CHAPTER 16 Stockholders’ Equity: Retained Earnings

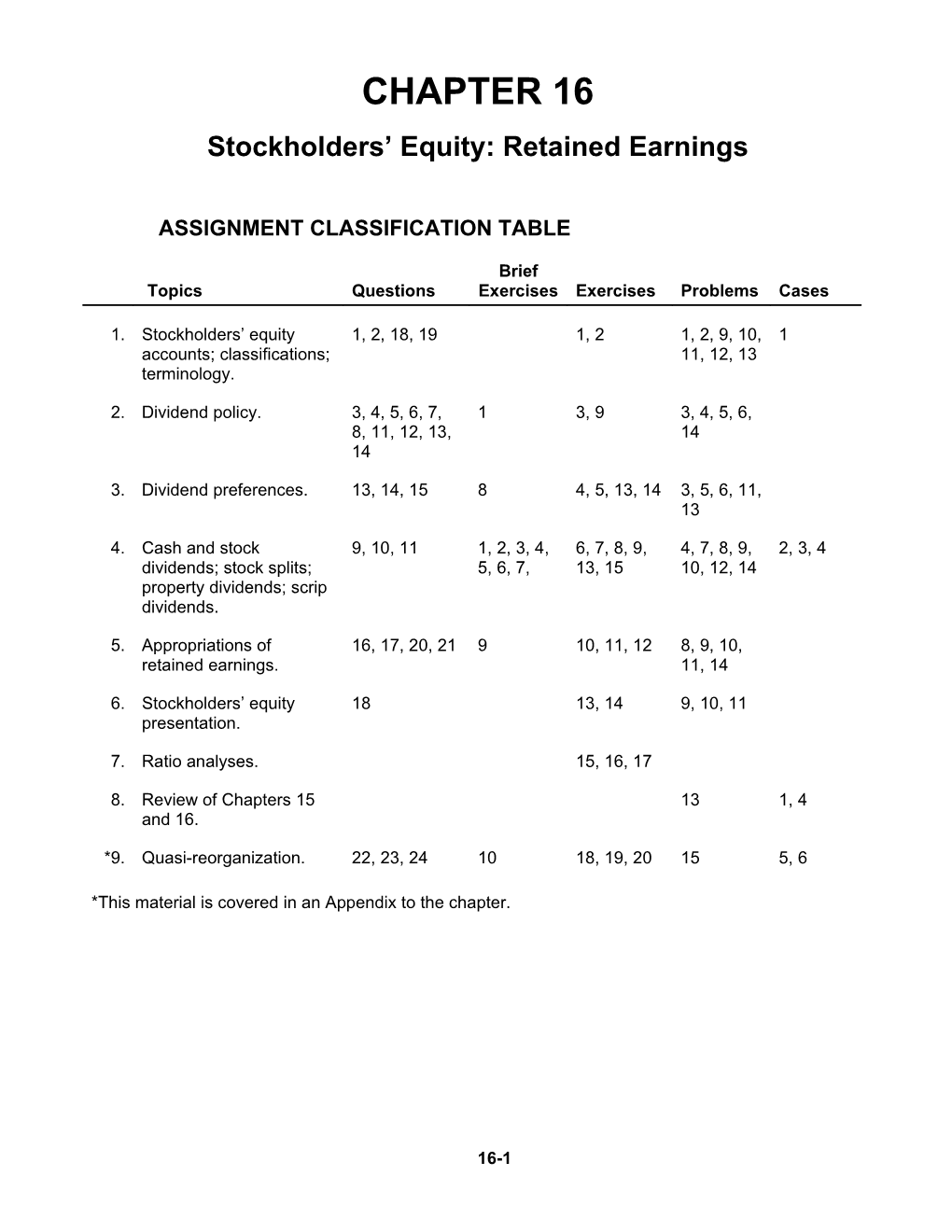

ASSIGNMENT CLASSIFICATION TABLE

Brief Topics Questions Exercises Exercises Problems Cases

1. Stockholders’ equity 1, 2, 18, 19 1, 2 1, 2, 9, 10, 1 accounts; classifications; 11, 12, 13 terminology.

2. Dividend policy. 3, 4, 5, 6, 7, 1 3, 9 3, 4, 5, 6, 8, 11, 12, 13, 14 14

3. Dividend preferences. 13, 14, 15 8 4, 5, 13, 14 3, 5, 6, 11, 13

4. Cash and stock 9, 10, 11 1, 2, 3, 4, 6, 7, 8, 9, 4, 7, 8, 9, 2, 3, 4 dividends; stock splits; 5, 6, 7, 13, 15 10, 12, 14 property dividends; scrip dividends.

5. Appropriations of 16, 17, 20, 21 9 10, 11, 12 8, 9, 10, retained earnings. 11, 14

6. Stockholders’ equity 18 13, 14 9, 10, 11 presentation.

7. Ratio analyses. 15, 16, 17

8. Review of Chapters 15 13 1, 4 and 16.

*9. Quasi-reorganization. 22, 23, 24 10 18, 19, 20 15 5, 6

*This material is covered in an Appendix to the chapter.

16-1 ASSIGNMENT CHARACTERISTICS TABLE

16-2 Level Time It Description of (minu e Diffic tes) m ulty

Equity items on the balance sheet. Simpl 15-20 E e 16 -1

Classification of equity items. Simpl 05-10 E e 16 -2

Cash dividend and liquidating dividend. Simpl 10-15 E e 16 -3

Preferred dividends. Simpl 10-15 E e 16 -4

Preferred dividends. Moder 10-15 E ate 16 -5

Stock split and stock dividend. Simpl 10-15 E e 16 -6

Stock dividends. Simpl 15-20 E e 16 -7

Entries for stock dividends and stock splits. Simpl 10-12 E e 16 -8

Dividend entries. Simpl 10-15 E e 16 -9

Computation of retained earnings. Simpl 05-10 E e 16 - 10

Retained earnings appropriations and disclosures. Moder 20-25 E ate 16 - 11

Stockholders’ equity section. Moder 20-25

16-3 E ate 16 - 12

Participating preferred, stock dividend, and Moder 20-30 E treasury stock retirement. ate 16 - 13

Dividends and stockholders’ equity section. Moder 30-35 E ate 16 - 14

Comparison of alternative forms of financing. Moder 20-25 E ate 16 - 15

Trading on the equity analysis. Moder 15-20 E ate 16 - 16

Computation of book value per share. Simpl 20-25 E e 16 - 17 *E Quasi-reorganization. Simpl 10-15 16 e - 18 *E Quasi-reorganization. Moder 15-20 16 ate - 19 *E Quasi-reorganization. Moder 20-25 16 ate - 20

Correction of equity items. Moder 20-30 P ate 16 -1

Equity shortage and treasury stock settlement. Moder 15-20 P ate 16 -2

Preferred stock dividends. Moder 30-40 P ate

16-4 16 -3

Stock dividend involving exchangeable shares and Compl 30-35 P cash in lieu of fractional shares. ex 16 -4

Cash dividend entries. 15-20 P Moder 16 ate -5

Preferred stock dividends. Moder 20-25 P ate 16 -6

Dividends and splits. Moder 30-35 P ate 16 -7

Entries for stockholders’ equity transactions. Moder 20-30 P ate 16 -8

Equity entries and retained earnings statement. Moder 25-35 P ate 16 -9

Equity entries and balance sheet presentation. Simpl 30-40 P e 16 - 10

Stockholders’ equity section of balance sheet. Simpl 20-25 P e 16 - 11

Stock and cash dividends. Simpl 25-35 P e 16 - 12

Analysis and classification of equity transactions. Compl 35-45 P ex 16 - 13

Memo on stock dividends and stock splits. Moder 25-30 P ate 16 - 14

16-5 Conceptual issues—equity. Moder 25-30 C ate 16 -1

Stock dividends and splits. Simpl 25-30 C e 16 -2

Stock dividends. Simpl 15-20 C e 16 -3

Stock dividend, cash dividend, and treasury stock. Moder 20-25 C ate 16 -4 *C Quasi-reorganization. Moder 20-30 16 ate -5 *C Quasi-reorganization. Moder 10-20 16 ate -6

*This material is presented in an appendix to the chapter. ANSWERS TO QUESTIONS

1. Contributed capital is gross capital paid in by investing stockholders. Contributed capital generally consists of capital stock and additional paid-in capital. Earned capital results from undistributed earnings and gains less losses. Equity capital is total net worth or total stock- holders’ equity.

2. Normally, retained earnings is decreased by (1) net losses, (2) prior period adjustments, (3) cash dividends, and (4) stock dividends, and increased by (1) net income, and (2) prior period adjustments. Retained earnings may also be affected by treasury stock transactions, quasi- reorganizations, and business combinations.

3. The dividend policy of a company is influenced by (1) the availability of cash, (2) the stability of earnings, (3) current earnings, (4) prospective earnings, (5) the existence or absence of contractual restrictions on working capital or retained earnings, and (6) a retained earnings balance.

4. Currently, the character of the legality of dividend payments, that is, the legal restrictions on distributions to corporate owners, for the 50 states may be divided into three groups. The largest group, operates under the 1950 Model Business Corporation Act which permits distributions to stockholders so long as the corporation is not insolvent. Insolvency is defined as the inability to pay debts as they come due in the normal course of business. Generally, in these states distri- bution in the form of dividends has to come from retained earnings or from current earnings.

A second group either follow the 1984 Revised Model Business Corporation Act or have distribution restrictions similar to it; i.e., (1) the corporation must be solvent and (2) distributions

16-6 must not exceed the fair value of net assets. Under the latter criterion, distributions are not limited to retained earnings or GAAP determined current earnings. Instead of being tied to the book value of the assets, distributions are linked to the fair (appraised) value of the assets— notable new criterion.

