45,896,724 33 GREENWOOD 4,063,903 4,512,256 34 HAMPTON 718,601 797,882 35 HORRY 16,108,004 17,885,133 36 JASPER 1,333,501 1,480,620 37 KERSHAW 3,596,398 3,993,174 38 LANCASTER 3,448,303 3,828,740 39 LAURENS 2,617,201 2,905,946 40 LEE 921,410 1,023,065 41 LEXINGTON 32,375,049 35,946,854 42 MCCORMICK 294,275 326,741 43 MARION 1,598,579 1,774,943

1 [4449-5] 1 MARLBORO 1,131,690 1,256,544 2 NEWBERRY 2,253,295 2,501,892 3 OCONEE 5,212,543 5,787,621 4 ORANGEBURG 4,236,300 4,703,673 5 PICKENS 5,786,316 6,424,696 6 RICH LAND 34,222,608 37,998,245 7 SALUDA 928,271 1,030,684 8 SPARTANBURG 20,388,696 22,638,096 9 SUMTER 6,336,144 7,035,184 10 UNION 1,085,420 1,205,170 11 WILLIAMSBURG 503,185 558,699 12 YORK 19,016,099 21,114,066 13 TOTAL 335,856,807 372,910,488 14 15 16 17 Projected Owner-Occupied Projected Applications 18 School for Reimbursements 19 Operations Property by School Districts 20 Tax Collections for the Exempted 21 Under Taxes on Operations 22 Current Law for Homes 23 FY 2007 Dollar for Dollar 24 FY 2008 25 26 ABBEVILLE 60 1,853,336 2,057,806 27 AIKEN 01 15,042,200 16,701,743 28 ALLENDALE 01 311,589 345,966 29 ANDERSON 01 4,708,706 5,228,198 30 ANDERSON 02 2,563,282 2,846,078 31 ANDERSON 03 1,079,261 1,198,331 32 ANDERSON 04 3,042,733 3,378,425 33 ANDERSON 05 8,545,147 9,487,897 34 BAMBERG 01 397,638 441,508 35 BAMBERG 02 337,791 375,058 36 BARNWELL 19 339,100 376,512 37 BARNWELL 29 103,739 115,185 38 BARNWELL 45 563,608 625,788 39 BEAUFORT 01 21,277,784 23,625,274 40 BERKELEY 01 13,852,585 15,380,883 41 CALHOUN 01 492,158 546,456 42 CHARLESTON 01 53,188,457 59,056,518 43 CHEROKEE 01 5,926,098 6,579,899

1 [4449-6] 1 CHESTER 01 1,812,320 2,012,265 2 CHESTERFIELD 01 2,299,593 2,553,298 3 CLARENDON 01 577,689 641,423 4 CLARENDON 02 1,210,081 1,343,584 5 CLARENDON 03 530,798 589,359 6 COLLETON 01 502,084 557,477 7 DARLINGTON 01 2,864,428 3,180,449 8 DILLON 01 177,874 197,498 9 DILLON 02 446,826 496,122 10 DILLON 03 250,340 277,959 11 DORCHESTER 02 9,878,625 10,968,493 12 DORCHESTER 04 692,922 769,369 13 EDGEFIELD 01 2,025,405 2,248,860 14 FAIRFIELD 01 1,135,506 1,260,782 15 FLORENCE 01 10,444,737 11,597,061 16 FLORENCE 02 323,903 359,638 17 FLORENCE 03 320,513 355,874 18 FLORENCE 04 180,910 200,869 19 FLORENCE 05 254,631 282,723 20 GEORGETOWN 01 6,585,692 7,312,264 21 GREENVILLE 01 45,575,443 50,603,592 22 GREENWOOD 50 4,545,280 5,046,742 23 GREENWOOD 51 560,131 621,928 24 GREENWOOD 52 360,836 400,645 25 HAMPTON 01 503,545 559,099 26 27 28 29 Projected Owner-Occupied Projected Applications 30 School for Reimbursements 31 Operations Property by School Districts 32 Tax Collections for the Exempted 33 Under Taxes on Operations 34 Current Law for Homes 35 FY 2007 Dollar for Dollar 36 FY 2008 37 HAMPTON 02 200,234 222,325 38 HORRY 01 17,080,307 18,964,707 39 JASPER 01 1,231,133 1,366,959 40 KERSHAW 01 4,782,527 5,310,164 41 LANCASTER 01 4,407,039 4,893,249 42 LAURENS 55 2,474,180 2,747,146 43 LAURENS 56 1,107,844 1,230,067

1 [4449-7] 1 LEE 01 597,233 663,124 2 LEXINGTON 01 22,319,133 24,781,510 3 LEXINGTON 02 1,913,726 2,124,859 4 LEXINGTON 03 1,330,189 1,476,943 5 LEXINGTON 04 1,469,015 1,631,085 6 LEXINGTON 05 23,965,898 26,609,955 7 MCCORMICK 01 981,530 1,089,818 8 MARION 01 97,246 107,973 9 MARION 02 113,315 125,816 10 MARION 07 321,199 356,636 11 MARLBORO 01 686,707 762,469 12 NEWBERRY 01 2,157,917 2,395,991 13 OCONEE 01 6,030,652 6,695,988 14 ORANGEBURG 03 1,539,851 1,709,736 15 ORANGEBURG 04 922,498 1,024,273 16 ORANGEBURG 05 2,543,103 2,823,673 17 PICKENS 01 6,409,656 7,116,806 18 RICHLAND 01 23,728,004 26,345,816 19 RICHLAND 02 26,104,392 28,984,381 20 SALUDA 01 937,522 1,040,955 21 SPARTANBURG 01 4,327,701 4,805,158 22 SPARTANBURG 02 5,743,320 6,376,956 23 SPARTANBURG 03 1,025,667 1,138,824 24 SPARTANBURG 04 1,179,785 1,309,945 25 SPARTAN BURG 05 4,453,399 4,944,723 26 SPARTAN BURG 06 6,104,755 6,778,267 27 SPARTANBURG 07 6,388,242 7,093,030 28 SUMTER 02 3,263,086 3,623,089 29 SUMTER 17 3,042,355 3,378,005 30 UNION 01 510,920 567,288 31 WILLIAMSBURG 01 100,375 111,449 32 YORK 01 3,383,319 3,756,587 33 YORK 02 4,459,282 4,951,256 34 YORK 03 12,897,395 14,320,311 35 YORK 04 9,036,506 10,033,466 36 STATE TOTAL 449,053,481 498,595,679 37 38

1 [4449-8] 65,565,975 131,131,950 196,697,925 262,263,900 327,829,875 Cumulative Total in Fund Revenue Needed to get State Funds toof 40% Base Student Cost 59-20-22 Unpaid Obligation at end of Fiscal Year Reimburse for Owner- Occupied Part II Section 1 Operations on Only Owner-Occupied Homes 12-37-220(B) Property Taxes Paid for 65,565,975 65,565,975 65,565,975 65,565,975 65,565,975 786,791,700 825,503,200 866,119,372 12-36-1110 Additional Sales Tax FY 2007-08 FY 2008-09 FY 2009-10 January-07 February-07 March-07 April-07 May-07 June-07 July-07 August-07 September-07 October-07 November-07 FY 2007-08FY 2007-08FY 2007-08FY 2007-08FY 2007-08FY ] 9

