SPA CAPITAL ADVISORS Ltd. 25, C-Block, Community Centre (Formerly SPA Merchant Bankers Ltd.) Janakpuri, New Delhi-110058 CIN : U99999DL1999PLC102626 Tel : 011 25517173, 45675500 Fax : 011-25572763 Email : [email protected]

To, Date: July 12th, 2016 The Trustee

Subject: Proposal for Investment in Mutual Funds

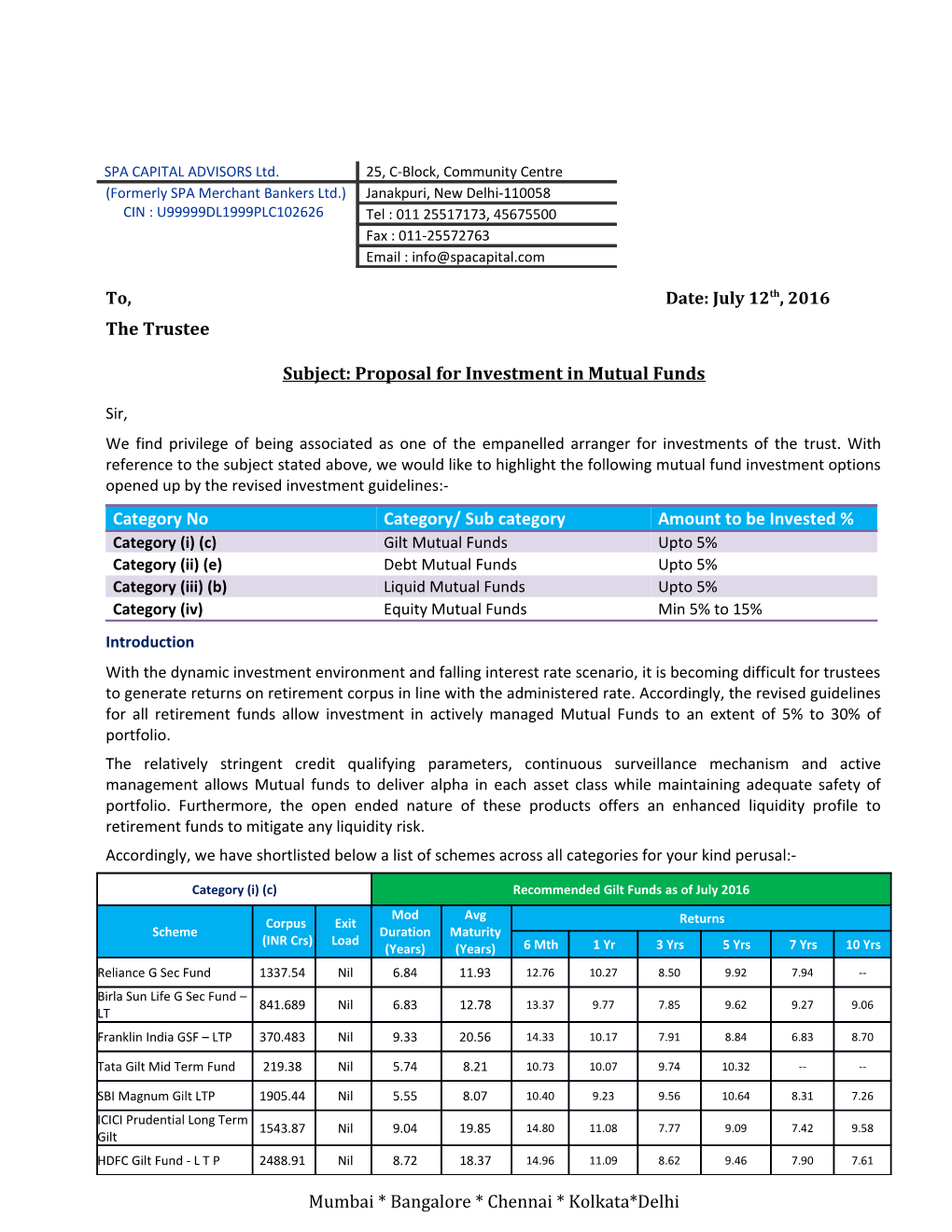

Sir, We find privilege of being associated as one of the empanelled arranger for investments of the trust. With reference to the subject stated above, we would like to highlight the following mutual fund investment options opened up by the revised investment guidelines:- Category No Category/ Sub category Amount to be Invested % Category (i) (c) Gilt Mutual Funds Upto 5% Category (ii) (e) Debt Mutual Funds Upto 5% Category (iii) (b) Liquid Mutual Funds Upto 5% Category (iv) Equity Mutual Funds Min 5% to 15% Introduction With the dynamic investment environment and falling interest rate scenario, it is becoming difficult for trustees to generate returns on retirement corpus in line with the administered rate. Accordingly, the revised guidelines for all retirement funds allow investment in actively managed Mutual Funds to an extent of 5% to 30% of portfolio. The relatively stringent credit qualifying parameters, continuous surveillance mechanism and active management allows Mutual funds to deliver alpha in each asset class while maintaining adequate safety of portfolio. Furthermore, the open ended nature of these products offers an enhanced liquidity profile to retirement funds to mitigate any liquidity risk. Accordingly, we have shortlisted below a list of schemes across all categories for your kind perusal:-

