ChangeWave Research: Corporate IT Spending June 1, 2011

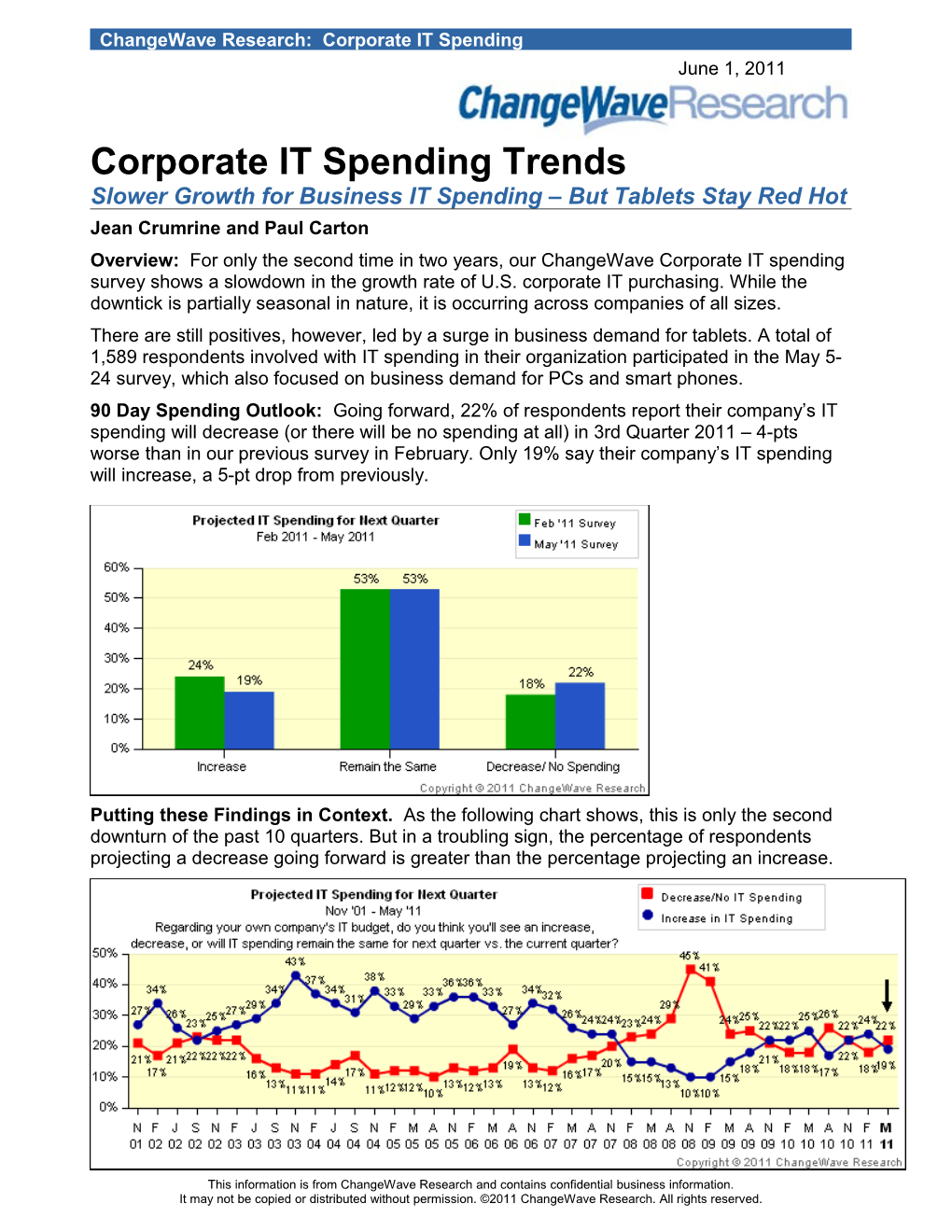

Corporate IT Spending Trends Slower Growth for Business IT Spending – But Tablets Stay Red Hot Jean Crumrine and Paul Carton Overview: For only the second time in two years, our ChangeWave Corporate IT spending survey shows a slowdown in the growth rate of U.S. corporate IT purchasing. While the downtick is partially seasonal in nature, it is occurring across companies of all sizes. There are still positives, however, led by a surge in business demand for tablets. A total of 1,589 respondents involved with IT spending in their organization participated in the May 5- 24 survey, which also focused on business demand for PCs and smart phones. 90 Day Spending Outlook: Going forward, 22% of respondents report their company’s IT spending will decrease (or there will be no spending at all) in 3rd Quarter 2011 – 4-pts worse than in our previous survey in February. Only 19% say their company’s IT spending will increase, a 5-pt drop from previously.

Putting these Findings in Context. As the following chart shows, this is only the second downturn of the past 10 quarters. But in a troubling sign, the percentage of respondents projecting a decrease going forward is greater than the percentage projecting an increase.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. ChangeWave Research: Corporate IT Spending

Seasonal factors clearly account for some of the downturn (historically, 3rd quarter IT spending projections have slowed in 7 of the past 10 years). But the pullback in spending growth is occurring across companies of all sizes – with smaller size companies (Less than 10 employees) showing the greatest weakness. Current Quarter Spending: We also asked respondents if their IT spending was on track thus far in the 2nd Quarter, and the results are quite similar to last time. A total of 15% say they’ve spent More than Planned so far in the quarter – up 2-pts from previously. Another 25% say they’ve spent Less than Planned – also up 2-pts.