[4449-9] [4449- 1 25,738,323 97,914,938 50,073,346 170,091,552 242,268,166 314,444,781 386,621,395 393,395,850 0 0 0 0 0 0 118,865,280 187,657,213 256,446,146 325,241,080 394,033,013 0 0 0 0 0 0 20,600,000 21,218,000 98,090,204

65,565,975 65,565,975 65,565,975 65,565,975 44,965,975 68,791,934 68,791,933 68,791,933 68,791,934 47,573,933 144,528,495 458,961,825 116,808,791 462,824,946 832,004,904 881,925,198 784,910,287 65,565,975 65,565,975 65,565,975 65,565,975 65,565,975 68,791,933 68,791,933 68,791,933 68,791,933 68,791,933 68,791,933 68,791,933 68,791,933 68,791,933 68,791,933 68,791,933 68,791,933 72,176,614 72,176,614 72,176,614 72,176,614 72,176,614 72,176,614 65,565,975 65,565,975

February-08 March-08 April-08 May-08 June-08 July-08 August-08 September-08 October-08 November-08 December-08 January-09 February-09 March-09 April-09 May-09 June-09 July-09 August-09 September-09 October-09 November-09 December-09 December-07 January-08 FY 2008-09 FY 2008-09 FY 2008-09 FY 2008-09 FY 2008-09FY 2008-09FY 2008-09FY 2008-09FY 2008-09FY 2009-10FY 2009-10FY 2009-10FY 2009-10FY 2009-10FY 2009-10FY FY 2007-08 FY 2007-08 FY 2007-08 FY 2007-08 FY 2007-08 FY 2007-08 FY 2007-08 FY 2008-09 FY 2008-09 FY 2008-09 FY

[4449-10] ] 10 [4449- 1 0 0 0 0 0 0 21,854,540 182,188,861 72,176,615 72,176,614 72,176,614 72,176,615 50,322,074 458,798,009 72,176,614 72,176,614 72,176,614 72,176,614 72,176,614 72,176,614

March-10 April-10 May-10 June-10 786,791,700 786,791,700 116,808,791 825,503,200 825,503,200 January-10 February-10 FY 2007-08 FY Sales Revenue Tax 2007-08 FY Payouts obligationUnpaid 2007- ofat FY end 08 2008-09FY Sales Revenue Tax 2008-09FY Payouts FY 2009-10 FY 2009-10 FY 2009-10 FY 2009-10 FY 2009-10 FY 2009-10 FY ] 11

[4449-11] [4449- 1 866,119,372 866,119,372 182,188,861 144,528,495 Unpaid obligation Unpaid 2009- ofat FY end 10 Unpaid obligation Unpaid 2008- ofat FY end 09 2009-10 FY Sales Revenue Tax 2009-10 FY Payouts ] 12

[4449-12} [4449- 1 2 1 1 2 3 4 5 6 7 8 9 A BILL 10 11 TO AMEND THE CODE OF LAWS OF SOUTH CAROLINA, 12 1976, BY ADDING SECTIONS 12-36-1110, 12-36-1120, AND 13 12-36-1130 SO AS TO IMPOSE AN ADDITIONAL TWO 14 PERCENT SALES AND USE TAX; TO AMEND SECTION 15 12-36-2120, AS AMENDED, RELATING TO SALES TAX 16 EXEMPTIONS, SO AS TO EXEMPT THE SALE OF 17 UNPREPARED FOOD; TO ADD SECTION 11-11-155 SO AS 18 TO CREATE THE HOMESTEAD EXEMPTION FUND AND 19 RESERVE FUND; TO AMEND SECTION 12-37-220, AS 20 AMENDED, RELATING TO PROPERTY TAX EXEMPTIONS, 21 SO AS TO PROVIDE AN ADDITIONAL EXEMPTION EQUAL 22 TO ONE HUNDRED PERCENT OF THE FAIR MARKET 23 VALUE OF OWNER-OCCUPIED RESIDENTIAL PROPERTY 24 FROM THE PROPERTY TAX, AND TO PROVIDE THAT THIS 25 EXEMPTION WITH CERTAIN EXCEPTIONS DOES NOT 26 APPLY WITH RESPECT TO PROPERTY TAX IMPOSED FOR 27 PAYMENT OF GENERAL OBLIGATION DEBT; TO ADD 28 SECTION 12-37-932 SO AS TO PROVIDE THAT THE FAIR 29 MARKET VALUE OF REAL PROPERTY FOR PURPOSES OF 30 THE PROPERTY TAX IS ITS FAIR MARKET VALUE AS 31 APPRAISED IN THE MANNER PROVIDED BY LAW WHEN 32 OWNERSHIP OF THE REAL PROPERTY LAST WAS 33 TRANSFERRED, INCREASED BY THE FAIR MARKET 34 VALUE OF IMPROVEMENTS MADE TO THE REAL 35 PROPERTY SINCE OWNERSHIP OF THE REAL PROPERTY 36 LAST WAS TRANSFERRED, TO PROVIDE THAT ON THE 37 FIRST DAY OF JANUARY IMMEDIATELY FOLLOWING 38 THE EFFECTIVE DATE OF THIS PROVISION THE DUTIES, 39 POWERS, AND FUNCTIONS OF LOCAL COUNTY 40 PROPERTY TAX ASSESSORS ARE TRANSFERRED TO AND 41 DEVOLVED UPON THE PROPERTY TAX DIVISION OF THE 42 STATE DEPARTMENT OF REVENUE, TO PROVIDE THAT

