Ryerson University Ontario Harmonized Sales Tax (OHST) Bulletin #2 - March 31, 2010

This bulletin examines the impact of OHST on purchases made after June 30, 2010 and provides advice on planning and savings opportunities with respect to the timing of purchases. While the federal and provincial governments continue to release OHST rules and interpretations, the following information will help you in determining how the OHST may apply to your operations.

The basic changes in tax application are as follows:

1. The Ontario Harmonized Sales Tax (OHST) becomes effective July 1, 2010. 2. The existing GST (5%) & PST (8%) are combined into a single OHST tax at 13%. The primary difference is the base on which the new OHST is applied. The current Ontario PST generally only taxes goods while the GST taxed goods and services. The new OHST follows the GST tax base and as such is applicable on both goods and services. 3. A second major difference is that we will receive a rebate of 67% of the federal portion (5%) and 78% of the provincial portion (8%) of the OHST. 4. OHST transition rules determine the tax implications for invoices and payments that straddle the July 1, 2010 implementation date. i.e. invoices and payments issued or made, a. after October 14, 2009, but before May 1, 2010, for goods and services delivered after July 1, 2010, and b. those issued May 1 - June 30 for goods & services delivered after July 1, 2010. The potential implication of each of these transition rules are illustrated and discussed in the upcoming FAQ and our information and training sessions.

There are 3 basic purchasing categories of goods and services illustrated below: Category 1: Services – consulting fees (e.g. legal, accounting, engineering) and service contracts (rental agreements, utilities) Category 2: Furniture, Equipment and Supplies. Category 3: Equipment used exclusively for research

