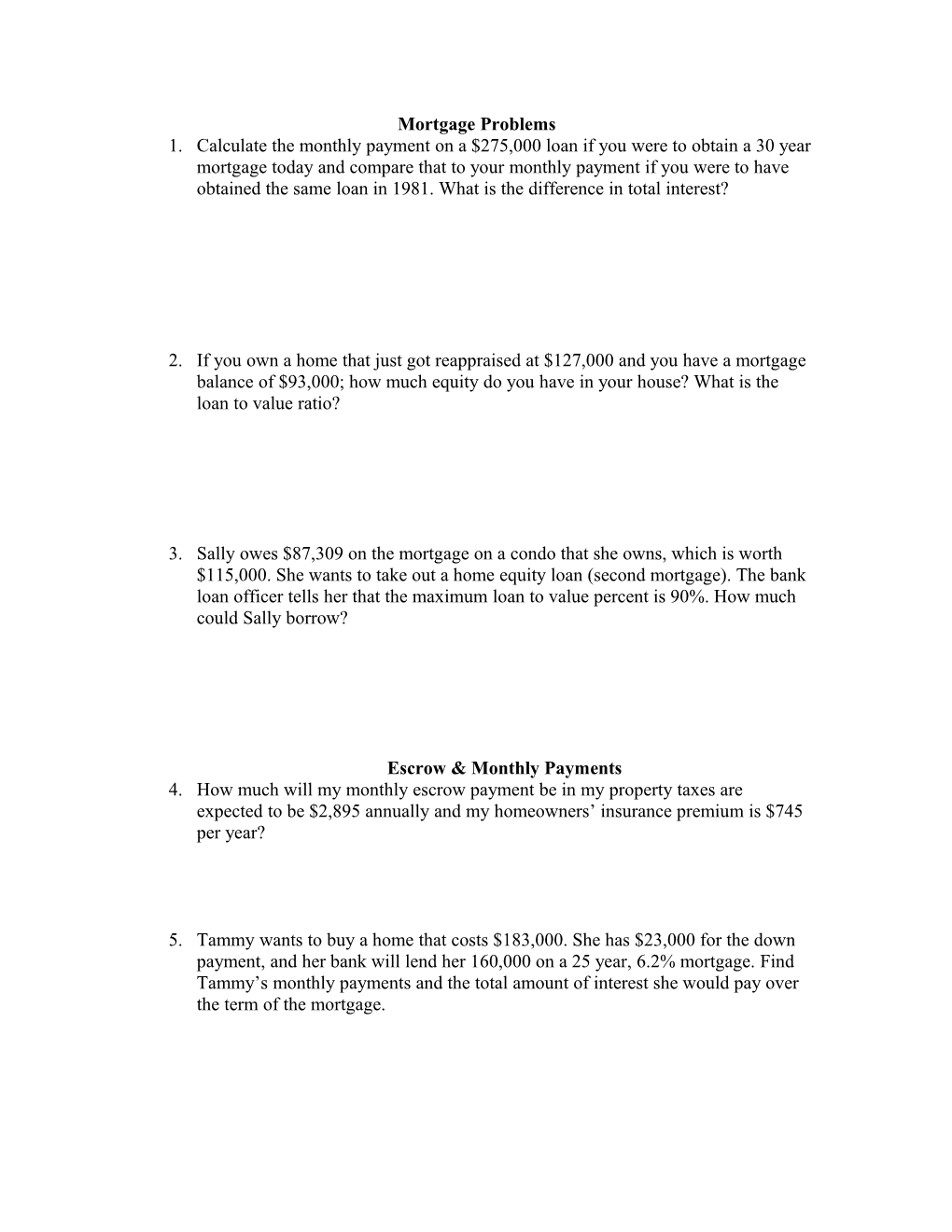

Mortgage Problems 1. Calculate the monthly payment on a $275,000 loan if you were to obtain a 30 year mortgage today and compare that to your monthly payment if you were to have obtained the same loan in 1981. What is the difference in total interest?

2. If you own a home that just got reappraised at $127,000 and you have a mortgage balance of $93,000; how much equity do you have in your house? What is the loan to value ratio?

