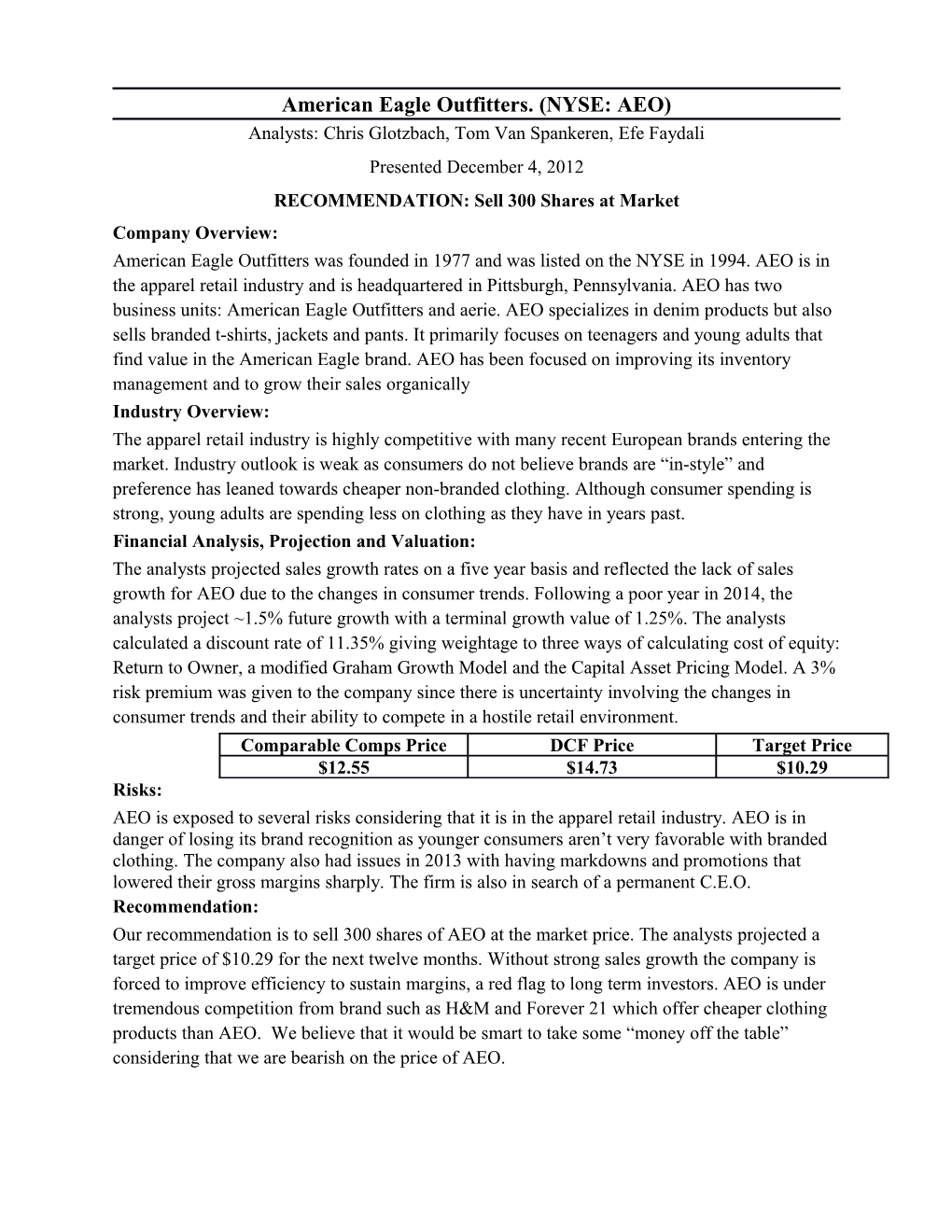

American Eagle Outfitters. (NYSE: AEO) Analysts: Chris Glotzbach, Tom Van Spankeren, Efe Faydali Presented December 4, 2012 RECOMMENDATION: Sell 300 Shares at Market Company Overview: American Eagle Outfitters was founded in 1977 and was listed on the NYSE in 1994. AEO is in the apparel retail industry and is headquartered in Pittsburgh, Pennsylvania. AEO has two business units: American Eagle Outfitters and aerie. AEO specializes in denim products but also sells branded t-shirts, jackets and pants. It primarily focuses on teenagers and young adults that find value in the American Eagle brand. AEO has been focused on improving its inventory management and to grow their sales organically Industry Overview: The apparel retail industry is highly competitive with many recent European brands entering the market. Industry outlook is weak as consumers do not believe brands are “in-style” and preference has leaned towards cheaper non-branded clothing. Although consumer spending is strong, young adults are spending less on clothing as they have in years past. Financial Analysis, Projection and Valuation: The analysts projected sales growth rates on a five year basis and reflected the lack of sales growth for AEO due to the changes in consumer trends. Following a poor year in 2014, the analysts project ~1.5% future growth with a terminal growth value of 1.25%. The analysts calculated a discount rate of 11.35% giving weightage to three ways of calculating cost of equity: Return to Owner, a modified Graham Growth Model and the Capital Asset Pricing Model. A 3% risk premium was given to the company since there is uncertainty involving the changes in consumer trends and their ability to compete in a hostile retail environment. Comparable Comps Price DCF Price Target Price $12.55 $14.73 $10.29 Risks: AEO is exposed to several risks considering that it is in the apparel retail industry. AEO is in danger of losing its brand recognition as younger consumers aren’t very favorable with branded clothing. The company also had issues in 2013 with having markdowns and promotions that lowered their gross margins sharply. The firm is also in search of a permanent C.E.O. Recommendation: Our recommendation is to sell 300 shares of AEO at the market price. The analysts projected a target price of $10.29 for the next twelve months. Without strong sales growth the company is forced to improve efficiency to sustain margins, a red flag to long term investors. AEO is under tremendous competition from brand such as H&M and Forever 21 which offer cheaper clothing products than AEO. We believe that it would be smart to take some “money off the table” considering that we are bearish on the price of AEO.

American Eagle Outfitters. (NYSE: AEO)

Total Page:16

File Type:pdf, Size:1020Kb

Recommended publications