The remaining states use a variety of hybrid restrictions that consist of solvency and balance sheet tests of liquidity and risk. To avoid illegally distributing corporate assets to stockholders, the relevant state corporation act should be examined and legal advice obtained.

5. Earnings may be retained in the business for the following reasons: 1. Agreements with specific creditors to retain all or a portion of the earnings in the form of assets to build up additional protection against possible loss for those creditors. 2. Requirements of state corporation laws requiring that earnings equivalent to the cost of treasury shares purchased be restricted against dividend declarations. 3. Desire for use of the assets represented by retained earnings in the operations of the business. This is sometimes called internal financing, reinvesting earnings, or “plowing” the profits back into the business. 4. Desire to smooth out dividend payments from year to year by accumulating earnings in good years and using such accumulated earnings as a basis for dividends in bad years. 5. Desire to build up a cushion or buffer against possible losses or errors in the calculation of profits.

16-7 Questions Chapter 16 (Continued)

6. In declaring a dividend, the board of directors must consider the condition of the corporation such that a dividend is (1) legally permissible and (2) economically sound.

In general, directors should give consideration to the following factors in determining the legality of a dividend declaration: 1. Retained earnings, unless legally encumbered in some manner, is usually the correct basis for dividend distribution. 2. Revaluation capital is seldom the correct basis for dividends (except possibly stock dividends). 3. In some states, additional paid-in capital may be used for dividends, although such dividends may be limited to preferred stock. 4. Deficits in retained earnings and debits in paid-in capital accounts must be restored before payment of any dividends. 5. Dividends in some states may not reduce retained earnings below the cost of treasury stock held.

In order that dividends be economically sound, the board of directors should consider: (1) the availability (liquidity) of assets for distribution; (2) agreements with creditors; (3) the effect of a dividend on investor perceptions (e.g. maintaining an expected “pay-out ratio”); and (4) the size of the dividend with respect to the possibility of paying dividends in future bad years. In addition, the ability to expand or replace existing facilities should be considered.

7. Some companies in certain industries are paying dividends that exceed their profits (net income) as adjusted for changes in specific price levels relevant to that industry. When the effects of inflation are considered and the current cost of the company’s assets (that is, the cost to replace those assets) is used as a basis for measuring net income, it is usually lower than historical cost (unadjusted for inflation) net income. On a capital maintenance basis of income measurement, a company may not be keeping up. Thus, the payment of dividends represents a distribution of capital rather than a distribution of current earnings only.

8. Dividends, at least cash dividends, are paid out of working capital. A balance must exist in retained earnings to permit a legal distribution of profits, but having a balance in retained earnings does not ensure the ability to pay a dividend if the cash situation does not permit it.

9. A cash dividend is a distribution in cash while a property dividend is a distribution in assets other than cash. A scrip dividend is a note payable evidencing a promise to pay a dividend at a future date. Any dividend not based on retained earnings is a liquidating dividend. A stock dividend is the issuance of additional shares of the corporation’s stock in a nonreciprocal exchange involving existing stockholders with no change in the par or stated value.

10. A stock dividend results in the transfer from retained earnings to paid-in capital of an amount equal to the market value of each share (if the dividend is less than 20-25%) or the par value of each share (if the dividend is greater than 20-25%). No formal journal entries are required for a stock split, but a notation in the ledger accounts would be appropriate to show that the par value of the shares has changed.

11. (a) A stock split effected in the form of a dividend is a distribution of corporate stock to present stockholders in proportion to each stockholder’s current holdings and can be expected to

16-8 Questions Chapter 16 (Continued)

cause a material decrease in the market value per share of the stock. Accounting Research Bulletin No. 43 specifies that a distribution in excess of 20% to 25% of the number of shares previously outstanding would cause a material decrease in the market value. This is a characteristic of a stock split as opposed to a stock dividend, but, for legal reasons, the term “dividend” must be used for this distribution. From an accounting viewpoint, it should be disclosed as a stock split effected in the form of a dividend because it meets the accounting definition of a stock split as explained above.

(b) The stock split effected in the form of a dividend differs from an ordinary stock dividend in the amount of other paid-in capital or retained earnings to be capitalized. An ordinary stock dividend involves capitalizing (charging) retained earnings equal to the market value of the stock distributed. A stock split effected in the form of a dividend involves no charge to retain- ed earnings or other paid-in capital if the par (stated) value of the stock is reduced in inverse proportion to the distribution. If the stock’s par (stated) value is not reduced in inverse proportion to the distribution of stock, other paid-in capital or retained earnings would be charged for the par (stated) value of the additional shares issued.

Another distinction between a stock dividend and a stock split is that a stock dividend usually involves distributing additional shares of the same class of stock with the same par or stated value. A stock split usually involves distributing additional shares of the same class of stock but with a proportionate reduction in par or stated value. The aggregate par or stated value would then be the same before and after the stock split.

(c) A declared but unissued stock dividend should be classified as part of corporate capital rather than as a liability in a statement of financial position. A stock dividend affects only capital accounts; that is, retained earnings is decreased and contributed capital is increased. Thus, there is no debt to be paid, and, consequently, there is no severance of corporate assets when a stock dividend is issued. Furthermore, stock dividends declared can be revoked by a corporation’s board of directors any time prior to issuance. Finally, the corporation usually will formally announce its intent to issue a specific number of additional shares, and these shares must be reserved for this purpose.

12. A partially liquidating dividend will be debited both to Retained Earnings and Additional Paid-in Capital. The portion of dividends that is a return of capital should be debited to Additional Paid-in Capital.

13. A property dividend is a nonreciprocal transfer of nonmonetary assets between an enterprise and its owners. A transfer of a nonmonetary asset to a stockholder or to another entity in a non- reciprocal transfer should be recorded at the fair value of the asset transferred, and a gain or loss should be recognized on the disposition of the asset.

14. (a) A retained earnings balance may be reduced by a distribution of assets to the stockholders (a dividend) or left intact and the offsetting assets used in the operations of the business. This second alternative appears to be Thomas Dewey Corporation’s policy. Among the possible reasons for such a policy are: 1. Thomas Dewey may have an agreement with specific creditors to retain a portion of the earnings in the form of assets to build up additional protection for those creditors.

16-9 Questions Chapter 16 (Continued)

2. Thomas Dewey may have purchased treasury stock; in some states, corporations are required to restrict earnings equivalent to the cost of treasury shares purchased. 3. Thomas Dewey may desire to retain the assets in the business, rather than pay them out as dividends, to finance growth or expansion. 4. Thomas Dewey may desire to build up a cushion against possible losses or errors in the calculation of profits.

(b) If management wishes to capitalize part of its earnings (reclassify amounts from earned to contributed capital) and thus retain earnings in the business on a permanent basis, it may issue a stock dividend. In a stock dividend, no assets are distributed, but either the fair value of the stock issued (for a small stock dividend) or the par value of the stock issued (for a large stock dividend) is transferred from retained earnings to common stock and additional paid-in capital. Therefore, while paid-in capital accounts increase, retained earnings decreases.

Another option available to Thomas Dewey is a retained earnings appropriation. Such an ap- propriation is a reclassification of retained earnings. When an appropriation is recorded, the company reports two classifications of retained earnings: unappropriated and appropriated. In effect, part of the retained earnings is labeled as being unavailable for dividend distribution for a specific reason such as the existence of contingencies or plant expansion. Although the appropriation is legally available for dividends, the stockholders are being informed that the amount appropriated will not be considered by the directors as being available for dividends. Therefore, the amount of retained earnings apparently available for dividend distribution is reduced.

15. (a) $5.50 = ($25 X [$88,000/($100,000 + ($25 X 12,000))]). (b) $29,500 = (10% X $100,000) + [$100,000 X (($88,000 – $10,000)/$400,000)]. (c) $15,000 = [$30,000 – (10% X $100,000 X 2 – $5,000)].

16. Retained earnings are appropriated because of (a) legal restrictions, (b) contractual restrictions, (c) the existence of a possible or expected loss, or (d) the necessity to protect the working capital position.

17. Appropriations of retained earnings are created upon board approval by transferring an amount from retained earnings to a “retained earnings appropriated for” account and are written off by transferring the appropriated amount back to retained earnings.

18. The accounting profession has suggested discontinuance of the term “surplus” in financial statements. Substitute terminology is recommended for surplus because the term “surplus” connotes a residue or “something not needed.” “Capital in excess of par (or stated value)” or “additional paid-in capital” should be used instead of the term “paid-in surplus.” “Retained earnings” should be used instead of “earned surplus.”

19. The use of the term “reserve” to describe such items as accumulated depreciation, allowances for uncollectible receivables, or current liabilities is not acceptable. The use of “reserve,” if the word is used at all, should be confined to appropriations of retained earnings.

20. Retained earnings may be restricted by bond indentures, operation of state law when treasury stock is purchased, or contractual agreements with creditors.

16-10 Questions Chapter 16 (Continued)

21. No. The sinking fund reserve is an appropriation of retained earnings. It is not a charge to expense. In arriving at net income an expense for depreciation should have been deducted. On the other hand, sinking fund reserve charges are made against retained earnings.

*22. A quasi-reorganization consists of the following steps: 1. All assets are revalued at appropriate current values so the company will not be burdened with excessive inventory or fixed asset valuations in following years. Any loss, or possibly gain, on revaluation of course increases, or decreases, the deficit. 2. Paid-in or other types of capital must be available or must be created, and it must be at least equal in amount to the deficit. If no such capital exists, it is created through donation of stock to the corporation by stockholders, by reduction of the par value of shares outstanding, or by some similar means. 3. The deficit is then charged against the paid-in capital and so eliminated.

