BRANCH ADMINISTRATION MANUAL

Labour Sponsored Investment Fund Client Name, Nominee, & Intermediary, Open and Registered Plans

Definition Labour Sponsored Investment Fund is an investment fund sponsored by labour organizations. Government rules must be followed and specific investment criteria must be met. These products often provide tax breaks for investors.

Order Entry Type Process: Purchase > Redemptions > Switches Process Owner: Branch Follow Up: HO Admin With Whom: Fund Company

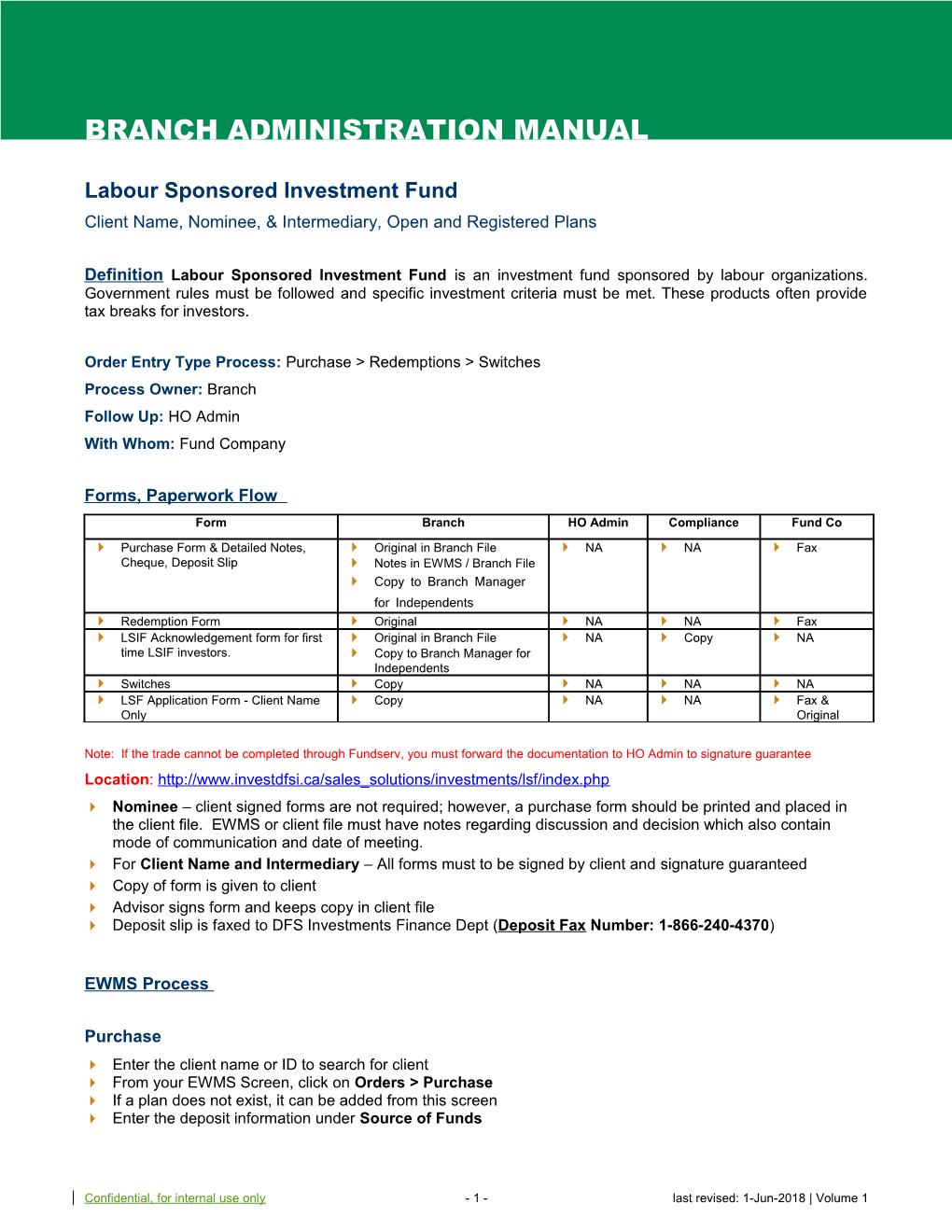

Forms, Paperwork Flow Form Branch HO Admin Compliance Fund Co Purchase Form & Detailed Notes, Original in Branch File NA NA Fax Cheque, Deposit Slip Notes in EWMS / Branch File Copy to Branch Manager for Independents Redemption Form Original NA NA Fax LSIF Acknowledgement form for first Original in Branch File NA Copy NA time LSIF investors. Copy to Branch Manager for Independents Switches Copy NA NA NA LSF Application Form - Client Name Copy NA NA Fax & Only Original

