Answers of Managerial Economics Homework #2 Chapter 5~Chapter 9

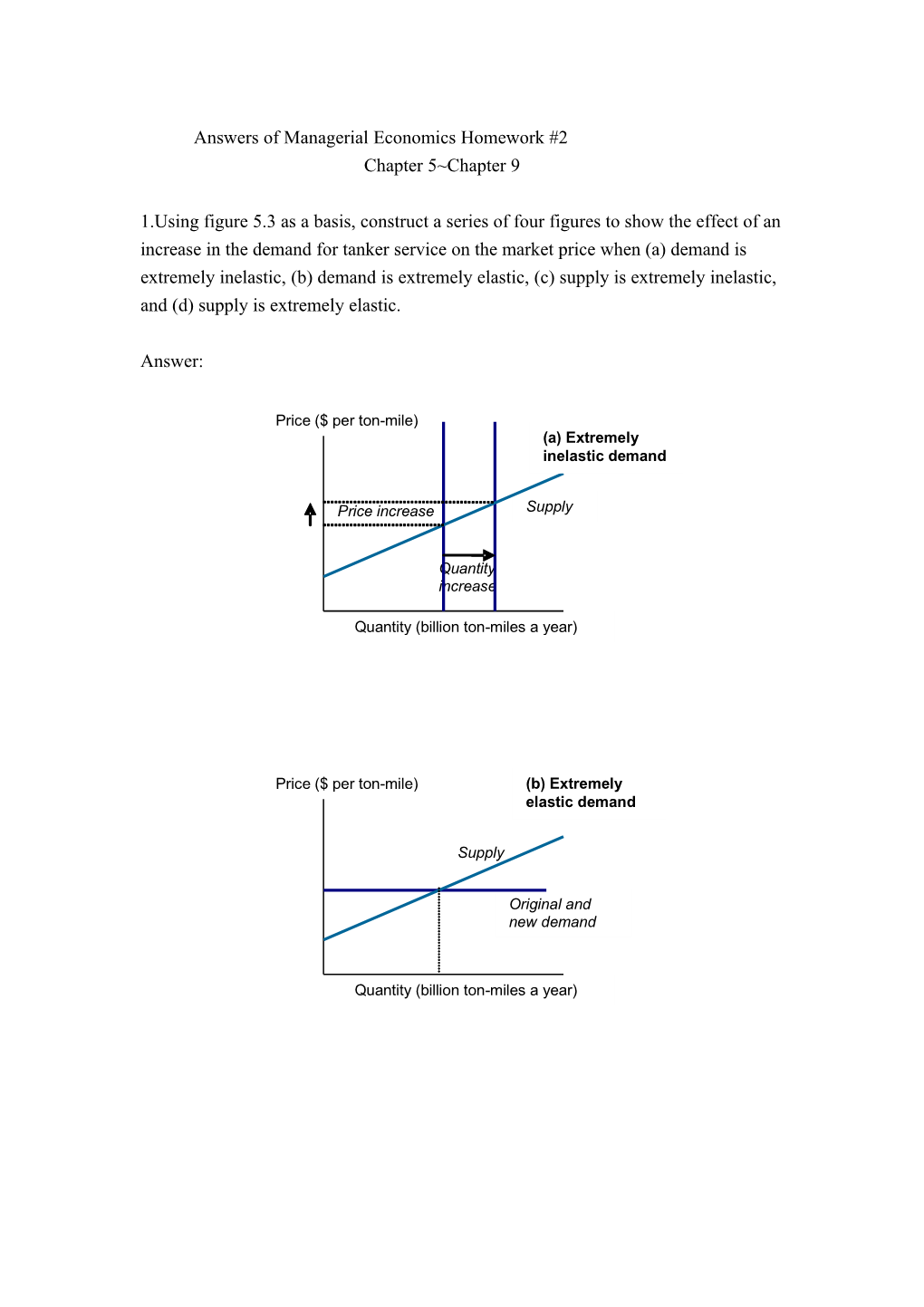

1.Using figure 5.3 as a basis, construct a series of four figures to show the effect of an increase in the demand for tanker service on the market price when (a) demand is extremely inelastic, (b) demand is extremely elastic, (c) supply is extremely inelastic, and (d) supply is extremely elastic.