Category (i) (c) Recommended Gilt Funds as of July 2016 Mod Avg Corpus Exit Returns Scheme Duration Maturity (INR Crs) Load (Years) (Years) 6 Mth 1 Yr 3 Yrs 5 Yrs 7 Yrs 10 Yrs Reliance G Sec Fund 1337.54 Nil 6.84 11.93 12.76 10.27 8.50 9.92 7.94 -- Birla Sun Life G Sec Fund – 841.689 Nil 6.83 12.78 13.37 9.77 7.85 9.62 9.27 9.06 LT Franklin India GSF – LTP 370.483 Nil 9.33 20.56 14.33 10.17 7.91 8.84 6.83 8.70

Tata Gilt Mid Term Fund 219.38 Nil 5.74 8.21 10.73 10.07 9.74 10.32 -- --

SBI Magnum Gilt LTP 1905.44 Nil 5.55 8.07 10.40 9.23 9.56 10.64 8.31 7.26 ICICI Prudential Long Term 1543.87 Nil 9.04 19.85 14.80 11.08 7.77 9.09 7.42 9.58 Gilt HDFC Gilt Fund - L T P 2488.91 Nil 8.72 18.37 14.96 11.09 8.62 9.46 7.90 7.61

Mumbai * Bangalore * Chennai * Kolkata*Delhi UTI Gilt Advantage Fund – 443.271 Nil 7.40 12.00 8.88 7.85 8.68 9.59 8.19 8.42 L T P

Mumbai * Bangalore * Chennai * Kolkata*Delhi Category (ii) (e) Recommended Short Term Funds as of July 2016 Mod Avg Corpus Returns Scheme Exit Load Duration Maturity (INR Crs) (Years) (Years) 6 Mth 1 Yr 3 Yrs 5 Yrs 7 Yrs 10 Yrs Kotak Income 1677.3 < 1 Year; 1% 1.58 1.99 8.82 9.33 9.18 9.28 -- -- Opportunities Fund < 12 Months; 2% HDFC Corporate Debt < 24 Months; 1%, 7061.58 2.47 3.37 9.47 9.69 ------Opportunities < 36 Months; 0.5%

Reliance RSF - Debt 6205.9 < 1 Year; 1% 1.40 1.75 9.08 8.93 9.19 9.32 8.46 7.42

Birla Sun Life Medium < 365 Days; 2%, 5976.99 2.55 4.49 10.21 10.01 10.15 10.55 9.41 -- Term Plan < 730 Days; 1% < 12 Month; 3%, < 24 Month; 1.5%, SBI Corporate Bond Fund 969.319 2.91 3.66 10.10 9.79 10.40 10.07 8.92 8.34 < 36 Month; 0.75% DSP BlackRock Income 3167.84 < 12 Month; 1% 2.18 2.93 9.63 9.86 9.69 9.36 8.31 7.87 Opportunities Fund

