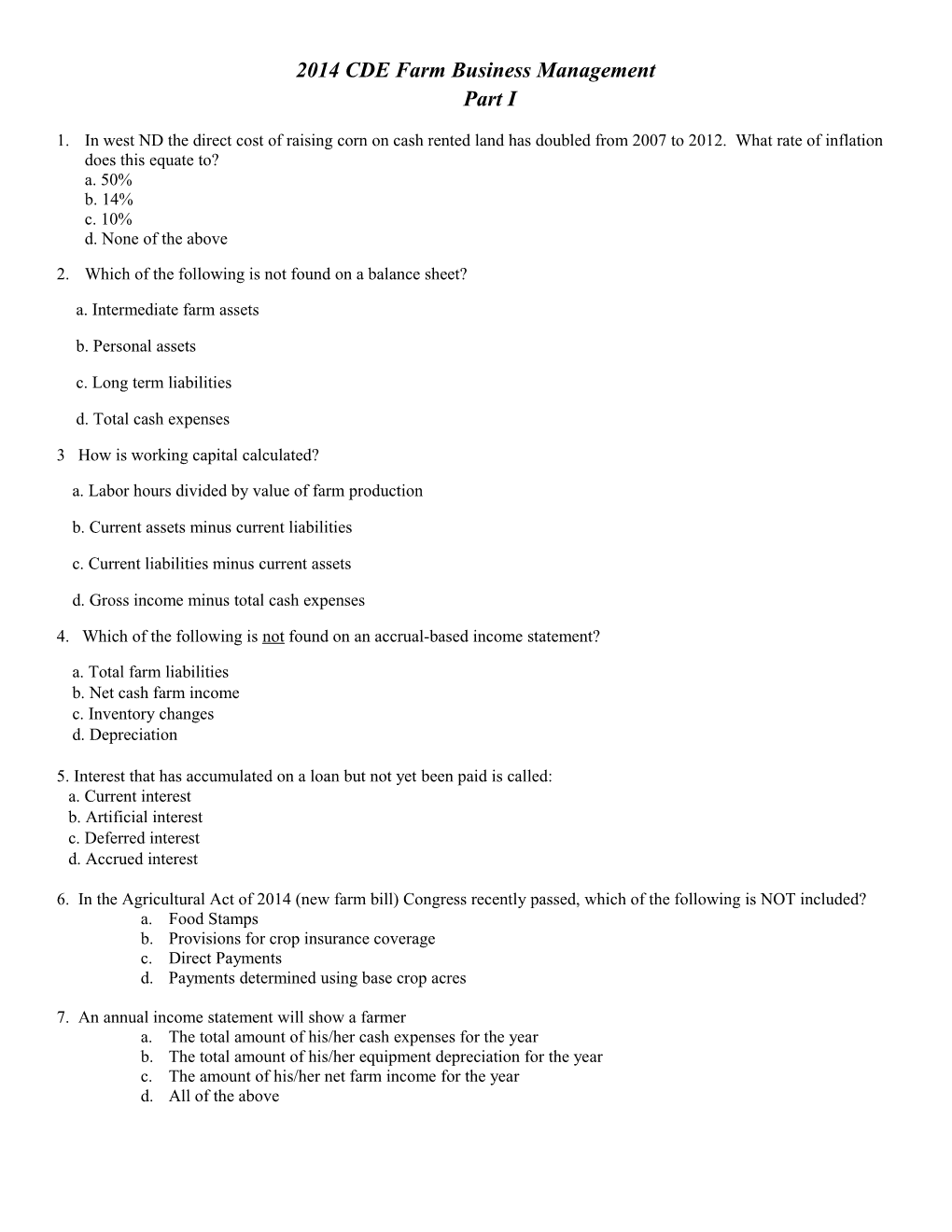

2014 CDE Farm Business Management Part I

1. In west ND the direct cost of raising corn on cash rented land has doubled from 2007 to 2012. What rate of inflation does this equate to? a. 50% b. 14% c. 10% d. None of the above

2. Which of the following is not found on a balance sheet?

a. Intermediate farm assets

b. Personal assets

c. Long term liabilities

d. Total cash expenses

3 How is working capital calculated?

a. Labor hours divided by value of farm production

b. Current assets minus current liabilities

c. Current liabilities minus current assets

d. Gross income minus total cash expenses

4. Which of the following is not found on an accrual-based income statement?

a. Total farm liabilities b. Net cash farm income c. Inventory changes d. Depreciation

5. Interest that has accumulated on a loan but not yet been paid is called: a. Current interest b. Artificial interest c. Deferred interest d. Accrued interest

6. In the Agricultural Act of 2014 (new farm bill) Congress recently passed, which of the following is NOT included? a. Food Stamps b. Provisions for crop insurance coverage c. Direct Payments d. Payments determined using base crop acres

