Name______

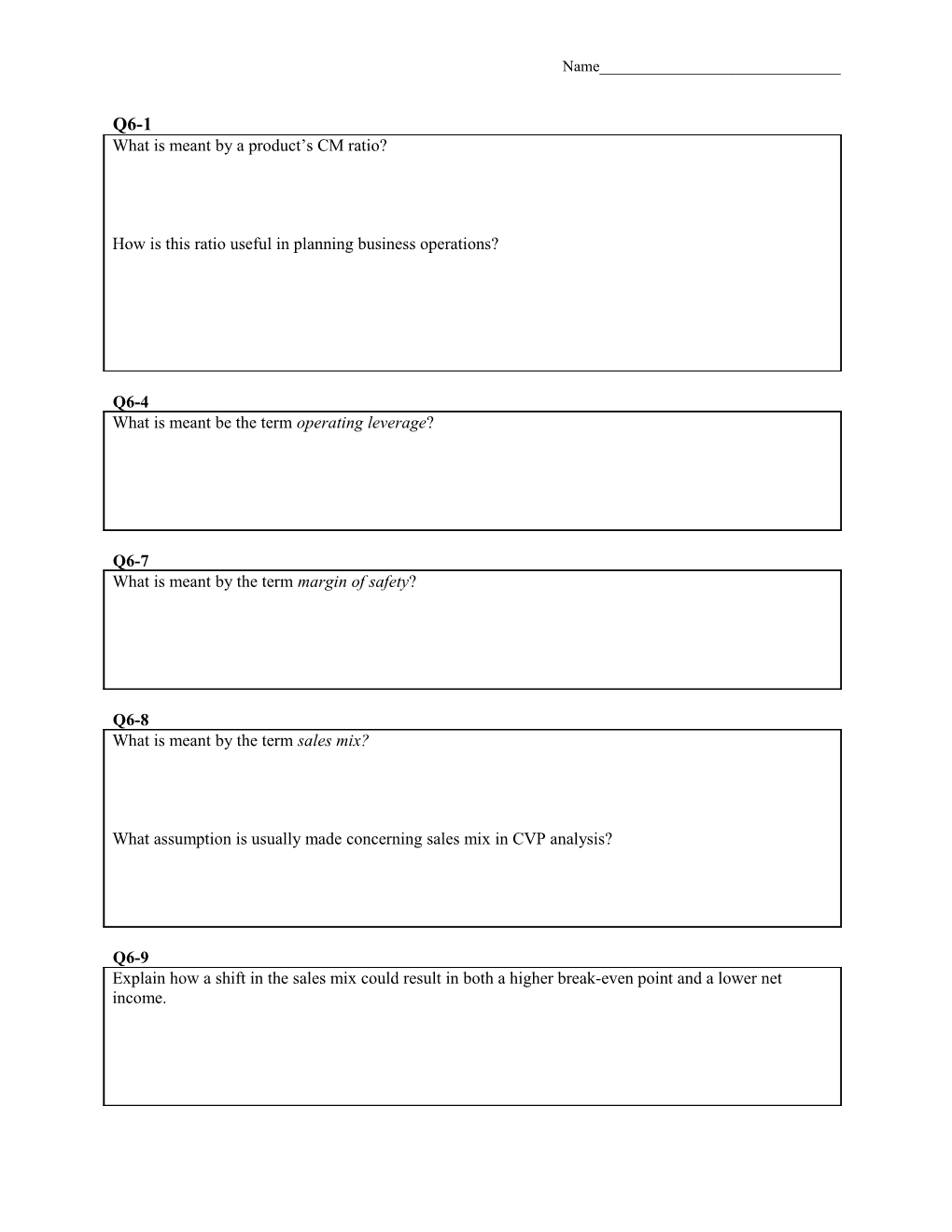

Q6-1 What is meant by a product’s CM ratio?

How is this ratio useful in planning business operations?

Q6-4 What is meant be the term operating leverage?

Q6-7 What is meant by the term margin of safety?

Q6-8 What is meant by the term sales mix?

What assumption is usually made concerning sales mix in CVP analysis?

Q6-9 Explain how a shift in the sales mix could result in both a higher break-even point and a lower net income. Name______

Exercise 6-1

Total Per Unit 1. Sales Less variable expenses Contribution margin Less fixed expenses Net operating income

2. Sales Less variable expenses Contribution margin Less fixed expenses Net operating income

3. Sales Less variable expenses Contribution margin Less fixed expenses Net operating income

4. Sales Less variable expenses Contribution margin Less fixed expenses Net operating income Name______

Exercise 6-2

1. CVP graph up to sales of 8,000 units.

2. Break-even point in unit sales Name______

Exercise 6-4. 1. The company’s contribution margin (CM) ratio:

2. The change in net operating income from an increase in total sales of $1,000 Name______

Exercise 6-12. 1. Monthly break-even point in units sold and in sales dollars.

2. Contribution margin at break-even point.

3. Units sold to earn a target profit of $90,000.

Contribution Income Statement:

Total Unit Name______

Exercise 6-12, continued

4. Margin of safety in dollar terms:

Margin of safety in percentage terms:

5. CM ratio?

If sales increase $50,000 per month & no change in fixed expenses, how much would your expect monthly net income to increase? Name______

Exercise 6-14 a.

Case Units Sold Sales Variable Contrib. Fixed Net Income Expenses Mgn / Unit Expenses (Loss) 1 15,000 $180,000 $120,000 $50,000

2 100,000 10 32,000 8,000

3 10,000 70,000 13 12,000

4 6,000 300,000 100,000 (10,000)

b.

Case Sales Variable Avg. Contrib. Fixed Expenses Net Income Expenses Mgn % (Loss) 1 $500,000 20% $7,000

2 400,000 260,000 100,000

3 60% 130,000 20,000

4 600,000 420,000 (5,000) Name______

Exercise 6-18 1. Flight Dynamic Sure Shot Total Amount % Amount % Amount %

2. Break-even point based on current sales mix:

3. If sales increase by P100,000 per month, by how much would you expect net operating income to increase? (What are your assumptions?) Name______

Problem 6-20

Product White Fragrant Loonzain Total

2. Break-Even Sales:

3.

Name______

Problem 6-24. 1. (1) (2) (3) (4) (5) (6) (7) (8) (9)

2 a. Line 3: Line 9: Break-even point: b. Line 3: Line 9: Break-even point: c. Line 3: Line 9: Break-even point: d. Line 3: Line 9: Break-even point: e. Line 3: Line 9: Break-even point: f. Line 3: Line 9: Break-even point: g. Line 3: Line 9: Break-even point: h. Line 3: Line 9: Break-even point: Name______

Exercise 6-15 1. Contribution Income Statement:

Total Unit

Degree of Operating Leverage:

2. At sales of 18,000 games (an increase of 3,000 games, or 20%), compute: a. Expected percentage increase in Net Operating Income

b. Expected total dollar Net Operating Income Name______

Problem 6-29

1. Contribution Income Statement:

Present Amount Per Unit %

Proposed Amount Per Unit %

2.

Present: Proposed: a. Degree of Operating Leverage

b. Dollar Sales to Break Even

c. Margin of Safety Name______

Problem 6-29, con’t.

3.

4. Break-Even Point in Dollar Sales under New Marketing Strategy