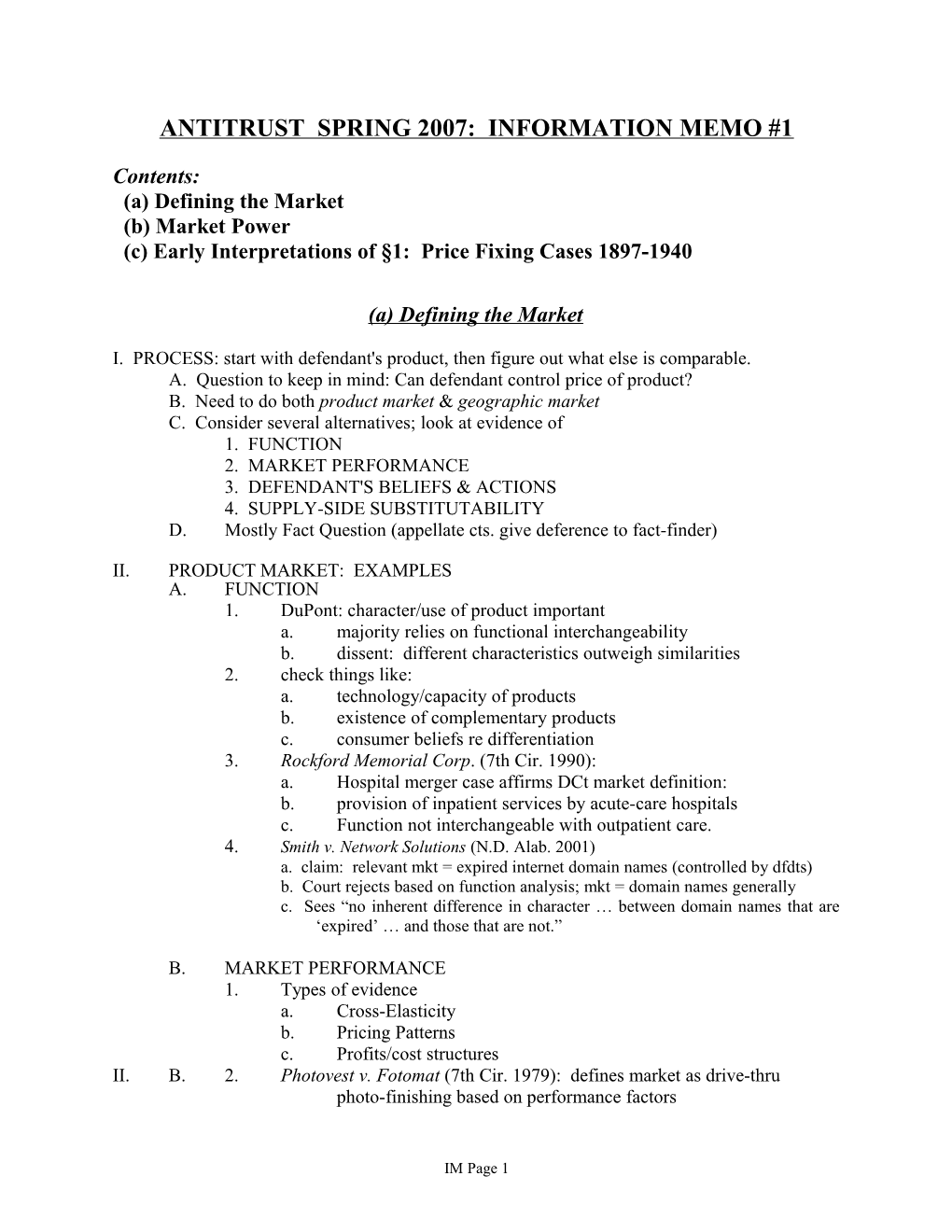

ANTITRUST SPRING 2007: INFORMATION MEMO #1

Contents: (a) Defining the Market (b) Market Power (c) Early Interpretations of §1: Price Fixing Cases 1897-1940

(a) Defining the Market

I. PROCESS: start with defendant's product, then figure out what else is comparable. A. Question to keep in mind: Can defendant control price of product? B. Need to do both product market & geographic market C. Consider several alternatives; look at evidence of 1. FUNCTION 2. MARKET PERFORMANCE 3. DEFENDANT'S BELIEFS & ACTIONS 4. SUPPLY-SIDE SUBSTITUTABILITY D. Mostly Fact Question (appellate cts. give deference to fact-finder)

II. PRODUCT MARKET: EXAMPLES A. FUNCTION 1. DuPont: character/use of product important a. majority relies on functional interchangeability b. dissent: different characteristics outweigh similarities 2. check things like: a. technology/capacity of products b. existence of complementary products c. consumer beliefs re differentiation 3. Rockford Memorial Corp. (7th Cir. 1990): a. Hospital merger case affirms DCt market definition: b. provision of inpatient services by acute-care hospitals c. Function not interchangeable with outpatient care. 4. Smith v. Network Solutions (N.D. Alab. 2001) a. claim: relevant mkt = expired internet domain names (controlled by dfdts) b. Court rejects based on function analysis; mkt = domain names generally c. Sees “no inherent difference in character … between domain names that are ‘expired’ … and those that are not.”

