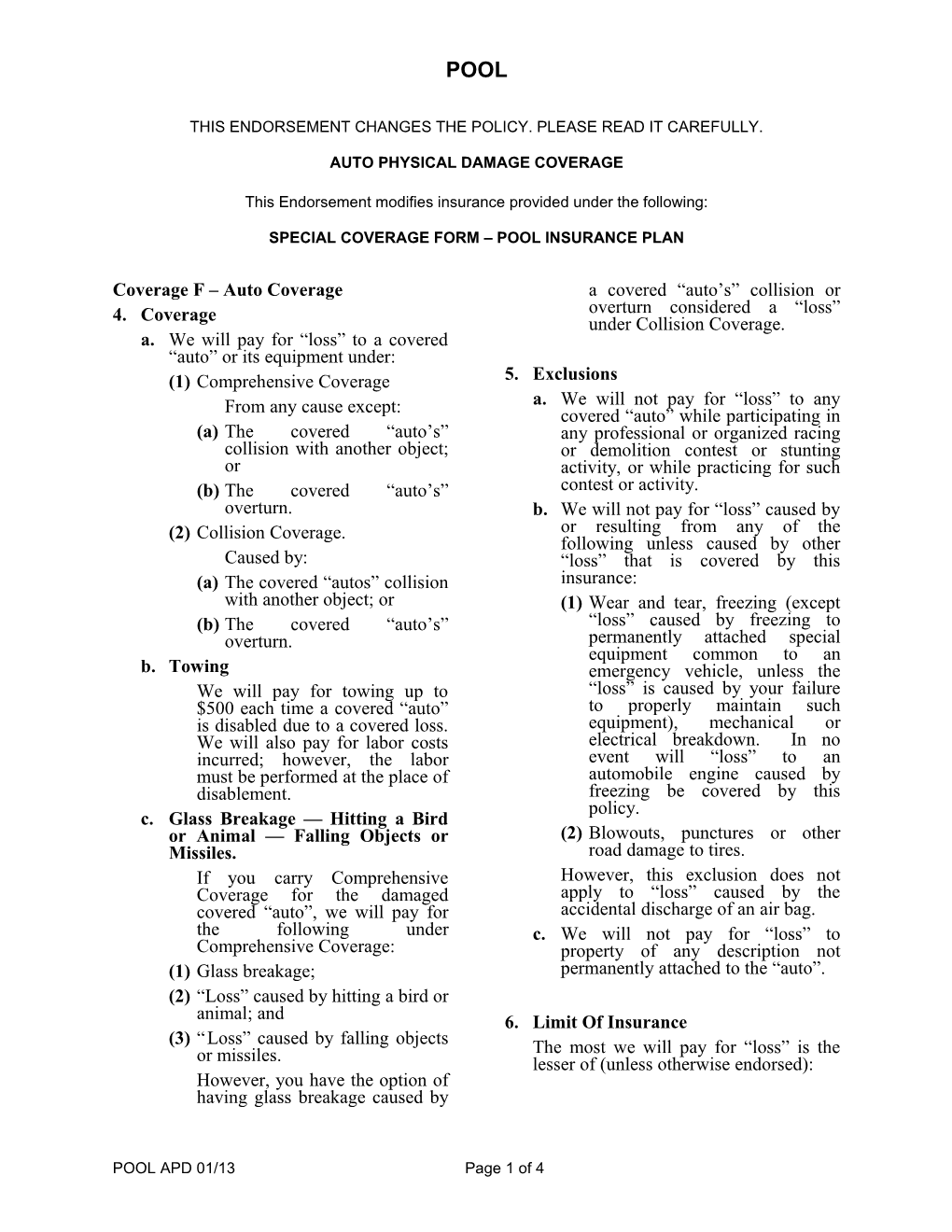

POOL

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

AUTO PHYSICAL DAMAGE COVERAGE

This Endorsement modifies insurance provided under the following:

