March 12, 2015

Occidental Petroleum Corporation (OXY-NYSE)

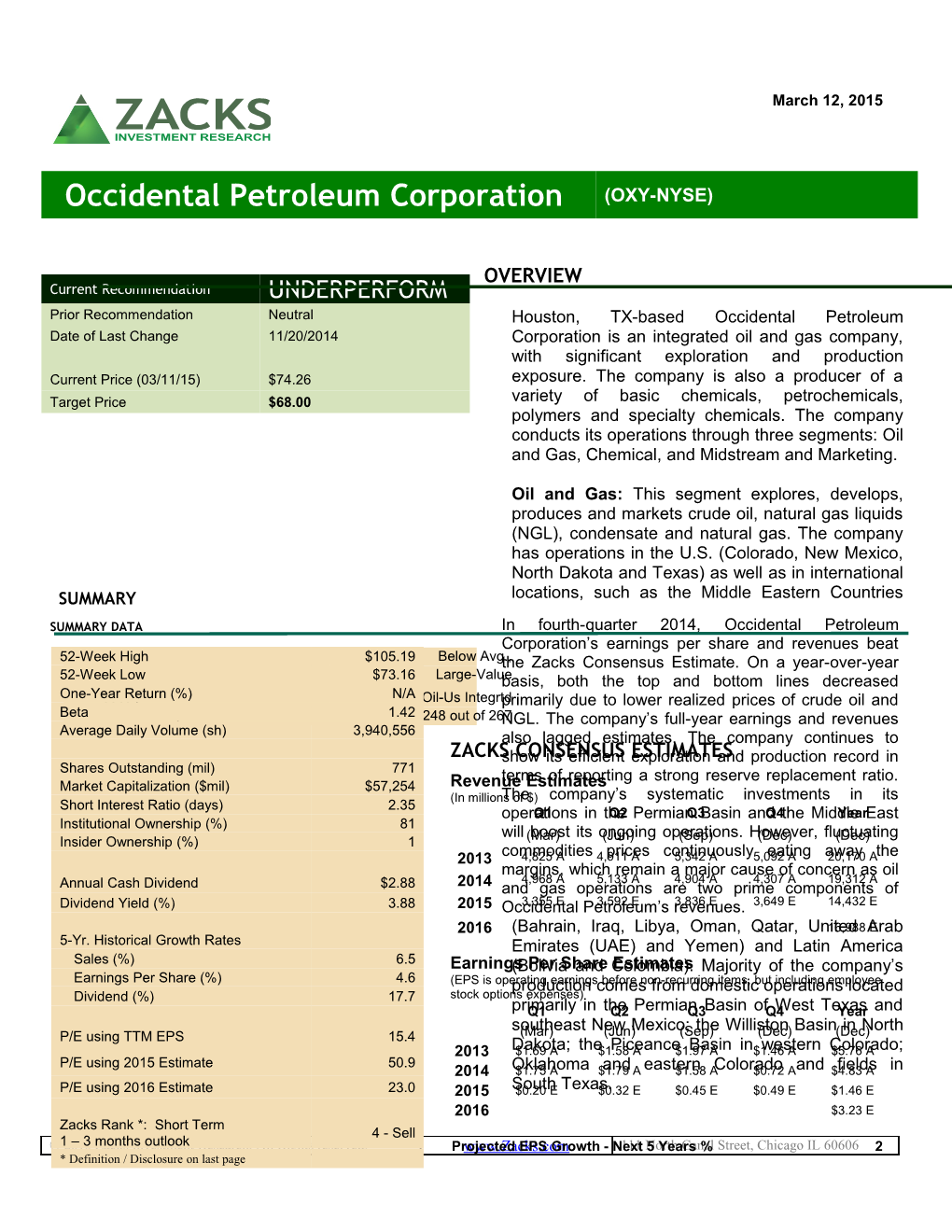

OVERVIEW Current Recommendation UNDERPERFORM Prior Recommendation Neutral Houston, TX-based Occidental Petroleum Date of Last Change 11/20/2014 Corporation is an integrated oil and gas company, with significant exploration and production Current Price (03/11/15) $74.26 exposure. The company is also a producer of a Target Price $68.00 variety of basic chemicals, petrochemicals, polymers and specialty chemicals. The company conducts its operations through three segments: Oil and Gas, Chemical, and Midstream and Marketing.

