LOAN REVIEW GUIDELINES Page 1

GUIDE FOR EVALUATION CREDIT RISK:

Future Repayment Ability:

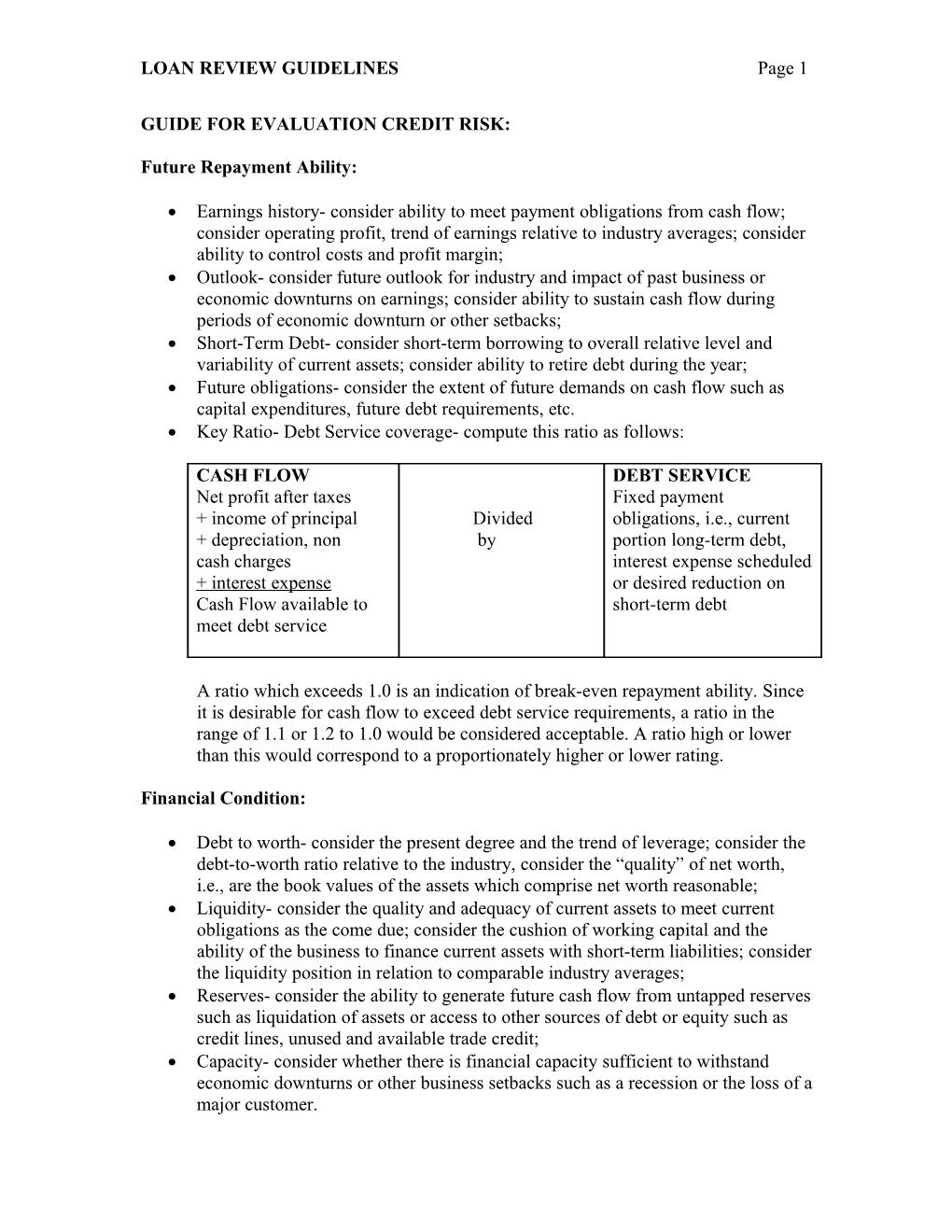

Earnings history- consider ability to meet payment obligations from cash flow; consider operating profit, trend of earnings relative to industry averages; consider ability to control costs and profit margin; Outlook- consider future outlook for industry and impact of past business or economic downturns on earnings; consider ability to sustain cash flow during periods of economic downturn or other setbacks; Short-Term Debt- consider short-term borrowing to overall relative level and variability of current assets; consider ability to retire debt during the year; Future obligations- consider the extent of future demands on cash flow such as capital expenditures, future debt requirements, etc. Key Ratio- Debt Service coverage- compute this ratio as follows:

CASH FLOW DEBT SERVICE Net profit after taxes Fixed payment + income of principal Divided obligations, i.e., current + depreciation, non by portion long-term debt, cash charges interest expense scheduled + interest expense or desired reduction on Cash Flow available to short-term debt meet debt service

A ratio which exceeds 1.0 is an indication of break-even repayment ability. Since it is desirable for cash flow to exceed debt service requirements, a ratio in the range of 1.1 or 1.2 to 1.0 would be considered acceptable. A ratio high or lower than this would correspond to a proportionately higher or lower rating.