SPECIAL COVERAGE FORM – POOL INSURANCE PLAN

Coverage F – Auto Coverage a covered “auto’s” collision or overturn considered a “loss” 4. Coverage under Collision Coverage. a. We will pay for “loss” to a covered “auto” or its equipment under: (1) Comprehensive Coverage 5. Exclusions a. We will not pay for “loss” to any From any cause except: covered “auto” while participating in (a) The covered “auto’s” any professional or organized racing collision with another object; or demolition contest or stunting or activity, or while practicing for such (b) The covered “auto’s” contest or activity. overturn. b. We will not pay for “loss” caused by (2) Collision Coverage. or resulting from any of the following unless caused by other Caused by: “loss” that is covered by this (a) The covered “autos” collision insurance: with another object; or (1) Wear and tear, freezing (except (b) The covered “auto’s” “loss” caused by freezing to overturn. permanently attached special equipment common to an b. Towing emergency vehicle, unless the We will pay for towing up to “loss” is caused by your failure $500 each time a covered “auto” to properly maintain such is disabled due to a covered loss. equipment), mechanical or We will also pay for labor costs electrical breakdown. In no incurred; however, the labor event will “loss” to an must be performed at the place of automobile engine caused by disablement. freezing be covered by this policy. c. Glass Breakage — Hitting a Bird or Animal — Falling Objects or (2) Blowouts, punctures or other Missiles. road damage to tires. If you carry Comprehensive However, this exclusion does not Coverage for the damaged apply to “loss” caused by the covered “auto”, we will pay for accidental discharge of an air bag. the following under c. We will not pay for “loss” to Comprehensive Coverage: property of any description not (1) Glass breakage; permanently attached to the “auto”. (2) “Loss” caused by hitting a bird or animal; and 6. Limit Of Insurance (3) “Loss” caused by falling objects The most we will pay for “loss” is the or missiles. lesser of (unless otherwise endorsed): However, you have the option of having glass breakage caused by

POOL APD 01/13 Page 1 of 4 a. The actual cash value of the appointed officials, and members of damaged or stolen property as of the any board, council, committee, time of the “loss”; or commission, agency or other organization of yours for the b. The cost of repairing or replacing the physical damage deductible damaged or stolen property with applicable to their personal auto other property of like kind and policy, up to $500 per “auto” for quality. damage to any “auto” owned or leased by the “employee”, volunteer, 7. Deductible elected or appointed official, or member of any board, council, For each covered “auto”, our committee, commission, agency or obligation to pay for, repair, return or other organization of yours which replace damaged or stolen property occurs while that "auto” is used in will be reduced by the applicable connection with your business. We deductible shown in the will not pay anyone more than once, Declarations. directly or indirectly, for the same elements of "loss". a. Deductible Waiver b. Hired Auto If a “loss” covered under this Auto If Comprehensive or Collision Coverage also involves a “loss” coverages are provided under this under another coverage part issued Coverage Form for any “auto” you by us only one deductible, the own, then the Physical Damage largest, will be applied. Regardless Coverages provided are extended to of the number of covered “autos” “autos” you hire. suffering a physical damage “loss” The most we will pay for “loss” to while engaged in a single “accident”, any hired “auto” is the lesser of only one deductible, the largest, shall $35,000 or Actual Cash Value or apply to the entire event. Cost of Repair, minus a deductible. b. Waiver of Collision Deductible The deductible will be equal to the largest deductible applicable to any This Auto Physical Damage owned “auto” for that coverage. No Coverage will not apply the deductible applies to “loss” caused deductible to “loss” caused by by fire or lightning. Subject to the collision by another vehicle if all of above limit and deductible these conditions are met: provisions, we will provide coverage (1) The “loss” to a covered “auto” is equal to the broadest coverage greater than the deductible applicable to any “auto” you own. amount; and We will also cover loss of use of the (2) The owner and driver of the other hired “auto” if it results from an vehicle are identified; and “accident” for which you are legally liable and the lessor incurs an actual (3) The owner and driver of the other financial loss, subject to a maximum vehicle has a liability policy of $500 per “accident”. covering the “loss”; and c. Commandeered Autos (4) The driver of the covered “auto” is not legally responsible, in any If Comprehensive and Collision way, for causing or contributing Coverage is provided, then to the “loss”. Comprehensive and Collision coverage is extended to “autos” you commandeer as a result of your 8. Coverage Extensions business activities or operations. a. Personal Auto – Physical Damage The most we will pay for “loss” to Deductible Recovery any commandeered “auto” is the We will reimburse your lesser of $500,000 or Actual Cash “employees”, volunteers, elected or Value or Cost of Repair, minus a

