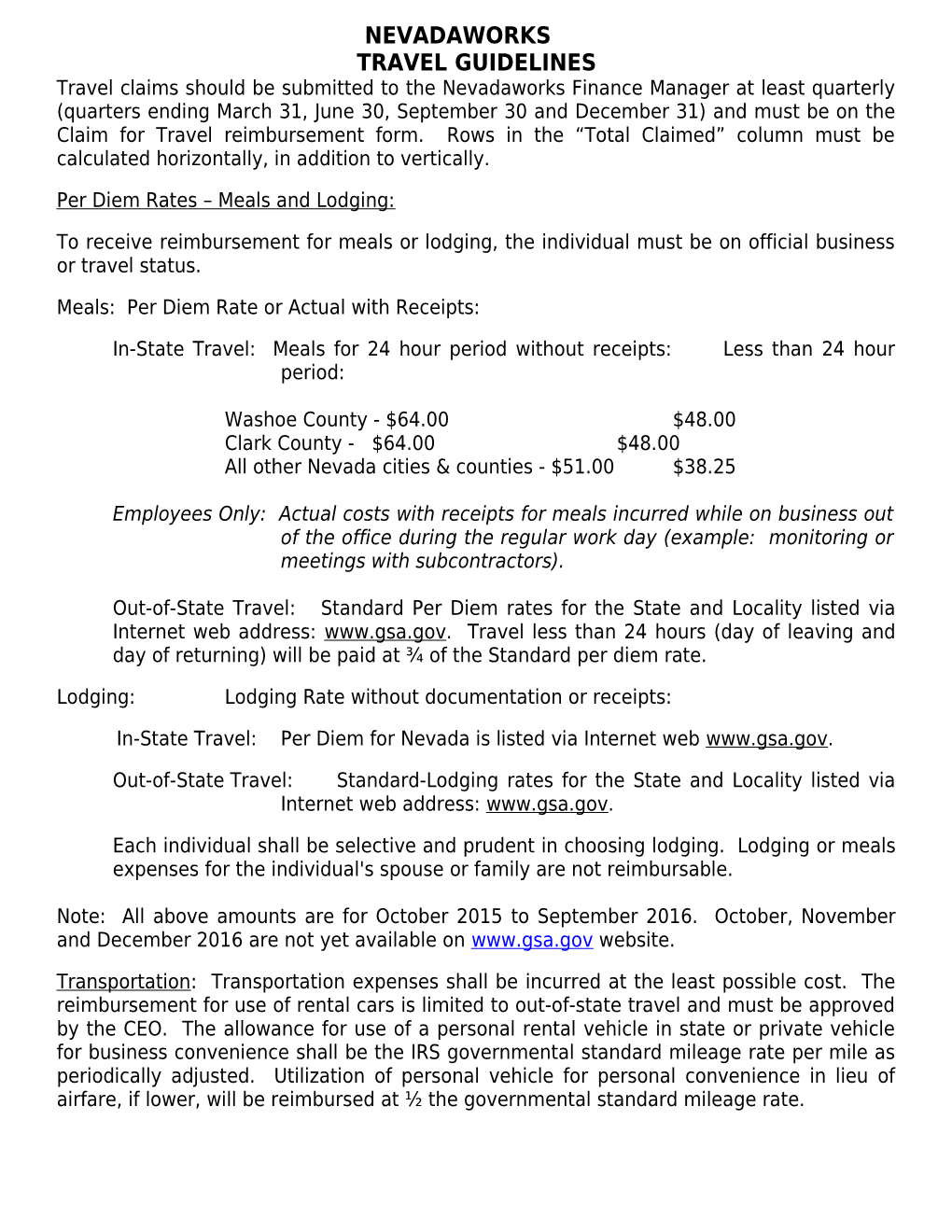

NEVADAWORKS TRAVEL GUIDELINES Travel claims should be submitted to the Nevadaworks Finance Manager at least quarterly (quarters ending March 31, June 30, September 30 and December 31) and must be on the Claim for Travel reimbursement form. Rows in the “Total Claimed” column must be calculated horizontally, in addition to vertically.

Per Diem Rates – Meals and Lodging:

To receive reimbursement for meals or lodging, the individual must be on official business or travel status.

Meals: Per Diem Rate or Actual with Receipts:

In-State Travel: Meals for 24 hour period without receipts: Less than 24 hour period:

Washoe County - $64.00 $48.00 Clark County - $64.00 $48.00 All other Nevada cities & counties - $51.00 $38.25

Employees Only: Actual costs with receipts for meals incurred while on business out of the office during the regular work day (example: monitoring or meetings with subcontractors).

Out-of-State Travel: Standard Per Diem rates for the State and Locality listed via Internet web address: www.gsa.gov. Travel less than 24 hours (day of leaving and day of returning) will be paid at ¾ of the Standard per diem rate.

Lodging: Lodging Rate without documentation or receipts:

In-State Travel: Per Diem for Nevada is listed via Internet web www.gsa.gov.

Out-of-State Travel: Standard-Lodging rates for the State and Locality listed via Internet web address: www.gsa.gov.

Each individual shall be selective and prudent in choosing lodging. Lodging or meals expenses for the individual's spouse or family are not reimbursable.

Note: All above amounts are for October 2015 to September 2016. October, November and December 2016 are not yet available on www.gsa.gov website.

Transportation: Transportation expenses shall be incurred at the least possible cost. The reimbursement for use of rental cars is limited to out-of-state travel and must be approved by the CEO. The allowance for use of a personal rental vehicle in state or private vehicle for business convenience shall be the IRS governmental standard mileage rate per mile as periodically adjusted. Utilization of personal vehicle for personal convenience in lieu of airfare, if lower, will be reimbursed at ½ the governmental standard mileage rate.

Effective: January 1, 2017 53.5 cents per mile When utilizing air transportation, travel shall be arranged at coach airfare, unless such service is unavailable.

Miscellaneous: Other travel expenses, such as convention registration fees; taxi, air porter or limousine fares from airport to hotel and return; parking or vehicle storage fees will be reimbursed when receipts are obtained. Reimbursement shall not be made for the cost of intoxicating liquors or more than one personal telephone call per day incurred in the course of such person's travel status.

NW-04 revised 1/2017

CLAIM FOR BUSINESS TRAVEL EXPENSES Board Member Employee Name: Date: Address: (Where you would like your travel reimbursement check mailed to) Transportation Date Purpose Per Total Cost Lodging s Activity-Function Miles Diem Claimed $ .535

COMMENTS: Total Expense Claimed $

Less: Travel Advance $ ( ) Balance $ I certify that the above claim is correct and the expenses were incurred in the course of my official duties.

Claimant: Payment Approval:

Signature Required Authorizing Signature

Submit Original Claim form to: 6490 South McCarran Blvd, Building A, Suite 1, Reno, NV 89509-6119 775-337-8600 fax 775-337-9589 www.nevadaworks.com NW-04 revised 1/2017