Note: If the trade cannot be completed through Fundserv, you must forward the documentation to HO Admin to signature guarantee Location: http://www.investdfsi.ca/sales_solutions/investments/lsf/index.php Nominee – client signed forms are not required; however, a purchase form should be printed and placed in the client file. EWMS or client file must have notes regarding discussion and decision which also contain mode of communication and date of meeting. For Client Name and Intermediary – All forms must to be signed by client and signature guaranteed Copy of form is given to client Advisor signs form and keeps copy in client file Deposit slip is faxed to DFS Investments Finance Dept (Deposit Fax Number: 1-866-240-4370)

EWMS Process

Purchase Enter the client name or ID to search for client From your EWMS Screen, click on Orders > Purchase If a plan does not exist, it can be added from this screen Enter the deposit information under Source of Funds

Confidential, for internal use only - 1 - last revised: 1-Jun-2018 | Volume 1 BRANCH ADMINISTRATION MANUAL

Select a new or existing investment

Select the type of purchase (usually dollars) Enter the dollar amount allocated for this investment Press Add, Validate and Process

Redemption Enter the client name or ID to search for client From your EWMS Screen click on Orders > Redemption Select the Plan from which the redemption is being placed Select Payee and Delivery - options are dependent on the plan type selected, example: Normal client payment - it will default to “Cheque to clients address” For all client held plans, choose ‘Normal Client Payment’ EFT to client’s bank account – EFT info MUST be completed in Bank Accounts under the CLIENT menu, not plan menu (the menu under plans is for FYI only) No Payment Applicable - Leave as available cash

Confidential, for internal use only - 2 - last revised: 1-Jun-2018 | Volume 1 BRANCH ADMINISTRATION MANUAL

Select the investment from the drop down list of current investments Select the LSIF Type Regular - tax credit clawbacks and DSC charges apply LSIF Shares/units – Tax Credit Clawback Free – Contributor disabled/terminally ill – No tax credit clawbacks apply due to the contributor being disabled or terminally ill, all documentation is sent to supplier, DSC fees apply LSIF Shares/units – Free of Tax credit clawbacks – holding period has expired - No tax credit clawbacks apply, DSC fees apply LSIF Shares/units – Tax Credit clawback free – Death - No tax credit clawbacks apply due to the contributor being deceased, DSC fees apply

Confidential, for internal use only - 3 - last revised: 1-Jun-2018 | Volume 1 BRANCH ADMINISTRATION MANUAL

LSIF Shares/units – Free of tax credit clawbacks and DSC – No tax credit clawbacks and DSC charges are applied

Enter the Type, Amount of the redemption, along the Net/Gross indictor If you entered Free of Tax Credit Clawbacks or Free of tax credit clawbacks and DSC, you must choose Units as your Type and enter the amount of units. Press Add, Validate and Process

Switches Enter the client name or ID to search for client From your EWMS Screen, click on Orders > Switch

Select the fund from which the Outbound Switch is being placed Enter the LSIF Type Regular - tax credit clawbacks and DSC charges apply

Confidential, for internal use only - 4 - last revised: 1-Jun-2018 | Volume 1 BRANCH ADMINISTRATION MANUAL

LSIF Shares/units – Free of Tax credit clawbacks – holding period has expired - No tax credit

clawbacks apply, DSC fees apply LSIF Shares/units – Free of tax credit clawbacks and DSC – No tax credit clawbacks and DSC charges are applied Ensure you enter the Type, Amount If you entered Free of Tax Credit clawbacks or Free of tax credit clawbacks and DSC, you must choose Units as your Type and enter the amount of units.

Once the outbound investment has been selected and added, you must select the fund to complete the Inbound Switch To select the fund, input the fund symbol if you know it otherwise use the search button Ensure you enter the Type, Amount (Usually percentage) Press Add, Validate and Process

Important Information If you are redeeming or switching Free of clawback units, you must always contact the LSIF Company to confirm the unit amounts. Fundserv eligible list below

Confidential, for internal use only - 5 - last revised: 1-Jun-2018 | Volume 1 BRANCH ADMINISTRATION MANUAL

Confidential, for internal use only - 6 - last revised: 1-Jun-2018 | Volume 1