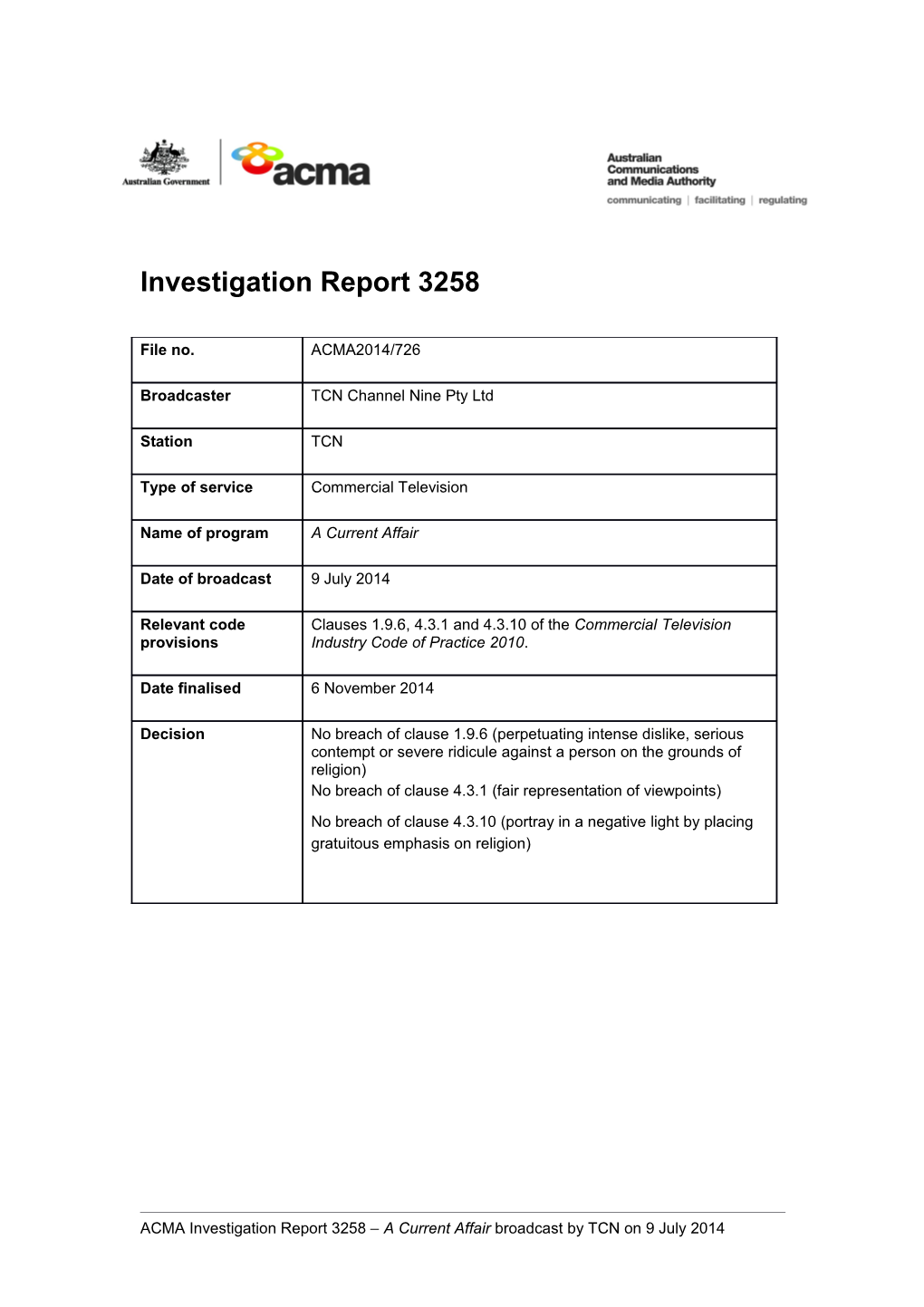

Investigation Report 3258

File no. ACMA2014/726

Broadcaster TCN Channel Nine Pty Ltd

Station TCN

Type of service Commercial Television

Name of program A Current Affair

Date of broadcast 9 July 2014

Relevant code Clauses 1.9.6, 4.3.1 and 4.3.10 of the Commercial Television provisions Industry Code of Practice 2010.