3. Sally owes $87,309 on the mortgage on a condo that she owns, which is worth $115,000. She wants to take out a home equity loan (second mortgage). The bank loan officer tells her that the maximum loan to value percent is 90%. How much could Sally borrow?

Escrow & Monthly Payments 4. How much will my monthly escrow payment be in my property taxes are expected to be $2,895 annually and my homeowners’ insurance premium is $745 per year?

5. Tammy wants to buy a home that costs $183,000. She has $23,000 for the down payment, and her bank will lend her 160,000 on a 25 year, 6.2% mortgage. Find Tammy’s monthly payments and the total amount of interest she would pay over the term of the mortgage. 6. Mike’s monthly mortgage payment is $675.13. His property taxes are $1,392 and his homeowners’ insurance premium is $885. He also pays $48.17 a month for PMI. Find his total monthly PITI payment.

7. Aaron and Cienna are considering buying a house for $175,000. They would make a $10,000 down payment, and borrow the rest with a 30-year fixed rate mortgage at 7.45%. Annual property taxes would be $5,700, and homeowners’ insurance would be $935. They would also need to pay $84.00 monthly for PMI. What would their total monthly payment (PITI) be?

8. If you wanted to buy a house worth $399,000, and you could afford to make a 20% down payment. What would your monthly payment be if you financed the rest with a 25-year mortgage at 6.98%? Annual property taxes are $10,384 and insurance would cost $2,850 per year.

How Much House Can You Afford?

9. You have a yearly salary of $36,000. Given that your housing expenses (PITI) can be no more than 28% of your monthly gross income, how much can you afford each month for your payment, taxes, and insurance (PITI)?

10. Given the same salary in problem 9, now assume you also have a car payment of $249 and student loans of $85. Given that all of your long-term debt cannot be more than 36% of your monthly gross income, what is your maximum debt and maximum PITI payment? 11. You and your roommate decide to buy a house together. You have an annual salary of $42,000 and your roommate makes $11.50 an hour. (Assume your roommate works full-time 52 weeks a year). Together you have no debt, and you have $20,000 for a down payment. Also assume taxes and insurance totals $250 a month. Find the following:

a. Maximum monthly PITI payment.

b. Maximum house price on a 30-year fixed mortgage at 4.5%

12. Julie and John Smith are in the market for a new house. Combined they have yearly salaries of $ 103,000 as well as income from their mutual funds of $5,400 a year. They also have two car payments which total $620 a month. Find the following:

a. Maximum PITI payment per month

b. Maximum total debt per month

c. What is the maximum price of a house they can afford if they have $35,000 to use as a down payment? (Assume same mortgage information as problem 11. Also assume taxes and insurance make up $300 of the monthly payment.) 13. You bought your home last year for $130,000. You made a down payment of 20%. Through your mortgage payments, you have reduced your debt by $2,000. The annual appreciation rate for homes in your area has averaged 3%. a. What was the amount of your down payment?

b. What was your initial loan amount?

c. How much do you owe now?

d. What is the current market value of your home?

e. What is your equity in the home now?

Up-Front Expenses

14. George wants to buy a house for $192,800. He is planning on making a 5% down payment, and closing costs will amount to $3,170. Annual property taxes are $5,155 and annual homeowners’ insurance premiums will total $1,250. How much money will he need up front?

15. Suppose you accept a mortgage for $150,000. What finance charge will you have to pay at closing if the lender charges (a) 1 point, (b) 2 points, or (c) 1.5 points 16. Suppose you buy a townhouse for $155,000, and make a 5% down payment. If you take out a mortgage that requires paying 1.75 points, how much will you pay for the points?

17. Heidi is looking for a mortgage for her house. The house costs $222,950 and she will make a 8% down payment. She is considering two different choices for a 30- year fixed rate loan. Points Interest Rate 0 7.75% 1.5 6.78% a. Find the up-front cost of the points is she chooses that option.

b. Find her monthly mortgage payment with each option.

c. How much would she save over 30 years by paying points, assuming that she keeps her loan for the full 30 years.

d. Find the payback period for paying points.

18. Hilda is buying a home for $74,000. She will make a 20% down payment and estimates closing costs as: legal fees, $950; title insurance, $140; property survey, $250; inspection, $175; loan processing fee, $84; recording fee, $740. What amount of mortgage loan will she need? What amount of cash will she need when she buys the house?