Chapter 9: Capital Assets, Intangibles, and Goodwill

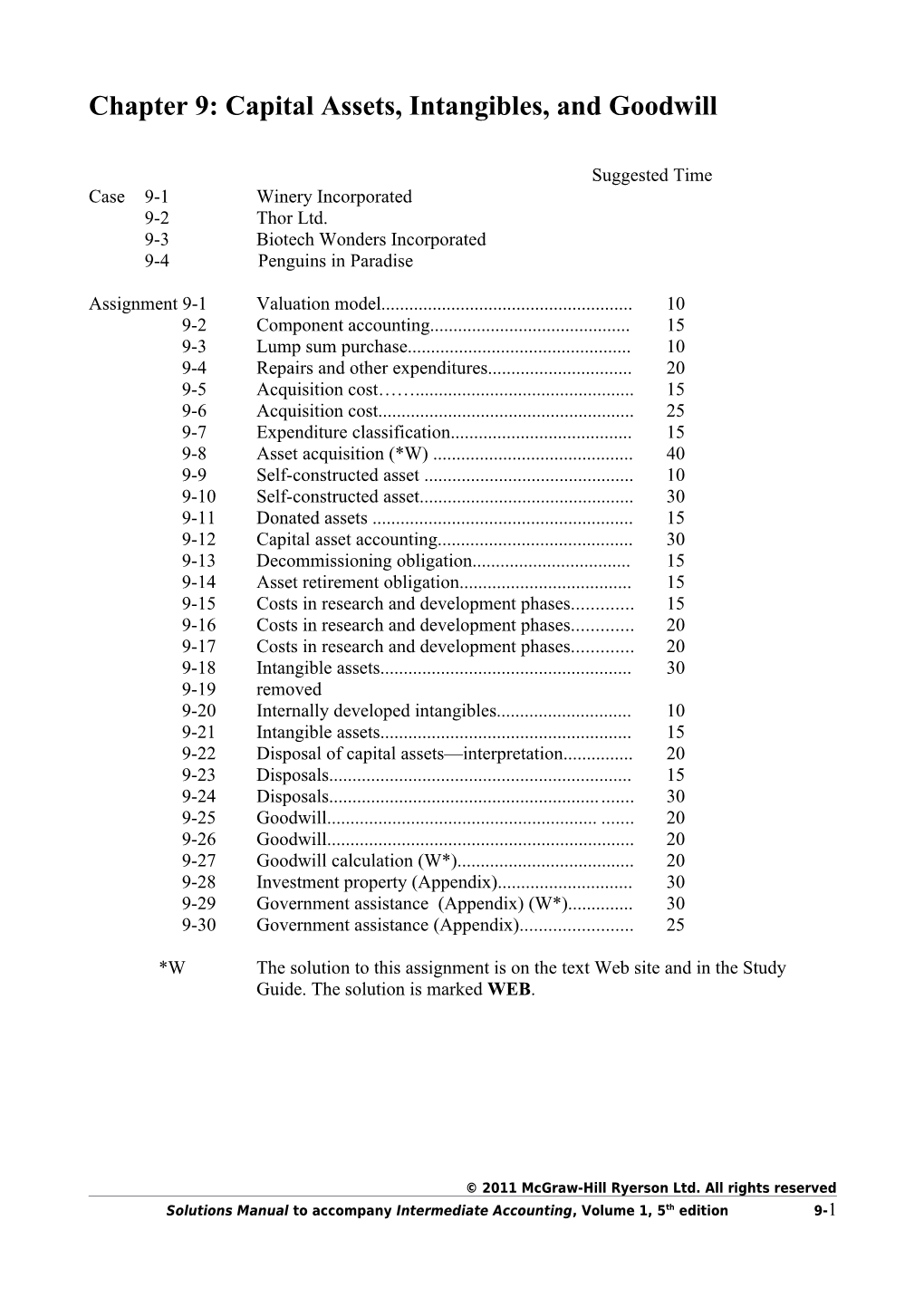

Suggested Time Case 9-1 Winery Incorporated 9-2 Thor Ltd. 9-3 Biotech Wonders Incorporated 9-4 Penguins in Paradise

Assignment 9-1 Valuation model...... 10 9-2 Component accounting...... 15 9-3 Lump sum purchase...... 10 9-4 Repairs and other expenditures...... 20 9-5 Acquisition cost……...... 15 9-6 Acquisition cost...... 25 9-7 Expenditure classification...... 15 9-8 Asset acquisition (*W) ...... 40 9-9 Self-constructed asset ...... 10 9-10 Self-constructed asset...... 30 9-11 Donated assets ...... 15 9-12 Capital asset accounting...... 30 9-13 Decommissioning obligation...... 15 9-14 Asset retirement obligation...... 15 9-15 Costs in research and development phases...... 15 9-16 Costs in research and development phases...... 20 9-17 Costs in research and development phases...... 20 9-18 Intangible assets...... 30 9-19 removed 9-20 Internally developed intangibles...... 10 9-21 Intangible assets...... 15 9-22 Disposal of capital assets—interpretation...... 20 9-23 Disposals...... 15 9-24 Disposals...... 30 9-25 Goodwill...... 20 9-26 Goodwill...... 20 9-27 Goodwill calculation (W*)...... 20 9-28 Investment property (Appendix)...... 30 9-29 Government assistance (Appendix) (W*)...... 30 9-30 Government assistance (Appendix)...... 25

*W The solution to this assignment is on the text Web site and in the Study Guide. The solution is marked WEB.

© 2011 McGraw-Hill Ryerson Ltd. All rights reserved Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition 9-1 Questions

1. a) Vines in a winery would be classified as a biological asset. b) Apartment building for rent would be classified as investment property. c) Manufacturing facility would be classified as property, plant and equipment. d) Dairy cows on a farm would be classified as a biological asset. e) Patent would be classified as an intangible asset.

2. A company might prefer to use fair value instead of historic cost if fair value were higher than historic cost and the assets were pledged as collateral with lenders. Fair value would be a more relevant attribute for the financial statement users (the lender) in these circumstances. Other situations may also exist where users would rather know fair values. Fair value is allowed as an option using the revaluation model for property, plant and equipment and intangible assets where there is an active market. Fair value less costs to sell is used for biological assets. Fair value is allowed as an option using the fair value model for investment property.Valuing a capital asset at fair value is not allowed under accounting standards for private enterprises.

3. Possible components for an airplane are: aircraft frame, engine, galley, seats, landing gear, navigation system, major inspection or overhaul. To be classified as a separate component the component would need to be signficant and have a different pattern or method of depreciation.

4. These would be an involuntary safety cost. These costs must be capitalized as part of the property, plant and equipment. The logic is that if the new sprinkling system was not installed the building would not comply with the safety code and would be shut down. Therefore, these costs are recognized as an asset because without them the building would not be able to provide a future benefit.

5. When several capital assets are purchased for a single lump sum, the cost of each asset usually must be separately recorded for accounting purposes. The assets may be subject to different depreciation rates or may not be subject to depreciation (e.g., land). In addition, accounting requires separate identification of different assets in the accounts. The apportionment of the single lump-sum purchase price should be based on the relative market value of each individual item acquired (the proportional method) or, in the absence of values for each asset, the incremental method which assigns the unallocated residual to the asset that cannot be valued.

6. Subsequent costs are capitalized when either the useful life is increased, or the productivity of the operational asset is enhanced, such that the asset will provide greater benefits beyond the current year.

7. Over time, both the capitalization and the write-off alternatives will end up the same for net assets and net income, as capitalization will eventually be nullified by depreciation. In the meantime, a company that capitalizes (and depreciates) expenditures will report higher net assets. Such a company will report higher income in the year of acquisition than one that writes off, but lower income in later years, when depreciation is recorded. A company that capitalizes (and depreciates) will report smoother income patterns. The actual cash flow will not differ between the two alternatives, but the company that capitalizes will show the outflow in investing activities, rather in operating activities and thus will over time have higher cash flow from operating activities. ©2011 McGraw-Hill Ryerson Ltd. All rights reserved 9-2 Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition 8. When capital assets are constructed for a company’s own use, the capitalized cost should be the sum of all costs incident to the construction efforts. This would include material costs, labour costs, and appropriate overhead costs directly related to the construction effort. a) For normal company overhead, there is a disagreement about the appropriate allocation. Some allocate as usual. Some companies do not allocate normal overhead to self-constructed assets. Others allocate a proportionate part: overhead that would have been applied to displaced production, if any. b) Excess costs of construction (exceeding the prospective cost of acquiring the asset from an outsider) should be expensed in the period that the self-constructed asset is completed or when the loss is measurable. c) Interest on construction loans must be capitalized since this would be a qualifying asset that takes a substantial time to complete. This would include loans taken out specifically for construction as well as a portion of general borrowings. 9. A donated asset would be recorded at the fair value of the truck. The credit would be to contributed surplus.

10. A liability must be recorded when the company is legally required to incur costs at the end of an asset's useful life or has a constructive obligation which is a business practice of incurring a cost. To measure the liability, the company must estimate the cost of future restoration or decommissioning cost, measured at the current cost, and then discount the amount using a pre- tax interest rate that reflects the risks related to the liability. The offsetting debit is to the related asset account, which then is depreciated over the life of the asset.

11. During any intervening years, the company must record interest expense, which will increase the asset retirement obligation.

12. Research and development phases are often very similar, and it takes considerable judgement to differentiate between them. Research is original and planned investigation undertaken with the hope of gaining new scientific or technical knowledge and understanding. Such investigation may or may not be directed toward a specific practical aim or application. Development is the application of research findings or other knowledge into a plan or design for the production of new or substantially improved products, prior to the commencement of commercial production or use. Costs in the research phase are expensed. Costs in the development phase may be deferred and amortized if they meet specific criteria; otherwise they must be expensed. The criteria are: a) technical feasibility established. b) intent to complete and then produce and market the product/process. c) ability to use or sell the asset. d) probable future benefits established: future markets or internal usefulness e) adequate resources exist to complete the project. f) identifiable costs.

Note especially item ‘d’, that requires substantiation of future cash flow that must accompany any asset.

13. Internally developed intangible asset costs may be capitalized if: (1) First, the intangible asset must be an identifiable intangible, which means that it is separable or able to be divided from an entity, or the asset must derive from contractual or legal rights,

© 2011 McGraw-Hill Ryerson Ltd. All rights reserved Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition 9-3 (2) Second, the recognition criteria are met: (a) the intangible asset must be controlled by the entity as a result of past transactions or events. (b) future economic benefits must flow from the intangible asset, for example, markets for the related product or the internal usefulness of the intangible asset must be clearly established, and (c) the cost must be reliably measurable.

14. An advertising/promotion cost would not create an asset that is severable or the result of contractual or legal rights, so it would not qualify for treatment as an asset. There might also be doubts about its probable future economic value, but this is a judgemental issue, whereas the severability test is objective.

15. Expenditures for planning activities related to a company web site are expensed, likely because they happen in advance of the specific web site application.

16. The gain means that the asset was sold for an amount higher than book value. If estimates of useful life and residual value used in depreciation were completely accurate, there would be no gain or loss on sale. Therefore, the gain is really a correction of estimation errors.

17. The carrying amount of the old part is derecognized and the remaining $2,000 amount would be a loss in the income statement.

18. Common items relating to capital assets in the CFS: a) Cash spent to acquire capital assets. b) Cash received on sale of capital assets. c) Gains and losses on sale, and depreciation, adjusted in operating activities (or omitted, if the direct method of presentation is used.)

19. Conceptually, goodwill is the expected value of future above-normal financial performance; it may be classified as internally generated or as purchased goodwill. Only the latter is recognized under GAAP in the financial statements. It arises when shares in a company are purchased and the price paid is greater than the sum of the market values of all of the identifiable net assets (tangible and intangible) acquired. The excess paid is recorded as goodwill.

20. Negative goodwill arises when a firm acquires a second firm at a purchase price less than the fair value of the net identifiable assets of the acquired firm. In such a purchase, the credit differential (purchase price less fair value of all net assets acquired) is used to proportionately write down acquired identifiable non-monetary assets. If these assets are reduced to nil, then the remaining negative goodwill is recorded as a gain in the income statement

©2011 McGraw-Hill Ryerson Ltd. All rights reserved 9-4 Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition Cases

Case 9-1 – Winery Incorporated

Overview

Winery Incorporated (WI) has recently incorporated. Their previous financial statements as a partnership used the cash basis of accounting and were prepared for tax purposes and management purposes only. They had no GAAP constraint. Taxes were paid by each partner not by the partnership. WI now has a bank that requires audited financial statements and has a covenant requiring a minimum current ratio. The bank will be interested in checking compliance with their covenant as well as cash flow predicition to see if there is adequate cash to make their interest and principal payments. WI has a GAAP constraint which requires the accrual basis of accounting. It must be determined what accounting standards WI will follow. They are considering using accounting standards for publically accountable enterprises to be comparable to their competitors. They are also considering the use of accounting standards for private enterprises. Management will be sensitive to any impact on the current ratio due to the convenant. It is important that standards are ethical and developed for the long-term since this is their first year-end as a corporation.

Issues 1. Valuation basis for vines and grapes 2. Valuation of winery license 3. Valuation of inventory – wine 4. Revenue recognition – wine 5. Software and web site development costs 6. Revenue recognition – annual fee 7. Inventory valuation – spoiled wine 8. Lawsuit 9. Hedge 10. Forgiveable loan

Analysis

For each issue the appropriate accounting policy using standards for publically accountable enterprises (IFRS) will be discussed then any difference if accounting standards for private enterprises was selected.

1. Valuation basis for vines and grapes

Part A The vines and growing grapes would be considered biological assets since they are living plants. Once the grapes are harvested these would be considered inventory. The value of the land would have to be separate from the value of the vines and grapes.

Biological assets are valued at fair value less any point of sale costs. These assets are not depreciated. Any gains or losses would be recognized in the income statement. Fair value of the vines and grapes would need to be determined each reporting date.

© 2011 McGraw-Hill Ryerson Ltd. All rights reserved Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition 9-5 WI will need to determine fair value for the vines and grapes separate from the land. Fair value could be based on recent sales or purchases of vines. The grapes can obtain a value from the active market for the purchase or sale of grapes. The land could be valued from recent real estate transactions. If fair values cannot be obtained in the market place a valuation could be completed based on discounted cash flows. Point of sale costs would be transportation costs to market.

When harvested the grapes would be transferred and reclassified as inventory at their fair value less point of sale costs.

Any changes in the fair value of the biological assets would impact net income. Any increases would have a favourable effect but decreases would have a negative impact. The vines and land would be classified as a non-current asset so there would be no impact on the current ratio. After being harvested, the grapes would be classified as inventory. As Wine can take over two years to produce, part of the grape inventory would need to be classified as non-current.

Part B

If accounting standards for private enterprise were selected the vines, grapes and land would be valued using cost. The land would not be depreciated. Since the vines have an indefinite lifespan they would also not be depreciated. The assets would be tested for impairment if an event or circumstance indicated impairment e.g. frost may damage the vines and cause a reduction in value.

Part A

2. Valuation of winery license

The winery license would be classified as an intangible asset. Since the license does not have an expiry date it would be considered an intangible asset with an indefinite lifespan. Since there is no active market for these licenses the cost model would be used for the licenses. The licenses would not be amortized but tested for impairment.

The license would be classified as a non current asset therefore there would be no impact on the current ratio.

Part B

The accounting would be identical in accounting standards for private enterprises.

3. Valuation of inventory – wine

The grapes while growing would be classified as biological asset. When harvested the grapes would be reclassified from biological assets to inventory at the fair value less point of sale costs. The grapes when crushed would then be transferred into wine inventory. The wine would be a manufactured inventory and would be classified as work in progress. The wine and grapes would be valued at lower of cost and net realizable value at each reporting date.

Wine would be classified as a current asset e.g. non premium wine which is expected to be sold within the year. The premium wine would also be classified as a current asset if this is the ©2011 McGraw-Hill Ryerson Ltd. All rights reserved 9-6 Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition normal operating cycle. Costs would include any direct costs and a portion of general overhead. In addition, the premium wine which is aged for a period of time up until two years may be a qualifying asset where interest must be capitalized. A portion of the interest on general borrowings, loan from bank, would be added to the cost of the wine.

The inventory that is classified as current would have a positive impact on the current ratio.

Part B

The accounting standards for private enterprises would not classify the grapes as a biological asset. They would be valued at cost. Interest costs may be capitalized if they relate to a specific borrowing not general borrowings. The loan is for general purposes therefore the interest costs would not be capitalized for the premium wine.

4. Revenue recognition – wine

Wine sold in the store or on the website would be recognized when delivered. There is no cash collection risk since customers would pay at purchase with the exception of the LCBO. The LCBO is a government run organization and there would not be cash collection risk.

Part B

The accounting would be similar in accounting standards for private enterprises.

5. Software and web site development costs

The acquired software would be classified as an intangible asset with a definite lifespan. The software would be amortized over the period of its intended use by WI. Web site costs which are in the planning stage or just for operating would be expensed. The consulting fees depending on their nature may have a portion capitalized. The training costs would be expensed. Costs to develop the website e.g. graphics design and the web domain name would be capitalized. Any capitalized costs would be amortized over the period of intended use of the website. The amortization period for the software and web site is likely a short period since it is technology based.

The intangible assets would be classified as a non-current asset therefore would not have an impact on the current ratio.

Part B

The accounting would be identicial in accounting standards for private enterprises.

6. Revenue recognition – annual fee

The annual fee has multiple elements since the customer receives bottles of wine and a subscription to the magazine. The fee would need to be allocated to the two elements based on relative fair value. The portion related to the wine would be recognized when the bottles of wine are delivered. The portion related to the subscription would be recognized as the subscription is delivered.

© 2011 McGraw-Hill Ryerson Ltd. All rights reserved Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition 9-7 Part B

The accounting would be similar in accounting standards for private enterprises.

7. Inventory valuation – spoiled wine

The wine that is spoiled would need to determine the net realizable value. The writedown would be to the net realizable value. Based on initial samples it indicates the wine is spoiled and unless there is an alternative use for the wine the value would be zero.

If the spoiled wine was classified as a current asset this would have a negative impact on the current ratio.

Part B

The accounting would be identical in accounting standards for private enterprises.

8. Lawsuit

The lawsuit would be a contingent liability. The lawsuit was been filed for $1 million but there is no evidence to support that WI will lose the lawsuit or the amount of the lawsuit. Therefore, there should be note disclosure of the lawsuit.

Part B

The accounting would be identicial in accounting standards for private enterprises.

9. Hedge

WI must decide if they wish to elect hedge accounting for the hedge. If they do not elect hedge accounting the forward contract or hedge would be recognized in fair value through profit and loss. The contract would be valued to fair value every reporting date and any changes in the value would impact net income. If hedge accounting is elected the cash flow hedge would have any change impact other comprehensive income.

Part B

The accounting would be identical in accounting standards for private enterprises for if hedge accounting is not elected. These standards do not have comprehensive income so there would not be the option of showing changes in value in other comprehensive income. The standards do not distinguish between a cash flow or a fair value hedge. If there is a critical match of key terms hedge accounting would be allowed.

10. Forgiveable loan

The forgiveable loan would be recognized when the criteria are met or expected to be met of hiring employees and a minimum purchase of fruit. Note disclosure would be required of the conditions.

©2011 McGraw-Hill Ryerson Ltd. All rights reserved 9-8 Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition The $1 million cannot all be recognized in the current period. If the criteria are expected to be met $500,000 would be deferred revenue and recognized next year. The $500,000 relating to the current year could be either netted against salary expenses or the purchase costs of fruit or the amount could be recognized as other income.

WI would not want to net the government assistance against the cost of the fruit since this would reduce the value of the inventory and have a negative impact on net income.

Part B

The accounting would be identical in accounting standards for private enterprises.

Case 9-2 - Thor Limited

Overview

Thor Limited (TL) is a manufacturer and supplier of farm equipment, fertilizer and seed. The costs under consideration are for a new product, which is risky, as are all start-up activities. Financial statements must be in accordance with GAAP to satisfy lenders, and presumably the investors in the new preferred share issue will use the financial statements to assess the success of the project and their investment. Part A assumes that TL would adopt accounting standards for public companies and part B assumes TL will adopt standards for private companies. Accounting policy choice should reflect the risky nature of this operation. The income statement under question will be used internally to determining James Watkins’ eligibility for a large bonus, and thus accounting policy decisions are ethically sensitive.

Issues

1. Revenue recognition 2. Cost and depreciation policy, capital assets 3. Accounting policy for costs to date 4. Draft income statement

Analysis

For each issue the appropriate accounting policy using standards for publically accountable enterprises (IFRS) will be discussed then any difference if accounting standards for private enterprises was selected.

1. Revenue recognition

Revenue is recognized when the risks and rewards of ownership are transferred to the purchaser, normally on delivery. While other divisions of TL record revenue on receipt of order, this corresponds to delivery and thus it is acceptable. For the Land-Plant operation, shipping lags behind receipt of order. It may be possible to recognize revenue for units that are ordered but not shipped, on the basis that they are produced, and ready for shipment. However, delayed shipping was not requested by the customer. Early revenue recognition is aggressive revenue recognition and potentially cause for concern given the risk of the new venture. The more ethical policy is recommended, where revenue is recognized only when units are shipped.

© 2011 McGraw-Hill Ryerson Ltd. All rights reserved Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition 9-9 Some “sold” units are essentially on consignment, with payment due only when the unit is sold, and the dealer-customer has full rights of return for six months. Here, the risks and rewards remain with TL until the unit is re-sold by the dealer. There is no past history to estimate returns. Sales should not be recorded until the unit is re-sold by the dealer.

Part B

The accounting would be identical in accounting standards for private enterprises.

©2011 McGraw-Hill Ryerson Ltd. All rights reserved 9-10 Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition 2. Cost and depreciation policy, capital assets

The cost of a capital asset includes all directly attributable costs. These include costs to get the asset in working order, and thus includes testing to determine if asset is functioning. Some of the costs listed for the operation, such as production set-up may qualify if they relate to equipment issues. Specific costs that are not allowed are the costs incurred for introducing new product including advertising. These costs must be reviewed to see what portion, if any, relates to machinery. In this analysis, production set up ($41,000) Other costs have not been capitalized. The decision will change the amount of depreciation recorded. Further investigation may change the preliminary calculations.

The tax credit, equal to 20% of the capital cost, is treated as either a direct reduction to the capital asset or as a separate deferred credit. Regardless of its statement of financial position disclosure, it is depreciated over the life of the equipment, using the same depreciation policy.

Depreciation policy for the equipment must be chosen based on the pattern of consumption. In addition, it must be determined if the capital assets have any significant components that would need to be depreciated separately. TL should use the same method that it uses for other manufacturing equipment, to be consistent, fair and equitable. This method is not disclosed, so this analysis is based on use of the service life method, where 570 hours of the total useful life of 18,000 hours were used in the current period. This would reflect the pattern of consumption of the assets life. This method is based on the critical estimate of total service life, and may be inaccurate as a result. However, it will result in more depreciation when the equipment is used more, which seems an appropriate measure of asset consumption and good measurement of results. Further investigation may change the method chosen. Residual values are assumed to be immaterial and have been ignored – again, a decision that might change.

Depreciation of production equipment is a product cost and will be expensed, or inventoried, based on the sales versus production levels.

Part B

The accounting would be identical in accounting standards for private enterprises.

© 2011 McGraw-Hill Ryerson Ltd. All rights reserved Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition 9-11 3. Treatment of costs to date

Development costs could be capitalized and amortized over the life of the project, beginning with commercial production, if capitalization criteria are met. This will reduce the deficit relating to the project at the outset, but dampen earnings in later periods. Alternatively, if capitalization criteria are not met, then the expenditures must be expensed because they provide no probable future benefit. Generally, information used for performance evaluation would be enhanced if these costs were deferred and amortized against future revenue, and bonuses based on performance would be measured more “fairly” than if expensing were required. However, GAAP is an overriding concern.

Prior year development costs, totaling $1,698,000 are the major cost item to be considered. Development costs may be capitalized and amortized if the product is technologically feasible, if management intend to take the product through to the market, if the entity is able to sell the product, if there is a market for the product, and if financing is in place and if costs are known.

While all those things are present at the end of the 4th quarter of the current year, many would have been absent earlier. For example, a financing plan was put in place late in the second quarter. It may well be that development costs cannot be capitalized and amortized because they were incurred before this point in time. On the other hand, TL’s Board of Directors, who supported the plan, may have demonstrated a commitment to raise financing in a variety of other ways if the preferred shares were not approved. In that case, the time line for the other criteria must be established. When all criteria are met, development costs may be capitalized from that point on. More information is needed to determine when this point was. For the purpose of this report, it is assumed that development costs must be expensed until the end of the 2nd quarter of the current year. Again, further investigation may change this decision.

This decision works “in favour” of the bonus, as prior years, not the current year, bear the cost of development costs. Since the project must recoup these costs to be deemed a success, this is not the most satisfactory result from a performance appraisal perspective, but statements must comply with GAAP.

Note that operating costs of the prior year are assumed to be expensed as incurred as there is no basis for capitalization.

It is generally accepted to capitalize legal costs associated with patent registration. For TL, this amounts to $204,000 ($134,000 + $60,000 + $10,000). For discussion of amortization, see below.

Part B

The accounting would be identical in accounting standards for private enterprises.

Analysis of other cost categories:

Product testing, $82,000 – prior to capitalization criteria met; expense Production planning, $156,000 + $18,000 = $174,000 – the bulk prior to capitalization critera met; expense Market research, $47,000 + $12,000 = $59,000 in this fiscal year - prior to capitalization criteria met and in the research phase; expense (also applies to the $20,000 in the prior fiscal year) ©2011 McGraw-Hill Ryerson Ltd. All rights reserved 9-12 Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition Sales and marketing support - $56,000 + $76,000 = $132,000 – period costs; expense Production cost over-runs, $225,000 – assumed to be the cost of an error and expensed. If it relates to getting equipment into place and operating, may be deferred and amortized. More investigation is needed. Administration costs – (current year $35,000 x 4 = $140,000) – period costs, expense Production costs – expensed with sale of product

As for amortization, it seems as though the estimate of 3-5 years is most appropriate, although it is a “guesstimate” on the company’s part. To be conservative, three years has been used, although perhaps this should be reevaluated, looking at two years. The project is risky dependent on government support and the technological advances of competitors. Long amortization periods are not appropriate. Straight-line amortization has been used for simplicity. but the amortization policy used for other such assets of TL should be consistently applied here.

Amortization of many of these costs is a product cost and will be expensed or inventoried, based on the sales versus production levels.

Part B

The accounting would be identical in accounting standards for private enterprises.

© 2011 McGraw-Hill Ryerson Ltd. All rights reserved Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition 9-13 5. Draft income statement

The draft income statement is shown in Exhibit 1. It should be viewed as a starting point only, and the many assumptions and questions raised in this report must be addressed before it can be finalized. In particular, the decision to expense the development costs in the prior year, if reversed, will have a large impact on the cost numbers.

However, based on tentative data, the income statement shows that the performance units have not been earned. This meets the intuitive assessment that bonuses should not be awarded until all costs have been assessed, including development costs. Performance measures for future years should be re-defined.

Exhibit 1 Thor Ltd Land Plant Project Draft income statement for the current year

Sales (42-4-12 units) 26 units x $67,400 $1,752,400

Product costs Production costs ($366,000 + $1,914,000) $2,280,000 Amortization of equipment (1) 89,900 Patent (2) 34,000 2,403,900 Cost of goods sold (26/48) 1,302,100 Gross profit 450,300 Administrative costs ($35,000 x4) 140,000 Product testing 82,000 Production planning 174,000 Market research 59,000 Production cost over-runs 225,000 Sales and marketing 132,000 Income (loss) before tax (361,700) Income tax (40%) 144,700 Net income (loss) $(217,000)

(1) ($3,423,000 x 80% (government grant) + $41,000 = $2,808,371 x 570/18,000; rounded (2) ($134,000 + $60,000 + $10,000) x 1/3 (three year amortization) x ½ year

©2011 McGraw-Hill Ryerson Ltd. All rights reserved 9-14 Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition Case 9-3 – Biotech Wonders Incorporated

Overview

BWI is a biotechnology company with four shareholders – the original scientist/founder and three venture capital funds. The company will be taken public when there is at least one more approved product. Given the intention to take the company public, ethically strong GAAP compliance is important. To use non-GAAP policies will only make restatement of prior years, needed for prospectus information, more difficult. It must also be decided if BWI will use the accounting standards for private enterprises until they decide to go public or adopt accounting standards for publically accountable enterprises (IFRS). Since, the decision to go public has already been made it is recommended that BWI use accounting standards for public companies. For the policies below the accounting would be similar if standards for private companies were used instead. BWI would likely prefer to show strong financial results – asset and profit position – but this is difficult in a research-based industry.

Issues

The following issues will be evaluated: 1. Cost capitalization 2. Ocean Growers investment 3. Exchange of capital assets 4. Depreciation policies 5. Qualitative evaluation

Analysis and recommendations

1. Cost capitalization

BWI’s major initiatives are meant to discover and refine all-natural products to deal with damage from repetitive stress injuries. The process for development and approval is long and expensive. The company has a policy of deferring costs only after Phase III testing, which demonstrates effectiveness of the treatment, is complete. (Phase III is necessary to get government approval to market the product.) Since most of the cost is incurred in Phase I, II and III testing, this automatically means that most of the expenditures for development are expensed. This is the case for the most recent product, now in Phase III testing. $2,100,000 was spent on this product in the last fiscal year, and this entire amount was expensed.

Under GAAP, research costs must be expensed. Only development costs that meet specific criteria may be deferred, and Phase III approval is critical to these criteria. It is not possible to be sure of technical feasibility before this approval is obtained. Therefore, to comply with GAAP, capitalization of costs once Phase III approval is obtained is the only appropriate policy to follow.

Note that other criteria in addition to technical feasibility must also be met for capitalization – intent to produce/sell, ability to produce/sell, proof of market, availability of financing, and known costs, in order to defer costs after Phase III. Availability of financing might be an issue if existing funds have been exhausted by clinical trials.

The effect of this policy is to create material deficits, as the major investment of company funds is in research and development activities. The deficit is $5.6 million at the end of the current fiscal

© 2011 McGraw-Hill Ryerson Ltd. All rights reserved Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition 9-15 year. The other impact of this policy is that the major (intangible) asset of the company is unrecorded.

2. Ocean Growers Investment

BWI owns 18% of the common shares of Ocean Growers and accounts for its shares using the cost method. The other 82% of OG shares are held by BWI’s controlling shareholder. OG has reported losses of $220,000 since BWI has made their investment, due to extensive research activities. It seems likely that BWI has significant influence over OG with the other 82% being owned by Dr. Sam Hickey, and should be using the equity method to account for its investment. This is the equivalent of recording the BWI portion of research costs on the income statement, and acknowledging that OG’s resources are used up in this activity.

BWI’s share of losses is $39,600 ($220,000 x 18%). This would decrease BWI’s income, and increase the deficit, by $39,600 (pre-tax), and reduce the carrying value of the investment to $20,400 ($60,000 - $39,600). Even at $20,400, the need for a LCM loss should be considered. OG only has value if their research is successful.

3. Exchange of capital assets

BWI has recorded a gain on the trade of equipment with a net book value of $108,000 for other equipment with a $125,000 book value and a $126,400 fair value. Fair value was used to value the transaction. Since the assets are similar, and probably do not have commercial substance since the configuration of cash flows is likely similar this is not appropriate.

BWI recorded a gain of $18,400 ($126,400 – $108,000) on the transaction. This must be reversed. In addition, the equipment is now depreciated based on $126,400 fair value. This must be adjusted to depreciation based on book value, $108,000. The difference is $1,840 in this year ($126,400 - $108,000 / 5 = $3,680; $3,680 x 6/12).

Capital assets will be reduced by $16,560 ($18,400 - $1,840) and the deficit will be increased by this amount.

4. Depreciation policies

BWI uses straight-line depreciation, which is perfectly acceptable. However, leasehold improvements are depreciated over ten years, when the agreed-upon lease term is only five years. Future renewal terms may not be included in the depreciation period unless contractually agreed upon.

This would double annual depreciation to $20,689 ($103,445/5). Current year losses would increase by $10,345. To date, three years of depreciation have been recorded ($31,034/$103,445 = .3). Accumulated depreciation would increase by $31,034, and the deficit would increase by $31,034 (pre-tax), $10,345 for the current year and $20,690 for the two prior years.

Note that deferred development costs should be amortized over projected future revenues, not ten years.

5. Qualitative evaluation

©2011 McGraw-Hill Ryerson Ltd. All rights reserved 9-16 Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition The primary asset of BWI is not recorded on the balance sheet, since research and development costs are primarily expensed. In order to properly evaluate the operations and potential of BWI, careful evaluation of the research portfolio is necessary. Expert scientists would have to be involved in this evaluation. Of interest is the effectiveness of the compounds in treating the targeted condition, and the overall market for the product once approved. Progress of the various compounds through the phase testing, patent position, quality of the research staff, are all factors to evaluate.

This is a classic knowledge-based business, and the financial statements are of little use in valuation.

© 2011 McGraw-Hill Ryerson Ltd. All rights reserved Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition 9-17 Case 9-4 – Penguins in Paradise

Overview

Many users will be relying on the financial statements of PIP. These various users are sometimes in conflict, and thus correct ethical decisions are crucial. Decisions cannot be made to help one group at the expense of another, or try to portray a particular “picture” to investors.

Most significantly, equity investors will be relying on the financial statements to calculate their participation payment. They will want accounting policies that maximize net income. In addition, they will want to ensure that PIP’s operations, particularly its costs, are being efficiently controlled.

The bank will also be relying on the financial statements to establish their share of revenue, and to ensure that the operations are under control. They will likely want to see statements that show positive cash flows.

The promoter will be relying on the financial statements in calculating his participation payment. Like all the other investors, he will want net income to be high in order to maximize his own income.

In setting the accounting policies, we will have to bear in mind that in this situation they will have a direct impact on PIP’s cash flows. Cash flows will be very important in the first stages of the life of the play, a period in which expenses will exceed revenues. Early recognition of expenses will decrease net income, and the participation payments which are based on operation profits.

Issues:

The issues are as follows:

1. Sale of reservation rights 2. Sale of movie rights 3. Government grant 4. Bank loan 5. Expenditure recognition

Sale of reservation rights

The timing of recognition of the fees earned from selling reservation rights must be determined. The amount relates to the future performance of the play, that being in 20x5. Therefore, there is a case for future recognition. Arguments favouring recognition in 20x4 include the fact that the critical event is selling the reservation rights, and that the amount is non-refundable. In addition, the amount paid cannot be applied against future ticket prices and no future services are to be rendered. Because the service has been rendered (rights to a reservation), the amount should be recognized in 20x4. A separate fee is paid for the actual performance.

In order to apply this accounting treatment, we must verify that the reservation fees are non- refundable.

Sale of movie rights

©2011 McGraw-Hill Ryerson Ltd. All rights reserved 9-18 Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition The payment received for the sale of the movie rights can be taken into income in the current year because there is no direct tie to future expenses or events. Alternatively, the amount that was paid is based on the expectation of the success of the play, and should be taken into income in future periods. At a minimum, the payment should be disclosed as an unusual item because it will not occur again.

Government grant

We must determine whether the government grant is attributable to income or capital. The treatment of this amount will affect the royalty payment. If the amount is taken into income immediately, the participation payments will increase. If the amount is offset against an asset that is depreciated, then the participation payments derived from the grant will be paid over time. If the grant is tied to hiring Canadians to perform in the play, then the amount should be credited against the related expense.

If the grant has to be spent on costumes and sets made in Canada, then the amount should be netted against the related assets. The grant should be recognized when it becomes payable, not when it is collected.

In order to decide how this amount should be recognized, we must determine what the 50% content rule pertains to—against what purchase should it be offset? We must also determine the length of time that the rules apply in case the amount has to be repaid at a later date.

Bank loan

We must determine how to record the payment to the bank that is based on the play’s success. The 5% interest that is payable as well as an accrual based on expected future revenue could be expensed. Alternatively, just the 5% interest amount could be expensed because the remaining balance that would have to be paid is uncertain and difficult to determine. The latter approach seems more reasonable. The commitment will have to be clearly disclosed.

Expenditure recognition

In general, the financial statements for the organization might look like one of the following: 1. All expenditures are expensed as incurred, and large initial deficits are recorded, followed by large profits if the play is a success 2. Many expenditures are capitalized as assets, and recognized as expenses in the same period as revenues.

Cash flow is better portrayed by alternative 1, and this alternative reflects the high risk of the project. Results of operations might be better reflected by alternative 2.

The situation should be reviewed to see if the requirements for internally developed intangibles apply, and, if so, if the stage play in rehearsal qualifies as something governed by contractual rights (ownership of the script and production rights). In any event, capitalization is dependent on the assessment of the likelihood that the play will have probable future economic benefit, and be profitable in the future. If the likelihood is not high, then alternative 1 will be followed; otherwise, #2 is appropriate.

Salaries and fees for rehearsal

© 2011 McGraw-Hill Ryerson Ltd. All rights reserved Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition 9-19 The expenditure can be recognized in either the current year or future years. Arguments can be made for either treatment. There is no certainty of the play succeeding and uncertain future benefit therefore the amount should be expensed in the current period. On the other hand, the amounts do relate to production in future years, and create an asset which is future potential revenue.

Costumes and sets

The costumes and sets can be expensed either in 20x4 or in future periods. An argument is the amount should be expensed immediately because there is uncertainty about the play’s success. However, the costumes and sets do relate to production in future years. Capitalizing the amount and recording depreciation in future years is justifiable.

Miscellaneous costs

Costs of administration and promotion should be expensed as incurred because there is no separately identifiable intangible asset that is created as a result.

Promoter’s fees

A related issue is what amount, if any, that should be accrued for the promoter’s fees. At present, the payment is too uncertain; thus, the amount should be accounted for in the year that an amount becomes payable.

©2011 McGraw-Hill Ryerson Ltd. All rights reserved 9-20 Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition Assignments

Assignment 9-1

a) Rental apartment buildings would qualify as investment property in IAS 40. The fair value model is available in IAS 40 or cost model in IAS 16. b) Manufacturing facility would have the choice of cost model or revaluation model in IAS 16. c) Vacant land if held for capital appreciation would qualify as investment property in IAS 40. The fair value model is available in IAS 40 or cost model in IAS 16. d) Vines in a winery would qualify as a biological asset in IAS 41 and would be valued at fair value less point of sale costs. e) Emission credits would be classified as an intangible asset in IAS 38 and since there is an active market would have the choice of the cost or revaluation model.

Assignment 9-2

Separate components would be material and have a different depreciation method or pattern. The following are some possible components.

a) Airplane – aircraft body, engine, galley, seats, landing gear, navigation system, major inspection, rotable spare parts b) Wind farm – blades, bearings, generator, tower, underground cable, major inspection, decommissioning costs c) Manufacturing facility – roof, shell building, wiring, heating system, elevator d) Cruise ship – engine, ship frame, galley, seats, major inspection e) Hydro lines – poles, wires, insulators, decommissioning costs

Assignment 9-3

To apportion the cost of $680,000 ($650,000 + $30,000):

Item Appraisal Value Proportion Apportioned Cost Land $ 120,000 1/6 $ 113,333 Equipment 240,000 2/6 226,667 Office building 360,000 3/6 340,000 $720,000 $680,000 To record purchase:

Land...... 113,333 Equipment...... 226,667 Office building...... 340,000 Cash...... 680,000

© 2011 McGraw-Hill Ryerson Ltd. All rights reserved Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition 9-21 Assignment 9-4

(a) Maintenance expense...... 26,70 0 Cash ...... 26,700 Regular maintenance that does not extend the life or improve utility is expensed.

(b) Maintenance expense...... 34,900 Cash...... 34,900 Painting is regular maintenance.

(c) Roof (new)...... 66,200 Loss……………………………………………………….. 2,000 Roof (old)………………………………………………. 2,000 Cash...... 66,200

Wiring...... 43,800 Cash...... 43,800 These journal entries assume the wiring and the roof are treated as separate components. The new roof extends the life of the building and is capitalized. The wiring was an involuntary safety cost and must be capitalized.

(d) Machinery ...... 50,500 HST paid ……………………………………………. 7,070 Cash ($50,500 x 1.14)...... 57,570 The machine is recorded at its price paid, not its reported higher FMV. HST is refundable and is not part of the cost of the machine.

(e) Machinery...... 2,700 Cash...... 2,700 The cost of the machine includes costs to ship and install it.

(f) Machinery...... 4,100 Repairs expense...... 8,000 Cash...... 12,100 The cost of the tuneup would be considered a cost to service and could be capitalized. This is likely a separate component. The unexpected repairs would likely be expensed. This is a gray area: who establishes what is known versus unexpected?

Assignment 9-5

Requirement 1

Purchase cost...... $1,250,600 Repair and renovation...... 192,000 Installation of cable...... 24,000 ©2011 McGraw-Hill Ryerson Ltd. All rights reserved 9-22 Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition Signage...... 19,600 Balance in building account...... $1,486,200

Requirement 2

Purchase cost...... $372,000 Demolition of old building...... 58,000 Legal fees...... 22,000 Title insurance...... 13,600 Salvage proceeds*...... ( 12,000) Balance in land account...... $453,600 *Salvage proceeds are offset against the purchase costs since it is assumed the amounts relate to proceeds from selling any items produced while bringing asset to the location. Requirement 3

Case A: Land improvements (or other separate accounts) would be used for the driveway work ($24,000 + $8,400) and the fence ($32,000). The $8,000 deposit with the utility company is an asset (prepaid).

Case B: The routine maintenance ($5,000) is expensed.

Assignment 9-6

Requirement 1 a) Machinery [($45,000 x 98%) + $400 + $1,100]...... 45,600 Interest expense ($45,000 x 2%)...... 900 Cash...... 46,500 The $200 allocation of salary of factory superintendent was not capitalized because there was no additional cost involved— the salary would have been paid notwithstanding the install- ation. The $200 may be included in this entry as a debit to expense. Freight paid by the vendor is not a separate cost to the company because it is implicitly included in the price of the machine. Moving the wall is included as a cost of installation. b) Machinery...... 700 Cash...... 700 The counter should be set up as a separate component and depreciated over its (shorter) useful life. c) Fixtures...... 4,109 Cash...... 1,500 Note payable (net)...... 2,609

Note, $3,000 x .86957 (P/F, 15%, 1)...... $2,609 Cash ...... 1,500 Cost of fixtures...... $4,109

© 2011 McGraw-Hill Ryerson Ltd. All rights reserved Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition 9-23 d) General factory overhead (expense)...... 850 Cash (or liability)...... 850 The salary of the operator of an inoperative machine is not a proper cost of the machine. e) Machinery (new motor)...... 1,250 Accumulated depreciation (10% x $900)...... 90 Loss on asset exchange...... 160 Machinery (old motor)...... 900 Cash...... 600 Exchange of similar assets with no commercial substance; valuation at book value ($810 + $600) but $1,250 maximum value so ends up at market.

Requirement 2

Depreciation expense, fixtures...... 722 Accumulated depreciation—fixtures...... 722 To record full year of depreciation on fixtures ($4,109 - $500) x 1/5 = $722.

Depreciation expense, machinery...... 4,660 Accumulated depreciation, machinery...... 4,660 To record full year of depreciation on machinery. Machinery, $45,600 x 1/10 = $4,560; machinery, $700 x 1/7 = $100;(counter), $4,560 + $100 = $4,660. No depreciation was recognized on the new motor because it was added after 20x4 year end.

©2011 McGraw-Hill Ryerson Ltd. All rights reserved 9-24 Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition Assignment 9-7

Item Classification a. Cost of a fan belt repair on the Repairs expense company’s truck. b. Cost of major overhaul engine large Equipment capitalize as a component piece of equipment expected every two for engine and depreciate over two years year period c. Lawyer’s fees associated with a Patent successful patent application. d. Lawyer’s fees associated with an Legal expense; patent is also likely unsuccessful patent application. written off e. Excess of the book value of an old asset Loss on exchange over the fair market value of the new asset in a trade of assets with no commercial substance. f. Surveyor’s fees. Land g. Cost to demolish an old building that is Land on a piece of land where a new building will be constructed. h. Future costs to restore land used for Land decommissioning cost gravel pit at end useful life i. Costs required to remove asbestos in Building capitalize involuntary safety building to bring up to safety code costs j. Cost to bulldoze land to make it flat for Land a building site. k. Cost of replacing tires in construction Tires as separate component for equipment expected to last two years construction equipment l. Cost of installing a new roof on the Building as a separate component company’s building. m. Cost to add new functions to a software Software (asset) package unique to the company n. Routine maintenance of web site. Expense (maintenance, marketing, etc.)

© 2011 McGraw-Hill Ryerson Ltd. All rights reserved Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition 9-25 Assignment 9-8 (WEB)

Requirement 1 a) Analysis of Land Account

Balance at 1 January...... $1,200,000

Land site number 101: Acquisition cost...... $6,000,000 Commission to real estate agent...... 360,000 Clearing costs...... $60,000 Less amount recovered...... (32,000 ) 28,000 Total land site number 101...... 6,388,000

Land site number 102: Land value...... 800,000 Building value...... 400,000 Demolition cost...... 80,000 Total land site number 102...... 1,280,000 Balance at 31 December...... $8,868,000 b) Analysis of Buildings Account

Balance at 1 January...... $2,600,000 Cost of new building constructed on land site number 102: Construction costs...... $600,000 Excavation fees...... 24,000 Architectural design fees...... 32,000 Building permit fee...... 8,000 664,000 Balance at 31 December...... $3,264,000 c) Site 103 is not analyzed since the land is “held for sale” therefore would not be included in property, plant and equipment or land.

Analysis of Leasehold Improvements Account

Balance at 1 January...... $ 1,600,000 Electrical work...... 180,000 Construction of extension to current work area ($300,000 x 1/2)...... 150,000 Office space improvements...... 240,000 Balance at 31 December...... $2,170,000

©2011 McGraw-Hill Ryerson Ltd. All rights reserved 9-26 Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition d) Analysis of Machinery and Equipment Account

Balance at 1 January...... $3,200,000 Cost of new machines acquired: Invoice price...... $540,000 Freight costs...... 4,000 Unloading charges...... 6,000 550,000 Balance at 31 December...... $3,750,000

Requirement 2

CFS Disclosure

Investing Activities 1 Acquisition of land ...... ($7,668,000) Acquisition of buildings...... (664,000) 2 Acquisition of leasehold improvements ...... (570,000) Acquisition of machinery and equipment...... (550,000)

Although not a capital asset, investing activities would also list the land investment of ($3,000,000)

1 $6,388,000 + $1,280,000. It’s unlikely separate disclosure of the two different pieces of land would be made. 2 $180,000 + $150,000 + $240,000

Assignment 9-9

Requirement 1

The only costs that should be capitalized are costs incurred specifically for construction of the building. Interest for general borrowings as well as borrowings that are specific to the construction. General interest cost should not be capitalized. Similarly, indirect costs can be capitalized, but only if they relate specifically to the construction project. General factory overhead should be allocated to self-constructed facilities if it qualifies.

Requirement 2

The direct and indirect costs, totaling $2,480,000, can be capitalized. Overhead of $30,000 must be reviewed to see if it qualifies for capitalization. Depreciation will commence when the building is complete and ready for use. However, the building is only 70% complete and still requires an estimated $1,000,000 in additional cost to complete. That would make the finished cost equal to $3,480,000 (or $3,510,000), which is higher than the bid of $3,200,000 from the construction company. The capitalized cost of the building should not be higher than its fair value. The fact that incurred costs are higher than the contract bid does not necessarily mean that the total estimated cost is higher than the building's fair value. Even if the construction company's bid had been

© 2011 McGraw-Hill Ryerson Ltd. All rights reserved Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition 9-27 accepted, the actual cost (with inevitable contract changes) may have been appreciably higher than the $3.2 million bid. Amethyst must evaluate the building's value. If the fair value is less than the amount capitalized, then a loss must be recorded for the excess of cost over fair value.

Assignment 9-10

Requirement 1

Cost to be capitalized: Materials...... $2,132,400 Subcontracted work (primarily electrical and plumbing)...... 691,800 Direct labour; plant workers assigned to construction tasks (3)...... 911,600 Direct labour; construction workers hired specifically for this project...... 247,200 Plant foreman used for construction supervision; salary and benefits...... 69,800 Direct labour; plant maintenance workers assigned to construction tasks.... 106,400 Engineering and architectural services...... 433,400 Overhead, direct plant labour (1) ($911,600 x $0.57)...... 519,612 Interest on construction loan (2)...... 151,800 Administration costs (4)...... 114,000 $5,378,012

Commentary (1) Plant overhead is assumed to be incurred for construction activities as well. No overhead is assumed for construction workers labour. The alternate assumption is acceptable. (2) Interest on construction is capitalized. If there were general borrowings a portion of the general borrowings would also be capitalized. (3) Otherwise idle time assigned to construction is capitalizable as long as the workers were really working productively on the building during this time. (4) Specific administration of the job is capitalizable, but an assignment of executive salaries is less likely to be appropriately included. Company policy should be established.

Requirement 2

If the outside bid had been $4,800,000, and the building actually built was identical to that quoted, then the maximum value capitalized should be $4,800,000, and a loss on construction of $578,012 should be recorded.

Requirement 3

Loan interest must be capitalized when the interest is related to a specific construction loan. In addition, if there were general borrowings a portion of the general borrowings would also be capitalized.

Assignment 9-11

Requirement 1 ©2011 McGraw-Hill Ryerson Ltd. All rights reserved 9-28 Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition a) Entry to record the donation: Building (appraised value plus transfer costs)...... 870,000 Contributed capital—donated assets...... 820,000 Cash...... 50,000 Some would argue that $820,000 is the maximum value at which the building can be recognized, as FMV. However, this solution assumes that FMV does not include transfer costs (or that city appraisals are not 100% of market value.) Others would argue that the asset should be valued at its $50,000 cash cost. Alternatives exist in practice. b) Entry to record renovation of building: Building improvements (asset account)...... 168,000 Cash...... 168,000 The building improvement would be recognized as a separate component because useful lives are different. c) Entries to record depreciation: Depreciation expense [($870,000 – 80,000) ÷ 25 years]...... 31,600 Accumulated depreciation...... 31,600

Depreciation expense, renovation cost ($168,000 ÷ 8 years).. 21,000 Accumulated depreciation, building improvements...... 21,000

Note that the company might depreciate donated capital to income at the same rate as the asset so the net charge to income is reduced to $21,000.

Requirement 2 Operating activities: Add back depreciation...... 52,600 Investing activities Acquisition of building ...... (50,000) Building renovations...... (168,000)

Requirement 3 Some object to capitalization and depreciation because the shareholders did not have to invest any capital in the asset—it was provided ‘free’. Why should net income be reduced by part of the capital cost, when there was no cost to the shareholders? (Note that the company might depreciate donated capital to income at the same rate as the asset to offset the charge to income. This addresses the above concern.)

Assignment 9-12

(a) Cash...... 400 Loss on disposal of equipment...... 5,600 Accumulated depreciation, equipment...... 34,000 Equipment...... 40,000

(b) Machinery ($35,700 x .98) + $4,000...... 38,986 Building (or other wiring account)...... 800

© 2011 McGraw-Hill Ryerson Ltd. All rights reserved Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition 9-29 Software...... 2,500 Discounts lost ($35,700 x .02)...... 714 Cash...... 43,000 Note: company practices will likely dictate the exact accounts debited for wiring and software. They may be a separate component in the machinery account.

(c) Maintenance expense...... 23,000 Cash...... 23,000

(d) Machinery...... 50,000 Cash...... 50,000

(e) Accumulated depreciation ($13,500 x .75)...... 10,125 Loss on building improvement...... 3,375 Building...... 13,500

Building...... 22,800 Cash...... 22,800

(f) Machine #1...... 35,867 Machine #2...... 17,933 Cash...... 53,800 $53,800 x 40/60 and 20/60, respectively

©2011 McGraw-Hill Ryerson Ltd. All rights reserved 9-30 Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition (g) Land 151,678 Discount on note 88,322 payable Cash 40,000 Notes payable 200,000 PV of note: $200,000 * (P/F 6%, 10) = $111,678

(h) Land 75,000 Building 400,000 Common shares 475,000 Appraised values are assumed to be more objective than the volatile stock price. If average share price were used, the transaction would be valued: Common shares, $406,250 (325,000 x $1.25) Land, $406,250 x 75/475 = $64,145 Building, $406,250 x 400/475 = $342,105

(i) Research 273,000 expense Deferred 157,000 development costs Cash 430,000 Developed projects are assumed to meet the capitalization criteria.

Deferred 89,600 development costs Cash 89,600 This may be related to patents © 2011 McGraw-Hill Ryerson Ltd. All rights reserved Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition 9-31 or trademarks, etc.

(j) Paving 112,100 Cash 112,100

Assignment 9-13

Requirement 1 Transmission tower ...... 2,100,000 Cash, etc...... 2,100,000

Transmission tower ...... 100,510 Asset retirement obligation...... 100,510 $180,000 × (P/F, 6%, 10) = $180,000 × 0.55839 = $100,510

Requirement 2 20X6:

Depreciation expense – transmission tower ($2,200,510 / 10) ...... 220,051 Accumulated depreciation – transmission tower...... 220,051

Interest expense ($100,510 x 6%) ...... 6,031 Asset retirement obligation...... 6,031

20X7:

Depreciation expense – transmission tower ($2,200,510 / 10) ...... 220,051 Accumulated depreciation – transmission tower...... 220,051

Interest expense ($100,510 + $6,031) x 6%))...... 6,392 Asset retirement obligation...... 6,392

Assignment 9-14

Initial entry Aircraft ...... 100,000,000 Cash, etc...... 100,000,000

Aircraft ...... 993,800 Asset retirement obligation...... 993,800 $10,000,000 × (P/F, 8%, 30) = $10,000,000 × 0.09938 = $993,800

Adjusting entries 20X1:

©2011 McGraw-Hill Ryerson Ltd. All rights reserved 9-32 Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition Depreciation expense – aircraft ($ 100,993,800/ 30) ...... 3,366,460 Accumulated depreciation – aircraft...... 3,366,460

Interest expense ($993,800 x 8%) ...... 79,504 Asset retirement obligation...... 79,504

20X2:

Depreciation expense – aircraft ($100,993,800 / 30) ...... 3,366,460 Accumulated depreciation – aircraft...... 3,366,460

Interest expense ($993,800 + $79,504) x 8%))...... 85,864 Asset retirement obligation...... 85,864

Assignment 9-15

© 2011 McGraw-Hill Ryerson Ltd. All rights reserved Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition 9-33 Requirement 1

Research expenditures must be expensed as incurred. Development expenditures must also be expensed, but may be capitalized and subsequently amortized if they meet the following criteria:

a) technical feasibility established. b) intent to complete and then produce and market the product/process. c) ability to use or sell the asset. d) probable future benefits established: future markets or internal usefulness e) adequate resources exist to complete the project. f) identifiable costs.

Requirement 2 a) development b) development c) neither (quality control) d) research e) neither (production) but may be development if methods are being established f) development g) neither (assumed routine) some may suggest development: depends on extent of redesign and past practice. h) research (reasonable overhead) i) research j) research k) development (testing and evaluation of product; may be research if assumed to be searching for an application)

Assignment 9-16

Requirement 1

GAAP requires that: Research costs are expensed. Development costs may be capitalized and amortized if they meet specific criteria; If the criteria are not met, development costs are expensed.

The criteria which must be met to defer development costs are: a) technical feasibility established. b) intent to complete and then produce and market the product/process. c) ability to use or sell the asset. d) probable future benefits established: future markets or internal usefulness e) adequate resources exist to complete the project. f) identifiable costs.

With reference to the expenditures of Bits Limited:

$150,000 understanding general water flow dynamics Research; expense

©2011 McGraw-Hill Ryerson Ltd. All rights reserved 9-34 Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition $20,000 market research with competitive sailors Research; expense $370,000 designing and testing certain Research; expense multi-hull alternatives, of which one was chosen as the superior alternative $576,000 refining and testing the chosen alternative. Development; capitalize

Requirement 2

If future sales markets were uncertain, then development expenditures would not meet the capitalization criteria, which require proven future markets. Development expenditures would be expensed in this case.

Assignment 9-17

Requirement 1

GAAP requires that: Research costs are expensed. Development costs may be capitalized and amortized if they meet specific criteria; If the criteria are not met, development costs are expensed.

The criteria which must be met to defer development costs are: a) technical feasibility established. b) intent to complete and then produce and market the product/process. c) ability to use or sell the asset. d) probable future benefits established: future markets or internal usefulness e) adequate resources exist to complete the project. f) identifiable costs.

Requirement 2

Assets are not established for research and many development projects because the future benefits are not probable. To qualify as an asset using the asset definition, probable future economic benefit must exist. For a research or development activity, this is the future revenue from sale of the product. However, if such revenue is not probable, then the asset fails the recognition criteria (probability) and must remain unrecognized. An expense results. This is supported by conservatism, which encourages a bias of understating assets in the presence of uncertainty. However, matching would be better served if the costs were capitalized and amortized in future periods when there is revenue.

Requirement 3

Victor’s accounting policy, to expense all R&D costs to date, seems appropriate because there is no saleable product until Phase III testing is successfully completed. While a clearly defined product exists once testing starts, technological feasibility is essentially determined in Phase III. The impact on Victor’s financial statements would be large losses, and deficits, recorded until Phase III is

© 2011 McGraw-Hill Ryerson Ltd. All rights reserved Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition 9-35 complete and revenue begins to flow. Accordingly, the financial statements are of little use to investors in judging the success of the project and test results and other scientific data would be far more relevant. Financials statements can indicate cash flow and cash reserves, which have to be adequate to get through Phase III testing.

Assignment 9-18

Costs must be considered by category. In general, this asset would meet the criteria for capitalization of internally developed intangibles, in that the product is severable, it is under the control of the entity, future benefits can be established, and the costs are reliably determinable. The critical issue is when future benefits are deemed to be present to the extent that capitalization may begin. Costs incurred in initial stages of software development are expensed, but once the product is technically and financially feasible, costs are deferred and amortized over a reasonable period

This company may designate its own milestones to establish technical and financial feasibility. They may begin capitalization after a working prototype is established. The latter is assumed in this solution, although actual practice may differ somewhat.

In this situation, the primary questions that have to be answered are:

1. At what point in time was technical and financial feasibility established? This is the capitalization point for software costs. It may be the end of 20x6 (prototype), second quarter in 20x6, or another time designated and substantiated by management. 2. What costs were incurred before and after this point? 3. Do marketing studies indicate a strong market for the product, enough to justify capitalization? This question is really part of 1, but is critical in capitalization decisions and should be examined carefully. If markets are very risky because of alternative technology and competition, no costs can be capitalized. This solution assumes that market studies are positive. Projections must be prepared. Break even analysis would be useful. Classifications are based on assumptions, which have to be clarified before final decisions can be made. Preliminary suggestions: Design costs, $675,800. Expense; assumed prior to prototype. Engineering costs, $244,600. Expense; assumed prior to prototype. Software development costs, $397,500. Expense portion prior to prototype and capitalize costs subsequent to prototype. Market research costs, $68,900. Likely done before criteria are met so part of feasibility study, expense. Administration costs, $670,000. Expense. Interest on bank loans, $62,500. Expense; period cost. Legal costs to register patents and copyrights amounted to $82,200. Capitalize and amortize over life (economic or legal, whichever is shorter) of patent /copyright as long as future value is established. Manufacturing equipment, $450,000. Capitalize. Amortize for units of prototype produced in 20x6; amortization to be expensed. Machine need not be amortized until production begins as long as technological obsolescence is not a large factor in its ongoing utility.

Assignment 9-19 - removed

©2011 McGraw-Hill Ryerson Ltd. All rights reserved 9-36 Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition Assignment 9-20

Requirement 1

Internally developed intangible asset costs may be deferred if: (1) First, the intangible asset must be an identifiable intangible, which means that it is separable or able to be divided from an entity, or the asset must derive from contractual or legal rights, (2) Second, the recognition criteria are met: (a) the intangible asset must be controlled by the entity as a result of past transactions or events. (b) future economic benefits must flow from the intangible asset, for example, markets for the related product or the internal usefulness of the intangible asset must be clearly established, and (c) the cost must be reliably measurable.

Requirement 2

None of the expenditures meets the first test for capitalization, because promotion costs, training costs and severance payments do not create assets that are severable or related to contractual or legal rights. These amounts should be expensed as incurred. These types of costs are specifically not allowed to be capitalized as internally developed intangibles.

Assignment 9-21

2 January Trademark...... 16,000 Cash...... 16,000

31 January Promotion expense (or Advertising)...... 4,000 Cash...... 4,000

1 February Trademark (or separate Logo account)...... 8,000 Cash...... 8,000

1 May Investment in patent, long-term...... 20,400 Cash...... 20,400

1 October Prepaid license...... 18,000 Cash...... 18,000

1 November Goodwill...... 72,000 Cash...... 72,000

Other assets would also be part of this entry; only goodwill was requested.

© 2011 McGraw-Hill Ryerson Ltd. All rights reserved Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition 9-37 31 December Legal fees expense...... 10,000 Loss on write-down of patent...... 20,400 Cash...... 10,000 Investment in patent, long-term...... 20,400

Recognition of the loss assumes that the patent is, in fact, worthless; further investigation should be done to support this contention.

Assignment 9-22 Requirement 1

Depreciation expense 6/12 × ($430,000 – $60,000)/8...... 23,125 Accumulated depreciation ...... 23,125

Cash ($208,500 – $3,000) ...... 205,500 Accumulated depreciation* ...... 138,750* Loss on disposal of machine ...... 85,750 Machine ...... 430,000

*($430,000 – $60,000) ÷ 8 × (½ + 2 + ½) = $138,750 accumulated depreciation. $3,000 of disposal costs are netted with cash and thus included in the loss on disposal.

Requirement 2 Had the machine been worthless at disposal, the loss would be $291,250. In this case, the entire book value of the machine, $291,250 ($430,000 – $138,750), would be written off as a loss.

Requirement 3 The machine had an economic value equal to the cash received. Therefore, ESC’s economic position has not been affected, assuming an arm’s-length transaction (i.e., not a related party transaction or undue influence by the buyer over the seller.) Although ESC would rather have the cash than the machine and in that sense is “better off”, from a purely cash standpoint at the date of the transaction, there has been no change in ESC’s value as a firm. The loss is the difference between book value and market value of the machine at the date of disposal. The book value reflects depreciation based on fixed values: original cost, estimated residual value, and estimated useful life. These values were not changed. Yet market conditions apparently have changed since the date of purchase. Depreciation has been recorded at a rate which seriously understates the decline in value of the machine. However, depreciation is not meant to reflect the decline in value annually, just allocate costs over the asset’s life. The loss is in a sense a change in estimate and places the adjustment to the previous underestimations of depreciation into the year of disposal.

Requirement 4 The loss does not, in itself, affect cash flow. The loss is included in net income. On the CFS, the loss will be added back to net income in the operations section using the indirect method, or omitted using the direct method. The net cash received on the disposal is shown in the investing activities section of the CFS.

©2011 McGraw-Hill Ryerson Ltd. All rights reserved 9-38 Solutions Manual to accompany Intermediate Accounting, Volume 1, 5th edition Assignment 9-23

Requirement 1 a) Depreciation expense, 20x6 ...... 2,100 Accumulated depreciation ...... 2,100 ($48,000 - $6,000 = $42,000) / 10 years = $4,200; $4,200 x 6/12 = $2,100

Cash ...... 36,000 Accumulated depreciation* ...... 23,100 Gain on disposal of assets ...... 11,100 Equipment ...... 48,000 *($4,200 x 5 years = $21,000) + $2,100 = $23,100 b) Building wing ...... 350,000 Cash ...... 350,000 To record addition on building. c) Depreciation expense ...... 22,666 Accumulated depreciation, building ...... 22,666 To record depreciation on wing added [($350,000 - $10,000) ÷ 15 years = $22,666]*

*Assumes building wing is a separate component of building.