4/9/2018 9:50 pm EDT (USA) - Updated

INTERMEDIATE ACCOUNTING II (306) SPRING 2011

NANTONG UNIVERSITY COLLEGE OF BUSINESS ADMINISTRATION

Instructors: Dr. Clarence Coleman Jr CPA Dr. Barbara Pierce CLASS LOCATION Nantong University CLASS TIME See schedule below OFFICE LOCATION Nantong University Email [email protected]

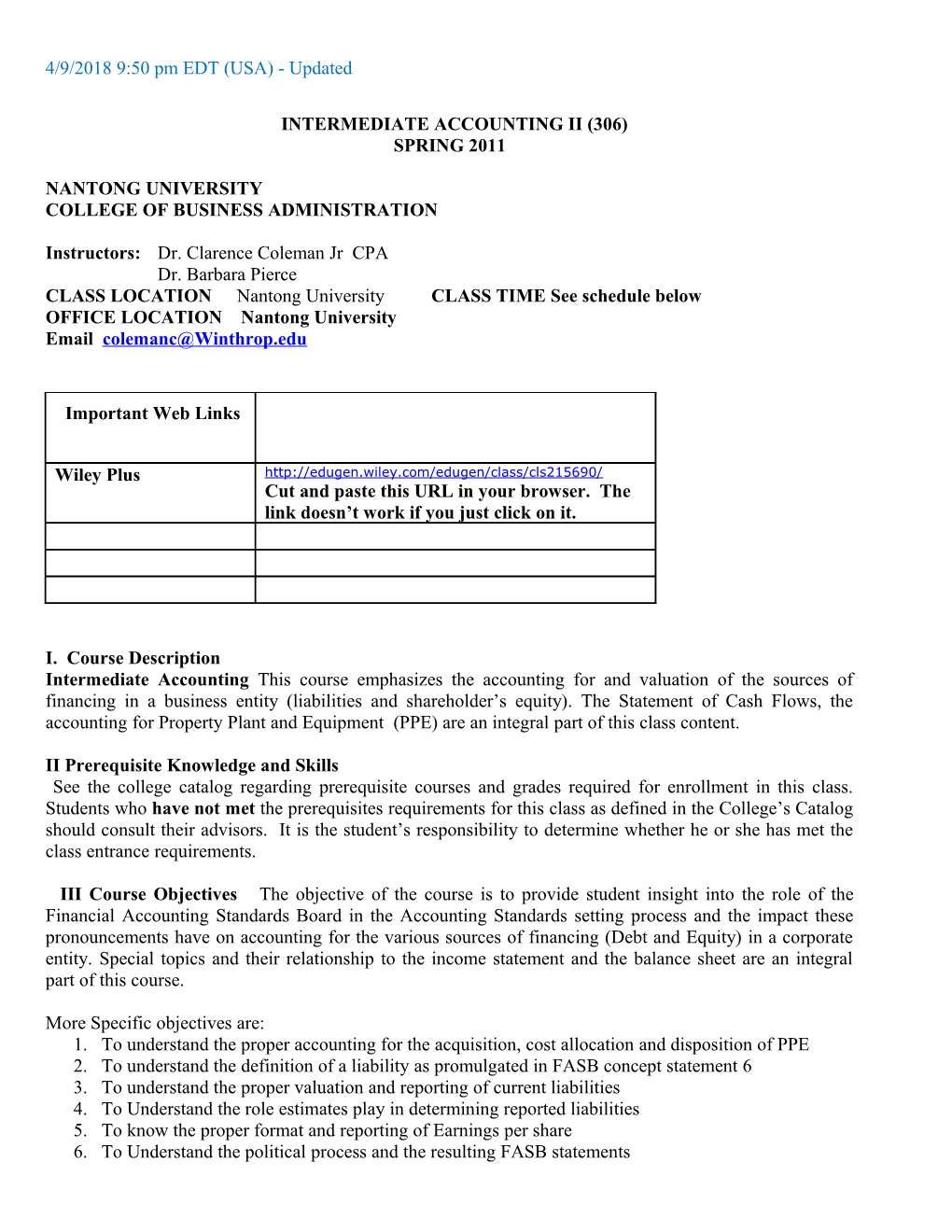

Important Web Links

Wiley Plus http://edugen.wiley.com/edugen/class/cls215690/ Cut and paste this URL in your browser. The link doesn’t work if you just click on it.

