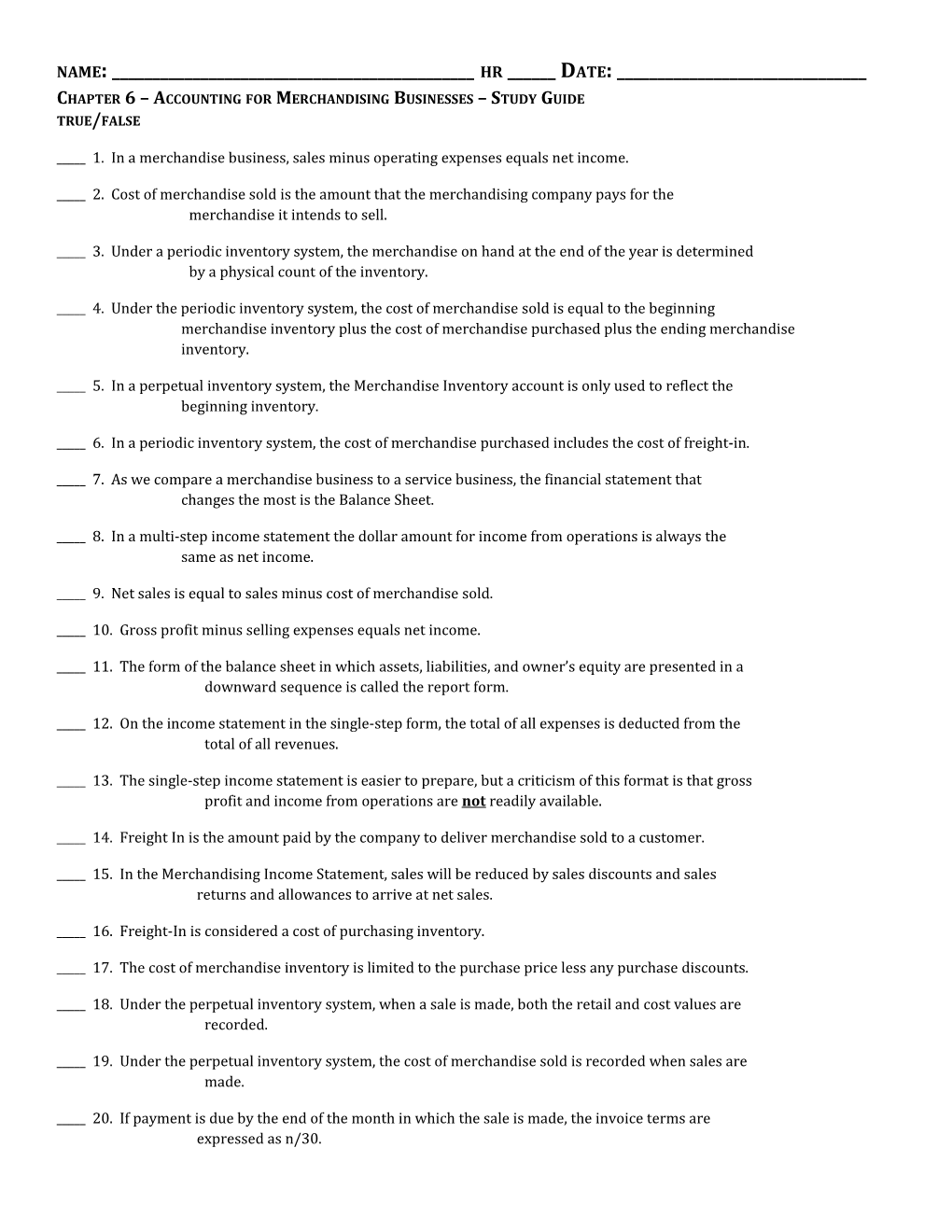

NAME: ______HR ______DATE: ______CHAPTER 6 – ACCOUNTING FOR MERCHANDISING BUSINESSES – STUDY GUIDE TRUE/FALSE

_____ 1. In a merchandise business, sales minus operating expenses equals net income.

_____ 2. Cost of merchandise sold is the amount that the merchandising company pays for the merchandise it intends to sell.

_____ 3. Under a periodic inventory system, the merchandise on hand at the end of the year is determined by a physical count of the inventory.

_____ 4. Under the periodic inventory system, the cost of merchandise sold is equal to the beginning merchandise inventory plus the cost of merchandise purchased plus the ending merchandise inventory.

_____ 5. In a perpetual inventory system, the Merchandise Inventory account is only used to reflect the beginning inventory.

_____ 6. In a periodic inventory system, the cost of merchandise purchased includes the cost of freight-in.

_____ 7. As we compare a merchandise business to a service business, the financial statement that changes the most is the Balance Sheet.