Oil and Gas: This segment explores, develops, produces and markets crude oil, natural gas liquids (NGL), condensate and natural gas. The company has operations in the U.S. (Colorado, New Mexico, North Dakota and Texas) as well as in international SUMMARY locations, such as the Middle Eastern Countries

SUMMARY DATA In fourth-quarter 2014, Occidental Petroleum Corporation’s earnings per share and revenues beat 52-WeekRisk HighLevel * $105.19 Below Avg.,the Zacks Consensus Estimate. On a year-over-year 52-WeekType Low of Stock $73.16 Large-Valuebasis, both the top and bottom lines decreased One-YearIndustry Return (%) N/A Oil-Us Integrtdprimarily due to lower realized prices of crude oil and Beta Zacks Industry Rank * 1.42 248 out of 267NGL. The company’s full-year earnings and revenues Average Daily Volume (sh) 3,940,556 also lagged estimates. The company continues to ZACKSshow CONSENSUS its efficient explorationESTIMATES and production record in Shares Outstanding (mil) 771 terms of reporting a strong reserve replacement ratio. Market Capitalization ($mil) $57,254 Revenue Estimates (In millionsThe of $) company’s systematic investments in its Short Interest Ratio (days) 2.35 operationsQ1 in theQ2 PermianQ3 Basin andQ4 the MiddleYear East Institutional Ownership (%) 81 will boost its ongoing operations. However, fluctuating Insider Ownership (%) 1 (Mar) (Jun) (Sep) (Dec) (Dec) 2013 commodities4,825 A 4,911 prices A continuously5,342 A 5,092 eating A away20,170 A the margins, which remain a major cause of concern as oil 4,968 A 5,133 A 4,904 A 4,307 A 19,312 A Annual Cash Dividend $2.88 2014 and gas operations are two prime components of Dividend Yield (%) 3.88 2015 Occidental3,355 E Petroleum’s3,592 E revenues.3,836 E 3,649 E 14,432 E 2016 (Bahrain, Iraq, Libya, Oman, Qatar, United16,988 ArabE 5-Yr. Historical Growth Rates Emirates (UAE) and Yemen) and Latin America Sales (%) 6.5 Earnings(Bolivia Per Share and Colombia).Estimates Majority of the company’s Earnings Per Share (%) 4.6 (EPS is operatingproduction earnings comes before non-recurring from domestic items, but operations including employee located Dividend (%) 17.7 stock options expenses) primarilyQ1 in theQ2 PermianQ3 Basin ofQ4 West TexasYear and southeast New Mexico; the Williston Basin in North P/E using TTM EPS 15.4 (Mar) (Jun) (Sep) (Dec) (Dec) 2013 Dakota;$1.69 A the$1.58 Piceance A $1.97 Basin A in$1.46 western A Colorado;$5.76 A P/E using 2015 Estimate 50.9 2014 Oklahoma$1.75 A $1.79 and A eastern$1.58 A Colorado$0.72 A and $4.83 fields A in P/E using 2016 Estimate 23.0 2015 South$0.20 E Texas.$0.32 E $0.45 E $0.49 E $1.46 E 2016 $3.23 E Zacks Rank *: Short Term 4 - Sell ©1 2015 – 3 monthsZacks Investment outlook Research, All Rights reserved. Projectedwww.Zacks.com EPS Growth - Next111 North5 Years Canal % Street, Chicago IL 60606 2 * Definition / Disclosure on last page Chemical: This segment works under the gas. In addition, the oil industry as a whole company’s wholly-owned subsidiary, OxyChem, competes with other industries in meeting having operations in 23 sites in the U.S. It global energy requirements. manufactures and markets polyvinyl chloride resins, chlorine and caustic soda. Like other oil and natural gas companies, Occidental Petroleum faces cost overruns and Midstream and Marketing: This segment development interruptions due to delays for encompasses operations that gather, treat, drilling and other approvals, property or