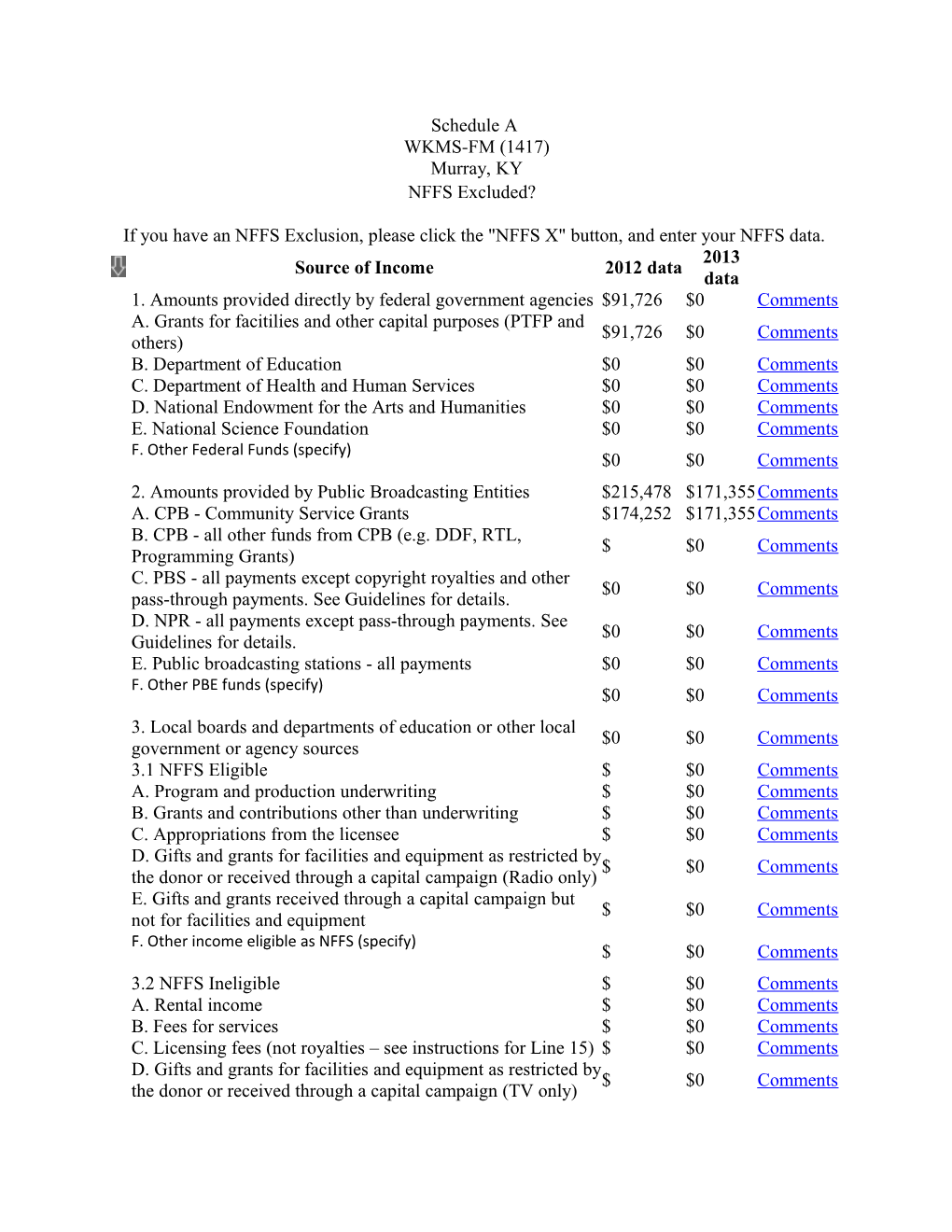

Schedule A WKMS-FM (1417) Murray, KY NFFS Excluded?

