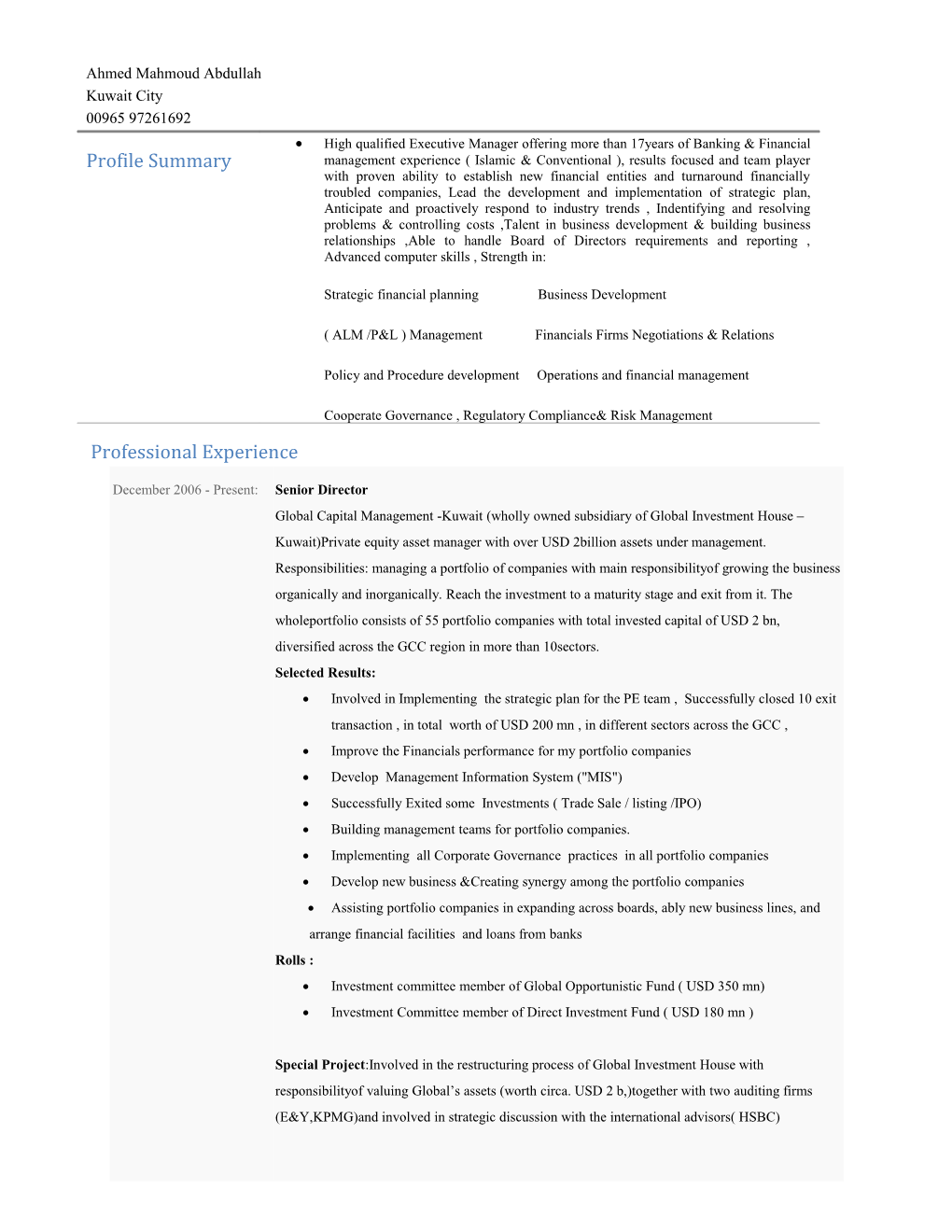

Ahmed Mahmoud Abdullah Kuwait City 00965 97261692 High qualified Executive Manager offering more than 17years of Banking & Financial Profile Summary management experience ( Islamic & Conventional ), results focused and team player with proven ability to establish new financial entities and turnaround financially troubled companies, Lead the development and implementation of strategic plan, Anticipate and proactively respond to industry trends , Indentifying and resolving problems & controlling costs ,Talent in business development & building business relationships ,Able to handle Board of Directors requirements and reporting , Advanced computer skills , Strength in:

Strategic financial planning Business Development

( ALM /P&L ) Management Financials Firms Negotiations & Relations

Policy and Procedure development Operations and financial management

Cooperate Governance , Regulatory Compliance& Risk Management Professional Experience

December 2006 - Present: Senior Director Global Capital Management -Kuwait (wholly owned subsidiary of Global Investment House – Kuwait)Private equity asset manager with over USD 2billion assets under management. Responsibilities: managing a portfolio of companies with main responsibilityof growing the business organically and inorganically. Reach the investment to a maturity stage and exit from it. The wholeportfolio consists of 55 portfolio companies with total invested capital of USD 2 bn, diversified across the GCC region in more than 10sectors. Selected Results: Involved in Implementing the strategic plan for the PE team , Successfully closed 10 exit transaction , in total worth of USD 200 mn , in different sectors across the GCC , Improve the Financials performance for my portfolio companies Develop Management Information System ("MIS") Successfully Exited some Investments ( Trade Sale / listing /IPO) Building management teams for portfolio companies. Implementing all Corporate Governance practices in all portfolio companies Develop new business &Creating synergy among the portfolio companies Assisting portfolio companies in expanding across boards, ably new business lines, and arrange financial facilities and loans from banks Rolls : Investment committee member of Global Opportunistic Fund ( USD 350 mn) Investment Committee member of Direct Investment Fund ( USD 180 mn )