IT Spending Categories: In terms of current quarter spending, of the 13 IT categories focused on in this survey, Security (Change in Net Difference Score = +2) and Virtualization (+2) have registered increases since last quarter. We’re also seeing a very slight improvement in PC spending this quarter. (Additional details are on pp.15-16 below.) On the downside, we’re seeing a decline in Operating Systems/Platforms (-3) and Software-as-a-Service (SaaS)/ Outsourced Application Management (-2). Corporate PC Demand Going forward, the findings show a sluggish environment in PC purchase plans for next quarter, with 2-in-3 respondents saying their company will buy desktops in 3rd Quarter – unchanged from the previous survey, and below last year’s high. Planned laptop purchasing (69%) is also unchanged for the fourth consecutive survey.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 2 ChangeWave Research: Corporate IT Spending

What impact is this relatively flat market having on the major PC manufacturers? Planned Laptops. In an encouraging sign for Dell, its planned corporate laptop buying is up 1-pt for next quarter. We note that Dell sells 80% of its PCs on the corporate market. Planned buying for Hewlett-Packard (15%) is down 1-pt – and while Apple’s planned laptop share (12%) is also down 1-pt, that’s from the all-time high reached in our previous survey.

We also asked enterprise respondents planning to buy laptops next quarter to tell us their company’s Netbook purchasing plans. The consensus estimate for Netbooks is a dismal 8% of planned laptop purchases for next quarter – down 1-pt from previously. Planned Desktops. Dell (29%) is down 1-pt in terms of desktop planned buying, while H-P (17%) is unchanged. Apple (7%), while also unchanged, remains at its all time high in planned enterprise desktops – one more indication that its recent iMac refresh is being well received. (Note that our May Consumer PC Survey Report uncovered an explosive move upward in Apple desktop sales due to its iMac refresh).

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 3 ChangeWave Research: Corporate IT Spending

Corporate Tablet Demand Overall IT spending may be lackadaisical, but corporate demand for tablets is simply soaring. A total of 12% of respondents say their company is currently providing employees with Tablet devices – up 3-pts since last quarter and a three-fold increase from a year ago.

Does your company currently provide employees with Tablet devices?

Note: The May and August 2010 survey question was “Has your company purchased Apple iPad tablets for business purposes?”

Current Share. Despite the entry of multiple new tablets, the Apple iPad (83%) continues to enjoy near total domination of the enterprise market.

Within the growing field of competitors, all remain far behind the iPad’s corporate share. Motorola (e.g., Xoom; 6%) is now in second place, followed by RIM (e.g., PlayBook; 5%). Bunched just behind them in a three-way tie are Dell (e.g., Streak; 4%), Samsung (e.g., Galaxy Tab; 4%) and H-P (e.g., Slate, DreamScreen; 4%). We note that H-P has declined 5-pts since February. iPad Leads in Corporate Tablet Satisfaction. In terms of business user satisfaction, the iPad remains in a class by itself with a 72% Very Satisfied corporate enterprise rating – compared to a 42% Very Satisfied rating for all other corporate tablets combined.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 4 ChangeWave Research: Corporate IT Spending

Next 90 Days – Planned Corporate Tablet Buying. Our latest survey shows another 2-pt increase in planned corporate buying of Tablets – with 18% of respondents now saying their company will purchase Tablets for their employees in the 3rd Quarter.

Importantly, this is more than three times the level of demand we saw three quarters ago.

The previous August 2010 survey question was “Over the next 90 days does your company plan on purchasing Apple iPad tablets for business purposes?”

The Apple iPad remains the overwhelming choice for planned corporate tablet buyers, with four-in-five (80%) saying they’ll purchase iPads next quarter – up 1-pt since February.

Who is the manufacturer of the Tablets your company is planning on buying?

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 5 ChangeWave Research: Corporate IT Spending

Although it’s a distant second to the iPad, Motorola (10%) has jumped 7-pts in terms of corporate planned tablet buying since the previous survey – a more than three-fold increase. RIM (8%; up 1-pt), Dell (6%; up 1-pt) and Samsung (6%; down 1-pt) are bunched together behind Motorola, with H-P (4%; down 3-pts) bringing up the rear.

How Companies are Using Tablets. We presented our corporate respondents with a list of business functions and asked them which ones their company is currently using their Tablet devices for.

Internet Access (74%; down 2-pts), Checking Email (74%; up 4-pts), and Working Away From the Office (70%; down 1-pt) remain the three most popular business uses – and Sales Support (45%) and Customer Presentations (42%) remain highly popular functions as well.

Strikingly, one-in-three companies providing Tablets to their employees say they’re using them as Laptop Replacements (34%), a graphic reminder of the serious long term threat that surging corporate Tablet demand poses to the laptop industry.

The Impact on Wireless Providers. We also asked respondents of companies planning to buy tablets which wireless service – if any – their company will be using.

The findings show Verizon (32%; up 5-pts) edging past AT&T (28%; down 9-pts) as the number one choice for wireless services among companies buying Tablets next quarter.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 6 ChangeWave Research: Corporate IT Spending

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 7 ChangeWave Research: Corporate IT Spending

Corporate Smart Phone Demand

Current Share. In terms of current mobile OS share, the survey shows significant advances for both the Apple iPhone OS (38%; up 3-pts) and the Google Android OS (GOOG; 27%; up 2-pts) since our previous corporate smart phone survey.

This is the sixth increase in a row for the Apple iOS.

Similarly, this is the sixth consecutive survey that we’ve witnessed major advances for Android in the corporate market – resulting in a nearly ten-fold increase over the past 18 months.

The momentum of both OS’s is occurring at the expense of industry leader Research In Motion (RIMM), whose Blackberry RIM OS share (61%) has declined another 3-pts since February.

Planned Corporate Smart Phone Buying. Overall, 37% of respondents report their company plans to buy smart phones next quarter – up 1-pt from previously.

