Russian market of citrus in week 33, 2017

After a few weeks of sleeping citrus market in Russia shook its wings. Movement of fruits in all segments improved, sound supply-demand ratio permitted to make wholesale prices stronger.

In oranges segment SA navels were traded in wholesale at average USD 11,67 – 12,50 for 15 kg carton. Valencias gathered USD 12,50 – 14,17. Argentinean valencias were available at average USD 13,34 for 15 kg.

Grapefruits returned to steady, though slow, movement under average wholesale price of USD 18,75 – 20,00 per carton of 15 kg. SA grapefruits (only South Africa is represented in the market) could be also bought at USD 15,00.

Good market in contrast to prolonged period of stagnation was for lemons. Good quality fruits either from SA ort Argentine were traded for USD 22,50 – 23,34 for 15 kg weight. Low quality Argentinean lemons offered in substantial volumes were sold at USD 16,00 for 18 kg weight.

Mandarins are in short supply. SA clementines, novas, murkots were traded in interval between USD 19,k17 and USD 18,34 for 10 kg carton. Argentinean clemenvillas available are of inferior quality and their price in wholesale was USD 12,50 – 13,34 for 10 kg.

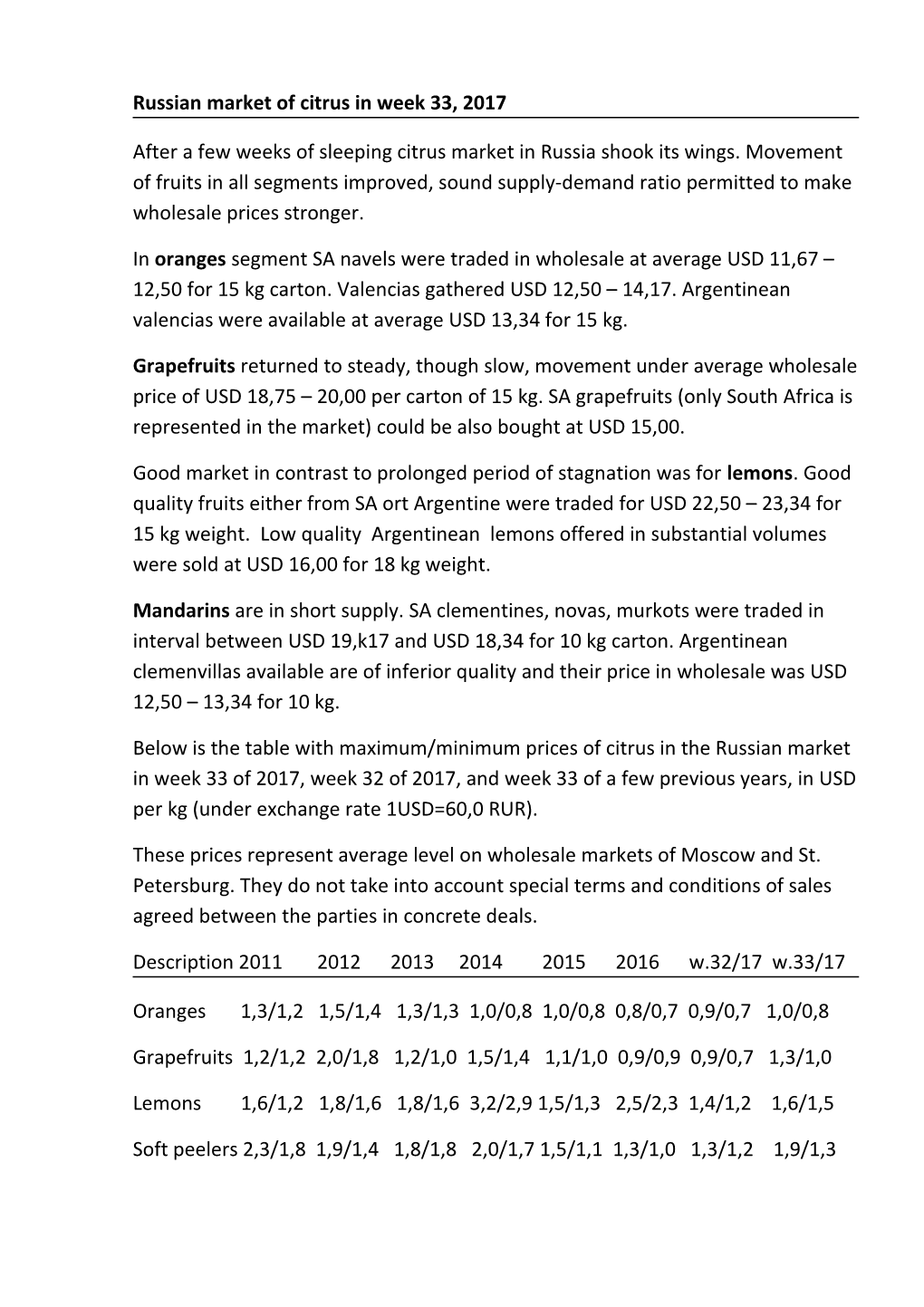

Below is the table with maximum/minimum prices of citrus in the Russian market in week 33 of 2017, week 32 of 2017, and week 33 of a few previous years, in USD per kg (under exchange rate 1USD=60,0 RUR).

These prices represent average level on wholesale markets of Moscow and St. Petersburg. They do not take into account special terms and conditions of sales agreed between the parties in concrete deals.

Description 2011 2012 2013 2014 2015 2016 w.32/17 w.33/17

Oranges 1,3/1,2 1,5/1,4 1,3/1,3 1,0/0,8 1,0/0,8 0,8/0,7 0,9/0,7 1,0/0,8

Grapefruits 1,2/1,2 2,0/1,8 1,2/1,0 1,5/1,4 1,1/1,0 0,9/0,9 0,9/0,7 1,3/1,0

Lemons 1,6/1,2 1,8/1,6 1,8/1,6 3,2/2,9 1,5/1,3 2,5/2,3 1,4/1,2 1,6/1,5

Soft peelers 2,3/1,8 1,9/1,4 1,8/1,8 2,0/1,7 1,5/1,1 1,3/1,0 1,3/1,2 1,9/1,3 I would like to continue conversation about problems of SA citrus exports to the Russian market during the current season which I started last week.. High standard in skills of growing fruits does not imply the same high standard in skills of foreign trade. Even the best musicians in the orchestra delegate to a conductor the power to create a fine performance. In structure of exporters to the Russian market alongside with experienced and seasoned exporters we observe big number of individuals who use internet facilities for establishing links and sales of SA fruits to any Russian buyer they think will reward their imagination. It would have been justifiable if they receive money before sending the