Answer:

Price ($ per ton-mile) (a) Extremely inelastic demand

Price increase Supply

Quantity increase

Quantity (billion ton-miles a year)

Price ($ per ton-mile) (b) Extremely elastic demand

Supply

Original and new demand

Quantity (billion ton-miles a year) Price ($ per ton-mile) (c) Extremely inelastic supply

Price New demand increase

Original demand

Quantity (billion ton-miles a year)

Price ($ per ton-mile) (d) Extremely New elastic supply Original demand demand

Quantity increase

Quantity (billion ton-miles a year)

2.Industry researchers R.S. Platou predicted that, between 2003–04, oil prices would fall by 5%, production of oil by OPEC and the former Soviet Union would increase, and deliveries of new tankers would exceed scrappage of older vessels. (Source: Platou Report 2004, www.platou.com).

a. Using suitable diagrams, explain how each of the following would affect the market for tanker services: (i) a fall in oil prices; (ii) an increase in production by OPEC and the former Soviet Union; (iii) new tanker deliveries; and (iv) scrappage of older vessels. b. Suppose that the net effect is to increase tanker rates. Illustrate the net effect on a single diagram. Explain the impact on the quantity of tanker services used. c. In actuality, oil prices increased by 25% between 2003 and 2004 and OPEC and the former Soviet Union production increased by about 10%. Modify your analyses in (a) for these changes. Answer: (a) Fall in oil price would reduce the operating costs of tankers, and hence, increase the supply of tanker services. Increase in oil production would increase the demand for tanker services. New tanker deliveries would increase the supply of tanker services, while scrappage would reduce the supply.

Price ($ per ton-mile) Original supply

Higher supply (new tankers > scrappage; lower oil price)

Higher demand Original (lower oil price) demand

Quantity (billion ton-miles a year)

(b) Please refer to diagram below. Quantity of tanker services used could be higher or lower, depending on the elasticities of demand and supply. Price ($ per ton-mile) New supply

Original supply Price increase New demand

Original demand

Quantity (billion ton-miles a year)

(c) In actuality, oil prices increased rather than fell. The net impact on the supply is ambiguous: it depends on which effect is larger – the increase in oil prices on the cost of tanker operations or the net increase in the tanker capacity. The revised figure is as follows: Price ($ per ton-mile) Lower supply (higher oil price) Original supply Higher supply (new tankers > scrappage) Original demand Lower demand (higher oil price) Quantity (billion ton-miles a year)

3.In 2002, Iraq’s Kirkuk region exported 0.5–0.8 million barrels of crude oil per day (mpd) by pipeline to the Turkish port of Ceyhan. Following the U.S.-led coalition attack against Iraq, the pipeline was sabotaged and Kirkuk oil exports were disrupted. Refineries in western Europe switched to buying oil from the Urals in Russia, which produce oil that is chemically similar to Kirkuk. Urals oil is shipped to western Europe by tanker from the Black Sea through the Bosporus and Dardanelles. However, by early 2004, the surge in European demand and congestion in the Bosporus and Dardanelles had lifted spot tanker rates to €39,000 per day (Source: “Bosporus Tanker Congestion Threatens Shortage of Oil,” Financial Times, January 12, 2004).

a. Using suitable demand and supply curves, illustrate the short-run effects of pipeline disruption on the tanker services market. b. Using your diagram for (a), illustrate the long-run effects of the pipeline disruption. c. When political conditions in Iraq are restored to normal, exports by pipeline will resume, and the demand for tanker services will fall. With lower charter rates, the owner of a tanker must decide whether to continue operating, temporarily lay up, or scrap the vessel. Explain how the owner should choose among these alternatives.

Answer: (a) Pipeline disruption increased the demand for tanker services. Price (€ per dayton-)mile) Short-run supply

Long-run supply €39,000

New demand

Original demand

Quantity (tanker-days)

(b) In the long run, the price would be higher than the original equilibrium, but lower than €39,000 per day. The quantity of tanker services would be higher than in the short run equilibrium, and in turn, higher than in the original equilibrium. (c) The choice between operating and laying up is a short run decision. If the short run rate is below the average variable cost, the owner should lay up the tanker. The choice between operating and scrapping is a long run decision. If the long run rate is below the average cost, the owner should scrap the tanker.

4.Typical real-estate broker: "In California, the seller always pays the broker's commission, so, buyers get brokerage services free."

MBA: "If the custom were for the buyer to pay the commission, then would sellers get brokerage services free?"