If you have an NFFS Exclusion, please click the "NFFS X" button, and enter your NFFS data. 2013 Source of Income 2012 data data 1. Amounts provided directly by federal government agencies $91,726 $0 Comments A. Grants for facitilies and other capital purposes (PTFP and $91,726 $0 Comments others) B. Department of Education $0 $0 Comments C. Department of Health and Human Services $0 $0 Comments D. National Endowment for the Arts and Humanities $0 $0 Comments E. National Science Foundation $0 $0 Comments F. Other Federal Funds (specify) $0 $0 Comments 2. Amounts provided by Public Broadcasting Entities $215,478 $171,355Comments A. CPB - Community Service Grants $174,252 $171,355Comments B. CPB - all other funds from CPB (e.g. DDF, RTL, $ $0 Comments Programming Grants) C. PBS - all payments except copyright royalties and other $0 $0 Comments pass-through payments. See Guidelines for details. D. NPR - all payments except pass-through payments. See $0 $0 Comments Guidelines for details. E. Public broadcasting stations - all payments $0 $0 Comments F. Other PBE funds (specify) $0 $0 Comments 3. Local boards and departments of education or other local $0 $0 Comments government or agency sources 3.1 NFFS Eligible $ $0 Comments A. Program and production underwriting $ $0 Comments B. Grants and contributions other than underwriting $ $0 Comments C. Appropriations from the licensee $ $0 Comments D. Gifts and grants for facilities and equipment as restricted by $ $0 Comments the donor or received through a capital campaign (Radio only) E. Gifts and grants received through a capital campaign but $ $0 Comments not for facilities and equipment F. Other income eligible as NFFS (specify) $ $0 Comments 3.2 NFFS Ineligible $ $0 Comments A. Rental income $ $0 Comments B. Fees for services $ $0 Comments C. Licensing fees (not royalties – see instructions for Line 15) $ $0 Comments D. Gifts and grants for facilities and equipment as restricted by $ $0 Comments the donor or received through a capital campaign (TV only) E. Other income ineligible for NFFS inclusion $ $0 Comments 4. State boards and departments of education or other state $8,679 $0 Comments government or agency sources 4.1 NFFS Eligible $ $0 Comments A. Program and production underwriting $ $0 Comments B. Grants and contributions other than underwriting $ $0 Comments C. Appropriations from the licensee $ $0 Comments D. Gifts and grants for facilities and equipment as restricted by $ $0 Comments the donor or received through a capital campaign (Radio only) E. Gifts and grants received through a capital campaign but $ $0 Comments not for facilities and equipment F. Other income eligible as NFFS (specify) $ $0 Comments 4.2 NFFS Ineligible $ $0 Comments A. Rental income $ $0 Comments B. Fees for services $ $0 Comments C. Licensing fees (not royalties – see instructions for Line 15) $ $0 Comments D. Gifts and grants for facilities and equipment as restricted by $ $0 Comments the donor or received through a capital campaign (TV only) E. Other income ineligible for NFFS inclusion $ $0 Comments 5. State colleges and universities $455,348 $468,832Comments 5.1 NFFS Eligible $ $468,832Comments A. Program and production underwriting $ $0 Comments B. Grants and contributions other than underwriting $ $0 Comments C. Appropriations from the licensee $ $448,262Comments D. Gifts and grants for facilities and equipment as restricted by $ $0 Comments the donor or received through a capital campaign (Radio only) E. Gifts and grants received through a capital campaign but $ $0 Comments not for facilities and equipment F. Other income eligible as NFFS (specify) Description Amount $ $20,570 Comments Institutional Support - Salaries$20,570 5.2 NFFS Ineligible $ $0 Comments A. Rental income $ $0 Comments B. Fees for services $ $0 Comments C. Licensing fees (not royalties – see instructions for Line 15) $ $0 Comments D. Gifts and grants for facilities and equipment as restricted by $ $0 Comments the donor or received through a capital campaign (TV only) E. Other income ineligible for NFFS inclusion $ $0 Comments 6. Other state-supported colleges and universities $0 $0 Comments 6.1 NFFS Eligible $ $0 Comments A. Program and production underwriting $ $0 Comments B. Grants and contributions other than underwriting $ $0 Comments C. Appropriations from the licensee $ $0 Comments D. Gifts and grants for facilities and equipment as restricted by $ $0 Comments the donor or received through a capital campaign (Radio only) E. Gifts and grants received through a capital campaign but $ $0 Comments not for facilities and equipment F. Other income eligible as NFFS (specify) $ $0 Comments 6.2 NFFS Ineligible $ $0 Comments A. Rental income $ $0 Comments B. Fees for services $ $0 Comments C. Licensing fees (not royalties – see instructions for Line 15) $ $0 Comments D. Gifts and grants for facilities and equipment as restricted by $ $0 Comments the donor or received through a capital campaign (TV only) E. Other income ineligible for NFFS inclusion $ $0 Comments 7. Private colleges and universities $0 $0 Comments 7.1 NFFS Eligible $ $0 Comments A. Program and production underwriting $ $0 Comments B. Grants and contributions other than underwriting $ $0 Comments C. Appropriations from the licensee $ $0 Comments D. Gifts and grants for facilities and equipment as restricted by $ $0 Comments the donor or received through a capital campaign (Radio only) E. Gifts and grants received through a capital campaign but $ $0 Comments not for facilities and equipment F. Other income eligible as NFFS (specify) $ $0 Comments 7.2 NFFS Ineligible $ $0 Comments A. Rental income $ $0 Comments B. Fees for services $ $0 Comments C. Licensing fees (not royalties – see instructions for Line 15) $ $0 Comments D. Gifts and grants for facilities and equipment as restricted by $ $0 Comments the donor or received through a capital campaign (TV only) E. Other income ineligible for NFFS inclusion $ $0 Comments 8. Foundations and nonprofit associations $0 $0 Comments 8.1 NFFS Eligible $ $0 Comments A. Program and production underwriting $ $0 Comments B. Grants and contributions other than underwriting $ $0 Comments C. Gifts and grants for facilities and equipment as restricted by $ $0 Comments the donor or received through a capital campaign (Radio only) D. Gifts and grants received through a capital campaign but $ $0 Comments not for facilities and equipment E. Other income eligible as NFFS (specify) $ $0 Comments 8.2 NFFS Ineligible $ $0 Comments A. Rental income $ $0 Comments B. Fees for services $ $0 Comments C. Licensing fees (not royalties – see instructions for Line 15) $ $0 Comments D. Gifts and grants for facilities and equipment as restricted by $ $0 Comments the donor or received through a capital campaign (TV only) E. Other income ineligible for NFFS inclusion $ $0 Comments 9. Business and Industry $131,516 $131,043Comments 9.1 NFFS Eligible $ $108,693Comments A. Program and production underwriting $ $108,693Comments B. Grants and contributions other than underwriting $ $0 Comments C. Gifts and grants for facilities and equipment as restricted by $ $0 Comments the donor or received through a capital campaign (Radio only) D. Gifts and grants received through a capital campaign but $ $0 Comments not for facilities and equipment E. Other income eligible as NFFS (specify) $ $0 Comments 9.2 NFFS Ineligible $ $22,350 Comments A. Rental income $ $22,350 Comments B. Fees for services $ $0 Comments C. Licensing fees (not royalties – see instructions for Line 15) $ $0 Comments D. Gifts and grants for facilities and equipment as restricted by $ $0 Comments the donor or received through a capital campaign (TV only) E. Other income ineligible for NFFS inclusion $ $0 Comments 10. Memberships and subscriptions (net of membership bad $203,979 $223,197Comments debt expense) 10.1 NFFS Exclusion – Fair market value of premiums that $ $0 Comments are not of insubstantial value 10.2 NFFS Exclusion – Membership bad debt expense (unless netted from the total in Line 10) 2012 2013 $ $0 Comments data data 10.3 Total number of 1,479 1,550 Comments contributors. 11. Revenue from Friends groups less any revenue included on line 10 2012 2013 $0 $0 Comments data data 11.1 Total number of Friends 0 0 Comments contributors. 12. Subsidiaries and other activities unrelated to public $0 $0 Comments broadcasting (See instructions) A. Nonprofit subsidiaries involved in telecommunications $ $0 Comments activities B. NFFS Ineligible – Nonprofit subsidiaries not involved in $ $0 Comments telecommunications activities C. NFFS Ineligible – For-profit subsidiaries regardless of the $ $0 Comments nature of its activities D. NFFS Ineligible – Other activities unrelated to public $ $0 Comments brodcasting 2013 Form of Revenue 2012 data data 13. Auction revenue (see instructions for Line 13) $0 $0 Comments A. Gross auction revenue $0 $0 Comments B. Direct auction expenses $0 $0 Comments 14. Special fundraising activities (see instructions for Line 14) $14,260 $0 Comments A. Gross special fundraising revenues $14,260 $0 Comments B. Direct special fundraising expenses $0 $0 Comments 15. Passive income $112 $107 Comments A. Interest and dividends (other than on endowment funds) $112 $107 Comments B. Royalties $0 $0 Comments C. PBS or NPR pass-through copyright royalties $0 $0 Comments 16. Gains and losses on investments, charitable trusts and gift annuities and sale of other assets (other than endowment $0 $0 Comments funds) A. Gains from sales of property and equipment (do not report $0 $0 Comments losses) B. Realized gains/losses on investments (other than $0 $0 Comments endowment funds) C. Unrealized gains/losses on investments and actuarial gains/losses on charitable trusts and gift annuities (other than $0 $0 Comments endowment funds) 17. Endowment revenue $34 $1,311 Comments A. Contributions to endowment principal $0 $0 Comments B. Interest and dividends on endowment funds $180 $186 Comments C. Realized net investment gains and losses on endowment funds (if this is a negative amount, add a hyphen, e.g., "- $ $638 Comments 1,765") D. Unrealized net investment gains and losses on endowment funds (if this is a negative amount, add a hyphen, e.g., "- $ $487 Comments 1,765") 18. Capital fund contributions from individuals (see $0 $0 Comments instructions) A. Facilities and equipment (except funds received from $0 $0 Comments federal or public broadcasting sources) B. Other $0 $0 Comments 19. Gifts and bequests from major individual donors 2012 2013

