CHAPTER 14

The Flexible Budget: Factory Overhead

Learning Objectives 1. Distinguish between the product-costing and control purposes of standard costs for factory overhead 2. Calculate and properly interpret standard cost variances for factory overhead using traditional approaches 3. Record factory overhead costs and associated standard cost variances 4. Apply standard costs to service organizations 5. Analyze overhead variances in an activity-based cost (ABC) system 6. Understand decision rules that can be used to guide the variance-investigation decision

New in this Edition 1. New discussion regarding the difference between the product-costing and control purposes of standard costs for factory overhead 2. Expanded discussion of the variance-decomposition question for overhead costs 3. New diagrammatical approach for overhead variance analysis (Exhibit 14.4 and Exhibit 14.5), and associated end-of-chapter assignment material. A new exhibit (Exhibit 14.6) can be used to illustrate three approaches to the decomposition of the total overhead variance for a period (i.e., a four-way breakdown, a three-way breakdown, and a two-way breakdown). 4. New alternative diagrammatical approach for overhead variance analysis (Exhibit 14.18) 5. Expanded set of Excel-based end-of-chapter assignment material 6. Significant expansion of Real-World Focus (RWF) items in the body of the chapter 7. Significant expansion of the variance disposition issue

Teaching Suggestions I most often cover this chapter in two days, and my focus is on the proper interpretation of the overhead variances. On day one I generally try to cover three topics: (1) the difference between the product-costing and control uses of standard costing for overhead; (2) the setting of standards for overhead application, including the choice of the denominator activity level; and (3) traditional overhead variance calculations. On day two I generally try to cover three topics: (1) the effect on standard costing of changes in the manufacturing environment, (2) journal entries for recording standard overhead costs and associated variances, (3) end-of-period disposition of overhead variances. Time permitting, I also provide on day two an overview of the variance-investigation decision, including statistical control charts and the decision-analysis approach explained in the appendix to the chapter.