B. MARKET PERFORMANCE 1. Types of evidence a. Cross-Elasticity b. Pricing Patterns c. Profits/cost structures II. B. 2. Photovest v. Fotomat (7th Cir. 1979): defines market as drive-thru photo-finishing based on performance factors

IM Page 1 3. Entertainment/Advertising: # of cases note that while all entertainment competes: some consumers have special preferences, so advertisers target specifically, resulting in narrow market definitions based on evidence of both function & market performance:

a. Int'l Boxing Club (1959): championship v. all boxing matches b. NCAA (1984): college football broadcasts v. all sports or all entertainment c. Syufy: 1st run movies v. theatrical exhibition + home video, cable, pay-per-view TV (see also Paramount Pictures cited in DuPont dissent on p.34)

C. DEFENDANT'S BELIEFS & ACTIONS 1. defendant's statements and behavior may represent good evidence of the relevant market. After all, you can argue, who knows better than the defendant who its real competitors are. 2. Grinnell concurrence/dissent rely on evidence of defendant's actions 3. DuPont dissent relies on internal memos

D. SUPPLY-SIDE SUBSTITUTABILITY 1. existence of manufacturers of other products who could switch to the product in question relatively easily if the price got high enough

2. Telex (10th Cir 1975) In IBM monopolization case, Court of Appeals rejects proposed market: plug-compatible peripheral products, in part because of supply substitutability

3. Image Technical Service (9th Cir. 1990), aff'd (US 1992): a. Fact Q as to whether service of Kodak micrographic equipment separate market or part of larger, micrographic service market. b. Really Q of whether there is supply side substitutability. c. # of recent cases examining the issue of parts or service markets for a particular brand-name product

4. Arbitrage (competition from prior buyers) is a form of supply-side substitution

5. Boyer : Ideal collusive group view: market is smallest group of sellers such that, were all its members to collude, bringing additional members into the group would give the firm only minimal short-term advantage" Includes potential supply-side substitutes.

IM Page 2 III. GEOGRAPHIC MARKET: EXAMPLES

A. FUNCTION 1. Consumer behavior: where will people travel to get the product? 2. Rockford Memorial Corp. (7th Cir. 1990) a. Court of Appeals affirms market definition for hospitals: b. "Rockford [Illinois] and its hinterland." c. Based on how far consumers will travel for hosp. services. 3. Grinnell dissent relies on consumer behavior re geography

B. MARKET PERFORMANCE 1. check pricing differentials in different geographic locales 2. Coffee Materials: FTC investigation coffee prices relied on local price differentials to argue local (not national) markets

C. DEFENDANT'S BELIEFS & ACTIONS 1. check marketing and pricing behavior 2. Grinnell majority defines market for security systems as nationwide based on evidence of defendant's behavior

D. SUPPLY-SIDE SUBSTITUTABILITY 1. ability of firms in other locales to compete if price is high enough 2. dependent on transportation costs 3. Adyston Pipe (6th Cir. 1898) a. multistate market (v. national) in pipe b. due to high freight costs 4. Coffee case: conflict between evidence of low transportation costs by defendants (suggesting large geographic market) and actual behavior, which suggested local markets.

E. RECENT CASE: FTC v. Tenet Healthcare (E.D. Mo. 1998) 1. Background a. Preliminary injunction preventing hospital merger b. Product market: general acute care in-patient hosp services c. Proposed geographic markets: i) FTC: 50 mile radius from Poplar Bluff, Mo. (PB) II) Ds: 65 mile radius (includes Jonesboro/St.Louis) d. some residents of PB go outside for hosp services. Why? i) P: emergencies; complex procedures ii) Ds: patients believe Poplar Bluff hospitals inferior