data data $0 $0 Comments 19.1 Total number of major 0 0 Comments individual donors 20. Other Direct Revenue Description Amount $52,000 $11 Comments misc revenue$11 21. Total Revenue (Sum of lines 1 through 12, 13.A, 14.A, $1,173,132$995,856Comments and 15 through 20) Click here to view all NFFS Eligible revenue on Lines 3 through 9.

Click here to view all NFFS Ineligible revenue on Lines 3 through 9. 2013 Adjustments to Revenue 2012 data data 22. Federal revenue from line 1. $91,726 $0 Comments 23. Public broadcasting revenue from line 2. $215,478 $171,355Comments 24. Capital funds exclusion—TV (3.2D, 4.2D, 5.2D, 6.2D, $0 $0 Comments 7.2D, 8.2D, 9.2D, 18A) 25. Revenue on line 20 not meeting the source, form, purpose, $52,000 $0 Comments or recipient criteria 26. Other automatic subtractions from total revenue $-146 $23,475 Comments A. Auction expenses – limited to the lesser of lines 13a or 13b $0 $0 Comments B. Special fundraising event expenses – limited to the lesser of $0 $0 Comments lines 14a or 14b C. Gains from sales of property and equipment – line 16a $0 $0 Comments D. Realized gains/losses on investments (other than $0 $0 Comments endowment funds) – line 16b E. Unrealized investment and actuarial gains/losses (other than $0 $0 Comments endowment funds) – line 16c F. Realized and unrealized net investment gains/losses on $-146 $1,125 Comments endowment funds – line 17c, line 17d G. Rental income (3.2A, 4.2A, 5.2A, 6.2A, 7.2A, 8.2A, 9.2A) $ $22,350 Comments H. Fees for services (3.2B, 4.2B, 5.2B, 6.2B, 7.2B, 8.2B, $ $0 Comments 9.2B) I. Licensing Fees (3.2C, 4.2C, 5.2C, 6.2C, 7.2C, 8.2C, 9.2C) $ $0 Comments J. Other revenue ineligible as NFFS (3.2E, 4.2E, 5.2E, 6.2E, $ $0 Comments 7.2E, 8.2E, 9.2E) K. FMV of high-end premiums (Line 10.1) $ $0 Comments L. Membership bad debt expense (Line 10.2) $ $0 Comments M. Revenue from subsidiaries and other activities ineligible as $ $0 Comments NFFS (12.B, 12.C, 12.D) 27. Total Direct Nonfederal Financial Support (Line 21 less Lines 22 through 26). (Forwards to line 1 of the Summary of $814,074 $801,026Comments Nonfederal Financial Support) Comments CommentNameDateStatus Schedule B WorkSheet WKMS-FM (1417) Murray, KY 2012 2013 1. Determine Station net direct expenses 2012 2013 1a. Total station operating expenses and capital outlays $1,618,927 $1,392,716 Comments (forwards from line 10 of Schedule E) Deductions (lines 1b.1. through 1b.7.): $157,446 $-9,543 Comments 1b.1. Capital outlays (from Schedule E, line 9 total) 1b.2. Depreciation $106,024 $43,736 Comments 1b.3. Amortization $0 $0 Comments 1b.4. In-kind contributions (services and other assets) $79,371 $93,235 Comments 1b.5. Indirect administrative support (see Guidelines for $261,212 $267,088 Comments instructions) 1b.6. Donated property and equipment (if not included on $0 $0 Comments line 1b.1) 1b.7. Other $0 $0 Comments

