Quarterly Labour Cost Survey E

T U

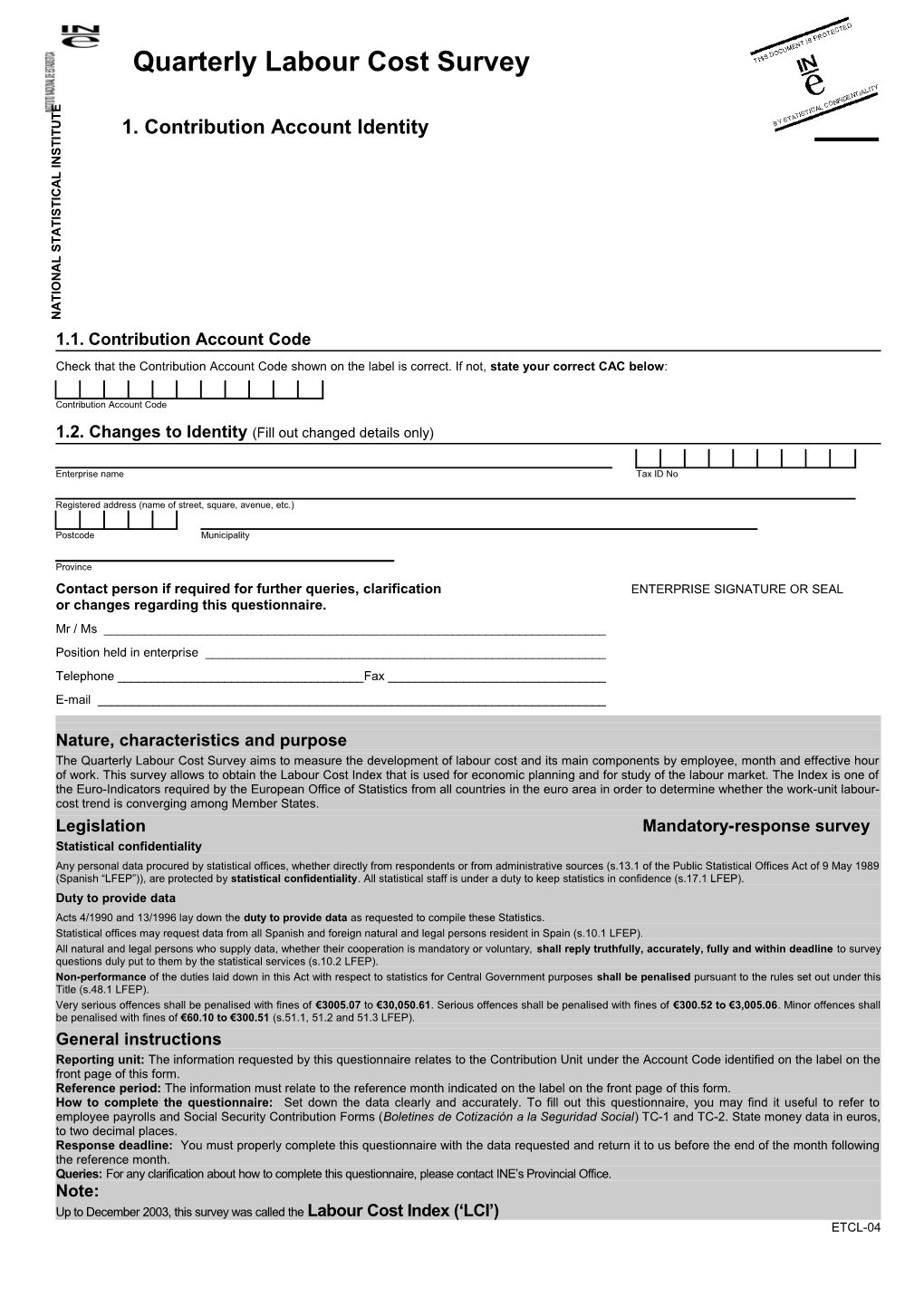

T 1. Contribution Account Identity I T S N I

L A C I T S I T A T S

L A N O I T A N 1.1. Contribution Account Code Check that the Contribution Account Code shown on the label is correct. If not, state your correct CAC below:

Contribution Account Code

1.2. Changes to Identity (Fill out changed details only)

Enterprise name Tax ID No

Registered address (name of street, square, avenue, etc.)