I. Course Description Intermediate Accounting This course emphasizes the accounting for and valuation of the sources of financing in a business entity (liabilities and shareholder’s equity). The Statement of Cash Flows, the accounting for Property Plant and Equipment (PPE) are an integral part of this class content.

II Prerequisite Knowledge and Skills See the college catalog regarding prerequisite courses and grades required for enrollment in this class. Students who have not met the prerequisites requirements for this class as defined in the College’s Catalog should consult their advisors. It is the student’s responsibility to determine whether he or she has met the class entrance requirements.

III Course Objectives The objective of the course is to provide student insight into the role of the Financial Accounting Standards Board in the Accounting Standards setting process and the impact these pronouncements have on accounting for the various sources of financing (Debt and Equity) in a corporate entity. Special topics and their relationship to the income statement and the balance sheet are an integral part of this course.

More Specific objectives are: 1. To understand the proper accounting for the acquisition, cost allocation and disposition of PPE 2. To understand the definition of a liability as promulgated in FASB concept statement 6 3. To understand the proper valuation and reporting of current liabilities 4. To Understand the role estimates play in determining reported liabilities 5. To know the proper format and reporting of Earnings per share 6. To Understand the political process and the resulting FASB statements Accounting 306 Schedule of Activities Page 2

7. To understand the conceptual framework and coherence to FASB pronouncements 8. To understand the form, content and role of Cash Flow Statement in financial reporting

Topic Covered: 1. Acquisition and Disposition of Property Plant and Equipment 2. Depreciation, Impairment & Depletion 3. Current Liabilities and Contingencies 4. Long Term Liabilities 5. Stockholders Equity 6. Earnings per share and Dilutive Securities 7. Statement of Cash Flows

Competencies Taught C1 Use multimedia and other emerging communication technologies C2 Communicate well orally and in writing and listen effectively C3Have the ability to organize information in a logical format, draw conclusions and support these conclusions with facts C4 Function effectively as a team member, Understand group dynamics, and interact with people of diverse backgrounds. C5 Read and interpret financial information both from a managerial and financial accountant’s perspective

IV TEXT AND REFERENCES Required: Intermediate Accounting, Kieso, Weygandt & Warfield , John Wiley & Sons, 13th edition. Any basic Financial Accounting book, preferably Kimmel, Weygandt and Keiso 3ed

Optional: CPA review , Financial by Gleim Wiley GAAP .

B: INSTRUCTIONAL METHODS:

B1. Lecture and Demonstration. The Instructor will emphasize certain topics drawn from the chapters to be covered in the course. Student are required to thoroughly read each chapter and complete the pre-chapter assignments before each lecture, in particular, attention should be given to theoretical concepts and related applied examples.

B2. Groups . Student may be assigned to teams of two to foure people for the purpose of in-class journal article reviews and accounting issue analysis from Wall Street Journal articles or other sources

VIII EVALUATION Points Grade Scale Examination I 250 900pts + A Examination II 300 800pts + B Examination Final 350 700pts + C Quizzes on Web-CT & Pre- Lecture Quizzes on Wiley Plus 100 600pts + D Below 600 F Accounting 306 Schedule of Activities Page 3

700pts + S

1000

ATTENDANCE Students are required to follow the College's attendance policy. A student whose absences exceed those designated in the college catalogue may be dropped from the course, unless the student has provided the instructor valid reasons for the absences.

PROFESSOR’S CLASS POLICIES AND NOTES 1 A student’s final examination score (prorated) will be used as the score earned on any of the interim examinations missed because of an EXCUSED absence. EXCUSED absences are allowed for family deaths, serious personal illness or other situations which are beyond the student's control. Due to the number of students who often miss one or more examinations, it is not practical to make exceptions to this policy.

2. NO CREDIT will be awarded for exercises or problems TURNED IN LATE. NO MAKEUP QUIZZES WILL BE ALLOWED. All quizzes will be made available at the day before we begin a chapter. Due to possible changes in topic scheduling due to inclement weather, unforeseen class absences, etc students are responsible for monitoring WebCt for Quiz availability and termination dates

3 Full credit will not be automatic on homework assignments turned in for points. NEATNESS, CLARITY, COMPLETENESS AND PROFESSIONALISM will be considered. Homework assignments and quizzes turned in on torn spiral edge paper, beverage stained paper or prepared in a manner that exhibit a lack of reasonable care will not receive full credit. Use Microsoft Word for essays and cases and use the Excel spreadsheet for all assignments turned in unless instructor states otherwise.