1 [4449] 1 1 THE SALES TAX EXEMPTIONS IN SECTION 12-36-2120 2 SHALL BE REVIEWED BY THE GENERAL ASSEMBLY 3 EVERY TEN YEARS BEGINNING IN 2010; TO AMEND 4 SECTIONS 11-11-150, 12-43-210, AND 12-43-220, ALL AS 5 AMENDED, RELATING TO THE TRUST FUND FOR TAX 6 RELIEF, REASSESSMENT AND THE VALUATION AND 7 CLASSIFICATION OF PROPERTY FOR PURPOSES OF THE 8 PROPERTY TAX, SO AS TO MAKE CONFORMING 9 AMENDMENTS AND OTHER CHANGES TO REFLECT 10 THESE PROVISIONS; TO AMEND ACT 406 OF 2000, 11 RELATING TO, AMONG OTHER THINGS, THE 12 HOMESTEAD EXEMPTION, SO AS TO DELETE AN 13 OBSOLETE PROVISION; TO REPEAL SECTIONS 14 12-37-223A, 12-37-270, 12-43-217, 12-43-250, 12-43-260, AND 15 12-43-295, ALL RELATING TO PROPERTY TAX; TO 16 PROVIDE FOR THE MANNER, AMOUNT, AND 17 CONDITIONS UNDER WHICH REVENUES IN THE 18 HOMESTEAD EXEMPTION FUND SHALL BE DISBURSED 19 TO PROPERTY TAXING ENTITIES OF THIS STATE 20 INCLUDING SCHOOL DISTRICTS TO REIMBURSE THEM 21 FOR THE REVENUE LOST AS A RESULT OF THE 22 PROPERTY TAX EXEMPTIONS; TO PROVIDE THAT LOCAL 23 SALES TAX AND LOCAL OPTION SALES TAX REVENUES 24 PROVIDING PROPERTY TAX RELIEF TO 25 OWNER-OCCUPIED RESIDENTIAL PROPERTY SHALL BE 26 APPLIED FOR PROPERTY TAX RELIEF TO OTHER 27 CLASSES OF PROPERTY; TO ADD SECTION 4-9-56 SO AS 28 TO LIMIT THE MILLAGE PROPERTY TAXING ENTITIES OF 29 THIS STATE MAY IMPOSE ON PROPERTY OTHER THAN 30 OWNER-OCCUPIED RESIDENTIAL PROPERTY, AND TO 31 PROVIDE FOR A SUPERMAJORITY VOTE OF THE 32 GOVERNING BODY OF THE ENTITY TO EXCEED THIS 33 LIMITATION; TO PROVIDE THAT ALL OF THE ABOVE 34 PROVISIONS ARE CONTINGENT UPON RATIFICATION OF 35 CERTAIN CONSTITUTIONAL AMENDMENTS TO ARTICLE 36 X OF THE STATE CONSTITUTION PROVIDING FOR AN 37 ADDITIONAL HOMESTEAD PROPERTY TAX EXEMPTION, 38 DETERMINATION OF FAIR MARKET VALUE OF 39 PROPERTY, AND RELATED MATTERS; TO AMEND 40 SECTIONS 11-27-30, 11-27-40, AND 11-27-50, ALL AS 41 AMENDED, RELATING TO THE EFFECT OF ARTICLE X OF 42 THE SOUTH CAROLINA CONSTITUTION ON BONDS OF 43 THE STATE, POLITICAL SUBDIVISIONS OF THE STATE,

1 [4449] 2 1 AND SCHOOL DISTRICTS, RESPECTIVELY, SO AS TO 2 DEEM AFTER JULY 1, 2006, A COMPLETE OR PARTIAL 3 SUCCESSOR-IN-INTEREST TO, OR OTHER TRANSFEREE 4 OF, OR OTHER ASSOCIATE OF THE STATE, A POLITICAL 5 SUBDIVISION, OR A SCHOOL DISTRICT TO BE THE 6 STATE, POLITICAL SUBDIVISION, OR SCHOOL DISTRICT 7 FOR BONDING PURPOSES WHEN THE SUCCESSOR, 8 TRANSFEREE, OR ASSOCIATE UNDERTAKES ALL OR A 9 PORTION OF THE OPERATION OR ASSUMES ALL OR A 10 PORTION OF A DUTY OF THE STATE, POLITICAL 11 SUBDIVISION, OR SCHOOL DISTRICT; TO AMEND 12 SECTION 12-37-670, RELATING TO LISTING AND 13 ASSESSMENT OF NEW STRUCTURES FOR PROPERTY TAX 14 PURPOSES, SO AS TO AUTHORIZE A COUNTY 15 GOVERNING BODY BY ORDINANCE TO REQUIRE THAT A 16 NEW STRUCTURE BE LISTED BY THE FIRST DAY OF THE 17 MONTH AFTER THE CERTIFICATE OF OCCUPANCY IS 18 ISSUED FOR THE STRUCTURE AND TO PROVIDE FOR THE 19 TIMING OF PAYMENT OF TAXES DUE; TO REPEAL 20 SECTION 12-37-680 RELATING TO A LOCAL COUNTY 21 ORDINANCE ADOPTING THE SAME RULE; TO AMEND 22 SECTION 12-43-215, RELATING TO OWNER-OCCUPIED 23 RESIDENTIAL PROPERTY IN CONNECTION WITH AD 24 VALOREM PROPERTY TAXATION, SO AS TO REQUIRE 25 EACH COUNTY TO SUBMIT AN ANNUAL REPORT TO THE 26 DEPARTMENT OF REVENUE LISTING THE NAMES AND 27 ADDRESSES OF ALL PROPERTY CLASSIFIED AS 28 “OWNER-OCCUPIED”; TO ADD SECTION 59-20-21 SO AS 29 TO PROVIDE THAT BEGINNING WITH THE YEAR 2006, 30 THE STATE BOARD OF EDUCATION, IN DETERMINING 31 THE MINIMUM EDUCATION PROGRAM DESIGNED TO 32 MEET STUDENTS’ NEEDS, MAY ONLY CONSIDER 33 FACTORS REQUIRED BY STATUTORY LAW OR WHICH 34 DIRECTLY AFFECT CLASSROOM LEARNING, AND THE 35 LOCAL MAINTENANCE OF EFFORT REQUIRED OF A 36 SCHOOL DISTRICT MUST BE BASED ON THESE 37 DETERMINATIONS; TO ADD SECTION 59-20-22 SO AS TO 38 PROVIDE THAT NOTWITHSTANDING A SCHOOL 39 DISTRICT’S INDEX OF TAXPAYING ABILITY, THE 40 MINIMUM STATE FUNDS A SCHOOL DISTRICT SHALL 41 RECEIVE IN ANY YEAR IS FORTY PERCENT OF THE 42 APPLICABLE YEAR’S BASE STUDENT COST, AND TO

1 [4449] 3 1 PROVIDE FOR THE MANNER IN WHICH ALL OF THESE 2 PROVISIONS SHALL TAKE EFFECT OR BE REPEALED. 3 Amend Title To Conform 4 5 Be it enacted by the General Assembly of the State of South 6 Carolina: 7 8 Part I 9 10 Property Tax Exemption, Determination of Fair Market Value, and 11 Sales Tax Increase 12 13 SECTION 1. A. Chapter 36, Title 12 of the 1976 Code is 14 amended by adding: 15 16 “Article 11 17 18 Additional Sales, Use, and Casual Excise Tax 19 20 Section 12-36-1110. Beginning on the first day of June of the 21 year in which this section takes effect, an additional sales, use, and 22 casual excise tax equal to two percent is imposed on amounts 23 taxable pursuant to this chapter, except that this additional two 24 percent tax does not apply to amounts taxed pursuant to Section 25 12-36-920, the tax on accommodations for transients, nor does this 26 additional tax apply to items subject to a maximum sales and use 27 tax pursuant to Section 12-36-2110. 28 29 Section 12-36-1120. The revenue of the tax imposed by this 30 article must be credited to the Homestead Exemption Fund 31 established pursuant to Section 11-11-155. 32 33 Section 12-36-1130. The Department of Revenue may 34 prescribe amounts that may be added to the sales price to reflect 35 the additional tax imposed pursuant to this article.” 36 37 B. Section 12-36-2120 of the 1976 Code, as last amended by Act 38 164 of 2005, is further amended by adding an appropriately 39 numbered item at the end to read: 40 41 “( ) unprepared food which lawfully may be purchased with 42 United States Department of Agriculture food coupons, but this 43 exemption does not apply to any local sales and use tax imposed or