fruits. No, in the overwhelming majority of cases they take risks (usually it’s not a big consignment) being seduced by promise of high price (this season, for example, USD 14,5 FOB for lemons, USD 11,00 FOB for grapefruits, USD 10-11 for oranges). When their fruits arrive in St. Petersburg they discover that payment is not coming, that the market is bad, that the price too high, that fruits have no stickers or correct documents, have no this or that, and that the quality is below standard. Last Wednesday I received a distress call from a SA exporter who complained that two containers of fruits which he contracted to a Russian buyer face tremendous problems in passing customs due to some not quite understandable reason. I easily found out that the only true reason was that the buyer did not care about the cargo. Why? Just because the fruits came without any advance payment : the naïve or chance taking SA exporter was thinking that he would receive his money after the goods arrived, cleared and sold. Gentlemen, but this is not right to work like that in the handicapped Russian market! By handicapped I mean that the Russian trade is unable to provide a common bank guarantee as security of payment. Now, we have a circle of established SA exporters who try to introduce payments discipline in the market. But the irresponsible fellow-individuals spoil their efforts by ruining the very foundation of trade which lies on financial discipline. Instead of building mutually beneficial trade relations the irresponsible individuals participate in building financial pyramids in the Russian fruits market. In the end of the day growers suffer. Because of the above irresponsible transactions South Africans compete with South Africans in the Russian citrus market, over flood the market with fruits, ruin wholesale prices. According to Russian sources losses of established Russian importer houses in trade with South African citrus this season reached minimum USD 8 per a carton of lemons, USD 4 per carton of lemons, USD 2 per carton of oranges (so far). Just imagine hard negotiations they will hold with their SA partners at World Food Moscow in September. Many say that they will have to cut down import of citrus from South Africa in summer season, just because they are unable to compete with oversupply of free deliveries by individuals. As regretful as it looks, the centrifugal forces of SA citrus export to Russia prevail and they will continue to constitute major risk for mutually beneficial work of South African and Russian trade houses in the Russian market. While the interest of the fruit industry lies in effectiveness of SA fruit exports as a whole, not in individual luck of chance takers.