Among the individual manufacturers, HTC and Motorola (MOT) are both reaping benefits due to the momentum of Android OS phones on the corporate market.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 8 ChangeWave Research: Corporate IT Spending

HTC. After a year long surge, last quarter saw a downtick in corporate demand for HTC. But its recent launching of several new 4G Android models has thrust HTC (14%) back in a big way, with a 2-pt uptick in corporate buying plans.

Motorola. Motorola (MOT; 17%; up 1-pt) released its Atrix 4G phone in late February and has now reached a new high for ChangeWave surveys over the past four years in planned corporate purchases.

Research In Motion. While RIM (55%; down 1-pt) still holds the largest share of total planned corporate buying going forward, after a precipitous three-year slide it remains stuck at its lowest level ever in a ChangeWave survey.

Apple. Apple (46%; up 1-pt) is now a close second to RIM in terms of planned corporate purchases, with a 1-pt increase over its previous all-time high reached in our February survey (which coincided with the release of the Verizon iPhone).

Samsung. Samsung (7%) finds itself up 1-pt in terms of planned corporate buying.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 9 ChangeWave Research: Corporate IT Spending

Bottom Line: For only the second time in two years, our ChangeWave Corporate IT spending survey shows a slowdown in the growth rate of U.S. corporate IT purchasing.

While the downtick is partially seasonal in nature, it is occurring across companies of all sizes – a worrisome sign.

But there are still major positives in the IT economy, led by a surge in business demand for tablet devices. Moreover, Apple currently finds itself in the best of possible worlds in the corporate market – benefiting from its hugely dominant position in tablets, as well as record share levels in terms of future smart phone buying. To top it off, Apple planned desktop sales remain at an all-time high due to the most recent iMac refresh.

Google’s Android OS continues to move forward in the corporate smart phone market – which is great news for HTC and Motorola going forward. And in a surprise development, the Motorola Xoom is showing some traction in the business tablet market, nudging ahead of RIM, Dell, Samsung and H-P.

The ChangeWave Research Network is a group of 25,000 highly qualified business, technology, and medical professionals – as well as early adopter consumers – who work in leading companies of select industries. They are credentialed professionals who spend their everyday lives on the frontline of technological change. ChangeWave surveys its Network members weekly on a range of business and consumer topics, and converts the information into a series of proprietary quantitative and qualitative reports.

Helping You Profit From A Rapidly Changing World ™ www.ChangeWaveResearch.com

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 10 ChangeWave Research: Corporate IT Spending Table of Contents

Summary of Key Findings...... 11

3rd Quarter 2011 Visibility...... 11

Projected IT Spending: A Comparison...... 11

Projected IT Spending For Next Quarter: Nov ’01 – May ‘11...... 12

Projected IT Spending By Company Size...... 12

2nd Quarter IT Spending...... 13

IT Spending Thus Far in Current Quarter (2Q 2011)...... 13

Green Light Spending...... 13

Willingness to Spend on IT Products & Services...... 13

A Closer Look at 2nd Half 2011...... 14

Looking Ahead – IT Budget for Next Half...... 14

IT Spending Categories...... 15

Corporate PC, Tablet and Smart Phone Markets ...... 17

Corporate PCs ...... 17

Corporate Tablets ...... 20

Corporate Smart Phones ...... 26

Spending for Energy Efficiency ...... 30

Spending for Cloud Computing ...... 32

ChangeWave Research Methodology...... 34

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 11 ChangeWave Research: Corporate IT Spending I. Summary of Key Findings Slower Growth for But Corporate Smart Phone Market U.S. Business IT Tablets Demand -Android and Apple Spending Continues to Soar OS Keep On Winning 90 Day Outlook Uptick in 3rd Quarter Demand Mobile OS – Current Share Only 19% say spending will 12% say their company uses Apple iOS (38%; up 3-pts) increase for 3rd Quarter tablets currently – up 3-pts Google Android OS (27%; up 2- 2011 – a 5-pt drop since the since previous survey pts) previous survey A huge 18% say their Windows Phone 7 (6%; 22% say their company’s IT company plans on buying unchanged) spending will decrease – tablets next quarter – a 2-pt RIM OS (61%; down 3-pts) increase from previously 4-pts worse than previously 3Q Smart Phone Buying Plans Current Quarter Planned Corporate Tablet HTC (14%; up 2-pts) IT Spending Remains Steady Buying Apple iPhone (46%; up 1-pt) 80% Apple iPad – up 1-pt 15% say they’ve spent More Motorola (17%; up 1-pt) 10% Motorola – up 3-pts Samsung (7%; up 1-pt) than Planned so far in 2nd 8% RIM Playbook – up 1-pt RIM (55%; down 1-pt) quarter, and 25% say they’ve 6% Dell – up 1-pt spent Less than Planned – 6% Samsung – down 1-pt Corporate PC Market essentially unchanged for 4% H-P – down 3-pts second survey in a row 3rd Quarter Planned Buying Tablet Satisfaction Ratings Desktops (66%; unchanged) Apple (72% Very Satisfied) Laptops (69%; unchanged) All Other Tablet Devices (42% Very Satisfied) Introduction: For only the second time in two years, our Corporate IT spending survey shows a slowdown in the growth rate of U.S. corporate IT purchasing. While the downtick is partially seasonal in nature, it is occurring across companies of all sizes. There are still positives, however, led by a surge in business demand for tablets. A total of 1,589 respondents involved with IT spending in their organization participated in the May 5- 24 survey, which also focused on business demand for PCs and smart phones. 90 Day Spending Outlook: Going forward, 22% of respondents report their company’s IT spending will decrease (or there will be no spending at all) in 3rd Quarter 2011 – 4-pts worse than in our previous survey in February. Only 19% say their company’s IT spending will increase, a 5-pt drop from previously.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 12 ChangeWave Research: Corporate IT Spending

Putting these Findings in Context. As the following chart shows, this is only the second downturn of the past 10 quarters. But in a troubling sign, the percentage of respondents projecting a decrease going forward is greater than the percentage projecting an increase.