*23. After a company has operated at a loss for several years and accumulated a deficit, it may attain a position that gives promise of successful operation in the future. To overcome the burden and disadvantages associated with a large deficit, such a company is permitted by some state laws to eliminate the deficit and proceed on much the same basis as if it had been legally reorganized.

*24. In subsequent balance sheets the retained earnings must be “dated” (1) for a period of approx- imately 10 years to show the fact and the date of the quasi-reorganization, and (2) for a period of at least three years from the quasi-reorganization date, the amount of accumulated deficit eliminated should be disclosed on the face of the balance sheet.

16-11 SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 16-1

Aug. 1 Retained Earnings...... 3,000,000 Dividends Payable...... 3,000,000

Aug. 15 No entry.

Sep. 9 Dividends Payable...... 3,000,000 Cash...... 3,000,000

BRIEF EXERCISE 16-2

Sep. 21 Available-for-Sale Securities...... 525,000 Gain on Appreciation of Securities...... 525,000

Retained Earnings...... 1,400,000 Property Dividends Payable...... 1,400,000

Oct. 8 No entry.

Oct. 23 Property Dividends Payable...... 1,400,000 Available-for-Sale Securities...... 1,400,000

BRIEF EXERCISE 16-3

Jan. 30 Retained Earnings...... 300,000 Notes Payable to Stockholders...... 300,000 (100,000 X $3.00)

Oct. 31 Notes Payable to Stockholders...... 300,000 Interest Expense...... 27,000 Cash...... 327,000 ($300,000 X 12% X 9/12 = $27,000)

16-12 BRIEF EXERCISE 16-4

Apr. 20 Retained Earnings...... 575,000 Paid-in Capital in Excess of Par...... 125,000 Dividends Payable...... 700,000

June 1 Dividends Payable...... 700,000 Cash...... 700,000

BRIEF EXERCISE 16-5

Declaration Date. Retained Earnings...... 650,000 Common Stock Dividend Distributable...... 100,000 Paid-in Capital in Excess of Par...... 550,000 (10,000 X $65 = $650,000; (10,000 X $10 = $100,000)

Distribution Date. Common Stock Dividend Distributable...... 100,000 Common Stock...... 100,000

BRIEF EXERCISE 16-6

Declaration Date. Retained Earnings...... 2,000,000 Common Stock Dividend Distributable...... 2,000,000 (200,000 X $10)

Distribution Date. Common Stock Dividend Distributable...... 2,000,000 Common Stock...... 2,000,000

BRIEF EXERCISE 16-7

(a) 900,000 (300,000 X 3) (b) $5 ($15 X 1/3) (c) $4,500,000 (900,000 X $5) (d) No entry.

16-13 BRIEF EXERCISE 16-8

(a) Preferred Common Current year (8% X $1,000,000) $80,000 Remainder ______$220,000 $80,000 $220,000

(b) Preferred Common Current year (8% X $1,000,000) $ 80,000 Arrears (2 X $80,000) 160,000 Remainder ______$60,000 $240,000 $60,000

BRIEF EXERCISE 16-9

(a) Retained Earnings...... 800,000 Retained Earnings Appropriated for Legal Contingencies...... 800,000

(b) Retained Earnings Appropriated for Legal Contingencies..... $ 800,000 Unappropriated...... 1,300,000 Total...... $2,100,000

BRIEF EXERCISE 16-10

Retained Earnings...... 125,000 Plant Assets...... 125,000

Common Stock...... 400,000 Paid-in Capital in Excess of Par...... 400,000

Paid-in Capital in Excess of Par...... 375,000 Retained Earnings...... 375,000

16-14 SOLUTIONS TO EXERCISES

EXERCISE 16-1 (15-20 minutes)

Stockholders’ Paid-in Retained Net Item Assets Liabilities Equity Capital Earnings Income 1. I NE I NE I I 2. NE I D NE D NE 3. NE NE NE NE NE NE 4. NE NE NE NE NE NE 5. D NE D NE D D 6. D D NE NE NE NE 7. NE I D NE D D 8. I NE I NE I I 9. NE I D NE D NE 10. D D NE NE NE NE 11. NE NE NE I D NE 12. NE NE NE NE NE NE

EXERCISE 16-2 (5-10 minutes)

1. C Net income 2. D Dividends payable 3. A Stock split 4. C Property dividends declared 5. A Preferred stock 6. A Common stock subscribed 7. C Retained earnings appropriated 8. D (Asset) Sinking fund 9. B Paid-in capital in excess of par—common

16-15 EXERCISE 16-3 (10-15 minutes)

(a) 6/1 Retained Earnings...... 8,000,000 Dividends Payable...... 8,000,000

6/14 No entry on date of record.

6/30 Dividends Payable...... 8,000,000 Cash...... 8,000,000

(b) If this were a liquidating dividend, the debit entry on the date of declaration would be to Paid-in Capital rather than Retained Earnings.

(c) One may observe that paying a dividend to the corporation is rather circular. It does raise some potential for misdirection. However, this scenario would simplify the routine cash disbursement to the registrar which acts as the dividend disbursing agent. The dividend is not income, rather it is a correction.

Cash...... 240,000 Retained Earnings...... 240,000

EXERCISE 16-4 (10-15 minutes)

Preferred Common Total (a) Preferred stock is non-cumulative, non-participating $16,000 $74,000 $90,000

(b) Preferred stock is cumulative, non-participating $48,000 $42,000 $90,000

16-16 EXERCISE 16-4 (Continued)

(c) Preferred stock is cumulative, participating $57,778 $32,222 $90,000*

*Dividends in arrears $32,000 $32,000 Current dividend 16,000 16,000 Pro rata share to common ($250,000 X 8%) $20,000 20,000 Balance dividend pro rata 20/45 X $22,000** 9,778 9,778 25/45 X $22,000** ______12,222 12,222 $57,778 $32,222 $90,000 **4.89% of par value.

EXERCISE 16-5 (10-15 minutes)

Preferred Common Total (a) One year in arrears $14,000 $ 14,000 Current year 14,000 $210,000 224,000 Participating (4%) 8,000 120,000 128,000 $366,000 - $238,000 $36,000 $330,000 $366,000 4% $3,200,000

(b) $14,000 $352,000 $366,000

(c) Current year $14,000 $210,000 $224,000 Additional 3% to common 90,000 90,000 Participating (1.625%) 3,250 48,750 52,000 $366,000 - $314,000 $17,250 $348,750 $366,000 1.625% $3,200,000

EXERCISE 16-6 (10-15 minutes)

(a) No entry—simply a memorandum indicating the number of shares has increased to 18 million and par has been reduced from $10 to $5 per share.

16-17 EXERCISE 16-6 (Continued)

(b) Retained Earnings...... 90,000,000 Stock Dividend Distributable...... 90,000,000

Stock Dividend Distributable...... 90,000,000 Common Stock...... 90,000,000

(c) Stock dividends and splits serve the same function with regard to the securities markets. Both techniques allow the board of directors to increase the quantity of shares and channel share prices into the “popular trading range.”

For accounting purposes the 20%-25% rule reasonably views large stock dividends as substantive stock splits. It is necessary to capitalize par value with a stock dividend because the number of shares is increased and the par value remains the same. Earnings are capitalized for purely procedural reasons.

EXERCISE 16-7 (15-20 minutes)

(a) Retained Earnings ($40 X 10% X 5,000,000)...... 20,000,000 Stock Dividend Distributable...... 500,000 Paid-in Capital in Excess of Par...... 19,500,000

Stock Dividend Distributable...... 500,000 Common Stock...... 500,000

(b) Retained Earnings...... 2,500,000 Stock Dividend Distributable...... 2,500,000

Stock Dividend Distributable...... 2,500,000 Common Stock...... 2,500,000

16-18 EXERCISE 16-7 (Continued)

(c) Stock dividends on treasury stock can be viewed as a purposeless act since the firm could simply issue previously unissued stock with a rather routine vote of the board of directors. However, corporations acquire treasury stock to have shares available for sale or other use which do not have to go through the registration process. By issuing stock dividends on treasury stock the proportion of the treasury stock to issued stock is retained. The possible need to register new shares is reduced.

(d) None. Stock dividends are simply a form of restructuring the common equity. Retained earnings are transferred to the Stock and Paid-in Capital accounts. The total book equity does not change.

EXERCISE 16-8 (10-12 minutes)

(a) Retained Earnings (15,000 X $37)...... 555,000 Common Stock Dividend Distributable...... 150,000 Paid-in Capital in Excess of Par...... 405,000

Common Stock Dividend Distributable.... 150,000 Common Stock...... 150,000

(b) Retained Earnings (300,000 X $10)...... 3,000,000 Common Stock Dividend Distributable...... 3,000,000

Common Stock Dividend Distributable.... 3,000,000 Common Stock...... 3,000,000

(c) No entry, the par becomes $5.00 and the number of shares outstand- ing increases to 600,000.

16-19 EXERCISE 16-9 (10-15 minutes)

(a) Retained Earnings...... 97,500 Common Stock Dividend Distributable...... 25,000 Paid-in Capital in Excess of Par...... 72,500 (50,000 shares X 5% X $39 = $97,500)

Common Stock Dividend Distributable...... 25,000 Common Stock...... 25,000

(b) Retained Earnings...... 80,000 Notes Payable to Stockholders...... 80,000

(c) No entry, memorandum note to indicate that par value is reduced to $2 and shares outstanding are now 250,000 (50,000 X 5).

