Consortax Client Centric Solutions

Tax Filing Services Tax Notes -2016

Dear Client,

Greetings!

Please fill the below Tax Notes and upload it in your login or even you can E-mail it to [email protected] along with your W2 & any other income statement and other relevant documents to prepare your Tax Return copy for TY2016.

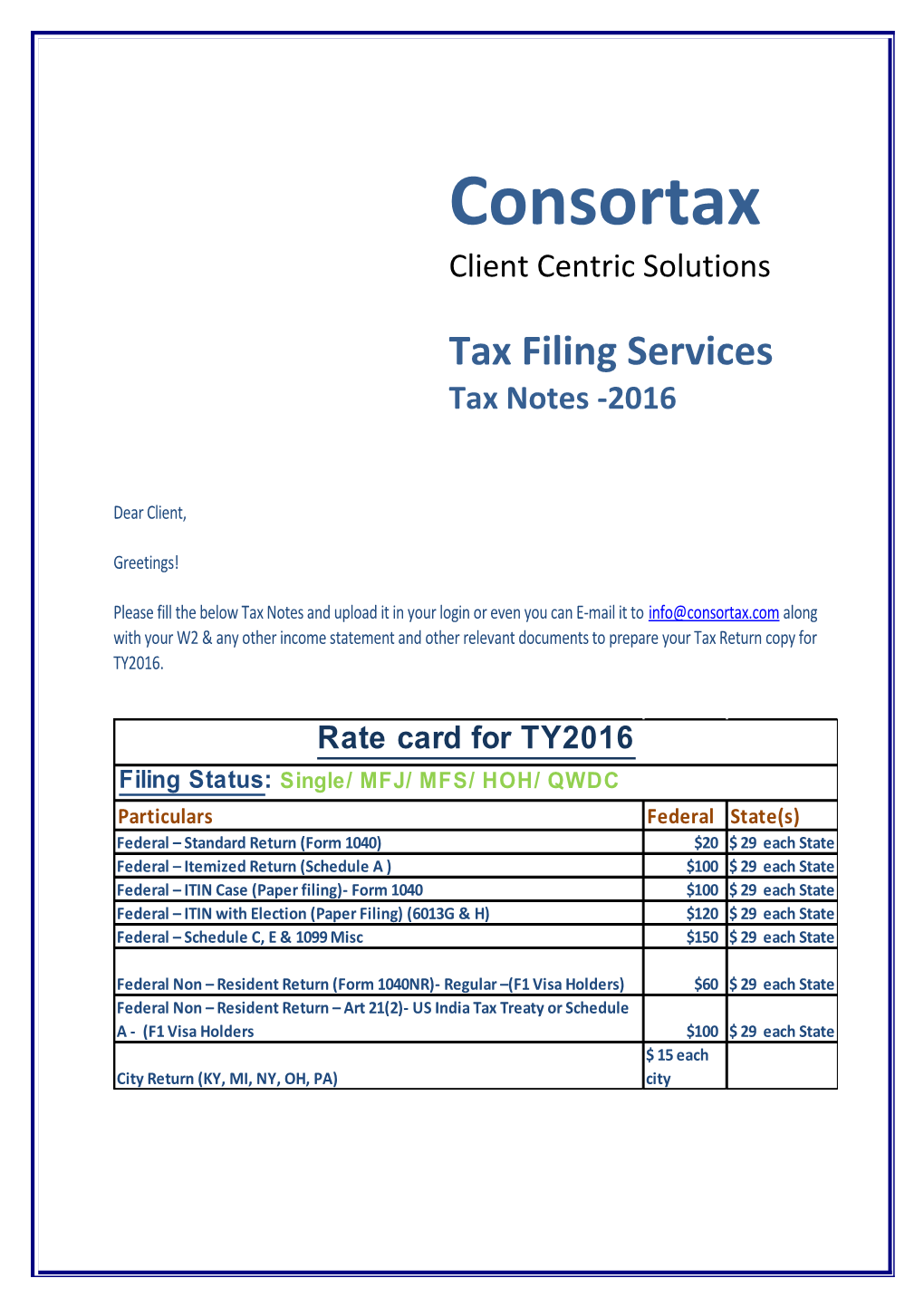

Rate card for TY2016 Filing Status: Single/ MFJ/ MFS/ HOH/ QWDC Particulars Federal State(s) Federal – Standard Return (Form 1040) $20 $ 29 each State Federal – Itemized Return (Schedule A ) $100 $ 29 each State Federal – ITIN Case (Paper filing)- Form 1040 $100 $ 29 each State Federal – ITIN with Election (Paper Filing) (6013G & H) $120 $ 29 each State Federal – Schedule C, E & 1099 Misc $150 $ 29 each State

Federal Non – Resident Return (Form 1040NR)- Regular –(F1 Visa Holders) $60 $ 29 each State Federal Non – Resident Return – Art 21(2)- US India Tax Treaty or Schedule A - (F1 Visa Holders $100 $ 29 each State $ 15 each City Return (KY, MI, NY, OH, PA) city

Consortax 2016 Client Centric Solutions

Tax Notes

PERSONAL INFORMATION: Basic Details Tax Payer Spouse Dependent- I Dependent- II First Name Last Name Date of Birth (mm/dd/yy) SSN/ITIN Relationship to Primary Taxpayer Visa Status as on Dec 31, 2016 Was any change in the Visa Status - 2016? pMarital Status as on Dec 31, 2016 Date of Marriage (mm/dd/yy) Current Address First Entry Date into US (mm/dd/yy) No. of months stayed in US during 2016 Home Number/Cell Number Email Id Note: Please enter the name exactly as it appears on the SSN/ITIN. If you do not have an SSN for your Spouse/Dependents, we can apply for ITIN.