_____ 8. In a multi-step income statement the dollar amount for income from operations is always the same as net income.

_____ 9. Net sales is equal to sales minus cost of merchandise sold.

_____ 10. Gross profit minus selling expenses equals net income.

_____ 11. The form of the balance sheet in which assets, liabilities, and owner’s equity are presented in a downward sequence is called the report form.

_____ 12. On the income statement in the single-step form, the total of all expenses is deducted from the total of all revenues.

_____ 13. The single-step income statement is easier to prepare, but a criticism of this format is that gross profit and income from operations are not readily available.

_____ 14. Freight In is the amount paid by the company to deliver merchandise sold to a customer.

_____ 15. In the Merchandising Income Statement, sales will be reduced by sales discounts and sales returns and allowances to arrive at net sales.

_____ 16. Freight-In is considered a cost of purchasing inventory.

_____ 17. The cost of merchandise inventory is limited to the purchase price less any purchase discounts.

_____ 18. Under the perpetual inventory system, when a sale is made, both the retail and cost values are recorded.

_____ 19. Under the perpetual inventory system, the cost of merchandise sold is recorded when sales are made.

_____ 20. If payment is due by the end of the month in which the sale is made, the invoice terms are expressed as n/30. _____ 21. When merchandise that was sold is returned, a credit to sales returns and allowances is made.

_____ 22. In a perpetual inventory system, when merchandise is returned to the seller, Cost of Merchandise Sold is one of the accounts debited to record the transaction.

_____ 23. Sales Returns and Allowances is a contra-revenue account.

_____ 24. Sales Discounts is a revenue account with a credit balance.

_____ 25. Retailers record all credit card sales as charge sales.

_____ 26. The service fee that credit card companies charge retailers varies and is the primary reason why some businesses do not accept all credit cards.

_____ 27. A seller may grant a buyer a reduction in selling price and this is called a sales allowance.

_____ 28. The effect of a sales return and allowance is a reduction in sales revenue and a decrease in cash or accounts receivable.

_____ 29. Merchandise Inventory normally has a debit balance.

_____ 30. A buyer who acquires merchandise under credit terms of 1/10, n/30 has 30 days after the invoice date to take advantage of the cash discount.

_____ 31. Discounts taken by the buyer for early payment of an invoice are credited to Cash Discounts by the buyer.

_____ 32. In a perpetual inventory system, merchandise returned to vendors reduces the merchandise inventory account.

_____ 33. When a large quantity of merchandise is purchased, a reduction allowed on the sale price is called a trade discount.

_____ 34. A deduction allowed to wholesalers and retailers from the price of merchandise listed in catalogs is called discounts.

_____ 35. If the ownership of merchandise passes to the buyer when the seller delivers the merchandise for shipment, the terms are stated as FOB destination.

_____ 36. A sale of $750 on account, subject to a sales tax of 6%, would be recorded as an account receivable of $750.

_____ 37. When merchandise is sold for $600 plus 6% sales tax, the Sales account should be credited for $636.

_____ 38. If merchandise costing $3,500, terms FOB destination, 2/10, n/30, with prepaid freight cost of $125, is paid within 10 days, the amount of the purchases discount is $70.

_____ 39. The buyer will include the sales tax as part of the cost of merchandise purchased.

_____ 40. If the perpetual inventory shrinkage would generally include a debit to Cost of Merchandise Sold.

MULTIPLE CHOICE

_____ 41. Net income plus operating expenses is equal to a. In what is sold b. The inclusion of gross profit in the income statement c. Accounting equation d. Merchandise inventory included in the balance sheet

_____ 42. Generally, the revenue account for a merchandising business is entitled a. Sales b. Net sales c. Gross sales d. Gross profit

_____ 43. What is the term applied to the excess of net revenue from sales over the cost of merchandise sold? a. Gross profit b. Income from operations c. Net income d. Gross sales

_____ 44. The term “inventory” indicates a. Merchandise held for sale in the normal course of business b. Materials in the process of production or held for production c. Supplies d. Both (a) and (b)

_____ 45. A company using the periodic inventory system has the following account balances: Merchandise Inventory at the beginning of the year, $3,600; Freight-In, $650; Purchases, $10,700; Purchases Returns and Allowances, $1,950; Purchases Discounts, $330. The cost of merchandise purchased is equal to a. $12,670 b. $9,070 c. $8,420 d. $17,230

_____ 46. A company, using the periodic inventory system, has merchandise inventory costing $175 on hand at the beginning of the period. During the period, merchandise costing $635 is purchased. At year-end, merchandise inventory costing $160 is on hand. The cost of merchandise sold for the year is a. $970 b. $650 c. $300 d. $620

