how to maximize profit when there are two production plants, long-run equilibrium

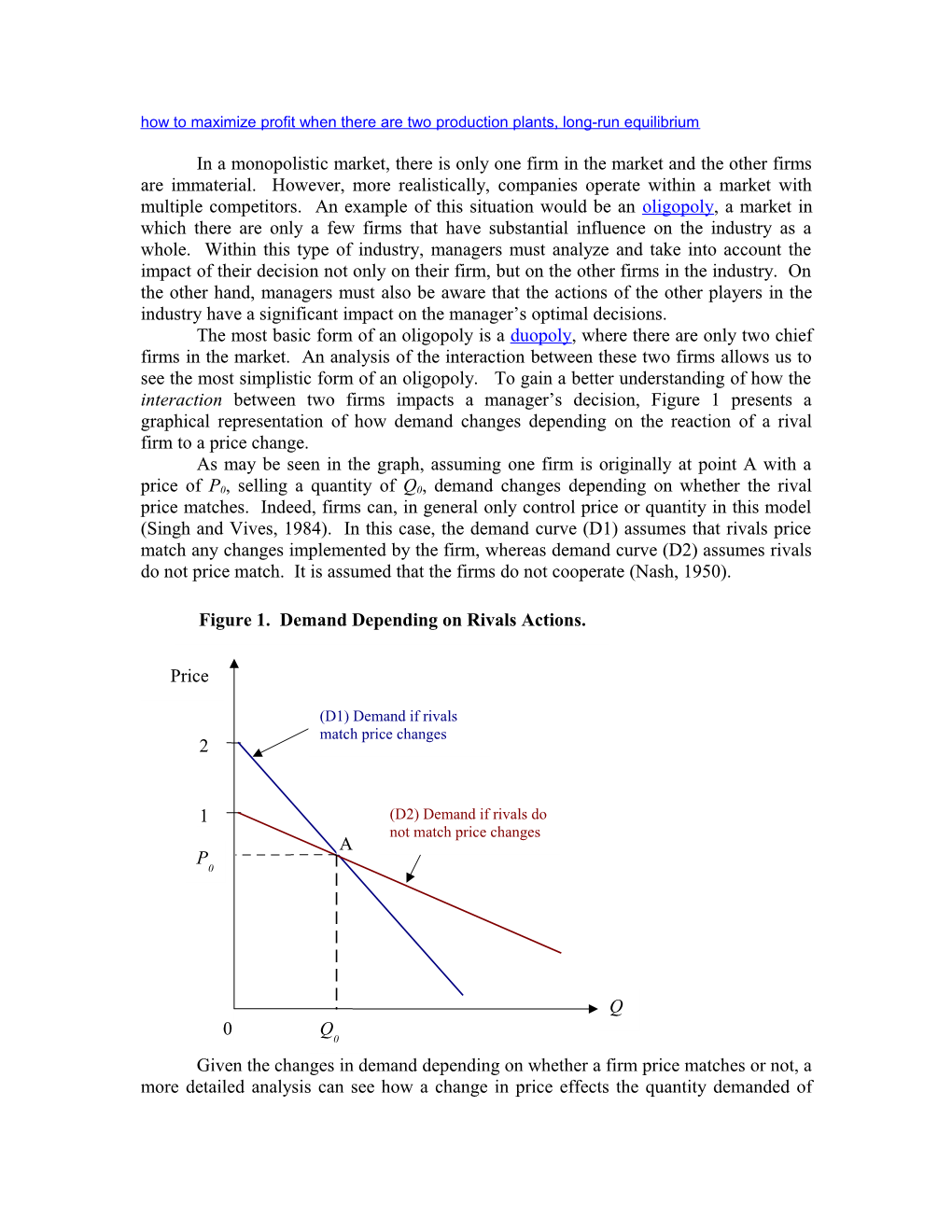

In a monopolistic market, there is only one firm in the market and the other firms are immaterial. However, more realistically, companies operate within a market with multiple competitors. An example of this situation would be an oligopoly, a market in which there are only a few firms that have substantial influence on the industry as a whole. Within this type of industry, managers must analyze and take into account the impact of their decision not only on their firm, but on the other firms in the industry. On the other hand, managers must also be aware that the actions of the other players in the industry have a significant impact on the manager’s optimal decisions. The most basic form of an oligopoly is a duopoly, where there are only two chief firms in the market. An analysis of the interaction between these two firms allows us to see the most simplistic form of an oligopoly. To gain a better understanding of how the interaction between two firms impacts a manager’s decision, Figure 1 presents a graphical representation of how demand changes depending on the reaction of a rival firm to a price change. As may be seen in the graph, assuming one firm is originally at point A with a price of P0, selling a quantity of Q0, demand changes depending on whether the rival price matches. Indeed, firms can, in general only control price or quantity in this model (Singh and Vives, 1984). In this case, the demand curve (D1) assumes that rivals price match any changes implemented by the firm, whereas demand curve (D2) assumes rivals do not price match. It is assumed that the firms do not cooperate (Nash, 1950).