Seasonal factors clearly account for some of the downturn (historically, 3rd quarter IT spending projections have slowed in 7 of the past 10 years).

But the pullback in spending growth is occurring across companies of all sizes – with smaller size companies (Less than 10 employees) showing the greatest weakness.

Projected IT Spending for Next Quarter (3Q 2011) – By Company Size:

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 13 ChangeWave Research: Corporate IT Spending

Current Quarter Spending: We also asked respondents if their IT spending was on track thus far in the 2nd Quarter, and the results are quite similar to last time. A total of 15% say they’ve spent More than Planned so far in the quarter – up 2-pts from previously. Another 25% say they’ve spent Less than Planned – also up 2-pts.

Willingness to Spend: When we asked respondents to rate the current willingness of their company to spend money on IT products and services, only 32% said their company is giving a Green Light to IT spending (i.e., spending is normal), down 6-pts from previously.

Another 62% said their company is giving a “Yellow/Red Light" to spending, which is 5-pts worse than the previous survey.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 14 ChangeWave Research: Corporate IT Spending

2nd Half 2011: Looking ahead at the entire 2nd half of 2011 (Jul-Dec), we see further signs of tightening. Only 21% now think their company’s IT budget will be greater than 1st half 2011 – 2-pts less than the previous survey.

At the same time, 26% believe their company’s IT budget will be less than 1st half 2011 – which is 9-pts worse than previously.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 15 ChangeWave Research: Corporate IT Spending

IT Spending Categories For which of the following main IT Spending categories - if any - have you spent more than planned thus far in the 2nd Quarter? (Check All That Apply) Current Previous Previous Previous Previous Survey Survey Survey Survey Survey May ‘11 Feb ‘11 Nov ‘10 Aug ‘10 May ‘10 PCs 11% 10% 12% 13% 13% Security 9% 8% 7% 7% 8% Software: Enterprise Applications 8% 7% 7% 7% 7% Servers 8% 8% 8% 7% 8% Storage 8% 7% 9% 7% 8% Networking 7% 7% 7% 7% 6% Application Development Software/Tools 5% 5% 5% 5% 6% Virtualization 5% 3% 4% 4% 4% Software: Operating Systems/ Platforms 4% 7% 6% 6% 7% Communications 4% 4% 3% 3% 3% Outsourced IT Services: Systems 3% 3% 4% 3% 3% Integration/Implementation Software-as-a-Service (SaaS)/ 1% 2% 1% 2% 1% Outsourced Application Management Business Process Outsourcing/Hosting 1% 1% 1% 1% 1% (BPO) Don't Know 20% 21% 19% 20% 19% Other 5% 6% 7% 6% 5% And for which of the following main IT Spending categories – if any – have you spent less than planned thus far in the 2nd Quarter? (Check All That Apply) Current Previous Previous Previous Previous Survey Survey Survey Survey Survey May ‘11 Feb ‘11 Nov ‘10 Aug ‘10 May ‘10 PCs 15% 16% 17% 20% 15% Servers 9% 10% 13% 14% 9% Software: Enterprise Applications 8% 7% 8% 9% 7% Software: Operating Systems/ Platforms 8% 8% 10% 12% 8% Storage 8% 8% 9% 10% 8% Application Development Software/Tools 7% 7% 8% 9% 7% Networking 7% 7% 8% 10% 7% Security 5% 6% 7% 7% 6% Communications 5% 6% 5% 6% 5% Outsourced IT Services: Systems 5% 5% 6% 7% 5% Integration/Implementation Virtualization 4% 4% 5% 6% 5% Software-as-a-Service (SaaS)/ 4% 3% 3% 4% 3% Outsourced Application Management Business Process Outsourcing/Hosting 3% 3% 3% 4% 3% (BPO) Don't Know 23% 24% 23% 22% 24% Other 3% 4% 3% 4% 3%

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 16 ChangeWave Research: Corporate IT Spending

Change in Net Difference Score: Current Survey (May ’11) vs. Previous Survey (Feb ’11) Current Previous Survey Survey Change Net Net in Net Overall IT Spending Categories Difference Difference Difference Score Score Score (May ’11) (Feb ’11) Security +4 +2 +2 Virtualization +1 -1 +2 PCs -4 -6 +2 Storage 0 -1 +1 Servers -1 -2 +1 Communications -1 -2 +1 Networking 0 0 0 Software: Enterprise Applications 0 0 0 Application Development Software/Tools -2 -2 0 Outsourced IT Services: Systems -2 -2 0 Integration/Implementation Business Process Outsourcing/Hosting (BPO) -2 -2 0 Software-as-a-Service (SaaS)/ Outsourced -3 -1 -2 Application Management Software: Operating Systems/ Platforms -4 -1 -3

IT Spending Categories: In terms of current quarter spending, of the 13 IT categories focused on in this survey, Security (Change in Net Difference Score = +2) and Virtualization (+2) have registered increases since last quarter. We’re also seeing a very slight improvement in PC spending this quarter. On the downside, we’re seeing a decline in Operating Systems/Platforms (-3) and Software-as-a-Service (SaaS)/ Outsourced Application Management (-2).