(d) January 5, 2002 Investments (Bonds)...... 35,000 Gain on Appreciation of Investments (Bonds)...... 35,000

Retained Earnings...... 135,000 Property Dividends Payable...... 135,000

January 25, 2002 Property Dividends Payable...... 135,000 Investments (Bonds)...... 135,000

EXERCISE 16-10 (5-10 minutes)

Total income since corporation $317,000 Less: Total cash dividends paid $60,000 Total value of stock dividends 30,000 90,000 Current balance of retained earnings 227,000 Less: Appropriation for plant extension 70,000 Current balance of unappropriated retained earnings $157,000

16-20 EXERCISE 16-11 (20-25 minutes)

(a) Retained Earnings 125,000 Retained Earnings Appropriated for Contingencies 125,000

(b) Duke Ellington Inc. Retained Earnings Statement For the Year Ended 12/31/01 January 1 unappropriated balance $320,000 Add: Net income 235,000 555,000 Deduct: Cash dividend on preferred $ 50,000 Cash dividend on common 70,000 Stock dividend on common 88,000 Appropriation for contingencies 125,000 333,000 December 31, unappropriated balance $222,000

(c) Duke Ellington Inc. Retained Earnings Section of Balance Sheet 12/31/01 Retained earnings Appropriated for contingencies $125,000 Unappropriated 222,000 Total $347,000

(d) Loss on Lawsuit 113,000 Lawsuit Liability 113,000

Retained Earnings Appropriated for Contingencies 125,000 Retained Earnings 125,000

16-21 EXERCISE 16-11 (Continued)

(e) Note 1. The company is a defendant in a lawsuit at 12/31/01. While a loss on this lawsuit is not probable and has not yet been recorded, the Company at its discretion has restricted retained earnings in the amount of $125,000. This amount of retained earnings is unavailable for dividends at 12/31/01.

EXERCISE 16-12 (20-25 minutes)

Bruno Corporation Stockholders’ Equity December 31, 2001 Capital stock Preferred stock, $4 cumulative, par value $50 per share; authorized 60,000 shares, issued and outstanding 10,000 shares $ 500,000 Common stock, par value $1 per share; authorized 600,000 shares, issued 200,000 shares, and outstanding 190,000 shares 200,000 Total capital stock 700,000 Additional paid-in capital— In excess of par value 1,300,000 From sale of treasury stock 160,000 Total paid-in capital 2,160,000 Retained earnings 301,000 Total paid-in capital and retained earnings 2,461,000 Less treasury stock, 10,000 shares at cost 170,000 Total stockholders’ equity $2,291,000

EXERCISE 16-13 (20-30 minutes)

(a) Preferred Common Total Dividends in arrears (1) $180,000 $180,000 Current year dividend (2) 90,000 $247,500 337,500 Participating dividend (3) 37,500 82,500 120,000 Total $307,500 $330,000 $637,500

(1) Dividends in arrears: $750,000 X 12% X 2 = $180,000

16-22 EXERCISE 16-13 (Continued)

(2) Current year dividend: Preferred: $750,000 X 12% = $90,000

Common: Issued $1,800,000 Treasury (7,500 X $20) 150,000 Outstanding (at par) 1,650,000 X 15% $ 247,500

(3) Participating dividend: Preferred Common Par value outstanding $750,000 $1,650,000 Participating rate Common rate $4 $20 = 20% Limit before participation 15% 5% X 5% X 5% $ 37,500 $ 82,500

(b) Retained Earnings (12,375 X $103)...... 1,274,625 Common Stock Dividends Distributable (12,375 X $20)...... 247,500 Paid-in Capital in Excess of Par...... 1,027,125 (12,375 X $83) (82,500 X 15% = 12,375 shares)

(c) Common Stock (7,500 X $20)...... 150,000 Paid-in Capital in Excess of Par (7,500 X $35)...... 262,500 Retained Earnings...... 330,000 Treasury Stock...... 742,500

16-23 EXERCISE 16-14 (30-35 minutes)

(a) 1. Dividends Payable—Preferred (2,000 X $10)...... 20,000 Dividends Payable—Common (20,000 X $2)...... 40,000 Cash...... 60,000

2. Treasury Stock...... 68,000 Cash (1,700 X $40)...... 68,000

3. Land ...... 30,000 Treasury Stock (700 X $40)...... 28,000 Paid-in Capital From Treasury Stock.... 2,000

4. Cash (500 X $105)...... 52,500 Preferred Stock (500 X $100)...... 50,000 Paid-in Capital in Excess of Par— Preferred...... 2,500

5. Retained Earnings (1,900 X $45)...... 85,500 Common Stock Dividend Distributable (1,900 X $5)...... 9,500 Paid-in Capital in Excess of Par— Common...... 76,000

6. Common Stock Dividend Distributable...... 9,500 Common Stock...... 9,500

7. Retained Earnings...... 66,800 Dividends Payable—Preferred (2,500 X $10)...... 25,000 Dividends Payable—Common (20,900 X $2)...... 41,800

8. Retained Earnings...... 200,000 Retained Earnings Appropriated for Plant Expansion...... 200,000

16-24 EXERCISE 16-14 (Continued)

(b) Anne Cleves Company Stockholders’ Equity—12/31/01 Capital stock Preferred stock, 10%, $100 par, 10,000 shares authorized, 2,500 shares issued and outstanding $ 250,000 Common stock, $5 par, 100,000 shares authorized, 21,900 shares issued, 20,900 shares outstanding 109,500 Total capital stock 359,500 Additional paid-in capital 205,500 Total paid-in capital 565,000 Retained earnings Appropriated for plant expansion $200,000 Unappropriated 427,700 627,700 Total paid-in capital and retained earnings 1,192,700 Less cost of treasury stock (1,000 shares common) 40,000 Total stockholders’ equity $1,152,700

Computations: Preferred stock $200,000 + $50,000 = $250,000 Common stock $100,000 + $ 9,500 = $109,500 Additional paid-in capital: $125,000 + $2,000 + $2,500 + $76,000 = $205,500

Unappropriated retained earnings: $450,000 – $85,500 – $66,800 – $200,000 + $330,000 = $427,700

Treasury stock $68,000 – $28,000 = $40,000

16-25 EXERCISE 16-15 (20-25 minutes)

(a) Mary Ann Benson Company is the more profitable in terms of rate of return on total assets. This may be shown as follows:

$660,000 Benson Company = 15.71% $4,200,000

$594,000 Kingston Company = 14.14% $4,200,000

It should be noted that these returns are based on net income re- lated to total assets, where the ending amount of total assets is con- sidered representative. If the rate of return on total assets uses net income before interest but after taxes in the numerator, the rates of return on total assets are the same as shown below:

$660,000 Benson Company = 15.71% $4,200,000

$594,000 + $120,000 – $54,000 $660,000 Kingston Company = $4,200,000 $4,200,000 = 15.71%

(b) Kingston Company is the more profitable in terms of return on stockholder’ equity. This may be shown as follows:

$594,000 Kingston Company = 22% $2,700,000

$660,000 Benson Company = 18.33% $3,600,000

(Note to instructor: To explain why the difference in rate of return on assets and rate of return on stockholders’ equity occurs, the following schedule might be provided to the student.)

16-26 EXERCISE 16-15 (Continued)

Kingston Company Rate of Return Accruing to Funds on Funds at Cost of Common Fund Supplies Supplied 15.71%* Funds Stock Current liabilities $ 300,000 $ 47,130 $ 0 $ 47,130 Long-term debt 1,200,000 188,520 66,000 ** 122,520 Common stock 2,000,000 314,200 0 314,200 Retained earnings 700,000 109,970 0 109,970 $4,200,000 $659,820 $66,000 $593,820 *Determined in part (a), 15.71% **The cost of funds is the interest of $120,000 (1,200,000 X 10%). This interest cost must be reduced by the tax savings (45%) related to the interest.

The schedule indicates that the income earned on the total assets (before interest cost) was $659,820. The interest cost (net of tax) of this income was $66,000, which indicates a net return to the common equity of $593,820.

(c) The Kingston Company earned a net income per share of $5.94 ($594,000 100,000) while the Benson Company had an income per share of $4.55 ($660,000 145,000). The Kingston Company has borrowed a substantial portion of its assets at a cost of 10% and has used these assets to earn a return in excess of 10%. The excess earned on the borrowed assets represents additional income for the stockholders and has resulted in the higher income per share. Due to the debt financing, Kingston has fewer shares of stock outstanding.

(d) Yes, from the point of view of income it is advantageous for the stockholders of the Kingston Company to have long-term debt outstanding. The assets obtained from incurrence of this debt are earning a higher return than their cost to the Kingston Company.

(e) Price earnings ratio. $101 Kingston Company = 17 times earnings. $5.94

16-27 EXERCISE 16-15 (Continued)

$63.50 Benson Company = 14 times earnings. $4.55

(f) Book value per share.

$2,000,000 + $700,000 Kingston Company = $27. 100,000

$2,900,000 + $700,000 Benson Company = $24.83. 145,000

EXERCISE 16-16 (15 minutes)

Rate of return on common stock equity:

$213,718 $213,718 = = 17.1% $875,000 + $75,000 + $300,000 $1,250,000

$135,000 Rate of interest paid on bonds payable: = 13.5% $1,000,000

Emporia Plastics, Inc. is trading on the equity successfully.