Postcode Municipality

Province Contact person if required for further queries, clarification ENTERPRISE SIGNATURE OR SEAL or changes regarding this questionnaire. Mr / Ms ______Position held in enterprise ______Telephone ______Fax ______E-mail ______

Nature, characteristics and purpose The Quarterly Labour Cost Survey aims to measure the development of labour cost and its main components by employee, month and effective hour of work. This survey allows to obtain the Labour Cost Index that is used for economic planning and for study of the labour market. The Index is one of the Euro-Indicators required by the European Office of Statistics from all countries in the euro area in order to determine whether the work-unit labour- cost trend is converging among Member States. Legislation Mandatory-response survey Statistical confidentiality Any personal data procured by statistical offices, whether directly from respondents or from administrative sources (s.13.1 of the Public Statistical Offices Act of 9 May 1989 (Spanish “LFEP”)), are protected by statistical confidentiality. All statistical staff is under a duty to keep statistics in confidence (s.17.1 LFEP). Duty to provide data Acts 4/1990 and 13/1996 lay down the duty to provide data as requested to compile these Statistics. Statistical offices may request data from all Spanish and foreign natural and legal persons resident in Spain (s.10.1 LFEP). All natural and legal persons who supply data, whether their cooperation is mandatory or voluntary, shall reply truthfully, accurately, fully and within deadline to survey questions duly put to them by the statistical services (s.10.2 LFEP). Non-performance of the duties laid down in this Act with respect to statistics for Central Government purposes shall be penalised pursuant to the rules set out under this Title (s.48.1 LFEP). Very serious offences shall be penalised with fines of €3005.07 to €30,050.61. Serious offences shall be penalised with fines of €300.52 to €3,005.06. Minor offences shall be penalised with fines of €60.10 to €300.51 (s.51.1, 51.2 and 51.3 LFEP). General instructions Reporting unit: The information requested by this questionnaire relates to the Contribution Unit under the Account Code identified on the label on the front page of this form. Reference period: The information must relate to the reference month indicated on the label on the front page of this form. How to complete the questionnaire: Set down the data clearly and accurately. To fill out this questionnaire, you may find it useful to refer to employee payrolls and Social Security Contribution Forms (Boletines de Cotización a la Seguridad Social) TC-1 and TC-2. State money data in euros, to two decimal places. Response deadline: You must properly complete this questionnaire with the data requested and return it to us before the end of the month following the reference month. Queries: For any clarification about how to complete this questionnaire, please contact INE’s Provincial Office. Note:

Up to December 2003, this survey was called the Labour Cost Index (‘LCI’) ETCL-04 A. Employees

Employees are defined as all salaried workers irrespective of their form of contract attached during the reference month to the Contribution Account indicated on the label on the front page. Employees are distinguished by working-time type. They may be full-time (they work the enterprise’s standard working day) or part-time (they work fewer hours than the enterprise’s standard working day or, if there is no standard, the legal maximum working day). Treat discontinuous permanent employees also as part-time. Full-time employees Part-time employees A1. Survey sample employees. Total employees for which Social Total employees Total employees Security contribution was mandatory for at least one day in the reference month.

A2. Of that total specify how many did not contribute throughout Total employees Total employees the entire month.

A3. For all employees not contributing throughout the full month, Contribution days Contribution days specify the total days contributed for by all such employees in the reference month.

B. Working time

State working time agreed under a collective pay agreement now in force or under an agreement between the parties.