Date finalised 6 November 2014

Decision No breach of clause 1.9.6 (perpetuating intense dislike, serious contempt or severe ridicule against a person on the grounds of religion) No breach of clause 4.3.1 (fair representation of viewpoints) No breach of clause 4.3.10 (portray in a negative light by placing gratuitous emphasis on religion)

ACMA Investigation Report 3258 – A Current Affair broadcast by TCN on 9 July 2014 Error: Reference source not found

Background In September 2014, the Australian Communications and Media Authority (the ACMA) commenced an investigation into a segment of the program A Current Affair broadcast on 9 July 2014 by TCN Channel Nine Pty Ltd, the licensee of TCN Sydney (the licensee).

A Current Affair is a current affairs program broadcast from 7.00pm to 7.30pm weekdays.

The segment in question concerned a report about the tax exemptions available to religious organisations in Australia. A transcript of the segment is at Attachment A.

The complainant alleged that the segment, by only referring to Christian religious organisations that received tax-free status, rather than including references to other religious organisations in Australia was ‘unbalanced’ and demonstrated an ‘anti-Christian bias’.

The complainant’s submissions are at Attachment B, and the licensee’s response is at Attachment C.

The complaint has been investigated in accordance with clauses 1.9.6 [provoke or perpetuate intense dislike, serious contempt or severe ridicule on the grounds of religion]; 4.3.1 [fair representation of viewpoints]; and 4.3.10 [portray group of persons in a negative light by placing gratuitous emphasis on religion] of the Commercial Television Industry Code of Practice 2010 (the Code).

The complainant has also alleged that a statement made in the segment ‘Churches are laughing all the way to the bank’ was ‘a very provocative, one-sided piece of “journalism”, bordering on propaganda, and it certainly reveals a vehemently anti-Christian bias. A politically correct or incorrect person (according to choice) may go so far as to cry, “bigotry”.'

The ACMA has reviewed the program material and notes that there was no statement made during the entirely of the segment that ‘Churches are laughing all the way to the bank’ as submitted by the complainant and the ACMA has not pursued this matter. Assessment This investigation is based on the complainant’s submission, the licensee’s response to the complainant, and a copy of the broadcast provided to the ACMA by the licensee. In assessing content for compliance with the Code, the ACMA considers the meaning conveyed by the relevant material that was broadcast. This is assessed according to the understanding of an ‘ordinary, reasonable’ viewer. Australian courts have considered an ‘ordinary, reasonable’ viewer to be:

A person of fair average intelligence, who is neither perverse, nor morbid or suspicious of mind, nor avid for scandal. That person does not live in an ivory tower, but can and does read between the lines in the light of that person’s general knowledge and experience of worldly affairs.1

1 Amalgamated Television Services Pty Ltd v Marsden (1998) NSWLR 158 at 164-167.

2 In considering compliance with the Code, the ACMA considers the natural, ordinary mean- ing of the language, context, tenor, tone and inferences that may be drawn. In the case of factual material which is presented, the ACMA will also consider relevant omissions (if any). Once the ACMA has applied this test to ascertain the meaning of the material that was broadcast, it then assesses compliance with the Code.

Issue 1: Provoke or perpetuate intense dislike, serious con- tempt or severe ridicule against a person or group of people on the grounds of religion Relevant Code clause

Proscribed Material

1.9 A licensee may not broadcast a program, program promotion, station identification or community service announcement which is likely, in all the circumstances, to:

1.9.6 provoke or perpetuate intense dislike, serious contempt or severe ridicule against a person or group of persons on the grounds of age, colour, gender, national or ethnic origin, disability, race, religion or sexual preference. Finding The licensee did not breach clause 1.9.6 of the Code. Reasons The complaint is that the segment unfairly focused on Christian organisations in its report on the tax-free status of religious organisations in Australia. The complainant considered that this demonstrated an anti-Christian bias and that it provoked or perpetuated dislike, contempt or ridicule of a person or group of persons on the grounds of their religion.