EXERCISE 16-17 (20-25 minutes)

(a) Common Preferred Stockholders’ equity Preferred stock $500,000 Common stock $ 750,000 Retained earnings Dividends in arrears (3 years at 8%) 120,000 Remainder to common* 380,000 ______$1,130,000 $620,000

Shares outstanding 750,000 Book value per share $1.51

16-28 EXERCISE 16-17 (Continued)

*Balance in retained earnings ($800,000 – $40,000 – $260,000) $500,000 Less dividends to preferred (120,000) Available to common $380,000

(b) Stockholders’ equity Preferred stock $500,000 Liquidating premium 30,000 Common stock $ 750,000 Retained earnings Dividends in arrears (3 years at 8%) $120,000 Remainder to common* 350,000 ______$1,100,000 $650,000

Shares outstanding 750,000 Book value per share $1.47

*Balance in retained earnings (800,000 – $40,000 – $260,000) $500,000 Less: Liquidating premium to preferred (30,000) Dividends to preferred (120,000) Available to common $350,000

*EXERCISE 16-18 (10-15 minutes)

Common Stock...... 300,000 Paid-in Capital in Excess of Par...... 300,000 (To record reduction in par value from $50 to $35 per share)

Retained Earnings...... 85,600 Plant Assets...... 85,600 (To record write-down of plant assets to fair market value)

16-29 *EXERCISE 16-19 (15-20 minutes)

Paid-In Capital in Excess of Par...... 275,600 Retained Earnings ($190,000 + $85,600)...... 275,600 (To eliminate accumulated deficit in retained earnings)

Retained Earnings...... 450,000 Inventories...... 120,000 Plant Assets...... 330,000 [$330,000 = $1,700,000 – ($1,290,000 + $80,000)]

Common Stock...... 850,000 Paid-in Capital in Excess of Par...... 850,000

Paid-in Capital in Excess of Par...... 1,070,000 Retained Earnings...... 1,070,000 ($450,000 + $620,000)

*EXERCISE 16-20 (20-25 minutes)

(a) Trudy Borke Corporation Balance Sheet As of June 30, 2000 Cash $ (5,000) Accounts payable $ 90,000 Accounts receivable 280,000 Notes payable 225,000 Inventory 290,000 Taxes and wages payable 60,000 Equipment 860,000 Mortgage payable 150,000 Accumulated depreciation (525,000) Common stock 375,000* Intangible assets 0 Retained earnings 0 $900,000 $900,000

*This is a plug-in number.

(b) A quasi-reorganization is a broad revaluation of assets and settle- ment of liabilities at less than face value. It further includes a major adjustment of shareholder interests. Most probably a quasi-reorga- nization is performed under direction of the U.S. Bankruptcy Court.

16-30 TIME AND PURPOSE OF PROBLEMS

Problem 16-1 (Time 20-30 minutes) Purpose—to provide the student with an understanding of the various components and accounts which appear in the stockholders’ equity section in addition to capital stock. The student is required to prepare a journal entry to close the single composite account previously used and establish the appropriately classified equity accounts with their respective balances.

Problem 16-2 (Time 15-20 minutes) Purpose—to provide the student with an understanding of the proper accounting for a series of trans- actions involving the reacquisition of an officer’s shares of the company’s stock at its book value in settlement for an account shortage and the distribution of these shares thus acquired to the other stockholders. The student is required to prepare the necessary journal entries to record these trans- actions and to determine the total stockholders’ equity after the stock distribution.

Problem 16-3 (Time 30-40 minutes) Purpose—to provide the student with an understanding of the dividend distribution to common and preferred stockholders, under conditions with one of the two preferred stock classifications being cumulative and fully participating; plus the determination of the limit on the total amount of dividends payable within the financial and legal constraints of the company. The student is required to prepare a worksheet showing the maximum amount available for cash dividends and how it would be distri- butable to the holders of the common shares and each of the preferred shares.

Problem 16-4 (Time 30-35 minutes) Purpose—to provide the student with an understanding of the proper accounting for a dividend distribution involving a stock dividend on the common stock of a corporation and cash dividends in lieu of issuing any fractional shares. This problem also includes shares of predecessor company stock that are exchangeable for the corporation’s common stock, for which the student must establish a dividend payment liability. The student is required to prepare the necessary entries and explanations to record the payment of these dividends.

Problem 16-5 (Time 15-20 minutes) Purpose—to provide the student with an understanding of the proper accounting for the declaration and payment of cash dividends on both preferred and common stock. This problem also involves a dividend arrearage on preferred stock, which will be satisfied by the issuance of shares of treasury stock. The student is required to prepare the necessary journal entries for the dividend declaration and payment, assuming that they occur simultaneously.

Problem 16-6 (Time 20-25 minutes) Purpose—to provide the student with an understanding of the effect which certain preferred stock provisions, such as cumulative and fully participating, have on dividend distributions to common and preferred stockholders. The student is required to allocate the dividends to each type of stock under two different assumptions: (1) the preferred stock does possess these two aforementioned provisions, and (2) the preferred stock does not.

Problem 16-7 (Time 20-25 minutes) Purpose—to provide the student with an understanding of the accounting effects related to the stock dividends and stock splits. The student is required to analyze their effect on total assets, common stock, paid in capital, retained earnings, and total stockholders’ equity.

16-31 Time and Purpose of Problems (Continued)

Problem 16-8 (Time 20-30 minutes) Purpose—to provide the student with an understanding of the respective entries for a series of transactions involving equity accounts, such as the declaration of property dividends and stock dividends, the donation of land, and the establishment of a retained earnings appropriation. The student is required to prepare the proper journal entries to reflect these transactions.

Problem 16-9 (Time 25-35 minutes) Purpose—to provide the student with an understanding of the respective entries to properly account for a series of transactions involving such items as the declaration and issuance of a stock dividend, a prior period adjustment, and appropriations of retained earnings. The student is required to prepare both the journal entries to reflect the above transactions and a retained earnings statement for the current year.

Problem 16-10 (Time 30-40 minutes) Purpose—to provide the student with an understanding of the proper accounting for a series of events involving an appropriation of retained earnings plus a distribution of stock dividends. The student is required to prepare both the respective journal entries to reflect the above transactions and the stockholders’ equity section of the balance sheet in proper form.

Problem 16-11 (Time 20-25 minutes) Purpose—to provide the student with an understanding of the effect which a series of transactions involving such items as the issuance and reacquisition of common and preferred stock, the donation of a block of preferred stock which was immediately resold, and a retained earnings appropriation, have on the company’s equity accounts. The student is required to prepare the stockholders’ equity section of the balance sheet in proper form reflecting the above transactions.

Problem 16-12 (Time 25-35 minutes) Purpose—to provide the student with an understanding of the proper accounting for the declaration and payment of both a cash and stock dividend. The student is required to prepare both the neces- sary journal entries to record the cash and stock dividends and the stockholders’ equity section of the balance sheet, including a note to the financial statements setting forth the basis of the accounting for the stock dividend.

Problem 16-13 (Time 35-45 minutes) Purpose—to provide the student a comprehensive problem involving all facets of the stockholders’ equity section. The student must prepare the stockholders’ equity section of the balance sheet, analyzing and classifying a dozen different transactions to come up with proper accounts and amounts. A good review of both Chapters 15 and 16.

Problem 16-14 (Time 35-45 minutes) Purpose—to provide the student with an understanding of the differences between a stock dividend and a stock split. Acting as a financial advisor to the Board of Directors, the student must report on each option and make a recommendation.

16-32 SOLUTIONS TO PROBLEMS

PROBLEM 16-1

(a) Treasury Stock—Preferred...... 250,000 Discount on Preferred Stock...... 60,000 Additional Capital...... 604,000 Paid-in Capital in Excess of Par, Common Stock...... 430,000 Land...... 400,000 Retained Earnings...... 84,000

Computation of credit balance in Retained Earnings: Net income $780,000 Add: Extraordinary gain 22,500 802,500

Deduct: Additional tax assessments $ 91,000 Extraordinary loss 118,500 Correction of an error 55,000 264,500 538,000 Less dividends 454,000 Balance in retained earnings $ 84,000

(b) The following items would have been closed to income summary: Net income per books $780,000 Extraordinary gain 22,500 Extraordinary loss (118,500) Additional tax assessment (91,000) Net income (adjusted) $593,000

16-33 PROBLEM 16-2

(a) Par value of capital stock $400,000) Retained earnings 144,000) Total book value of stock $544,000)

Book value per share = $544,000 4,000 $ 136)

Book value of 750 shares = 750 X $136 = $102,000) Amount of shortage (83,000) Cash paid by company $ 19,000)

(b) -1-

Due from Treasurer 83,000 Inventory 83,000)

-2-

Treasury Stock 102,000 Due from Treasurer 83,000) Cash 19,000)

-3-

Retained Earnings 102,000 Treasury Stock 102,000)

(c) Capital stock $400,000) Retained earnings ($144,000 – $102,000) 42,000) Total stockholders’ equity $442,000)

(d) Par value of 750 shares at $100 each $ 75,000) Amount of inventory shortage (85,000) Loss from purchase of treasury stock $ (10,000)

16-34 PROBLEM 16-2 (Continued)

-1-

Due from Treasurer 85,000 Inventory 85,000

-2-

Treasury Stock 75,000 Retained Earnings 10,000 Due from Treasurer 85,000

-3-

Retained Earnings 75,000 Treasury Stock 75,000

16-35 PROBLEM 16-3

In this problem, it is important to understand the capital structure, which consists of a common stock, an 8% nonparticipating noncumulative preferred stock, and a 5% fully participating cumulative preferred stock. Also the business had operated for five years and no dividends have been paid. Dividends are payable only from retained earnings.