_____ 47. The form of income statement that derives its name from the fact that the total of all expenses is deducted from the total of all revenues is called a a. Multiple-step statement b. Revenue statement c. Report-form statement d. Single-step statement

_____ 48. Multiple-step income statements show a. Gross profit but not income from operations b. Neither gross profit nor income from operations c. Both gross profit and income from operations d. Income from operations but not gross profit

_____ 49. When the three sections of a balance sheet are presented on a page in a downward sequence, it is called the a. Account form b. Comparative form c. Horizontal form d. Report form

_____ 50. The statement of owner’s equity shows a. Only net income, beginning and ending capital b. Only total assets, beginning and ending capital c. Only net income, beginning capital, and withdrawals d. All the changes in the owner’s capital as a result of net income, net loss, additional investments, and withdrawals

_____ 51. Merchandise inventory is classified on the balance sheet as a a. Current Liability b. Current Asset c. Long-Term Asset d. Long-Term Liability

_____ 52. The inventory system employing accounting records that continuously disclose the amount of inventory is called a. Retail b. Periodic c. Physical d. Perpetual

_____ 53. When the perpetual inventory system is used, the inventory sold is shown on the income statement as a. Cost of merchandise sold b. Purchases c. Purchases returns and allowances d. Net purchases

_____ 54. Dorman Co. sold merchandise to Smith Co. on account, $18,000, terms 2/15, net 45. The cost of the merchandise sold is $15,500. Dorman Co. issued a credit memo for $1,750 for merchandise returned that originally cost $1,400. The Smith Co. paid the invoice within the discount period. What is the amount of net sales from the above transactions? a. $16,250 b. $14,100 c. $15,925 d. $13,818

_____ 55. Using a perpetual inventory system, the entry to record the sale of merchandise on account includes a a. Debit to Sales b. Debit to Merchandise Inventory c. Credit to Merchandise Inventory d. Credit to Accounts Receivable

_____ 56. Merchandise is ordered on June 13; the merchandise is shipped by the seller and the invoice is prepared, dated, and mailed by the seller on June 16; the merchandise is received by the buyer on June 18; the entry is made in the buyer’s accounts on June 19. The credit period begins with what date? a. June 13 b. June 16 c. June 18 d. June 19

_____ 57. Using a perpetual inventory system, the entry to record the return from a customer of merchandise sold on account includes a a. Credit to Sales Returns and Allowances b. Debit to Merchandise Inventory c. Credit to Merchandise Inventory d. Debit to Cost of Merchandise Sold

_____ 58. If merchandise sold on account is returned to the seller, the seller may inform the customer of the details by issuing a a. Sales invoice b. Purchase invoice c. Credit memo d. Debit memo

_____ 59. The arrangements between buyer and seller as to when payments for merchandise are to be made are called a. Credit terms b. Net cash c. Cash on demand d. Gross cash

_____ 60. In credit terms of 3/15, n/45, the “3” represents the a. Number of days in the discount period b. Full amount of the invoice c. Number of days when the entire amount is due d. Percent of the cash discount

_____ 61. Merchandise with a sales price of $800 is sold on account with term 2/10, n/30. The journal entry to record the sale would include a a. Debit to Cash for $800 b. Debit to Sales Discounts for $16 c. Credit to Sales for $800 d. Debit to Accounts Receivable for $784

_____ 62. Merchandise subject terms 1/10, n/30, FOB shipping point, is sold on account to a customer for $25,000. The seller paid freight costs of $2,000 and issued a credit memo for $10,000 prior to payment. What is the amount of the cash discount allowable? a. $170 b. $150 c. $130 d. $250

_____ 63. The entry to record the return of merchandise from a customer would include a a. Debit to Sales b. Credit to Sales c. Debit to Sales Returns and Allowances d. Credit to Sales Returns and Allowances _____ 64. When a buyer returns merchandise purchased for cash, the buyer may record the transaction using the following entry a. Debit Merchandise Inventory; Credit Cash b. Debit Cash; credit Merchandise Inventory c. Debit Cash; credit Sales Returns and Allowances d. Debit Sales Returns and Allowances; credit Cash

_____ 65. When merchandise is returned under the perpetual inventory system, the buyer would credit a. Merchandise Inventory b. Purchases Returns and Allowances c. Accounts Payable d. Depending on the inventory system used

_____ 66. The amount of the total cash paid to the seller for merchandise purchased would normally Include a. Only the list price b. Only the sales tax c. The list price plus the sales tax d. The list price less the sales tax