4 Students are encourages to collaborate ( study groups) on home work assignments. Assignments that are turned in for a grade should reflect the work product of the individual student unless it is a group assignment.

5 Due to the large amount and sometimes complex material we will cover in a relative short period, class time is not sufficient to allow mastery of the subject matter. In planning your schedule, allow approximately two to three hours of study time for each class meeting.

6 Attend class regularly. Habitual absences will be noted through periodic attendance checks. Failure to sign the attendance roll will result in your being marked absent for that day. Without prior arrangements with the professor, students not in attendance at the end and beginning of class will be marked absent as per the College’s policy. Notify the Professor of planned absences.

7 Work as many ASSIGNED and UNASSIGNED problems and exercises as possible. The assignments as set forth in the outline provides only the minimum work necessary to comprehend the subject matter. We will complete a representative sample of all work assigned during class.

9 Please do not eat in class. You may quietly drink any legal beverage permitted on campus. Accounting 306 Schedule of Activities Page 4

10 Student who arrive for class after class has begun, disrupt those students who have arranged their schedules to arrive timely. Please arrive on time. If you must depart class before the official end of the class period, please see me. Early departures are disruptive and unprofessional.

11 Please place your beepers and or cell phones on vibrate.

12 All class email communication will be made using WEB-CT or Skype as determined by the professor

13 Students are not permitted to give or receive assistance to each other during examination. Students who are observed giving or receiving assistance to each other during examinations will receive zero on the examination. Accounting 306 Schedule of Activities Page 5

Intermediate II Accounting 306 As we progress through the course, it may become necessary to revise the syllabus. The table below will be our master key to finding updates to the syllabus.

Master Update Table Chapter Original Update#1 Update#2 Update#3 Chapter 10 2.22.2011 3/7/2011 9pm Chapter 11 2.22.2011 3/7/2011 9pm Chapter 13 2.22.2011 3/7/2011 9pm Chapter 14 2.22.2011 3/7/2011 9pm Chapter 15 2.22.2011 3/7/2011 9pm Chapter 16 2.22.2011 3/7/2011 9pm Chapter 23 2.22.2011 3/7/2011 9pm

My Wiley Plus course is being activated next week. As soon as I am able to access the course I will add those practice assignments and quizzes to the syllabus that follows. Accounting 306 Schedule of Activities Page 6

Chapter 10, Acquisition and Disposition of Property plant and Equipment

March 7-8 Learning Objectives 1. Describe Property Plant and Equipment 2. Identify the cost to include in initial recording of property Plant and equipment 3. Describe the Accounting problems associated with Self-Constructed assets 4. Describe the accounting problems associated with interest capitalization

Before Class Pages LO 1 - 4 PNC Source Preparation WP Wiley P no points WebCt QZP Quiz Points Description No Points Wiley Plus Animated Chapter Presentation (PPTs’) Points Wiley Plus Pre- lecture time unlimited No Points Wiley Plus Post Lecture time unlimited Points Wiley Plus Home Work graded due before 5/14 noon No Points Wiley Plus Interest capitalization tutorial No Points Wiley Plus Depreciation of Long Lived assets tutorial

WebCT Pages LO 1 - 4 Assignment Learning Description E Exercise Objectives P Problem E10-1 2 Acquisition cost of Realty E10-5 2,3,4 Treatment of Various costs E10-8 4 Capitalization of Interest E10-9 4 Capitalization of Interest

Solutions to the above assigned exercises will be posted via WebCt Accounting 306 Schedule of Activities Page 7

Chapter 10, Acquisition and Disposition of Property plant and Equipment

Learning Objectives 5. Describe Property Plant and Equipment 6. Identify the cost to include in initial recording of property Plant and equipment 7. Describe the Accounting problems associated with Self-Constructed assets 8. Describe the accounting problems associated with interest capitalization

Before Class Pages LO 5 - 7 PNC Source Description Preparation WP Wiley P no points WebCt QZP Quiz Points No Points Wiley Plus Animated Chapter Presentation (PPTs’) Points Wiley Plus Pre- lecture time unlimited No Points Wiley Plus Post Lecture time unlimited Points Wiley Plus Home Work graded due before 5/14 noon No Points Wiley Plus Interest capitalization tutorial No Points Wiley Plus Depreciation of Long Lived assets tutorial