Retained earnings at the end of 2002 is $1,412,500 computed as follows:

Monie Love Inc. Schedule of Retained Earnings as of December 31, 2002

1998 net loss $(225,000) 1999 net loss (140,000) 2000 net loss (180,000) 2001 net income 422,500 2002 net income 1,535,000 Balance 12/31/02 $1,412,500

16-36 PROBLEM 16-3 (Continued)

MONIE LOVE INC. Maximum Cash Dividend Distribution December 31, 2002

Common 8% 5% Stock Preferred Preferred Total Stock Stock

5% preferred stock, dividends in arrears for 1998-2001 ($1,500,000 X 5% X 4 years) $ 300,000 $ 300,000 8% preferred stock dividends for 2002 ($500,000 X 8%) $40,000 40,000 5% preferred stock dividends for 2002 ($1,500,000 X 5%) 75,000 75,000 Distribution of remaining retained earnings (Schedule 1) $357,500 000,000 640,000 997,500 $357,500 $40,000 $1,015,000 $1,412,500

Schedule 1 Distribution of Remaining Retained Earnings

Common 5% Stock Preferred Total Stock Dividends on common stock at preferred rate ($750,000 X 5%) $ 37,500 $ 37,500 Distribution of remaining retained earnings of $960,000* based on the ratio of par values: $750,000 Common stock X $960,000* 320,000 320,000 $1,500,000 $750,000

$1,500,000 5% preferred stock X $960,000 0000,000 $640,000 640,000 $1,500,000 $750,000 $357,500 $640,000 $997,500

16-37 PROBLEM 16-4

-1- Retained Earnings 2,372,916 Common Stock Dividend Distributable 564,980 Paid-in Capital in Excess of Par 1,807,936 (To record 4% stock dividend of shares issued and outstanding, exclusive of fractional shares) 3,048,750 – 1,100 – 222,750 = 2,824,900; 2,824,900 X 4% = 112,996; 112,996 X $21 = $2,372,916

Common Stock Dividend Distributable 564,980 Common Stock 564,980 (To record issuance of 112,996 shares of common stock in payment of 4% stock dividend)

-2- Retained Earnings 187,110 Cash 187,110 (To record payment of cash dividend on fractional shares) 222,750 X 4% = 8,910; 8,910 X $21 = $187,110

Management may decide whether a stock dividend shall be applicable to treasury shares. If the student assumes such a decision, the following additional entries would be necessary.

-3- Retained Earnings 924 Common Stock Dividend Distributable 220 Paid-in Capital in Excess of Par—Common 704 (To record 4% stock dividend applicable to shares held in treasury) 1,100 X 4% = 44; 44 X $21 = $924

16-38 PROBLEM 16-4 (Continued)

Common Stock Dividend Distributable 220 Common Stock 220 (To record issuance of 44 shares of common stock in payment of 4% stock dividend on treasury shares)

16-39 PROBLEM 16-5

(a) For Preferred in arrears:

Retained Earnings 12,000 Treasury Stock 12,000*

Shares *Preferred stock outstanding—$50 par 15,000 15,000 10 = 1,500 shares of treasury stock issued as dividend $33,600 4,200 shares = $8 1,500 X $8 = $12,000

For 6% preferred current: Retained Earnings 45,000 Cash 45,000* *(6% X $750,000)

For $.30 per share common: Retained Earnings 89,190 Cash 89,190*

*Since all preferred dividends must be paid before the common dividend, outstanding common shares include—

As of Dec. 31, 2001 (300,000 – 4,200) 295,800 shares Preferred distribution—1 common for every 10 preferred shares 1,500 shares 297,300 shares Common dividend .30 /share Amount of common cash dividend $ 89,190

The suggested cash dividend could be paid only if state law did not restrict the retained earnings balance in the amount of the cost of treasury stock. Total dividends would be $178,740,* which is adequately covered by the cash balance. The retained earnings balance, after adding the 2002 net income (estimated at $77,000), is sufficient to cover the dividends.**

16-40 PROBLEM 16-5 (Continued)

*Preferred in arrears (6% X $750,000) $ 45,000 Current preferred (6% X $750,000) 45,000 Common dividend ($.30 X 295,800) 88,740 Total cash dividend $178,740

**Beginning balance $105,000 Net income 77,000 Total balance available 182,000 If restricted by cost of treasury shares (33,600) Available to pay dividends $148,400

16-41 PROBLEM 16-6

Assumptions

(a) (b) Preferred, noncumulative Preferred, cumulative and nonparticipating and fully participating Year Paid-out Preferred Common Preferred Common 1999 $13,000 $5.20 -0- $ 5.20 -0- 2000 $26,000 $6.00 $ .73a $ 6.80b $ .60c 2001 $57,000 $6.00 $2.80d $14.25e $1.43e 2002 $76,000 $6.00 $4.07f $19.00g $1.90g $26,000 – $15,000* $26,000 – $17,000** a$.73 = c$.60 = 15,000 15,000

*($15,000 = $6 X 2,500) **($17,000 = $6.80 X 2,500)

$57,000 – $15,000 b$6 + $.80 (for 1999) d$2.80 = 15,000 e Per Share Total Preferred Common Total amount to be distributed $57,000 Preferred dividend ($6 X 2,500) (15,000) $6.00 Available for common and participation 42,000 Ratable dividend to common (6% X $150,000) (9,000) $.60 Available for participation 33,000 Preferred (.0825 X $100) 8.25 Common (.0825 X $10) .83

$33,000 (.0825 = ) $250,000 + $150,000

Totals $14.25 $1.43

16-42 PROBLEM 16-6 (Continued)

$76,000 – $15,000 f$4.07 = 15,000 g Per Share Total Preferred Common Total amount to be distributed $76,000 Preferred dividend ($6 X 2,500) (15,000) $ 6.00 Available for common and participation 61,000 Ratable dividend to common (6% X $150,000) (9,000) $ .60 Available for participation 52,000 Preferred (.13 X $100) 13.00 Common (.13 X $10) 1.30

$52,000 (.13 = ) $250,000 + $150,000

Totals $19.00 $1.90

16-43 PROBLEM 16-7

Transactions:

(a) Assuming Gutsy Co. declares and pays a $.50 per share cash dividend. (1) Total assets—decrease $5,000 (2) Common stock—no effect (3) Paid-in capital in excess of par—no effect (4) Retained earnings—decrease $5,000 (5) Total stockholders’ equity—decrease $5,000

(b) Gutsy declares and issues a 10% stock dividend when the market price of the stock is $14. (1) Total assets—no effect (2) Common stock—increase $2,000 (10,000 X 10%) X $2 (3) Paid-in capital in excess of par—increase $12,000 (1,000 X $14) – $2,000 (4) Retained earnings—decrease $14,000 ($14 X 1,000) (5) Total stockholders’ equity—no effect

(c) Gutsy declares and issues a 40% stock dividend when the market price of the stock is $15 per share. (1) Total assets—no effect (2) Common stock—increase $8,000 (10,000 X 40%) X $2 (3) Paid-in capital in excess of par—no effect (4) Retained earnings—decrease $8,000 (5) Total stockholders’ equity—no effect

(d) Gutsy declares and distributes a property dividend (1) Total assets—decrease $30,000 (5,000 X $6) (2) Common stock—no effect (3) Paid-in capital in excess of par—no effect (4) Retained earnings—decrease $30,000 (5) Total stockholders’ equity—decrease $30,000

16-44 PROBLEM 16-7 (Continued)

Note: The journal entries made for the above transaction are: Investments in ABC stock 20,000 Gain in appreciation of securities 20,000 (To record increase in value of securities to be issued)

Retained Earnings 50,000 Investment in ABC stock 50,000 (To record distribution of property dividend)

(e) Gutsy declares a 2-for-1 stock split (1) Total assets—no effect (2) Common stock—no effect (3) Paid-in capital in excess of par—no effect (4) Retained earnings—no effect (5) Total stockholders’ equity—no effect

16-45 PROBLEM 16-8

(a) Fire Loss 71,000 Building (net) 71,000

Note: As a result of the fire, the appropriation for fire insurance might be reversed at this point. But, because of the risk of additional uninsured fires, the appropriation may also remain.

(b) Investments 36,505 Gain on Appreciation of Securities 36,505 (4,900* shares X $16) $78,400 Less cost of 4,900 shares = 41,895** $36,505

*$500,000 $10 = 50,000 shares – 1,000 shares = 49,000 shares 10 = 4,900 shares **[($68,400 8,000 shares) X 4,900 shares]

Retained Earnings—Unappropriated 78,400 Property Dividends Payable 78,400

Note: This transaction is a partial distribution and the entry represents a revaluation of only the 4,900 shares distributed of the total of 8,000 on hand. Some might argue for recognizing appreciation on the entire 8,000 shares, which would result in carrying the remaining investment account at other than historical cost.

