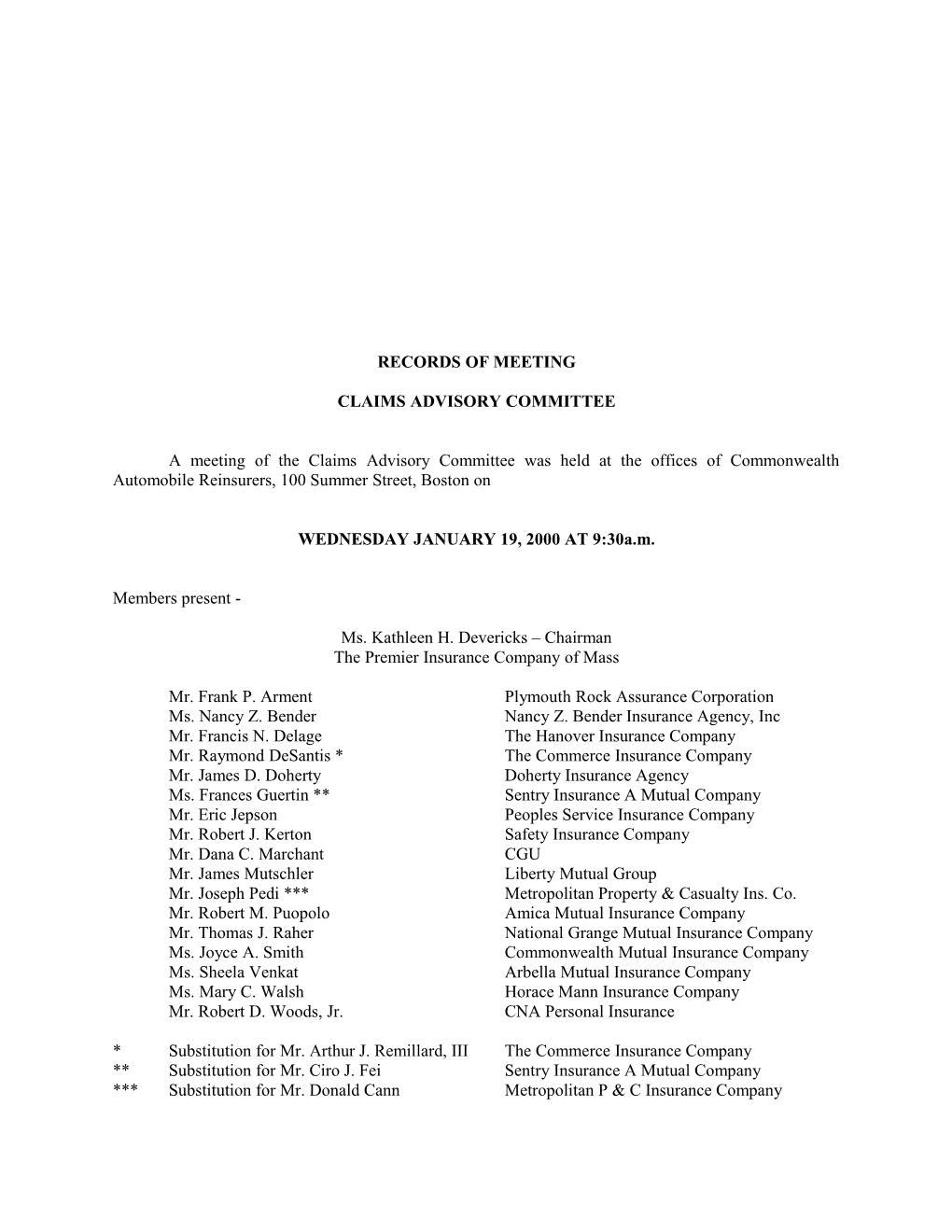

RECORDS OF MEETING

CLAIMS ADVISORY COMMITTEE

A meeting of the Claims Advisory Committee was held at the offices of Commonwealth Automobile Reinsurers, 100 Summer Street, Boston on

WEDNESDAY JANUARY 19, 2000 AT 9:30a.m.