WebCt Pages LO 1 - 4 Assignment Learning Description E Exercise Objectives P Problem E10-11 2, 3, 5 Entries for Equipment Acquisition E10-17 5 Non Monetary exchange E10-18 5 Non Monetary Exchange E10-22 6 Analysis of subsequent Expenditures

Solutions to the above assigned exercises will be posted via WebCt Accounting 306 Schedule of Activities Page 8

Chapter 11, Acquisition and Disposition of Property plant and Equipment

March 8 - 9 Learning Objectives Before Class 1. Explain the concept of Depreciation 2. Identify the factors involved in the depreciation process 3. Compare Activity, Straight Line and decreasing charge methods 4. Explain Special depreciation methods Pages LO 1 - 4 PNC Source Preparation WP Wiley P no points WebCt QZP Quiz Points Description No Points Wiley Plus Animated Chapter Presentation (PPTs’) Points Wiley Plus Pre- lecture time unlimited No Points Wiley Plus Post Lecture time unlimited Points Wiley Plus Home Work graded due before 5/14 noon No Points Wiley Plus Impairment tutorial No Points Wiley Plus Depreciation of Long Lived assets tutorial

In Class Pages LO 1 - 4 Assignment Learning Description E Exercise Objectives P Problem BE11-2 2, 3 Depreciation Computation BE11-4 2,3 Depreciation – Conceptual Understanding E11-6 2, 3 Depreciation Computation Five methods E11-9 2,3 Depreciation , Composite E11-11 2,3 Change in Estimate

Solutions to the above assigned exercises will be posted via WebCt Accounting 306 Schedule of Activities Page 9

Chapter 11, Acquisition and Disposition of Property plant and Equipment

Learning Objectives 5. Explain the Accounting Issues related to Asset Impairments 6. Explain the accounting procedures for depletion of natural resources. 7.Expain how to report and analyze property plant and equipment and natural resources

Before Class Pages LO 5 - 7 PNC Source Description Preparation WP Wiley P no points WebCt QZP Quiz Points No Points Wiley Plus Animated Chapter Presentation (PPTs’) Points Wiley Plus Pre- lecture time unlimited No Points Wiley Plus Post Lecture time unlimited Points Wiley Plus Home Work graded due before 5/14 noon

In Class Pages LO 1 - 4 Assignment Learning Description E Exercise Objectives P Problem BE11-9 6 Depletion BE11-10 7 Ratios E11-17 5 Impairment E11-21 6 Depletion

Solutions to the above assigned exercises will be posted via WebCt

March 10, 2011 (Thursday) - 9 am Examination I Chapters 10 - 11 Accounting 306 Schedule of Activities Page 10

Chapter 13, Current liabilities and Contingencies

March 11, 2011 Learning Objectives BEFORE CLASS 1. Describe the nature Type and valuation of current Liabilities 2. Explain the classification of short term liabilities expected to be refinanced 3. Identify types of employee related liabilities Pages LO 1 - 3 PNC Source Preparation WP Wiley P no points WebCt QZP Quiz Points Description No Points Wiley Plus Animated Chapter Presentation (PPTs’) Points Wiley Plus Pre- lecture time unlimited No Points Wiley Plus Post Lecture time unlimited Points Wiley Plus Home Work graded due before 5/14 noon

In Class Pages LO 1 - 3 Assignment Learning Description E Exercise Objectives P Problem E13-3 2 Refinancing of short term debt E13-4 2 Refinancing of short term debt E13-5 3 Compensated absences E13-8 3 Payroll tax Entries

Solutions to the above assigned exercises will be posted via WebCt after in class presentation. Accounting 306 Schedule of Activities Page 11

Chapter 13, Current liabilities and Contingencies

Learning Objectives

Before Class 4. Identify the criteria used to account for and disclose gain and loss contingencies 5. Explain the accounting for the different types of loss contingencies 6. Indicate how to present and analyze liabilities and contingencies Pages LO 4 - 6 PNC Source Description Preparation WP Wiley P no points WebCt QZP Quiz Points No Points Wiley Plus Animated Chapter Presentation (PPTs’) Points Wiley Plus Pre- lecture time unlimited No Points Wiley Plus Post Lecture time unlimited Points Wiley Plus Home Work graded due before 5/14 noon

In Class Pages LO 4 - 6 Assignment Learning Description E Exercise Objectives P Problem E13-10 5 Warranties E13-12 5 Premium Entries E13-19 6 Ratio computation and effect on transactions

Solutions to the above assigned exercises will be posted via WebCt after in class presentation Accounting 306 Schedule of Activities Page 12

