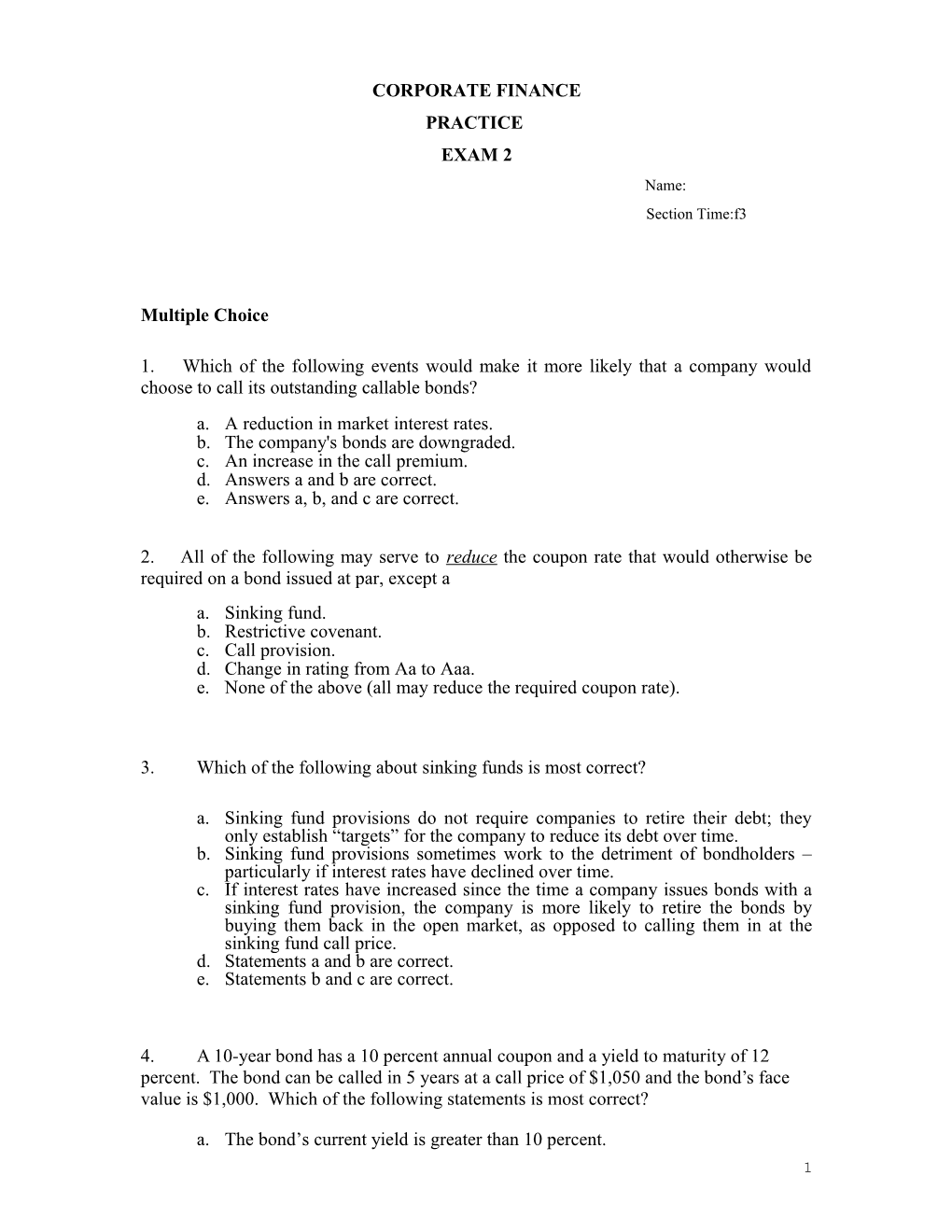

CORPORATE FINANCE PRACTICE EXAM 2 Name: Section Time:f3

Multiple Choice

1. Which of the following events would make it more likely that a company would choose to call its outstanding callable bonds? a. A reduction in market interest rates. b. The company's bonds are downgraded. c. An increase in the call premium. d. Answers a and b are correct. e. Answers a, b, and c are correct.

2. All of the following may serve to reduce the coupon rate that would otherwise be required on a bond issued at par, except a a. Sinking fund. b. Restrictive covenant. c. Call provision. d. Change in rating from Aa to Aaa. e. None of the above (all may reduce the required coupon rate).

3. Which of the following about sinking funds is most correct?

a. Sinking fund provisions do not require companies to retire their debt; they only establish “targets” for the company to reduce its debt over time. b. Sinking fund provisions sometimes work to the detriment of bondholders – particularly if interest rates have declined over time. c. If interest rates have increased since the time a company issues bonds with a sinking fund provision, the company is more likely to retire the bonds by buying them back in the open market, as opposed to calling them in at the sinking fund call price. d. Statements a and b are correct. e. Statements b and c are correct.