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 17 ChangeWave Research: Corporate IT Spending II. Corporate PCs, Tablets and Smart Phones

(A) Corporate PC Demand

Going forward, the findings show a sluggish environment in PC purchase plans for next quarter, with 2-in-3 respondents saying their company will buy desktops in 3rd Quarter – unchanged from the previous survey, and below last year’s high. Planned laptop purchasing (69%) is also unchanged for the fourth consecutive survey.

What impact is this relatively flat market having on the major PC manufacturers?

Planned Laptops. In an encouraging sign for Dell, its planned corporate laptop buying is up 1-pt for next quarter. We note that Dell sells 80% of its PCs on the corporate market. Planned buying for Hewlett-Packard (15%) is down 1-pt – and while Apple’s planned laptop share (12%) is also down 1-pt, that’s from the all-time high reached in our previous survey.

Netbooks. We also asked enterprise respondents planning to buy laptops next quarter to tell us their company’s Netbook purchasing plans. The consensus estimate for Netbooks is a dismal 8% of planned laptop purchases for next quarter – down 1-pt from previously.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 18 ChangeWave Research: Corporate IT Spending

(FOR THOSE COMPANIES BUYING LAPTOPS IN 3rd QUARTER 2011) What percentage of the laptops your company is buying in the 3rd Quarter will be Netbooks? (NOTE: "Netbooks" are low-cost, highly portable laptops designed for basic computing - such as web browsing, email, word processing and other general purpose applications.)

Planned Desktops. Dell (29%) is down 1-pt in terms of desktop planned buying, while H-P (17%) is unchanged. Apple (7%), while also unchanged, remains at its all time high in planned enterprise desktops – one more indication that its recent iMac refresh is being well received. (Note that our May Consumer PC Survey Report uncovered an explosive move upward in Apple desktop sales due to its iMac refresh).

Note that about 70% of H-P’s sales come from outside the U.S., while our ChangeWave surveys focus primarily on the U.S. market.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 19 ChangeWave Research: Corporate IT Spending

(FOR THOSE COMPANIES BUYING COMPUTERS IN 3rd QUARTER 2011) Who is the manufacturer and what computer type(s) is your company planning on buying? (Check All That Apply)

Desktops Current Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey May ‘11 Feb ‘11 Nov ‘10 Aug ‘10 May ‘10 Feb ‘10 Dell - Desktops 29% 30% 30% 30% 33% 32% Hewlett-Packard 17% 17% 17% 17% 17% 17% (including Compaq) - Desktops Apple - Desktops 7% 7% 7% 7% 7% 7% Don't Know 6% 6% 7% 6% 6% 7% Lenovo (formerly IBM) - 5% 5% 4% 5% 5% 5% Desktops Acer (including 2% 2% 2% 3% 2% 2% Gateway and eMachines) - Desktops Sony - Desktops 1% 0% 1% 1% 1% 1% ASUS - Desktops 1% 1% 1% 1% 1% 1% Other - Desktops 2% 2% 2% 2% 3% 2% Not Buying Desktops in 34% 34% 33% 35% 31% 31% 3rd Quarter

Laptops Current Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey May ‘11 Feb ‘11 Nov ‘10 Aug ‘10 May ‘10 Feb ‘10 Dell - Laptops 28% 27% 29% 29% 31% 31% Hewlett-Packard 15% 16% 17% 16% 16% 16% (including Compaq) - Laptops Apple - Laptops 12% 13% 12% 11% 12% 11% Lenovo (formerly IBM) - 10% 10% 9% 10% 10% 11% Laptops Toshiba - Laptops 4% 4% 3% 3% 4% 5% Sony - Laptops 2% 2% 1% 2% 2% 2% Acer (including 2% 2% 2% 3% 3% 2% Gateway and eMachines) - Laptops ASUS - Laptops 1% 2% 1% 2% 1% 2% Other - Laptops 1% 1% 1% 1% 1% 1% Don't Know 7% 7% 7% 6% 6% 6% Not Buying Laptops in 31% 31% 31% 31% 27% 29% 3rd Quarter

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 20 ChangeWave Research: Corporate IT Spending

And for those companies buying computers in 3rd Quarter 2011, what operating system(s) will be installed on your new computers? Current Previous Previous Previous Previous Survey Survey Survey Survey Survey May ‘11 Feb ‘11 Nov ‘10 Aug ‘10 May ‘10 Linux 5% 5% 6% 5% 6% Mac OS X Snow Leopard 11% 11% 10% 8% 10% Windows 7 Ultimate 5% 5% 5% 3% 5% Windows 7 Professional 40% 41% 40% 35% 37% Windows 7 Home Premium 3% 3% 3% 3% 4% Other Windows OS 16% 15% 16% 22% 24% Other OS 0% 1% 1% 0% 0% Don't Know 5% 5% 6% 5% 5% Not Buying Computers in 3rd 19% 19% 18% 21% 17% Quarter

Computer Operating Systems. We also asked corporate respondents about the operating systems they’ll be installing on their new PCs next quarter, and 48% say they plan on installing Windows 7 – down 1-pt from previously. The percentage who say their company will be installing Mac OS X Snow Leopard (11%) is unchanged from previously.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 21 ChangeWave Research: Corporate IT Spending (B) Corporate Tablet Demand

Overall IT spending may be lackadaisical, but corporate demand for tablets is simply soaring.

Does your company currently provide employees with Tablet devices? Current Previous Previous Previous Previous Survey Survey Survey Survey Survey May ‘11 Feb ‘11 Nov ‘10 Aug ‘10 May ‘10 Yes 12% 9% 7% 6% 4% No 82% 86% 88% 87% 91% Don't Know 6% 5% 5% 7% 5%

Note: The previous May 2010 and August 2010 survey question asked “Has your company or organization purchased Apple iPad tablets for business purposes?” A total of 12% of respondents say their company is currently providing employees with Tablet devices – up 3-pts since last quarter and a three-fold increase from a year ago.