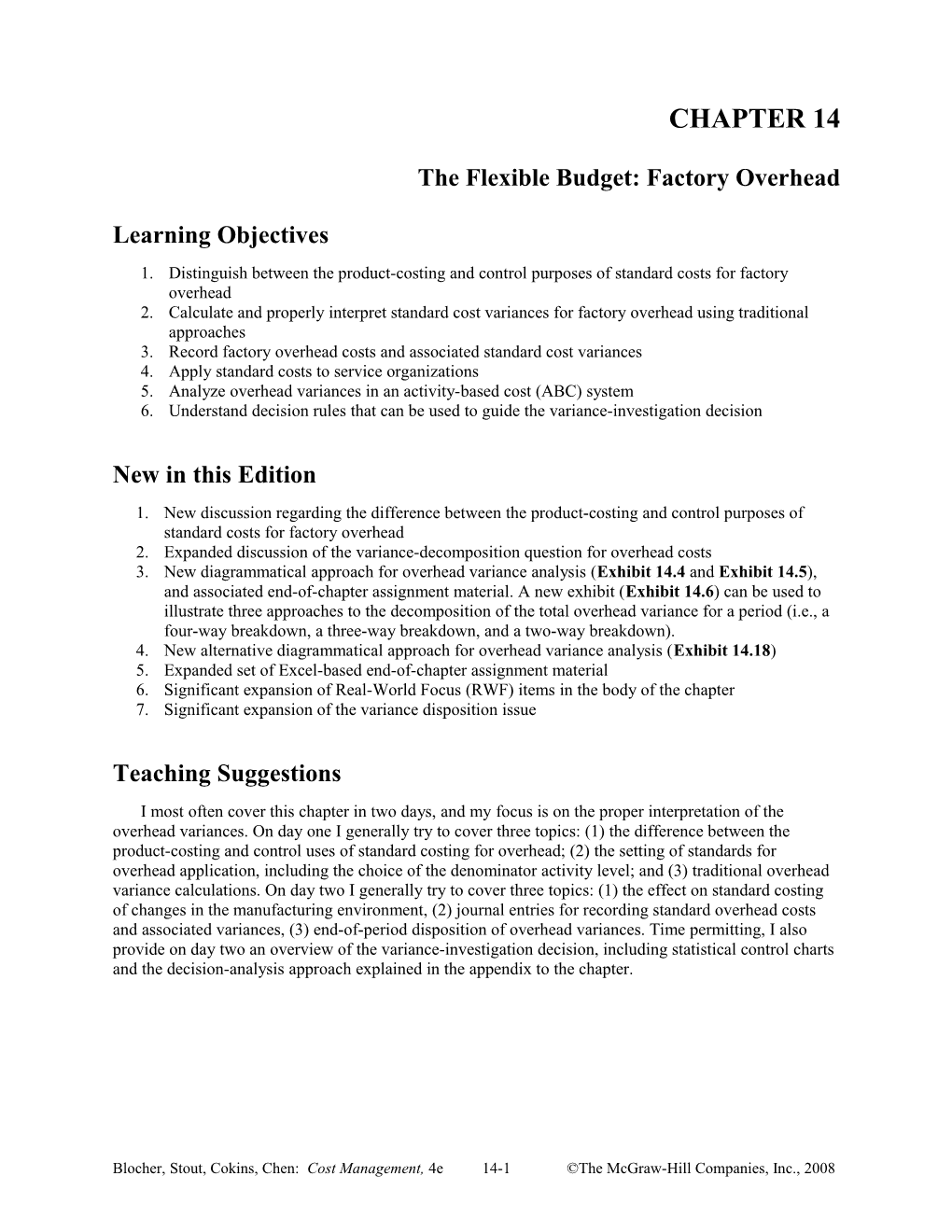

Blocher, Stout, Cokins, Chen: Cost Management, 4e 14-1 ©The McGraw-Hill Companies, Inc., 2008 Assignment Matrix Learning Objectives Text Features

l t s s s e . y e a e d n e c c s n g i i c i e a o n v o e r i

v h n i e t h o t t t t r i g s a a h a n t i e a E n r d r r g a i z t S E e i a i t

a n t S l e s v n s r r V a o a e

e O c p n t g v d - r S r d n t n a I u

Estimated c I n e O o

u a h e

J e d Completion r h c C e o i T r v

Time (in v B P r n O

A e

l o Item minutes) s s i S o e s n r c i t o c n i n e t 14-30 20-25 X X a o i a D l c r

14-31 20-25 X u X a c 14-32 20-25 X l V a

14-33 20-25 X C 14-34 40 X X 14-35 40 X 14-36 10-15 X 14-37 15-20 X X 14-38 30 X 14-39 20-25 X 14-40 30-40 X 14-41 15 X X 14-42 20-25 X 14-43 45-50 X X 14-44 40-45 X X 14-45 50-60 X X 14-46 30-40 X 14-47 30-40 X 14-48 40-45 X X 14-49 30-40 X X 14-50 30-40 X X X 14-51 30-40 X 14-52 40-45 X X 14-53 15 X X 14-54 30 X 14-55 20-30 X X 14-56 60 X X X 14-57 45-50 X X 14-58 40-45 X X 14-59 45 X 14-60 45-50 X 14-61 60 X X 14-62 50-60 X X 14-63 50 X X X 14-64 45 X X X 14-65 40 X 14-66 20 X X 14-67 45 X X X 14-68 50-60 X X X X 14-69 45 X 14-70 20-25 X 14-71 25 X 14-72 20 X 14-73 30 X X 14-74 40 X 14-75 50 X X X X 14-76 45-50 X X X

Blocher, Stout, Cokins, Chen: Cost Management, 4e 14-2 ©The McGraw-Hill Companies, Inc., 2008 Lecture Notes