Members present -

Ms. Kathleen H. Devericks – Chairman The Premier Insurance Company of Mass

Mr. Frank P. Arment Plymouth Rock Assurance Corporation Ms. Nancy Z. Bender Nancy Z. Bender Insurance Agency, Inc Mr. Francis N. Delage The Hanover Insurance Company Mr. Raymond DeSantis * The Commerce Insurance Company Mr. James D. Doherty Doherty Insurance Agency Ms. Frances Guertin ** Sentry Insurance A Mutual Company Mr. Eric Jepson Peoples Service Insurance Company Mr. Robert J. Kerton Safety Insurance Company Mr. Dana C. Marchant CGU Mr. James Mutschler Liberty Mutual Group Mr. Joseph Pedi *** Metropolitan Property & Casualty Ins. Co. Mr. Robert M. Puopolo Amica Mutual Insurance Company Mr. Thomas J. Raher National Grange Mutual Insurance Company Ms. Joyce A. Smith Commonwealth Mutual Insurance Company Ms. Sheela Venkat Arbella Mutual Insurance Company Ms. Mary C. Walsh Horace Mann Insurance Company Mr. Robert D. Woods, Jr. CNA Personal Insurance

* Substitution for Mr. Arthur J. Remillard, III The Commerce Insurance Company ** Substitution for Mr. Ciro J. Fei Sentry Insurance A Mutual Company *** Substitution for Mr. Donald Cann Metropolitan P & C Insurance Company Records of Meeting -2- January 19, 2000 Claims Advisory Committee

CAR Staff present -

Ms. Valerie B. Gedziun Vice President – Claims Mr. Robert W. Bell Claims Manager Mr. Richard Dalton Senior Claims Examiner Mr. Anthony Keegan Claims Examiner

Also present –

Ms. Kausor Bhatti Empire Insurance Company Mr. Joseph Haswell Norfolk & Dedham Ms. Julie Hennessey Liberty Mutual Group Mr. James Lynch Quincy Mutual Insurance Company Ms. Sue A. Shimeall The Hanover Insurance Company Mr. William Zukas Quincy Mutual Insurance Company

Claims Advisory Committee Chairman, Ms. Kathleen H. Devericks, called the meeting to order at 9:30 AM.

CA 00. 01 Records of Previous Meeting

A motion was made by Mr. Doherty and seconded by Mr. Marchant to approve the Records of the Claims Advisory Committee meeting of August 25, 1999, the Auto Damage Appraisers Licensing Board Subcommittee meetings of October 14, 1999 and December 10, 1999, and the SDIP Subcommittee meeting of November 9, 1999 as written. The motion passed unanimously.

CA 00. 02 Automobile Damage Appraisers Licensing Board Subcommittee

Mr. Woods reported that at the December 10, 1999 ADALB Subcommittee meeting, the principal item concerned an invitation from the ADALB to the subcommittee to attend the ADALB meeting of 12/16/99 to discuss possible changes to the Direct Payment Plan. The subcommittee agreed to attend the meeting and express through a letter from Ms. Gedziun that the subcommittee is not in a position to, nor does it feel the need to, address changes to the Direct Payment Plan. The subcommittee did, however, feel it may be beneficial to discuss issues pertaining to licensed appraisers, supplements and reinspections.

Mr. Woods reported that the subcommittee did attend the December 16, 1999 meeting and these issues were discussed. Mr. Woods reported that the ADALB indicated its position is that once it becomes Records of Meeting -3- January 19, 2000 Claims Advisory Committee known that a repair involves insurance, CMR 211 and CMR 212 apply to both body shop appraisers and insurance company appraisers. This is consistent with the position held by the Subcommittee.

CA 00. 03 Performance Standards

Mr. Bell summarized the results of the 1999 Annual Report of Compliance with the Performance Standards. The report is required by Chapter 273, Section 41 of the Acts of 1988.

