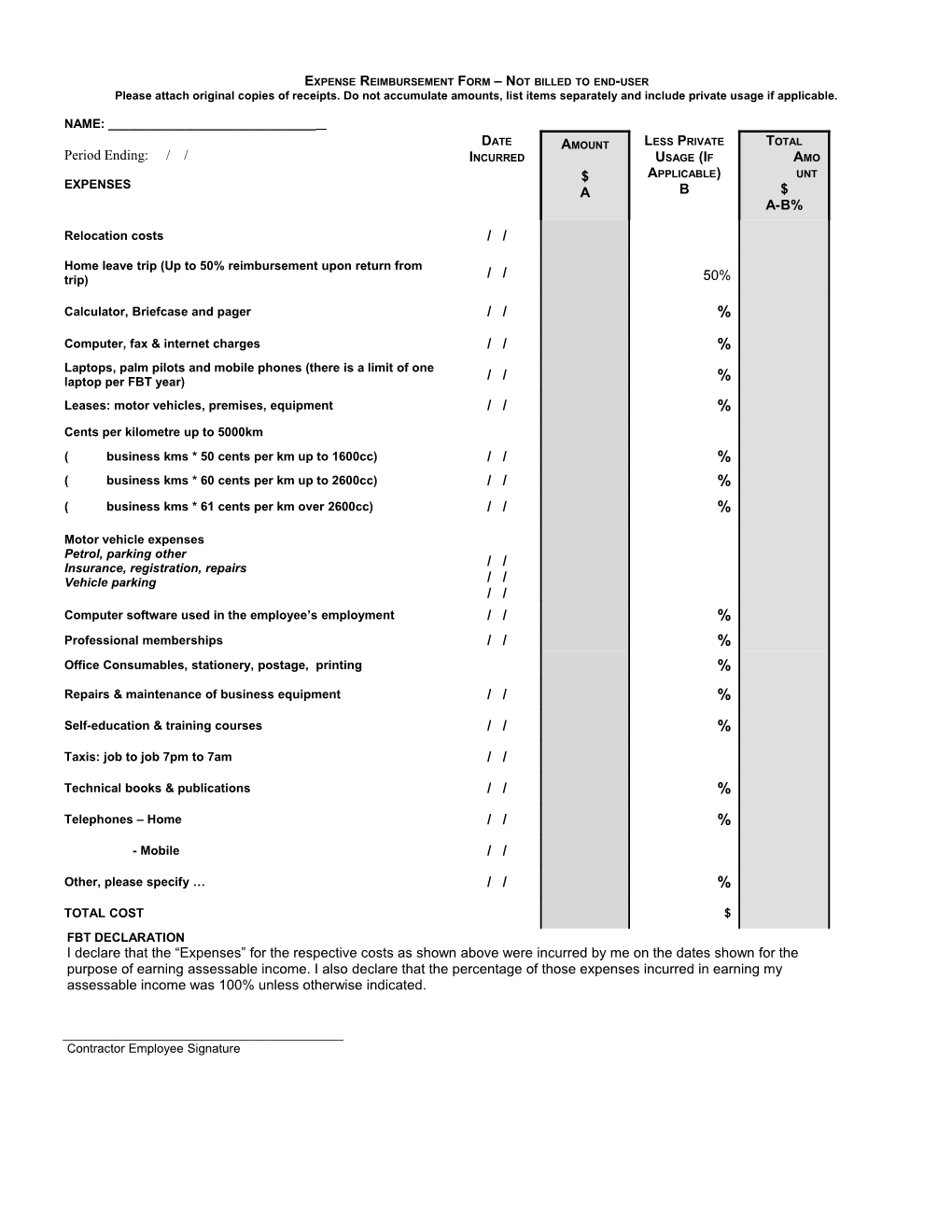

EXPENSE REIMBURSEMENT FORM – NOT BILLED TO END-USER Please attach original copies of receipts. Do not accumulate amounts, list items separately and include private usage if applicable.