Chapter 14, Long Term Liabilities March 12, 2011 Learning Objectives 1. Describe the formal procedures associated with issuing long term debt 2. Identify the various types of bond issues 3. Describe the accounting valuation of bonds at the date of issue 4. Apply the methods of bond discount and premium amortization

BEFORE CLASS Pages LO 1 - 4 PNC Source Preparation WP Wiley P no points WebCt QZP Quiz Points Description No Points Wiley Plus Animated Chapter Presentation (PPTs’) Points Wiley Plus Pre- lecture time unlimited No Points Wiley Plus Post Lecture time unlimited Points Wiley Plus Home Work graded due before 5/14 noon

In Class Pages LO 1 - 4 Assignment Learning Description E Exercise Objectives P Problem E14-3 3,4 Entries for bond transactions E14-4 3,4 Entries for bond transactions –Straight line E14-5 3,4 Entries for bond transactions –Effective E14-6 3,4 Amortization schedule – Straight Line E14-7 3,4 Amortization schedule – Effective

Solutions to the above assigned exercises will be posted via WebCt after in class presentation Accounting 306 Schedule of Activities Page 13

Chapter 14, Long Term Liabilities Learning Objectives 5. Describe the accounting for the extinguishment of debt 6. Explain the accounting for long term notes payables 7. Explain the reporting of off-balance sheet financing arrangements 8. Indicate how to present and analyze long term debt

BEFORE CLASS Pages LO 5 - 9 PNC Source Description Preparation WP Wiley P no points WebCt QZP Quiz Points No Points Wiley Plus Animated Chapter Presentation (PPTs’) Points Wiley Plus Pre- lecture time unlimited No Points Wiley Plus Post Lecture time unlimited Points Wiley Plus Home Work graded due before 5/14 noon

In Class Pages LO 5 -9 Assignment Learning Description E Exercise Objectives P Problem E14-10 3,4 Entries for bond Transactions E14-13 3,4,5 Retirements and issuance of Bonds E14-16 6 Entries Zero interest bearing notes

Solutions to the above assigned exercises will be posted via WebCt after in class presentation

March 14, 2011 (Monday) am Examination2 Chapters 13 -14 Accounting 306 Schedule of Activities Page 14

Chapter 15, Shareholders equity March 15, 2011 Learning Objectives 1. Discuss the characteristic of the corporate form of organization 2. Identify the key components of stock holders equity 3. Explain the accounting procedure for Issuing stock 4. Describe the accounting procedure for treasury stock BEFORE CLASS Pages LO 1 - 4 PNC Source Preparation WP Wiley P no points WebCt QZP Quiz Points Description No Points Wiley Plus Animated Chapter Presentation (PPTs’) Points Wiley Plus Pre- lecture time unlimited No Points Wiley Plus Post Lecture time unlimited Points Wiley Plus Home Work graded due before 5/14 noon

In Class Pages LO 1 - 4 Assignment Learning Description E Exercise Objectives P Problem E15-1 3 Recording the Issuance of Common Stock E15-3 3 Issue stock for land E15-5 3, 5 Lump sum sale common and preferred E15-6 3, 4 Stock Issuance and repurchase (Treasury stock)

Solutions to the above assigned exercises will be posted via WebCt after in class presentation Accounting 306 Schedule of Activities Page 15

Chapter 15, Shareholders’ Equity Learning Objectives 5. Explain the accounting and reporting for preferred stock 6. Describe the policies used in distributing dividends 7. Identify the various forms of dividend distributions 8. Explain the accounting for small and large stock dividend and for stock splits 9. Indicate how to present and analyze stockholders equity

BEFORE CLASS Pages LO 5 - 9 PNC Source Description Preparation WP Wiley P no points WebCt QZP Quiz Points No Points Wiley Plus Animated Chapter Presentation (PPTs’) Points Wiley Plus Pre- lecture time unlimited No Points Wiley Plus Post Lecture time unlimited Points Wiley Plus Home Work graded due before 5/14 noon

In Class Pages LO 5 -8 Assignment Learning Description E Exercise Objectives P Problem E15-14 8 Entries for Stock splits and stock dividends E15-15 7,8 Dividend entries E15-16 6,7,8 Computation of Retained Earnings E15-21 10* Appx Preferred dividends

Solutions to the above assigned exercises will be posted via WebCt after in class presentation Accounting 306 Schedule of Activities Page 16