Real-estate broker, clearly losing patience: "That is a purely hypothetical scenario, but if that situation were to arise, yes, I guess you're right."

a. Assume that each seller pays a brokers' commission of $18,000. Then, the supply of houses includes the cost of brokerage. Illustrate the market equilibrium with a price of $310,000 per house and sale of 200,000 houses a year. b. Now suppose that buyers rather than sellers pay the $18,000 commission. Using your figure, illustrate the following: (i) shift the supply curve down by $18,000 since sellers do not pay the commission, and (ii) shift the demand curve down by $18,000 since buyers now pay the commission. c. Compare the market equilibria of (a) and (b) in terms of (i) the net price received by sellers, and (ii) the net price paid by buyers. (Net prices are net of brokerage commission, if any).

Answer: The net price would not be affected for either buyer or seller.

price ($’000) (b)(i) supply curve shifts down s 310

(b) (ii) demand curve shifts down 0 200 Quantity (‘000 houses per year)

5.E-commerce is predicted to reduce the cost of intermediary services such as those of travel agencies, real-estate brokers, and investment advisors. Consider the market for air travel. Suppose that, with conventional travel agencies, the market equilibrium price is $300 per ticket, including a $15 intermediation cost. The quantity bought is 2 million tickets a year. With e-commerce, however, the intermediation cost falls to $2 per ticket.

a. Using suitable demand and supply curves, illustrate the original equilibrium with conventional travel agencies. Represent the intermediation cost by shifting the supply curve. b. Illustrate the new equilibrium with e-commerce. c. What factors determine the extent to which consumers will benefit from e- commerce? Explain your answer with demand and supply curves.

Answer: In the market for air travel, the demand arises from business and leisure travelers while airlines provide the supply. Price ($/ticket) Decrease in intermediation m cost: supply 300 n curve shifts down

0 2 Quantity (million tickets per year)

(a) The $15 intermediation cost shifts up the supply curve and the equilibrium is at m with a price of $300 and quantity of 2 million tickets per year. (b) With e-commerce, the cost of intermediation falls to $2, and the new equilibrium is at n, with a lower price and larger quantity. (c) The elasticities of demand and supply with respect to price.

6.Qantas operates a fleet of over 100 Boeing jet aircraft. Commercial passenger jets must be operated by a pilot and co-pilot. Many jets carry cargo in their "bellies", under the passenger seating areas. Consider each of the following costs. Identify which are joint costs of passenger and belly cargo services, which are fixed costs of passenger service, and which are both.

a. Cockpit personnel: All jets, large and small, require a pilot and co-pilot. Belly cargo service requires no additional officers in the cockpit. b. Airport landing fees: Some airports charge landing fees by weight of the aircraft, while others levy a fixed fee, regardless of weight. c. Fuel: Larger aircraft and those carrying heavier loads will consume relatively more fuel.

Answer: (a) Joint cost, and also a fixed cost. (b) If the landing fee varies with weight, then it is not joint or fixed. If a jet carries an additional 100 pounds of cargo, the airline must pay additional fees. Similarly, if the jet carries an additional passenger. If the landing fee is fixed, then it is a joint cost and a fixed cost. (c) Neither a joint cost, nor a fixed cost. If a jet carries an additional 100 pounds of cargo, the airline must spend more on fuel. Similarly, if the jet carries an additional passenger.

7.In April 1996, the Singapore Technologies Group acquired disk-drive manufacturer Micropolis for S$80 million. Micropolis was hit by a severe downturn in the disk drive industry, and despite S$550 million in loans, the company had to be liquidated in late 1997. Liquidators estimated the market value of Micropolis’s assets to be S$76 million as compared with their S$274 million book value. Table 7.14 lists the estimates for various categories of assets.

a. Which of the following best describes the difference between book value and estimated realizable value: (i) sunk cost, (ii) opportunity cost, (iii) fixed cost? Explain your answer. b. Define “specificity” as the ratio of book value less estimated realizable value to book value, in percentage terms. Calculate the specificity of (i) inventories and work-in-progress, (ii) production equipment, and (iii) factory. c. Explain the relation between sunk costs and specificity. d. Explain why Micropolis’s inventories and work-in-progress and production equipment have a higher specificity than the factory.

Table. Micropolis: Assets, December 1997 (S$ million)

Book value Estimated Specificity realizable value (%) Inventories and work-in- progress 130 13 90 Production equipment 34 4 88 Factory 70 45 36 Other items 40 14 Total 274 76 Answer: (a) Sunk cost. There is no way to sell the assets for their book value. The difference between the book and realizable value cannot be avoided. (b) See Table 7.14, last column. (c) The higher is degree to which the cost of an asset is sunk, the higher is its specificity. (d) Inventories and work-in-progress may be quite specific to Micropolis in the sense that other manufacturers cannot easily integrate them into their production processes. By contrast, the factory might be easily converted into other uses.

