UTAH CHARTER SCHOOL FINANCE AUTHORITY CREDIT ENHANCEMENT PROGRAM

UTAH CHARTER ACADEMIES

BOND DOCUMENT REQUIREMENTS FOR DISCUSSION

In December, 2010, the Utah Charter School Finance Authority (the “Issuer”) issued its Charter School Revenue Bonds (Utah Charter Academies Project) Series 2010 (Taxable Qualified School Construction Bonds) (the “Series 2010 Bonds”) for the purpose of facilitating the financing of the acquisition and construction of charter school facilities to be operated by Utah Charter Academies (the “Charter School”) and to be located in West Valley City (the “Accelerated Campus”). The Series 2010 Bonds were issued pursuant to a Trust Indenture dated as of December 1, 2010 (the “Indenture”) between the Issuer and Zions First National Bank, as trustee (the “Trustee”). The Charter School has requested that the Issuer issue additional bonds under the Indenture (the “Series 2015 Bonds” and together with the Series 2010 Bonds, the “Bonds”) for the purpose of financing or refinancing the acquisition, construction and/or equipping of (i) additional charter school facilities located adjacent to the Accelerated Campus (the “Accelerated 2 Campus”), (ii) charter school facilities located at 12892 S. Pony Express Road in Draper, Utah (the “Draper 1 Campus”), (iii) charter school facilities located at 11938 S. Lone Peak Parkway, Draper, Utah (the “Draper 2 Campus”) and (iv) an expansion to the Accelerated 2 Campus (the “Accelerated Addition”). The Charter School is requesting that the Series 2015 Bonds be issued under the Issuer’s Credit Enhancement Program and that the Series 2010 Bonds remain unenhanced.