Figure 1. Demand Depending on Rivals Actions.

Price

(D1) Demand if rivals match price changes 2

1 (D2) Demand if rivals do not match price changes A P 0

Q 0 Q 0 Given the changes in demand depending on whether a firm price matches or not, a more detailed analysis can see how a change in price effects the quantity demanded of firm. Figure 2 presents the effect of a price decrease both when the rival firm price matches and when it does not.

Figure 2. Effect of Price Decrease on Quantity Demanded Depending on Rival Response.

Price

P 0

P L

D2

D1 Q 0 Q Q Q 0 L1 L2

As seen in the graph, when a price decrease occurs, if the rival firm does not respond and holds its price constant, the price reducing firm sells more. However, if the firm price matches, the potential increase in units sold is reduced by the price match. On the other hand, as seen in Figure 3, the opposite happens when a price increase is implemented. Figure 3. Effect of Price Increase on Quantity Demanded Depending on Rival Response.

Price

P H P 0

D2

D1 Q 0 Q Q Q D2 D1 0

As seen in the graph, when a price increase occurs, if the competing firm does not respond and holds its price constant, the price increasing firm looses a greater number of sales than if the rival firm matches the increase.

A well-known example of a duopoly is in the soft drink industry, Coca-Cola vs. Pepsi (Kopalle et al., 1996). Within the soft drink industry, these two companies are the most dominant producers and their decisions directly impact each other. Managers at each firm must constantly determine how they will respond to price changes by the rival soft drink maker. To show how the previously discussed fundamentals could work in a real-world setting, assume that you are manager at Coca-Cola and have heard that Pepsi recently received damaging news from a supplier (the supplier is experiencing a shortage of a key ingredient in Pepsi), and in response, Pepsi is price-locking its products in order to keep its supply constant until the supplier can recover. As a manager, how do you respond? As a manager, you have three options: 1) Increase your prices, 2) Decrease your prices, or 3) do nothing. If you increase your prices, and Pepsi does not price match, Coca-Cola will loose a great deal of sales. If you do nothing, nothing will occur. There should be no change in the quantity demanded. However, if you decrease prices, the number of units of Coca-Cola products should increase dramatically because Pepsi cannot price match.

In the long-run, if a rival with match any price change, a manager maximizes profits when marginal revenue equals marginal cost associated for demand curve D1 (see Figure 1). If rivals do not price match, the manager will maximize profits when the marginal revenue equals marginal cost for demand curve D2 (see Figure 1). References

Henderson, A. (1954). The theory of duopoly. Quarterly Journal of Economics, 64(4), 565-584.

Kopalle, P. K., Rao, A. G., and J. L. Assuncao. (1996). Asymmetric Reference Price Effects and Dynamic Pricing Policies. Marketing Science, 15(1), 60-85.

Nash, J. (1950). Equilibrium points in n-person games. Proceedings of the National Academy of Sciences, 36(1), 48-49.

Singh, N. and X. Vives (1984). Price and quantity competition in a differentiated duopoly. Rand Journal of Economics, 15(4) 546-554.

Questions:

1). A market with only two firms present is called a:

A). Triopoly B). Monopoly C). Duopoly D). Biopoly E). None of the above

Answer: C. A duopoly is a form of a oligopoly comprised of only two firms.

2). When a rival matches any price change, demand becomes ______elastic than if they do not.

A). More B). Less C). No change D). Unable to determine

Answer: B. For any price reduction, a firm will sell more if their rivals do not price match than if they do. A price decrease will only increase the demanded quantity by a small amount when rivals price match and vice versa, if they do not price match, a firm will sell more.

3). The most important element in calculating the benefit of a price change in a duopoly is:

A). The number of firms B). Calculating when MC=TR C). Determining demand D). Calculating risk E). Predicting the interaction between the firms

Answer: E. Predicting the interaction between the two firms is the most important element in determining how to best optimize profits. Depending on whether a rival firms will price match in response to a price change determines the benefit level of any managerial decision.

4). Which of the following would be considered a duopoly:

A). Pepsi and Coca-Cola B). Home Depot and Lowes C). DishNetwork and DirecTV D). Sirius and XM E). All of the above

Answer: E. All of the above would be considered a duopoly within their respective industries. Each pairing are major competitors and the dominant players in their industries.

5). Profit maximization is accomplished in a duopoly when:

A). ATC=MR B). MC=AVC C). E=MC2 D). MR=MC E). MC=TC

Answer: D. Regardless of whether a firm price matches in a duopoly, a manager’s profit is maximized when marginal revenue is equal to marginal cost associated with the respective demand curve.