Name:______

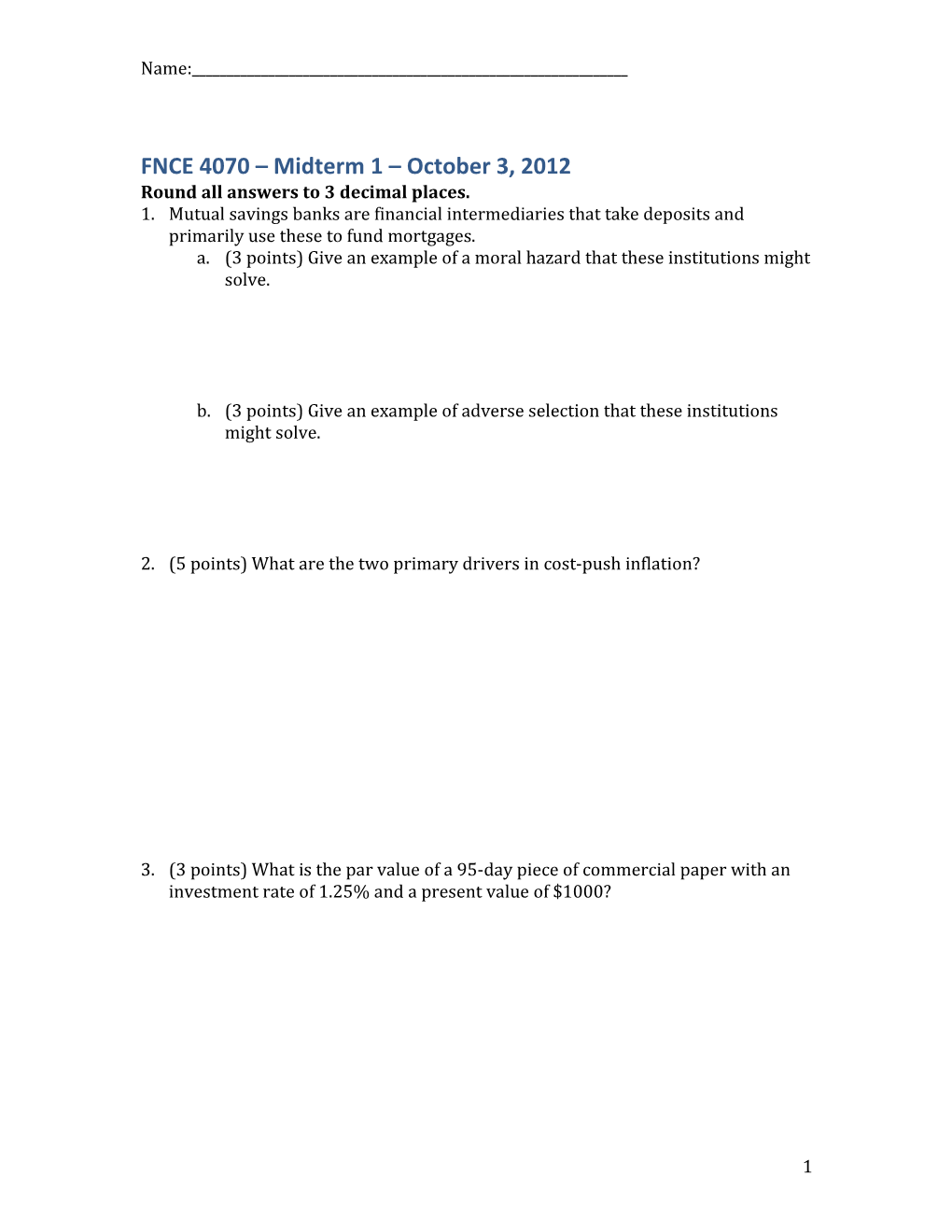

FNCE 4070 – Midterm 1 – October 3, 2012 Round all answers to 3 decimal places. 1. Mutual savings banks are financial intermediaries that take deposits and primarily use these to fund mortgages. a. (3 points) Give an example of a moral hazard that these institutions might solve.

b. (3 points) Give an example of adverse selection that these institutions might solve.

2. (5 points) What are the two primary drivers in cost-push inflation?

3. (3 points) What is the par value of a 95-day piece of commercial paper with an investment rate of 1.25% and a present value of $1000?

1 Name:______

4. The following chart shows the relationship between the British Pound (GBP) and the Euro (EUR). a. (1 point) If 1 Euro is worth less than one Pound then in what units is the following graph?

b. (2 points) In what month would an English family have preferred to travel to France (EUR is the currency used in France)? Why?

c. (2 points) Does an exchange rate of 1.34 represent a strengthening or a weakening of the EUR vs. the GBP relative to the exchange rate on September 18th, 2012 (the last date on this graph)?

2 Name:______

5. Assume the expectations theory of interest rates. a. (2 points) What is the present value of a 13W T-bill with a quote of 1.25%?

b. (2 points) From part (a) what is the discount factor between today and 13 weeks?

c. (2 points) What is the present value of a 26W T-bill with a quote of 2.25%?

d. (2 points) From part (c) what is the discount factor between today and 26 weeks?

e. (2 points) What is the expected discount factor between 13 weeks and 26 weeks?

f. (3 points) What is the expected quote for a 13W T-bill starting in 13 weeks time?

3 Name:______

6. The current 1-year interest rate is 2%. Economists forecast one-year interests of 2.5%, 3%, 4% and 5% for years 2, 3, 4 and 5. These are all annualized interest rates. Assume the liquidity premium theory for interest rates and that the liquidity premium for two years is 0.30% and the liquidity premium for 3 years is 0.40%. a. (8 points total) Complete the following table. Cashflow Maturity Present Value 750 2 1050 3

b. (2 points) Would you expect the present value of these cashflows to be larger or smaller under the expectations theory of interest rates? Explain your answer.

7. The following question refers to the Fed Funds rate a. (2 points) What does this rate refer to?

b. (2 points) Explain two ways in which the Federal Reserve can influence the Fed Funds rate.

4 Name:______

8. A bond has the following cashflows: Years Cashflow 1 $200 2 $240 3 $120

a. (4 points) If the yield to maturity on this bond is 5% then what is its duration?

b. (2 points) If its yield to maturity moved to 5.25% would you expect its duration to increase or to decrease? Why?

c. (6 points) I buy this bond today for $500. I hold the bond for two years. If the yield to maturity when I sell the bond is 5% and I assume that my reinvestment rate on any cash I receive is 5% then what will be my return on this investment?

d. (3 points) If the brokerage cost of buying this bond increases would you expect demand for it to increase or decrease? How would you expect this to affect its price? Why?

5 Name:______

9. Assume the Market Segmentation Theory of the term structure of interest rates. Assume that there are 4 investable markets for bonds – short-term corporates, short-term Treasuries, long-term corporates and long-term Treasuries. a. (4 points) Draw supply and demand curves for short and long-term treasuries according to this theory. Draw and label two separate graphs.

b. (4 points) The Federal Reserve has embarked on an open market operation (OMO) where they are buying long-term treasuries and selling short-term treasuries. Show on the graphs what you would expect the effect of this OMO to be. Clearly label the effect as (b). Explain.

6 Name:______

c. (6 points) Assume that the below graph represents the initial corporate yield curve. On this graph draw the expected corporate yield curve after the operation described in (b). Explain.

10. In the following question we are going to discuss LIBOR. a. (2 points) What does LIBOR stand for?

b. (2 points) What is the primary usage of LIBOR?

c. (1 point) Which bank paid record fines for attempting to manipulate LIBOR?

7