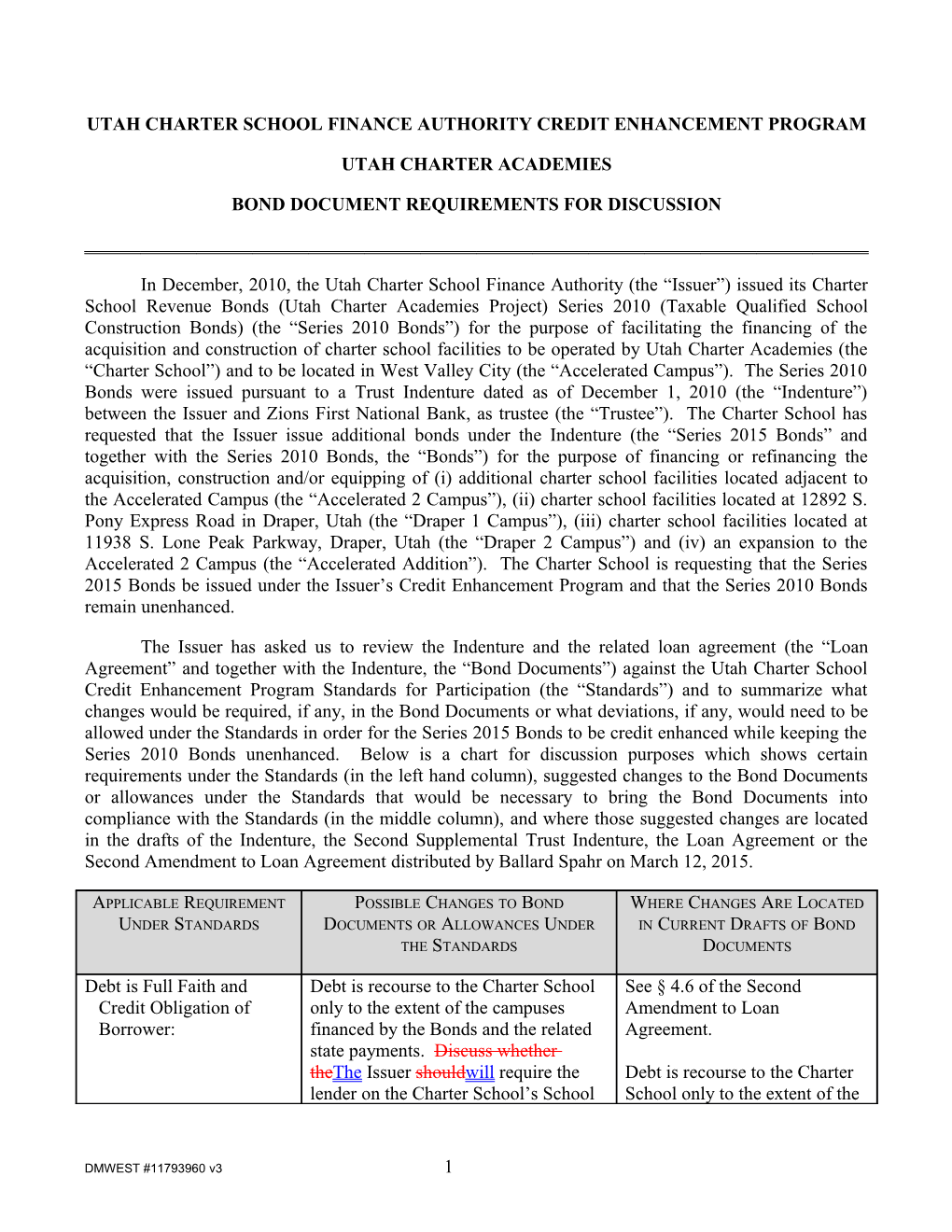

The Issuer has asked us to review the Indenture and the related loan agreement (the “Loan Agreement” and together with the Indenture, the “Bond Documents”) against the Utah Charter School Credit Enhancement Program Standards for Participation (the “Standards”) and to summarize what changes would be required, if any, in the Bond Documents or what deviations, if any, would need to be allowed under the Standards in order for the Series 2015 Bonds to be credit enhanced while keeping the Series 2010 Bonds unenhanced. Below is a chart for discussion purposes which shows certain requirements under the Standards (in the left hand column), suggested changes to the Bond Documents or allowances under the Standards that would be necessary to bring the Bond Documents into compliance with the Standards (in the middle column), and where those suggested changes are located in the drafts of the Indenture, the Second Supplemental Trust Indenture, the Loan Agreement or the Second Amendment to Loan Agreement distributed by Ballard Spahr on March 12, 2015.

APPLICABLE REQUIREMENT POSSIBLE CHANGES TO BOND WHERE CHANGES ARE LOCATED UNDER STANDARDS DOCUMENTS OR ALLOWANCES UNDER IN CURRENT DRAFTS OF BOND THE STANDARDS DOCUMENTS

Debt is Full Faith and Debt is recourse to the Charter School See § 4.6 of the Second Credit Obligation of only to the extent of the campuses Amendment to Loan Borrower: financed by the Bonds and the related Agreement. state payments. Discuss whether theThe Issuer shouldwill require the Debt is recourse to the Charter lender on the Charter School’s School School only to the extent of the

DMWEST #11793960 v3 1 for New Americans campus (NCB) to campuses financed by the enter into an intercreditor agreement to Bonds. specify the rights of the multiple lenders in the event of a default. Execute Intercreditor Agreement. Bond Purchasers Have The Trustee will have a first priority See definitions of “Mortgage” First Lien Mortgage: lien on the fee interest in the Draper 1 and “Series 2015 Mortgage” as and 2 Campuses solely for the benefit well as §§ 2.6 and 3.1 in the of the Series 2015 bondholders. The Second Supplemental Indenture, Series 2010 Bonds will not be secured § 4.9 of the Loan Agreement by the Draper 1 and 2 Campuses. The and § 3.2 of the Second Trustee will also have a first priority Amendment to Loan lien on the leasehold interest and a Agreement. second priority lien on the fee interest in the Accelerated 2 Campus which will secure all the Bonds. The second priority lien on the fee interest in the Accelerated 2 Campus will be subject to forbearance until the new market tax credit structure terminates. Under the terms of the new market tax credit structure, the Issuer may not initially have a first priority fee interest in the Accelerated 2 Campus. Fully-Funded Debt Service The Indenture will provide that either See § 3.5 of the Second Reserve Fund and Notice (i) the debt service reserve fund is only Supplemental Indenture. of Shortfall: pledged for the Series 2015 Bonds and that moneys therein can only be used to The Debt Service Reserve Fund make payments on the Series 2015 is split into two accounts – one Bonds, or (ii) there will be separate for the Series 2010 Bonds and debt service reserve funds for the one for the Series 2015 Bonds. Series 2010 Bonds and the Series 2015 Moneys in these accounts are Bonds and that moneys therein can only to be used to pay principal only be used to make payments on the and interest on their respective bonds to which such debt service Series of Bonds. reserve funds are pledged. In any event, Goldman Sachs, holder of all Series 2010 Bonds will not have any right or interest in moneys in the debt service reserve fund for the Series 2015 Bonds. This change and others modify the security of Goldman Sachs in the Indenture and per the Indenture will require Goldman Sachs’ consent on the supplemental indenture as well as a no- adverse effect opinion from bond counsel.