Category (iii) (b) Recommended Liquid Funds as of July 2016 Avg Corpus Mod Duration Returns Scheme Exit Load Maturity (INR Crs) (Years) (Days) 1 Mth 3 Mth 6 Mth 1 Yr Reliance Liquid Fund - Cash Plan 5641.99 Nil 0.12 0.14 6.87 7.00 7.36 7.29

SBI Magnum Insta Cash - Cash Plan 2258.86 < 3 Days; 0.1% 0.09 0.10 7.50 7.77 8.08 8.05

UTI Money Market 8099.59 Nil -- 0.09 7.61 7.76 8.09 8.08

Birla Sun Life Cash Plus 30295.5 Nil 0.12 0.12 7.57 7.80 8.19 8.11

SBI Premier Liquid Fund 29160.7 Nil 0.09 0.10 7.40 7.67 8.06 8.02

IDBI Liquid Fund 4928.78 Nil 0.06 0.06 7.39 7.60 7.92 7.94

HDFC Liquid Fund - Premium Plan 33193.3 Nil 0.09 0.10 7.60 7.82 8.12 8.12

DSP Blackrock Liquidity Fund 5734.75 Nil 0.06 0.06 7.48 7.71 8.00 7.98

Kotak Floater - ST 8115.45 Nil 0.12 0.12 7.60 7.82 8.10 8.12

ICICI Prudential Money Market Fund 11567.9 Nil 0.09 0.09 7.57 7.79 8.09 8.07

Mumbai * Bangalore * Chennai * Kolkata*Delhi Category (iv) (b) Recommended Diversified Equity Funds as of July 2016 Corpus Returns Schemes Launch Date Exit Load (INR Crs) 1 Yr 2 Yrs 3 Yrs 5 Yrs 7 Yrs 10 Yrs Large Cap Funds UTI Bluechip Flexicap Fund 20-Feb-06 1654.46 < 1 Year; 1% 2.40 9.24 15.73 10.92 12.27 10.88

Kotak 50 04-Feb-03 1301.08 < 1 Year; 1% 4.78 15.02 18.59 12.08 14.19 13.01

Reliance Top 200 Fund 08-Aug-07 2136.57 < 1 Year; 1% -1.23 11.81 21.63 13.02 14.72 --

SBI Blue Chip Fund 14-Feb-06 6344.49 < 1 Year; 1% 7.09 17.70 22.94 16.51 15.89 12.40

Birla Sun Life Frontline Equity Fund 30-Aug-02 11847.1 < 365 Day;1% 5.09 13.64 20.42 14.40 16.65 16.48 <12 DSP BlackRock Top 100 Equity 10-Mar-03 3368.7 1.77 8.73 15.61 9.77 12.85 14.01 Months;1% Franklin India Bluechip 01-Dec-93 7209.33 < 1 Year; 1% 6.16 14.47 18.28 11.98 14.96 14.29 ICICI Prudential Focused Bluechip 23-May-08 10755.6 < 1 Year; 1% 5.33 11.68 19.03 13.15 17.29 -- Equity Mid Cap Funds Kotak Emerging Equity Scheme 30-Mar-07 871.567 < 1 Year; 1% 11.42 27.12 35.92 21.15 22.02 -- <12 Sundaram Select Midcap 30-Jul-02 3553.07 8.10 22.48 32.95 19.01 22.45 17.54 Months;1% UTI Mid Cap Fund 07-Apr-04 3321.07 <1 Year,1% 6.09 23.28 37.62 21.59 25.05 16.72

SBI Magnum Mid Cap Fund 29-Mar-05 1965.14 <1 Year,1% 10.31 27.30 38.57 23.72 22.59 15.36

Birla Sun Life Mid Cap Fund – Plan A 3-Oct-02 1590.73 < 365 Day;1% 7.16 21.22 29.02 16.46 18.96 17.24

HDFC Mid-Cap Opportunities Fund 25-Jun-07 10997.4 <1 Year,1% 9.69 21.35 32.86 19.95 25.09 --

BNP Paribas Mid Cap Fund 2-May-06 579.103 < 1 Year; 1% 4.56 20.99 31.38 21.87 24.64 13.19

