Project Nine - Fiduciary and Permanent Funds

Learning Objectives: In this project, you will

record the investment transactions of the fund record inter-fund transfers between the permanent fund and the governmental fund.

Preparing the Transaction Data The following events occurred in August 31, 2007 and need to be entered into the accounting records.

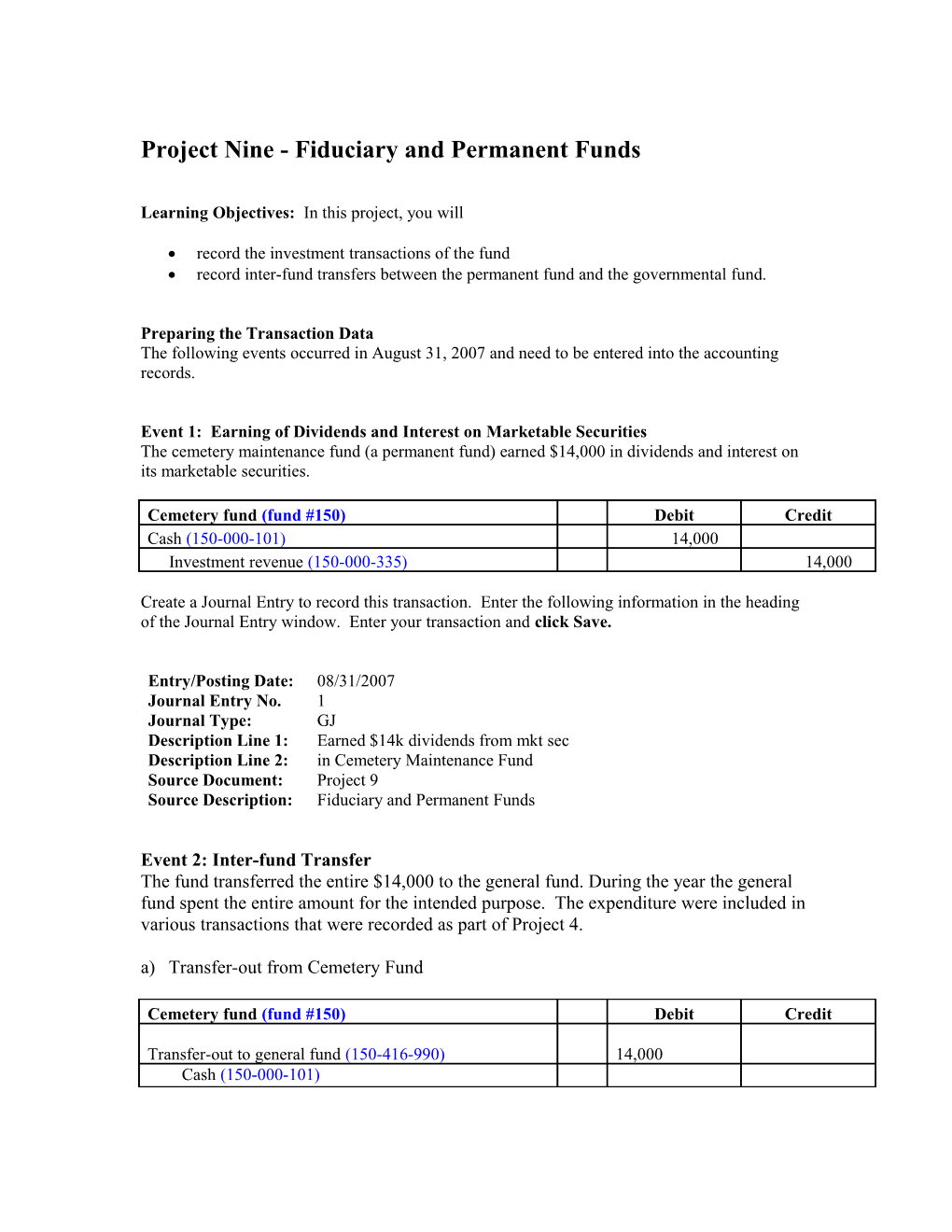

Event 1: Earning of Dividends and Interest on Marketable Securities The cemetery maintenance fund (a permanent fund) earned $14,000 in dividends and interest on its marketable securities.