This chapter uses the concepts introduced in Chapter 13 to explain the key role flexible budgets and variances play in the planning and control of factory overhead (i.e., indirect manufacturing) costs. The chapter focuses on (1) the product-costing vs. control use of standard overhead costs, (2) how to determine standard factory overhead costs, including choice of the denominator activity level for setting the fixed overhead application rate, (3) how to compute traditional standard cost variances for variable and fixed manufacturing overhead costs, (4) the interpretation of these variances, (5) journal entries for standard overhead costs as well as end-of-period disposal of standard cost variances, (6) the effect on standard costing of changes in the manufacturing environment, and (7) the variance-investigation decision (based, fundamentally, on the “management-by-exception” philosophy).

Product-Costing vs. Control Purposes of Standard Overhead Costs

this discussion is new to the 4th edition of the text; the discussion can be built around two new exhibits in the chapter: Exhibit 14.1 (variable factory overhead) and Exhibit 14.3 (fixed factory overhead) Steps in Establishing the Standard Variable Factory Overhead

• Determining the behavior patterns of variable factory overhead costs:

o The standard variable factory overhead for a manufacturing firm is a function of both the number of units to be manufactured and activities of the manufacturing process. o Use of proper cost drivers is very important. • Selecting one or more appropriate cost drivers for applying variable factory overhead to cost objects (such as, products, services, or divisions):

o Using a single cost driver, such as direct labor hours (DLHs), for applying variable factory overhead is satisfactory only if the total variable factory overhead relates to the selected cost driver. o An activity-based cost (ABC) driver applies factory overhead to products or services according to the activity level of manufacturing operations and is likely to result in more accurate allocation of variable overhead costs. Activities that change the amount of factory overhead may be unit-based, batch-based, product-based, and facility-based. Unit-based cost drivers include machine hours, direct labor hours, and units of materials. Batch-based cost drivers include the number of times materials and parts are moved during manufacturing, number of set-ups, number of times materials are parts are received and inspected. Product-based cost drivers include number of products, number of processes, and number of schedule changes. Facility- based cost drivers relate mostly with the size of operations, not with production activities.

• Computing the standard variable factory overhead rate:

Estimated Total Variable Overhead of thePeriod S tan dard VariableOverhead Rate Estimated Amountof theActivityMeasure Analyzing Variable Overhead Variances

Total factory overhead variance, or variable overhead flexible budget variance (OFV), is the difference between the total variable factory overhead cost incurred and the total standard variable factory overhead for the number of units manufactured. This difference is also the under- or over-applied variable

Blocher, Stout, Cokins, Chen: Cost Management, 4e 14-3 ©The McGraw-Hill Companies, Inc., 2008 overhead. New to the 4th edition is text Exhibit 14.4, which can be used to illustrate the total variable overhead variance and its decomposition into spending and efficiency components.

o Variable overhead spending variance (OSV) is the difference between actual variable overhead costs incurred and budgeted variable overhead for the actual quantity of the cost driver for applying variable factory overhead.

o Variable overhead efficiency variance (OEV) is the difference between the budgeted variable factory overhead for the actual quantity of the cost driver for applying variable factory overhead and the budgeted variable factory overhead for the standard allowed activity units for the period. Alternatively, this variance can be defined as the difference between the budgeted variable overhead based on inputs and the budgeted variable overhead based on outputs. It is important to point out to students that this variance does not reflect efficiency or inefficiency in using variable overhead cost items. Rather, it relates to efficiency or inefficiency in use of the activity variable (or cost driver) used to apply standard variable overhead to production.

o Alternative Format for Variable Overhead Variances: the following diagram can be used as an alternative to, or in conjunction with, text Exhibit 14.4 to illustrate the breakdown of the total variable overhead variance into a spending and an efficiency variance.