Special Project:Involved in the restructuring process of Global Investment House with responsibilityof valuing Global’s assets (worth circa. USD 2 b,)together with two auditing firms (E&Y,KPMG)and involved in strategic discussion with the international advisors( HSBC) Board member in the following companies :

Emirates Retakaful Insurance company – Board Member since inception 2014 – Date

( Islamic Sharia Reinsurance / USD 120 mn paid up capital ) DIFC / Dubai / UAE , Heading the Investment & Finance committee , Risk management committee member ,

Al FajerRetakaful Insurance Company –Board Member since 2008 – Date

( Islamic Sharia reinsurance / KD 50 m paid up capital ) Kuwait - assisted in implementing investment policies. and Corporate Governance practices acting as investment committee member, the company witnessed a decent growth in the book of business , improved the combined ratio for its insurance portfolio , and recognized one of the major player in the Global Retakaful Sector.In 2014 the company moved the operation to DIFC under the name of Emirates Re,

Gulf Takaful Company – Board Member / since 2007- Date

(Islamic Sharia Insurance / KD 15 m paid up capital ) Kuwait – assisting in restructuring the company in terms of applying new polices , launching new products , restructuring their investment portfolio and expanding company’s operation among the MENA . Implementing investment policies. and Corporate Governance practices acting as investment committee member,

Elaj Group – Board Member / since 2010 – Date

( Healthcare / SAR 200 m paid in capital ) KSA – Investment committee member ,

Future Kid Entertainment- Board Member / since 2013 – date

( Kids Entertainment Zone centres / KD 10 m paid in capital ) Kuwait – Audit & Strategy committee member ,

KGL Logistic Company – Board Member –since 2007 – 2012

(Logistic / KD 20 Paid up capital) Kuwait – assisted the company to restructure their debts with local banks, involved in the IPO committee of the company (successful listing in KSE), resigned from the BOD after successful exit ( 20% absolute ROI )

United Towers Company – Board Member - since 2007 –2012

( Islamic Real Estate / KD 45 m paid up capital ) Kuwait – assisted the company to raise KD 40 m Islamic finance for the construction of one of the tallest towers in Kuwait ( UTC tower/ 62 floors )

Al Rayan Holding Company – Vice Chairman/ Board Member –since 2007 – 2009

(Islamic Education / KD 20m paid up capital) Kuwait- assisted the company to raise KD 5 m c Islamic finance to acquire more Schools , also launching a new financing program with coordination with local bank to finance tuition fees

Global Investment House , Egypt – Managing Director ( approved by Egyptian - CMA ) since 2007 – 2010

( Investment Banking / USD 20 m paid in capital ) Egypt – assisted in setting up the company, assisted in raising EGP 100 m for the PVD financing for the brokerage arm and sourcing 3 Investment Banking Mandates ( Oil& Gas , Banking & Real Estate ) .

May 2005 - December Section Head - Investment Banking 2006: Piraeus Bank - Egypt • Debt workouts and restructuring • Corporate Advisory for clients; M&A, Business sale, and Capital Raising • Finance projects; through debt issues primarily on the basis of cash flow • Va1uing equity investments using valuation methods • Managing multimillion loan syndications • Promoting investment opportunities in Egypt ( Privatization program) • Monitoring & Managing Long term portfolio amounting EGP 150 mm.

March 2001 - May 2005: Senior Investment & Banking Analyst Piraeus Bank - Egypt Business Development: • Assist the Managing Director to develop strategies and preparing the bank business plan. • Quartile monitoring of the bank performance relative to the banking sector • Following-up the directives of theBank’s Board of Directors.

: Special Projects: Project Manager : Banking development ( 2002-2004) From 2002 was part of a team consist of the bank’s MD , treasurer and head of consultant to develop the bank , during that project bank branches increased from 8 to 40 , implementation of a new IT system , and getting the approval from the regulator to conduct Investment Banking activities . Project Manager of establishing the Sudanese Egyptian Bank. ( 2005 ) Preparing the Feasibility study, visiting Sudan to conduct market study and opening contact channel with the central bank, developed all the necessary approvals, setting up systems, policies & procedures, and finally setting up first operating branch. The Capital increase & Takeover of ECB - Piraeus Bank Acquired 79.7% of the Egyptian Commercial Bank (2006) Involved and responsible in most of the tasks related to that project from preparing the Information Memorandum of the bank to participating in the Road Show spanning the GCC and Europe, the road show was very successful as the bank received around 12 letters of intent from different banking/investment entities, Prepared Data Room for the DD process, also acting as the due diligence process’smain coordinator.

July 1999 - March 2002: Senior Credit Officer Egyptian Commercial Bank •Responsible for managing and monitoring Credit portfolio of EGP 120 mm. •Responsible for preparing credit approval memorandum. •Perform market and business risk studies for various clients. •Ensure proper follow up all client related matters. •Preparing C.B.E. (Central Bank of Egypt) statistics. •Preparing risk module (Monthly /quarterly basis).

Education

May 2004: Egyptian Investment Management Association - EIMA, Cairo, Egypt Certification/diploma, Certified Portfolio Manager

September 2003: Arabic Academy for Financial and Banking Sciences, Cairo, Egypt Master's degree, Banking Sciences - Risk Management

June 1998: Faculty of Commerce, Cairo University, Cairo, Egypt Bachelor's degree/higher diploma, Accounting

Memberships

Organization Membership/Role Member Since

American Chamber of Commerce in Egypt Banking and Financial Committee August 2005