IM Page 3 III. E. 2. FTC Evidence a. testimony of employers and 3d party payors i) only go outside for emergencies/specialists ii) employees/participants won’t go outside for price rise A) convenient B) loyal to family drs. w ties to local hosps. iii) 3d party payors saw intense local competition in PB iv) if PB price increase, wouldn’t force locals to go outside v) larger outside hosps have much higher prices b. outside hospitals: 10% PB price rise wouldn’t affect us c. records show procedures done outside PB on PB residents are more complex/specialized 3. Ct: common sense local market: Distance matters for hosps. (b) Ascertaining Market Power

I. Market Power is "power to affect price and to exclude competition"

II. Most Commonly measured by market share. A. Dependent on market definition B. Amount of market power needed depends on cause of action

III. Courts increasingly look beyond market share A. barriers to entry/expansion B. performance analysis: examine how market functions a. profits b. price leadership or stability c. Some types of conduct evidence of market power i) price discrimination ii) exclusionary behavior iii) price rises to increase profit

IV. Arguments that market share misstates market power

A. Syufy Enterprises (9th Cir 1990)(share overstates) 100% market share nor evidence of market power where no barriers to entry and no evidence of monopoly performance. For a purportedly complete list of movie titlesembedded in the opinion, see The Syufy Rosetta Stone, 1992 B.Y.U. L. Rev. 457 (1992)

B. General Foods (Coffee) (share understates) FTC lawyers unsuccessfully argued that barriers to entry and the way the market operated gave the defendant more power than its share numbers would indicate

IM Page 4 (c) Early Interpretations of §1: Price Fixing Cases 1897-1940

I. Pre-Clayton Act Cases A. US v. Trans-Missouri Freight Assn (1897) 1. 18 RRs controlling traffic west of Mississippi agree to rates; defend §1 charge on ground that rates set were reasonable 2. Majority: §1 violation; every contract in restraint of trade illegal. a. contract collateral to sale of property might not be included in spirit or letter of law. b. competition necessary to secure just & proper rates. 3 White Dissent: a. can’t interpret Act literally b. should be allowed to enter contracts to restrain ruinous competition c. reasonable contracts OK at common law; here prices reasonable

B. Joint Traffic (1898): Another RR rate agreement 1. Majority finds violation again, backs off pure literalist approach 2. Agreements entered into "for the purpose of promoting the legitimate business of an individual or corporation, with no purpose to thereby affect or to restrain interstate commerce, and which does not directly restrain such commerce, is not...covered by the act." 3. Gives contracts probably OK: a. formation of corporation or partnership b. joint sales agents c. lease by farmer, manufacturer or merchant of additional farm, factory or shop

C. Adyston Pipe & Steel (6th Cir 1898; aff'd 1899) (famous case) 1. cast-iron pipe mfrs (65% of pipe over 3/4 of US) a. fixed prices; divided territories: b. Ds argue Trans-Missouri just applies to RRs 2. 6th Cir. Opinion (Taft): Ds lose. a. reasonable price standard unadministrable b. naked restraints per se illegal. c. ancillary restraints can be ok. E.g.: i) partnerships ii) contracts incident to sale of business d. Protection of ancillary restraints only goes as far as necessary to protect main purpose of contract. 3. U.S. Supreme Ct affirms because prices unreasonable anyway

D. Standard Oil (1911) uses reasonableness test in case w lots of bad conduct

IM Page 5 II. Development of Rule of Reason/Per Se Dichotomy 1918-1940

A. Chicago Board of Trade (1918): Challenge to Grain Exchange rule 1. Can’t sell some types of grain overnight/on weekends except at last market price 2. govt: literal price-fix 3. SCt finds no violation under Rule of Reason a. regulation of business hours improves market b. famous test for Rule of Reason in course materials B. Trenton Potteries (1927) : price-fix by 80+% makers of sanitary porcelain 1. Reasonable prices not a defense 2. Too hard to determine & monitor prices 3. cf. Chic Bd of Trade: prices set by competition in open market C. Appalachian Coals (1933): 1. joint sales agreement among coal sellers set prices for all a. making most of coal in region; small part of national mkt b. wouldn’t begin w/o 70% of sellers in region 2. SCt held arrangement not facial violation: looks like Rule of Reason a. little market power b. arguably pro-competitive 3. Often seen as depression anomaly D. Socony Vacuum (1940) 1. Oil cos. agree to buy from specific refineries at fair market price. a. Gasoline prices had been dropping b. Clear that purpose was to stabilize prices higher. 2. SCt: “Under the Sherman Act a combination formed for the effect of raising, depressing, fixing, pegging or stabilizing the price of a commodity is per se illegal.” a. Congressional policy choice; courts must follow b. famous language in fn59 in materials re market power

IM Page 6