FINANCIAL FORECASTING

Breakeven analysis and cash budgeting are both short-term planning tools. It is equally important that long-term planning be periodically reviewed to ensure that the short-term goals are consistent with the long-term objectives, as well as to provide advance notice of the needs of the corporation so that appropriate decisions can be made and actions taken.

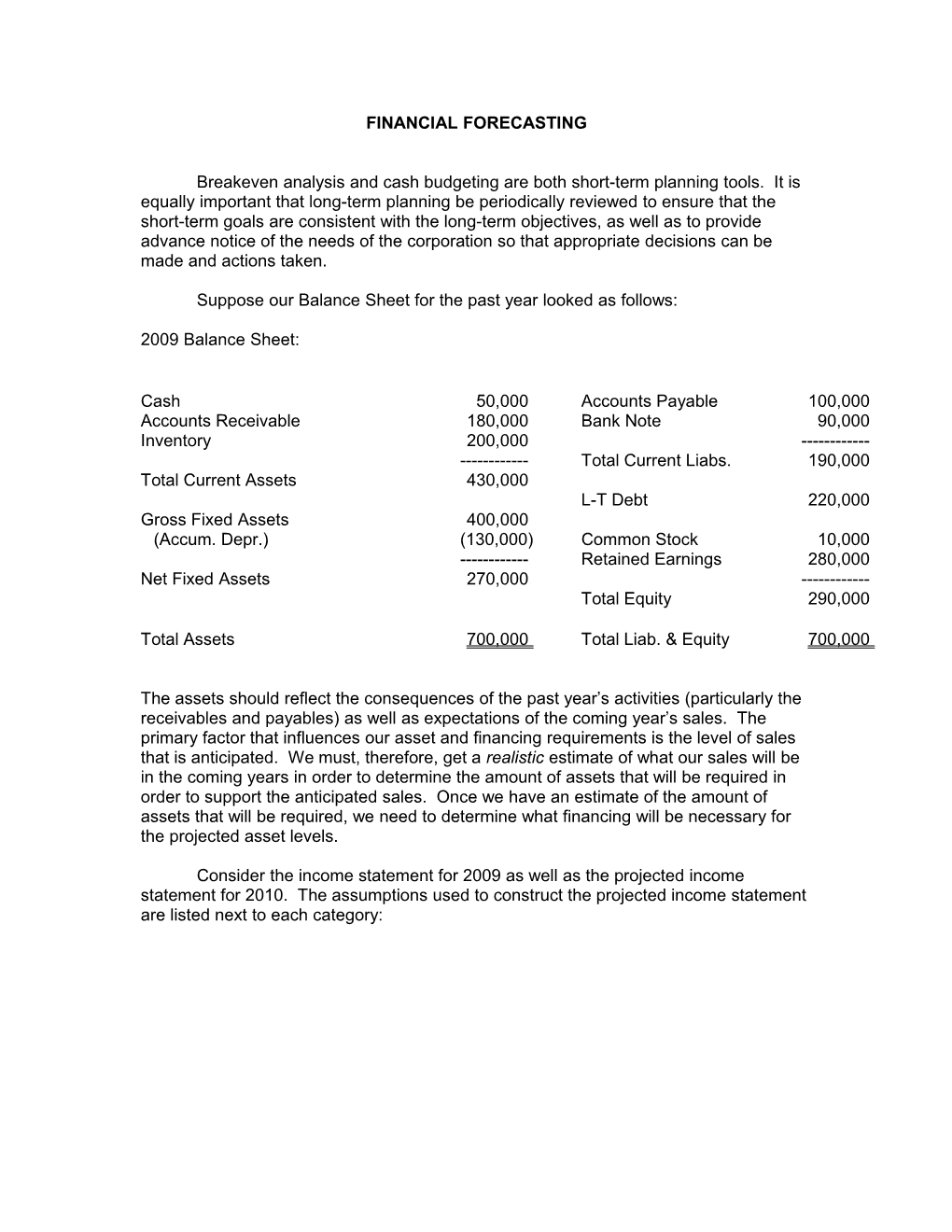

Suppose our Balance Sheet for the past year looked as follows:

2009 Balance Sheet:

Cash 50,000 Accounts Payable 100,000 Accounts Receivable 180,000 Bank Note 90,000 Inventory 200,000 ------Total Current Liabs. 190,000 Total Current Assets 430,000 L-T Debt 220,000 Gross Fixed Assets 400,000 (Accum. Depr.) (130,000) Common Stock 10,000 ------Retained Earnings 280,000 Net Fixed Assets 270,000 ------Total Equity 290,000

Total Assets 700,000 Total Liab. & Equity 700,000

The assets should reflect the consequences of the past year’s activities (particularly the receivables and payables) as well as expectations of the coming year’s sales. The primary factor that influences our asset and financing requirements is the level of sales that is anticipated. We must, therefore, get a realistic estimate of what our sales will be in the coming years in order to determine the amount of assets that will be required in order to support the anticipated sales. Once we have an estimate of the amount of assets that will be required, we need to determine what financing will be necessary for the projected asset levels.