1b.8. Total deductions $604,053 $394,516 Comments 1c. Station net direct expenses $1,014,875 $998,200 Comments 2. Institutional support rate calculation (Note: Choose one method only - either 2a or 2b) 2a. Net direct expense method 2a.1. Station net direct Expenses (forwards from line 1) $1,014,875 $998,200 Comments 2a.2. Licensee net direct activities $68,433,172$68,520,125Comments 2a.3. Percentage of allocation (2a.1 divided by 2a.2) %1.483016 %1.456798 Comments (forward to line 2c.5 below) 2b. Salaries and wages method 2b.1. Station salaries and wages $0 $0 Comments 2b.2. Licensee salaries and wages for direct activities $0 $0 Comments 2b.3. Percentage of allocation (2b.1 divided by 2b.2) % %0 Comments (forward to line 2c.5 below) 2c. Institutional support calculation 2c.1. Choose applicable cost groups that benefit the station Comments

Budget and Analysis Campus Mail Service Computer Operations Financial Operations Human Resources Insurance Internal Audit Legal Payroll President's Office 2012 2013 Purchasing Other

Not Applicable 2c.2. Costs per licensee financial statements $18,782,552$18,888,657Comments 2c.3. LESS: Cost groups that do not benefit the operations of $3,416,822 $2,872,167 Comments the public broadcast station 2c.4. Costs benefiting station operations $15,365,730$16,016,490Comments 2c.5. Percentage of allocation (from line 2a.3 or 2b.3) %1.483016 %1.456798 Comments 2c.6. Total institutional costs benefiting station operations $227,876 $233,327 Comments 3. Physical plant support rate calculation 3a. Net square footage occupied by station 10,009 10,009 Comments 3b. Licensee's net assignable square footage 3,429,906 3,429,906 Comments 3c. Percentage of allocation (3a divided by 3b) (forward to %0.291816 %0.291816 Comments line 3d.5 below) 3d.1. Choose applicable cost groups that benefit the station

Building Maintenance Custodial Services Director of Operations Elevator Maintenance Grounds and Landscaping Motor Pool

Refuse Disposal Roof Maintenance Utilities Security Services Facilities Planning Other

Not Applicable 3d.2. Costs per licensee financial statements $15,561,619$16,151,451Comments 3d.3. LESS: Cost groups that do not benefit the operations $4,137,787 $4,582,009 Comments of the public broadcast station 3d.4. Costs benefiting station operations $11,423,832$11,569,442Comments 3d.5. Percentage of allocation (from line 3c.) %0.291816 %0.291816 Comments 3d.6. Total physical plant support costs benefiting station $33,336 $33,761 Comments 2012 2013 operations 4. Total costs benefiting station operations (forwards to $261,212 $267,088 Comments line1 on tab3) Comments CommentNameDateStatus Occupancy List WKMS-FM (1417) Murray, KY Type of OccupancyLocationValue Schedule B Totals WKMS-FM (1417) Murray, KY 2012 2013

data data 1. Total support activity benefiting station $261,212 $267,088 Comments 2. Occupancy value 0 $0 Comments 3. Deductions: Fees paid to the licensee for overhead recovery, $0 $0 Comments assessment, etc. 4. Deductions: Support shown on lines 1 and 2 in excess of $0 $0 Comments revenue reported in financial statements. 5. Total Indirect Administrative Support (Forwards to Line 2 of $261,212 $267,088 Comments the Summary of Nonfederal Financial Support) 6. Please enter an institutional type code for your licensee. SU SU Comments Comments CommentNameDateStatus Schedule C WKMS-FM (1417) Murray, KY Donor 2013 2012 data Code data 1. PROFESSIONAL SERVICES (must be eligible as $0 $0 Comments NFFS) A. Legal $0 $0 Comments B. Accounting and/or auditing $0 $0 Comments C. Engineering $0 $0 Comments D. Other professionals (see specific line item instructions in Guidelines before completing) $0 $0 Comments