Total Standard Activity Measure Actual Input x Standard Rate Per for the Output x Standard Rate Unit of the Activity Measure for Per Unit of the Activity Measure Actual Applying Variable Overhead for Applying Variable Overhead Cost Incurred (AH x SR) (SH x SR)

Spending Variance Efficiency Variance

Variable Overhead Flexible Budget Variance or, Under- or Over-applied Variable Overhead

Interpreting Variable Overhead Variances Unlike direct materials and direct labor variances, the total variable factory overhead cost, in addition to varying with volume, also varies with activities that change categorically or at intervals such as the number of production runs, number of batches, and type of product. Because of imperfect association between the cost driver (or drivers) for applying overhead and the variable factory overhead costs, a variable factory overhead spending variance may include both price and usage variances.

The variable overhead efficiency variance reflects the effect of deviation in quantities only if the cost driver for applying the overhead is a perfect surrogate for the unknown actual cost drivers for the overhead. Steps in Determining Standard Fixed Factory Overhead Rate

Because the total fixed factory overhead does not vary with changes in the activity level, there is in effect no activity measure for fixed factory overhead during the period. However, many firms use fixed overhead application rates to charge fixed overhead to cost objects in order to determine “full manufacturing costs.” The steps to determine fixed factory overhead rates include:

Blocher, Stout, Cokins, Chen: Cost Management, 4e 14-4 ©The McGraw-Hill Companies, Inc., 2008 • Determine the total budgeted fixed factory overhead for the period. • Select a cost driver for applying fixed factory overhead. • Calculate the denominator activity level (quantity) for the selected cost driver. • Compute the fixed factory overhead application rate.

EstimatedTotalFixedOverheadof thePeriod S tan dard FixedOverhead Rate Estimated Deno min ator Amountof theSelected ActivityMeasure The denominator activity level can be set at: theoretical capacity, practical capacity, normal capacity, or budgeted capacity usage. For reasons discussed in the chapter, we prefer the use of “practical capacity” as the denominator activity level for setting the fixed overhead application rate.

Analyzing Fixed Overhead Variances Fixed factory overhead variances include the fixed overhead spending variance (FOSV) and the fixed overhead production volume variance. New to the 4th edition is Exhibit 14.5, which provides a diagrammatic representation of the determination of these two variances.

o Fixed overhead spending variance (FOSV) is the difference between the actual and the budgeted fixed factory overhead for the period. This variance is also referred to as fixed overhead flexible budget variance, or simply fixed overhead budget variance. Neither the actual units produced nor the actual level of the cost driver incurred during the period has any effect on the amount of the fixed factory overhead spending variance.

o Fixed overhead production volume variance (FOVV) is the difference between the budgeted fixed overhead and the total fixed overhead applied to the units manufactured during the period. Other terms for this variance are denominator variance, idle-capacity variance, and output- level variance.

o Alternative Representation of Fixed Overhead Variances: The difference between the actual and the applied fixed factory overhead is referred to as underapplied or overapplied fixed factory overhead. This is the total variance to be analyzed for product-costing purposes. The following diagram can be used as an alternative to, or in conjunction with, text Exhibit 14.5:

Total Standard Activity Units for the Output Achieved x Standard Fixed OVH rate per Actual Budgeted Total Unit of Activity Cost Incurred Fixed Overhead (SH x SR)

Spending Variance Production Volume Variance, (or, Flexible Budget Variance) Denominator Variance, or Output-level Variance

Under- or Over-applied Fixed Overhead

Blocher, Stout, Cokins, Chen: Cost Management, 4e 14-5 ©The McGraw-Hill Companies, Inc., 2008 Interpreting Fixed Overhead Variances

Factors contributing to fixed overhead spending variances include ineffective budget procedures, inadequate control of costs, and misclassification of cost items.

Factors contributing to fixed overhead production volume variances include management decisions to change the budgeted operating level, unexpected changes in market demand, or unforeseen problems in manufacturing operations. This variance can also be a measure of facility or capacity utilization (and for this reason is sometime referred to as the “idle-capacity variance”).