In determining whether the licensee has breached clause 1.9.6, consideration must be giv- en to the following: identification of the relevant person or group and the relevant ground; and whether the broadcast was likely to provoke or perpetuate intense dislike, serious contempt or severe ridicule against the relevant individual/group on that ground. The complainant identified Christian people as the relevant group, with the relevant grounds being religion. However, the ACMA is not satisfied that the program did in fact identify Christian people or groups of Christians (or any other person or group) in the manner that meets the require- ments of this clause. At the start of the segment, the host’s opening statement made it clear that the editorial fo- cus was to examine the tax-free status of religious organisations in Australia by stating:

Now the growing community anger at tax exemptions for religious groups. Politicians and many tax payers say the concessions are unfair and want the organisations to pay up.

ACMA Investigation Report 3258 – A Current Affair broadcast by TCN on 9 July 2014 3 Error: Reference source not found

Further, the segment noted that there are more than 17,000 religious organisations in Aus- tralia, all of which receive the tax concessions. The segment featured the reactions and opinions of a number of people as the tax-free nature of those organisations is explored. While the complainant submitted that the segment only referred to Christian organisations, the segment did refer to two non-Christian organisations as examples of organisations that receive the tax-free status. These are the Church of Scientology and the Victorian Spiritu- alists Union. The ACMA acknowledges that a number of Christian organisations were featured during the segment. However, these organisations, along with the non-Christian organisations featured, were mentioned only as examples of all the religious organisations that had be- nefited from the tax-free status. The ACMA considers that, as the segment focused on religious organisations in general who receive tax-free concessions, rather than Christian people or Christian groups, the program did not identify a relevant person or group of people as required by clause 1.9.6 in this instance. That being the case, the ACMA does not need to determine whether the program material was likely to provoke or perpetuate intense dislike, serious contempt or severe ridicule against the relevant individual/group on the basis of religion.

Issue 2: Portray in a negative light by placing gratuitous emphasis on religion Relevant Code clause

News and Current Affairs Programs

4.3 In broadcasting news and current affairs programs, licensees:

4.3.10 must not portray any person or group of persons in a negative light by placing gratuitous emphasis on age, colour, gender, national or ethnic origin, physical or mental disability, race, religion or sexual preference. Nevertheless, where it is in the public interest, licensees may report events and broadcast comments in which such matters are raised. Finding The licensee did not breach clause 4.3.10 of the Code. Reasons For the same reasons set out under clause 1.9.6, the ACMA has determined that the program did not meet the threshold for identifying (or portraying) a person or group of persons on the basis of one of the characteristics outlined in clause 4.3.10. As discussed, the segment was concerned with religious organisations in general rather than people or groups of people who identify with a particular religion. In addition, the ACMA is not satisfied that the emphasis placed on the religious nature of the organisations in question was ‘gratuitous’ in the sense contemplated in clause 4.3.10

4 of the Code. In reaching this conclusion, the ACMA has considered the ordinary meaning of the word ‘gratuitous’, as defined in the online Macquarie Dictionary (Sixth Edition): Gratuitous adjective 2. being without reason, cause or justification. The segment concerned the fact that the organisations were only able to claim a tax-free status because they were religious. In this context, references to these organisations were justified. As the material did not breach clause 4.3.10 of the Code, it is not necessary for the ACMA to consider whether its broadcast was in the public interest.