Hours agreed: Full-time employees Part-time employees B1. Hours per employee (*) B2. Total hours/ month (TC-2) For FULL-TIME employees specify hours agreed per employee and year and indicate weekly working time for the majority in the Hours/year Total hours reference month Hours (en el month Hours de ref.) Hours/week (Sum of hours by part-time For PART-TIME employees add up hours/month agreed or engaged , (in reference month) Hours Min. employees in the reference for all part-time employees detailed in section A. month. Days/week (in reference month) Days You can quote these hours from contribution form TC-2)

Holiday leave and public holidays:

B3. Annual holiday leave agreed per employee. Choose only one option from the following two: 1 Calendar days Days 2 Working days Days

B4. Non-official leave agreed by employee and year. Non- Working days Days recoverable working days or working days granted voluntarily by the (exclude public holidays employer (non-recoverable public-holiday extensions, etc.) and holiday leave)

Overtime and additional working hours: Full-time employees Part-time employees B5. Total number of overtime/additional working hours paid and/or compensated with rest time in the reference month. Overtime Overtime + additional hours (Overtime payments must be stated at D1.1 and paid rest time in respect of overtime must be stated at C1.7)

Only fill out this section if your enterprise operates in the TRANSPORT SECTOR: Add up hours of presence provided in the reference month by the total of employees, sorted by working-time type. Presence time is time in which an employee is at the employer’s disposal without doing actual work (e.g., the employee is waiting or on stand-by). Full-time employees Part-time employees B6. Total number of presence hours worked in the reference month by all workers, sorted by working-time type. Hours Hours

(*) NOTE: If you cannot obtain a representative working day per FULL-TIME EMPLOYEE in section B1, add up the hours agreed or engaged for all employees in the reference month: Hours This option may be useful to: - Contribution Units of Temporary Employment Enterprises whose employees are assigned to others. - Contribution Units with many different agreed forms of working-time for which a representative working day per employee cannot be obtained in order to fill out sections B1, B2, B3 and B4. C. Time not worked

Indicatetotal days or hours (as specified) not worked by all survey-sample employees in the reference month. Add up days and hours not worked by all employees, sorted by working-time type. Full-time employees Part-time employees C1. Paid time not worked: C1.1. Holiday leave taken in reference month. State in calendar or working days in accordance with your option at B3. Days Days C1.2. Public holidays in the reference month, including official holidays and unofficial extensions/waivers. Working days Working days C1.3. Days absent due to Temporary Incapacity (TI). (Payments for TI days to be stated at D2.1.). Calendar days Calendar days C1.4. Maternity leave and leave relating to adoption or prior foster- parenting. Calendar days Calendar days C1.5. Paid leave relating to marriages, births, death or serious illness of a family relative, moving home, other. Working days Working days C1.6. Hours or days not worked for technical, economic, organisational or production reasons, with or without a Redundancy Hours-reduction Hours-reduction Plan in progress. and/or and/or Days-suspension Days-suspension C1.7. Rest hours granted as compensation for overtime (overtime stated at B5). Hours Hours C1.8. Other paid hours not worked in respect of trade union representation, performance of unavoidable duties, sitting examinations, medical appointments, lactation, occupational training, etc. Hours Hours C1.9. Hours lost at workplace due to occasional lack of work, atmospheric accidents, machine breakdown, power cuts, lack of raw Hours Hours materials and other causes of force majeure. Do not include lost hours later recovered Do not include lost hours later recovered C2. Unpaid time not worked: C2.1. Labour disputes. Strikes, irrespective of scope. Do not include any Choose only one of the following: Choose only one of the following: time recovered later. 1 Hours 1 Hours

2 Days 2 Days

C2.2. Hours not worked for other reasons. Absenteeism, unpaid leave, lock-outs, legal guardianship duties, penalties, other. Hours Hours

D. Earnings and non-earnings payments

State the figures requested in aggregate form, adding up payments made in the reference month for all employees attached to the Contribution Account. These amounts must be stated gross, i.e., before deduction of withholding tax and employee Social Security contributions. Full-time employees Part-time employees