POOL APD 01/13 Page 2 of 4 deductible of $500. No deductible following amounts for each mutual applies to “loss” caused by fire or aid assistance made for you by lightning. Subject to the above limit another municipality: and deductible provisions, we will provide coverage equal to the (1) Necessary and actual expenses broadest coverage applicable to any incurred; or “auto” you own. (2) Five Thousand Dollars ($5,000). We will also cover loss of use of the No deductible will apply to this commandeered “auto” if it results reimbursement. Coverage shall be from an “accident” for which you are excess of the responding legally liable and the owner incurs an municipality’s Physical Damage actual financial loss, subject to a coverage. maximum of $500 per “accident”. . d. Lease Gap Coverage g. Care, Custody or Control If a long-term leased “auto” is a We will pay for loss to: covered “auto” and the lessor is named as an Additional Insured - (1) “ Autos” of others left in your Lessor, in the event of a total “loss” care, custody or control while we will pay your additional legal being impounded, attended, obligation to the lessor for any serviced, repaired, parked or difference between the actual cash stored by you; and value of the “auto” at the time of the (2) Property transported by you, “loss” and the “outstanding balance” other than property owned by of the lease. you or any insured. “Outstanding balance” means the Subject to a maximum of $250,000 amount you owe on the lease at the for all “loss” in any one event, the time of “loss” less any amounts most we will pay is $50,000 any one representing taxes; overdue “auto” under (1) above and $100,000 payments; penalties, interest or any one “loss” under (2) above. charges resulting from overdue payments; additional mileage The insurance provided under (1) charges; excess wear and tear above does not apply to any covered charges; and lease termination fees. “auto” including any “auto” owned by you or any insured. e. Temporary Transportation Expense Our obligation to pay for “loss” applies only to the amount of “loss” We will pay for transportation in excess of $1,000 deductible each expense incurred by you because of “accident”. We may pay all or any the covered damage to a covered part of the deductible amount to “auto.” We will pay only for those affect settlement of any claim or covered “autos” for which you carry “suit” and you shall promptly Comprehensive or Collision reimburse us for that part of the Coverage. No deductible shall deductible we paid upon written apply. demand by us. f. Mutual Aid Reimbursement We will not pay anyone more than We will reimburse you for the once, directly or indirectly, for the expense of mutual aid assistance same element of loss. incurred by you when you request h. “ Employee’s” Or Volunteer’s assistance from another municipality Personal Effects in Autos because of a covered “loss” to an “auto” of the responding (1) Such personal effects are located municipality. within an “auto” owned by you, that “employee” or that volunteer; and The amount we will reimburse you will be limited to the lesser of the

POOL APD 01/13 Page 3 of 4 (2) The “employee” or volunteer is (2) Return the stolen property, at our acting within the scope of their expense. We will pay for any duties for you. damage that results to the “auto” We will not pay for “loss” caused by from the theft; or theft to personal effects from an (3) Take all or any part of the unattended “auto” unless: damaged or stolen property at an (1) The “auto” is equipped with a agreed or appraised value. fully enclosed body or c. Concealment, Misrepresentation compartment; and Or Fraud (2) The “loss” is a direct result of This coverage is void in any case of forcible entry (of which there is fraud by you at any time as it relates visible evidence) into a fully to this coverage. It is also void if enclosed body, the doors and you or any other insured, at any time, windows of which were securely intentionally conceal or misrepresent locked, or from a compartment a material fact concerning: which was locked. (1) This coverage; The most we will pay for “loss” to personal effects is $2,500 in any one (2) The covered “auto”; “accident”. (3) Your interest in the covered We will not pay anyone more than once, “auto”; or directly or indirectly, for the same (4) A claim under this coverage. element of loss. No oral or written statement, representation or warranty made by the insured or on his behalf in the 9. Conditions negotiation for or procurement of a. Appraisal For Physical Damage this coverage shall be deemed Loss material or defeat or void this coverage, unless such statement, If you and we disagree on the representation or warranty was false amount of “loss”, either may demand and made with intent to deceive, or an appraisal of the “loss”. In this unless the matter misrepresented or event, each party will select a made a warranty increased the risk or competent appraiser. The two contributed to the "loss" and no appraisers will select a competent breach of a warranty in this coverage and impartial umpire. The appraisers shall defeat or void this coverage, will state separately the actual cash unless the breach of such warranty value and amount of “loss”. If they increased the risk at the time of fail to agree, they will submit their "loss," or contributed to the "loss," or differences to the umpire. A existed at the time of the "loss." decision agreed to by any two will be binding. Each party will: Our authorized representative's knowledge will be considered our (1) Pay its chosen appraiser, and knowledge. If our authorized (2) Bear the other expenses of the representative knows before an appraisal and umpire equally. "accident" or "loss" something which violates a policy condition, this will If we submit to an appraisal, we will not void the policy or defeat a still retain our right to deny the recovery for a claim. claim. b. Loss Payment Physical Damage Coverages If we elect to rescind this coverage, we will At our option we may: notify the insured of our intention within 60 (1) Pay for, repair or replace days after acquiring knowledge of sufficient damaged or stolen property; facts to constitute grounds for rescission.

POOL APD 01/13 Page 4 of 4