border process, transport, store, trade and market crude disputes, and equipment failures. These factors oil, natural gas, NGL, condensates and carbon may impact the company’s production growth dioxide. It also offers these services to third parties. and targeted returns. The segment operates in Colorado, Louisiana, New Mexico, Oklahoma and Texas in the U.S., Canada, Oil and gas companies often face risks due to the UAE, Qatar and Singapore. the occurrence of catastrophic events, including hurricanes, earthquakes and floods. Regular At the end of 2014, Occidental Petroleum’s total operations are sometimes affected because of proved reserves came in at 2,819 barrels of oil the damages caused to infrastructure, repairing equivalent (BOE). costs of which add to the company’s operating expenses. RISKS REASONS TO SELL Occidental Petroleum follows a systematic Ongoing volatility of crude oil prices is a primary capital investment program to boost its reserves cause of concern for the energy companies like in the U.S. and Middle East. The company’s Occidental Petroleum, which generate a capital expenditure in 2014 stood at around substantial portion of their revenues from oil $8.93 billion, including $2.99 billion spent in the and gas operations. In 2014, the company’s oil fourth quarter, and plans to invest $5.8 billion in and gas segment contributed 71.9% to its net 2015. Its prime assets in the Permian Basin revenue. Occidental Petroleum had obtained continue to drive results with a 42% year-over- 78.2% of its 2013 revenues from oil and gas year rise in oil production in the quarter. For operations. In the fourth quarter, the company’s 2015, the company projects capital spending for earnings and revenues were impacted the Permian operations to be around $2.2 negatively primarily due to lower crude oil billion, with focus on oil production. In addition, realized prices. the company is making strategic investments in several parts of the Middle East including Qatar As of March 12, 2015, crude oil price is and the United Arab Emirates. hovering around $48 per barrel. In the fourth quarter, worldwide realized crude oil price was Positive outcomes from domestic and foreign $71.58 per barrel, down 24.4% sequentially and projects coupled with synergies from capital 27.9% year over year. The oil supply glut due to investments allow Occidental Petroleum to higher production in the U.S. remains a major maintain a stable replacement ratio. In 2014, overhang on oil prices. If this situation persists, the company’s total reserve replacement ratio Occidental Petroleum’s financial performance was 174%, including a domestic ratio of 266%. will be adversely impacted. The company expects oil and gas production to increase 6%–10% in 2015 on the Al Hosn gas Occidental Petroleum’s businesses operate in project beginning production in the UAE and highly competitive environments, which could strong contribution from the Permian assets. adversely affect its profitability, growth and management of its businesses. The company Occidental Petroleum is currently repositioning faces intense competition from other oil and gas itself through assets monetization and companies, which include state-owned foreign divestments to create a portfolio of low-risk and oil companies, major integrated oil companies long reserve-life properties that will provide and independent producers of oil and natural steady production growth. During the fourth