Mr. Bell reported that four additional companies were reviewed by the CAR Claim Department in 1999 to obtain a wider variety of claims handling practices and procedures. For the second consecutive year, the number of warnings issued for non-compliance remained low with four companies receiving warnings. One company, Electric Insurance Company, was fined. However, Mr. Bell pointed out that a subsequent review of this company shows the company to be in compliance. In addition to the warnings issued for non-compliance as a result of the claim reviews, five companies were warned for non- compliance with the reinspection requirements. A final determination on compliance will be made in March when all of the reinspection figures have been submitted to CAR.

Reporting on the CAR SIU, Mr. Bell said in 1999 the SIU also reviewed four additional companies. He pointed out that investigations independent of file reviews were also undertaken with one case being referred to the Insurance Fraud Bureau as it was suspected that a body shop was creating additional damage to vehicles. Other cases involving the Postmaster General and NICB are still pending.

Mr. Bell said the SIU also evaluates figures submitted to CAR both through the DCD and the Physical Damage Report. Some of the more notable findings were a nineteen percent increase in the number of files referred for Medical Bill Reviews and a sixteen percent increase in the amount of physical damage claims referred for SIU investigation.

Mr. Bell pointed out that the CAR SIU reviews also entail checking for the accuracy of reported savings. It was found that there are enough debatable reported savings in this area to merit emphasis in the upcoming SIU reviews. The findings will be reported in the annual report to the Division of Insurance in 2000.

Mr. Bell reviewed the activities of the CAR Claim Department that are undertaken for the purpose of aiding the compliance efforts of the Servicing Carriers. The activities consisted of the twelfth annual Cost Containment Seminars, expanding the Average Cost Per Claim Report and making it available on-line, establishing a CAR web site that allows companies to report quarterly SIU savings over the internet and provides access to meeting notices and records, the success of the ADALB Subcommittee in maintaining communication with the ADALB, and the SDIP Subcommittee working with the Division of Insurance in an effort to make the appeal process on surcharges more efficient.

Concluding, Mr. Bell said the industry exceeded the requirements for compliance with the measured standards for the second consecutive year. He said an additional element to the 2000 evaluation will be the measurement of the Standard requiring immediate notification by the PIP carrier to tort carrier upon satisfaction of the tort threshold. He also informed the committee that the Standards are due to be reviewed in mid 2000.

Mr. Doherty moved to send the report to the Governing Committee for approval. The motion was seconded by Mr. Marchant and passed unanimously. Records of Meeting -4- January 19, 2000 Claims Advisory Committee

CA 00. 04 Educational Subcommittee

Ms. Devericks announced the subcommittee members and the dates for the Cost Containment Seminars. The members are Mssrs. Mutschler, Delage, Doherty, Cann, Fei, Jepsen, Kerton, Woods, and Ms. Devericks. The chairman is Mr. Mutschler. The seminar dates are May 16, 2000 in Randolph and May 23, 2000 in Marlboro.

CA 00. 05 SDIP

Mr. Delage reported that the pilot program for the Document Review Process has been extended as the results were inconclusive. The additional information supplied by the insureds has resulted in a lower than expected turnover rate. The January meeting has been cancelled and will be rescheduled at a later date.

Ms. Gedziun distributed the Merit Rating Board Statement of SDIP Inquires and SDIP Claims. This report contained all policy and claim merit rating submissions for the month of December and for all of 1999. The average industry error rate for claims submissions was 6.4 percent while the error rate for policy submissions was 1.0 percent. There is no explanation as to why the policy error rates are so much lower than the claims errors. The SDIP Subcommittee recommended the distribution of these reports to the Claims Advisory Committee members as the results are not sent to the claim departments. The Committee reviewed the reports and agreed to discuss them individually with their merit rating liaisons.

There being no further business, a motion was made by Mr. Doherty and duly seconded by Mr. Marchant to adjourn the meeting.

The motion passed on a unanimous vote.

The meeting adjourned at 10:30 AM.

Robert W. Bell, CPCU Claims Manager

Boston, Massachusetts January 20, 2000

Note: These Records have not been approved. They will be considered for approval at the next Claims Advisory Committee meeting.