2. GENERAL OPERATIONAL SERVICES (must be $20,708 $28,852 Comments eligible as NFFS) A. Annual rental value of space (studios, offices, or tower $0 $0 Comments facilities) B. Annual value of land used for locating a station-owned $0 $0 Comments transmission tower C. Station operating expenses BS$20,70 BS $28,852 Comments Donor 2013 2012 data Code data 8 D. Other (see specific line item instructions in Guidelines before completing) $0 $0 Comments

3. OTHER SERVICES (must be eligible as NFFS) $44,506 $53,597 Comments A. ITV or educational radio $0 $0 Comments B. State public broadcasting agencies (APBC, FL-DOE, $0 $0 Comments eTech Ohio) $44,50 C. Local advertising BS BS $53,597 Comments 6 D. National advertising $0 $0 Comments 4. Total in-kind contributions - services and other assets eligible as NFFS (sum of lines 1 through 3), forwards to $65,214 $82,449 Comments Line 3a. of the Summary of Nonfederal Financial Support 5. IN-KIND CONTRIBUTIONS INELIGIBLE AS NFFS $12,143 $10,786 Comments A. Compact discs, records, tapes and cassettes $0 $0 Comments B. Exchange transactions $0 $0 Comments C. Federal or public broadcasting sources $0 $0 Comments $12,14 D. Fundraising related activities BS BS $10,786 Comments 3 E. ITV or educational radio outside the allowable scope $0 $0 Comments of approved activities F. Local productions $0 $0 Comments G. Program supplements $0 $0 Comments H. Programs that are nationally distributed $0 $0 Comments I. Promotional items $0 $0 Comments J. Regional organization allocations of program services $0 $0 Comments K. State PB agency allocations other than those allowed $0 $0 Comments on line 3(b) L. Services that would not need to be purchased if not $0 $0 Comments donated M. Other $0 $0 Comments 6. Total in-kind contributions - services and other assets (line 4 plus line 5), forwards to Schedule F, line 1c. Must $77,357 $93,235 Comments agree with in-kind contributions recognized as revenue in the AFS. Comments CommentNameDateStatus Schedule D WKMS-FM (1417) Murray, KY 2012 Donor 2013

data Code data 1. Land (must be eligible as NFFS) $ $0 Comments 2. Building (must be eligible as NFFS) $ $0 Comments 3. Equipment (must be eligible as NFFS) $ $0 Comments 4. Vehicle(s) (must be eligible as NFFS) $ $0 Comments 5. Other (specify) (must be eligible as NFFS) $ $0 Comments 6. Total in-kind contributions - property and equipment eligible as NFFS (sum of lines 1 through 5), forwards to Line 3b. of the $ $0 Comments Summary of Nonfederal Financial Support 7. IN-KIND CONTRIBUTIONS INELIGIBLE AS NFFS $ $0 Comments a) Exchange transactions $ $0 Comments b) Federal or public broadcasting sources $ $0 Comments c) TV only—property and equipment that includes new facilities (land and structures), expansion of existing facilities and $ $0 Comments acquisition of new equipment d) Other (specify) $ $0 Comments 8. Total in-kind contributions - property and equipment (line 6 plus line 7), forwards to Schedule F, line 1d. Must agree with in- $ $0 Comments kind contributions recognized as revenue in the AFS. Comments CommentNameDateStatus Schedule E WKMS-FM (1417) Murray, KY EXPENSES

(Operating and non-operating) PROGRAM SERVICES 2012 data 2013 data 1. Programming and production $533,165 $547,374 Comments A. Restricted Radio CSG $ $24,797 Comments B. Unrestricted Radio CSG $ $148,381 Comments C. Other CPB Funds $ $0 Comments D. All non-CPB Funds $ $374,196 Comments 2. Broadcasting and engineering $170,399 $161,213 Comments A. Restricted Radio CSG $ $0 Comments B. Unrestricted Radio CSG $ $0 Comments C. Other CPB Funds $ $0 Comments D. All non-CPB Funds $ $161,213 Comments 3. Program information and promotion $106,746 $105,829 Comments A. Restricted Radio CSG $ $0 Comments B. Unrestricted Radio CSG $ $0 Comments C. Other CPB Funds $ $0 Comments D. All non-CPB Funds $ $105,829 Comments EXPENSES

