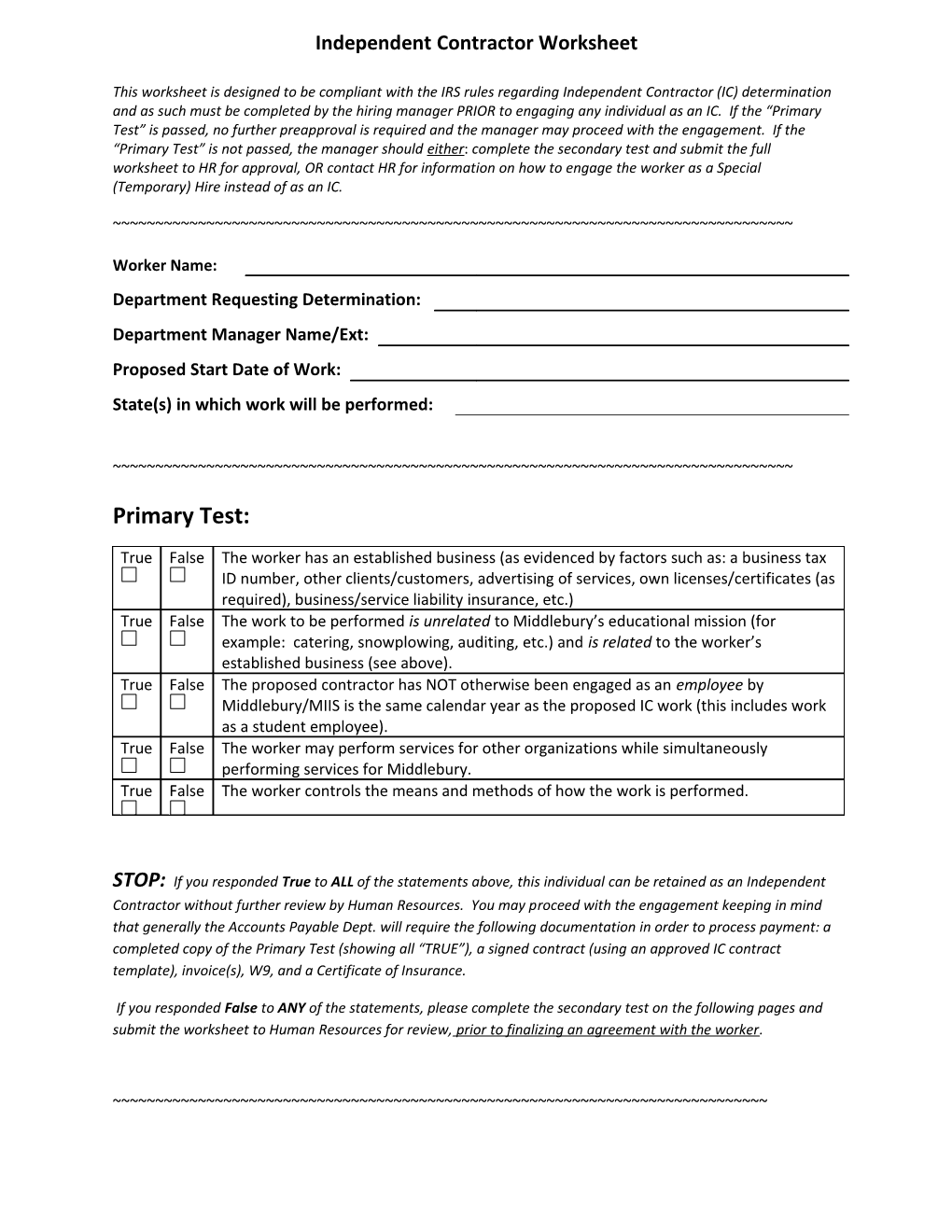

Independent Contractor Worksheet

This worksheet is designed to be compliant with the IRS rules regarding Independent Contractor (IC) determination and as such must be completed by the hiring manager PRIOR to engaging any individual as an IC. If the “Primary Test” is passed, no further preapproval is required and the manager may proceed with the engagement. If the “Primary Test” is not passed, the manager should either: complete the secondary test and submit the full worksheet to HR for approval, OR contact HR for information on how to engage the worker as a Special (Temporary) Hire instead of as an IC.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Worker Name: Department Requesting Determination: Department Manager Name/Ext: Proposed Start Date of Work: State(s) in which work will be performed:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Primary Test:

True False The worker has an established business (as evidenced by factors such as: a business tax ID number, other clients/customers, advertising of services, own licenses/certificates (as required), business/service liability insurance, etc.) True False The work to be performed is unrelated to Middlebury’s educational mission (for example: catering, snowplowing, auditing, etc.) and is related to the worker’s established business (see above). True False The proposed contractor has NOT otherwise been engaged as an employee by Middlebury/MIIS is the same calendar year as the proposed IC work (this includes work as a student employee). True False The worker may perform services for other organizations while simultaneously performing services for Middlebury. True False The worker controls the means and methods of how the work is performed.

STOP: If you responded True to ALL of the statements above, this individual can be retained as an Independent Contractor without further review by Human Resources. You may proceed with the engagement keeping in mind that generally the Accounts Payable Dept. will require the following documentation in order to process payment: a completed copy of the Primary Test (showing all “TRUE”), a signed contract (using an approved IC contract template), invoice(s), W9, and a Certificate of Insurance.

If you responded False to ANY of the statements, please complete the secondary test on the following pages and submit the worksheet to Human Resources for review, prior to finalizing an agreement with the worker.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ Secondary Test: (Please note that fields will expand as you type.)

Duties

1. Please describe the work the individual is being engaged to perform:

2. Where (in what state, and on whose premises) will the work be performed? Will Middlebury direct where the work will be performed?

Behavioral Factors

1. Will the worker use his/her own tools and equipment (for example: computer equipment, catering equipment, testing equipment, etc.) or Middlebury’s? Please describe.

2. Is the worker expected to personally do the work, or simply ensure that the work is done (that is, is it acceptable for the worker to send one of his/her employees to perform the work)?

3. Does Middlebury retain the right to direct the manner in which the work is performed or only the outcome/results? Please describe.

4. To what extent does Middlebury direct when the work will be done? (Due date only? Daily/weekly scheduled hours? Other?)

5. Will Middlebury direct the order or sequence in which the work is to be performed? If so, please elaborate.

6. Will the worker receive training from Middlebury in order to complete or perform the work for the project? If so, please describe.

Financial Factors

1. To the extent necessary for the particular line of business, does the worker have a demonstrable investment in his/her business (owns/leases equipment, office space, etc.)? Please describe.

2. To what extent does the worker make his/her services available to the marketplace (advertises, actively solicits business, etc.)?

3. What is the proposed method of payment for the work (Flat rate based on bid? Hourly rate for all hours worked? Monthly retainer? Other?)

4. Will Middlebury pay any of the worker’s business expenses? If yes, explain.

5. Will the worker bear the risk of making a profit or sustaining a loss under the work arrangement?

Type of Relationship Factors

1. To what extent are the services/work to be performed related to Middlebury’s regular business (that is, education) and/or the same as the work performed by employees of Middlebury?

2. Does the manager propose to enter into a written contract for services (independent contractor agreement) with the worker? Please attach draft of proposed contract, if available.

3. How long is the relationship expected to last?

4. Does Middlebury intend to provide the worker with any benefits (housing, meals, access to the recreation facilities, other)? If so, please elaborate.

STOP: Submit completed Worksheet to Human Resources for approval PRIOR to engaging the worker as an IC. You will be notified of the results of the status determination. If the request is approved you will be able to proceed with the engagement, however keep in mind that generally the Accounts Payable Dept. will require the following documentation (in addition to this approved worksheet) in order to process payment(s): a signed contract (using an approved IC contract template), invoice(s), W9, and a Certificate of Insurance.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

For HR Office Use Only

Reviewed By: Date Independent Contractor Status Approved: YES NO