Cemetery fund (fund #150) Debit Credit Cash (150-000-101) 14,000 Investment revenue (150-000-335) 14,000

Create a Journal Entry to record this transaction. Enter the following information in the heading of the Journal Entry window. Enter your transaction and click Save.

Entry/Posting Date: 08/31/2007 Journal Entry No. 1 Journal Type: GJ Description Line 1: Earned $14k dividends from mkt sec Description Line 2: in Cemetery Maintenance Fund Source Document: Project 9 Source Description: Fiduciary and Permanent Funds

Event 2: Inter-fund Transfer The fund transferred the entire $14,000 to the general fund. During the year the general fund spent the entire amount for the intended purpose. The expenditure were included in various transactions that were recorded as part of Project 4. a) Transfer-out from Cemetery Fund

Cemetery fund (fund #150) Debit Credit

Transfer-out to general fund (150-416-990) 14,000 Cash (150-000-101) 14,000

b) Transfer-in to General Fund

General fund

Cash (101-000-101) 14,000

Transfer-in from cemetery fund (101-000-390) 14,000

Create a Journal Entry to record this transaction. Enter the following information in the heading of the Journal Entry window. Then enter your transaction and click Save.

Entry/Posting Date: 08/31/2007 a) - #2 Journal Entry No. b) - #3 Journal Type: GJ Description Line 1: a) Transferred entire $14k to general fund Description Line 2: a) from Permanent Fund Description Line 1: b) Received 14K transfer from Cem. Fund Source Document: Project 9 Source Description: Fiduciary and Permanent Funds

Event 3: Recognition of change in securities’ market values During the year the market value of its securities decreased from $240,000 to $238,000

Cemetery fund (fund #150) Debit Credit

Investment revenue (150-000-335) 2,000

Marketable securities (150-000-103) 2,000

Create a Journal Entry to record this transaction. Enter the following information in the heading of the Journal Entry window. Then enter your transaction and then Save.

Entry/Posting Date: 08/31/2007 Journal Entry No. 4 Journal Type: GJ Description Line 1: Decreased in the mkt value of sec Description Line 2: from $240k to $238k Source Document: Project 9 Source Description: Fiduciary and Permanent Funds

Reviewing the Transactions and Backing Up Your Files Once all of the transactions have been entered, print the Journal Entries Report (enter Your name-Project 9 Trans. in the Option Subheading field) and carefully review your data entry.

9-2 The grand total for your report (JE #1 - #4) should be $44,000. If your total is different, then you have made an error and need to find and correct it before proceeding.

If you find errors, return to the Journal Entry screen, recall the Journal Entry and make the necessary corrections. Remember to Save your Journal Entry after you make changes. Re-print the Journal Entries Report to verify that the changes have been saved.

When you are satisfied that your entries are correct, back up your files. Record the system date and time in the form provided and also enter the backup information into your Backup Log.

System date: ______System time: ______

Append the transactions to the Master Journal Entry File. Your Append Report should show totally 4 journal entries appended. (note: your number of entries might differ if you needed to make correcting entries or inadvertently combined entries). In addition, Starting Master JE# should be 52 and Ending Master JE# should be 55.

Reviewing the Audit Report After your transactions have been appended, select Process from the Main Menu and then choose Audit Report to review the Journal Entries that are ready to post. When the Audit Report window appears, enter Your name-Project9 Trans. in the Optional Subheading field. Make sure that the From Posting Date field says 08/31/2007 and set the To Posting Date field to 08/31/2007. To complete the process print the report by using either FinePrint or the connected printer. The grand total in the Audit Report should be $44,000.

To Turn in for This Project Journal Entries Report showing the four transactions Append Report showing four entries appended Starting Master JE# is 52 and Ending Master JE# is 55. Audit Report with account totals checked to show reconciliation with the Journal Entry Report

9-3