1 [4449] 4 1 enacted before May thirty-first of the year in which this item takes 2 effect that is administered by the Department of Revenue which 3 does not contain a specific exemption with respect to food items 4 but does apply to any local sales and use tax imposed or enacted 5 on or after June first of the year in which this item takes effect.” 6 7 C. The provisions of Section 4-10-350(F) and (G) of the 1976 8 Code apply mutatis mutandis with respect to the tax imposed 9 pursuant to Article 11, Chapter 36, Title 12 of the 1976 Code as 10 added by this section. 11 12 SECTION 2. Chapter 11, Title 11 of the 1976 Code is amended 13 by adding: 14 15 “Section 11-11-155. (1) For each fiscal year in which and 16 after which this section takes effect, the revenue from the tax 17 imposed pursuant to Section 12-36-1110, and an amount equal to 18 the total of reimbursements paid pursuant to the provisions of 19 Sections 12-37-251 and 12-37-270 in fiscal year 2005-2006 is 20 automatically credited to a fund separate and distinct from the state 21 general fund known as the ‘Homestead Exemption Fund’. The 22 Board of Economic Advisors shall account for the Homestead 23 Exemption Fund revenue separately from general fund revenues, 24 and the board shall make an annual estimate of the receipts by the 25 Homestead Exemption Fund by February fifteenth of each year. 26 This estimate shall be transmitted to the State Treasurer, 27 Comptroller General, and the Chairmen of the House Ways and 28 Means Committee and the Senate Finance Committee. No portion 29 of these revenues may be credited to the Education Improvement 30 Act (EIA) Fund. 31 (2) There is established in the State Treasury the Homestead 32 Exemption Fund Reserve (Reserve) as a fund separate and distinct 33 from the Homestead Exemption Fund, the general fund of the 34 State, and all other funds. Any revenue received from the 35 imposition of the two percent additional sales and use tax imposed 36 pursuant to Section 12-36-1110 for a fiscal year above what the 37 Board of Economic Advisors estimated for that fiscal year must be 38 transferred into the Reserve. Establishing this Reserve in the 39 required amount is the second priority use of Homestead 40 Exemption Fund revenues in a fiscal year. Balances in the Reserve 41 at the end of a fiscal year remain in this Reserve. If revenues in 42 the Homestead Exemption Fund available for reimbursements in a 43 fiscal year are less than that amount as estimated by the Board of

1 [4449] 5 1 Economic Advisors for the fiscal year, the State Budget and 2 Control Board must first apply so much of the Reserve as is 3 necessary or available to offset the deficit before the balance may 4 be paid from the state general fund. Secondly, to the extent 5 monies are available in the Reserve after any transfers to the 6 Homestead Exemption Fund to offset a deficit, these monies shall 7 then be transferred by the Budget and Control Board to the state 8 general fund to reimburse it for any distributions made to 9 supplement reimbursements required to be made from the 10 Homestead Exemption Fund. 11 (3) An unexpended balance in the Homestead Exemption 12 Fund or Reserve Fund at the end of a fiscal year must remain in the 13 Homestead Exemption Fund or Reserve Fund. 14 (4) Earnings on the Homestead Exemption Fund or Reserve 15 Fund must be credited to the Homestead Exemption Fund or 16 Reserve Fund. 17 (5) Nothing in this section prohibits appropriations by the 18 General Assembly of additional revenues to the Homestead 19 Exemption Fund.” 20 21 SECTION 3. Section 12-37-220(B) of the 1976 Code, as 22 amended by Act 161 of 2005, is further amended by adding a new 23 item at the end appropriately numbered to read: 24 25 “( )(a) Beginning with the year in which this item takes effect 26 and to the extent not already exempt pursuant to Section 27 12-37-250, one hundred percent of the fair market value of 28 owner-occupied residential property eligible for and receiving the 29 special assessment ratio allowed owner-occupied residential 30 property pursuant to Section 12-43-220(c) is exempt from all 31 property taxes imposed for other than the repayment of general 32 obligation debt. 33 (b) Notwithstanding any other provision of law, property 34 exempted from property tax in the manner provided in this item is 35 considered taxable property for purposes of bonded indebtedness 36 pursuant to Sections 14 and 15 of Article X of the Constitution of 37 this State.” 38 39 SECTION 4. Article 5, Chapter 37, Title 12 of the 1976 Code is 40 amended by adding: 41 42 “Section 12-37-932. (A) For determining assessed value of 43 property for purposes of the property tax and notwithstanding any

1 [4449] 6 1 other provision of law, beginning with the year in which this 2 section takes effect the fair market value of real property for 3 purposes of the property tax is its fair market value as appraised in 4 the manner provided by law when ownership of the real property 5 last was transferred, increased by the fair market value, as 6 appraised in the manner provided by law, of improvements made 7 to the real property since ownership of the real property last was 8 transferred. 9 (B)(1) For purposes of this section, ownership of real property 10 is not considered to have been transferred if transferred in fee 11 simple in a transfer not subject to federal income tax in the 12 following circumstances: 13 (a) 102, limited to transfer to a spouse or surviving 14 spouse, (Gifts and Inheritances), 15 (b) 1033 (Conversions--Fire and Insurance Proceeds to 16 Rebuild), 17 (c) 1041 (Transfers of Property Between Spouses or 18 Incident to Divorce), 19 (d) 351 (Transfer to a Corporation Controlled by 20 Transferor), 21 (e) 355 (Distribution by a Controlled Corporation), 22 (f) 368 (Corporate Reorganizations), and 23 (g) 721 (Nonrecognition of Gain or Loss on a 24 Contribution to a Partnership). 25 Number references in the above subitems are to sections of the 26 Internal Revenue Code of 1986, as defined in Section 12-6-40. 27 (2) In the case of real property classified pursuant to Section 28 12-43-220(c), ownership is not considered to have been 29 transferred: 30 (a) if the transferor returns a life estate in the real property 31 and the transferor continues to occupy the real property as his legal 32 residence; and 33 (b) real property which has been transferred to a trust if 34 the transferor and settler is a life beneficiary of the trust and 35 continues to occupy the real property as his legal residence. 36 (C) For purposes of determining a ‘base year’ fair market value 37 pursuant to this section, the fair market value of real property is its 38 appraised value applicable for property tax year 2006 increased by 39 the fair market value of subsequent improvements, or if ownership 40 of the real property has been transferred after 2005, applying the 41 provisions relating to ownership transfer contained in this section, 42 when ownership last was transferred.