(c) Cash 5,800 Paid-in Capital from Treasury Stock—Preferred 300 Treasury Stock 5,500

(d) Retained Earnings—Unappropriated 58,800 Common Stock Dividend Distributable 24,500 Paid-in Capital in Excess of Par—Common 34,300 (49,000 X 5% = 2,450 shares @ $24 = $58,800)

16-46 PROBLEM 16-8 (Continued)

(e) Land 42,000 Revenue from Contribution 42,000

(f) Retained Earnings Unappropriated 55,000 Retained Earnings Appropriated for Fire Insurance 95,000 Retained Earnings Appropriated for Contingencies 25,000 Retained Earnings Appropriated for Plant Expansion 125,000

16-47 PROBLEM 16-9

(a) -1- Cash Dividends Payable 11,750 Cash (9,400 X $1.25) 11,750

-2- Unappropriated Retained Earnings 106,220 Common Stock Dividend Distributable 94,000 Paid-in Capital in Excess of Par 12,220 [(10% X 9,400) X $13]

-3- Unappropriated Retained Earnings 70,000 Inventory 70,000

-4- Cash 70,200 Paid-in Capital from Treasury Stock 9,000 Treasury Stock 61,200

-5- Common Stock Dividend Distributable 94,000 Common Stock 94,000

-6- Retained Earnings Appropriated for Treasury Stock 61,200 Unappropriated Retained Earnings 21,200 Retained Earnings Appropriated for Plant Expansion 40,000

Unappropriated Retained Earnings 18,051 Cash Dividends Payable 18,051 (10,940 X $1.65)

-7- Income Summary 235,000 Unappropriated Retained Earnings 235,000

16-48 PROBLEM 16-9 (Continued)

(b) The unappropriated retained earnings balance at December 31 is computed as follows:

Unappropriated balance, January 1 $328,800 Prior period adjustment: Correction of an error (70,000) Corrected balance 258,800 Add: Net income $235,000 Reduction in appropriation for treasury stock 61,200 296,200 555,000 Deductions and appropriations: Cash dividend 18,051 Stock dividend 106,220 Increase in appropriation for plant expansion 40,000 164,271 Unappropriated balance, December 31 $390,729

16-49 PROBLEM 16-10

(a) Dec. 15, 2001 Unappropriated Retained Earnings 90,000 Retained Earnings Approp. for Plant Expansion 90,000

Dec. 31, 2001 Income Summary 530,000 Unappropriated Retained Earnings 530,000

Nov. 1, 2002 Factory Building (Plant & Equipment) 330,000 Cash 330,000

Dec. 14, 2002 Retained Earnings Approp. for Plant Expansion 360,000 Unappropriated Retained Earnings 360,000

Unappropriated Retained Earnings (25,000 X $47) 1,175,000 Common Stock Dividends Distributable 250,000 Paid-in Capital in Excess of Par 925,000

Dec. 31, 2002 Income Summary 600,000 Unappropriated Retained Earnings 600,000

Jan. 23, 2003 Common Stock Dividend Distributable 250,000 Common Stock 250,000

16-50 PROBLEM 16-10 (Continued)

(b) Stockholders’ Equity: Common stock, $10 par value, 300,000 shares authorized, 200,000 shares issued and outstanding $2,000,000 Common stock dividend distributable, 25,000 shares 250,000 Paid-in capital in excess of par 4,525,000 Total paid-in capital 6,775,000 Retained earnings 2,115,000* Total stockholders’ equity $8,890,000

*$2,160,000 + $530,000 – $1,175,000 + $600,000 = $2,115,000

16-51 PROBLEM 16-11

Jadzia Dax Corporation STOCKHOLDERS’ EQUITY December 31, 2001 Paid-in Capital: Preferred stock, $100 par value 10,000 shares authorized, 4,000 shares $400,000 issued & outstanding

Common stock, $50 par value 15,000 shares authorized, 8,000 shares issued 7,700 shares outstanding 400,000 $ 800,000

Additional Paid-in Capital: Paid-in capital in excess of par— preferred 52,000 Paid-in capital in excess of par— common 61,000 Paid-in capital from treasury stock— preferred 4,700 117,700 Total Paid-in Capital 917,700

Retained Earnings: Unappropriated 140,600 Appropriated for treasury stock 19,800 Appropriated for fixed asset replacement 75,000 235,400* 1,153,100 Less cost of treasury stock (300 shares—common) 19,800 Total Stockholders’ Equity $1,133,300

*$610,000 – $312,600 – $62,000

16-52 PROBLEM 16-12

(a) Retained Earnings 1,200,000 Cash 1,200,000 (Cash dividend of $.60 per share on 2,000,000 shares)

(b) Retained Earnings 4,200,000 Common Stock 1,200,000 Additional Paid-in Capital 3,000,000 (Stock dividend of 6%, 120,000 shares, at $35 per share)

(c) STOCKHOLDERS’ EQUITY Common stock—$10 par value Issued 2,120,000 shares $21,200,000 Additional paid-in capital 8,000,000 Retained earnings 24,300,000 Total stockholders’ equity $53,500,000

Statement of Retained Earnings For the Year Ended December 31, 2001

Balance, January 1, 2001 $24,000,000 Net income for 2001 5,700,000 29,700,000

Deduct dividends on common stock: Cash $1,200,000 Stock (see note) 4,200,000 5,400,000 Balance December 31, 2001 $24,300,000

Statement of Additional Paid-in Capital For the Year Ended December 31, 2001

Balance January 1, 2001 $5,000,000 Excess of fair value over par value of 120,000 shares of common stock distributed as a dividend (see note) 3,000,000 Balance December 31, 2001 $8,000,000

16-53 PROBLEM 16-12 (Continued)

Note: The 6% stock dividend (120,000 shares) was distributed to stockholders of record at the close of business on December 31, 2001. For the purposes of the dividend, the stock was assigned an average price of $35 per share based upon the average quoted market over a short period preceding the dividend date. The par value of $10 per share ($1,200,000) was credited to Capital Stock and the balance of $25 per share ($3,000,000) to Additional Paid-in Capital.

Average market has been chosen to eliminate the chance that any one day’s market might have been affected by some unusual circumstances.

The use of the average market price is a judgment call. The problem does provide an opportunity to emphasize to students that some flexibility exists in GAAP rules, and that judgment often plays an important part in the final answer.

16-54 PROBLEM 16-13

The requirement is to prepare the stockholders’ equity section of Ohio Company’s June 30, 2001, balance sheet.

Note that the Ohio Company is authorized to issue 300,000 shares of $10 par value common and 100,000 shares of $25 par value, cumulative and nonparticipating preferred.

At the beginning of the year, Ohio had 110,000 common shares outstanding, of which 95,000 shares were issued at $31 per share, resulting in $950,000 (95,000 shares at $10) of common stock and $1,995,000 of additional paid-in capital on common stock (95,000 shares at $21). The 5,000 shares exchanged for a plot of land would be recorded at $50,000 of stock and $170,000 of paid-in capital (use the current market value of the land on July 24 to value the stock issuance). The 10,000 shares issued in 2000 at $42 a share resulted in $100,000 of common stock and $320,000 of paid-in capital.

The 2000 stock subscriptions resulted in 2,000 shares being issued at $46, which adds $20,000 of stock and $72,000 of paid-in capital. The remaining subscriptions for 8,000 shares resulted in $80,000 of capital stock subscribed and paid-in capital of $288,000. The 2,000 shares of treasury stock purchased resulted in a debit balance of treasury stock of $78,000. Later, 500 shares were sold at $21,000, which brings the balance down to $58,500 (1,500 shares at $39 per share).

The gain on treasury shares ($21,000 minus $19,500 cost) is a separate paid-in capital amount. The 5% stock dividend on January 15 resulted in an increase of 5,500 shares. Recall that there were 110,000 shares outstanding at the beginning of the year and 2,000 were issued due to the stock subscriptions. The purchase of 2,000 treasury shares occurred before the stock dividend, bringing the number of shares outstanding at the time of the dividend (December 2000) to 110,000 shares. The resale of 500 treasury shares occurred after the stock dividend.

The issuance of 50,000 shares of preferred at $44 resulted in $1,250,000 (50,000 shares at $25) of preferred stock outstanding and $950,000 (50,000 shares at $19) of paid-in capital on preferred. The cash dividends only af- fect the retained earnings. Note that the preferred stock is in arrears for the

16-55 PROBLEM 16-13 (Continued)

$1.00 dividend that should have been declared in June, 2001. Ending re- tained earnings is the beginning balance of $690,000 plus net income of $40,000, less the preferred dividend of $50,000 and the common stock dividend of $286,000 (5,500 shares at $52), resulting in $394,000. $50,000 of this is appropriated for the bond sinking fund.

Ohio Company Stockholders’ Equity June 30, 2001 Capital stock 8% preferred stock, $25 par value, cumulative and non-participating, 100,000 shares authorized, 50,000 shares issued and outstanding—Note A $1,250,000

Common stock, $10 par value, 200,000 shares authorized, 117,500 shares issued with 1,500 shares held in the treasury $1,175,000

Common stock subscribed, $10 par value, 8,000 shares 80,000

Total common stock issued and subscribed 1,255,000

Additional paid-in capital On preferred stock 950,000 On common stock 3,076,000* On treasury stock 1,500 4,027,500

Total paid-in capital 6,532,500

16-56 PROBLEM 16-13 (Continued)

Retained earnings Appropriated—Note B 50,000 Unappropriated 344,000 394,000

Total capital and retained earnings 6,926,500

Less: Treasury stock, 1,500 shares at cost 58,500 Stock subscriptions receivable 368,000 426,500

Total stockholders’ equity $6,500,000

Note A: Ohio Company is in arrears on the preferred stock in the amount of $50,000. Note B: Ohio Company is required to appropriate retained earnings in an amount that is equal to the sinking fund deposit that is to be accumulated to retire a term loan.

*Premium on Common Stock: Issue of 95,000 shares X ($31 – $10) $1,995,000 Plot of land 170,000 10,000 share subscription (10/31/99) [10,000 X ($42 – $10)] 320,000 5,500 shares as dividend [5,500 X ($52 – $10)] 231,000 10,000 share subscription (10/1/00) [10,000 X ($46 – $10)] 360,000 $3,076,000

16-57 PROBLEM 16-14

To: Jenny Durdil Board of Directors

From: Good Student, Financial Advisor

Date: Today

Subject: Report on the effects of a stock dividend and a stock split

INTRODUCTION

As financial advisor to the Board of Directors for Jenny Durdil, I have been asked to report on the effects of the following options for creating interest in Jenny Durdil stock: a 20% stock dividend, a 100% stock dividend, and a 2-for-1 stock split. The board wishes to maintain stockholders’ equity as it presently appears on the most recent balance sheet. The Board also wishes to generate interest in stock purchases, and the current market value of the stock ($120 per share) may be discouraging potential investors. Finally, the Board thinks that a cash dividend at this point would be unwise.

