NAME:

STANDARD 1 STARTER

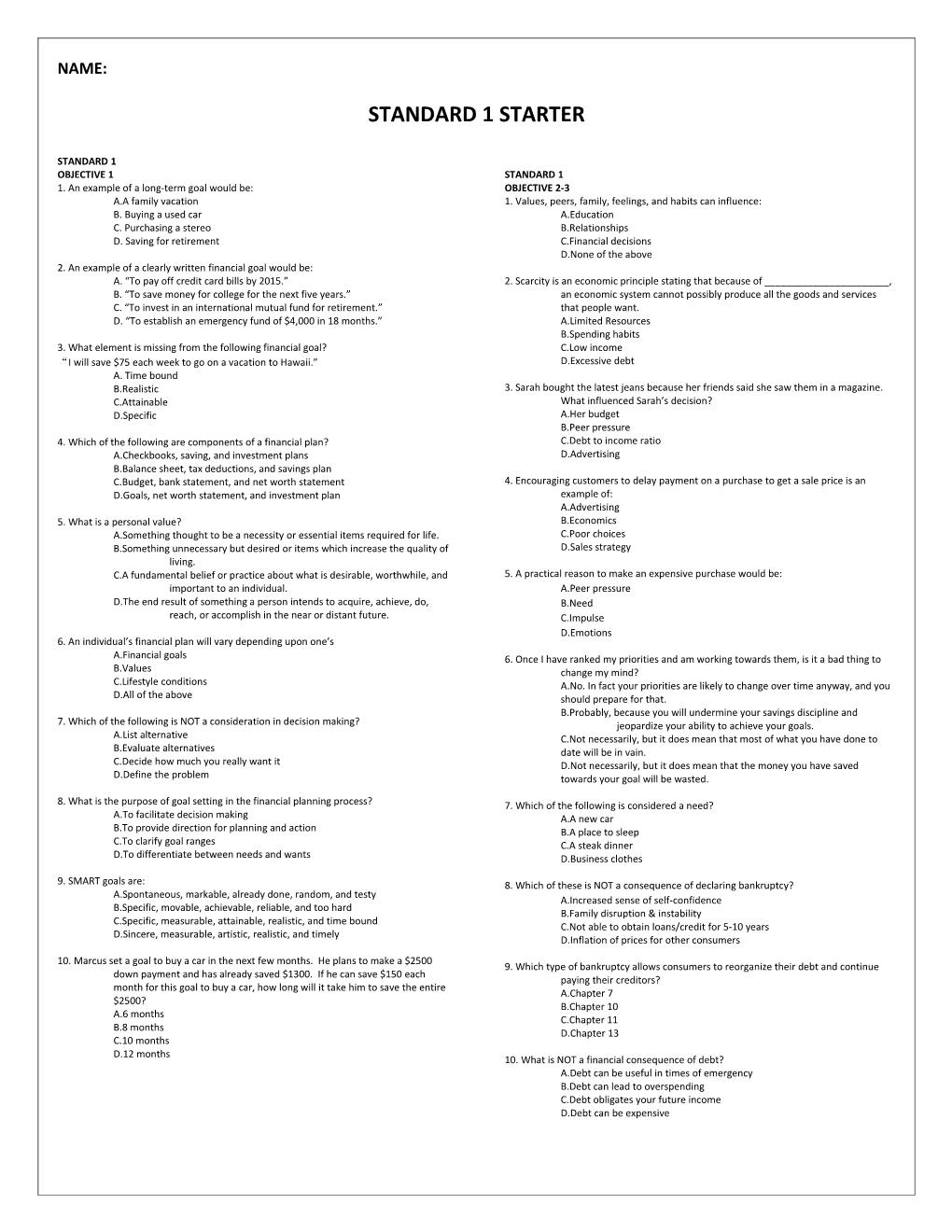

STANDARD 1 OBJECTIVE 1 STANDARD 1 1. An example of a long-term goal would be: OBJECTIVE 2-3 A.A family vacation 1. Values, peers, family, feelings, and habits can influence: B. Buying a used car A.Education C. Purchasing a stereo B.Relationships D. Saving for retirement C.Financial decisions D.None of the above 2. An example of a clearly written financial goal would be: A. “To pay off credit card bills by 2015.” 2. Scarcity is an economic principle stating that because of ______, B. “To save money for college for the next five years.” an economic system cannot possibly produce all the goods and services C. “To invest in an international mutual fund for retirement.” that people want. D. “To establish an emergency fund of $4,000 in 18 months.” A.Limited Resources B.Spending habits 3. What element is missing from the following financial goal? C.Low income “I will save $75 each week to go on a vacation to Hawaii.” D.Excessive debt A. Time bound B.Realistic 3. Sarah bought the latest jeans because her friends said she saw them in a magazine. C.Attainable What influenced Sarah’s decision? D.Specific A.Her budget B.Peer pressure 4. Which of the following are components of a financial plan? C.Debt to income ratio A.Checkbooks, saving, and investment plans D.Advertising B.Balance sheet, tax deductions, and savings plan C.Budget, bank statement, and net worth statement 4. Encouraging customers to delay payment on a purchase to get a sale price is an D.Goals, net worth statement, and investment plan example of: A.Advertising 5. What is a personal value? B.Economics A.Something thought to be a necessity or essential items required for life. C.Poor choices B.Something unnecessary but desired or items which increase the quality of D.Sales strategy living. C.A fundamental belief or practice about what is desirable, worthwhile, and 5. A practical reason to make an expensive purchase would be: important to an individual. A.Peer pressure D.The end result of something a person intends to acquire, achieve, do, B.Need reach, or accomplish in the near or distant future. C.Impulse D.Emotions 6. An individual’s financial plan will vary depending upon one’s A.Financial goals 6. Once I have ranked my priorities and am working towards them, is it a bad thing to B.Values change my mind? C.Lifestyle conditions A.No. In fact your priorities are likely to change over time anyway, and you D.All of the above should prepare for that. B.Probably, because you will undermine your savings discipline and 7. Which of the following is NOT a consideration in decision making? jeopardize your ability to achieve your goals. A.List alternative C.Not necessarily, but it does mean that most of what you have done to B.Evaluate alternatives date will be in vain. C.Decide how much you really want it D.Not necessarily, but it does mean that the money you have saved D.Define the problem towards your goal will be wasted.

8. What is the purpose of goal setting in the financial planning process? 7. Which of the following is considered a need? A.To facilitate decision making A.A new car B.To provide direction for planning and action B.A place to sleep C.To clarify goal ranges C.A steak dinner D.To differentiate between needs and wants D.Business clothes

9. SMART goals are: 8. Which of these is NOT a consequence of declaring bankruptcy? A.Spontaneous, markable, already done, random, and testy A.Increased sense of self-confidence B.Specific, movable, achievable, reliable, and too hard B.Family disruption & instability C.Specific, measurable, attainable, realistic, and time bound C.Not able to obtain loans/credit for 5-10 years D.Sincere, measurable, artistic, realistic, and timely D.Inflation of prices for other consumers 10. Marcus set a goal to buy a car in the next few months. He plans to make a $2500 9. Which type of bankruptcy allows consumers to reorganize their debt and continue down payment and has already saved $1300. If he can save $150 each paying their creditors? month for this goal to buy a car, how long will it take him to save the entire A.Chapter 7 $2500? B.Chapter 10 A.6 months C.Chapter 11 B.8 months D.Chapter 13 C.10 months D.12 months 10. What is NOT a financial consequence of debt? A.Debt can be useful in times of emergency B.Debt can lead to overspending C.Debt obligates your future income D.Debt can be expensive STANDARD 2 STARTER

STANDARD 2 OBJECTIVE1 1. Which of the following is an employee benefit that an employer may provide? a. Retirement benefits b. Tuition reimbursement 6. Which is a mandatory payroll deduction? c. Vacation and sick days A. Retirement fund d. All of the above B .Interest income C. Health insurance 2. Many young people receive health insurance benefits through their parents. Which of D. Social security the following statements is true about health insurance coverage? a. You continue to be covered by your parents’ insurance as long as you live at home, regardless of your age. b. You are covered by your parents’ insurance until you marry, regardless 7. Which tax is the Federal Government’s leading source of revenue? of your age. A. Unemployment tax c. If your parents become unemployed, your insurance coverage may stop, B. Medicare tax regardless of your age. C. Personal income tax d. Young people don’t need health insurance because they are so healthy. D. Social Security tax

3. Which one of the following could NOT be called income? a. Interest paid on a loan 8. What is the purpose of the Form W-4? b. Interest received from a savings account A. Verifies an employee’s eligibility to work c. A paycheck B. Allows the employee to join a tax-deferred savings plan d. An allowance C. Determines how much of an employee’s paycheck will be withheld for federal income taxes 4. Which of the following is NOT usually an employee benefit that an employer may D. Informs the employer which method of payment the employee prefers provide the employee? a. Clothes 9. Your take home pay is less than the total amount you earn from your job, which of b. Vacation and sick days the following best describes what is taken out of your total pay: c. Insurance A. Federal Income tax, Social Security, and Medicare contributions d. Employee discounts B. Federal Income tax, Property tax, Medicare contributions C. Federal Income tax, Sales tax, Property tax 5. What is income? D. Federal Income tax, Sales tax, Social Security contributions A. Money spent B. Money earned 10. Which is NOT one of the three most common ways an employer may handle paying C. Money saved his/her employees: D. Money invested A. Paycheck with the paycheck stub B. Cash STANDARD 2 C. Direct deposit OBJECTIVE 2 D. Payroll card 1 .Take-home pay is also called: A. Disposable income STANDARD 2 B. Fixed income OBJECTVIE 3 C. Net income 1. What is the definition of ‘human capital’? D. Gross income A. The process of self-investment B. The combination of all events in an individual’s life 2. What is a 401(K) plan? C. Purchasing wanted or desired items A. A portion of salary deducted from net pay and placed in a special D. Decisions influenced by friends, coaches and teachers account. B. Money set aside to pay medical expenses not covered by insurance. 2. What is an occupation? C. A portion of salary deducted from gross pay and placed in a special A. A work role with a specific organization account. B. A wide category of jobs with similar characteristics D. A plan that specifies benefits to be received at retirement age, based on C. A lifetime journey of building and making good use of skills, knowledge, total earnings and years of work. and experiences D. The combination of leisure activities, family influence and personal interests 3. Sam earns $550 per month in net income. He shares living expenses with a roommate. His expenses are: food, $160/month; rent, $130/month; utilities, 3. What is a standard of living? $25/month; and transportation, $20/month. How much does Sam have left each month A. State of being happy, healthy and prosperous to save and spend on other items, based on his monthly net income? B. A plan for success A. $300 C. Something unnecessary but desired B. $170 D. Minimum necessities, comforts, or luxuries thought to be essential. C. $245 D. $215 4. Which of the following best describes a career? A. Skills obtained from completing various jobs 4. When depositing a check you’ve received into your account, it is best to: B. Building skills, knowledge, and experiences throughout a lifetimes A. Sign the back of the check immediately to save time in line at the bank C. An occupation held during one part of a person’s life B. Use a small portable safe to lock up the check as you travel in the car D. Personal satisfaction obtained from completing a job C. Use a restrictive endorsement with your signature, account, number, and ‘for deposit only’ 5. Which of the following is NOT a characteristic of transferable skills? D. Use an open endorsement and sign only your name on the back A. Transferable skills are acquired through various life experiences B. Transferable skills can only be applied to one job 5. What is the largest recommended percentage of your net monthly income that C. Transferable skills create a greater range of career opportunities should be set aside for housing? D. Transferable skills enhance an individual’s human capital A. 15-20% B. 20-25% 6. Having a career implies that a person: C. 25-30% A. Is interested in the most money that can be achieved D. 30-35% B. Must have completed an advanced college degree C. Has a commitment to a profession which requires continued education D. Will not be required to change jobs within a professional area

7. Steven is considering taking a job with a company that is offering gym memberships, flexible hours, and repayment of education loans, merchandise discounts, and childcare. These components of the job offer are called: A. Fringe benefits B. Job perks C. Work incentives D. Competitive hiring practices

8. The first step in filling out a job application is to: A. Write with a pen with blank ink B. Start over if you make an error C. Use the computer to fill out the application if your hand writing is hard to read D. Read the application completely before you start to insure accuracy

9. If being fired is the reason for changing job, an appropriate response on a job application concerning this situation would be: A. Involuntary separation B. Voluntary separation C. Seasonal job D. Quit

10. Salary, location and environment, and benefits are factors to consider when: A. Determining your cost of living expenses B. Evaluating a job offer C. Researching future career opportunities D. Estimating annual income STANDARD 3 STARTER

STANDARD 3 - OBJECTIVE 1 1. A spending plan for managing money during a given period of time is a: A.Budget B.Envelope system STANDARD 3 - OBJECTIVE 2 C.Savings account 1. The maximum amount you can charge on a credit card is called the A.Credit limit D.Roth IRA B.Capacity C.Collateral for the card 2. Jill pays $375.93 every month for her cay payment. This payment is a: D.Credit ratio A.Minimum balance

B.Credit score 2. Which of the following is a good reason to use a credit card? C.Fixed expense A.Expensive way to borrow due to high interest rates D.Variable expense B.Less to spend in the future due to paying off purchases from the past C.Responsible use can help establish good credit history 3. To pay yourself first means: D.Higher risk for impulsive buying and overspending A.Creating a plan for who you pay first, after yourself. B.Having a trusted person hold your money for you. C.Having a personal identification number on your accounts. D.Putting money in savings before paying bills.

4. Which is a factor in developing a monthly financial budget? 3. Which is not a type of credit? A.Car loan A. Insurance B.Car registration B.Entertainment C.Gas company card C.Transportation D.House mortgage D.All of the above 4. Suki wants to move into her own apartment after graduating from high school, but 5. A financial institution owned by its members that provides savings and checking she is worried that she won’t be able to rent an apartment without accounts and other services to its members is a (n): significant credit history. What can Suki do to start using credit wisely? A.Bank A.Rent an apartment with a with a friend who will sign the lease B.Credit union B.Apply for a store credit card C.Investment brokerage C.Apply for several major credit cards D.ATM D.Close her checking account to avoid bouncing a check 6. What percent of your monthly income is the recommended amount to be set aside

for housing? 5. Which of the following agencies provide free credit reports for consumers? A.40%-45% A.Equifax, credit unions, landlords B.25%-30% B.Credit unions, banks, loan officers C.15%-20% C.Experian, credit Reporters, universitites D.5%-10% D.Trans Union, Experian, Equifax 7. If expenses were to exceed income on a spending plan, what would be a financially 6. Which of the following can impact your credit rating? smart solution? A.Borrowing money from a friend to pay for lunch A.Decrease expenses B.Living with your parents until you ear enough money to afford to rent an B.Use a credit card more often apartment C.Earn less income C.Paying cash for a used car D.Increase purchases D.Making a late car loan payment 8. Which of the following is a control method for spending plans? 7. What is credit? A.Envelope system A.An arrangement to receive cash, goods, or services now and pay for them B.Spending plan template in the future C.Check register system B.A fee for borrowed money D.All of the above C.The maximum amount of money that can be charged to a credit card D.A plastic card that holds pre-approved credit 9. When items are bought on credit and paid for over a long period of time, the cost to the buyer: 8. If an individual uses credit and does not pay the required amount by the due date, A.Is the same as if the items were bought with cash they are charged a (n): B.Is less than if the items were bought with cash A.Minimum payment C.Is more than if the items were bought with cash B.Late payment fee D.Depends on the method of payment C.Annual percentage rate D.Annual fee 10. A federal government agency that insures deposits and banks is the: A.UCEA

B.FDIC 9. If a credit card is lost or stolen and reported within 48 hours, how much is the owner C.FAFSA liable for if the card was used illegally before the credit card company was D.FREA notified of the loss? A.$100 B.$75 C.$50 D.$25

10. A loan to be repaid in a certain number of payments with a certain interest rate is a: A.Installment loan B.Revolving credit C.Unsecured loan D.Collateral A.Liability coverage B.Underinsured motorist C.Collision D.Comprehensive

STANDARD 3 OBJECTIVE 3 9. If you were in a car accident, which of the following is needed when you file a claim? Match the letter of the definition with the corresponding term. A.A memo from the police who responded to the accident B.Your insurance policy 1. ______Bait and Switch C.A note from any witnesses or other person involved in the accident 2. ______Ponzi Scheme D.The address of the location where the accident occurred 3. ______Consumer Protection Laws 4. ______Fraud 10. What coverage reimburses a car owner if the car is stolen? 5. ______Identity Theft A.Deductible 6. ______Spam BCollision 7. ______Scams C.Comprehensive 8. ______Skimming D.Liability 9. ______Affinity Fraud 10. ______Bureau of Consumer Protection STANDARD 3 OBJECTIVE 5 A. Fraudulent or deceptive schemes 1. Driving home from school one day, you swerved to miss a cat and ran into a tree. The B. Designed to ensure fair trade competition and the free flow of truthful information in the repairs are expensive. What type of automobile insurance coverage will marketplace. reimburse the damages to your car? C. A scam that targets members of a certain demographic. D. A deliberate deception, designed to secure unfair or unlawful gain. A.Collision E. Unwanted advertising distributed through e-mail. B.Liability F. A federal agency which provides state and local consumer protection offices which help consumers C.Comprehensive with questions and problems. G. Is a fraudulent investment operation that pays returns to separate investors, not from any actual D.Underinsured motorist profit earned by the organization, but from their own money or money paid by subsequent investors. H. Someone wrongfully acquires and uses a consumer’s personal identification, credit, or account 2. Referring to managing risk, what does it mean to transfer it? information. A.To take measure to prevent loss I. Luring consumers with advertised, but nonexistent, bargains and then switching them to a more B.To set aside resources to cover potential loss expensive product. J. Is the theft of credit card information used in an otherwise legitimate transaction. C.To shift the possibility of loss to another person D.To take measures to eliminate the cause of potential loss STANDARD 3 OBJECTIVE 4 1. In managing risk, what does it mean to transfer it? A.To take measures to prevent loss 3. In general, who would most need life insurance? B.To shift the possibility of loss to another person A.A single person just beginning a career C.To set aside resources to cover potential loss B.A young married couple with small children D.To take measures to eliminate the cause of potential loss C.A working couple with grown children living on their own D.A retired person who is marries and has investments 2. Liability insurance protects you against A.Lawsuits 4. At your young age, what are the two types of insurance most necessary for you? B.Personal injuries A.Liability and renters’ C.Sickness B.Travel and liability D.Property damage C.Automobile and disability D.Health and automobile 3. When you apply for automobile insurance on your own, you will need to provide the insurance company with all of the following except: 5. Lupe needs to pay $123 per month in order to purchase a health insurance policy. A.Your Social Security number This monthly payment is known as the: B.Your employer’s name and address

C.Your history of driving violations A.Deductible D.The vehicle identification number of the car you want to insure. B.Co-insurance C.Premium 4. Which of the following pairs represents the general types of insurance often provided D.Moral Hazard by employers? A.Liability insurance and homeowners’ insurance 6. Which of the following best describes the benefits of having insurance? B. Life insurance and liability insurance A.The policyholder may become better off financially if an accident occurs C.Disability insurance and medical insurance B.Insurance combined with emergency savings provides a sense of financial D.Homeowners’ insurance and disability insurance security and peace of mind. C.The policyholder no longer has to worry about paying for financial losses 5. There are six general types of insurance. Which of the following is one of those six? resulting from an accident A.Liability D.It is required by law to purchase insurance so the benefits do not matter. B.Collision C.Cash value 7. Insurance can be purchased to protect one from which of the following losses? D.Uninsured motorist A.Stock market losses B.Health care expenses 6. What are the two most important types of insurance you need at your young age? C.Maintaining the price of your home A.Liability and renters’ D.Car maintenance B.Travel and liability C.Automobile and disability 8. At the first of the year, Tanya received her first medical bill. It totaled $1000. Her D.Health and automobile health insurance policy has a $500 deductible and 20% co-insurance. How much of the bill will Tanya be responsible to pay? 7. Which one of the following will not affect the cost of automobile insurance? A. $0, insurance will cover the entire medical bill A.Cost of repairs B. $500 B.Mileage C. $600 C.Driving record D. $700 D.Color of car 9. The beneficiary of a life insurance policy is the individual who: 8. While driving to the store, you swerved to miss a dog and drove into a tree. You and A.Sold the policy the dog are all right, but it will be expensive to repair the damage to your car. What B.Purchased the policy type of automobile insurance coverage will provide reimbursement for damages to your C.Is the executor of the insured’s estate car? D.Receives any proceeds if the insured person dies A.Coverage 10. As part of James’s new job, his employers will provide health, life, and disability B.Employee benefits insurance. Access to this insurance is provided in addition to his regular C.Household production salary. This is known as: D.Government programs STANDARD 4 STARTER

STANDARD 4 OBJECTIVE 1 1. The phrase "pay yourself first" means that you: A.Buy something for yourself before paying bills. B.Donate money to a charity before paying bills. C.Put money in your savings account before paying bills. D.Put all money in your checking account before paying bills. STANDARD 4 OBJECTIVE 2 2. What is the primary factor that will affect how much is earned in a savings account? 1. Which investment has low risk, a low rate of return, and is long-term? A.Minimum balance A.Mutual funds B.Passbook savings account B.Real estate C.Hours the bank is open C.Stocks D.Interest rate D.Bonds 3. The most effective saving strategy would be: 2. Which of these does NOT have a physical location, but is only an electronic exchange? A.Putting money in a safe hiding place. A.regional exchanges B.Having a trusted person hold your money for you. B.AMEX C.Direct deposit into a savings account. C.NYSE D.Using cash for all transactions. D.NASDAQ 4. P.Y.F. stands for: 3. Which one of the following types of investments has the highest risk and the highest A.Pay yourself first potential rate of return? B.Protect your family A.Stocks C.Protect your finances B.Money market mutual fund D.Percentage yield formula C.Government bonds D.Savings bonds 5. Many savings programs are protected by the Federal Government against loss. Which of the following is not? 4. Which statement below is true about mutual funds? A.A bond issued by one of the 50 States A.Mutual funds offer guaranteed returns. B.A certificate of deposit at the bank B.Consumers can choose which stock to include in your mutual funds. C.A U. S. Savings Bond C.All mutual funds buy stocks. D.A U. S. Treasury Bond D.Mutual funds are convenient and professionally managed. 6 .Joey has a savings account at his bank. Which of the following would be correct 5. When evaluating investment alternatives you should remember: about the interest that he earns on this account: A.It is better to find a company that can invest for you. A.Sales tax may be charged on the interest he earns.

B.Joey cannot earn interest until he turns 18. B.It is wise to diversify. C.If Joey’s income is high enough, the government will tax his interest C.To put all your eggs in one basket. earnings. D.Banks and credit unions are the best choice. D.Joey will be able to live comfortably on the interest he earns. 6. What type of broker not only helps clients buy or sell investments, but they offer 7 .Money in a savings account is protected by the FDIC or NCUA to what amount? research and investment advice as well. A. $10,000 A.Discount broker B. $25,000 B.Full-service broker C. $100,000 C.Online broker D. $250,000 D.Investment advisor

8 .All of the following are ways to save except one: 7. Which of these is NOT a major INDEX of how well the stock market is doing? A.Payroll deductions A.DOW B.Change jar B.NASDAQ C.Mutual funds

D.Open a savings account C.S&P 500 D.KOA 9. Emergencies and unexpected events, to eliminate future stress, to buy a good or service that is suddenly wanted, and to purchase a planned good or service 8. Spreading your money among different types of savings and investments is called: in the future are all: A.Diversification A.Causes of bankruptcy B.Compounding B.Investment opportunities C.Time value of money C.Ways to save D.Short selling D.Reasons to save 9. Matthew and Alicia just had a baby. They received money as baby gifts and want to 10 .True or false. FDIC stands for Federal Deposit Insurance Corporation. put it away for the baby’s education. Which of the following is likely to have the highest growth over the next 18 years? A.Savings bond B.Savings account C.Stocks D.Checking account

10. A company that issues bonds is actually: A.Selling small pieces of ownership in its business. B.Lending money C.Borrowing money D.Introducing a new product B.Cash value C.Present value D.Time value

STANDARD 4 OBJECTIVE 3 1. Liquidity is: A.Turning assets quickly into cash B.Investing interest earning in mutual funds STANDARD 4 C.Spending freely OBJECTIVE 4 D.Buying stocks 1 .If an investor can earn 9% interest on an investment, approximately how long will it take to double in value? 2. The time value of money can best be explained using which of the following concepts: A.8 years A.The risk-to-return relationship B.72 months B.The rule of 72 C.12 years C.The "pay yourself first" philosophy D.9 years D.The dynamics of compounding interest 2. What is a 401(K)? 3. What does risk mean in regard to investments? A.A portion of salary deducted from net pay and placed in a special A.Uncertain outcome account. B.Certain outcomes B.Money set aside to pay medical expenses not covered by insurance. C.High rate of return C.A portion of salary deducted from gross pay and placed in a special D.Low rate of return account D.A plan that specifies benefits to be received at retirement age, based on 4 .The basic rule of a risk-to-return relationship is that the: total earnings and years of work. A.Higher the risk, the lower the return rate 3 .The rule of 72 is useful in calculating the: B.Higher the risk, the higher the return rate A.Time required to double an investment C.Lower the risk, the higher the return rate B.Age of money D.The two are not related C.Fluctuations of the stock market D.Interest an investor needs to earn to reach a goal

5. What two factors will influence your investment choice? 4 .The process of earning interest on interest is:

A.Safety and risk A.Rate of return

B.Growth and income B.Diversification

C.Growth and risk C.Compounding D.Interest bearing D.Safety and income 5 .A common mistaken belief about retirement is: 6. Due to the effects of inflation, in the future a dollar will be worth: A.Your retirement could last a long time A.The same as a dollar today B.You will spend more money when you retire B.More than a dollar today C.Saving just a Little bit will help C.Less than a dollar today

D.It depends on the interest rate D.You will have plenty of time to start saving for retirement

7. Many people put aside money to take care of unexpected expenses. If Susan and Joe 6. What approximate interest rate would an investor need to earn in order to double have money put aside for emergencies, in which of the following forms the value of an investment in six years? would be of LEAST benefit to them if they needed it right away? A.10 A.Checking account B.12 B.Invested in a down payment of the house C.6 C.Savings account D.72 D.Stock 7. Monica adds $500 to her mutual fund every year for the next 10 years. Mason 8. The time value of money refers to the relationship among three factors. These factors decides to wait 10 years when he knows he will have a lump sum of $5,000 include all of the following except: to invest in a mutual fund. If both Monica and Mason earn the same A.Money interest rate (7% on average), who will have more money in their mutual B.Rate of interest fund in 20 years? C.inflation A.They will have the same balance because they each invested the same D.Time amount at the same interest rate. B.Mason 9 .The profit from an investment is: C.Monica A.Risk D. It depends on their income. B.Liquidity 8. Retirement income paid by a company is called: C.Return A. 401(k) D.Inflation B. Pension 10. The cash value of an investment at a particular time in the future is: C. Rents and profits A.Future value D. Social security 9. Albert Einstein called this the “greatest mathematical discovery of all time:” 10 .IRA stands for: A. The time value of money A. Interest-earning Retirement Account B. the Rule of 72 B. Interest-bearing Retirement Account C. Compounding C. Individual Retirement Annuity D. Roth IRA’s D .Individual Retirement Account