PROBLEM14-3A______

On December 1, 2001, the Itami Wholesale Company is attempting to project cash receipts and disbursements through January 31, 2002. On this latter date, a note will be payable in the amount of £100,000. This amount was borrowed in September to carry the company through the seasonal peak in November and December.

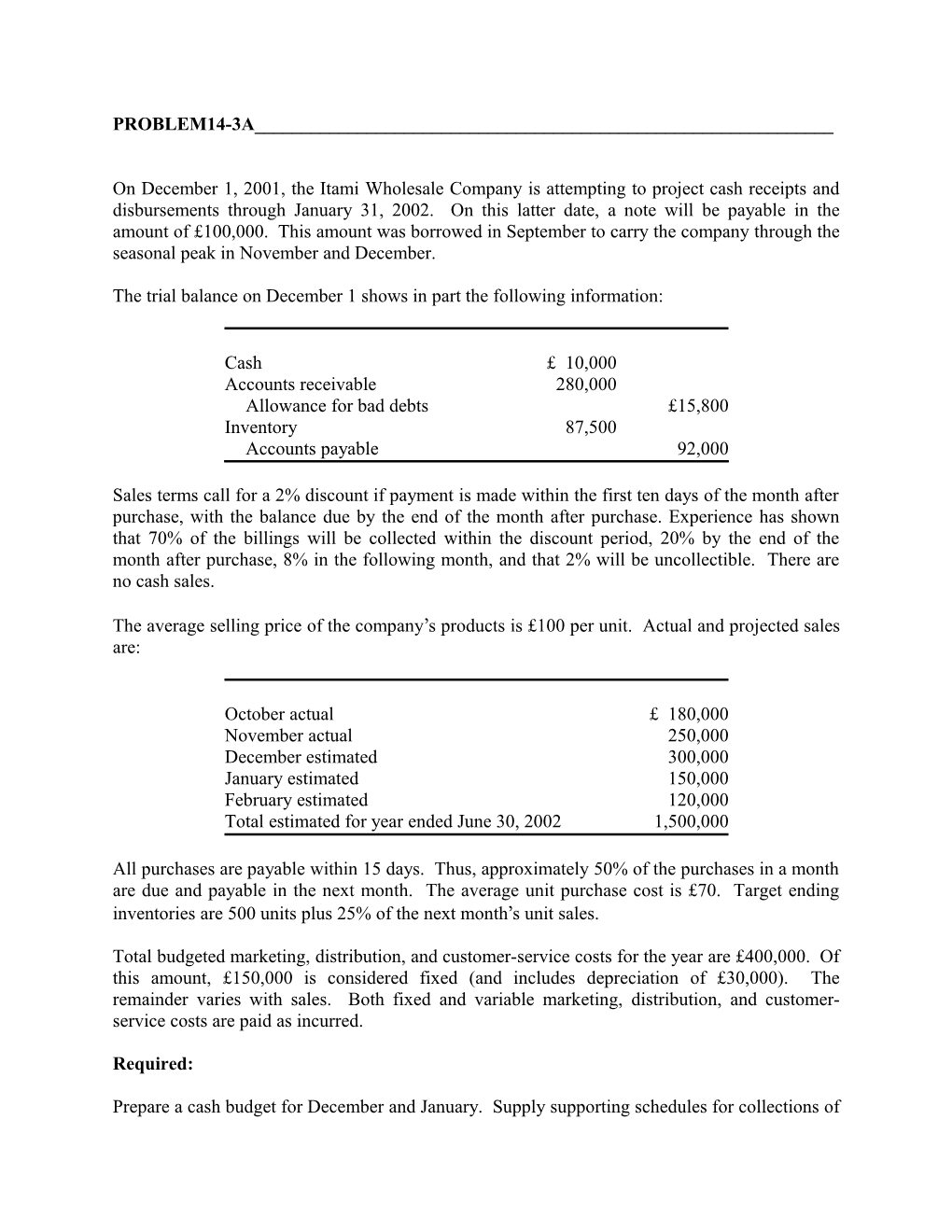

The trial balance on December 1 shows in part the following information:

Cash £ 10,000 Accounts receivable 280,000 Allowance for bad debts £15,800 Inventory 87,500 Accounts payable 92,000

Sales terms call for a 2% discount if payment is made within the first ten days of the month after purchase, with the balance due by the end of the month after purchase. Experience has shown that 70% of the billings will be collected within the discount period, 20% by the end of the month after purchase, 8% in the following month, and that 2% will be uncollectible. There are no cash sales.

The average selling price of the company’s products is £100 per unit. Actual and projected sales are:

October actual £ 180,000 November actual 250,000 December estimated 300,000 January estimated 150,000 February estimated 120,000 Total estimated for year ended June 30, 2002 1,500,000

All purchases are payable within 15 days. Thus, approximately 50% of the purchases in a month are due and payable in the next month. The average unit purchase cost is £70. Target ending inventories are 500 units plus 25% of the next month’s unit sales.

Total budgeted marketing, distribution, and customer-service costs for the year are £400,000. Of this amount, £150,000 is considered fixed (and includes depreciation of £30,000). The remainder varies with sales. Both fixed and variable marketing, distribution, and customer- service costs are paid as incurred.

Required:

Prepare a cash budget for December and January. Supply supporting schedules for collections of receivables, payments for merchandise, and marketing, distribution, and customer-service costs. PROBLEM 14-3A Continued

Instructions:

1. Review the printed template called Problem 14-3 that follows these instructions. Most of the problem data have been entered for you in the data input section of the spreadsheet.

2. There are 30 FORMULAS in the template that you need to provide to complete your analysis. Using the spaces provided below, write the formulas where requested in the template.

FORMULA 1 ______FORMULA 16 ______

FORMULA 2 ______FORMULA 17 ______

FORMULA 3 ______FORMULA 18 ______

FORMULA 4 ______FORMULA 19 ______

FORMULA 5 ______FORMULA 20 ______

FORMULA 6 ______FORMULA 21 ______

FORMULA 7 ______FORMULA 22 ______

FORMULA 8 ______FORMULA 23 ______

FORMULA 9 ______FORMULA 24 ______

FORMULA 10 ______FORMULA 25 ______

FORMULA 11 ______FORMULA 26 ______

FORMULA 12 ______FORMULA 27 ______

FORMULA 13 ______FORMULA 28 ______

FORMULA 14 ______FORMULA 29 ______

FORMULA 15 ______FORMULA 30 ______PROBLEM 14-3A Continued

3. Click the Lotus or Excel icon from the program manager screen to start the spreadsheet program. Click on the Open File SmartIcon/Button to retrieve the template for the problem. Then enter the 30 FORMULAS where indicated on the template.

4. Click the Save File SmartIcon/Button to save your work.

5. Click the Print SmartIcon to display the Print dialog box. Click the OK button to print your work.

For Excel users, click the Print Button to print your work.