1 [4449] 7 1 (D) Nothing in this section diminishes the right of a taxpayer 2 aggrieved by the fair market value of the taxpayer’s real property 3 determined in the manner provided in this section or as otherwise 4 determined by law to appeal that value pursuant to Section 12-60- 5 2110 or 12-60-2510(A)(4) and have a value as determined on 6 appeal substituted for that value.” 7 8 SECTION 5. A. Section 12-43-220 of the 1976 Code, as last 9 amended by Act 145 of 2005, is further amended by adding a new 10 undesignated paragraph at the end of the section to read: 11 12 “As used in this section, fair market value with reference to real 13 property means fair market value determined in the manner 14 provided pursuant to Section 1A, Article X of the Constitution of 15 this State and Section 12-37-932.” 16 17 B. Section 12-43-210 of the 1976 Code, as last amended by Act 18 69 of 2003, is further amended to read: 19 20 “Section 12-43-210. (A) All property must be assessed 21 uniformly and equitably throughout the State. The South Carolina 22 Department of Revenue may promulgate regulations to ensure 23 equalization which must be adhered to by all assessing officials in 24 the State. 25 (B) No reassessment program may be implemented in a county 26 unless all real property in the county, including real property 27 classified as manufacturing property, is reassessed in the same 28 year.” 29 30 C. Section 1B of Act 406 of 2000 is amended to read: 31 32 “(B) The exemption amount of the homestead exemption 33 allowed pursuant to Section 12-37-250 of the 1976 Code is raised 34 from twenty to fifty thousand dollars for property tax year 2000 35 and thereafter, to be funded as provided herein. The amount 36 appropriated to the Trust Fund for Tax Relief must be used to 37 reimburse counties, municipalities, school districts, and special 38 purpose districts, as applicable, for this increased exemption 39 amount in the manner provided in Section 12-37-270 of the 1976 40 Code. For tax years after 2000, an amount sufficient to fund the 41 exemption provided herein must be appropriated from the Tobacco 42 Settlement Fund, before any reductions or withdrawals as may be 43 provided by law, to the Trust Fund for Tax Relief and must be

1 [4449] 8 1 used to reimburse counties, municipalities, school districts, and 2 special purpose districts, as applicable, for this increased 3 exemption amount in the manner provided in Section 12-37-270 of 4 the 1976 Code. Reserved.” 5 6 D. Items (1) and (2) of Section 11-11-150(A) of the 1976 Code, 7 as added by Act 419 of 1998, are amended to read: 8 9 “(1) Section 12-37-251 for the residential property tax 10 exemption Reserved; 11 (2) Section 12-37-270 for the homestead exemption for 12 persons over age sixty-five or disabled Reserved;” 13 14 E. Sections 12-37-270, 12-43-217, 12-43-260, and 12-43-295, all 15 of the 1976 Code, are repealed. 16 17 F. Section 12-37-223A of the 1976 Code is repealed. 18 19 SECTION 6. Assessors and other staff responsible for the 20 assessment of property for ad valorem taxation purposes are 21 required to receive nine hours of instruction each year in the laws 22 applicable to assessment for ad valorem taxation, methods of 23 valuating property, administration of the assessor’s office and 24 records of the assessor’s office, and other functions related to the 25 assessor’s office. This instruction must be received from the 26 Department of Revenue or other providers or courses approved by 27 the Department of Revenue. 28 29 SECTION 7. (A) The sales tax exemptions in Section 30 12-36-2120 of the 1976 Code shall be reviewed by the General 31 Assembly at its 2010 session and at its sessions every ten years 32 thereafter. 33 (B)(1) There is established the Joint Sales Tax Exemptions 34 Review Committee composed of seven members; three of whom 35 must be members of the Senate appointed by the Chairman of the 36 Senate Finance Committee, one of whom must be a member of the 37 minority party; three of whom must be members of the House of 38 Representatives appointed by the Chairman of the House Ways 39 and Means Committee, one of whom must be a member of the 40 minority party; and one of whom must be the Governor or the 41 Governor’s appointee who shall serve at the Governor’s pleasure. 42 The committee shall elect a chairman and vice chairman from 43 among its members. All legislative members shall serve ex

1 [4449] 9 1 officio. The committee shall assist the General Assembly in 2 performing its duties under the provisions of subsection (A) in 3 addition to its duties required by this subsection. 4 (2) In carrying out its responsibilities under this act, the 5 committee shall: 6 (a) make a detailed and careful study of the State’s sales tax 7 exemptions, comparing South Carolina laws to other states; 8 (b) publish a comparison of the State’s sales tax exemptions 9 to other states’ laws; 10 (c) recommend changes, and recommend introduction of 11 legislation when appropriate; 12 (d) submit reports and recommendations annually to the 13 Governor and the General Assembly regarding sales tax 14 exemptions. 15 (3) In carrying out its responsibilities under this act, the 16 committee may: 17 (a) hold public hearings; 18 (b) receive testimony of any employee of the State or any 19 other witness who may assist the committee in its duties; 20 (c) call for assistance in the performance of its duties from 21 any employee or agency of the State. 22 (4) The committee may adopt by majority vote rules not 23 inconsistent with this act that it considers proper with respect to 24 matters relating to the discharge of its duties under this section. 25 Professional and clerical services for the committee must be made 26 available from the staffs of the General Assembly, the Budget and 27 Control Board, and the Department of Revenue. The members of 28 the committee may not receive mileage, per diem, subsistence, or 29 any form of compensation for their service on the committee. 30 31 SECTION 8. A. 1. Section 4-12-30(D)(2)(a)(i) and (ii) is 32 amended to read: 33 34 “(i) for real property, using the original income tax basis for 35 South Carolina income tax purposes without regard to 36 depreciation, if real property is constructed for the fee or is 37 purchased in an arm’s length transaction; otherwise, the property 38 must be reported at its fair market value for ad valorem property 39 tax purposes as determined by appraisal. The fair market value 40 estimate established for the first year of the fee remains the fair 41 market value of the real property for the life of the fee; and 42 (ii) for personal property, using the original tax basis for 43 South Carolina income tax purposes less depreciation allowable

1 [4449] 10 1 for property tax purposes, except that the sponsor is not entitled to 2 any extraordinary obsolescence.” 3 2. Section 4-12-30(E) of the 1976 Code is amended to read: 4 5 “(E) Calculations pursuant to subsection (D)(2) must be made 6 on the basis that the property, if taxable, is allowed all applicable 7 property tax exemptions except the exemption allowed under 8 Section 3(g) of Article X of the Constitution of this State and the 9 exemption allowed pursuant to Section 12-37-220(B)(32) and 10 (34).” 11 B. Items (1) and (2) of Section 12-44-50(A) of the 1976 Code 12 are amended to read: 13 14 “(1) During the exemption period, the sponsor shall pay, or be 15 responsible for payment, to the county the annual fee payment in 16 connection with the economic development property which has 17 been placed in service, in an amount not less than the property 18 taxes that would be due on the economic development property if 19 it were taxable but using: 20 (a) an assessment ratio of not less than six percent, or four 21 percent for those projects qualifying under the enhanced 22 investment definition; 23 (b) a millage rate that is, either: 24 (i) fixed for the life of the fee; or 25 (ii) is allowed to increase or decrease every fifth year in 26 step with the average cumulative actual millage rate applicable to 27 the project based upon the preceding five-year period; and 28 (c) a fair market value for the economic development 29 property: 30 (i) if real property is constructed for the fee or is 31 purchased in an arm’s length transaction, the fair market value of 32 real property is determined by using the original income tax basis 33 for South Carolina income tax purposes without regard to 34 depreciation, otherwise the property must be reported at its fair 35 market value for ad valorem property taxes as determined by 36 appraisal. The fair market value estimate established for the first 37 year of the fee remains the fair market value of the real property 38 for the life of the fee; 39 (ii) fair market value for personal property is determined 40 by using the original tax basis for South Carolina income tax 41 purposes less depreciation allowable for property tax purposes, 42 except that the sponsor is not entitled to extraordinary 43 obsolescence; and