Issue 3: Fair representation of viewpoints Relevant Code clause

4.3: In broadcasting news and current affairs programs, licensees:

4.3.1: must broadcast factual material accurately and represent viewpoints fairly, having regard to the circumstances at the time of preparing and broadcasting the program;

4.3.1.1: An assessment of whether the factual material is accurate is to be determined in the context of the segment in its entirety. Finding The licensee did not breach clause 4.3.1 of the Code. Reasons The complaint is that the segment was ‘unbalanced’, ‘one-sided’ and revealed a ‘vehemently anti-Christian bias’ on the basis that it: > featured examples only from the Christian religion; > left the audience with the impression that it is only Christian churches that are not paying land rates; and > omitted the fact that people who are employed by religious groups are required to pay income tax on their salaries. The ACMA notes that there is no requirement in the Code for impartiality in current affairs programs. In determining whether or not a licensee has represented a viewpoint fairly (having regard to the circumstances at the time of preparing and broadcasting the program), the ACMA takes into account that the Code does not require a licensee to present all material which it obtains. The overriding requirement is that, where a viewpoint is included, it must be represented fairly. A program may omit material, but must not misrepresent a viewpoint in doing so. In this case, the program took a critical stance on the issue and presented the viewpoint that the tax concessions for religious organisations is unfair. Nevertheless, in regard to the complainant’s concerns, the ACMA is satisfied that the broadcast material represented viewpoints fairly on the basis of the following factors:

ACMA Investigation Report 3258 – A Current Affair broadcast by TCN on 9 July 2014 5 Error: Reference source not found

> the segment did not allege that only Christian religious organisations are tax exempt; > the segment stated that there are over 17,000 religious institution in Australia, all of which are granted the tax-free concessions; > the segment also referred to non-Christian religious organisations in Australia that are tax exempt (the Church of Scientology and the Victorian Spiritualists Union); > while it is noted that employees of religious organisations pay personal income tax, the segment clearly focused on religious organisations that receive tax-free status; and > the ordinary, reasonable viewer would be aware that the segment focused on the tax rules that apply to religious organisations, as opposed to those that apply to the people who work for them in a wage earning capacity. Accordingly, the ACMA is satisfied that the licensee did not breach clause 4.3.1 of the Code in relation to this broadcast.

6 Attachment A Transcript – A Current Affair – 9 July 2014

Presenter: Now the growing community anger at tax exemptions for religious groups. Politicians and many tax payers say the concessions are unfair and want the organisations to pay up. Interviewee 1: Why should I pay tax and they don’t? Reporter (narrated): Pensioner (Interviewee 1) thinks of this block of land North West of Brisbane as his patch of God’s country. But he has to pay his rates. The neighboring church, on its lush 62 acres, doesn’t. Interviewee 1: I think it’s wrong that they should get something for nothing. Interviewee 2: If you own property you need to be paying rates – bills like everybody else, because if not, it’s not fair.

Reporter (narrated): (Interviewee 2) lives in the shadow of an 8 million dollar, gold trimmed temple. A temple blessed with tax cuts. Interviewee 2: They need to start paying taxes like every other business Reporter (narrated): You mightn’t go to church to donate to the collection plate, but we’re all giving them money, and in ways you’d never imagine. Senator Nick Xenophon: In terms of a tax concessions there are figures from between two or three billion dollars up to 20 billion dollars Reporter (narrated): From the cathedral, to concert sermons, to the cereal aisle, religious organisations are cashing in to the tune of billions of dollars – and they’re not paying tax. TV commercial: 110 years ago a few Australians started a little business. Reporter (narrated): That little business, Sanitarium, is one of our best known. TV commercial: You’ve probably heard of them – their name - ‘Sanitarium’. Reporter (narrated): But did you know this Aussie staple is owned by the Seventh Day Adventist Church. Its big profits, and it made more than 300 million dollars last year are tax free. TV commercial (song): It’s Australia’s favorite breakfast, Wheatbix is No. 1. Senator Nick Xenophon: As much as I love my Wheatbix, I don’t think eating Wheatbix is a religious experience. Reporter (narrated): Senator Nick Xenophon lost faith when Scientology was granted tax exemption. It’s one of an estimated 17,000 religious organisations across Australia out of reach of the tax man. Senator Nick Xenophon: There ought to be some stricter guidelines in terms of a public benefit test.