Chapter 16, Dilutive Securities and Earnings Per Share March 16, 2011

Learning Objectives 1. Describe the accounting for the issuance, conversion and retirement of convertible securities 2. Explain the accounting for convertible preferred stock 3. Contrast the accounting for stock warrants and for stock warrants issued with other securities 4. Describe the accounting for stock compensation plans under Generally Accepted Accounting Principles (GAAP) 5. Discuss the controversy involving stock compensation plans BEFORE CLASS Pages LO 1 - 5 PNC Source Preparation WP Wiley P no points WebCt QZP Quiz Points Description No Points Wiley Plus Animated Chapter Presentation (PPTs’) Points Wiley Plus Pre- lecture time unlimited No Points Wiley Plus Post Lecture time unlimited Points Wiley Plus Home Work graded due before 5/14 noon

In Class Pages LO 1 – 5 Assignment Learning Description E Exercise Objectives P Problem E16-1 3 Issuance and Conversion of Bonds E16-5 1 Conversion of Bonds E16-8 3 Issuance of Bonds and detachable warrants E16-11 4 Issuance, Exercise, and termination of stock options E16-13 4 Accounting for restricted stock

Solutions to the above assigned exercises will be posted via WebCt after in class presentation Accounting 306 Schedule of Activities Page 17

Chapter 16, Dilutive Securities and Earnings Per Share

Learning Objectives 6. Compute Earning Per Share (EPS) in a simple capital structure 7. Compute Earning Per Share in a Complex capital structure

BEFORE CLASS Pages LO 5 - 7 PNC Source Description Preparation WP Wiley P no points WebCt QZP Quiz Points No Points Wiley Plus Animated Chapter Presentation (PPTs’) Points Wiley Plus Pre- lecture time unlimited No Points Wiley Plus Post Lecture time unlimited Points Wiley Plus Home Work graded due before 5/14 noon

In Class Pages LO 5 -7 Assignment Learning Description E Exercise Objectives P Problem E16-15 6 Weighted Average Shares outstanding E16-16 6 EPs Simple capital structure E16-18 6 EPS Simple capital structure E16-22 7 EPS with convertible bonds (various situations)

Solutions to the above assigned exercises will be posted via WebCt after in class presentation Accounting 306 Schedule of Activities Page 18

Chapter 23, Statement of Cash Flows March 17, 2011

Learning Objectives 1. Describe the purpose of the Statement of Cash Flows 2. Identify the major classifications of cash flows 3. Differentiate between net income and net cash flows from operation activities 4. Contrast the direct and indirect method for calculation net cash flows from operating activities 5. Determine net cash flows from investing and financing activities 6. Prepare a cash flow statement

BEFORE CLASS Pages LO 1 -6 (Indirect method) PNC Source Preparation WP Wiley P no points WebCt QZP Quiz Points Description No Points Wiley Plus Animated Chapter Presentation (PPTs’) Points Wiley Plus Pre- lecture time unlimited No Points Wiley Plus Post Lecture time unlimited Points Wiley Plus Home Work graded due before 5/14 noon

In Class Pages LO 1 – 6 Indirect method Assignment Learning Description E Exercise Objectives P Problem E23-1 2 Classifications of transactions E23-3 3, 4 Operating section Indirect method E23-6 3, 4 Operating section Indirect method E23-11 6 SCF indirect method

Solutions to the above assigned exercises will be posted via WebCt after in class presentation Accounting 306 Schedule of Activities Page 19

Chapter 23, Statement of Cash Flows

Learning Objectives 5. Determine net cash flows from investing and financing activities 6. Prepare a cash flow statement 7. Identify the sources of information for a statement of cash flows

BEFORE CLASS Pages LO 1 – 7 Direct Method PNC Source Description Preparation WP Wiley P no points WebCt QZP Quiz Points No Points Wiley Plus Animated Chapter Presentation (PPTs’) Points Wiley Plus Pre- lecture time unlimited No Points Wiley Plus Post Lecture time unlimited Points Wiley Plus Home Work graded due before 5/14 noon

In Class Pages LO 1 -7 Direct Method Assignment Learning Description E Exercise Objectives P Problem E23-4 3, 4 Operating section direct method E23-5 3, 4 Operating section Direct method E23-7 3, 4 Operating section Direct method E23-9 6 SCF direct method

Solutions to the above assigned exercises will be posted via WebCt after in class presentation

March 18, 2011 (Friday) - 8:30 am Examination III Chapters 15, 16, 23