1 [4449] 11 1 (d) to establish the millage rate for purposes of subsection 2 (A)(1)(b)(i) or the first five years millage under (A)(1)(b)(ii), the 3 millage rate must be no lower than the cumulative property tax 4 millage rate levied by, or on behalf of, all taxing entities within 5 which the project is located on either: 6 (i) June thirtieth of the year preceding the calendar year 7 in which the fee agreement is executed; or 8 (ii) the millage rate in effect on June thirtieth of the 9 calendar year in which the fee agreement is executed. 10 (2) The fee calculation must be made so that the property, if 11 taxable, is allowed all applicable property tax exemptions except 12 the exemption allowed under Section 3(g) of Article X of the 13 Constitution of this State and the exemption allowed pursuant to 14 Section 12-37-220(B)(32) and (34).” 15 16 Part II 17 18 Distribution of Revenues and Millage Limitations 19 20 SECTION 1. (A)(1) For the year 2007, property taxing entities of 21 this State other than school districts must be reimbursed from the 22 Homestead Exemption Fund dollar for dollar for the property taxes 23 collected by them from owner-occupied residential property for the 24 year 2006 for all purposes other than payment of general 25 obligation debt. The Comptroller General shall pay these 26 reimbursements on or after January 1, 2008, upon application of 27 the property taxing entity. 28 (2) Beginning January 1, 2008, property taxing entities of 29 the State other than school districts must be reimbursed from the 30 Homestead Exemption Fund for the taxes not collected because of 31 the exemption allowed in the new item added to Section 32 12-37-220(B) of the 1976 Code in Part I of this act in the manner 33 provided in this item. The Comptroller General shall pay these 34 reimbursements upon application of the property taxing entity and 35 the reimbursement shall be equal to the amount distributed in the 36 previous year plus the reimbursement increases provided for in 37 subsection (C). The reimbursement increase of a property taxing 38 entity other than a school district as provided in subsection (C) for 39 any year stated as a percentage shall be multiplied by the entity’s 40 reimbursement amount for the previous year to determine the total 41 distribution to the entity for the year. No such property taxing 42 entity shall receive less in reimbursements beginning in 2008 than 43 it received in 2007.

1 [4449] 12 1 (B)(1) For the year 2007, school districts of this State must be 2 reimbursed from the Homestead Exemption Fund dollar for dollar 3 for the property taxes collected by them from owner-occupied 4 residential property for the year 2006 for all purposes other than 5 payment of general obligation debt. The Comptroller General 6 shall pay these reimbursements on or after January 1, 2008, upon 7 application of the school district. 8 (2) Beginning January 1, 2008, school districts of this State 9 must be reimbursed from the Homestead Exemption Fund for the 10 taxes not collected because of the property tax exemption allowed 11 in the new item added to Section 12-37-220(B) of the 1976 Code 12 in Part I of this act in the manner provided in this item. The 13 Comptroller General shall pay these reimbursements upon 14 application of the school district and the reimbursement shall be 15 equal to the amount distributed in the previous year plus the 16 reimbursement increases provided for in subsection (C). The 17 reimbursement increases of the several school districts as provided 18 in subsection (C) for any year shall be aggregated and the 19 reimbursement increase a particular school district shall receive for 20 that year shall be equal to an amount that is the school district’s 21 proportionate share of such funds based on the district’s weighted 22 pupil units as a percentage of statewide weighted pupil units as 23 determined annually pursuant to the Education Finance Act. No 24 school district shall receive less in reimbursements beginning in 25 2008 than it received in 2007. For purposes of the reimbursement 26 increases school districts receive under this item based on 27 weighted pupil units determined pursuant to the Education Finance 28 Act, an additional add-on weighting for students in poverty of 0.20 29 shall be included in the weightings provided in Section 59-20- 30 40(1)(c) of the 1976 Code. The weighting for poverty shall 31 provide additional revenues for students in kindergarten through 32 grade twelve who qualify for Medicaid or who qualify for reduced 33 or free lunches, or both. Revenues generated by this weighting 34 must be used by districts and schools to provide services and 35 research-based strategies for addressing academic or health needs 36 of these students to ensure their future academic success, to 37 provide summer school, reduced class size, after school programs, 38 extended day, instructional materials, or any other research-based 39 educational strategy to improve student academic performance. 40 All amounts received by a district pursuant to the Education 41 Finance Act must be expended only for classroom instruction and 42 costs and expenses directly associated with classroom instruction.

1 [4449] 13 1 (C) Beginning with the 2008 reimbursements to all property 2 taxing entities of this State, these reimbursements must be 3 increased on an annual basis by an inflation factor equal to the 4 percentage increase in the previous year of the Consumer Price 5 Index, Southeast Region, as published by the United States 6 Department of Labor, Bureau of Labor Statistics plus the 7 percentage increase in the previous year in the population of the 8 entity as determined by the Office of Research and Statistics of the 9 Budget and Control Board. Distribution of these reimbursement 10 increases shall be as provided in subsections (A) and (B) of this 11 section. 12 (D) The percentage of population growth in any year for any 13 property taxing entity entitled to reimbursements from the 14 Homestead Exemption Fund shall be based on estimates for such 15 growth in the county wherein the property taxing entity is located 16 as determined by the Office of Research and Statistics of the 17 Budget and Control Board. Where the property taxing entity 18 encompasses areas in more than one county, the population growth 19 in that entity shall be the average of the growth in each county 20 weighted to reflect the existing population of the property taxing 21 entity in that county as compared to the existing population of the 22 property taxing entity as a whole. 23 (E) Upon the beginning of reimbursements to property taxing 24 entities including school districts as provided in this Part, 25 reimbursements for a particular year must be paid to the property 26 taxing entities by August thirty-first of that year. 27 (F) Notwithstanding any other provision of this section, the 28 reimbursements provided pursuant to this section apply for real 29 property located in redevelopment project areas pursuant to the 30 Tax Increment Financing Law and the Tax Increment Financing 31 Act for counties and for real property subject to a redevelopment 32 plan adopted before the effective date of this act, the 33 reimbursements provided pursuant to this section must not be less 34 than dollar for dollar for the duration of the plan. 35 36 SECTION 2. (A) For purposes of determining reimbursements to 37 property taxing entities including school districts for taxes not 38 collected because of the property tax exemption allowed in the 39 new item added to Section 12-37-220(B) of the 1976 Code in Part 40 I of this act, ad valorem property tax revenue of a property taxing 41 entity not collected as a result of a one percent local option sales 42 tax or local sales tax imposed in the entity pursuant to state or local