Financial Condition:

Debt to worth- consider the present degree and the trend of leverage; consider the debt-to-worth ratio relative to the industry, consider the “quality” of net worth, i.e., are the book values of the assets which comprise net worth reasonable; Liquidity- consider the quality and adequacy of current assets to meet current obligations as the come due; consider the cushion of working capital and the ability of the business to finance current assets with short-term liabilities; consider the liquidity position in relation to comparable industry averages; Reserves- consider the ability to generate future cash flow from untapped reserves such as liquidation of assets or access to other sources of debt or equity such as credit lines, unused and available trade credit; Capacity- consider whether there is financial capacity sufficient to withstand economic downturns or other business setbacks such as a recession or the loss of a major customer. LOAN REVIEW GUIDELINES Page 2

Collateral:

Liquidity- consider how readily collateral can be converted to cash to reduce loan outstandings; Controllability- consider to what extent collateral can be managed and controlled by the Credit Union for maximum realization of value in liquidation; Condition- consider the present condition of collateral and the impact this may have on liquidation; Determining value- consider the availability and adequacy of information to support a reasonable estimate of collateral value, i.e., appraisals, receivable agings, recent costs, knowledge of re-sale market, etc,; Loan to Value- estimate the value of collateral in liquidation and consider the extent of coverage of loan outstandings; factor into this analysis the estimated costs to hold and liquidate collateral; Guarantor or co-obligor- consider the financial support of guarantor or co-obligor.

Administration:

Loan Structure- consider the appropriateness of the loan structure to the purpose of the loan and the source of repayment; Manageability- consider Credit Union’s ability to manage the loan relationship in order to understand and stay informed of the business and the risk elements of the credit; Financial information- consider the quality and completeness of the financial information provided to the Credit Union; consider the confidence in the accuracy of the financial information and the level of CPA assurance; consider the timeliness and frequency of the financial information; File content- consider how adequately the loan file presents the history of the relationship, the purpose of loans, recent events and changes, etc.

Management Ability of Borrower:

Marketing- consider management’s understanding of the product, the competition, the customer and the promotion of the product; Operation- consider management’s overall knowledge of production and the ability to take advantage of opportunity or mitigate losses in down periods; consider whether technology is utilized effectively; consider the management and control of inventory; Financial management- consider management’s knowledge and understanding of financial statements; consider the effectiveness of managing accounts receivable; consider the understanding and management of cash flow; consider the ability of management to make short-and long-term financial projections; consider management’s ability to anticipate future borrowing needs. LOAN REVIEW GUIDELINES Page 3

History and Character:

Experience- consider the length and stability of the relationship with the Credit Union; consider how well the borrower is known to the Credit Union; Repayment history- consider the past repayment performance with other creditors; Cooperation- consider the willingness and the initiative of the borrower to keep the Credit Union informed; consider the extent of cooperation with the Credit Union in past negotiations; Character- consider the character and integrity of the borrower; consider the effort put forth to honor obligations to creditors.

A GUIDE FOR COLLATERAL ANALYSIS

Following are some general guidelines to assist in the analysis of collateral.

1) Acceptability of collateral is measured in terms of: Liquidity- how readily can the asset be converted to cash to reduce loans outstanding. Controllability- to what extent can the lender manage and control the collateral for maximum realization of value in liquidation. Condition- the character and condition of collateral is important to the marketability of the asset. 2) Collateral analysis is more difficult for long-term loans. The value of the asset must be evaluated over a longer time period and particularly with fixed assets, the collateral may depreciate in value at a rate faster than the principal balance of the loan is reduced be payments. In addition, values may vary over economic cycles. 3) In estimating the amount in liquidation that would be available for debt reduction, always consider the extent of priority liens that would reduce the amount of the net proceeds available. 4) Costs to liquidate collateral should be considered in the evaluation. Potential costs to consider include maintenance and storage costs, cost of carrying a non-earning asset, the cost of management and clerical time devoted to the workout and liquidation, etc. 5) Factors to Consider for Liquidation Analysis:

Cash Offsets to deposit accounts may bring a business down and may jeopardize ability to liquidate other collateral (i.e., work-in-process inventory). Waiting too long for offset may enable borrower to divert cash to uses other than repayment. LOAN REVIEW GUIDELINES Page 4

Accounts Receivable May be reduced by contra-accounts, alleged offsets, warranty commitments, repair contracts. Completeness and timeliness of A/R record (names, addresses, agings, etc.) may affect collectability. Location of receivables and difficulty of litigation may affect collectibility. Costs of lender’s record-keeping, collection efforts, etc. should be considered in liquidation evaluation. Quality of debtor’s products may affect the willingness of the account to pay. The position of other secured lenders should be considered in the liquidation evaluation.

Inventory Consider the cost of maintenance and storage including security costs (alarms, locks, etc.) Repurchase agreements that lenders have with suppliers can sometimes enhance the lender’s ability to liquidate inventory at a higher percentage of cost. Consider whether work-in-process could be completed. If so, consider cost of hiring necessary personnel and paying production costs to complete WIP. Location and ability of lender to monitor and manage repossessed inventory can limit the ability to realize value in liquidation. Obsolescence and perishabilty of inventory are important considerations in estimating liquidation value. Consider the extent that IRS and other superior liens will reduce the net proceeds of inventory liquidation.

Equipment Liquidation values of equipment are heavily influenced by the number of potential users. Highly-specialized equipment generally will be liquidated at a lower percentage of book value. Consider the economic condition of the industry into which the equipment is to be sold. An industry that is experiencing problems will narrow the population of potential buyers and consequently reduce the value of repossessed equipment. Consider the cost to dismantle, move and store repossessed equipment. Is the equipment experiencing functional or technological obsolescence? LOAN REVIEW GUIDELINES Page 5

Real Estate Consider the costs to maintain real estate if held in the lender’s OREO portfolio. Consider the changes in the real estate market since the last appraisal- for example appraised values can fluctuate dramatically with interest rates and economic changes. Consider to what extent the facility is a special purpose building which would be more difficult to liquidate. Are there leases that generate a cash flow for debt repayment? Unpaid real estate taxes constitute a prior lien. Has the condition of the real estate changed since the date of the last appraisal? If so, consider this in the liquidation estimate. Does the real estate need physical improvements or repairs before it is marketable?

6) Corporations, S-Corps, Partnerships- Suggested Discounting Percentages Cash- 100% Receivables- General- 70% of book value or: 0-30 days – 80% 31-60 days – 75% 61-90 days - 65% 91-120 days – 20% Over 120 days – 10% Consumer/Retail accounts receivable – 50% Contractors subject to bonding and retainages – exclude all receivables from bonded projects and use a factor of 50% of other projects. Contractor receivables from incomplete jobs- 0% Inventory- General- 50% of book value or: Work-in-Process- 10% Special inventory, limited market- of book value Perishable inventory- 10% of book value Stored farm products- 90% of market price. Equipment- General- 40% of depreciated book value or: Vehicles- 80% NADA of wholesale value Farm Equipment- 50% of recent auction or estimated dealer retail price Specialized- 20% of depreciated book value Restaurant equipment- 10% of depreciated book value Furniture and fixtures- 25% of depreciated book value Leasehold improvements- 10% of book value LOAN REVIEW GUIDELINES Page 6

Recent appraisals- use 50% of market, 75% of forced liquidation values Real Estate- General- 75% of appraised value of commercial real estate; 80% of appraised value of residential real estate. Single purpose real estate- 70% of appraised value. If commercial building has stood vacant for more than one year – 60% of appraised value If multi-tenant office or apartment is less than 50% occupied for last 6 months- 60% of appraised value. Farm land values will be determined periodically by the Officers’ Loan Committee, based on current selling prices in the area. ** These liquidation percentages are only guidelines and should be used as such. Information may exist which would give reason for departing from the guidelines and when this is the case, it is appropriate to document these reasons.

7) Personal Financial Statement- Recommended discounting percentages Cash –100% Savings Accounts – 100% Accounts & Notes Receivable- Relatives, Individuals 0% Corporation, Partnership or S-Corp 40% Unknown 0% Cash Value of Life Insurance –80% Pension and Profit Sharing, Keogh’s, IRA’s – 70% Stocks and Bonds Marketable – 80% Non-Marketable – 0% Equity in Business – 0% Real Estate With Appraisal – 70%- 80% W/O Appraisals – 65% Automobile – 50% Personal Property- furniture, jewelry, furs, etc. 0%