Problems

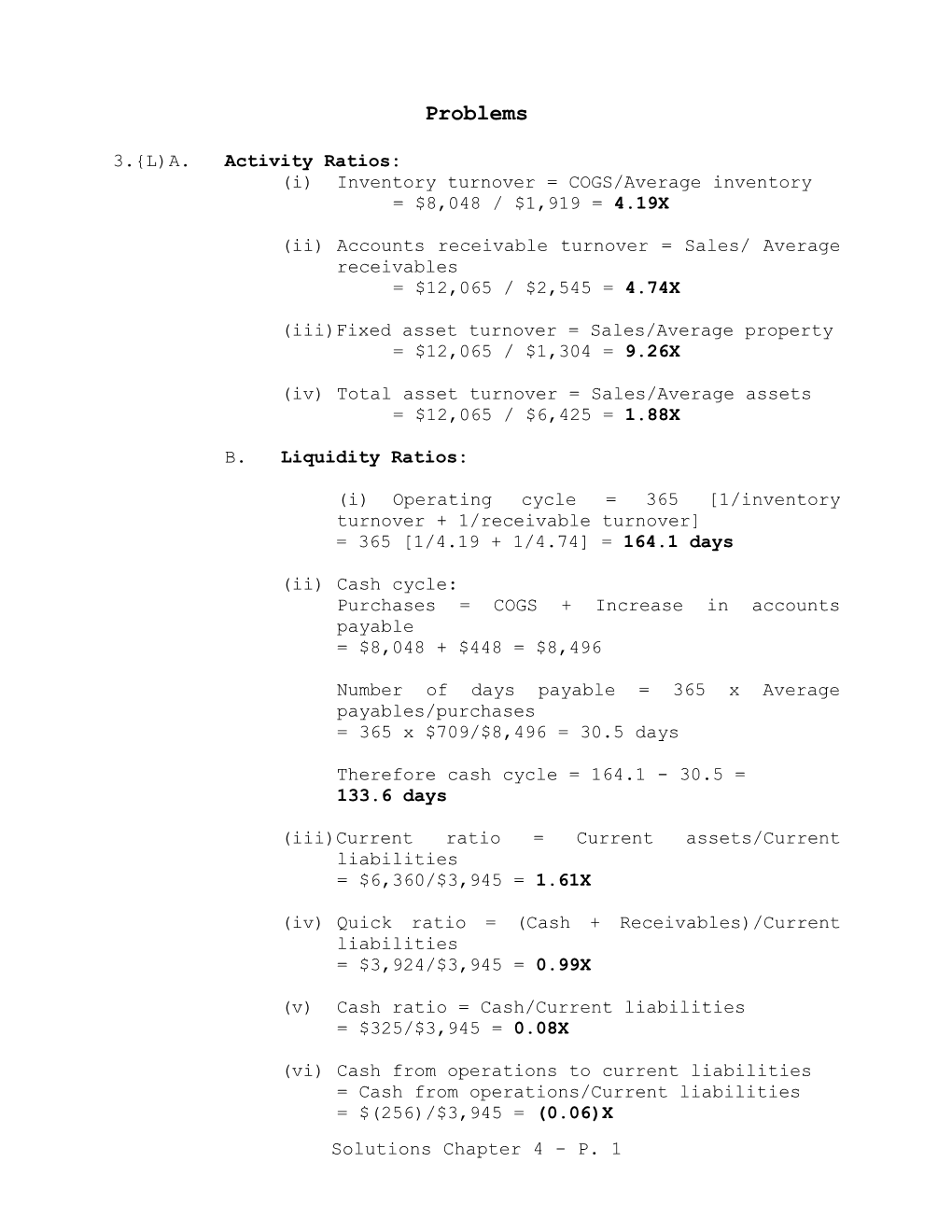

3.{L)A. Activity Ratios: (i) Inventory turnover = COGS/Average inventory = $8,048 / $1,919 = 4.19X

(ii) Accounts receivable turnover = Sales/ Average receivables = $12,065 / $2,545 = 4.74X

