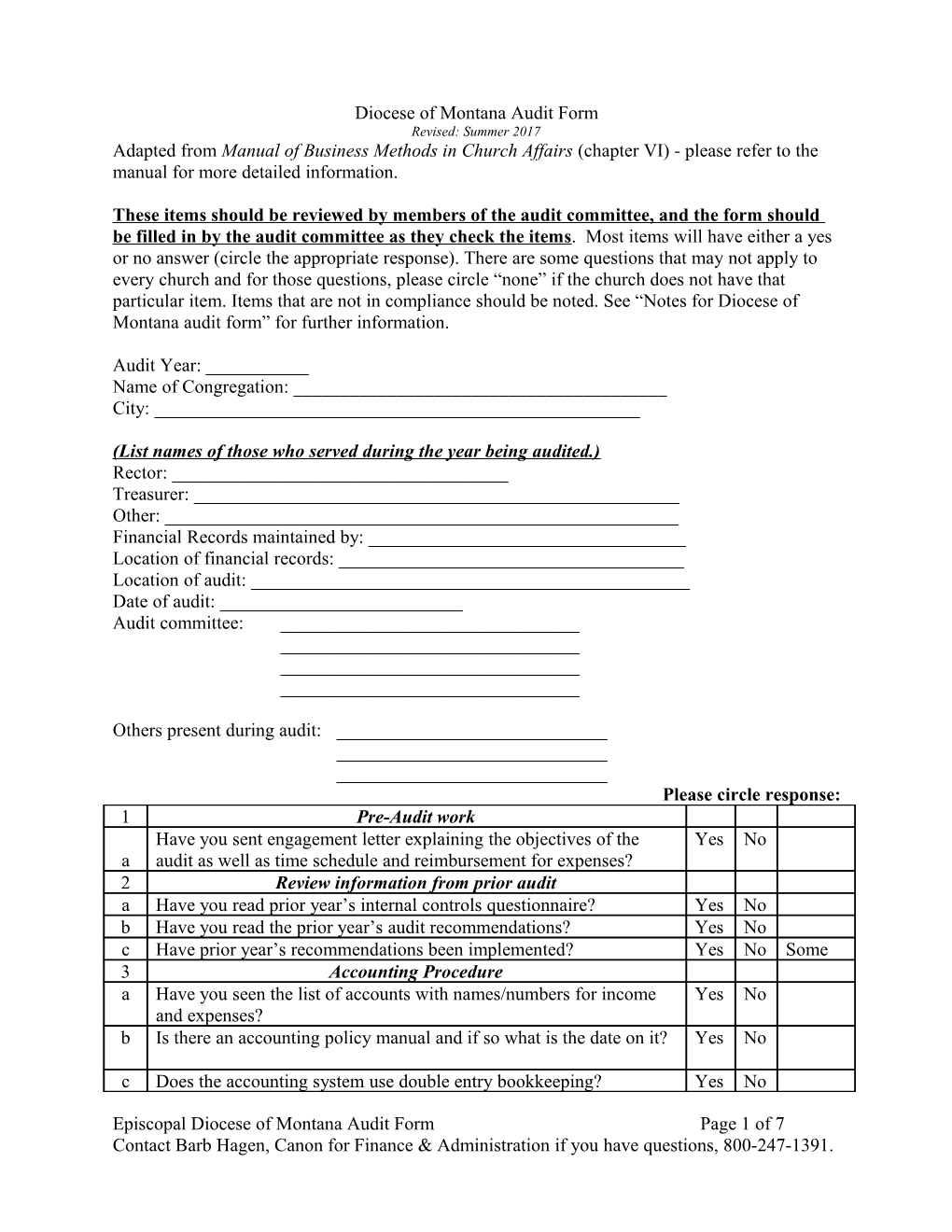

Diocese of Montana Audit Form Revised: Summer 2017 Adapted from Manual of Business Methods in Church Affairs (chapter VI) - please refer to the manual for more detailed information.