1 [4449] 14 1 law shall nevertheless be considered collected for purposes of 2 determining reimbursements under Part II of this act. 3 (B) Beginning June 1, 2007, funds derived from a one percent 4 local sales tax or local option sales tax imposed in a jurisdiction 5 pursuant to state or local law which are used to reduce ad valorem 6 property taxes imposed on owner-occupied residential property, 7 must be thereafter applied on a pro-rata basis to reduce ad valorem 8 property taxes on all other classes of property. 9 10 SECTION 3. To the extent revenues in the Homestead Exemption 11 Fund are insufficient to pay all reimbursements required by law, 12 the difference must be paid from the state general fund. 13 14 SECTION 4. Chapter 9, Title 4 of the 1976 Code is amended by 15 adding: 16 17 “Section 4-9-56. (A) Beginning with the year 2007, a property 18 taxing entity in this State including a school district may not levy 19 any ad valorem taxation on owner-occupied residential property to 20 which the exemption provided in the new item added to Section 21 12-37-220(B) of the 1976 Code in Part I of this act apply, with the 22 exception of any levy for general obligation bonded debt purposes. 23 A property taxing entity including school districts which violates 24 this provision must have its aid-to-subdivisions allocations in 25 future general appropriations acts reduced until the violation is 26 cured. The millage levied by a property taxing entity for the year 27 2006 shall be the millage used to determine the property tax 28 revenue lost as a result of the exemptions provided in the new item 29 added to Section 12-37-220(B) of the 1976 Code in Part I of this 30 act. 31 (B) Beginning with the year 2007, a property taxing entity of 32 this State including a school district may increase ad valorem 33 property tax millage on all classes of real and personal property for 34 general operating purposes, except owner-occupied residential 35 property, above that levied for the previous year by an inflation 36 factor equal to the percentage increase in the previous year of the 37 Consumer Price Index, Southeast Region, as published by the 38 United States Department of Labor, Bureau of Labor Statistics plus 39 the percentage increase in the previous year in the population of 40 the entity as determined by the Office of Research and Statistics of 41 the Budget and Control Board. Any millage increase above this 42 limitation requires a supermajority vote of the governing body of 43 the entity entitled to levy property taxes defined as an affirmative

1 [4449] 15 1 vote by seventy-five percent of the total membership of the 2 governing body of the entity. Seventy-five percent of the total 3 membership of the governing body of the entity must be 4 determined without rounding a fractional number into a whole 5 number for the purpose of computing the required vote total. 6 If a property taxing entity does not increase millage by the 7 maximum millage increase allowed pursuant to this subsection 8 without a supermajority vote, the difference between the millage 9 rate actually imposed and the maximum millage that could have 10 been imposed for that year without a supermajority vote is deemed 11 ‘unused’ millage. 12 In calculating the maximum annual millage increase that may be 13 imposed without a supermajority vote, there must be added to the 14 otherwise applicable total any unused millage from the preceding 15 two tax years.” 16 17 Part II A 18 19 Spending Limits 20 21 SECTION 1. Article 5, Chapter 11, Title 11 of the 1976 Code 22 is amended by adding: 23 24 “Section 11-11-415. (A) Except when a lower spending limit 25 applies pursuant to Section 11-11-410, State appropriations for a 26 fiscal year may not exceed appropriations authorized by the 27 spending limitation prescribed in this section. State appropriations 28 subject to the spending limitation are those appropriations 29 authorized annually in the annual general appropriations act and 30 any supplemental appropriations acts or joint resolutions for that 31 fiscal year which fund general purposes. A statement of total 32 ‘General Revenues’ must be included in the annual general 33 appropriations act. As used in this section the appropriations 34 limited as defined in this subsection must be those funded by 35 ‘General Revenues’ as defined in the general appropriations act for 36 fiscal year 2007-2008. All additional nonfederal and nonuser fee 37 revenue items must be included in that category as they may be 38 created by act of the General Assembly. 39 (B)(1) The limitation on State appropriations for a fiscal year as 40 provided in subsection (A) is the greater of: 41 (a) base-year appropriations increased by a percentage 42 equal to the annual percentage increase in state personal income

1 [4449] 16 1 for the most recently completed calendar year for which this figure 2 is available; or 3 (b) base-year appropriations increased by a percentage 4 equal to the state’s growth in population applied ratably over the 5 period of the decennial United States census assuming a rate of 6 increase equal to the rate in the most recently completed United 7 States census for which population figures are available over the 8 next preceding census and a percentage equal to the increase, if 9 any, in the consumer price index in the most recently ended 10 calendar year, as determined by the Bureau of Labor Statistics of 11 the United States Department of Labor. 12 (2) As used in this subsection: 13 (a) ‘base-year appropriations’ means general fund 14 appropriations for the current fiscal year as of February fifteenth, 15 including both recurring and nonrecurring revenues from whatever 16 source derived and regardless of the time the appropriations are 17 effective except that appropriations for the Capital Reserve Fund 18 are not included in base-year appropriations. This general fund 19 total must be adjusted to reflect any mid-year appropriations 20 reductions, however imposed, made, or scheduled as of February 21 fifteenth; and 22 (b) ‘state personal income’ means total personal income 23 for a calendar year as determined by the Office of State Budget of 24 the State Budget and Control Board based on the most recent data 25 provided by the United States Department of Commerce. 26 (3) The Office of Research and Statistics of the State Budget 27 and Control Board, upon approval by the State Economist and in 28 consultation with the director of the board’s Office of State 29 Budget, shall calculate and provide the appropriate percentages for 30 population, consumer price index, and state personal income 31 growth to the Ways and Means Committee of the House of 32 Representatives and the Senate Finance Committee no later than 33 February fifteenth of each year. 34 (C) The Comptroller General shall notify the Governor, the 35 Speaker of the House, and the President Pro Tempore of the Senate 36 if the spending limit as contained in this section is exceeded. The 37 General Assembly shall then take corrective action immediately 38 upon meeting in the next regular session or a special session called 39 for that purpose. This subsection does not apply to funds 40 transferred from the general reserve fund to the general fund. 41 (D) Notwithstanding the provisions of subsection (A) of this 42 section, the General Assembly may suspend the spending

1 [4449] 17 1 limitation for a fiscal year for a specific amount by a special vote 2 as provided in this subsection by enactment of legislation. 3 The special vote referred to in this subsection means an 4 affirmative recorded roll-call vote in each branch of the General 5 Assembly by at least two-thirds of the total membership in each 6 branch.” 7 8 SECTION 2. Article 3, Chapter 1, Title 6 of the 1976 Code is 9 amended by adding: 10 11 “Section 6-1-335. (A) The spending limit imposed on a local 12 governing body pursuant to this section is in addition to and not in 13 lieu of any other limit on spending or on the taxing power of a 14 local governing body. Where a limit on spending by or on the 15 taxing power of a local governing body imposed by the 16 Constitution of this State or by general or local laws of this State 17 imposes any limit resulting in a more restrictive spending limit 18 than the limit imposed pursuant to this section, the more restrictive 19 limit applies. 20 (B) The limit on all appropriations for a fiscal year by a local 21 governing body, except for appropriations to service general 22 obligation debt or for the purposes provided in Section 6-1-320(B) 23 is the greater of: 24 (1) base-year appropriations increased by a percentage equal 25 to the annual percentage increase in state personal income for the 26 most recently completed calendar year for which this figure is 27 available; or 28 (2) base-year appropriations increased by a percentage equal 29 to the jurisdiction’s growth in population applied ratably over the 30 period of the decennial United States census assuming a rate of 31 increase equal to the rate in the most recently completed United 32 States census for which population figures are available over the 33 next preceding census and a percentage equal to the increase, if 34 any, in the consumer price index in the most recently ended 35 calendar year, as determined by the Bureau of Labor Statistics of 36 the United States Department of Labor. For a school district, the 37 population increase portion of this calculation is replaced by the 38 actual annual increase in the student enrollment for the most recent 39 year for which that figure is available for the district. 40 (C) As used in this section: 41 (1) ‘base-year appropriations’ means appropriations for the 42 current fiscal year as of February fifteenth, including both 43 recurring and nonrecurring revenues from whatever source derived