8.Table 8.2 describes the demand and costs for Solar Pharmaceutical's Gamma-1 drug. Suppose that the costs have been changed to a fixed cost of $75 million, and a constant marginal cost of $50 per unit. The demand remains the same.

a. Prepare a new table of revenues and costs according to the new data. b. What is the profit-maximizing price and production scale? c. At that production scale, what are the marginal revenue and the marginal cost?

Answer: (a) Modified version of Table 8.2.

Price Sales Total Marginal Total Marginal Profit Revenue revenue cost cost ($) ($) ($) ($) ($) ($) 200 0.0 0 75 -75 190 0.2 38 190 85 50 -47 180 0.4 72 170 95 50 -23 170 0.6 102 150 105 50 -3 160 0.8 128 130 115 50 13 150 1.0 150 110 125 50 25 140 1.2 168 90 135 50 33 130 1.4 182 70 145 50 37 120 1.6 192 50 155 50 37 110 1.8 198 30 165 50 33 100 2.0 200 10 175 50 25 90 2.2 198 -10 185 50 13 Note: Sales, total revenue, total cost, and profit in millions

(b) Two prices yield the same maximum profit of $37 million a year. One of the profit-maximizing prices is $120 per unit, and the corresponding scale is 1.6 million units per year. Comment: If we analyzed the demand in greater detail with price increments of $5, we would determine that the actual profit- maximizing price is $125, which yields a profit of $37.5 million a year. (c) At that scale, the marginal revenue = marginal cost = $50 per unit.

9.Hong Kong Director-General of Telecommunications Anthony Wong expressed concern about the effect of license auctions on the price of telecommunications: “There’s good and bad in auctioning off spectrum … it may raise costs for telecoms providers” (“Telecoms chief sees further fall in long-distance tariffs”, South China Morning Post, December 31, 1999, Business 1.) a.Typically, licenses are transferable, but the one-time license fee, once paid, is not refundable. From an operational standpoint, how does the cost of a license depend on the price, if any, that the owner paid for it? b.How does the one-time license fee affect the marginal cost of providing telecommunications service? How does it affect the profit-maximizing scale of operations? c.Suppose that the one-time license fee is changed to an annual charge based on the telecommunications provider’s revenue. How would the new policy affect the service provider’s profit-maximizing scale of operations?

Answer: (a) The cost of a license depends on the prevailing market price of licenses, which may have little or no relation to the price that the owner paid for it at an earlier time. (b) The one-time license fee is a fixed cost with respect to the scale of operations and does not affect the marginal cost. Hence it does not affect the profit- maximizing scale of operations. (c) The annual charge based on the telecommunications provider’s revenue would raise the provider’s marginal cost, and hence reduce the profit- maximizing scale.

10.Referring to figure 9.1, suppose that Mercury Airlines’ marginal revenue and demand curves cross the marginal cost curve at quantities of 3,000 and 6,000 seats a week, respectively. All other data remain the same.

a. Calculate the profit under policies of (i) uniform pricing, and (ii) complete price discrimination. b. Suppose that Mercury implements complete price discrimination. Explain why it should sell up to the quantity where the buyer’s marginal benefit equals Mercury’s marginal cost. c. Explain why Mercury’s profit is higher with complete price discrimination than with uniform pricing.

Answer: (a) The best way to answer this question starts from a diagram.

4000

p

800

0 3000 6000 quantity (seats per week)

(i) Under uniform pricing, the profit-maximizing quantity is where MR=MC or Q=3000. Referring to the figure, at that Q, the price p on the demand curve must be halfway between 800 and 4000. Hence, p = 2,400 dirhams, and profit = (2,400 - 800) x 3000 = 5,800,000 dirhams. (ii) Under complete price discrimination, the seller should sell the quantity where MB = MC. Referring to the Figure, that quantity is Q = 6000. Then, total revenue is the area under the demand curve up to Q = 6000, hence TR = [(4000+800)/2] x 6000 = 14,400,000 dirhams. Now total cost, TC = 800 x 6000 = 4,800,000 dirhams, hence the profit = 14,400,000 – 4,800,000 = 9,600,000 dirhams.