These items should be reviewed by members of the audit committee, and the form should be filled in by the audit committee as they check the items. Most items will have either a yes or no answer (circle the appropriate response). There are some questions that may not apply to every church and for those questions, please circle “none” if the church does not have that particular item. Items that are not in compliance should be noted. See “Notes for Diocese of Montana audit form” for further information.

Audit Year: ______Name of Congregation: ______City: ______

(List names of those who served during the year being audited.) Rector: ______Treasurer: ______Other: ______Financial Records maintained by: ______Location of financial records: ______Location of audit: ______Date of audit: ______Audit committee: ______

Others present during audit: ______Please circle response: 1 Pre-Audit work Have you sent engagement letter explaining the objectives of the Yes No a audit as well as time schedule and reimbursement for expenses? 2 Review information from prior audit a Have you read prior year’s internal controls questionnaire? Yes No b Have you read the prior year’s audit recommendations? Yes No c Have prior year’s recommendations been implemented? Yes No Some 3 Accounting Procedure a Have you seen the list of accounts with names/numbers for income Yes No and expenses? b Is there an accounting policy manual and if so what is the date on it? Yes No c Does the accounting system use double entry bookkeeping? Yes No

Episcopal Diocese of Montana Audit Form Page 1 of 7 Contact Barb Hagen, Canon for Finance & Administration if you have questions, 800-247-1391. 4 Vestry Minutes a Are signed, original vestry minutes available for the year? Yes No b Have you read all of the vestry minutes? Yes No c Have the auditor’s findings from last year been recorded in the vestry Yes No minutes? d Is approval of special funding noted in the vestry minutes? Yes No e Is vestry approval of the budget noted in the minutes? Yes No f Is it noted in the vestry minutes that they have seen financial Yes No statements (income statement and balance sheet) and compared actual income and expense to budget or discussed major discrepancies? g Are changes to the budget approved by the vestry? Yes No h Does the vestry review the budget at least quarterly? Yes No i Are quarterly reports for all other funds, including restricted and Yes No None investment funds provided to the vestry? j Has the vestry approved property purchase or disposal of equipment? Yes No None k Has the vestry approved investment purchases or sales or met with Yes No None the investment broker? l Is there any mention of loans or leases in the minutes? Yes No None m If there are loans or any other debt for the year being audited, has the Yes No None vestry approved them? n If there are loans or any other debt for the year being audited, has the Yes No None Bishop and Diocesan Standing Committee approved them? o Is there mention of endowments or restricted gifts? Yes No None p Are clergy housing allowances recorded in the vestry minutes prior to Yes No paying the cleric? q If the amount of pledges vs. actual received is significantly different, Yes No None is it mentioned in the vestry minutes? r Does the vestry see minutes from other groups authorized to spend Yes No None money? (ECW, guilds etc.) 5 Cash Receipts a Review the cash counting sheets – do they match deposit slips for the Yes No week? b Are the cash counting sheets signed by two unrelated people? Yes No c Are the cash counting sheets signed by two different people each Yes No week? d If pledge or offering envelopes are used, have you compared a Yes No None sample of them with the deposits? e Is other cash (such as from fundraisers or ECW etc.) deposited Yes No None weekly? f Does the stamp for endorsing checks say, “For Deposit only”? Yes No g Are all cash receipts deposited into the general operating account? Yes No h Review a sample of the letters to donors. Do they have the language Yes No required by the IRS regarding contributions over $250? 6 Cash Disbursements – look at cancelled checks or copies a Are checks pre-numbered and used in sequence? Yes No