Who is the manufacturer(s) of the Tablets your company currently provides? (Check All That Apply)

Current Share. Despite the entry of multiple new tablets, the Apple iPad (83%) continues to enjoy near total domination of the enterprise market.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 22 ChangeWave Research: Corporate IT Spending

Within the growing field of competitors, all remain far behind the iPad’s corporate share. Motorola (e.g., Xoom; 6%) is now in second place, followed by RIM (e.g., PlayBook; 5%). Bunched just behind them in a three-way tie are Dell (e.g., Streak; 4%), Samsung (e.g., Galaxy Tab; 4%) and H-P (e.g., Slate, DreamScreen; 4%). We note that H-P has declined 5-pts since February.

Current Previous Previous Survey Survey Survey May ‘11 Feb ‘11 Nov ‘10 Apple (e.g., iPad, iPad 2) 83% 82% 82% Motorola (e.g., Xoom) 6% NA NA RIM/Blackberry (e.g., PlayBook) 5% NA NA Dell (e.g., Streak) 4% 5% 7% H-P (e.g., Slate, DreamScreen) 4% 9% 11% Samsung (e.g., Galaxy Tab) 4% 2% 0% Acer (e.g., Iconia) 2% NA NA Archos (e.g., 101, 70) 1% 0% 0% Asus (e.g., Eee Pad, Eee Slate) 1% NA NA LG (e.g., G-Slate) 1% NA NA Motion (e.g., C5v, F5v) 1% NA NA ViewSonic (e.g., gTablet, ViewPad) 1% 1% NA Sony (e.g., Dash) 0% 1% 2% Don't Know 1% 1% 1% Other 1% 5% 4% iPad Leads in Corporate Tablet Satisfaction

In terms of business user satisfaction, the iPad remains in a class by itself with a 72% Very Satisfied corporate enterprise rating – compared to a 42% Very Satisfied rating for all other corporate tablets combined.

How satisfied is your company with the Tablets produced by the following manufacturers? (Please rate only those your company currently provides or has previously provided.)

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 23 ChangeWave Research: Corporate IT Spending

Next 90 Days – Planned Corporate Tablet Buying. Our latest survey shows another 2-pt increase in planned corporate buying of Tablets – with 18% of respondents now saying their company will purchase Tablets for their employees in the 3rd Quarter.

Importantly, this is more than three times the level of demand we saw three quarters ago.

The previous August 2010 survey question was “Over the next 90 days does your company plan on purchasing Apple iPad tablets for business purposes?”

The Apple iPad remains the overwhelming choice for planned corporate tablet buyers, with four-in-five (80%) saying they’ll purchase iPads next quarter – up 1-pt since February.

Who is the manufacturer of the Tablets your company is planning on buying? (Check All That Apply)

Although it’s a distant second to the iPad, Motorola (10%) has jumped 7-pts in terms of corporate planned tablet buying since the previous survey – a more than three-fold increase. RIM (8%; up 1-pt), Dell (6%; up 1-pt) and Samsung (6%; down 1-pt) are bunched together behind Motorola, with H-P (4%; down 3-pts) bringing up the rear.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 24 ChangeWave Research: Corporate IT Spending

(FOR THOSE COMPANIES BUYING TABLETS IN 3rd QUARTER 2011) Who is the manufacturer of the Tablets your company is planning on buying? (Check All That Apply) Current Previous Previous Survey Survey Survey May ‘11 Feb ‘11 Nov ‘10 Apple (e.g., iPad, iPad 2) 80% 79% 78% Motorola (e.g., Xoom) 10% 3% NA RIM/Blackberry (e.g., PlayBook) 8% 7% 9% Dell (e.g., Streak) 6% 5% 9% Samsung (e.g., Galaxy Tab) 6% 7% 4% H-P (e.g., Slate, DreamScreen) 4% 7% 8% Asus (e.g., Eee Pad, Eee Slate) 2% 1% 1% HTC (e.g., Flyer) 2% NA NA Toshiba (e.g., Tablet) 2% 3% 2% Acer (e.g., Iconia) 1% 1% 1% LG (e.g., G-Slate) 1% 2% NA Motion (e.g., C5v, F5v) 1% NA NA Sony (e.g., Dash) 0% 1% 1% Don't Know 0% 1% 0% Other 3% 4% 5%

How Companies are Using Tablets. We presented our corporate respondents with a list of business functions and asked them which ones their company is currently using their Tablet devices for.

Internet Access (74%; down 2-pts), Checking Email (74%; up 4-pts) and Working Away From the Office (70%; down 1-pt) remain the three most popular business uses – and Sales Support (45%) and Customer Presentations (42%) remain highly popular functions as well.

Strikingly, one-in-three companies providing Tablets to their employees say they’re using them as Laptop Replacements (34%), a graphic reminder of the serious long term threat that surging corporate Tablet demand poses to the laptop industry.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 25 ChangeWave Research: Corporate IT Spending

What business functions does your company/organization currently use Tablets for? (Check All That Apply) Current Previous Previous Survey Survey Survey May ‘11 Feb ‘11 Nov ‘10 Internet Access 74% 76% 73% Checking Email 74% 70% 69% Working Away From the Office 70% 71% 67% Sales Support 45% 42% 46% Customer Presentations 42% 41% 45% Laptop Replacement 34% 33% 38% GPS Navigation 10% 12% 12% Healthcare Applications 9% 9% 8% Netbook Replacement 8% 16% 18% Desktop Replacement 4% 9% 6% Other 5% 7% 5% *Previous Nov ’10 survey question asked: What business functions does your company/ organization currently use the iPad for?