7. An annual income statement will show a farmer a. The total amount of his/her cash expenses for the year b. The total amount of his/her equipment depreciation for the year c. The amount of his/her net farm income for the year d. All of the above 8. A farmer’s costs to grow an acre of corn are $342. Assuming a price of $3.80 per bushel, how many bushels per acre will this producer need to harvest to breakeven? a. 111 b. 99 c. 90 d. 78

9. Which of the following ratios would be the best indicator of farm profitability? a. Rate of return on farm assets b. Asset turnover rate c. Working capital to gross income ratio d. Debt to Asset Ratio

10. Which of the following would not be found on a cash flow statement? a. Total grain sales b. Loan payments c. Depreciation d. Family living expenses

11. Pasture cost for beef cattle has been increasing over time. Grazing land can be rented by the per acre cost for the season , or sometimes is paid for by the AUM ( animal unit month) which is a cow grazing for a months time. What is the least expensive way given this info: the pasture rents for $12 per acre. You are allowed to graze 45 cows for 5.5 months. Cow owners must keep fence adequately repaired. The pasture consist of 600 acres. Pasture rent can be paid on an aum basis at $ 25 per AUM. There is good water for cattle on the 600 acres.

a. Least expensive is to pay by the acre in this case b. Least expensive is to pay by the AUM in this case c. Cannot determine best method based on info given.

12. A loan taken out for a piece of machinery to be paid back over five years is a(n): a. Current Liability b. Long Term Liability c. Intermediate Liability d. Other Liability

13. The following is NOT an example of an opportunity cost: a. The cash rent income given up to farm a quarter of land. b. Death loss in a cattle operation. c. The value of working off the farm full time instead of working full time on the farm. d. Soybean revenue foregone when corn is planted.

14. Which of the following statements is true? a. As demand for corn increases, the price of corn decreases. b. When the supply of corn is long, the price rises. c. There is no relationship between the demand for corn and the price of corn. d. When the supply of corn is long, the price of corn decreases.

15. Allocating the cost of an asset over the useful life of the asset is called: a. Depreciation b. Asset Allocation c. Appreciation d. Expense Election 16. You have just won the lottery. You are offered the choice of taking $10,000 today or $13,000 over a five year period. Which of these should you consider in making your decision? a. Your college education. b. Your current debt. c. The time value of money. d. Your need for a new car.

17. The term used to identify the difference between the cash price and the futures price for the time, place and quality where delivery actually occurs is: a. Net price b. Basis c. Option d. Cash Market

18. The purpose of generating an annual income statement is to determine a. If purchasing a new bull is a wise decision b. If one should enroll in the FSA farm program c. Collateral available for a loan d. Net farm income

19. A farmer’s costs to grow an acre of wheat are $220. If it yields 40 bushels per acre, what is his cost per bushel? a. $1.81 b. $3.69 c. $4.40 d. $5.50

20. Which of the following is a current asset? a. Corn in the grain bin

b. Cow in the field.

c. Grain bin

d. Fence

21. Which of the following statements is true in defining the relationship between a balance sheet and an income or profit and loss statement? a. The income statement shows how much your assets are worth. b. A balance sheet shows what you own while an income statement shows what your assets earn. c. The income statement shows what you own while the balance sheet shows what your assets earn. d. The balance sheet and income statement are not related.

22. A forward contract is defined as: a. An agreement to buy or sell a set amount of a commodity at a predetermined price and date usually on a commodities

trading floor. b. A cash market transaction in which delivery of the product is deferred until after the contract has been made. c. Contract to sell product at a specific price at a specific date. d. A contract that gives the purchaser the right to purchase the product at a specified price.

23. Which of the following statements regarding cash flow analysis is NOT true? a. It is important to do a cash flow analysis on a regular basis to avoid cash flow problems. b. Cash flow analysis can help you make good management decisions. c. You will need to estimate the timing of your cash inflows and cash outflows to do an accurate cash flow analysis. d. Cash flow analysis uses historic data, not projections. 24. Which of the following would be the best example of an overhead cost? a. Farm insurance b. Repairs c. Land rent d. Fertilizer

25. How do you calculate Net Farm Income: a. Gross Income – Total Cash Farm Expenses b. Total Assets – Total Liabilities c. Gross Income – Total Cash Farm Expenses – Depreciation +/- Inventory Changes d. Gross Income – Total Cash Farm Expenses – Capital Purchases

26. Which of the following debt-to-equity ratios is stronger? a. 95% to 5% b. 15% to 85% c. 45% to 55% d. 10% to 90%

27. Which Farm Financial Ratio is calculated through using the balance sheet: a. Profitability b. Repayment Capacity c. Liquidity d. Financial Efficiency

28. Define Solvency a. Shows the borrower’s ability to repay term debts on time b. The difference between the value of goods produced and the cost of resources used in their production c. Ability of your business to pay all its debts if it were sold tomorrow d. Ability of your farm business to meet financial obligations as they come due