RECOMMENDATION

In order to meet the needs of Jenny Durdil Inc., the board should choose a 2-for-1 stock split. The stock split is the only option which would not change the stockholders’ equity section of the company’s balance sheet.

DISCUSSION OF OPTIONS

The three above-mentioned options would all result in an increased number of common shares outstanding. Because the shares would be distributed on a pro rata basis to current stockholders, each stockholder of record would maintain his/her proportion of ownership after the declaration. All three options would probably generate significant interest in the stock.

16-58 PROBLEM 16-14 (Continued)

A 20% STOCK DIVIDEND

This option would increase the shares outstanding by 20 percent, which translates into 1,000,000 additional shares of $10 par value common stock.

The problem with this type of stock dividend is that GAAP requires these shares to be accounted for at their current market value if it significantly exceeds par.

The following journal entry must be made to record this dividend.

Retained Earnings 120,000,000 Common Stock Dividend Distributable 10,000,000 Paid in Capital in Excess of Par 110,000,000

Although the Common Stock and the Paid in Capital accounts increase, Retained Earnings decreases dramatically. This reduction in Retained Earnings may hinder Jenny Durdil’s success with the subsequent stock offer.

A 100% STOCK DIVIDEND

This option would double the number of $10 par value common stock currently issued and outstanding. Because this type of dividend is considered, in substance, a stock split, the shares do not have to be accounted for at market value. Instead, Retained Earnings is reduced only by the par value of the additional shares, while Dividend Distributable and, later, Common Stock are increased for that same amount. However, when 5,000,000 shares are already issued and outstanding, the reduction in Retained Earnings reflecting the stock dividend is still great: $50,000,000. In addition, no increase in the Paid in Capital account occurs.

The following journal entry would be made to record the declaration of this dividend:

Retained Earnings 50,000,000 Common Stock Dividend Distributable 50,000,000

16-59 PROBLEM 16-14 (Continued)

A 2-FOR-1 STOCK SPLIT

This options doubles the number of shares issued and outstanding; however, it also cuts the par value per share in half. No accounting treatment beyond a memorandum is required for the split because the effect of splitting the par value cancels out the effect of doubling the number of shares. Therefore, Retained Earnings remains untouched as does the Common Stock and Paid in Capital Accounts. In addition, the lower par value along with the decreased market value will encourage investors who might otherwise consider the stock too expensive.

CONCLUSION

To generate the greatest interest in Jenny Durdil stock while maintaining the present Stockholders’ Equity section of the balance sheet, you should opt for the 2-for-1 stock split.

16-60 TIME AND PURPOSE OF CASES

Case 16-1 (Time 25-30 minutes) Purpose—to provide a five-part theory case on equity based on Statement of Financial Accounting Concepts No. 6. It requires defining terms and analyzing the effects of equity transactions on financial statement elements.

Case 16-2 (Time 25-30 minutes) Purpose—to provide the student with an understanding of the conceptual framework which underlies a stock dividend and a stock split. The student is required to explain what a stock dividend is, the amount of retained earnings to be capitalized in connection with a stock dividend, and how it differs from a stock split both from a legal standpoint and an accounting standpoint. This case also requires an explanation of the various reasons why a corporation declares a stock dividend or a stock split.

Case 16-3 (Time 15-20 minutes) Purpose—to provide the student with an understanding of the theoretical concepts and implications that underlie the issuance of a stock dividend. The student is required to discuss the arguments against either considering the stock dividend as income to the recipient or issuing stock dividends on treasury shares.

Case 16-4 (Time 20-25 minutes) Purpose—to provide the student with a situation containing a cash dividend declaration, a stock dividend, and a reacquisition and reissuance of shares requiring the student to explain the accounting treatment.

*Case 16-5 (Time 20-30 minutes) Purpose—to provide the student with an understanding of the concepts which comprise a quasi- reorganization. The student is required to describe the characteristics of a quasi-reorganization and list the conditions under which it generally is justified.

*Case 16-6 (Time 10-20 minutes) Purpose—to provide the student with an understanding of the relationship which exists when a stock dividend is issued, thus capitalizing the retained earnings transferred to capital stock, and the later reduction of the par value of each share of its stock so as to restore the capital to the original amount. The student is required to comment on these transactions as they apply to the specifics mentioned in this case.

16-61 SOLUTIONS TO CASES

CASE 16-1

(a) Equity, or net assets, is the owners’ residual interest in the assets of an entity that remains after deducting liabilities; in other words, equity equals assets less liabilities. Assets are probable future economic benefits controlled by a particular entity as the result of past transactions or events, and liabilities are probable future sacrifices of economic benefits arising from present obligations of a particular entity which result from past transactions or events; therefore equity can be defined as future economic benefits which will not be sacrificed to satisfy present obligations.

(b) Transactions or events that change owners’ equity include revenues and expenses, gains and losses, investments by owners, distributions to owners, and changes within owners’ equity.

(c) Investments by owners are increases in net assets resulting from transfers by other entities of something of value to obtain ownership. Examples of investments by owners are issuance of preferred or common stock, conversion of convertible bonds, reissuance of treasury stock, assessments on stock, and issuance of stock warrants. Generally, investments by owners cause an increase in assets in addition to the increase in equity.

(d) Distribution to owners are decreases in net assets resulting from transferring assets to owners, rendering services for owners or incurring liabilities to owners. Examples of distributions to owners are cash or property dividends and purchase of treasury stock. Dividends generally initially cause an increase in liabilities but eventually cause a decrease in assets in addition to the decrease in equity. The purchase of treasury stock causes a decrease in assets in addition to the decrease in equity.

(e) Some examples of changes within owners’ equity that do not change the total amount of owners’ equity are retirement of treasury stock, quasi-reorganization (except revaluing of assets), conversion of preferred stock into common stock, stock dividends, and retained earnings appropriations.

CASE 16-2

(a) A stock dividend is the issuance by a corporation of its own stock to its stockholders on a pro-rata basis without receiving payment therefor. The stock dividend results in an increase in the amount of the legal or stated capital of the enterprise. The dividend may be charged to retained earnings or to any other capital account that is not a part of legal capital.

(1) From the legal standpoint a stock split is distinguished from a stock dividend in that a split results in an increase in the number of shares outstanding and a corresponding decrease in the par or stated value per share. A stock dividend, though it results in an increase in the number of shares outstanding, does not result in a decrease in the par or stated value of the shares.

(2) The major distinction is that a stock dividend requires a journal entry to decrease retained earnings and increase paid-in capital, while there is no entry for a stock split. Also, from the accounting standpoint the distinction between a stock dividend and a stock split is dependent upon the intent of the board of directors in making the declaration. If the intent is to give to

16-62 stockholders some separate evidence of a part of their pro-rata interests in accumulated cor- porate earnings, the action results in a stock dividend. If the intent is to issue enough shares to CASE 16-2 (Continued)

shares to reduce the market price per share of the stock, the action results in a stock split, regardless of the form it may take. In other words, if the action takes the form of a stock dividend but reduces the market price markedly, it should be considered a stock split. Such reduction will seldom occur unless the number of shares issued is at least 20% to 25% of the number pre- viously outstanding.

(b) The usual reason for issuing a stock dividend is to give the stockholders something on a dividend date and yet conserve working capital.

A stock dividend that is charged to retained earnings reduces the total accumulated earnings, and all stock dividends reduce the per share earnings. Issuing a stock dividend to achieve these ends would be a public relations gesture in that the public would be less likely to criticize the corporation for high profits or undue retention of earnings.

A stock dividend also may be issued for the purpose of obtaining a wider distribution of the stock. Although this is the main consideration in a stock split, it may be secondary consideration in the issuance of a stock dividend. The issuance of a series of stock dividends will accomplish the same objective as a stock split.

A stock split is intended to obtain wider distribution and improved marketability of shares by means of a reduction in the market value of the company’s shares.

(c) The amount of retained earnings to be capitalized in connection with a stock dividend (in the accounting sense) might be (1) the legal minimum (usually par or stated value), (2) the average paid-in capital per outstanding share, or (3) the market value of the shares.

The third basis is generally recommended on the grounds that recipients tend to regard the market value of the stock received as a dividend as the amount of earnings distributed to them. If the corporation in such cases does not capitalize an amount equal to the fair value of the shares distributed as a dividend, there is left in the corporation’s retained earnings account an amount of earnings that the stockholders believe has been distributed to them. This amount would be subject to further stock dividends or to cash dividends. The recipients might thus be misled into believing that the company’s distributions—and earnings—are greater than they actually are.

If the per share market value of the stock is materially reduced as a result of a distribution (usually 20%-25% of shares outstanding or more), no matter what form the distribution takes, the action is in substance a stock split and should be so designated and treated to the extent required by legal considerations.

CASE 16-3

(a) The case against treating an ordinary stock dividend as income is supported by a majority of accounting authorities. It is based upon “entity” and “proprietary” interpretations.

16-63 If the corporation is considered an entity separate from stockholders, the income of the corporation is corporate income and not income to stockholders, although the equity of the

CASE 16-3 (Continued) stockholders in the corporation increases as income to the corporation increases. This position is consistent with the interpretation that a dividend is not income to the recipient until it is realized as a result of a division, distribution, or severance of corporate assets. The stock dividend received merely redistributes each stockholder’s equity over a large number of shares. Selling the stock dividend under this interpretation has the effect of reducing the recipient’s proportionate share of the corporation’s equity.

A similar position is based upon a “proprietary” interpretation. Income of the corporation is considered income to the owners and, hence, stock dividends represent only a reclassification of equity since there is no increase in total proprietorship.