Solutions Guide: Please reword the answers to essay type parts so as to guarantee that your answer is an original. Do not submit as is

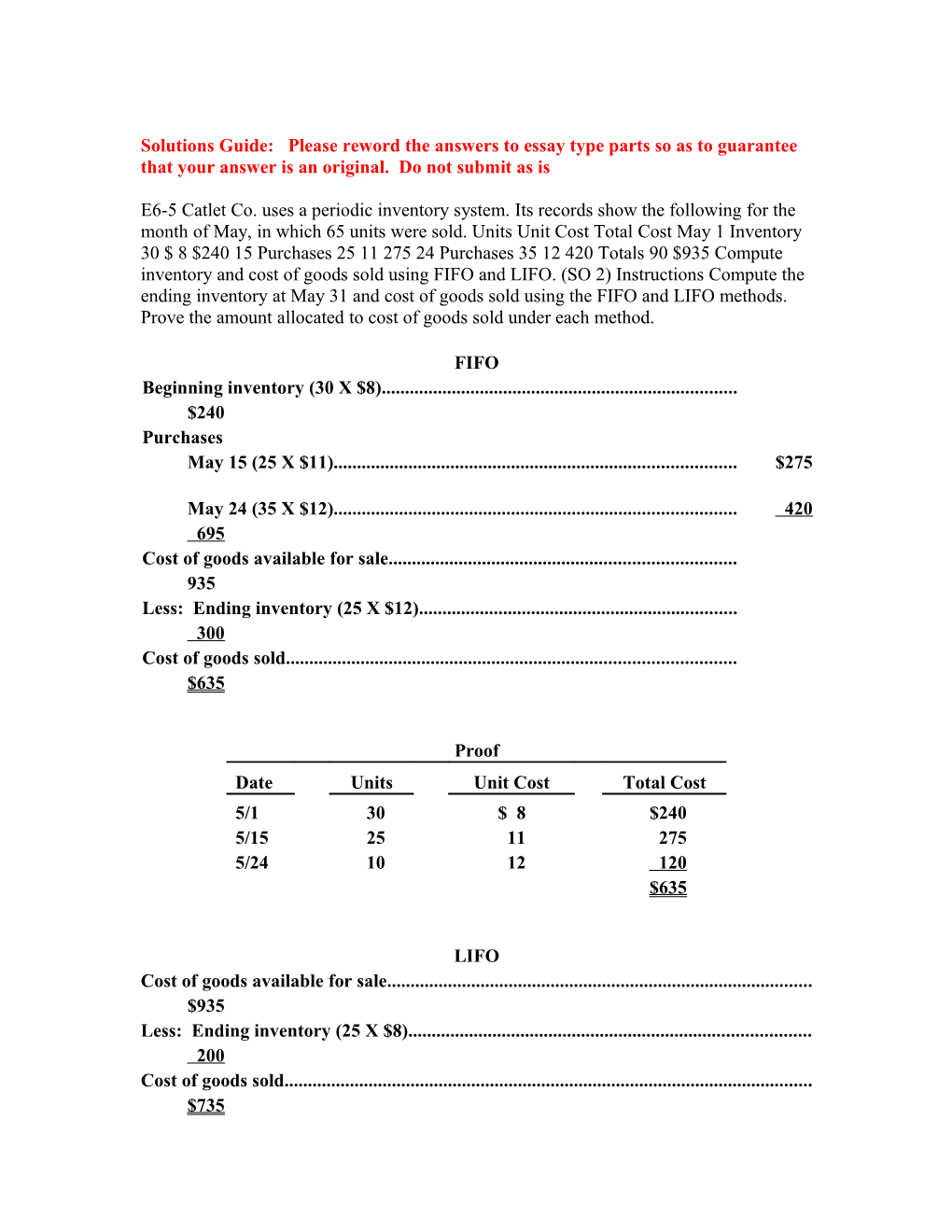

E6-5 Catlet Co. uses a periodic inventory system. Its records show the following for the month of May, in which 65 units were sold. Units Unit Cost Total Cost May 1 Inventory 30 $ 8 $240 15 Purchases 25 11 275 24 Purchases 35 12 420 Totals 90 $935 Compute inventory and cost of goods sold using FIFO and LIFO. (SO 2) Instructions Compute the ending inventory at May 31 and cost of goods sold using the FIFO and LIFO methods. Prove the amount allocated to cost of goods sold under each method.

FIFO Beginning inventory (30 X $8)...... $240 Purchases May 15 (25 X $11)...... $275

May 24 (35 X $12)...... 420 695 Cost of goods available for sale...... 935 Less: Ending inventory (25 X $12)...... 300 Cost of goods sold...... $635

Proof Date Units Unit Cost Total Cost 5/1 30 $ 8 $240 5/15 25 11 275 5/24 10 12 120 $635

LIFO Cost of goods available for sale...... $935 Less: Ending inventory (25 X $8)...... 200 Cost of goods sold...... $735 Proof Date Units Unit Cost Total Cost 5/24 35 $12 $420 5/15 25 11 275 5/1 5 8 40 $735

E6-12 Staley Watch Company reported the following income statement data for a 2-year period. 2008 2009 Sales $210,000 $250,000 Cost of goods sold Beginning inventory 32,000 44,000 Cost of goods purchased 173,000 202,000 Cost of goods available for sale 205,000 246,000 Ending inventory 44,000 52,000 Cost of goods sold 161,000 194,000 Gross profit $ 49,000 $ 56,000 Staley uses a periodic inventory system. The inventories at January 1, 2008, and December 31, 2009, are correct. However, the ending inventory at December 31, 2008, was overstated $5,000. Instructions (a) Prepare correct income statement data for the 2 years. (b) What is the cumulative effect of the inventory error on total gross profit for the 2 years? (c) Explain in a letter to the president of Staley Company what has happened—i.e., the nature of the error and its effect on the financial statements.

(a) 2008 2009 Sales...... $210,000 ...... $250,000 Cost of goods sold Beginning inventory...... 32,000 39,000 Cost of goods purchased...... 173,000 202,000 Cost of goods available for sale...... 205,000 241,000 Ending inventory ($44,000 – $5,000)...... 39,000 52,000 Cost of goods sold...... 166,000 189,000 Gross profit...... $ 44,000$ 61,000 (b) The cumulative effect on total gross profit for the two years is zero as shown below: Incorrect gross profits: $49,000 + $56,000 = $105,000 Correct gross profits: $44,000 + $61,000 = 105,000 Difference $ 0 (c) Dear Mr./Ms. President: Because your ending inventory of December 31, 2008 was overstated by $5,000, your net income for 2008 was overstated by $5,000. For 2009 net income was understated by $5,000. In a periodic system, the cost of goods sold is calculated by deducting the cost of ending inventory from the total cost of goods you have available for sale in the period. Therefore, if this ending inventory figure is overstated, as it was in December 2008, then the cost of goods sold is understated and therefore net income will be overstated by that amount. Consequently, this overstated ending inventory figure goes on to become the next period’s beginning inventory amount and is a part of the total cost of goods available for sale. Therefore, the mistake repeats itself in the reverse. The error also affects the balance sheet at the end of 2008. The inventory reported in the balance sheet is overstated; therefore, total assets are overstated. The overstatement of the 2008 net income results in the retained earnings account balance being overstated. The balance sheet at the end of 2009 is correct because the overstatement of the retained earnings account at the end of 2008 is offset by the understatement of the 2009 net income and the inventory at the end of 2009 is correct.

Thank you for allowing me to bring this to your attention. If you have any questions, please contact me at your convenience.

Sincerely,