29. Deposits at commercial banks are insured by a. the Federal Reserve b. the Treasury c. the FDIC d. the Chicago Mercantile Exchange

30. In the simplest terms, a market is the interaction of a. goods and services b. business with consumers and government c. supply and deman d. wholesalers and retailers

31. The price of land depends on a. its productivity b. the price that its products command c. the demand for it d. all of the above 32. A purely competitive industry is characterized by a. no single seller with any control over price b. a single seller c. much advertising d. a small number of large firms

33. If you were to hedge your wheat in the futures market you would: a. Sell a futures contract b. Buy a futures contract c. Buy an option in the futures market d. Sell a cash contract

34. If I purchased some farm land for $1,500/acre, the real estate taxes were $5/acre and I received 80$/a cash rent what would my rate of return be calculated as a. 5% b. 1875% c. 5.33% d. 6%

35. What is the most important reason for doing a year-end balance sheet and income statement? a. for Taxes b. For your own information c. For your banker d. Measure progress

36. Farmer Fred has the following statistics on December 31: Current Liabilites-122,221, Intermediate Assets-$333,444, Long Term Liabilities-$298,765, Long Term Assets-$666,666, Intermediate Liabilities-$255,001, and Current Assets- $162,556. What is his current ratio?

a. .63

b. .75

c. 1.17

d. 1.33

37. Using Farmer Fred’s data in question 6, what is his net worth?

a. $486,679

b. $675,987

c. $1,162,666

d $1,838,653

38. Using Farmer Fred’s data in question 6, what is his debt to asset ratio?

a. 72% b. 60% c. 42% d. 33%

39. During the summer a rancher runs 9 bulls with 260 cows. When checked in November, 10 cows are determined to be open. Those 10 cows are sold. During calving season 248 cows give birth to 248 calves. The total number of calves weaned is 242 head. The total weight of the steer calves weaned is 72,842 pounds. The total weight of the heifer calves weaned is 69,212 pounds. How many pounds were weaned per cow exposed? a. 546 b. 568 c. 573 d. 587

40. What is my net farm income if I have 100,000 of farm income, 20,000 of non-farm income, 65,000 of farm expenses(includes depreciation), 30,000 of non-farm expenses and 15,000 of principle owed on my tractor (there are no inventory changes)? a. $10,000 b. $35,000 c. $20,000 d. $40000

41. A current ratio is not as important on what type of farm: a. Grain farm b. Grain and Livestock Farm c. Dairy Farm d. It makes no difference

42. A farmer’s goal may be to have a net income ratio of 20%. He/she wants a net income of at least $80,000. What would be the $ target for Gross Income on the accrual adjusted basis? a. $160,000 b. $400,000 c. $1,600,000 d. none of the above

43.When a producer is deciding to spend money on an enterprise a. Marginal costs need to be greater than marginal returns b. Marginal returns need to be greater than marginal costs c. He should consult with his neighbors d. He should consult with his spouse

44. Asset turnover is a measure of: a. Efficiency b. Liquidity c. Solvency d. repayment capacity 45. Trade quotas reduce total volume of imports a. but have no effect on prices charged in the domestic market b. but may lead to lower prices in domestic markets c. and usually increase prices paid by consumers in domestic markets d. all of the above

46. Which of the following are types of business organizations according to the legal system?

a. proprietorship, partnership, and corporation

b. monopoly, pure competition, and oligopoly

c. retail, wholesale, and service

d. primary, secondary, and tertiary 47. Which of the following directly affects a rancher’s net return per cow? a. The cost per animal unit month of pasture b. Market price for the calves at weaning c. Pounds weaned per exposed cow d. All of the above

48. Working capital is influenced by: a. Value of grain on inventory b. Long term debt c. Accounts payable d. a & c

49. Operating Profit Margin is calculated by: a. Dividing Farm Net Worth by the Value of Farm Production b. Multiplying the Rate of Return on Farm Assets times Farm Net Worth c. Subtracting the Value of Operator’s Labor and Management from Net Farm Income d. Net Farm Income plus interest Paid minis value of unpaid family labor and management divided by value of farm production

50. Long term assets (on a balance sheet using the following classifications: Current Assets, Intermediate Assets and Long Term Assets) generally include all of the following items. a. Land, Buildings, Breeding Livestock and Co-op Equity b. Land, Buildings and Co-op Equity c. Land and Buildings d. Land 2014 CDE Farm Management Test Key part 1

1 B 39 A

2 D 40 B

3 B 41 C

4 A 42 B

5 D 43 B

6 C 44 A

7 D 45 C

8 C 46 A

9 D 47 D

10 C 48 D

11 B 49 D

12 C 50 B

13 B

14 D

15 A

16 C

17 B

18 D

19 D

20 A

21 B

22 C

23 D

24 A

25 C

26 D 27 C

28 C

29 C

30 C

31 D

32 A

33 A

34 C

35 D

36 D

37 A

38 D