BANK INFORMATION: (Needed For Direct Deposit of Refund / Auto Withdrawal of Owe Amount) Bank Name Routing Number Account Number Account Type (Savings/Checking) Account Owner Name

RESIDENCY INFORMATION: Taxpayer (mm/dd/yy) Spouse (mm/dd/yy) Tax Year States Resided Period of Stay States Resided Period of Stay

2016 2015 2014 2013 Note: States Resided details are required to ascertain – Full Year/Part Year/ Non Resident for 2016.

Please provide the residency details properly for ALL the tax years listed above. This will help our Tax Experts to determine your correct "Residential Status" and check if we can go back and work on your previous year tax returns to get you any additional refund that you missed out. If you have not stayed in US in any of the above years, please write "N/A" which means "Not Applicable".

FOR IOWA/MASSACHUSETTS RESIDENTS ONLY: 2 Once our client, Life time client Consortax 2016 Client Centric Solutions

Taxpayer (Yes/No) Spouse (Yes/No) Did you or your Spouse file an Iowa Income Tax Return last year? If YES - Provide last year federal tax return Are you or your Spouse covered by Massachusetts Health Insurance? If YES - Provide Form 1099-HC NOTE: IGNORE THIS SECTION IF YOU WERE NEVER A RESIDENT OF IOWA/MASSACHUSETTS

JOB INFORMATION: NOTE: IF YOU HAD WORKED WITH TWO EMPLOYERS DURING 2016 THEN PLEASE MENTION AS EMP-I & EMP-II / CL –I & CL -II. Taxpayer Spouse Employer Name Employer Location (City, State) Occupation / Designation Employment Start Date Employment End Date Visa Status Do you work at Employer Location (or) at Client Location on projects?

DETAILS OF EXPENSES INCURRED WHILE WORKING ON CLIENT PROJECT: (Fill this only if you/your spouse are/were working at Client Location and NOT Employer Location)

Taxpayer Spouse Particulars Client I Client II Client I Client II

Client Name Client Project Location (City, State) Project Start Date (mm/dd/yy)

Project End Date (mm/dd/yy) Monthly Rent(including utilities)

Daily Meal Expense Mode of Transport & Cost- (if not using your own vehicle) One-way distance between your Home & Client Location One-way distance between your Employer Location & Client Location Expenses incurred to visit your Employer Location Note: Project Start Date is the date you exactly commenced the project. This can be found from the Deputation Letter/Transfer Memorandum issued by your Employer while deputing you on this project. Project End Date is the date you completed the project. If you are still working, please write ‘Till Date’ in the Project End Date. As regards Rent, enter only the amount paid by you

RELOCATION EXPENSES:

3 Once our client, Life time client Consortax 2016 Client Centric Solutions

(Enter Airfare + Transportation Charges + Onward Meals & Tips + Boarding & Lodging+ Packing Charges) to the extent not reimbursed by your Employer though incurred by you)

Type of Relocation Amount of Expense Incurred a) Have you moved/relocated from one CL to another CL during the TY 2016? b) Have you moved/relocated from EL to CL during the TY 2016? c) Have you moved/relocated from one EL to another EL during the TY 2016? d) Have you moved/relocated from India to US during the TY 2016 for the purpose of employment?

Note: The moving distance between the two locations must be at least 50 Miles as per the IRS. EL stands for Employer Location and CL stands for Client Location. Enter expenses amount only to the extent not reimbursed by your Employer.

JOB RELATED EXPENSES: (Enter the Expenses Incurred that are not reimbursed by your Employer in 2016)

Expense Type Taxpayer $ Spouse Amount $ Amount a) Cost of Professional Books , Magazines & Supplies b) Cost of Professional Membership Subscription c) Uniform Expenses (For Attorneys/Doctors/similar professionals) d) Internet Charges per month e) Cell Phone Charges per month f) Job Training or Higher Education Expenses g) Parking and Toll Fees, if any paid on Client Locations h) Employment Visa Processing Fees (including Attorney Fees) i) Last Year Tax Preparation Fees j) Home Mortgage Interest & Points (For property in US) k) Property Taxes (For property in US) l) Home Mortgage Interest (For property in Foreign Country) – Please mention Bank Name, Bank Address & Interest Amount in USD - Provide only Interest Amount not your EMI m) Property Taxes (For property in India) n) Student Loan Interest Paid in US - Provide Form 1098-E o) Tuition Fees Paid in US - Provide Form 1098-T p) Contributions to IRA (Individual Retirement Account) - This is not 401K provided by your Employer. If Roth IRA, please mention Roth IRA q) Contributions of HSA (Health Savings Account) – (Please provide supporting documents) r) Safe Deposit Box Rental / Margin Interest on Stocks s) Educator Expenses (if you/your spouse is a Teacher/Faculty) t) Medical Expenses (Read Note Below) w) State Income Taxes Paid at the time of filing of your 2015 tax return Please Provide 2015 Tax Return