ACMA Investigation Report 3258 – A Current Affair broadcast by TCN on 9 July 2014 7 Error: Reference source not found

Reporter (narrated): Take the mega-rich, mega-church Hillsong. It made more than 55 million dollars a year, tax free. Then there’s the Mormon Church. Conservative estimates suggest it’s collecting close to a billion dollars in tax free money each year. Interviewee 2: I think it’s just too in-your-face, and if it’s gunna be broadcasting how much money you’ve got? – do the right thing and pay the bills to go with it. Reporter (narrated): The list of exemptions is long – company tax, land tax, GST, payroll tax, even fringe benefits. Interviewee 3: This is a result of ancient law that was first created under the reign of Elizabeth the first in 1601. Reporter (narrated): Dr (Interviewee 3) has spent years arguing the antiquated law is unfair. Interviewee 3: They can have money in the bank, they can have shareholdings, they can have trust accounts – all those kinds of passive, income generating ah structures. And they can also get involved in commercial businesses and all, all of that activity will be tax exempt. Reporter: The religious organisations, including Sanitarium argue the tax break helps with charity work but trying to find out exactly how much money is being spent where is very difficult. And now the federal government wants to abolish the only independent watchdog even attempting to keep track. Interviewee 3: Of an organisation called the Victorian Spiritualists Union, and their website states that they promote ah, the afterlife, clairvoyance, reincarnation, healing, astrology, and anything that will bring us a wider and better understanding of life. Now that’s just their personal beliefs, but all Australian taxpayers are subsidising that. Interviewee 1: Ah, everybody else has got to pay tax. I’m 73 years old and the taxation department is still trying to make me pay tax. Presenter: And we approached the Mormon Church for comment on that story, but they declined.

8 Attachment B Complainant’s submissions

The complainant submitted the following to the licensee on 11 July 2014: In reference to Channel 9's A Current Affair program (ACA) hosted by Tracy Grimshaw, broadcast on Wednesday 9th July, 2014. It was with a substantial degree of disturbance that I watched ACA's unbalanced presentation which came on at 7.15 pm, in regard to the non-payment of taxes and land rates by religious groups. From memory, I think it was stated that there are approximately 1,700 different religious groups in Australia, and that they are all tax exempted. Clearly, this includes all religions, and not simply the Christian religion. Why then, did ACA take it upon themselves to feature examples only from the Christian religion in this segment? Surely ACA and Channel 9 are aware of the rapidly increasing influence of Islam in Australia, and in nearly all other countries. So why did Islam fail to rate a mention in this context? Could it be that Channel 9 and ACA are fearful of a backlash by Muslims, and therefore we must not, at any price, risk offending them? Or are you bowing to the Politically Correct crowd who cry 'racist' (a no- brainer since Islam is not a race) or they cry 'Islamophobe' (inappropriate since a phobia means an irrational fear) if Islam is in any way placed under scrutiny? And what about other religions such as Buddhism, Hinduism and Bahai - why did they not rate a mention by ACA? The segment's visual presentation showed several different Christian denominations, nothing else. Was this done because Christians usually make no fuss when they are scrutinized? – always 'turning the other cheek' even when confrontation is necessary - unlike a significant percentage of one particular religion, whose members not only threaten, they tend to deliver violence when they are scrutinized. No need for a name, is there? Another issue that needed to be explained by ACA, and it was not explained in this segment, is that people who are employed by religious groups are obligated to pay income tax on their salaries. Hillsong church was singled out in this segment. The employees of Hillsong pay their taxes. The employees of other churches likewise pay their taxes. I believe that many people are ignorant of this fact, and so they mistakenly believe that the government receives no taxes whatsoever from anybody who is employed by a church! Church employees do pay income tax! By not mentioning this fact in its segment, ACA was making an unbalanced presentation, and was very possibly exploiting and perpetuating people's ignorance about churches and the tax system. As for paying land rates to councils, that is another issue, but again, why did ACA leave the viewing public with the impression that it is only Christian churches who are not paying land rates? (by filming only the facades of churches, and not mosques etc) Finally, to make ACA's biased and unbalanced presentation complete, came the statement, 'Churches are laughing all the way to the bank.' I have spent many years connected with many different churches, and I can state categorically that I have never seen or heard of any church pastor or church member, 'laughing all the way to the bank,' * or anything akin to this outrageous comment. With emphasis, this particular segment by ACA on Wednesday, 9th July 2014, was a very provocative, one-sided piece of 'journalism,' bordering on propaganda, and it certainly reveals a vehemently anti-Christian bias. A politically correct or incorrect person (according to choice) may go so far as to cry, 'bigotry.' Would ACA dare to make the statement - 'Muslim clerics are laughing all the way to the bank.' (?) Somehow, I think not.