D. Accrued total (gross). Total payments in the months in respect of all , , items, both earnings and non-earnings. € € Break down the above total into the items set out below: D1. Payments for earnings: D1.1. Overtime/additional hours. (Overtime/additional hours statedat , , B5). € € D1.2. Bonuses. Regular bonuses not paid pro rata, profit-shares, non- , , monthly target bonuses and incentives, other payments made in respect of a term in excess of one month. € € D1.3. Arrears paid in the month but in respect of earlier periods + , , outstanding obligations. € € D2. Total non-earnings payments: Expense accounts, transport supplements, compensation and reimbursements, Social Security benefits, , , sick leave pay (Temporary Incapacity), compensation for transfers, € € suspensions or lay-offs, contract termination pay, other. Of these total non-earnings payments, specify:

D2.1Temporary incapacity due to common illness, occupational , , disease, occupational accident or non-occupational accident: Delegated payments + enterprise benefits for the first 15 days + € € Supplements to TI benefits. D2.2. Unemployment: Delegated payments + voluntary improvement , , paid by employer as a supplement to public employment office (INEM) benefits. € € D2.3. Other direct social benefits. Supplements to pensions and Social Security subsidies, private retirement plans, leave premiums and early retirement, death and survival, invalidity or disability, medical care and , , family benefits (study grants, study expense bursaries, crêches, marriages and births, etc.). € €

D2.4. Severance pay. Include lay-off process earnings, and exclude , , outstanding obligations (earnings due, pay in lieu of holidays, etc., which € € must be stated at D1.3). Exclude temporary contract termination pay (to be stated at D2). Employees affected by severance Employees affected by severance E. Compulsory Social Security contributions

Indicate, with the aid of Contribution Form TC-1 (TC-1/4 for enterprises covered by the Coalmining Special Scheme) (2), the number of employees and the CONTRIBUTIONS/AMOUNTS accrued in the reference month only, to which the Form refers, irrespective of whether or not such amounts have been paid into the relevant collection office. Please state CHARGES/AMOUNTS, not CONTRIBUTION BASES.

If you prefer, you may attach a copy of Contribution Form TC-1 to this questionnaire. If so, you need not fill out this section. Employees entered on TC-1

E1. Number of employees appearing in TC-1 header...... Number of employees

(1) CHARGES/AMOUNTS settled on TC-1

E2. Common contingencies...... ( Field 111 ) (2) , €

E3. Overtime due to force majeure...... ( Field 112 ) (2) , €

E4. Other overtime...... ( Field 113 ) (2) , €

E5. Common services contribution...... ( Field 114 ) (2) , €

E6. Employers’ common contingencies contribution...... ( Field 115 ) (2) , €

E7. Other items...... ( Field 116 ) (2) , €

E8. Deductions for excluded contingencies...... ( Field 131 ) , €

E9. Deductions for vol. col. common illness / non-occupational accident...... ( Field 132 ) , €

E10. Temporary Incapacity...... ( Field 201 ) , €

E11. Reductions...... ( Field 209 ) , €

E12. TI charges...... ( Field 311 ) , €

E13. IMS charges...... ( Field 312 ) , €

E14. IT, occup. accident and occup. disease compensation...... ( Field 410 ) , €

E15. Unemployment, FOGASA and occup...... ( Field 511 ) , €

E16. Employer’s contribution (Unemployment, FOGASA, OTFP)...... ( Field 512 ) , €

E17. Rebates / subsidies...... ( Field 601 ) , €

E18. Partial unemployment compensation...... ( Field 602 ) , €

(1) The fields specified are the fields in TC-1 that you must copy over into this questionnaire. (2) Enterprises covered by the Coalmining Special Scheme must transcribe the following fields of Contribution Form TC-1/4 at points E2 to E7:

E2= fields 111+112 of Contribution Form TC-1/4 E3= 0 E4= 0 E5= field 113 of Contribution Form TC-1/4 E6= field 114 of Contribution Form TC-1/4 E7= field 115 of Contribution Form TC-1/4

REMARKS: