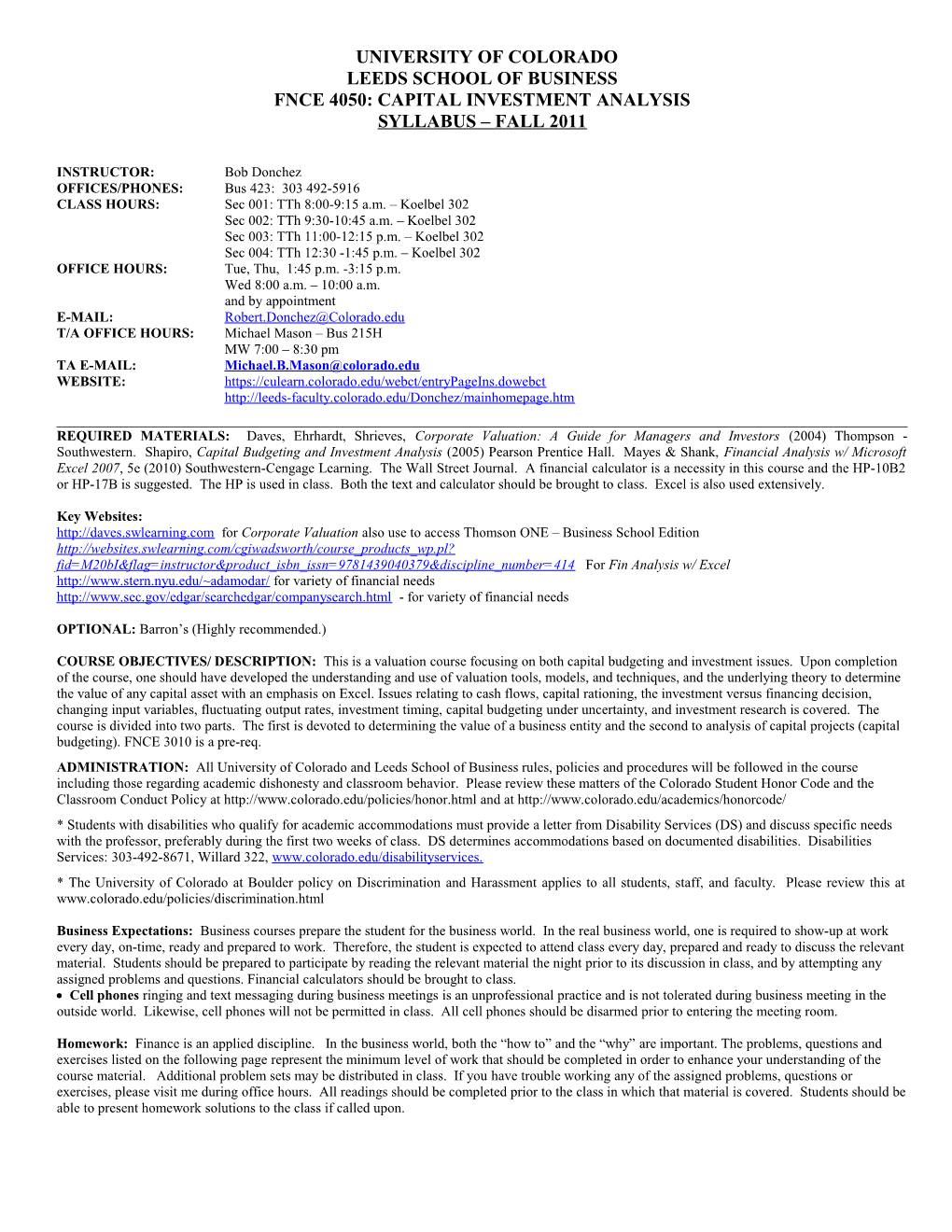

UNIVERSITY OF COLORADO LEEDS SCHOOL OF BUSINESS FNCE 4050: CAPITAL INVESTMENT ANALYSIS SYLLABUS – FALL 2011

INSTRUCTOR: Bob Donchez OFFICES/PHONES: Bus 423: 303 492-5916 CLASS HOURS: Sec 001: TTh 8:00-9:15 a.m. – Koelbel 302 Sec 002: TTh 9:30-10:45 a.m. – Koelbel 302 Sec 003: TTh 11:00-12:15 p.m. – Koelbel 302 Sec 004: TTh 12:30 -1:45 p.m. – Koelbel 302 OFFICE HOURS: Tue, Thu, 1:45 p.m. -3:15 p.m. Wed 8:00 a.m. – 10:00 a.m. and by appointment E-MAIL: [email protected] T/A OFFICE HOURS: Michael Mason – Bus 215H MW 7:00 – 8:30 pm TA E-MAIL: [email protected] WEBSITE: https://culearn.colorado.edu/webct/entryPageIns.dowebct http://leeds-faculty.colorado.edu/Donchez/mainhomepage.htm

REQUIRED MATERIALS: Daves, Ehrhardt, Shrieves, Corporate Valuation: A Guide for Managers and Investors (2004) Thompson - Southwestern. Shapiro, Capital Budgeting and Investment Analysis (2005) Pearson Prentice Hall. Mayes & Shank, Financial Analysis w/ Microsoft Excel 2007, 5e (2010) Southwestern-Cengage Learning. The Wall Street Journal. A financial calculator is a necessity in this course and the HP-10B2 or HP-17B is suggested. The HP is used in class. Both the text and calculator should be brought to class. Excel is also used extensively.

Key Websites: http://daves.swlearning.com for Corporate Valuation also use to access Thomson ONE – Business School Edition http://websites.swlearning.com/cgiwadsworth/course_products_wp.pl? fid=M20bI&flag=instructor&product_isbn_issn=9781439040379&discipline_number=414 For Fin Analysis w/ Excel http://www.stern.nyu.edu/~adamodar/ for variety of financial needs http://www.sec.gov/edgar/searchedgar/companysearch.html - for variety of financial needs

OPTIONAL: Barron’s (Highly recommended.)

COURSE OBJECTIVES/ DESCRIPTION: This is a valuation course focusing on both capital budgeting and investment issues. Upon completion of the course, one should have developed the understanding and use of valuation tools, models, and techniques, and the underlying theory to determine the value of any capital asset with an emphasis on Excel. Issues relating to cash flows, capital rationing, the investment versus financing decision, changing input variables, fluctuating output rates, investment timing, capital budgeting under uncertainty, and investment research is covered. The course is divided into two parts. The first is devoted to determining the value of a business entity and the second to analysis of capital projects (capital budgeting). FNCE 3010 is a pre-req. ADMINISTRATION: All University of Colorado and Leeds School of Business rules, policies and procedures will be followed in the course including those regarding academic dishonesty and classroom behavior. Please review these matters of the Colorado Student Honor Code and the Classroom Conduct Policy at http://www.colorado.edu/policies/honor.html and at http://www.colorado.edu/academics/honorcode/ * Students with disabilities who qualify for academic accommodations must provide a letter from Disability Services (DS) and discuss specific needs with the professor, preferably during the first two weeks of class. DS determines accommodations based on documented disabilities. Disabilities Services: 303-492-8671, Willard 322, www.colorado.edu/disabilityservices. * The University of Colorado at Boulder policy on Discrimination and Harassment applies to all students, staff, and faculty. Please review this at www.colorado.edu/policies/discrimination.html

Business Expectations: Business courses prepare the student for the business world. In the real business world, one is required to show-up at work every day, on-time, ready and prepared to work. Therefore, the student is expected to attend class every day, prepared and ready to discuss the relevant material. Students should be prepared to participate by reading the relevant material the night prior to its discussion in class, and by attempting any assigned problems and questions. Financial calculators should be brought to class. Cell phones ringing and text messaging during business meetings is an unprofessional practice and is not tolerated during business meeting in the outside world. Likewise, cell phones will not be permitted in class. All cell phones should be disarmed prior to entering the meeting room.

Homework: Finance is an applied discipline. In the business world, both the “how to” and the “why” are important. The problems, questions and exercises listed on the following page represent the minimum level of work that should be completed in order to enhance your understanding of the course material. Additional problem sets may be distributed in class. If you have trouble working any of the assigned problems, questions or exercises, please visit me during office hours. All readings should be completed prior to the class in which that material is covered. Students should be able to present homework solutions to the class if called upon. Grading: There will be three exams each worth 15% of the semester grade. A group term project accounts for 45%. Homework, quizzes, class participation, attendance, and employment search responsibilities account for 10%. Failure to complete the employment search responsibilities in its entirety will result in a failing score “F” on the homework, quizzes, class participation, attendance, employment search duties portion of the final grade. The “Business Meetings: Conduct / Expectations / Assessment” and “E-Mail Conduct / Policy” also affects grading as addressed in that memorandum. In addition, there is an improvement factor taken into consideration with the exams, which can alter the weights of each exam. This is best shown through an example. If a student scores 60 %, on the first exam, then improves to 70 % on the second, the weight of the first score drops 2% from 15% to 13% while the weight of the improved second exam is bumped from 15% to 17%. If the third exam results improve (to, say 80% in the example) the third exam’s weight becomes 17%, while the first exam’s weight drops from 13% to 11%. The exams will cover material assigned since the previous exam. There will be no make-up exams.

Employment Search Responsibilities: The Leeds Business School’s Career Connections will partner with students in the job search process. As part of this, each student will individually have to complete certain job search related tasks, as part of their final evaluation. 1. Attend the in-class info sessions conducted by Leeds’ Career Connections 2. Register on Career Services Online (CSO) 3. Produce a resume 4. Post your resume on CSO 5. Have an appointment with a Career Connections advisor to review your resume. 6. Attend Finance / Accounting Senior Conference Night 7. Register and become a member of LinkedIn.com, join the group: University of Colorado, Leeds School of Business, BuffAlums

Term Project: Three person groups will complete a valuation analysis of a public corporation. Each group will have a unique company. There will be no duplication. Selection of the company is on a first-come, first serve basis, submitted in writing in proper business format by Thursday, September 1, 2011. It is imperative that each group daily follows/gathers information about its company and industry. Interim Executive Summaries and Status Reports will be submitted periodically through the semester, on 9/15, 10/4, 10/20. The following areas must be presented in the final paper, due Thursday, November 17, 2011.

Structure of the Paper: The paper is broken into seven “units.” o Unit 1: The Company, Industry and Competitors. o Unit 2: Financial Performance Analysis o Unit 3: Cost of Capital, Capital Structure Analysis and Distributions o Unit 4: Financial Statement Forecasts o Unit 5: Cash Flow Valuation o Unit 6: Relative (Multiples) Valuation Analysis o Unit 7: Summary and Conclusions o A detailed description of each part will be forthcoming