Debt Service Payments Series 2010 Bonds are payable on 3/15, See §§ 3.3 and 3.9 FIRST and April 15 and October 15: 6/15, 9/15 and 12/15—Series 2015 SECOND of Second Bonds are payable 4/15 and 10/15 to Supplemental Indenture. ensure timely appropriations if any; The Bond Principal Funds and because of timing mismatch of Bond Interest Funds are split payments, the Issuer may desire to into two accounts – one for the segregatewill require that the Bond Series 2010 Bonds and one for Fund be segregated for payments on the Series 2015 Bonds. Once the Series 2010 and Series 2015 Bonds moneys are deposited in these so that the Bond Fund in connection accounts, they may only be used with the Series 2010 Bonds is not to pay principal and interest on allowed to secure the Series 2015 their respective Series of Bonds. Bonds and vice versa. Borrower Covenant to Under the Standards, Debt Coverage See § 7.5 of the Second Maintain a Minimum Ratio is calculated as (revenues – Amendment to Loan Agreement Debt Coverage Ratio: expenditures + interest cost + and definitions of “Net Income depreciation). The Standards seem to Available for Debt Service for include all the charter school’s Issuer’s Requirements,” revenues and expenses. “Pledged Revenues for Issuer’s Requirements” and “Operating QUERY: Should this test only include Expenses for Issuer’s debt issued under or secured by the Requirements in Second Indenture? Supplemental Indenture. Additional Bonds Coverage Same issue as in #5 above. See § 8.13 of the Loan Ratio Test: Agreement as amended by § 7.4 of the Second Amendment to Loan Agreement. See also definitions of “Net Income Available for Debt Service for Issuer’s Requirements,” “Pledged Revenues for Issuer’s Requirements” and “Operating Expenses for Issuer’s Requirements in Second Supplemental Indenture.

These provisions include the revenues and expenses of all the Charter School’s campuses. Consent of Issuer to To comply with the Standards, the See § 6.6 of the Second Amend Indenture, Debt Bond Documents need to be amended Supplemental Indenture and § Service Reserve to add a provision specifying that any 9.6 of the Second Amendment Requirements, Maturity Series of Bonds won’t be accelerated to Loan Agreement. Schedule, Acceleration without Issuer consent assuming that

DMWEST #11793960 v3 3 the State is current on its moral The bond documents do notwill obligation appropriations. Goldman be revised to allow for Sachs’ consent, as owner of the Series acceleration of the Series 2010 2010 Bonds would be necessary for Bonds without Issuer consent. this changeThe Issuer will allow Goldman to accelerate the Series 2010 Bonds without the consent of the Issuer. Level Annual Debt Service This should only be applicable to credit See § 5.5 of the Second Payments: enhanced bonds (Series 2015 Bonds) Amendment to Loan Agreement.

The Series 2015 Bonds are to have level annual debt service payments. Issuer Right to Direct As the Issuer desires that its right to See § 6.6 of the Second Remedies for All direct remedies apply to all Bonds, and Supplemental Indenture and § Bondholders in the Event in order to comply with the Standards, 9.6 of the Second Amendment of a Draw on Moral the Bond Documents need to be to Loan Agreement. Obligation: amended to add a provision specifying that Issuer has the right to direct As currently drafted, the bond remedies in the event there is an documents allow the Issuer to appropriation under the Credit direct remedies as if the sole Enhancement Program. Goldman owner of the Bonds (both 2010 Sachs’ consent, as owner of the Series and 2015) if there has been an 2010 Bonds would be necessary for appropriation under the Credit this change. Enhancement Program that has not been reimbursed by the Charter School. The Issuer, however, may not take any remedies that would modify the key terms of the Series 2010 Bonds or that would jeopardize the status of the Series 2010 Bonds as Qualified School Construction Bonds without the consent of the Series 2010 Bond owners

Document comparison by Workshare Compare on Wednesday, May 20, 2015 4:56:57 PM Input: Document 1 ID interwovenSite://DMS-FIRM/DMWEST/11793960/3 #11793960v3

Legend: Insertion Deletion Moved from Moved to Style change Format change Moved deletion Inserted cell Deleted cell Moved cell Split/Merged cell Padding cell

Statistics: Count Insertions 7 Deletions 5 Moved from 0 Moved to 0 Style change 0 Format changed 0 Total changes 12