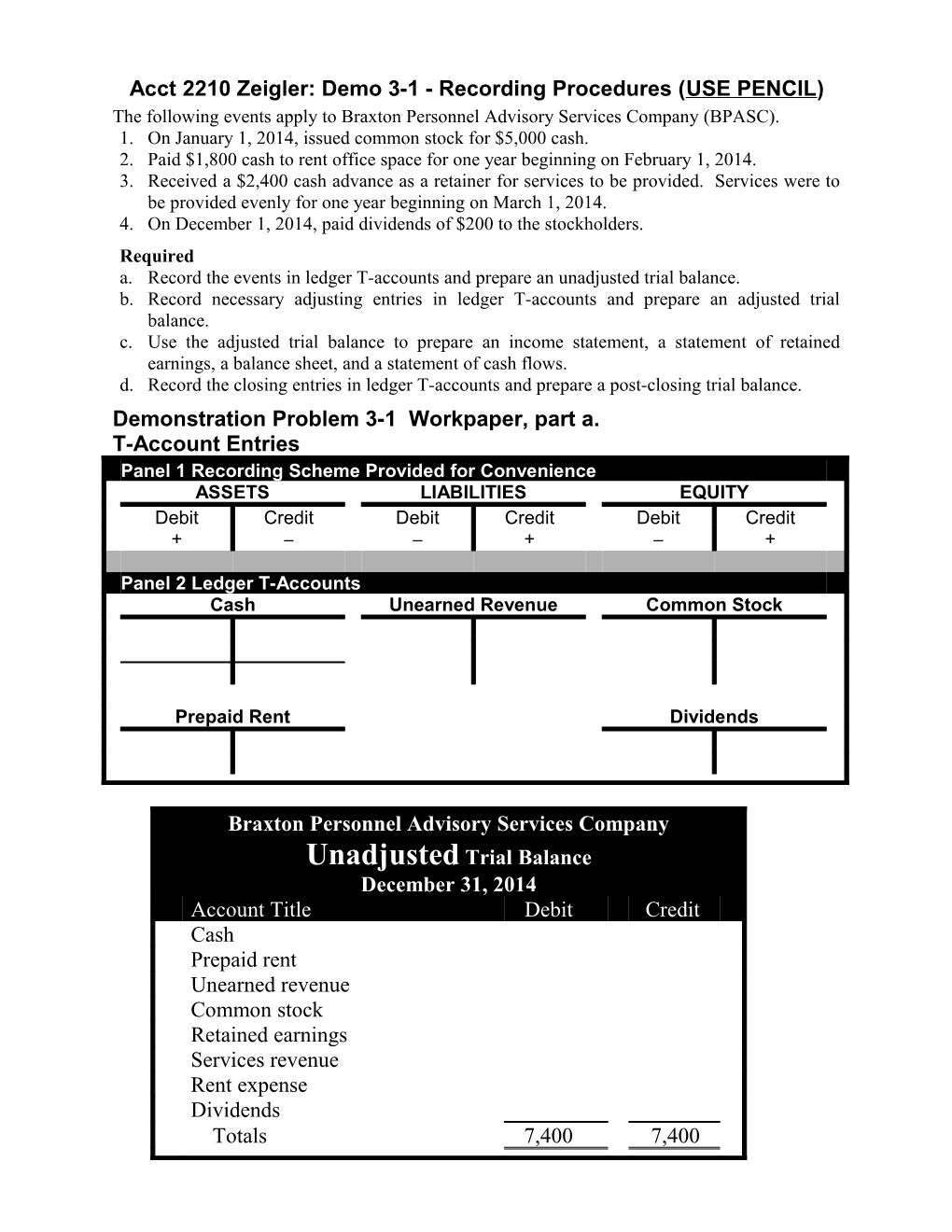

Acct 2210 Zeigler: Demo 3-1 - Recording Procedures (USE PENCIL) The following events apply to Braxton Personnel Advisory Services Company (BPASC). 1. On January 1, 2014, issued common stock for $5,000 cash. 2. Paid $1,800 cash to rent office space for one year beginning on February 1, 2014. 3. Received a $2,400 cash advance as a retainer for services to be provided. Services were to be provided evenly for one year beginning on March 1, 2014. 4. On December 1, 2014, paid dividends of $200 to the stockholders. Required a. Record the events in ledger T-accounts and prepare an unadjusted trial balance. b. Record necessary adjusting entries in ledger T-accounts and prepare an adjusted trial balance. c. Use the adjusted trial balance to prepare an income statement, a statement of retained earnings, a balance sheet, and a statement of cash flows. d. Record the closing entries in ledger T-accounts and prepare a post-closing trial balance. Demonstration Problem 3-1 Workpaper, part a. T-Account Entries Panel 1 Recording Scheme Provided for Convenience ASSETS LIABILITIES EQUITY Debit Credit Debit Credit Debit Credit + ─ ─ + ─ +

Panel 2 Ledger T-Accounts Cash Unearned Revenue Common Stock

Prepaid Rent Dividends

Braxton Personnel Advisory Services Company Unadjusted Trial Balance December 31, 2014 Account Title Debit Credit Cash Prepaid rent Unearned revenue Common stock Retained earnings Services revenue Rent expense Dividends Totals 7,400 7,400 Demonstration Problem 3-1 Workpaper, part b. T-Account Adjusting Entries Panel 1 Recording Scheme Provided for Convenience ASSETS LIABILITIES EQUITY Debit Credit Debit Credit Debit Credit + ─ ─ + ─ +

Panel 2 Ledger T-Accounts Cash Unearned Revenue Common Stock (1) 5,000 1,800 (2) 2,400 (3) 5,000 (1) (3) 2,400 200 (4) Bal. 5,400

Prepaid Rent Services Revenue (2) 1,800

Rent Expense

Dividends (4) 200

Braxton Personnel Advisory Services Company Adjusted Trial Balance December 31, 2014 Account Title Debit Credit Cash Prepaid rent Unearned revenue Common stock Retained earnings Services revenue Rent expense Dividends Totals 7,400 7,400 Demonstration Problem 3-1 Workpaper, part c. Financial Statements

Braxton Personnel Advisory Services Company Financial Statements Income Statement For the Year Ended December 31, 2014 Services revenue $ Rent expense Net income $ 350

Statement of Retained Earnings Beginning retained earnings $ 0 Plus: Net income Less: Dividends Ending retained earnings $ 150 Balance Sheet as of December 31, 2014 Assets Cash $ Prepaid rent Total assets $ 5,550 Liabilities Unearned revenue $

Stockholders’ equity Common stock 5,000 Retained earnings Total stockholders’ equity Total liabilities and stockholders’ equity $ Statement of Cash Flows Net cash flow from operating activities $

Net cash flow from investing activities

Net cash flow from financing activities Net change in cash Beginning cash balance Ending cash balance $ 5,400

Demonstration Problem 3-1 Workpaper, part d. T-Acct. Closing Entries Panel 1 Recording Scheme Provided for Convenience ASSETS LIABILITIES EQUITY Debit Credit Debit Credit Debit Credit + − − + − +

Panel 2 Ledger T-Accounts Cash Unearned Revenue Common Stock (1) 5,000 1,800 (2) (adj2) 2,000 2,400 (3) 5,000 (1) (3) 2,400 200 (4) 400 Bal. 5,000 Bal. Bal. 5,400

Prepaid Rent Retained Earnings (2) 1,800 1,650(adj1) Bal. 150

Services Revenue 2,000(adj2)

Rent Expense (adj1) 1,650

Dividends (4) 200

Braxton Personnel Advisory Services Company Post-closing Trial Balance December 31, 2014 Account Title Debit Credit Cash Prepaid rent Unearned revenue Common stock Retained earnings Services revenue Rent expense Dividends Totals