Franklin India Prima Fund 01-Dec-93 4015.89 <1 Year,1% 10.68 24.00 32.11 21.68 23.80 16.50 <18 Canara Robeco Emerging Equities 11-Mar-05 1038.32 6.82 23.88 39.40 22.50 25.71 17.71 Months;1% Multi Cap Funds Birla Sun Life Equity Fund 27-Aug-98 2479.92 <365 day;1% 7.09 13.45 25.83 15.33 16.07 14.82

HDFC Capital Builder Fund 01-Feb-94 1234.71 < 1 Year;1% 5.73 14.12 22.80 13.78 17.94 15.55

Kotak Select Focus Fund 11-Sep-09 4729.9 <1 Year,1% 8.20 19.41 25.10 16.27 -- --

SBI Magnum Equity Regular 1-Jan-91 1603.56 <1 Year,1% 5.99 14.18 18.83 12.71 14.99 14.17 <12 SBI Magnum Multiplier Plus Regular 28-Feb-93 1580.41 4.20 17.32 24.87 15.37 16.78 15.31 Months;1% HDFC Equity 1-Jan-95 15205.6 <1 Year,1% 1.01 8.03 20.59 10.95 16.40 15.26 <12 DSP BlackRock Opportunities 16-May-00 894.335 9.04 17.65 22.61 13.49 16.26 14.13 Months;1% Reliance Growth 08-Oct-95 5241.23 < 1 Year;1% 2.15 14.87 23.85 12.96 15.31 15.37

BNP Paribas Equity Fund 23-Sep-04 1428.01 < 1 Year;1% 0.32 13.34 20.40 15.22 15.69 13.14

Franklin India Prima Plus 29-Sep-94 7923.15 < 1 Year;1% 6.48 19.69 24.85 16.27 18.28 16.72

ICICI Prudential Dynamic Plan 31-Oct-02 5419.07 < 1 Year;1% 6.55 8.56 20.38 12.33 16.47 15.05

ICICI Prudential Value Discovery Fund 16-Aug-04 12377.1 < 12Month;1% 7.45 18.16 32.65 19.83 24.57 18.69

Mumbai * Bangalore * Chennai * Kolkata*Delhi Category (iv) (c) Recommended ETF & Index Funds as of July 2016 Launch Corpus Returns Index Fund Exit Load Date (INR Crs) 1 Yr 2 Yrs 3 Yrs 5 Yrs 7 Yrs 10 yrs ICICI Prudential Nifty Index Fund 26-Feb-02 213.649 Nil 1.77 7.03 13.5 9.2 11.84 11.41 Franklin India Index Fund Nifty 26-Mar-04 230.236 < 30 Days;1% 1.63 6.92 12.74 8.71 11.41 10.49 SBI Nifty Index Fund 17-Jan-02 222.502 Nil 1.59 6.41 12.21 8.4 11.15 9.48 Birla Sun Life Index Fund 18-Sep-02 136.388 Nil 1.57 6.91 12.72 8.47 11.04 10.02 < 3 HDFC Index Nifty Fund 17-Jul-02 187.677 2.08 7.41 13.44 9.05 11.34 9.3 Months;1% IDBI Nifty Index Fund 25-Jun-10 136.834 Nil 0.7 5.94 12.17 8.34 -- -- Exchange Traded Funds CPSE ETF 28-Mar-14 1932.59 Nil -11.77 -6.48 ------GS Nifty BeES 28-Dec-01 1003.3 Nil 2.18 7.5 13.64 9.69 12.36 11.55

Hope you will find our advice in order and help you in optimizing returns with Mutual funds. For any further information we request you to call upon the undersigned:

Sincerely, For SPA Capital Advisors Ltd.

Sd-

Mr. Rahul Chandalia Senior Manager (Research) EUIN – E146916 099104 93859; 011-4567 5536

Disclaimer: - The information contained in this report is obtained from reliable sources. In no circumstances should it be considered as an offer to sell/buy or, a solicitation of any offer to, buy or sell the securities or commodities mentioned in this report. No representation is made that the transactions undertaken based on the information contained in the report will be profitable, or that they will not result in losses. SPA and/or its representatives will not be liable for the recipients’ investment decision based on this report. Mumbai * Bangalore * Chennai * Kolkata*Delhi