Equity Research OXY | Page 2 quarter, the company sold its interest in the operating costs as a result of increased workover BridgeTex Pipeline Company, LLC for $1.1 and maintenance activities. billion. The company had previously completed several divestments, including its interest in On a GAAP basis, the company posted a loss of Plains All American Pipeline GP for $1.7 billion $4.41 per share in the fourth quarter against and the Hugoton Field operations for $1.3 earnings of $2.04 per share a year ago. The billion. These initiatives will enable the company variance between GAAP and adjusted earnings to utilize the proceeds in profitable exploration was due to the combined impact of charges from and production ventures as well as strategic domestic, foreign, chemical and midstream asset acquisitions. impairments and assets under the Joslyn project, a charge associated with mark-to-market adjustments Moreover, on Dec 1, 2014, Occidental for the California Resources Corporation Petroleum completed the separation of its investments and foreign tax legislation and dividend Californian operations and formed a standalone tax effects, and spin-off charges. This was partially entity. This company is currently aiming to offset by gains from the sale of the BridgeTex focus on its Permian business and deploy Pipeline and a portion of its investment in the Plains resources in lucrative projects that sync well All American Pipeline, GP, and tax effect of pre-tax with its long-term goal. adjustments.

Occidental Petroleum repurchases shares and In 2014, adjusted earnings stood at $4.83 per pay regular dividends to maximize shareholder share, missing the Zacks Consensus Estimate of wealth. In 2014, the company repurchased over $5.87 by 17.7%. Annual earnings decreased 16.1% 26 million of shares of its common stock for from the year-ago figure. $2.5 billion, including around 4.8 million shares bought during the fourth quarter. It has around The company’s GAAP earnings per share were 71 million shares remaining under the current $0.79 in 2014 compared with $7.32 a year ago. authorization. In Oct 2014, the company raised the total number of shares authorized for its Total Revenue share repurchase program by 60 million to 185 million shares. In the quarter under review, Occidental Petroleum's total revenue was $4.31 billion, beating the Zacks Occidental Petroleum increased dividends for Consensus Estimate by 9.2%. The top line dropped the past 12 consecutive years. In 2014, the 15.3% from $5.09 billion a year ago, primarily due company paid $2.21 billion as dividend, up to lower Oil and Gas (23.4% year over year) 42.3% year over year. These initiatives revenue. This was partially offset by higher collectively enable the company to retain contribution from the Midstream, Marketing and investor interest in the stock. Other (38.3%) and Chemical (1.1%) operations.

The company’s total revenue was $19.3 billion in RECENT NEWS 2014, down 4.3% year over year, missing the Zacks Consensus Estimate by 13.8%. Occidental Petroleum Beats on Q4 Earnings, Down Y/Y – Jan 29, 2015 Quarterly Highlights

Occidental Petroleum Corporation reported fourth- Occidental Petroleum’s average daily net oil, liquids quarter 2014 adjusted earnings of $0.72 per share, and gas production volume was 616,000 barrels of surpassing the Zacks Consensus Estimate of $0.68 oil equivalents (BOE). The 7.1% year-over-year by 5.9%. On a year-over-year basis, however, increase was primarily due to higher contribution quarterly earnings plunged 50.7% primarily due to from the Permian Resources operations coupled lower crude oil and natural gas liquids (NGL) with operational improvements. realized prices, an increase in depreciation, depletion and amortization expenses and a rise in The company’s daily sales volume was 635,000 BOE, up 3.3% from 615,000 BOE a year ago due

Equity Research OXY | Page 3 to higher sales volumes in the U.S. and the Middle East/North Africa. Occidental Petroleum’s Return on Equity (ROE) of 11.0% in the trailing 12 months is higher than its Realized price for worldwide crude oil decreased industry peers. This indicates that the company is 27.9% year over year to $71.58 per barrel. investing its funds more efficiently than its peers.

Worldwide realized NGL prices were $27.39 per Our target price of $68.00 reflects a P/E multiple of barrel compared with $40.44 per barrel a year ago. 46.6 based on 2015 EPS.

Worldwide natural gas prices edged up 1.8% year over year to $2.21 per thousand cubic feet (MCF). Key Indicators P/E P/E Business Update P/E P/E Est. 5-Yr P/CF P/E 5-Yr 5-Yr F1 F2 EPS Gr% (TTM) (TTM) High Low In 2014, Occidental Petroleum’s domestic reserve (TTM) (TTM) replacement ratioOccidental stood Petroleum at 266%, Corporation while the (OXY) total 50.9 23.0 2.0 7.2 15.4 19.3 9.0 company replacement ratio was 174%. The Industry Average 62.4 N/A 3.7 3.8 12.1 26.6 6.9 company’s provedS&P 500 reserves were 2.82 billion BOE 16.2 15.1 10.7 14.6 17.8 18.4 12.0 at the end of 2014. ConocoPhillips (COP) 74.1 21.9 0.6 4.9 11.5 13.7 8.7 Financial UpdateHess Corporation (HES) N/A N/A 6.5 4.7 16.7 20.6 7.9 Marathon Oil Corporation (MRO) N/A N/A N/A 4.3 13.3 18.7 5.0 TTM is trailing 12 months; F1 is 2015 and F2 is 2016, CF is operating cash flow As of Dec 31, 2014, Occidental Petroleum had long-term debt (including current maturities)P/B of P/B P/B ROE D/E Div Yield EV/EBITDA Last $6.84 billion compared with $6.94 billion as of5-Yr Dec High 5-Yr Low (TTM) Last Qtr. Last Qtr. (TTM) 31, 2013. The company’s total debt-to-capitalizationQtr. Occidental Petroleum 1.7 2.8 1.4 11.0 0.2 3.9 10.1 ratio was 16%,Corporation higher than (OXY) the Dec 31, 2013 level.