Episcopal Diocese of Montana Audit Form Page 2 of 7 b Are all voided checks cancelled and retained? Yes No c Are all checks payable to a specified payee and not to cash? Yes No d Are the original paid invoices marked “Paid” with the date and check Yes No number? e Are checks signed by the authorized signers? Yes No f Do checks have two signatures? Yes No g If there are checks written to “cash” Is there adequate documentation Yes No None to support them? h Are bills approved by someone other than the person who signs Yes No checks? i Compare checks to check register for amounts and payees. Are there Yes No discrepancies? j Look at register for assessment payments. Are checks written to the Yes No diocese before the 10th of each month? k If the church has a credit card, please list the limit on the card, and NA the cardholder’s names below:

l Is the credit card paid in full each month? Yes No NA m Do receipts noting the expenses accompany each statement? There Yes No NA should be a receipt for each charge on the bill. Please list any discrepancies or issues below:

7 Journal Entries – Review journal entries to check the following: a Are there journal entries? Yes No b Is there adequate explanation regarding the reason for the entry? Yes No None c Are journal entries approved by someone other than the person Yes No None making the entry?

Bank Account Reconciliation – Compare bank statements with registers a Are all bank accounts in the name of the church? Yes No b Are all bank statements reconciled (including discretionary funds)? Yes No c Look at a sample of discretionary fund checks. Are there checks Yes No written to vendors (without explanation) that could be for operating expenses? d Look at bank statements for other accounts (ECW, guilds etc.). Are Yes No None they reconciled? e Are there transfers between accounts? Yes No f If there are transfers between accounts, have both sides of the transfer Yes No None been accounted for? g Are there debit or credit memos? (NSF checks, bank errors) Yes No

Episcopal Diocese of Montana Audit Form Page 3 of 7 h Is the check register adjusted for debit and credit memos (if Yes No None applicable)? i Are there checks outstanding more than 90 days? Yes No j Are there checks outstanding more than 180 days? Yes No k Are checks outstanding more than 180 days voided at year end? Yes No None l Have you looked at the January statement for the next year to see that Yes No December checks have cleared? m Have you looked at the December statement from the previous year Yes No to see that December checks have cleared in January of the audit year? n Are bank interest and charges recorded? Yes No None

9 Petty Cash: a If the church has petty cash, follow the procedure listed: None b Count Petty Cash. List amount of cash: c Add up receipts. List amount of receipts: d Does the cash on hand + the amount of receipts = the amount of petty Yes No None cash on the balance sheet? 10 Investments: a Are the investment statements in the name of the church? Yes No None b Are investment income and dividends recorded? Yes No None c What is the market value of investments at the beginning of the year? d What is market value at the end of the year? e Does the market value from the investment statement match the Yes No None market value listed on the financial statements for January and December? (beginning and end of year) f Are there withdrawals from the investments? Yes No g If there are withdrawals, verify the money was transferred to another Yes No None church account (checking, savings, and other investment). Can you see which account(s) funds were transferred into? h Are all investment accounts included on the financial reports to the Yes No None vestry? 11 Endowment Funds and Trusts a Have you reviewed information about endowments as well as their Yes No None terms? b Are terms of the trust or endowment being followed? Yes No None 12 Property and Equipment a Is there an inventory list? See the notes for audit form for the Yes No required items on the list. b Walk through the church and look for some of the items on the list. Yes No Were you able to locate the items? c Were you able to review deeds for land and buildings? Yes No 13 Financial Statements Look at the year end financial statements and the annual budget.