_____ 67. A sales invoice included the following information: merchandise price, $5,000; freight, $900; terms 1/10, n/eom, FOB shipping point. Assuming that a credit for merchandise returned of $700 is granted prior to payment, that the freight has already been prepaid by the seller, and that the invoice is paid within the discount period, what is the remaining amount of cash that should be received by the seller? a. $4,257 b. $4,300 c. $3,400 d. $4,950

_____ 68. Merchandise is sold for cash. The selling price of the merchandise is $3,000 and the sale is subject to a 7% state sales tax. The journal entry to record the sale would include a. A debit to Cash for $3,000 b. A credit to Sales for $3,210 c. A credit to Sales Tax Payable for $210 d. None of the above

_____ 69. If the buyer is to pay the freight costs of delivering merchandise, delivery terms are stated as a. FOB shipping point b. FOB destination c. FOB n/30 d. FOB buyer

_____ 70. Merchandise with an invoice price of $5,000 is purchased on September 2 subject to terms of 2/10, n/30, FOB destination. Freight costs paid by the seller totaled $200. What is the cost of merchandise if paid on September 12, assuming the discount is taken? a. $5,200 b. $5,096 c. $4,704 d. $4,900

_____ 71. When goods are shipped FOB destination and the seller pays the freight charges, the buyer a. Journalizes a reduction for the cost of merchandise b. Journalizes a reimbursement to the seller c. Does not take a discount d. Makes no journal entry for the freight

_____ 72. Isaac Co. sells merchandise on credit to Sonar Co in the amount of $9,600. The invoice is dated on April 15 with terms of 1/15, net 45. What is the amount of the discount and up to what date must the invoice be paid in order for the buyer to take advantage of the discount? a. $80, April 30 b. $192, April 25 c. $96, April 30 d. $96, April 25

_____ 73. Discounts taken by a buyer because of early payment are recorded on the seller’s accounting records as a. Purchases discount b. Sales discount c. Trade discount d. Early payment discount

_____ 74. Who pays the freight costs when the terms are FOB shipping point? a. The ultimate customer b. The buyer c. The seller d. Either the seller or the buyer

_____ 75. Who pays the freight cost when the terms are FOB destination? a. The seller b. The buyer c. The customer d. Either the buyer or the seller

_____ 76. A retailer purchases merchandise with a catalog list price of $15,000. The retailer receives a 15% trade discount and credit terms of 2/10, n/30. How much cash will be needed to pay this invoice within the discount period? a. $15,000 b. $14,700 c. $12,750 d. $12,495

_____ 77. Which of the following items would affect the cost of merchandise inventory acquired during the period? a. Quantity discounts b. Cash discounts c. Freight-in d. All of the above

_____ 78. Under a perpetual inventory system a. Accounting records continuously disclose the amount of inventory b. Increases in inventory resulting from purchases are debited to Purchases c. There is no need for a year-end physical count d. The purchase returns and allowances account is credited when goods are returned to vendors

_____ 79. Inventory shortage is recorded when a. Merchandise is returned by a buyer b. Merchandise purchased from a seller is incomplete or short c. Merchandise is returned to a seller d. There is a difference between a physical count of inventory and inventory records

_____ 80. What is the major difference between periodic and perpetual inventory system? a. Under the periodic inventory system, the purchase of inventory will be debited to the Purchases account b. Under the periodic inventory system, no journal entry is recorded at the time of the sale of inventory c. Under the periodic inventory system, all adjustments such as purchases returns and allowances and discounts are reconciled at the end of the month. d. All are correct

PROBLEMS

81. Based upon the following data, determine the cost of merchandise sold for August.

Merchandise Inventory August 1 $ 75,560 Merchandise Inventory August 31 96,330 Purchases 373,880 Purchases Returns & Allowances 14,760 Purchases Discounts 10,900 Freight In 4,135

Cost of merchandise sold: 82. Sampson Co. sold merchandise to Batson Co. on account, $46,000, terms 2/15, net 45. The cost of the merchandise sold is $38,500. Sampson Co. issued a credit memo for $1,500 for merchandise returned that originally cost $950. The Batson Co. paid the invoice within the discount period. Prepare the entries that both Sampson and Batson Companies would record for the above.

83. Using the perpetual inventory system, journalize the entries for the following selected transactions:

(a) Sold merchandise on account, for $12,000. The cost of the merchandise sold was $6,500. (b) Sold merchandise to customers who used MasterCard and VISA, $9,500. The cost of the merchandise sold was $5,300. (c) Sold merchandise to customers who used American Express, $2,900. The cost of the merchandise sold was $1,700. (d) Paid an invoice from First National Bank for $385, representing a service fee for processing MasterCard and VISA sales. (e) Received $4,325 from American Express Company after a $115 collection fee had been deducted.