1 [4449] 18 1 and regardless of the time the appropriations are effective except 2 for appropriations for the purposes exempt from the limit pursuant 3 to subsection (B) of this section. This total must be adjusted to 4 reflect any mid-year appropriations reductions, however imposed, 5 made, or scheduled as of February fifteenth; and 6 (2) ‘state personal income’ means total personal income for 7 a calendar year as determined by the Office of State Budget of the 8 State Budget and Control Board based on the most recent data 9 provided by the United States Department of Commerce. 10 (D) The Office of Research and Statistics of the State Budget 11 and Control Board, upon approval by the State Economist and in 12 consultation with the director of the board’s Office of State 13 Budget, shall calculate and provide the appropriate percentages for 14 population, consumer price index, and state personal income 15 growth to the local governing body no later than February fifteenth 16 of each year.” 17 18 SECTION 3. The provisions of this Part take effect as provided in 19 Part IV of this act and first apply for appropriations for fiscal years 20 beginning after June 30, 2009. 21 22 Part III 23 24 Miscellaneous Provisions 25 26 SECTION 1. A. Section 11-27-30 of the 1976 Code, as last 27 amended by Act 27 of 2001, is further amended by adding an item 28 at the end to read: 29 30 “9. For purposes of this section, a complete or partial 31 successor-in-interest to, or other transferee of, the State or other 32 associate of any kind of the State is deemed to be the State when 33 the successor, transferee, or associate undertakes all or a portion of 34 the operation or assumes all or a portion of a duty of the State.” 35 36 B. Section 11-27-40 of the 1976 Code, as last amended by Act 37 113 of 1999, is further amended by adding an item at the end to 38 read: 39 40 “10. For purposes of this section, a complete or partial 41 successor-in-interest to, or other transferee of, the political 42 subdivision of the State or other associate of any kind of the 43 political subdivision of the State is deemed to be the political

1 [4449] 19 1 subdivision of the State when the successor, transferee, or 2 associate undertakes all or a portion of the operation or assumes all 3 or a portion of a duty of the political subdivision of the State.” 4 5 C. Section 11-27-50 of the 1976 Code, as last amended by Act 6 113 of 1999, is further amended by adding an item at the end to 7 read: 8 9 “8. For purposes of this section, a complete or partial 10 successor-in-interest to, or other transferee of, the school district or 11 other associate of any kind of the school district is deemed to be 12 the school district when the successor, transferee, or associate 13 undertakes all or a portion of the operation or assumes all or a 14 portion of a duty of the school district.” 15 16 D. The provisions of subsections A., B., and C. of this section 17 apply with regard to all transfers made after July 1, 2006, to which 18 these subsections apply. 19 20 SECTION 2. A. Section 12-37-670 of the 1976 Code is 21 amended to read: 22 23 “Section 12-37-670. (A) Each owner of land on which any 24 new structures have been erected which shall not have been 25 appraised for taxation shall list them for taxation with the county 26 auditor of the county in which they may be situate on or before the 27 first day of March next after they shall become subject to taxation. 28 No new structure shall be listed or assessed until it is completed 29 and fit for the use for which it is intended. 30 (B)(1) Notwithstanding the provisions of subsection (A), a 31 county governing body may by ordinance provide that an owner of 32 land on which a new structure has been erected and which has not 33 been appraised for taxation shall list the new structure for taxation 34 with the county auditor of the county in which it is located by the 35 first day of the next month after a certificate of occupancy is issued 36 for the structure. A new structure must not be listed or assessed 37 until it is completed and fit for the use for which it is intended, as 38 evidenced by the issuance of the certificate of occupancy. 39 (2) Additional property tax attributable to improvements 40 listed with the county auditor on or before June thirtieth is due for 41 the period from July first to December thirty - first for that property 42 year, and payable when taxes are due on the property for that 43 property tax year. Additional property tax attributable to

1 [4449] 20 1 improvements listed with the county auditor after June thirtieth of 2 the property tax year is due and payable when taxes are due on the 3 property for the next property tax year. 4 (3) If a county governing body elects by ordinance to impose 5 the provisions of this subsection, this election is also binding on all 6 municipalities within the county imposing ad valorem property 7 taxes.” 8 9 B.Section 12-37-680 of the 1976 Code is repealed. 10 11 SECTION 3. Section 12-43-215 of the 1976 Code is amended to 12 read: 13 14 “Section 12-43-215. (A) When owner-occupied residential 15 property assessed pursuant to Section 12-43-220(c) is valued for 16 purposes of ad valorem taxation, the value of the land must be 17 determined on the basis that its highest and best use is for 18 residential purposes. 19 (B) Each county must submit to the Department of Revenue an 20 annual report, in a form to be determined by the department, listing 21 the names and addresses of all residential property in the county 22 which is classified as ‘owner - occupied’.” 23 24 SECTION 4. Chapter 20, Title 59 of the 1976 Code is amended 25 by adding: 26 27 “Section 59-20-21. Beginning with the year 2007, the State 28 Board of Education, in determining the minimum education 29 program designed to meet students’ needs, may only consider 30 factors required by statutory law or which directly affect classroom 31 learning, and the local maintenance of effort required of a school 32 district must be based on these determinations.” 33 34 SECTION 5. Chapter 20, Title 59 of the 1976 Code is amended 35 by adding: 36 37 “Section 59-20-22. Notwithstanding a school district’s index of 38 taxpaying ability, the minimum state funds a district shall receive 39 in any year is forty percent of the applicable year’s base student 40 cost.” 41 42 Part IV 43

1 [4449] 21 1 Time Effective 2 3 SECTION 1. This act, except as otherwise provided herein and 4 except for Parts III and IV, takes effect upon ratification of 5 amendments to Article X of the Constitution of this State proposed 6 at the general election of 2006 defining fair market value of real 7 property as its fair market value when it’s ownership last was 8 transferred, increased by the value of improvements, and providing 9 for an additional exemption from the property tax of one hundred 10 percent of the fair market value of owner-occupied residential 11 property. Parts III and IV of this act take effect upon approval by 12 the Governor. 13 14 SECTION 2. Notwithstanding any other provision of law, a 15 county governing body is authorized to conduct a referendum at 16 the same time as the 2006 general election as to whether or not a 17 local option sales tax presently imposed in that jurisdiction should 18 be repealed. If the qualified electors of the county vote in favor of 19 repealing the local option sales tax, the tax shall be repealed as of 20 January 1, 2007. 21 ----XX---- 22

1 [4449] 22