4. A 10-year bond has a 10 percent annual coupon and a yield to maturity of 12 percent. The bond can be called in 5 years at a call price of $1,050 and the bond’s face value is $1,000. Which of the following statements is most correct?

a. The bond’s current yield is greater than 10 percent. 1 b. The bond’s yield to call is less than 12 percent. c. The bond is selling at a price below par. d. Both answers a and c are correct. e. None of the above answers is correct. 5. If the expected rate of return on a stock exceeds the required rate, a. The stock is experiencing supernormal growth. b. The stock should be sold. c. The company is probably not trying to maximize price per share. d. The stock is a good buy. e. Dividends are not being declared.

6. Which of the following statements regarding constant growth stock valuation is most correct?

a. Assume that the required rate of return on a given stock is 12%. If the stock’s dividend is growing at a constant rate of 4%, its expected dividend yield is 4% as well. b. The expected capital gain yield on a stock is equal to the expected return less the dividend yield. c. A stock’s dividend yield must at least equal the expected growth rate. d. All of the answers above are correct. e. Answers b and c are correct.

7. For a typical firm with a given capital structure, which of the following is correct? All cost are after taxes.

a. cost of debt > cost of equity > WACC. b. cost of equity > cost of debt > WACC. c. WACC > cost of equity > cost of debt. d. cost of equity > WACC > cost of debt. e. None of the statements above is correct.

8 Which of the following factors in the discounted cash flow (DCF) approach to estimating the cost of common equity is the least difficult to estimate?

a. Expected growth rate, g. b. Dividend yield, D1/P0. c. Required return, ks. d. Expected rate of return, kˆs . e. All of the above are equally difficult to estimate.

9. Which of the following regarding the Capital Asset Pricing Model (CAPM) is most correct?

a. The CAPM approach to estimating a firm's cost of common stock never gives a better estimate than the DCF approach. b. The CAPM approach is typically used to estimate a firm's cost of preferred 2 stock. c. The risk premium used in the bond-yield-plus-risk-premium method is the same as the one used in the CAPM method. d. In practice, the DCF method and the CAPM method usually produce exactly the same estimate for ks. e. The statements above are all false. 10. Which of the following statements regarding WACC is most correct?

a. Since stockholders do not generally pay corporate taxes, corporations should focus on before-tax cash flows when calculating the weighted average cost of capital (WACC). b. When calculating the weighted average cost of capital, firms should include the cost of accounts payable. c. When calculating the weighted average cost of capital, firms should rely on historical costs rather than marginal costs of capital. d. Answers a and b are correct. e. None of the answers above is correct.

11. Which of the following statements is incorrect?

a. Assuming a project has normal cash flows, the NPV will be positive if the IRR is less than the cost of capital. b. If the multiple IRR problem does not exist, any independent project acceptable by the NPV method will also be acceptable by the IRR method. c. If IRR = k (the cost of capital), then NPV = 0. d. NPV can be negative if the IRR is positive. e. The NPV method is not affected by the multiple IRR problem.

12. A company estimates that its weighted average cost of capital (WACC) is 10 percent. Which of the following independent projects should the company accept?

a. Project A requires an up-front expenditure of $1,000,000 and generates a net present value of $3,200. b. Project B has a modified internal rate of return of 9.5 percent. c. Project C requires an up-front expenditure of $1,000,000 and generates a positive internal rate of return of 9.7 percent. d. Project D has an internal rate of return of 9.5 percent. e. None of the projects above should be accepted.

3 Multiple Choice Problems Calculate decimals to four places.

13. Due to a number of lawsuits related to toxic wastes, a major chemical manufacturer has recently experienced a market re-evaluation. The firm has a bond issue outstanding with 15 years to maturity and a coupon rate of 8%, with interest paid semiannually. The required nominal rate on this debt has now risen to 16%. What is the current value of this bond? a. $1,273 b. $1,000 c. $7,783 d. $ 550 e. $ 450

14. A corporate bond matures in 14 years. The bond has an 8 percent semiannual coupon and a par value of $1,000. The bond is callable in five years at a call price of $1,050. The price of the bond today is $1,075. What are the bond’s yield to maturity and yield to call?

a. YTM = 14.29%; YTC = 14.09% b. YTM = 3.57%; YTC = 3.52% c. YTM = 7.14%; YTC = 7.34% d. YTM = 6.64%; YTC = 4.78% e. YTM = 7.14%; YTC = 7.05%