(iii)Fixed asset turnover = Sales/Average property = $12,065 / $1,304 = 9.26X

(iv) Total asset turnover = Sales/Average assets = $12,065 / $6,425 = 1.88X

B. Liquidity Ratios:

(i) Operating cycle = 365 [1/inventory turnover + 1/receivable turnover] = 365 [1/4.19 + 1/4.74] = 164.1 days

(ii) Cash cycle: Purchases = COGS + Increase in accounts payable = $8,048 + $448 = $8,496

Number of days payable = 365 x Average payables/purchases = 365 x $709/$8,496 = 30.5 days

Therefore cash cycle = 164.1 - 30.5 = 133.6 days

(iii)Current ratio = Current assets/Current liabilities = $6,360/$3,945 = 1.61X

(iv) Quick ratio = (Cash + Receivables)/Current liabilities = $3,924/$3,945 = 0.99X

(v) Cash ratio = Cash/Current liabilities = $325/$3,945 = 0.08X

(vi) Cash from operations to current liabilities = Cash from operations/Current liabilities = $(256)/$3,945 = (0.06)X Solutions Chapter 4 - P. 1 (vii)Defensive interval = 365 x [Cash + Receivables]/Projected expenditures = 365 x $3,924/$9,828 = 146 days

Where projected expenditures estimated as total costs and expenses less depreciation = $10,151 - $323 = $9,828 C. Solvency Ratios

(i) Debt to equity = Debt (nontrade)/Equity = $1,170/$3,803 = 0.31

(ii) Debt to capital = Debt/(debt + equity) = $1,170/$4,973 = 0.24

(iii)Times interest earned = Earnings before interest and tax/interest expense = $2,337/$78 = 29.96X

(iv) Capital expenditures ratio = Cash from operations/Capital expenditures = $(256)/$798 = (0.32)X

D. Profitability Ratios

(i) Gross Margin: = (Sales - COGS)/Sales = ($12,065 - $8,048)/$12,065 = 33.3%

(ii) Operating income to sales = Operating income/Sales = $2,337/$12,065 = 19.4%

(iii)Return on sales = Net income / Sales = $1,265/$12,065 = 10.5%

(iv) Return on assets = (Net income + [Interest expense (1-tax rate)]) / Average Assets = ($1,265 + [$78 (1-.44)])/$6,425 = 20.4%

Return on assets (pretax) = Earnings before interest and taxes/Average assets = $2,337/$6,425 = 36.4%

(v) Return on equity = Net income/Average equity = $1,265/$3,336 = 37.9%

Solutions Chapter 4 - P. 2 4.{M}Three component disaggregation of ROE:

1. Profitability Net income / Sales = 10.5% x 2. Asset turnover Sales / Average assets = 1.88X x 3. Leverage Average assets/Average equity = 1.93X = Return on equity Net income / Average equity = 37.9%

Five component model:

1. Operating margin EBIT / Sales = 19.4% x 2. Interest burden Pretax income / EBIT = 0.97X x 3. Tax burden Net income / Pretax income = 0.56X x 4. Asset turnover Sales / Average assets = 1.88X x 5. Leverage Average assets/Average equity = 1.93X = Return on equity = Net income / Average equity = 37.9%

Solutions Chapter 4 - P. 3 8.{L}A.Company Industry 1 Chemicals and drugs (Monsanto) 2 Aerospace (Boeing) 3 Computer software (Altos Computer) 4 Department stores (J.C. Penney) 5 Consumer foods (Quaker Oats) 6 Electric utility (SCEcorp) 7 Newspaper publishing (Knight Ridder) 8 Consumer finance (Household Finance) 9 Airline (AMR Corp.)

B. The airline, consumer finance, and electric utility industries are service industries. They are characterized by the absence of cost of goods sold and inventories. Companies 6, 8, and 9 have the lowest ratios (COGS/sales and inventories/total assets). Newspaper publishing may also be considered a service industry; we will return to this later. Company 8 is the consumer finance company. It has a high level of debt balanced by a high level of receivables and investments (loans and securities). Much of its debt is short- term, reflecting the short maturities of its loans. It has almost no fixed assets. The ratio of interest expense to revenues is the highest for this company. Both the electric utility and airline firms would have high fixed assets; utilities generally have higher assets (lower asset turnover), are more profitable, and have higher debt and interest expense. Airlines, on the other hand, have high current liabilities for trade payables (payments to suppliers) and for advance ticket sales (other current liabilities). We conclude that company 6 is the electric utility and company 9 is the airline. Companies 1, 2, and 3 have high R&D expense, consistent with the aerospace, chemicals and drugs, and computer software industries. Aerospace would have the highest inventory (low inventory turnover). Customer prepayments under long term contracts result in lower receivables and large customer advances (other current liabilities). Therefore, company 2 is the aerospace firm. Distinguishing company 1 from company 3 is difficult. Computer software and drugs are both characterized by high R & D. The inclusion of chemicals, however, should lower the intensiveness of R&D, suggesting that company 3 is the computer software firm. Computer software, lacking manufacturing, is less capital intensive than chemicals and drugs and the latter is generally more profitable. Further, the chemical industry (being older) should have "older" plant (greater proportion

Solutions Chapter 4 - P. 4 depreciated). Company 1 is, therefore, the chemical and drugs firm and company 3 is in the computer software industry. Companies 4, 5, and 7 remain. Company 4 has high inventories and COGS, the highest receivables relative to assets, and high asset turnover, all of which suggest a retailer. It has no R&D, high advertising expense, and low pretax profit margins. Company 4 is the department store firm. Company 5 has high net property relative to assets, and the highest ratio of advertising to revenues. Company 5 must be the consumer foods company. Company 7 is the newspaper publisher. It has very low inventory but high cost of goods sold; inventory is primarily newsprint while cost of goods sold includes the high cost of reporting and production. Company 7 has the highest intangibles (newspapers purchased) and very high pretax profit margins (most newspapers have only indirect competition). This exercise was intended to show that industries have balance sheet and income statement characteristics that set them apart from others. These characteristics are often used to compare firms within an industry (e.g. advertising as a percentage of sales for consumer goods firms). Summarized data should be used with caution, however. Different firms (even in the same industry) classify identical items differently. Thus the analyst should examine original financial statements to achieve better comparability. Differences among firms may be due to operational or classification differences. When management is available to answer questions, these differences are often useful starting points for obtaining a better understanding of the firm.

Solutions Chapter 4 - P. 5 15.{M} A.and B: The following liquidity, solvency, and profitability ratios can be used to support the conclusions reached in Problem 6 of Chapter 3:

19X1 19X2 19X3 19X4 19X5 M COMPANY

Turnover Ratios: Inventory 3.60 3.43 3.27 3.17 2.96 Receivables 3.34 3.22 3.09 3.24 3.25 Payables 7.87 7.47 7.76 10.85 12.79

Number of days: Inventory 101.29 106.51 111.54 115.02 123.33 Receivables 109.20 113.25 118.00 112.70 112.00 Payables (46.40) (48.90) (47.00) (33.60) (28.50) Cash cycle 164.09 170.86 182.54 194.12 206.83

Current ratio 1.71 1.57 1.75 1.55 1.60 Quick ratio 1.09 0.99 1.11 0.91 0.93

Debt-to-equity 0.78 0.97 1.17 1.60 2.14 Interest coverage 6.33 4.84 4.94 4.00 1.35 Return on equity 0.14 0.13 0.11 0.11 0.03 G COMPANY

Turnover ratios: Inventory 3.43 3.84 3.87 3.84 4.73 Receivables 5.38 6.07 6.11 6.07 6.10 Payables 10.19 10.61 10.52 10.34 12.47

Number of days: Inventory 106 95 94 95 77 Receivables 68 60 60 60 60 Payables (36) (34) (35) (35) (29) Cash cycle 138 121 119 120 108

Current ratio 2.23 2.13 1.95 2.29 2.30 Quick ratio 1.07 1.01 0.92 1.08 1.05

Debt-to-equity 0.38 0.49 0.63 0.71 0.74 Interest coverage 4.27 5.77 4.70 4.62 4.27 Return on equity 0.05 0.09 0.11 0.12 0.12

Solutions Chapter 4 - P. 6 C. The deterioration in M company's liquidity and financial position can be seen from the cash cycle, which increased to 207 days in 19X5 from 164 days in 19X1. Also see the decline in the current and the quick ratios. M company's debt-to-equity ratio has more than doubled from 0.78 to 2.14, accompanied by a decline in interest coverage from 6.33x to 1.35x. That decline resulted from both the increasing leverage and the decreasing ROE (from .14 in 19X1 to .03 in 19X5). G company's cash cycle has declined (improved) and its liquidity ratios remained steady. The problem here is the higher leverage and low interest coverage (albeit, a steady 4.27 with modest change during the five years shown). Profitability (ROE) increased from .05 to .12. The substantial growth has been managed well so far but it remains to be seen whether the firm can manage future growth as well.

16.{L}Sales growth: revenues grew at a 25% compound annual rate from $287 million in 1985 to $865 million in 1990. However, a substantial portion of this increase came in 1987 (from $295 million to $685 million). Sales grew at a less than 9% compound annual rate from 1987 to 1990. Gross margin was stable and averaged 26% over the 1985-1990 period. The explosive growth in net income came in part from cost controls (e.g. S,G&A as a percentage of sales was 20% in 1985 and 17% in 1990). Interest expense declined considerably (1988-1990) after three years of high debt levels. These trends can be seen from the disaggregation of ROE that follows.

The ratios used in the following analysis are based on income before extraordinary items and discontinued operations. 1985 ratios use year-end balances; average balances are used for all other years. Note: ATA = average total assets.

Year Net income x Sales = Net income x ATA = ROE Sales ATA ATA Ave. equity 1985 0.92% x 2.52X = 2.31% x 24.69X = 57.14% 1986 1.46 x 1.34 = 1.95 x 14.34 = 28.01 1987 2.58 x 1.94 = 4.99 x 7.95 = 39.68 1988 3.59 x 1.94 = 6.95 x 4.24 = 29.43 1989 4.12 x 2.03 = 8.36 x 2.81 = 23.47 1990 4.43 x 2.20 = 9.74 x 2.22 = 21.58

Solutions Chapter 4 - P. 7 The interesting result shown by the disaggregation is that ROE declined sharply at the same time that profit margins (net income/sales) were rising. The steady decline in equity turnover explains this apparent contradiction. Equity grew from a nominal amount in 1985 (4% of assets) to nearly half of total assets by the end of 1990. Not only did Harley pay nominal if any dividends to stockholders but the firm sold equity as well. (Net income was about $120 million over the 1986-1990 period while equity increased by $194 million.) Harley is a classic case of deleveraging. Total debt (current + long-term) declined by $138 million, from about $210 million at the end of 1986 to barely $72 million four years later. Thus more than 70% ($138/$194) of the equity increase over the 1986-1990 period was used for debt reduction rather than for investment purposes. Harley's return on assets did multiply fourfold over the 1985-1990. The firm's 21.58% return on equity in 1990, while very respectable, is far below what it would have been if Harley had remained highly leveraged.

Further Analysis of Harley: After Tax 1986 1987 1988 1989 1990 ROA 4.5% 9.1% 10.7% 11.2% 11.5% ROE 27.9% 39.7% 29.4% 23.5% 21.6%

Net income/Sales profitability 1.5% 2.6% 3.6% 4.1% 4.4% Sales/Assets activity 1.34 1.94 1.94 2.03 2.20 Assets/Equity solvency 14.34 7.95 4.24 2.81 2.21 ROE - 3 way 27.9% 39.7% 29.4% 23.5% 21.6%

EBIT/Sales operations 5.7% 8.2% 9.3% 9.0% 8.6% EBT/EBIT financing 43.5% 54.7% 65.1% 74.7% 84.6% Net income/EBT taxes 58.7% 57.3% 59.0% 61.5% 61.2% Net income/Sales profitability 1.5% 2.6% 3.6% 4.1% 4.4% Sales/Assets activity 1.34 1.94 1.94 2.03 2.20 Assets/Equity solvency 14.34 7.95 4.24 2.81 2.21 ROE - 5 way 27.9% 39.7% 29.4% 23.5% 21.6%

EBIT/Sales 5.7% 8.2% 9.3% 9.0% 8.6% Sales/Assets 1.34 1.94 1.94 2.03 2.20 ROA (pretax) 7.6% 15.9% 18.0% 18.3% 18.9%

Solutions Chapter 4 - P. 8