Consider the income statement for 2009 as well as the projected income statement for 2010. The assumptions used to construct the projected income statement are listed next to each category: Income Statements: 2009 2010 Actual Projected ======Revenues 1,000,000 1,200,000 20% increase Cost of Goods Sold 500,000 600,000 50% of Sales ------Gross Profit 500,000 600,000

Gen. & Adm. Expense Salaries 220,000 226,600 3% inflation Rent 60,000 60,000 Contractual Repairs & Maintenance 14,000 14,420 3% inflation Travel 23,000 23,690 3% inflation Utilities 12,000 12,360 3% inflation Depreciation 40,000 44,000 MACRS determined ------EBIT 131,000 218,930

Interest Expense 30,000 30,000 ------Taxable Income 101,000 188,930

Taxes (35%) 35,350 66,126 ------Net Income 65,650 122,805

Less: Dividends 25,000 25,000 ------Addition to Retained Earnings 40,650 97,805

If we intend to be able to meet the growing demand, we need to be sure that we have the necessary assets on hand to support our projected level of sales, as well as the ability to finance these projected asset levels. The easiest means of projecting the balance sheet is to utilize the percent-of-sales method of projection. This technique takes each account on the balance sheet that varies with sales and expresses it as a percentage of sales. This percentage is then applied to the projected sales level to determine what levels can reasonably be expected for these accounts.

If we assume that the balance sheet for 2009 above was about right for the level of sales of $1 million that we experienced in 2009, then we can project the balance sheet for 2010 given our projected sales of $1.2 million for the year:

$50,000 Cash = = 5% * $1,200,000 = $60,000 $1,000,000 $180,000 A / R = = 18% * $1,200,000 = $216,000 $1,000,000

$200,000 Inventory = = 20% * $1,200,000 = $240,000 $1,000,000

$400,000 Fixed Assets = = 40% * $1,200,000 = $480,000 $1,000,000

$100,000 A / P = = 10% * $1,200,000 = $120,000 $1,000,000

Note that your bank doesn’t just automatically give you more money, nor are long-term bonds automatically issued. In fact, aside from accounts payable and other accruals (which are referred to as spontaneous sources of financing) which have a zero cost, how assets are financed is a decision variable (that we will look at in detail later). Thus, simply leave these accounts alone.

The only other account that is a direct function of sales is the retained earnings account which is a function of both our profitability and dividend policy. Recall the relationship between successive retained earnings accounts:

Beginning R/E + Net Income – Dividends = Ending Retained Earnings

$280,000 + $122,805 - $25,000 = $377,805

We now can fill in our entire projected balance sheet for 2010. Since total assets must equal total liabilities and equity, we will used Additional Financing Required as a balancing figure. 2010 Balance Sheet:

Cash 60,000 Accounts Payable 120,000 Accounts Receivable 216,000 Bank Note 90,000 Inventory 240,000 ------Total Current Liabs. 210,000 Total Current Assets 516,000 L-T Debt 220,000 Gross Fixed Assets 480,000 (Accum. Depr.) (174,000) Common Stock 10,000 ------Retained Earnings 377,805 Net Fixed Assets 306,000 ------Total Equity 387,805

Add’l Financing Req’d 4,196

Total Assets 822,000 Total Liab. & Equity 822,000

Ultimately, the Additional Financing Required figure must be reduced to zero. This is where decisions must be made. One source, for example may be that additional Fixed Assets are not require; i.e., there is sufficient unutilized capacity to accommodate the 20% increase in sales without any additions. This would reduce the asset requirements and, hence, the financial requirements of the firm. Another alternative might be to reduce the dividends being paid. Or additional bank loans may be taken out. In any event, we now know what our financing requirements are and we can begin looking for ways of covering our shortfall.

The final step we should take is to construct the Statement of Cash Flows for 2010. It appears as follows:

2010 Statement of Cash Flows

From Operations: Net Income 122,805 Depreciation 44,000 ------Operating Cash Flow 166,805

Accounts Receivable ( 36,000) Inventory ( 40,000) Accounts Payable 20,000 ------Working Capital ( 56,000)

Total From Operations 110,805 From Investment Activities:

Fixed Assets (80,000) ------Total From Investments (80,000)

From Financing Activities:

Add'l Fin. Required 4,196 Dividends (25,000) ------Total From Financing (20,805)

Total Cash Flow 10,000

Plus: Beginning Cash 50,000

Ending Cash 60,000

The figures were calculated as follows:

Accounts Receivable = 180,000 – 216,000 = (36,000) Inventory = 200,000 – 240,000 = (40,000) Accounts Payable = 120,000 – 100,000 = 20,000 Fixed Assets = 400,000 – 480,000 = (80,000) Add’l Fin. Required = 4,196 – 0 = 4,196 Dividends = Beg. R/E + Net Income – End. R/E = 280,000 + 122,805 – 377,805 = (25,000)

Speaking of the Fixed Assets, consider the following graph: Fixed Assets Percent-of-Sales

Sales As may be observed, plant and equipment comes in “chunks” – you cannot build one- fifth of a plant. Thus, sometimes the percent-of-sales approach is not the best one.

As another example, consider inventories. Perhaps the best description of the relationship between inventories and sales is described by a linear (or simple) regression.

Inventory (Sales)

This illustrates some of the drawbacks to the percent-of-sales method. Inventory Percent-of-Sales

Over- estimate Linear

Regression

Under- estimate

Sales

The percent-of-sales method forces the line through the origin. In the case of the inventory regression, this results in an under-estimate of the requirements at low levels of sales and an over-estimate at high levels.

What would happen if we used a linear regression on Accounts Receivable?