The Impact on Wireless Providers

We also asked respondents of companies planning to buy tablets which wireless service – if any – their company will be using. The findings show Verizon (32%; up 5-pts) edging past AT&T (28%; down 9-pts) as the number one choice for wireless services among companies buying Tablets next quarter.

For those companies buying tablets in 3rd Quarter 2011, which wireless service provider - if any - will your company use for your tablets?

Note: 30% of respondents in the current May 2011 survey say ‘Don’t Know/Other’, compared with 28% in the previous February 2011 survey.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 26 ChangeWave Research: Corporate IT Spending

(C) Corporate Smart Phone Demand

Mobile Operating Systems

Current Share. In terms of current mobile OS share, the survey shows significant advances for both the Apple iPhone OS (38%; up 3-pts) and the Google Android OS (GOOG; 27%; up 2-pts) since our previous corporate smart phone survey.

This is the sixth increase in a row for the Apple iOS.

Similarly, this is the sixth consecutive survey that we’ve witnessed major advances for Android in the corporate market – resulting in a nearly ten-fold increase over the past 18 months.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 27 ChangeWave Research: Corporate IT Spending

The momentum of both OS’s is occurring at the expense of industry leader Research-In- Motion (RIMM), whose Blackberry RIM OS share (61%) has declined another 3-pts since February.

Which of the following mobile Operating Systems are used on the Smart Phones your company currently provides? (Check All That Apply) Current Previous Previous Previous Previous Survey Survey Survey Survey Survey May ‘11 Feb ‘11 Nov ‘10 Aug ‘10 May ‘10 Blackberry OS (RIM) 61% 64% 64% 66% 69% iOS (Apple) 38% 35% 33% 31% 30% Android (Google) 27% 25% 20% 16% 10% Windows Phone 7/ Windows 6% 6% 7% 9% 10% Mobile (6.5 or earlier) Palm OS/Web OS (Palm Pre) 3% 4% 5% 6% 7% Symbian 2% 2% 2% 2% 2% Mobile Linux 0% 1% 1% 0% 1% Don't Know 3% 3% 4% 4% 3%

*In the previous Nov ’10 and earlier surveys the response choice was Windows Mobile

Planned Corporate Smart Phone Buying. Overall, 37% of respondents report their company plans to buy smart phones next quarter – up 1-pt from previously.

Among the individual manufacturers, HTC and Motorola (MOT) are both reaping benefits due to the momentum of Android OS phones on the corporate market.

HTC. After a year long surge, last quarter saw a downtick in corporate demand for HTC. But its recent launching of several new 4G Android models has thrust HTC (14%) back in a big way, with a 2-pt uptick in corporate buying plans.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 28 ChangeWave Research: Corporate IT Spending

Motorola. Motorola (MOT; 17%; up 1-pt) released its Atrix 4G phone in late February and has now reached a new high for ChangeWave surveys over the past four years in planned corporate purchases.

Research In Motion. While RIM (55%; down 1-pt) still holds the largest share of total planned corporate buying going forward, after a precipitous three-year slide it remains stuck at its lowest level ever in a ChangeWave survey.

Apple. Apple (46%; up 1-pt) is now a close second to RIM in terms of planned corporate purchases, with a 1-pt increase over its previous all-time high reached in our February survey (which coincided with the release of the Verizon iPhone).

Samsung. Samsung (7%) finds itself up 1-pt in terms of planned corporate buying.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 29 ChangeWave Research: Corporate IT Spending

(FOR THOSE COMPANIES BUYING SMART PHONES IN 3rd QUARTER 2011) Who is the manufacturer of the Smart Phones your company is planning on buying? (Check All That Apply) Current Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey May ‘11 Feb ‘11 Nov ‘10 Aug ‘10 May ‘10 Feb ‘10 Research In Motion (e.g., 55% 56% 58% 62% 66% 67% Blackberry) Apple (e.g., iPhone) 46% 45% 40% 34% 35% 34% Motorola (e.g., Droid 2, Droid 17% 16% 16% 15% 12% 12% X, Atrix 4G) HTC (e.g. Thunderbolt, 14% 12% 17% 16% 10% 8% Incredible, EVO 4G) Samsung (e.g., Focus, 7% 6% 6% 4% 3% 3% Fascinate, Galaxy S 4G) Nokia (e.g., N8, Nuron, E7) 3% 3% 4% 4% 5% 4% LG (e.g., Optimus, Vortex, 2% 2% 2% 1% 2% 2% Quantum) Palm (e.g., Pre, Pixi) 2% 2% 1% 2% 3% 4% Dell (e.g., Venue, Venue Pro) 1% 1% NA NA NA NA T-Mobile (e.g., myTouch 4G, 1% 1% 1% 2% 1% 1% Google G2) Other 1% 0% 1% 1% 2% 1%

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 30 ChangeWave Research: Corporate IT Spending III. Corporate IT Spending on Energy Efficiency

We asked respondents about their company’s spending on energy efficient products over the next 6 months.

Looking at the next 6 months, do you think there will be an increase in your company’s spending on energy efficient products/technologies, a decrease in spending, or will there be no change? Current Previous Previous Survey Survey Survey May ‘11 Feb ‘11 Mar ‘08 Increase in Spending 11% 11% 23% Decrease in Spending 9% 8% 8% No Change 55% 55% 51% No Spending on Energy Efficient 14% 12% 9% Prod/Technologies Don’t Know 11% 13% 9%

A total of 11% report there will be an Increase in spending on energy efficient products – unchanged from February, and another 9% say Decrease, which is 1-pt higher than previously.

