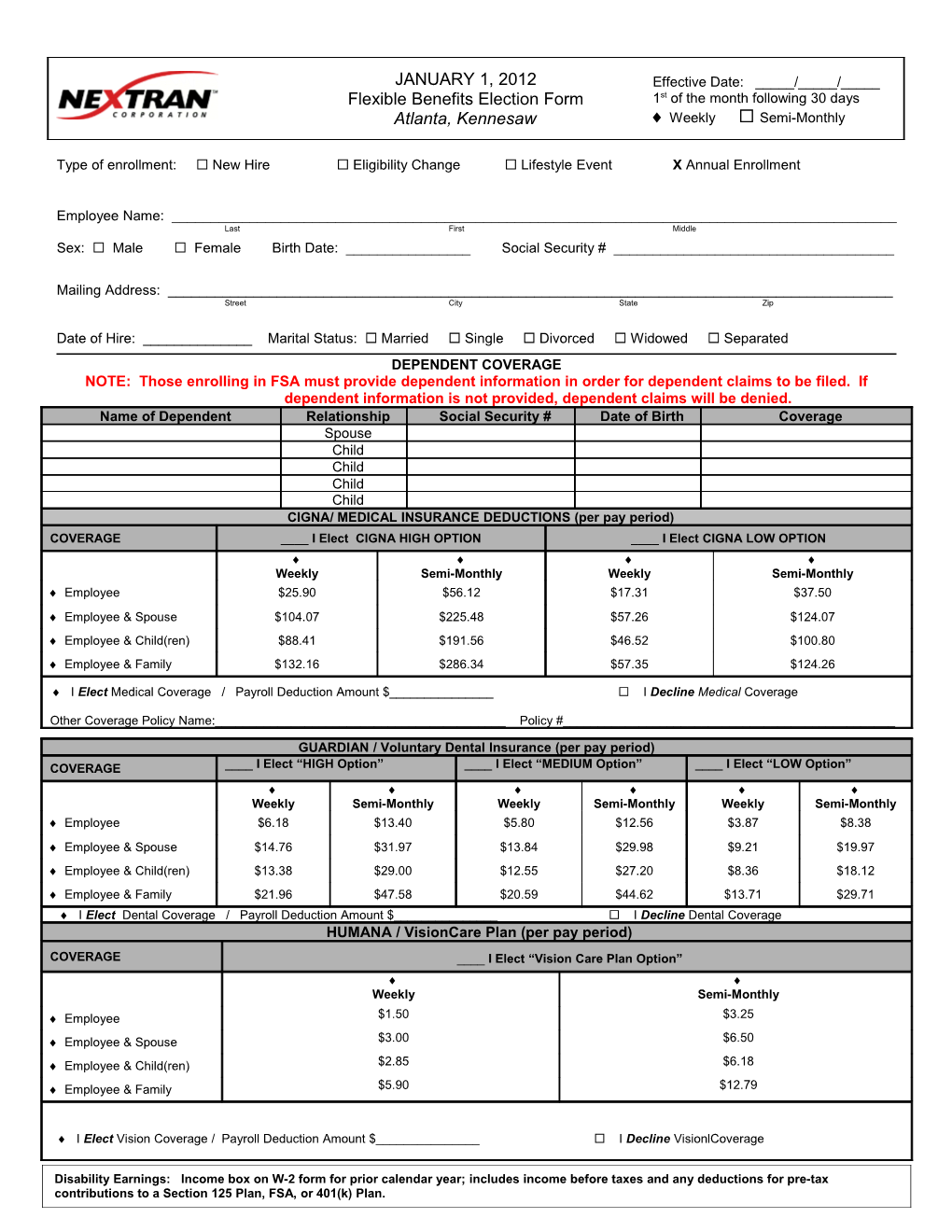

JANUARY 1, 2012 Effective Date: _____/_____/_____ Flexible Benefits Election Form 1st of the month following 30 days Atlanta, Kennesaw Weekly Semi-Monthly

Type of enrollment: New Hire Eligibility Change Lifestyle Event X Annual Enrollment

Employee Name: ______Last First Middle Sex: Male Female Birth Date: ______Social Security # ______

Mailing Address: ______Street City State Zip

Date of Hire: ______Marital Status: Married Single Divorced Widowed Separated DEPENDENT COVERAGE NOTE: Those enrolling in FSA must provide dependent information in order for dependent claims to be filed. If dependent information is not provided, dependent claims will be denied. Name of Dependent Relationship Social Security # Date of Birth Coverage Spouse Child Child Child Child CIGNA/ MEDICAL INSURANCE DEDUCTIONS (per pay period) COVERAGE ____ I Elect CIGNA HIGH OPTION ____ I Elect CIGNA LOW OPTION Weekly Semi-Monthly Weekly Semi-Monthly Employee $25.90 $56.12 $17.31 $37.50 Employee & Spouse $104.07 $225.48 $57.26 $124.07 Employee & Child(ren) $88.41 $191.56 $46.52 $100.80 Employee & Family $132.16 $286.34 $57.35 $124.26

I Elect Medical Coverage / Payroll Deduction Amount $______ I Decline Medical Coverage

