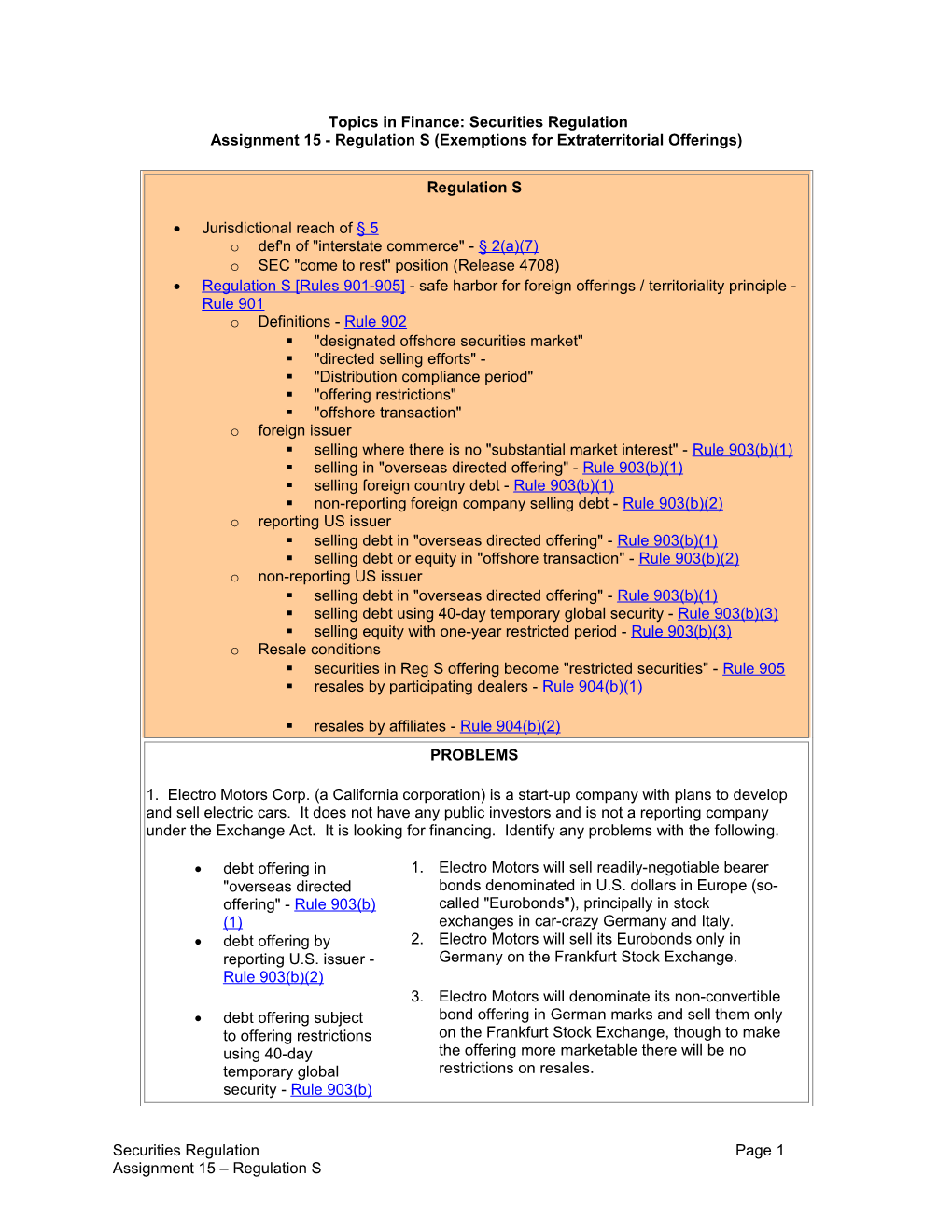

Topics in Finance: Securities Regulation Assignment 15 - Regulation S (Exemptions for Extraterritorial Offerings)

Regulation S

Jurisdictional reach of § 5 o def'n of "interstate commerce" - § 2(a)(7) o SEC "come to rest" position (Release 4708) Regulation S [Rules 901-905] - safe harbor for foreign offerings / territoriality principle - Rule 901 o Definitions - Rule 902 . "designated offshore securities market" . "directed selling efforts" - . "Distribution compliance period" . "offering restrictions" . "offshore transaction" o foreign issuer . selling where there is no "substantial market interest" - Rule 903(b)(1) . selling in "overseas directed offering" - Rule 903(b)(1) . selling foreign country debt - Rule 903(b)(1) . non-reporting foreign company selling debt - Rule 903(b)(2) o reporting US issuer . selling debt in "overseas directed offering" - Rule 903(b)(1) . selling debt or equity in "offshore transaction" - Rule 903(b)(2) o non-reporting US issuer . selling debt in "overseas directed offering" - Rule 903(b)(1) . selling debt using 40-day temporary global security - Rule 903(b)(3) . selling equity with one-year restricted period - Rule 903(b)(3) o Resale conditions . securities in Reg S offering become "restricted securities" - Rule 905 . resales by participating dealers - Rule 904(b)(1)

. resales by affiliates - Rule 904(b)(2) PROBLEMS

1. Electro Motors Corp. (a California corporation) is a start-up company with plans to develop and sell electric cars. It does not have any public investors and is not a reporting company under the Exchange Act. It is looking for financing. Identify any problems with the following.

debt offering in 1. Electro Motors will sell readily-negotiable bearer "overseas directed bonds denominated in U.S. dollars in Europe (so- offering" - Rule 903(b) called "Eurobonds"), principally in stock (1) exchanges in car-crazy Germany and Italy. debt offering by 2. Electro Motors will sell its Eurobonds only in reporting U.S. issuer - Germany on the Frankfurt Stock Exchange. Rule 903(b)(2) 3. Electro Motors will denominate its non-convertible debt offering subject bond offering in German marks and sell them only to offering restrictions on the Frankfurt Stock Exchange, though to make using 40-day the offering more marketable there will be no temporary global restrictions on resales. security - Rule 903(b)

Securities Regulation Page 1 Assignment 15 – Regulation S (3) 2. Dulces, Inc. (a Delaware corporation) designs and sells women's footwear worldwide. Its common stock is traded on Nasdaq, and Dulces is a reporting company under the Exchange Act. Any problems with the following? See In re Candie’s, Inc. , Securities Act Release No. 7263 (Feb. 21, 1996).

1. Dulces will issue new shares of common stock at a debt offering in 40% discount to mysterious Swiss investors for "overseas directed unsecured promissory notes on which no interest offering" - Rule 903(b) will accrue for 51 days. After a 40-day restricted (1) period, the Swiss purchasers can resell the shares debt or equity offering on U.S. trading markets -- and use the proceeds in "offshore from these resales to pay Dulces. transaction" - Rule 2. Dulces will issue new shares of common stock that 903(b)(2) will be deposited with a Swiss bank, which will then issue Global Depositary Receipts equity offering subject representing Dulces shares. These GDRs to offering restrictions (denominated in U.S. dollars) will be sold to and one-year European investors and traded on the major distribution European stock exchanges. compliance period and selling 3. Dulces will issue bonds denominated in Deutsche restrictions - Rule marks to institutional investors in Germany. There 903(b)(3) will be no restrictions on resales into the United States.

Securities Regulation Page 2 Assignment 15 – Regulation S