Alternative Analysis of Factory Overhead Variances

The preceding discussion, including text Exhibit 14.4 and Exhibit 14.5, refers to what is called a “four- way analysis of the total overhead variance” for the period. Text Exhibit 14.6 can be used to illustrate the four-way approach to variance decomposition.

However, the total factory overhead variance can also be viewed in a 2-variance or 3-variance format. The 3-variance breakdown creates a factory overhead spending variance by combining variable overhead spending variances and fixed overhead spending variances into one variance. The variable overhead efficiency variance and fixed overhead production volume variance remain intact. The 2-variance format further combines overhead spending variance with variable overhead efficiency variance. This combined variance is called the factory overhead flexible budget variance. New to the 4th edition Exhibit 14.7 which can be used to illustrate all three approaches to the decomposition of the total overhead variance (i.e., four-way, three-way, and two-way breakdowns of the total variance). Also new to the 4th edition is Exhibit 14.18, which provides an alternative diagrammatic representation of the overhead variance decomposition process.

Journal Entries and Disposition of Overhead Variances

After discussing overhead variances, I then cover journal entries associated with the recording of standard overhead costs and associated standard cost variances (for product-costing purposes). This discussion is a straightforward extension of the material covered in the Appendix to Chapter 13.

New to the 4th edition is a greatly expanded discussion of the variance-disposition question, that is, what the accountant must do at the end of the period to dispose of any standard cost variance. (Students should recall that the variances are recorded in what we call “temporary” or “nominal” accounts and, as such, must be closed out to zero at the end of the year.) Thus, the discussion of the variance-disposition issue can begin with a distinction between interim (e.g., end of quarter) and annual (i.e., end of year) statements. The appropriate disposition of standard cost variances is partly a function of the timing of the variance calculation. It is also a function of whether the net variance is considered material or immaterial.

A company can dispose of variances in the income statement of the period in which the variance is incurred by charging them to the cost of goods sold (CGS). Alternatively, the firm can prorate (i.e., allocate) the variance among the CGS and ending inventory accounts, including raw materials, finished goods, and work-in-process. (Note, however, that overhead and labor variances would be allocated only to WIP inventory, finished goods inventory, and CGS; only the materials purchase price variance would be allocated in part to the ending inventory of raw materials.)

Firms are likely to prorate variances when the variances are caused due to inappropriate standards or bookkeeping errors. Proration of variances would be inappropriate if the variances are caused due to operational inefficiencies.

Blocher, Stout, Cokins, Chen: Cost Management, 4e 14-6 ©The McGraw-Hill Companies, Inc., 2008 The Variance Investigation Decision

I tell students that the standard cost variances that are reported by the accountant can be thought of in terms of “information signals” to management. Using the principle of “management by exception,” the task is to determine when to assume that an exception has occurred, that is, a variance due to a systematic (nonrandom) cause.

Text Exhibit 14.16 can be used by the instructor to frame the discussion. As indicated by this exhibit, variances can be classified as uncontrollable (random) or controllable (nonrandom, or systematic). Controllable variances can be caused by one or a combination of the following factors:

o prediction error o modeling error o measurement error o implementation error

The point here is that the cause of the controllable variance will dictate the appropriate course of corrective action to take. On the other hand, variances judged to be uncontrollable (random) require no corrective action on the part of management.

Control charts (e.g., Exhibit 14.17) and statistical control charts can be used to help identify random from nonrandom (controllable) variances. As discussed in the Appendix to this chapter, the variance investigation decision under uncertainty can be modeled through the use of payoff tables (see Table 14A.1 and 14A.2). Of particular importance in this model is the determination of the indifference probability, as illustrated in Table 14A.3.

Blocher, Stout, Cokins, Chen: Cost Management, 4e 14-7 ©The McGraw-Hill Companies, Inc., 2008