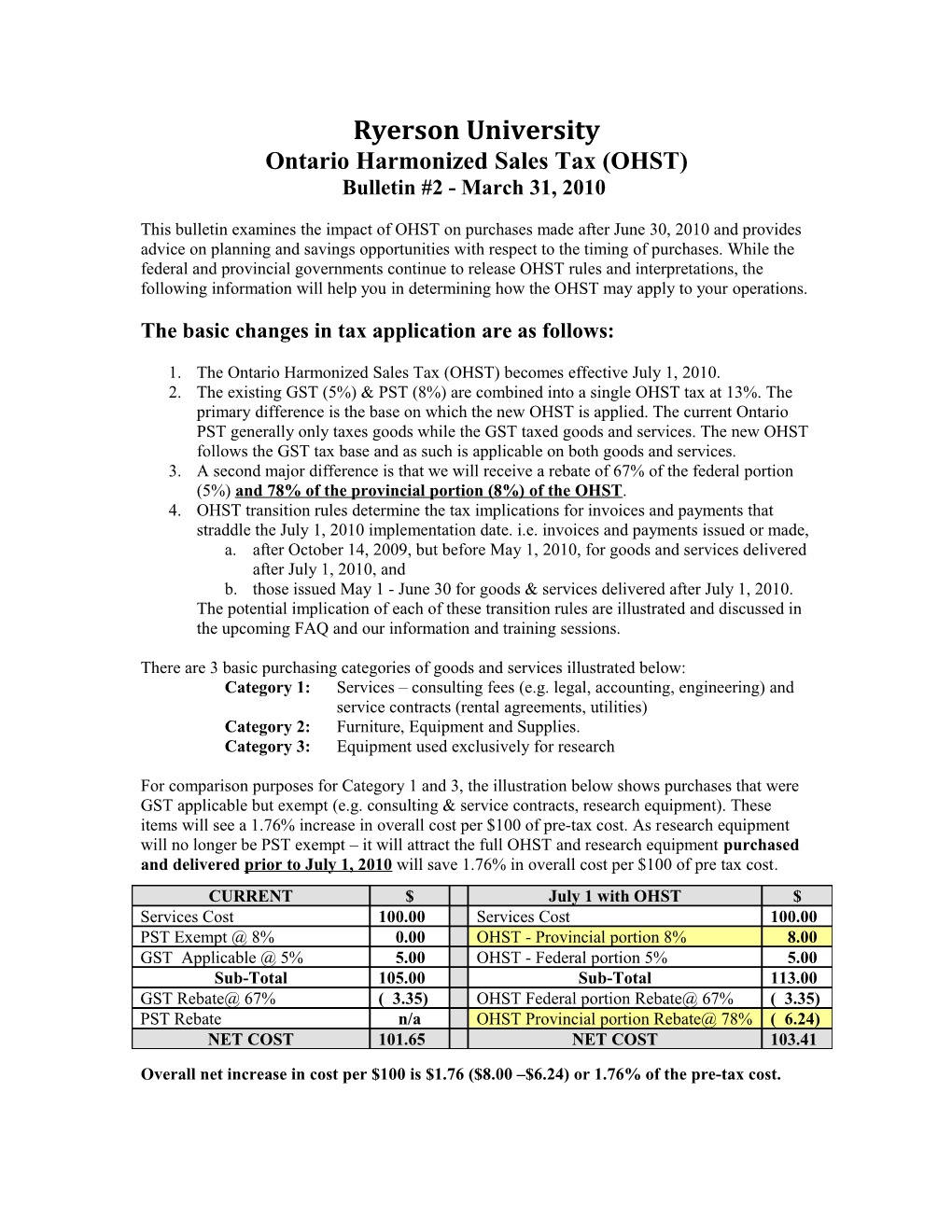

For comparison purposes for Category 1 and 3, the illustration below shows purchases that were GST applicable but exempt (e.g. consulting & service contracts, research equipment). These items will see a 1.76% increase in overall cost per $100 of pre-tax cost. As research equipment will no longer be PST exempt – it will attract the full OHST and research equipment purchased and delivered prior to July 1, 2010 will save 1.76% in overall cost per $100 of pre tax cost. CURRENT $ July 1 with OHST $ Services Cost 100.00 Services Cost 100.00 PST Exempt @ 8% 0.00 OHST - Provincial portion 8% 8.00 GST Applicable @ 5% 5.00 OHST - Federal portion 5% 5.00 Sub-Total 105.00 Sub-Total 113.00 GST Rebate@ 67% ( 3.35) OHST Federal portion Rebate@ 67% ( 3.35) PST Rebate n/a OHST Provincial portion Rebate@ 78% ( 6.24) NET COST 101.65 NET COST 103.41

Overall net increase in cost per $100 is $1.76 ($8.00 –$6.24) or 1.76% of the pre-tax cost. For Category 2 comparison purposes, the illustration below shows a purchase that previously was GST & PST applicable (e.g. furniture, equipment, supplies) now see a 6.24% decrease in overall cost per $100. CURRENT $ July 1 with OHST $ Equipment Cost 100.00 Equipment Cost 100.00 PST Applicable @ 8% 8.00 OHST - Provincial portion 8% 8.00 GST Applicable @ 5% 5.00 OHST - Federal portion 5% 5.00 Sub-Total 113.00 Sub-Total 113.00 GST Rebate@ 67% ( 3.35) OHST Federal portion Rebate@ 67% ( 3.35) PST Rebate n/a OHST Provincial portion Rebate@ 78% ( 6.24) NET COST 109.65 NET COST 103.41

Overall net decrease in cost per $100 is $6.24 or 6.24% of the pre-tax cost.

2010-11 Fiscal Impact

The following Acquisition of goods & Services table will assist departments in planning their 2010-11 expenses and provide guidance on whether to accelerate or delay purchases over the next few months.

Delivery of Delivery of Goods & Goods & Service Prior to Services After Increased Cost or Goods or Service July 1, 2010 June 30, 2010 Savings on Purchases After June 30, 2010 Effective Rate of Effective OHST Tax Rate of Tax Purchases to Accelerate GST PST Feder Provin al cial Research Equipment Consulting & Professional Services 1.65% 0% 1.65% 1.76% Net Cost Increase of Training Seminars 1.76% Total % 1.65% 3.41% Purchases to Delay Equipment (not used in Research) Furniture & Supplies Net Saving 1.65% 8% 1.65% 1.76% Computers & Accessories of 6.24% Software (not custom) Total % 9.65% 3.41% No Change Books - Library & Bookstore 0% 0% 0% 0% No Impact Other Items Energy (gas, fuel, electricity) Net Cost Increase of 1.65% 0% 1.65% 1.76% Office Rent 1.76% Renovation Contracts (Supply/Install) May increase or decrease See Note 2 Note 1: The above table should only be used for evaluating cost impacts on administrative, academic and research activities and NOT for commercial operations. Note 2: It is uncertain what impact the OHST will have on the pricing for construction and renovation contracts after June 30, 2010 as overall pricing will depend on the relative composition of labour & material in the work.

Coming Next:

Bulletin #3 to be issued on April 9, 2010 will address OHST implications on the sale of goods and services by the University to external organizations.

Departments currently generating taxable sales should immediately think about possible implications on business systems, processes, forms and where applicable, consult their application service providers to determine whether modifications are made to their billing systems to accommodate the new OHST on July 1, 2010.

Reminders:

Financial Services puts all OHST information and bulletins on our webpage - http://www.ryerson.ca/financialservices/about/news/HST/index.html

If you have any questions on the new OHST, they can be submitted to our HST Help email capability - [email protected]. If we cannot answer your question immediately, we will research the issue and ensure that the question is responded to.

OHST information and Training sessions will be made available in April. All sessions will be posted on the Human Resources website training calendar.

Peter Gee On behalf of the HST Coordinating Committee