In 2014, the company’sIndustry Average cash from operations1.1 was1.1 1.1 8.2 N/A 1.9 4.9 $9.4 billion, downS&P 500from $10.4 billion in the6.2 prior-year9.8 3.2 25.4 N/A 2.0 N/A period.

In the fourth quarter, Occidental Petroleum’s total capital expenditure was $2.99 billion compared with $1.95 billion in the year-ago period.

Guidance

For 2015, Occidental Petroleum provided a capital expenditure guidance of $5.8 billion. The company expects oil and gas production to increase 6%–10% in 2015, considering the commencement of the Al Hosn Gas Project.

VALUATION

Shares of Occidental Petroleum are currently trading at 15.4x trailing 12-month EPS, compared with the industry average of 12.1x and the S&P 500 average of 17.8x. Over the last five years, the company’s shares have traded in the P/E band of 9.0x to 19.3x.

Equity Research OXY | Page 4 Earnings Surprise and Estimate Revision History DISCLOSURES & DEFINITIONS

The analysts contributing to this report do not hold any shares of OXY. The EPS and revenue forecasts are the Zacks Consensus estimates. Additionally, the analysts contributing to this report certify that the views expressed herein accurately reflect the analysts’ personal views as to the subject securities and issuers. Zacks certifies that no part of the analysts’ compensation was, is, or will be, directly or indirectly, related to the specific recommendation or views expressed by the analyst in the report. Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources we believe to be reliable, but is not guaranteed as to accuracy and does not purport to be complete. Because of individual objectives, the report should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed herein are subject to change. This report is not to be construed as an offer or the solicitation of an offer to buy or sell the securities herein mentioned. Zacks or its officers, employees or customers may have a position long or short in the securities mentioned and buy or sell the securities from time to time. Zacks uses the following rating system for the securities it covers. Outperform- Zacks expects that the subject company will outperform the broader U.S. equity market over the next six to twelve months. Neutral- Zacks expects that the company will perform in line with the broader U.S. equity market over the next six to twelve months. Underperform- Zacks expects the company will under perform the broader U.S. Equity market over the next six to twelve months. The current distribution of Zacks Ratings is as follows on the 1023 companies covered: Outperform - 15.1%, Neutral - 77.2%, Underperform – 6.4%. Data is as of midnight on the business day immediately prior to this publication.

Our recommendation for each stock is closely linked to the Zacks Rank, which results from a proprietary quantitative model using trends in earnings estimate revisions. This model is proven most effective for judging the timeliness of a stock over the next 1 to 3 months. The model assigns each stock a rank from 1 through 5. Zacks Rank 1 = Strong Buy. Zacks Rank 2 = Buy. Zacks Rank 3 = Hold. Zacks Rank 4 = Sell. Zacks Rank 5 = Strong Sell. We also provide a Zacks Industry Rank for each company which provides an idea of the near-term attractiveness of a company’s industry group. We have 264 industry groups in total. Thus, the Zacks Industry Rank is a number between 1 and 264. In terms of investment attractiveness, the higher the rank the better. Historically, the top half of the industries has outperformed the general market. In determining Risk Level, we rely on a proprietary quantitative model that divides the entire universe of stocks into five groups, based on each stock’s historical price volatility. The first group has stocks with the lowest values and are deemed Low Risk, while the 5th group has the highest values and are designated High Risk. Designations of Below-Average Risk, Average Risk, and Above-Average Risk correspond to the second, third, and fourth groups of stocks, respectively.

Research Analyst Priyam Bhattacharya Copy Editor Sayantani Sinharoy Content Ed. Jewel Saha

Lead Analyst Jewel Saha

QCA Jewel Saha

Equity Research OXY | Page 5