(Operating and non-operating) PROGRAM SERVICES 2012 data 2013 data 1. Programming and production $533,165 $547,374 Comments SUPPORT SERVICES 2012 data 2013 data 4. Management and general $468,852 $478,387 Comments A. Restricted Radio CSG $ $0 Comments B. Unrestricted Radio CSG $ $0 Comments C. Other CPB Funds $ $0 Comments D. All non-CPB Funds $ $478,387 Comments 5. Fund raising and membership development $38,148 $32,860 Comments A. Restricted Radio CSG $ $0 Comments B. Unrestricted Radio CSG $ $0 Comments C. Other CPB Funds $ $0 Comments D. All non-CPB Funds $ $32,860 Comments 6. Underwriting and grant solicitation $38,147 $32,860 Comments A. Restricted Radio CSG $ $0 Comments B. Unrestricted Radio CSG $ $0 Comments C. Other CPB Funds $ $0 Comments D. All non-CPB Funds $ $32,860 Comments 7. Depreciation and amortization (if not allocated to $106,024 $43,736 Comments functional categories in lines 1 through 6) A. Restricted Radio CSG $ $0 Comments B. Unrestricted Radio CSG $ $0 Comments C. Other CPB Funds $ $0 Comments D. All non-CPB Funds $ $43,736 Comments 8. Total Expenses (sum of lines 1 to 7) must agree with $1,461,481$1,402,259Comments audited financial statements A. Total Restricted Radio CSG (sum of Lines 1.A, 2.A, 3.A, $ $24,797 Comments 4.A, 5.A, 6.A, 7.A) B. Total Unrestricted Radio CSG (sum of Lines 1.B, 2.B, 3.B, $ $148,381 Comments 4.B, 5.B, 6.B, 7.B) C. Total Other CPB Funds (sum of Lines 1.C, 2.C, 3.C, 4.C, $ $0 Comments 5.C, 6.C, 7.C) D. Total All non-CPB Funds (sum of Lines 1.D, 2.D, 3.D, $ $1,229,081Comments 4.D, 5.D, 6.D, 7.D) INVESTMENT IN CAPITAL ASSETS

Cost of capital assets purchased or donated 2012 data 2013 data 9. Total capital assets purchased or donated $157,446 $-9,543 Comments 9a. Land and buildings $0 $0 Comments 9b. Equipment $157,446 $-9,543 Comments 9c. All other $0 $0 Comments 10. Total expenses and investment in capital assets (Sum of$1,618,927$1,392,716Comments INVESTMENT IN CAPITAL ASSETS

Cost of capital assets purchased or donated 2012 data 2013 data lines 8 and 9) Additional Information

(Lines 11 + 12 must equal line 8 and Lines 13 + 14 must equal line 9) 2012 data 2013 data 11. Total expenses (direct only) $1,382,110$1,309,024Comments 12. Total expenses (indirect and in-kind) $79,371 $93,235 Comments 13. Investment in capital assets (direct only) $157,446 $-9,543 Comments 14. Investment in capital assets (indirect and in- $0 $0 Comments kind) Comments CommentNameDateStatus Schedule F WKMS-FM (1417) Murray, KY 2013 data 1. Data from AFR a. Schedule A, Line 21 $995,856 Comments b. Schedule B, Line 5 $267,088 Comments c. Schedule C, Line 6 $93,235 Comments d. Schedule D, Line 8 $0 Comments e. Total from AFR $1,356,179Comments

Choose Reporting Model

You must choose one of the three reporting models in order to complete Schedule F. After making your selection, click the "Choose" button below, which will display your reporting model. When changing to a different reporting model all data entered in the current reporting model will be lost.

FASB

GASB Model A proprietary enterprise-fund financial statements with business-type activities only

GASB Model B public broadcasting entity-wide statements with mixed governmental and business-type activities

2013 data 2. GASB Model B public broadcasting entity-wide statements with

mixed governmental and business-type activities a. Charges for services $108,693 Comments b. Operating grants and contributions $93,235 Comments c. Capital grants and contributions $0 Comments d. Other revenues $1,154,251Comments e. Total From AFS, lines 2a-2d $1,356,179Comments Reconciliation 2013 data 3. Difference (line 1 minus line 2) $0 Comments 4. If the amount on line 3 is not equal to $0, click the “Add” button and list the reconciling items. $0 Comments

Comments CommentNameDateStatus