ID Code TEC-TU-00029

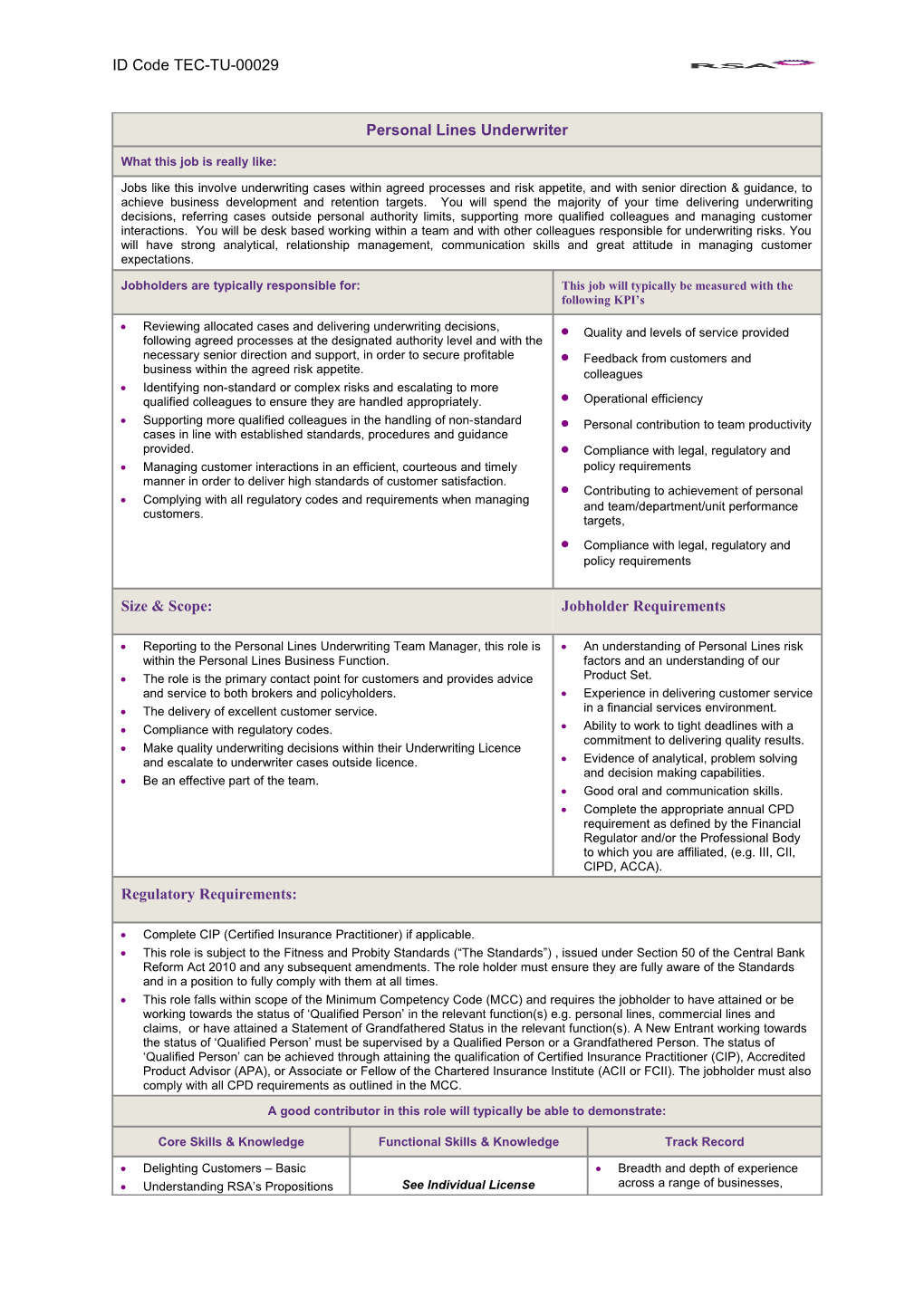

Personal Lines Underwriter

What this job is really like:

Jobs like this involve underwriting cases within agreed processes and risk appetite, and with senior direction & guidance, to achieve business development and retention targets. You will spend the majority of your time delivering underwriting decisions, referring cases outside personal authority limits, supporting more qualified colleagues and managing customer interactions. You will be desk based working within a team and with other colleagues responsible for underwriting risks. You will have strong analytical, relationship management, communication skills and great attitude in managing customer expectations.

Jobholders are typically responsible for: This job will typically be measured with the following KPI’s

Reviewing allocated cases and delivering underwriting decisions, Quality and levels of service provided following agreed processes at the designated authority level and with the necessary senior direction and support, in order to secure profitable Feedback from customers and business within the agreed risk appetite. colleagues Identifying non-standard or complex risks and escalating to more qualified colleagues to ensure they are handled appropriately. Operational efficiency Supporting more qualified colleagues in the handling of non-standard Personal contribution to team productivity cases in line with established standards, procedures and guidance provided. Compliance with legal, regulatory and Managing customer interactions in an efficient, courteous and timely policy requirements manner in order to deliver high standards of customer satisfaction. Contributing to achievement of personal Complying with all regulatory codes and requirements when managing and team/department/unit performance customers. targets, Compliance with legal, regulatory and policy requirements

Size & Scope: Jobholder Requirements

Reporting to the Personal Lines Underwriting Team Manager, this role is An understanding of Personal Lines risk within the Personal Lines Business Function. factors and an understanding of our The role is the primary contact point for customers and provides advice Product Set. and service to both brokers and policyholders. Experience in delivering customer service The delivery of excellent customer service. in a financial services environment. Compliance with regulatory codes. Ability to work to tight deadlines with a commitment to delivering quality results. Make quality underwriting decisions within their Underwriting Licence and escalate to underwriter cases outside licence. Evidence of analytical, problem solving and decision making capabilities. Be an effective part of the team. Good oral and communication skills. Complete the appropriate annual CPD requirement as defined by the Financial Regulator and/or the Professional Body to which you are affiliated, (e.g. III, CII, CIPD, ACCA). Regulatory Requirements:

Complete CIP (Certified Insurance Practitioner) if applicable. This role is subject to the Fitness and Probity Standards (“The Standards”) , issued under Section 50 of the Central Bank Reform Act 2010 and any subsequent amendments. The role holder must ensure they are fully aware of the Standards and in a position to fully comply with them at all times. This role falls within scope of the Minimum Competency Code (MCC) and requires the jobholder to have attained or be working towards the status of ‘Qualified Person’ in the relevant function(s) e.g. personal lines, commercial lines and claims, or have attained a Statement of Grandfathered Status in the relevant function(s). A New Entrant working towards the status of ‘Qualified Person’ must be supervised by a Qualified Person or a Grandfathered Person. The status of ‘Qualified Person’ can be achieved through attaining the qualification of Certified Insurance Practitioner (CIP), Accredited Product Advisor (APA), or Associate or Fellow of the Chartered Insurance Institute (ACII or FCII). The jobholder must also comply with all CPD requirements as outlined in the MCC.

A good contributor in this role will typically be able to demonstrate:

Core Skills & Knowledge Functional Skills & Knowledge Track Record

Delighting Customers – Basic Breadth and depth of experience Understanding RSA’s Propositions See Individual License across a range of businesses, ID Code TEC-TU-00029

– Basic products or types of customer Understanding RSA - Basic Experience of working in claims or Understanding the Marketplace - actuarial roles Basic Customer service experience in Working Effectively – Basic financial services industry or other service industry e.g. retail. Building Effective Relationships – Basic Understanding Data – Basic Using Judgement – Basic Communicating Effectively – Basic Delivering Results - Basic