Episcopal Diocese of Montana Audit Form Page 4 of 7 The treasurer should prepare an Income Statement (Also called Profit and Loss) and a Balance Sheet. a Does the assessment expense on the Income Statement equal the Yes No amount listed on the report from the diocese? b Do the figures on the parochial report match the figures on the Yes No income Statement? (compare income and expenses for year end) c Are land and buildings shown on the Balance Sheet at their historical Yes No value or insured value? d Are there reserve funds set aside for building maintenance or major Yes No repairs? 14 Pledges and Other Gifts a Test the postings and arithmetic on pledge cards (or donor records). Test 10% of the pledges. Total number of pledges tested:______See notes for audit form for detail on ways to test pledges. b Do the records of total receipts per individual pledge agree with the Yes No amounts recorded on the deposits or the amounts on the donor records? c Compare budget to actual pledges received. Is the amount Yes No reasonably close? d Have you reviewed information on wills, life insurance policies, life, Yes No None income, endowment and annuity gifts gifted to the church? 15 Payroll and Employee Issues a Have you seen personnel files? Yes No b Have you seen a letter of call (for clergy) or employment (for Yes No None laypeople)? c Are pay rates and effective dates approved? Yes No None d Have you seen a signed IRS form W4 for each employee (including Yes No None clergy)? e Have you seen a signed and verified Department of Justice I9 form Yes No None for each employee (including clergy)? f Have you seen copies of new hire forms for each employee? (or Yes No None notation about when the reporting was made to the state for both lay and clergy). g Have you seen written record of hours worked, approved by a Yes No None Supervisor (For hourly employees)? h Have you seen records that show gross pay and deductions from Yes No None gross pay? (with adjustments from box 12) i Do the totals on the W2s equal the total expenses for salaries on the Yes No None Income Statement? (with adjustments from box 12) j Do the totals for salary and taxes on W3 form match the quarterly Yes No None 941 forms? k Have you seen a W2 form for each employee? Yes No None l Are other income and withholding items included in Box 12 on the Yes No None W2 forms? Such as: imputed income, 403(b) withholdings, health savings account contributions, unreimbursed travel expense and moving expenses as applicable

Episcopal Diocese of Montana Audit Form Page 5 of 7 m Are payroll tax returns filed on a timely basis? Yes No None n Are payroll tax deposits made on a timely basis? Yes No None o Look at state quarterly unemployment reports. Do salaries match Yes No None totals on 941? (Minus clergy – they are excluded from unemployment). Note: Churches are not required to pay Federal Unemployment Tax (FUTA) for any employees. p Review annual worker’s compensation reports. Are all employees Yes No None listed? (Clergy are included on this report). q r If those who are paid for their services do not provide their own Yes No None worker’s compensation coverage, have they been added to the church’s report or does the church have a copy of their Independent Contractor certificate that waives coverage? s Are a W9 form and Independent contractor certificate provided by Yes No None every contractor or anyone who is paid for their services? t Review pension expense on the income statement. It should equal Yes No None 18% of the salary plus housing for a priest or 9% of salary for a lay person. Has the correct amount been paid for pension? u Are forms 1099 provided for all individuals who are not employees Yes No None and for all entities paid $600 or more annually? 16 Payables a If church uses the cash basis, circle “None.” None b If there are unpaid balances, does the balance sheet match what is on Yes No None the statement from the creditor? c If there are loans, have you reviewed the schedule of payments? Yes No None d Look at payments made in the January after the audit year. Do any of Yes No the payments appear that they should have been paid in December? e If so, are they on the December statements as a liability? Yes No f Are there any prepaid items listed in assets? Yes No None g Are any items showing as a prepaid item that should have been listed Yes No None as an expense in the year being audited? 17 Other a Review insurance polices. Are they up to date? Yes No b Is the worker’s compensation poster posted? Yes No None c Is the unemployment insurance poster posted? (if church has lay Yes No None employees d Are the OSHA and minimum wage employment posters posted? (if Yes No None church has lay employees) e Look at by-laws and articles of incorporation. What are the dates on the documents? f Review the annual incorporation report filed with the state. Is there Yes No are report on file for the year being audited? g Have you explained the vestry letter to the priest and treasurer and Yes No told them where to find it? h What are the church’s positive financial practices? Please note the practices they should continue.

Episcopal Diocese of Montana Audit Form Page 6 of 7 Please mail completed form (along with the internal controls questionnaire and the audit findings letter) by September 1 to:

Barb Hagen Episcopal Diocese of Montana PO Box 2020Helena, MT 59624

Episcopal Diocese of Montana Audit Form Page 7 of 7