4 Once our client, Life time client Consortax 2016 Client Centric Solutions

VEHICLE INFORMATION: If Vehicle Used to Commute to Client Location/Business Location a) Vehicle Owned during the TY 2016? b) Hybrid or Alternative Motor Vehicle? c) Was the Vehicle used for travel to Client Locations? If YES - Please provide the following information: 1) Make & Model of the Vehicle 2) Purchase Date 3) Cost Price 4) Total Mileage during TY 2016 5) One-way commuting distance between Home & Client Location 6) Sales & Excise Tax paid on the vehicle bought in TY 2016

CHILD & DEPENDENT CARE EXPENSES: Day Care Expenses- If Tax Payer & Spouse Both are Working a. Name of the Dependent for whom these expenses were incurred b. Name of the Institution/Person to whom the amount was paid c. Federal ID/SSN of the Institution/Person to whom the amount was paid d. Address of the Institution (Street Address, City, State, Zip code) e. Amount of Expenditure Incurred f. Amount reimbursed by the Employer, if any

CHARITABLE CONTRIBUTIONS S.no Name-Charitable Institution Amount Donated Item/Property No.# Trips Receipts (Y/N) Donated 1 2

PURCHASE & SALE OF SHARES/SECURITIES Sale Details

Purchased Share Units Rate per Unit Date Sold Share Name/Details Units Rate Per Unit Date Name/Details

FIRST TIME HOME BUYER CREDIT: (Yes/No) a. Have you purchased (or) entered into a binding contract to buy a home in US after April 8th, 2009 but before May 1st, 2010?

5 Once our client, Life time client Consortax 2016 Client Centric Solutions b. Is this the first home that you bought in US? c. Is this home used for your principal residence purposes? d. Is this home used as a 'vacation home' or 'rental property'? e. Have you owned a main home at any time during the three years immediately preceding the date of purchase of current home? f. Enter the cost price of such home g. Did you claim any First Time Home Buyer Credit on 2010 return?

Rental Income (If Any): Particulars Details a. Property Type? (Residential/Commercial) b. Location/Address c. Specify the following: a. No. of months rented in year 2016 b. No. of months you used for personal purpose d. Property is owned by (Taxpayer/Spouse/Joint) e. Date this property was purchased (mm/dd/yy) f. Rental Expenses incurred to earn Rent, if any

FOREIGN INCOME & EXPENSES (IF ANY): Particulars Salary Income Dividend Interest Rental Income Income Income a. Foreign Income from which source b. Amount of Foreign Income c. Foreign Taxes (if any) withheld

Please send us the below mentioned Tax Source Documents if you have any:

Duly filled Tax Notes of 2016 (Mandatory) Dec 2016- Paystub (Mandatory) Wage Income – Form W2/Corrected W2 (Mandatory) Interest Income – Form 1099-INT Dividend Income – Form 1099-DIV State Tax Refund– Form 1099-G Self-Employment Income/Business Income – Form 1099-MISC Purchase & Sale of Shares/Securities – Form 1099-B Retirement Distributions – Form 1099-R Income from S-Corp/LLP/LLC – Schedule K1 Rental Income from US Property Foreign Tax Certificate - (Foreign Income-2016) Student Loan Interest – Form 1098-E Home Mortgage Interest – Form 1098 Prior Year Federal & State Tax Return (if New Client) (Mandatory)

Note: We require your Tax Source Documents for the Preparation of your Tax Return.

ADDITIONAL NOTES: Additional Information: If you have missed any.

6 Once our client, Life time client Consortax 2016 Client Centric Solutions

REFER YOUR FRIENDS/COLLEAGUES:

We thank you for investing your time in filling this Tax Notes and we request you to kindly offer us the privilege of serving the tax planning and filing needs of your friends/colleagues/employee group for the Tax Year 2016.

We would be pleased to honor you with a Referral Bonus @ $10 per referral. Please enter their Names & Contact Details below.

Name of your Friend/Colleague Email Id Contact Number

PLEASE CONTACT: To know more about our services, you may simply call us at (909) 991-7200 or send an email to [email protected], so that one of our Tax Experts will contact you and provide you the best tax consulting/advices and tax preparation services.

We assure you of our best talent and service at all times.

Sincerely, Consortax Solutions – Planning Team 5126 W Swayback Pass, Phoenix, AZ 85083 Phone (909) 991-7200 / (909) 666-7562 / (973) 873-6101 / (408) 256-8156 Web: www.consortax.com|Email: [email protected]

7 Once our client, Life time client