NAME: ______DATE AMOUNT LESS PRIVATE TOTAL Period Ending: / / INCURRED USAGE (IF AMO $ APPLICABLE) UNT EXPENSES A B $ A-B%

Relocation costs / /

Home leave trip (Up to 50% reimbursement upon return from / / trip) 50%

Calculator, Briefcase and pager / / %

Computer, fax & internet charges / / % Laptops, palm pilots and mobile phones (there is a limit of one laptop per FBT year) / / % Leases: motor vehicles, premises, equipment / / % Cents per kilometre up to 5000km ( business kms * 50 cents per km up to 1600cc) / / % ( business kms * 60 cents per km up to 2600cc) / / % ( business kms * 61 cents per km over 2600cc) / / %

Motor vehicle expenses Petrol, parking other Insurance, registration, repairs / / Vehicle parking / / / / Computer software used in the employee’s employment / / % Professional memberships / / % Office Consumables, stationery, postage, printing %

Repairs & maintenance of business equipment / / %

Self-education & training courses / / %

Taxis: job to job 7pm to 7am / /

Technical books & publications / / %

Telephones – Home / / %

- Mobile / /

Other, please specify … / / %

TOTAL COST $ FBT DECLARATION I declare that the “Expenses” for the respective costs as shown above were incurred by me on the dates shown for the purpose of earning assessable income. I also declare that the percentage of those expenses incurred in earning my assessable income was 100% unless otherwise indicated.

______Contractor Employee Signature NOTES TO THE REIMBURSEMENTS

PLEASE ENSURE THAT RECEIPTS ARE KEPT FOR ALL EXPENSES WHEN MAKING A CLAIM FOR REIMBURSEMENT; THE AMOUNTS CLAIMED FOR A REIMBURSEMENT WILL BE SALARY PACKAGED AND THE RESULT WILL BE A FURTHER REDUCTION FOR BOTH PAYG TAX AND SUPERANNUAITON; WHERE AN EXPENSE HAS BEEN INCURRED PRIOR TO JOINING FREESPIRIT (FS), YOU WILL NEED TO CALL ONE OF THE TAXATION CONSULTANTS BEFORE A CLAIM SHOULD BE MADE IN ORDER TO DETERMINE THE DEDUCTIBILITY OF THE EXPENSE; IT SHOULD BE NOTED THAT LAPTOP COMPUTERS WILL BE REIMBURSABLE WHILE DESKTOP COMPUTERS WILL NOT BE REIMBURSABLE THROUGH FS; WHERE A PURCHASE HAS BEEN MADE IN A CURRENCY OTHER THAN AUSTRALIAN DOLLARS ($AUD), YOU WILL NEED TO CONVERT THE AMOUNT TO $AUD USING THE EXCHANGE RATE (OR CURRENT EXCHANGE RATE) AT THE DATE OF PURCHASE, PRIOR TO CLAIMING THE AMOUNT FOR A REIMBURSEMENT; WHERE A HOME LEAVE TRIP IS TAKEN, 50% OF THE AMOUNT MAY BE REIMBURSED. ONLY ONE TRIP MAY BE CLAIMED DURING ANY FBT YEAR (1ST APRIL TO THE 31ST MARCH); IF AN ITEM HAS BEEN PURCHASED WITH AN INDIVIDUAL COST IN EXCESS OF $1000, AND YOU WISH TO HAVE THE ITEM REIMBURSED, PLEASE CALL FS BEFORE YOU COMPLETE THE REIMBURSEMENT FORM; AS PART OF THE FBT DECLARATION THAT MUST BE SIGNED WHEN PUTTING IN A CLAIM FOR REIMBURSEMENT, YOU MUST ENSURE THE AMOUNTS BEING CLAIMED REPRESENT THE BUSINESS COMPONENT ONLY. YOU MUST CLEARLY SHOW THE PRIVATE PORTION OF AN EXPENSE WHERE YOU USE IT FOR PRIVATE PURPOSES.

IF YOU ARE UNSURE ABOUT WHETHER AN EXPENSE IS CLAIMABLE AS A REIMBURSEMENT, PLEASE CALL ONE OF OUR TAXATION CONSULTANTS.

NB: Reimbursements: In order to satisfy DIMA guidelines in respect to minimum taxable salary thresholds, only sponsored individuals with remuneration packages above $110,000 will be able to have their deductible expenses reimbursed as part of their package. For those with remuneration packages below $110,000, they will have to claim any deductible expenses in their income tax return.