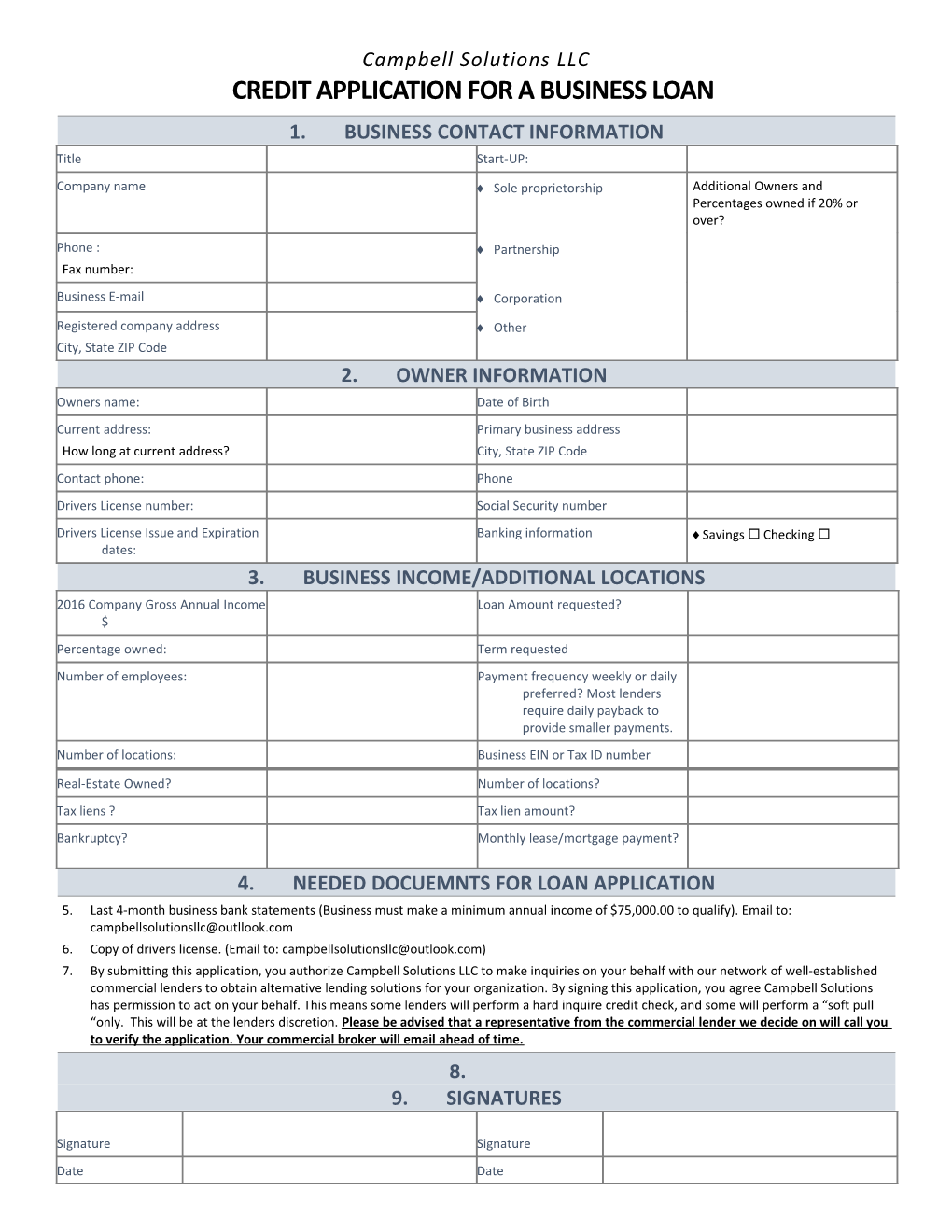

Campbell Solutions LLC CREDIT APPLICATION FOR A BUSINESS LOAN 1. BUSINESS CONTACT INFORMATION Title Start-UP:

Company name Sole proprietorship Additional Owners and Percentages owned if 20% or over?

Phone : Partnership Fax number:

Business E-mail Corporation

Registered company address Other City, State ZIP Code 2. OWNER INFORMATION Owners name: Date of Birth Current address: Primary business address How long at current address? City, State ZIP Code Contact phone: Phone Drivers License number: Social Security number

Drivers License Issue and Expiration Banking information Savings Checking dates: 3. BUSINESS INCOME/ADDITIONAL LOCATIONS 2016 Company Gross Annual Income Loan Amount requested? $ Percentage owned: Term requested Number of employees: Payment frequency weekly or daily preferred? Most lenders require daily payback to provide smaller payments. Number of locations: Business EIN or Tax ID number

Real-Estate Owned? Number of locations? Tax liens ? Tax lien amount? Bankruptcy? Monthly lease/mortgage payment?

4. NEEDED DOCUEMNTS FOR LOAN APPLICATION 5. Last 4-month business bank statements (Business must make a minimum annual income of $75,000.00 to qualify). Email to: [email protected] 6. Copy of drivers license. (Email to: [email protected]) 7. By submitting this application, you authorize Campbell Solutions LLC to make inquiries on your behalf with our network of well-established commercial lenders to obtain alternative lending solutions for your organization. By signing this application, you agree Campbell Solutions has permission to act on your behalf. This means some lenders will perform a hard inquire credit check, and some will perform a “soft pull “only. This will be at the lenders discretion. Please be advised that a representative from the commercial lender we decide on will call you to verify the application. Your commercial broker will email ahead of time. 8. 9. SIGNATURES

Signature Signature Date Date