ACMA Investigation Report 3258 – A Current Affair broadcast by TCN on 9 July 2014 9 Error: Reference source not found

The complainant subsequently submitted the following to the licensee on 18 August 2014: You have provided much detail in your reply, quoting several clauses covered by the Commercial Television Code of Practice, and explaining how ACA and Channel 9 complied with these codes in the way it presented the 9th July segment about tax exemptions given to religious organizations in Australia. Yes, it is true that the ACMA does not prevent current affairs programs from taking a particular editorial stance or presenting only one particular point of view. However, let's be clear about one thing - the reason that ACA chose to focus on Christian churches rather than on other religious groups in its segment on tax exemption, rests solely on this basis - By focusing on Christian churches, no threats or any violent backlash are guaranteed. If featuring Islamic groups, threats and / or a violent backlash are a very real possibility. By focusing on Christian churches, no issues about 'political correctness' will rear their heads. If giving as examples - the Muslim religion, Hinduism, Buddhism or Bahai, issues about 'political correctness' more than likely will rear their heads, with any number of predictable no-brainers emanating from the vociferous PC crowd. Thus Channel 9 and ACA decided to 'go with the flow', and follow the path of least resistance, rather than provide the viewing public with a precise, balanced presentation, by nominating and filming a decent representative sample of the various religions who are the recipients of tax and land rates exemptions. Have you ever heard of the saying - 'Following the paths of least resistance is what makes rivers and men crooked?' (?) From your letter, it is clear that Channel 9 and ACA are aware that individuals employed by religious organizations are required by law to pay income tax. After all, it is your business, and therefore it is in your interests to know these things. However, I wonder whether or not all of ACA's viewers possess a similar degree of discernment and enlightenment? Commercial TV stations, as much as government funded TV stations all share in a responsibility to educate the general public by confronting ignorance and dispelling possible 'urban myths'. The last line of page 1 of your letter dated 7 August 2014 seems to imply that Channel 9 and ACA are not 100% convinced that individual employees of religious organizations are actually paying income tax. So, should we be surprised if there is confusion and ignorance amongst members of the general public about this subject? The second page of your reply quotes Codes 1.9.6 and 4.3.10 in an attempt to deny that the segment in question could provoke or perpetuate dislike, contempt or ridicule of a person or group of persons on the grounds of their religion. Although your letter makes the point that, according to Census statistics, the vast majority of Australians identify as Christian, one needs to be 'living under a rock' to be ignorant of this simple fact - That the vast majority of Australians have very little if anything to do with churches, except perhaps on occasions such as weddings, funerals or christenings for family members. One also needs to be 'living under a rock' to deny that there is already a great deal of anti-Christian rhetoric in the various media outlets, as well as in many of our educational institutions at all levels. The idea of 'churches laughing all the way to the bank' (as per ACA's segment on 9th July) fits snugly into the category of 'easy target syndrome' for the reasons that I have previously outlined. In my letter dated 11th July, I asked a simple question which your letter dated 7th August did not answer - Would ACA dare to make the statement - 'Muslim clerics are laughing all the way to the bank.' (?) Even if it is simply ‘'yes’, ‘no’ or ‘not sure’, I would appreciate an answer to this question.