While there is virtually no change from last quarter, we note that this is markedly different from what we found back in March 2008, when 23% reported an Increase in spending on energy efficient products.

We also presented respondents with a list of IT products and asked how important each was to their company’s effort to become more “eco-efficient”. The following chart shows the percentage who say each product is Very Important compared with the findings from our previous survey in February:

How important is each of the following IT products in your company’s effort to become more “eco-efficient?”

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 31 ChangeWave Research: Corporate IT Spending

Virtualization Software (21%; up 2-pts) – the only product registering an increase since February – now ranks first in terms of importance to their company’s eco-efficiency efforts.

Power and Cooling Equipment (20%; down 1-pt) comes in second, closely followed by Storage Hardware/Software (19%; down 2-pts).

We note that Systems Management and Monitoring (12%; down 5-pts) experienced the biggest declines from previously.

Here are the overall results for the current survey:

Not Very Somewhat Not Very Important Important Important Important at All Virtualization Software (n=428) 21% 26% 21% 32% Power and Cooling Equipment (n=445) 20% 35% 17% 27% Storage Hardware/Software (n=467) 19% 42% 16% 24% Data Center Services (inc. design and 15% 29% 21% 36% operation) (n=406) Microprocessors/CPUs (n=440) 14% 37% 22% 27% Large or Consolidated Servers (inc. 13% 29% 19% 39% mainframes) (n=410) Blade Servers (n=384) 12% 30% 20% 39% Systems Management and Monitoring 12% 42% 17% 30% (n=414)

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 32 ChangeWave Research: Corporate IT Spending IV. Corporate IT Spending for Cloud Computing

We also took a closer look at spending for cloud computing.

Does your company currently utilize cloud computing technologies, products or services?

Current Survey May ‘11 Yes 22% No 67% Don't Know 11%

Better than one-in-five (22%) respondents say their company currently utilizes cloud computing technologies, products or services.

In which of the following ways does your company use cloud computing? (Check All That Apply)

Current Survey May ‘11 Software as a Service (SaaS) – (e.g., Salesforce.com) 59% Platform as a Service (PaaS) – (e.g., Google AppEngine) 25% Infrastructure as a Service (IaaS) – (e.g., Amazon EC2) 27% Don’t Know 7% Other 9%

Over the next 6 months, does your company plan to utilize cloud computing technologies, products or services?

Current Survey May ‘11 Yes 24% No 53% Don't Know/NA 23%

Going forward, one-in-four (24%) say their company has plans to use cloud computing over the next six months.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 33 ChangeWave Research: Corporate IT Spending

And over the next 6 months, does your company plan to increase its spending on cloud computing, decrease its spending, or will your company’s cloud computing spending remain the same compared to the previous 6 months?

Current Survey May ‘11 Increase Spending 51% Decrease Spending 1% Remain the Same 41% Don’t Know 4% Not Applicable/No Answer 2%

Fully half (51%) of the respondents in companies planning to use cloud computing say their spending will Increase, while only 1% say Decrease.

Finally, in which of the following ways will your company increase its spending on cloud computing over the next 6 months? (Check All That Apply)

Current Survey May ‘11 Software as a Service (SaaS) – (e.g., Salesforce.com) 62% Platform as a Service (PaaS) – (e.g., Google AppEngine) 32% Infrastructure as a Service (IaaS) – (e.g., Amazon EC2) 41% Don’t Know 6% Other 5%

Among those companies planning to increase spending on cloud computing, better than three-in-five (62%) say they’ll increase spending for Software as a Service (SaaS), compared with 41% for Infrastructure as a Service (IaaS) and 32% for Platform as a Service (PaaS).

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 34 ChangeWave Research: Corporate IT Spending ChangeWave Research Methodology

The current findings are based on a survey of ChangeWave Research Network members involved with IT spending in their organization, conducted May 5-24, 2011. The goal of the survey was to get an up-to-date picture of IT spending for the 3rd Quarter of 2011. To this end, the survey was composed of a sample of 1,589 accredited members.

ChangeWave's proprietary research and business intelligence gathering system is based upon the systematic gathering of valuable business and investment information directly over the Internet from accredited members.

The Research Network is assembled from senior technology and business executives in leading companies of select industries. More than half of members (53%) have advanced degrees (e.g., Master's or Ph.D.) and 91% have at least a four-year bachelor's degree.

The business and investment intelligence provided by ChangeWave provides a real-time view of companies, technologies and business trends in key market sectors, along with an in-depth perspective of the macro economy – well in advance of other available sources.

About ChangeWave Research

ChangeWave Research, LLC, identifies and quantifies "change" in industries and companies through surveying a network of thousands of business executives and professionals working in more than 20 industries.

The ChangeWave Research Network is a group of 25,000 highly qualified business, technology, and medical professionals – as well as early adopter consumers – who work in leading companies of select industries. They are credentialed professionals who spend their everyday lives on the frontline of technological change. ChangeWave surveys its Network members weekly on a range of business and consumer topics, and converts the information into a series of proprietary quantitative and qualitative reports.

ChangeWave delivers its products and services on the Web at www.ChangeWaveResearch.com.

ChangeWave Research does not make any warranties, express or implied, as to results to be obtained from using the information in this report. Investors should obtain individual financial advice based on their own particular circumstances before making any investment decisions based upon information in this report.

For More Information:

ChangeWave Research Telephone: 301-250-2200 7101 Wisconsin Ave. Fax: 301-926-8413 Suite 1350 www.ChangeWaveResearch.com Bethesda, MD 20814 [email protected]

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 35 ChangeWave Research: Corporate IT Spending

Helping You Profit From A Rapidly Changing World ™ www.ChangeWaveResearch.com

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 36