(b) Mercury maximizes its profit by producing the quantity where the buyer’s marginal benefit equals Mercury’s marginal cost. If it sold a larger quantity, so that the marginal benefit is less than the marginal cost, then its profit would be lower. By contrast, if it sold a smaller quantity, it could increase profit by selling more. (c) Complete price discrimination yields more profit than uniform pricing because it extracts a higher price from existing buyers and extends sales to new buyers who would not be served under uniform pricing.

11.Microsoft offers special discounts to students. Other publishers have developed special "student" editions of their software with fewer features than the regular packages.

a. Why do publishers offer discounts to students? b. What is the purpose of developing less powerful "student" editions? c. Should software publishers also offer discounts to senior citizens or develop "senior citizen" editions?

Answer: (a) Student demand is relatively more elastic than that of the average software user for several reasons: they have relatively lower income and students may have more opportunity to and less inhibition about copying software. Students can be directly segmented through student IDs. Accordingly, software publishers can use direct segment discrimination. Then, they should set a lower price to students. (b) One problem with discrimination is that potential users of the high-price item such as businesses might purchase software from students. Software publishers can deter this arbitrage by targeting less powerful editions at students. (c) The answer depends on whether the demand of senior citizens for software is more or less elastic relative to the average user. If the demand is more elastic, then the publisher should engage in price discrimination. 12.In 2004, U.S. consumer products manufacturers distributed 27.548 billion coupons, with a face value of over $280 billion, of which a mere 1.2% were redeemed by consumers. Why do manufacturers spend millions of dollars to distribute coupons when the redemption rate is so low? Why don’t they manufacturers directly cut the wholesale prices of the products, which would be much cheaper to administer?

a. Some say that retailers would absorb a direct wholesale price cut instead of passing it on to consumers. They argue that, by contrast, retailers cannot absorb the value of coupons. Suppose that the retail sector is perfectly competitive. Compare the demand-supply equilibrium in the retail market with (i) a wholesale price cut of 50 cents and (ii) widespread distribution of 50-cent coupons. For this part, you should apply the analysis of tax incidence from chapter 6, treating a price cut or coupon like a negative tax, and may assume that all consumers use coupons. b. Would there be any difference between the wholesale price cut and using coupons if the retailer were a monopoly? (Continue to treat a price cut or coupon like a negative tax, and assume that all consumers use coupons.) c. Explain how coupons may be used to discriminate among consumers on price. Compare this explanation to the argument that retailers would absorb a wholesale price cut.

Answer: (a) Competitive retail market (i) The 50-cent wholesale price cut will shift down the retail supply curve by 50 cents (increase the supply), resulting in a lower retail price and larger quantity. Referring to the Figure, the original equilibrium is at a. The new equilibrium is at c, with price P’ and quantity Q. How much the retail price falls will depend on the price elasticities of demand and supply. (ii) The issuance of coupons will affect the demand side. Assuming that all consumers use 50-cent coupons, this will shift the retail demand up by 50 cents (increase the demand), resulting in a higher retail price and larger quantity. Referring to the Figure, the original equilibrium is at a. The new equilibrium is at b, with price P’’ and quantity Q. The net price to the consumer is P’’ - 50 = P’. Comparing (i) and (ii), the final equilibrium in the retail market will be the same -- the new quantity of sales and the net price to the consumer will be the same. cents per unit

original supply supply with wholesale 50 cents price cut b p” a p p’ demand with coupons 50 cents c original demand

0 quantity

(b) Monopoly retail industry (i) Then, a wholesale price cut would reduce the monopoly’s marginal cost by 50 cents. The monopoly would maximize profit at the sales quantity where the (unchanged) MR = the new MC. The new price is P’ and the sales are Q’. (ii) Assuming all consumers use the 50- cent coupons, then the coupons would shift the retail demand up by 50 cents. This would shift up the monopoly’s MR by 50 cents also. The monopoly would maximize profit at the sales quantity where the new MR = the (unchanged) MC. The new price is P’’ and the sales are Q’. The net price to the consumer is P’’ - 50 = P’. The figure shows the impact on the retail market will be the same -- the new quantity of sales and the net price to the consumer will be the same. Hence, there is no difference between the wholesale price cut and using coupons. cents per unit

p” p

p’ original marg. cost

50 cents marginal cost after wholesale price cut

0 Q Q’ sales

(c) In reality, not all consumers use coupons. Assuming that consumers with more elastic demand are more likely to use coupons, the retailer can use coupons to target a discount (and hence a lower price) at the consumer segment with the more elastic demand. This is a case of indirect segment discrimination.