Other Coverage Policy Name:______Policy #______

GUARDIAN / Voluntary Dental Insurance (per pay period) COVERAGE ____ I Elect “HIGH Option” ____ I Elect “MEDIUM Option” ____ I Elect “LOW Option” Weekly Semi-Monthly Weekly Semi-Monthly Weekly Semi-Monthly Employee $6.18 $13.40 $5.80 $12.56 $3.87 $8.38 Employee & Spouse $14.76 $31.97 $13.84 $29.98 $9.21 $19.97 Employee & Child(ren) $13.38 $29.00 $12.55 $27.20 $8.36 $18.12 Employee & Family $21.96 $47.58 $20.59 $44.62 $13.71 $29.71

I Elect Dental Coverage / Payroll Deduction Amount $______ I Decline Dental Coverage HUMANA / VisionCare Plan (per pay period)

COVERAGE ____ I Elect “Vision Care Plan Option” Weekly Semi-Monthly Employee $1.50 $3.25 Employee & Spouse $3.00 $6.50 Employee & Child(ren) $2.85 $6.18 Employee & Family $5.90 $12.79

I Elect Vision Coverage / Payroll Deduction Amount $______ I Decline VisionlCoverage

Disability Earnings: Income box on W-2 form for prior calendar year; includes income before taxes and any deductions for pre-tax contributions to a Section 125 Plan, FSA, or 401(k) Plan. Voluntary Short Term Disability (per pay period) 60% of weekly earnings / Maximum Weekly Benefit: $1,000 I Elect LFG Short-term Disability (STD) Payroll Deduction Amount Use this calculation for weekly pay period Annual Earnings: $______52 x .60 10 x $0.495 x 12 52 = $______(weekly) Use this calculation for semi-monthly pay period Annual Earnings: $______52 x .60 10 x $0.495 x 12 24 = $______(semi-monthly) I Decline STD (Note: Guarantee-Issued available when first eligible OR during annual open enrollment meetings.) Voluntary Long Term Disability (per pay period) 60% of monthly earnings / Maximum Monthly Benefit: $6,000 I Elect LFG Long-term Disability Payroll Deduction Amount Use this calculation for $______(weekly) weekly pay period Annual Earnings: $______12 x $0.50100 x 12 52 = Use this calculation for $______(semi-monthly) semi-monthly pay period Annual Earnings: $______12 x $0.50100 x 12 24 = I Decline LT Disability (Note: Guarantee-Issued available when first eligible OR during annual open enrollment meetings.) Group Basic Life Insurance Employer paid $50,000 Basic Term Life (Reduction of benefit applies for those 65+ yrs) Optional Life Insurance (per pay period) I Elect LFG Optional Life Insurance Employee Benefit Amt: $______Monthly Prem.: $______Payroll Deduction Amt: $______Spouse Benefit Amt: $______Monthly Prem.: $______Payroll Deduction Amt: $______Child(ren) Benefit Amt: $______Monthly Prem.: $______Payroll Deduction Amt: $______ I Decline Optional Life Flexible Spending Account (per pay period) I Elect: Medical Care FSA ($4,000 Maximum) Annual Amt $______Per Pay Period $______ Dependent Care FSA ($5,000 / $2,500 maximum) Annual Amt $______Per Pay Period $______My email address is: ______ I Decline to participate in the Flexible Spending Accounts Summary of Deductions (per pay period) Pre-Tax Post-Tax Medical Dental Vision STD LTD Optional Life Medical FSA Dependent Care FSA TOTAL Terms and Conditions - Section 125 Plans Only I cannot change or revoke this compensation reduction agreement at any time during the plan year unless I have a change in Family Status, or Job Status for Employee, or Employee’s Spouse, as stated in the Plan Document. The Plan Administrator may reduce or cancel my compensation reduction or otherwise modify this agreement in the event he/she believes it advisable in order to satisfy certain provisions of the Internal Revenue Code. If my required contributions for the elected benefits are increased or decreased while this agreement remains in effect, my compensation reduction will automatically be adjusted to reflect that increase or decrease. The reduction in my cash compensation reduction under this agreement shall be in addition to any reductions under other agreements of benefit plan. My Social Security Benefits may be slightly reduced as a result of my election. This agreement will automatically terminate if the plan is terminated or discontinued, or if I cease to receive compensation from the Company which, before reduction hereunder, is at least equal to the amount of that reduction. Prior to the first day of each plan year I will be offered the opportunity to change my benefits election for the following plan year. If I do not complete and return a new election form at that time, I will be treated as having elected to continue my benefit coverage then in effect for the new Plan Year. In addition, this compensation reduction agreement will continue by its terms in the amount of the required contribution for the benefit option. I agree to accept issue of the debit card in conjunction with Flexible Spending Account deductions and will abide by the terms of the debit card holder agreement accompanying issue of the Card. I will be fully responsible for any taxes, fines or penalties incurred because of my failure or my dependent’s failure to follow the terms of issue. Any amount of the Medical and Dependent Care Flexible Spending Accounts that is not used during a plan year to provide benefits will be forfeited and may not be paid to me in cash or used to provide benefits specifically for me in a later year. Employee Agreement By signing this election form I acknowledge that I have read and agree to follow all terms and conditions as stated above. Nextran Corporation and I hereby agree that my cash compensation will be reduced by the amounts set forth above for each pay period during the Plan Year (or during such portion of the year as remains after the date of this agreement). This agreement is subject to the terms of Nextran Corporation’s Premium Payment Plan as amended from time to time in effect, shall be governed by and construed in accordance with applicable laws, shall take effect as a sealed instrument under applicable laws, and revokes any prior election and compensation reduction agreement relating to such plan(s).

______Employee Signature Date

1-1-12