10 ACMA Investigation Report 3258 – A Current Affair broadcast by TCN on 9 July 2014 11 Error: Reference source not found

Attachment C Licensee’s submission The licensee responded to the complainant on 7 August 2014: We write in response to your letter of complaint received on 16 July 2014 regarding a segment on A Current Affair about tax exemptions given to religious organisations in Australia broadcast on 9 July 2014 (the Segment). At the outset, we would like to apologise for any offence caused by the Segment as it is not our intention to upset our viewers. Your complaint raises issues of religious bias and inaccuracy, which are covered by the Commercial Television Code of Practice (Code). For the reasons set out below, we believe that the Segment was presented accurately and fairly and did not contain anti-Christian bias and accordingly we maintain that we complied with the Code. Inaccuracy The Code states at clause 4.3.1 that: 4.3.1 "In broadcasting news and current affairs programs, licensees must broadcast factual material accurately and represent viewpoints fairly, having regard to the circumstances at the time of preparing and broadcasting the program", The Australian Communications and Media Authority (the ACMA) regulates compliance with the Code. In prior investigations, the ACMA has held that the requirement to represent viewpoints fairly does not prevent current affairs programs from taking a particular editorial stance or presenting only one particular point of view. Nine maintains that all factual material conveyed in the Segment was broadcast accurately and fairly. On the basis of ACMA's previous findings about editorial stance as stated in the paragraph above, A Current Affair was not obliged under the Code to present the views of, or factual material related to, other religions (that were not specifically covered in the Segment). A Current Affair used the selected group of religions as representative of all religions to demonstrate the overall premise of the Segment, which was that religious organisations in Australia are by law exempt from the payment of many taxes. Also, given that the vast majority of Australians identify as Christian (according to the 2011 Census), the selected religions for the Segment are representative of a majority of Australians. Further, the Segment focussed on whether religious organisations themselves are tax-exempt by law, not whether individuals employed by, or members of, such religious organisations are required by law to pay income tax, or that they actually pay any such taxes (as you raise in your letter). Nine maintains that A Current Affair has no obligation under the Code to convey such material as part of the Segment as it was not a part of the editorial focus of the Segment. 'Anti-Christian bias' The Code provides that a broadcaster must not: 1.9.6 provoke or perpetuate intense dislike, serious contempt or severe ridicule against a person or group of persons on the grounds of age, colour, gender, national or ethnic origin, disability, race, religion or sexual preference. In previous investigations, the ACMA has held that the above provision sets a high threshold and that content must be strong to meet the benchmark of ‘intense, serious or severe’. There are also a range of exceptions to this requirement, including a fair report on any event or matter of identifiable public interest.

12 Further, the Code provides in relation to news and current affairs programs specifically that broadcasters: 4.3.10"must not portray any person or group of persons in a negative light by placing gratuitous emphasis on age, colour, gender, national or ethnic origin, physical or mental disability, race, religion or sexual preference". Nevertheless, where it is in the public interest, licensees may report events and broadcast comments in which such matters are raised. Having reviewed the footage of the Segment, Nine denies that it provoked or perpetuated dislike, contempt or ridicule against any person or group of persons on any of the specified grounds (let alone meet the high benchmark set by the Code and ACMA) or portrayed any person or group of persons in a negative light by placing gratuitous emphasis on their religion. In any event, we believe the public interest exception is relevant as the Segment presented a fair report of the views presented. Accordingly, we do not believe the Segment breaches clauses 1.9.6 or 4.3.10 of the Code in this instance. In light of our investigations, we believe that the material in the Segment was accurate, fair and did not produce prejudice against any person or group of persons on any ground and we therefore maintain we have complied with the Code. However if you are not satisfied with this response, you may refer the matter to the Australian Communications and Media Authority.

ACMA Investigation Report 3258 – A Current Affair broadcast by TCN on 9 July 2014 13