15. Albright Motors is expected to pay a year-end dividend of $3.00 a share (D1 = $3.00). The stock currently sells for $30 a share. The required (and expected) rate of return on the stock is 16 percent. If the dividend is expected to grow at a constant rate, g, what is g? a. 13.00% b. 10.05% c. 6.00% 4 d. 5.33% e. 7.00%

16. Cartwright Brothers’ stock is currently selling for $40 a share. The stock is expected to pay a $2 dividend at the end of the year. The stock’s dividend is expected to grow at a constant rate of 7 percent a year forever. The risk-free rate (kRF) is 6 percent and the market risk premium (kM – kRF) is also 6 percent. What is the stock’s beta? a. 1.06 b. 1.00 c. 2.00 d. 0.83 e. 1.08

17. An analyst has collected the following information regarding Christopher Co.:

The company’s capital structure is 70 percent equity, 30 percent debt. The yield to maturity on the company’s bonds is 9 percent. The company’s year-end dividend is forecasted to be $0.80 a share. The company expects that its dividend will grow at a constant rate of 9 percent a year. The company’s stock price is $25. The company’s tax rate is 40 percent. The company anticipates that it will need to raise new common stock this year. Its investment bankers anticipate that the total flotation cost will equal 10 percent of the amount issued. Calculate the company’s WACC.

a. 10.41% b. 12.56% c. 10.78% d. 13.55% e. 9.29%

18. Vanderheiden Inc. is considering two average-risk alternative ways of producing its patented polo shirts. Process S has a cost of $8,000 and will produce net cash flows of $5,000 per year for 2 years. Process L will cost $11,500 and will produce cash flows of $4,000 per year for 4 years. The company has a contract that requires it to produce the shirts for only 4 years. If cash inflows occur at the end of each year, and if its cost of capital is 10%, by what amount will the better project increase Vanderheiden's value?

a. $ 677.69 b. $1,098.89 c. $1,179.46 d. $1,237.76 e. $1,312.31 5 19. A company is analyzing two mutually exclusive projects, S and L, whose cash flows are shown below:

Years 0 1 2 3 4

S -1,100 900 350 50 10 L -1,100 0 300 500 850 The company's cost of capital is 12 percent, and it can get an unlimited amount of capital at that cost. What is the regular IRR of the better project? a. 13.09% b. 12.00% c. 17.46% d. 13.88% e. 12.53%

20. Martin Fillmore is a big football star who has been offered contracts by two different teams. The payments (in millions of dollars) he receives under the two contracts are listed below:

Team A Team B Year Cash Flow Cash Flow 0 $8.0 $2.5 1 4.0 4.0 2 4.0 4.0 3 4.0 8.0 4 4.0 8.0 Fillmore is committed to accepting the contract which provides him with the highest net present value (NPV). At what discount rate would he be indifferent between the two contracts? a. 10.85% b. 11.35% c. 16.49% d. 19.67% e. 21.03%

6 PROBLEMS Use four decimals. Round final $ answers to cents (i.e. $0.00), and final % values to basis points (i.e. 0.00%)

1. You have been given the following projections for Cali Corporation for the coming year.

Sales = 10,000 units Sales price per unit = $10 Variable cost per unit = $5 Fixed costs = $10,000 Bonds outstanding = $15,000 kd on outstanding bonds= 8% Tax rate = 40% Shares of common stock outstanding= 10,000 shares Beta = 1.4 kRF = 5% kM = 9% Dividend payout ratio = 60% Growth rate = 8% Calculate the current price per share for Cali Corporation.

7 2. Taylor Technologies has a target capital structure which is 40 percent debt and 60 percent equity. The equity will be financed with retained earnings. The company’s bonds have a yield to maturity of 10 percent. The company’s stock has a beta = 1.1. The risk-free rate is 6 percent, the market risk premium is 5 percent, and the tax rate is 30 percent. The company is considering a project with the following cash flows:

Project A Year Cash Flow 0 -$50,000 1 35,000 2 43,000 3 60,000 4 -40,000 What is the project’s modified internal rate of return (MIRR)?

8 3. A baseball player is offered a 5-year contract which pays him the following amounts:

Year 1: $1.2 million Year 2: 1.6 million Year 3: 2.0 million Year 4: 2.4 million Year 5: 2.8 million Under the terms of the agreement all payments are made at the end of each year.

Instead of accepting the contract, the baseball player asks his agent to negotiate a contract which has a present value of $1 million more than that which has been offered. Moreover, the player wants to receive his payments in the form of a 5- year annuity due. All cash flows are discounted at 10 percent. If the team were to agree to the player's terms, what would be the player's annual salary (in millions of dollars)?

9 10