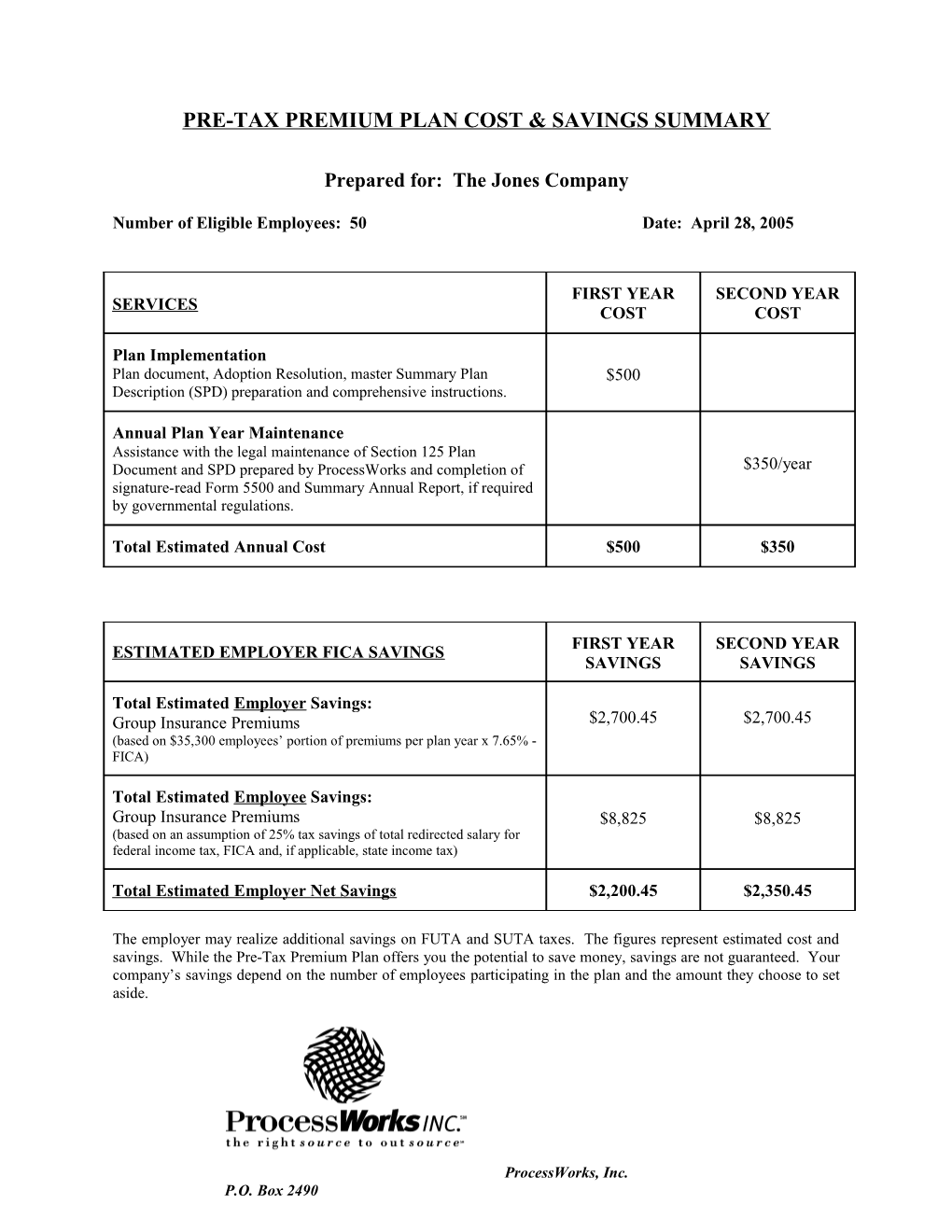

PRE-TAX PREMIUM PLAN COST & SAVINGS SUMMARY

Prepared for: The Jones Company

Number of Eligible Employees: 50 Date: April 28, 2005

FIRST YEAR SECOND YEAR SERVICES COST COST

Plan Implementation Plan document, Adoption Resolution, master Summary Plan $500 Description (SPD) preparation and comprehensive instructions.

Annual Plan Year Maintenance Assistance with the legal maintenance of Section 125 Plan Document and SPD prepared by ProcessWorks and completion of $350/year signature-read Form 5500 and Summary Annual Report, if required by governmental regulations.

Total Estimated Annual Cost $500 $350

FIRST YEAR SECOND YEAR ESTIMATED EMPLOYER FICA SAVINGS SAVINGS SAVINGS

Total Estimated Employer Savings: Group Insurance Premiums $2,700.45 $2,700.45 (based on $35,300 employees’ portion of premiums per plan year x 7.65% - FICA)

Total Estimated Employee Savings: Group Insurance Premiums $8,825 $8,825 (based on an assumption of 25% tax savings of total redirected salary for federal income tax, FICA and, if applicable, state income tax)

Total Estimated Employer Net Savings $2,200.45 $2,350.45

The employer may realize additional savings on FUTA and SUTA taxes. The figures represent estimated cost and savings. While the Pre-Tax Premium Plan offers you the potential to save money, savings are not guaranteed. Your company’s savings depend on the number of employees participating in the plan and the amount they choose to set aside.

ProcessWorks, Inc. P.O. Box 2490 Brookfield, WI 53008-2490 (262) 789-8181 (800) 236-8187 www.processworksinc.com